Asia Pacific Dandruff Treatment Market

Market Size in USD Billion

CAGR :

%

USD

1.65 Billion

USD

2.43 Billion

2024

2032

USD

1.65 Billion

USD

2.43 Billion

2024

2032

| 2025 –2032 | |

| USD 1.65 Billion | |

| USD 2.43 Billion | |

|

|

|

|

Dandruff Treatment Market Size

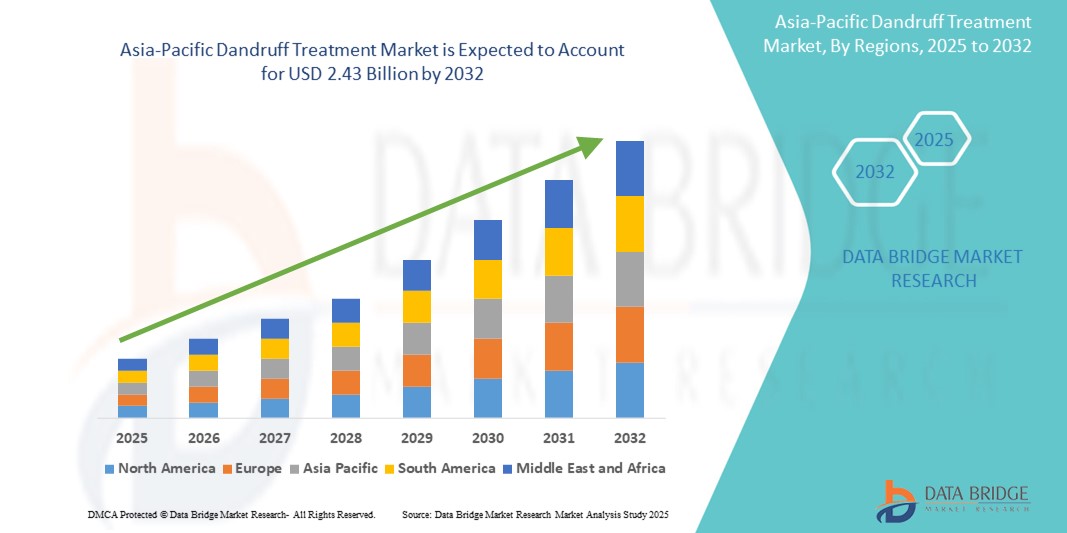

- The Asia-Pacific Dandruff Treatment market size was valued at USD 1.65 billion in 2024 and is expected to reach USD 2.43 billion by 2032, at a CAGR of 8.6% during the forecast period

- The Asia-Pacific Dandruff Treatment Market encompasses a diverse range of medicated shampoos, topical formulations, leave-on products, and systemic therapies designed to manage and prevent dandruff caused by factors such as seborrheic dermatitis, Malassezia overgrowth, and dry scalp conditions. These treatments are essential for alleviating flaking, itching, scalp irritation, and inflammation among diverse patient populations across the region.

- The growing prevalence of scalp-related disorders, rising consumer awareness regarding personal care and hygiene, and increasing availability of over-the-counter treatment options have significantly boosted market adoption. Advances in formulation technology, such as pH-balanced, sulfate-free, and long-lasting anti-relapse products, are improving treatment efficacy, patient compliance, and overall scalp health outcomes.

Dandruff Treatment Market Analysis

- The Asia-Pacific Dandruff Treatment Market is driven by the rising incidence of scalp-related conditions such as seborrheic dermatitis, fungal infections, and dry scalp, coupled with increasing consumer awareness about personal grooming and hair health. The expanding urban population, growing disposable incomes, and heightened demand for innovative, dermatologist-recommended products are further accelerating market growth across the region.

- Technological advancements—including the development of novel antifungal formulations, sulfate-free and pH-balanced shampoos, and long-acting leave-on treatments—are transforming the dandruff treatment landscape. The adoption of herbal and natural solutions featuring ingredients like tea tree oil, salicylic acid, and coal tar is gaining traction among consumers seeking safer, more sustainable alternatives.

- India dominates the Asia-Pacific Dandruff Treatment Market, holding the largest revenue share of 28.3% in 2025, driven by a high prevalence of dandruff among the young population, strong presence of domestic and international brands, and the rapid growth of e-commerce distribution channels. The country’s large consumer base, frequent product innovations, and rising influence of digital marketing and social media endorsements contribute to its market leadership.

- Disease Related Dandruff, are expected to dominate the Asia-Pacific Dandruff Treatment market with a market share of 41.2% in 2025 owing to their proven efficacy, ease of application, and availability across multiple price points. These products remain the first-line treatment choice for mild to moderate dandruff cases, while combination therapies and prescription solutions are increasingly used for severe or recurrent conditions.

Report Scope and Dandruff Treatment Market Segmentation

|

Attributes |

Dandruff Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dandruff Treatment Market Trends

“Shift Toward Natural Formulations, Digital Engagement, and Personalization”

- A key trend in the Asia-Pacific Dandruff Treatment Market is the increasing consumer shift toward herbal, natural, and dermatologically tested products. Formulations containing tea tree oil, aloe vera, neem extracts, and other plant-based ingredients are gaining popularity due to their perceived safety and minimal side effects, especially among younger consumers and those with sensitive scalps

- For instance, Himalaya’s Anti-Dandruff range leverages herbal actives such as tea tree oil and rosemary to target fungal growth while soothing irritation, aligning with the rising preference for holistic and preventive scalp care

- Brands are increasingly leveraging digital marketing and e-commerce channels to educate consumers on scalp health and drive product adoption. Interactive tools, influencer collaborations, and targeted social media campaigns are enhancing consumer awareness and engagement across urban and semi-urban markets.

- The market is witnessing growing demand for personalized dandruff treatment solutions tailored to individual scalp types, hair textures, and severity of symptoms. Companies are introducing customizable regimens combining medicated shampoos, leave-on serums, and scalp exfoliants to address specific needs

- Increasing incidence of dandruff linked to stress, pollution, and changing lifestyles is reinforcing the demand for regular scalp care products as part of daily hygiene routines. This dynamic is fueling sustained growth of both mass-market and premium product segments throughout Asia-Pacific

Dandruff Treatment Market Dynamics

Driver

“Rising Awareness of Scalp Health and Demand for Effective Treatment Solutions”

- The increasing prevalence of dandruff and seborrheic dermatitis across Asia-Pacific—driven by factors such as pollution, humid climates, stress, and changing haircare routines—is significantly fueling the demand for effective and convenient treatment products.

- For instance, rising disposable incomes and urbanization in countries like India, China, and Indonesia are contributing to higher spending on personal care and specialized scalp treatments

- Growing awareness among consumers about the importance of maintaining scalp hygiene and preventing recurrence is driving adoption of medicated shampoos, leave-on treatments, and herbal formulations.

- Aggressive marketing campaigns and educational initiatives by leading brands are playing a pivotal role in reducing stigma around dandruff and encouraging proactive treatment.

- The expansion of organized retail channels, e-commerce platforms, and dermatology clinics is improving product accessibility, especially in emerging economies where over-the-counter solutions are increasingly favored for mild to moderate cases. Rising incidence of skin sensitivity and allergies associated with harsh chemical treatments is boosting demand for dermatologically tested and sulfate-free formulations, further expanding the premium segment of the market.

Restraint/Challenge

“Price Sensitivity and Regulatory Complexity”

- The high cost of premium and specialized dandruff treatment products—particularly dermatologist-recommended formulations and prescription-based solutions—limits accessibility for lower-income populations across several Asia-Pacific markets.

- For instance, medicated shampoos containing patented antifungal agents or combination therapies are often priced beyond the reach of mass-market consumers, restricting widespread adoption.

- Regulatory requirements for medicated and cosmeceutical products vary significantly across the region, creating complexity for manufacturers seeking approval and market entry. Countries such as India, China, and Japan enforce distinct standards for labeling, safety testing, and marketing claims, extending product launch timelines and compliance costs.

- The presence of counterfeit and substandard dandruff treatment products in informal retail channels undermines consumer trust and poses safety risks, making it difficult for reputable brands to differentiate their offerings and maintain brand integrity.

- Data privacy concerns related to digital scalp analysis tools, mobile apps, and online consultations are emerging as more brands integrate technology into treatment personalization, creating additional compliance and trust challenges in markets with evolving data protection regulations.

Dandruff Treatment Market Scope

The market is segmented on the basis type, mode of prescription, product, drug type, age group, gender, end user and distribution type.

- By Type

On the basis of Type, the Dandruff Treatment Market is into Fungal Dandruff, Dry Skin–Related Dandruff, Oily Scalp–Related Dandruff, and Disease-Related Dandruff. The Disease-Related Dandruff segment is expected to dominate the market with the largest revenue share of 41.2% in 2025 owing to the high prevalence of Malassezia-related scalp conditions and the widespread use of antifungal shampoos and medicated treatments targeting this etiology.

The Oily Scalp–Related Dandruff segment is anticipated to witness the fastest growth rate of 5.2% from 2025 to 2032, driven by changing lifestyles, rising pollution levels, and increased awareness of targeted scalp care solutions for sebum control.

- By Mode of Prescription

On the basis of Mode of Prescription, the Dandruff Treatment market is segmented into OTC and Prescription products. The Two-Compartment Model held the largest market revenue share in 2025 due to the strong presence of over-the-counter antifungal shampoos and scalp treatments readily available in pharmacies, supermarkets, and online platforms.

The Prescription is expected to witness the fastest CAGR from 2025 to 2032, supported by the increasing incidence of chronic and severe seborrheic dermatitis cases requiring dermatologist-supervised treatment.

- By Product

On the basis of Product, the Dandruff Treatment market is segmented into Non-Medicated and Medicated. The Medicated held the largest market revenue share in 2025 reflecting strong demand for clinically proven products containing active ingredients like ketoconazole, zinc pyrithione, and selenium sulfide.

The Non-Medicated is expected to witness the fastest CAGR from 2025 to 2032, grow steadily, fueled by consumer interest in natural, herbal, and cosmetic dandruff control products.

- By Drug Type

On the basis of Drug Type, the Dandruff Treatment market is segmented into Branded and Generics. The Branded held the largest market revenue share in 2025 owing to brand trust, aggressive marketing campaigns, and premium product positioning.

The Generics is expected to witness the fastest CAGR from 2025 to 2032, as affordability and expanding generic manufacturing capacity improve access to effective treatments.

- By Age Group

On the basis of Age Group, the Dandruff Treatment market is segmented into Adults, Pediatrics, and Neonates. The Adults held the largest market revenue share in 2025 driven by the higher incidence of dandruff among the working population and the widespread use of preventive scalp care.

The Pediatrics is expected to witness the fastest CAGR from 2025 to 2032, supported by rising awareness of scalp conditions in children and the development of mild, pediatric-specific formulations

- By Gender

On the basis of Gender, the Dandruff Treatment market is segmented into Male and Female. The Male held the largest market revenue share in 2025 as dandruff prevalence is typically higher among men due to factors such as greater sebum production and shorter hair cycles.

The Female is expected to witness the fastest CAGR from 2025 to 2032, grow at a robust pace, reflecting increased adoption of premium and cosmetic solutions tailored to women’s scalp and hair care preferences.

- By End Users

On the basis of End Users, the Dandruff Treatment market is segmented into Homecare, Dermatology Centers, Specialty Clinics, and Others. The Homecare held the largest market revenue share in 2025 attributed to the convenience and affordability of self-administered treatments.

The Dermatology Centers is expected to witness the fastest CAGR from 2025 to 2032, significant growth, driven by the rising number of patients seeking professional advice for persistent and severe dandruff conditions.

- By Distribution Type

On the basis of Distribution Type, the Dandruff Treatment market is segmented into Supermarkets/Hypermarkets, Convenience Stores, Pharmacies, Retail Stores, Online Stores, and Others. The Pharmacies segment accounted for the largest market revenue share in 2024, due to strong consumer trust and widespread product availability.

The Online Stores segment is expected to witness the fastest CAGR from 2025 to 2032, reflecting the rapid adoption of e-commerce platforms, digital promotions, and doorstep delivery services across Asia-Pacific.

Dandruff Treatment Market Regional Analysis

- India dominates the Asia-Pacific Dandruff Treatment market, capturing the largest revenue share of 28.5% in 2025, driven by leadership is driven by the country’s large population base, high prevalence of dandruff due to humid climate conditions, and strong consumer awareness of scalp hygiene. India’s dynamic personal care industry is characterized by the presence of both multinational brands and established domestic players such as Hindustan Unilever, Marico, and Dabur, which actively innovate and expand their dandruff product portfolios.

- Widespread availability of medicated and herbal formulations across pharmacies, supermarkets, and e-commerce platforms supports consistent demand. Additionally, aggressive marketing campaigns and celebrity endorsements boost product visibility and consumer adoption. The rise of organized retail, growth of dermatology clinics in metropolitan areas such as Mumbai, Delhi, and Bangalore, and increasing disposable incomes further strengthen India’s market position. The shift toward natural, sulfate-free, and pH-balanced treatments is a prominent trend fueling premium product sales.

China Dandruff Treatment Market Insight

The China Dandruff Treatment Market is expected to witness robust growth over the forecast period, supported by rapid urbanization, lifestyle changes, and higher spending on premium personal care products. Large urban centers such as Shanghai, Beijing, and Guangzhou are experiencing increased demand for medicated shampoos and specialist treatments addressing dandruff and seborrheic dermatitis. China’s thriving e-commerce ecosystem—led by platforms like Tmall and JD.com—facilitates wide distribution of domestic and imported products, including international brands like Head & Shoulders, Selsun Blue, and Kérastase. The growing middle-class population, combined with heightened awareness about scalp health and the availability of dermatologist-recommended solutions, is driving market expansion. Additionally, regulatory efforts to improve product quality and safety standards are strengthening consumer trust in both medicated and cosmetic dandruff treatments.

Japan Dandruff Treatment Market Insight

The Japan Dandruff Treatment Market is poised for steady growth, underpinned by an aging population increasingly seeking gentle, effective scalp care and by consumers’ preference for high-quality, dermatologically tested products. Leading personal care manufacturers such as Kao Corporation and Shiseido have introduced specialized formulations catering to sensitive skin, dry scalp, and chronic dandruff concerns. Consumers in Japan exhibit strong brand loyalty, favoring products with clinical validation and innovative delivery systems. Demand is further reinforced by the popularity of multifunctional haircare regimens that combine dandruff prevention with hair nourishment and scalp rejuvenation. Urban centers including Tokyo, Osaka, and Nagoya are key hubs for product launches and promotional campaigns. Rising consumer interest in natural and additive-free formulations is also supporting growth in the premium segment.

Dandruff Treatment Market Share

The Dandruff Treatment industry is primarily led by well-established companies, including:

- Hindustan Unilever Limited (India)

- Procter & Gamble (U.S.)

- L’Oréal S.A. (France)

- Johnson & Johnson Services, Inc. (U.S.)

- The Himalaya Drug Company (India)

- Kao Corporation (Japan)

- Shiseido Company, Limited (Japan)

- Marico Limited (India)

- Unza International Ltd (Singapore)

- Dabur India Ltd. (India)

- Galderma S.A. (Switzerland)

- Cipla Ltd. (India)

- Reckitt Benckiser Group plc (U.K.)

- Alpecin (Dr. Wolff Group) (Germany)

- Henkel AG & Co. KGaA (Germany)

- HeadBlade, Inc. (U.S.)

- Phyto – Laboratoire Native (France)

- VLCC Personal Care Ltd. (India)

- Lotus Herbals Pvt. Ltd. (India)

- Emami Limited (India)

Latest Developments in Asia-Pacific Dandruff Treatment Market

- In May 2025, Hindustan Unilever Limited launched the Clear Complete Care Advanced Anti-Dandruff Shampoo in India and Southeast Asia, featuring a pH-balanced formulation with activated charcoal and clinically proven actives to target persistent dandruff while maintaining scalp hydration. This reflects the growing consumer demand for multifunctional, dermatologically tested solutions in the region.

- In February 2025, Marico Limited introduced an upgraded Parachute Advansed Ayurvedic Anti-Dandruff Hair Oil across India and Bangladesh, incorporating neem, rosemary, and tea tree oil. The launch underscores the strong market trend toward natural and herbal formulations for preventive scalp care.

- In November 2024, Johnson & Johnson Services, Inc. expanded the availability of Neutrogena T/Gel Therapeutic Shampoo in Japan, South Korea, and Australia through major e-commerce platforms and pharmacy chains, supporting the rising preference for dermatologist-recommended treatments across Asia-Pacific.

- In August 2024, L’Oréal S.A. launched a new Kérastase Symbiose range in China and Singapore, combining salicylic acid and piroctone olamine for intensive dandruff control and scalp barrier repair, addressing demand for premium, salon-grade treatments.

- In March 2024, The Himalaya Drug Company introduced an enhanced Anti-Dandruff Shampoo Gentle Care variant with improved antifungal efficacy and sulfate-free formulation in India and Malaysia, catering to consumers seeking mild, daily-use products for sensitive scalps.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC DANDRUFF TREATMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 REGULATORY SCENARIO FOR DANDRUFF TREATMENT

4.1.1 JAPAN REGULATORY SCENARIO FOR DANDRUFF TREATMENT

4.1.2 CHINA REGULATORY SCENARIO FOR DANDRUFF TREATMENT

4.1.3 EUROPEAN REGULATORY SCENARIO FOR DANDRUFF TREATMENT

5 EPIDEMIOLOGY

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING NUMBER OF MALASSEZIA SPECIES IN ENVIRONMENT

6.1.2 INCREASING PREVALENCE OF HIV

6.1.3 RISING AWARENESS REGARDING THE TARGET DISEASE

6.1.4 INCREASING LEVEL OF STRESS

6.1.5 CHANGING LIFESTYLE AND GROWING URBANIZATION

6.2 RESTRAINTS

6.2.1 INCREASING ADOPTION OF NO-POO CAMPAIGN

6.2.2 AVAILABILITY OF VARIOUS DANDRUFF TREATMENT SUBSTITUES

6.2.3 SIDE EFFECTS OF DANDRUFF TREATMENT PRODUCTS

6.3 OPPORTUNITIES

6.3.1 INTRODUCTION OF INNOVATIVE PRODUCTS

6.3.2 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.3 INCREASING E-COMMERCE OF HAIR CARE PRODUCTS

6.3.4 RISING DISPOSABLE INCOME

6.4 CHALLENGES

6.4.1 PRODUCT RECALL

6.4.2 INCREASING PREVALENCE OF COVID-19

6.4.3 ENVIRONMENTAL ISSUES WITH SHAMPOOS BOTTLE DISPOSAL

7 COVID-19 IMPACT ON ASIA-PACIFIC DANDRUFF TREATMENT MARKET

7.1 PRICE IMPACT

7.2 IMPACT ON DEMAND

7.3 IMPACT ON SUPPLY CHAIN

7.4 STRATEGIC DECISIONS FOR MANUFACTURERS

7.5 CONCLUSION

8 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY TYPE

8.1 OVERVIEW

8.2 FUNGAL DANDRUFF

8.3 DRY SKIN-RELATED DANDRUFF

8.4 OILY SCALP-RELATED DANDRUFF

8.5 DISEASE RELATED DANDRUFF

9 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY MODE OF PRESCRIPTION

9.1 OVERVIEW

9.2 OTC

9.3 PRESCRIPTION

10 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY PRODUCT

10.1 OVERVIEW

10.2 NON- MEDICATED

10.2.1 SHAMPOO

10.2.1.1 Anti- Dandruff Shampoo

10.2.1.1.1 Neem

10.2.1.1.2 Tea Tree

10.2.1.1.3 Reetha

10.2.1.1.4 Jujube Bark Extract

10.2.1.1.5 Coconut

10.2.1.1.6 Hibiscus

10.2.1.1.7 Others

10.2.1.2 Normal Shampoo

10.2.1.2.1 Normal Hair Shampoo

10.2.1.2.2 Oily Hair Shampoo

10.2.1.2.3 Dry, Damaged Hair Shampoo

10.2.1.2.4 Volumizing Shampoo

10.2.1.2.5 Others

10.2.2 OILS

10.2.2.1 Coconut Oil

10.2.2.2 Eucalyptus

10.2.2.3 Lemon Oil

10.2.2.4 Sunflower

10.2.2.5 Almond Oil

10.2.2.6 Argan Oil

10.2.2.7 Others

10.2.3 SERUM

10.2.3.1 Tea Tree

10.2.3.2 Eucalyptus

10.2.3.3 Piroctone Olamine

10.2.3.4 Camphor

10.2.3.5 Peppermint

10.2.3.6 Basil & Cedarwood

10.2.3.7 Rosemary

10.2.3.8 Lemon

10.2.3.9 Others

10.2.4 HAIR MASK

10.2.4.1 Tea Tree Oil

10.2.4.2 Lemon Oil

10.2.4.3 Argan Oil

10.2.4.4 Others

10.2.5 OTHERS

10.3 MEDICATED

10.3.1 SHAMPOO

10.3.1.1 Anti-Dandruff Shampoos

10.3.1.1.1 Pyrithione Zinc Shampoos(Dermazinc, Head & Shoulders, Jason Dandruff Relief 2 in 1, Others)

10.3.1.1.2 Selenium Sulfide Shampoos (Head & Shoulders Intensive, Selsun Blue, Others)

10.3.1.1.3 Shampoos Containing Salicylic Acid (Neutrogena T/Sal Shampoo, Baker's P & S, Others)

10.3.1.1.4 Ketoconazole Shampoos (Nizoral A-D, Extina, Others)

10.3.1.1.5 Tar-Based Shampoos (Neutrogena T/Gel, Scytera, Others)

10.3.1.1.6 Others

10.3.1.2 Normal Shampoos

10.3.1.2.1 Normal Hair Shampoos

10.3.1.2.2 Oily Hair Shampoos

10.3.1.2.3 Dry, Damaged Hair Shampoo

10.3.1.2.4 Volumizing Shampoo

10.3.1.2.5 Others

10.3.2 DRY SHAMPOOS

10.3.2.1 Denatured Alcohol

10.3.2.2 Magnesium Stearate

10.3.2.3 Laminaria Saccharina Extract

10.3.2.4 Others

11 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY DRUG TYPE

11.1 OVERVIEW

11.2 BRANDED

11.3 GENERICS

12 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY AGE GROUP

12.1 OVERVIEW

12.2 ADULTS

12.3 PEDIATRICS

12.4 NEONATES

13 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY GENDER

13.1 OVERVIEW

13.2 MALE

13.3 FEMALE

14 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY END USER

14.1 7.1 OVERVIEW

15 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY DISTRIBUTION TYPEE

15.1 OVERVIEW

15.2 SUPERMARKETS /HYPERMARKETS

15.3 CONVENIENCE STORES

15.4 PHARMACIES

15.5 RETAIL STORES

15.6 ONLINE STORES

15.7 OTHERS

16 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY GEOGRAPHY

16.1 ASIA-PACIFIC

16.1.1 CHINA

16.1.2 JAPAN

16.1.3 INDIA

16.1.4 AUSTRALIA

16.1.5 SOUTH KOREA

16.1.6 SINGAPORE

16.1.7 THAILAND

16.1.8 MALAYSIA

16.1.9 INDONESIA

16.1.10 PHILIPPINES

16.1.11 VIETNAM

16.1.12 REST OF ASIA-PACIFIC

17 ASIA-PACIFIC DANDRUFF TREATMENT MARKET: COMPANY LANDSCAPE

17.1 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, COMPANY LANDSCAPE

17.1.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

18 SWOT ANALYSIS

19 COMPANY PROFILES

19.1 PROCTER & GAMBLE

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENT

19.2 UNILEVER

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 L'ORÉAL

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENTS

19.4 KAO CORPORATION

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENT

19.5 JOHNSON & JOHNSON CONSUMER INC. (A SUBSIDIARY OF JOHNSON & JOHNSON SERVICES, INC.)

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENT

19.6 ACTICON LIFE SCIENCES

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT DEVELOPMENT

19.7 ALLIANCE PHARMA PLC

19.7.1 COMPANY SNAPSHOT

19.7.2 REVENUE ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT DEVELOPMENTS

19.8 ARCADIA CONSUMER HEALTHCARE

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENTS

19.9 ARION HEALTHCARE

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENT S

19.1 CIPLA INC.

19.10.1 COMPANY SNAPSHOT

19.10.2 REVENUE ANALYSIS

19.10.3 PRODUCT PORTFOLIO

19.10.4 RECENT DEVELOPMENT

19.11 DABUR

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENT

19.12 GLENMARK PHARMACEUTICALS LIMITED

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT DEVELOPMENT

19.13 HENKEL AG & CO. KGAA

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUE ANALYSIS

19.13.3 PRODUCT PORTFOLIO

19.13.4 RECENT DEVELOPMENTS

19.14 JĀSÖN® NATURAL PRODUCTS, INC. (A SUBSIDIARY OF HAIN CELESTIAL)

19.14.1 COMPANY SNAPSHOT

19.14.2 REVENUE ANALYSIS

19.14.3 PRODUCT PORTFOLIO

19.14.4 RECENT DEVELOPMENT

19.15 JOHN PAUL MITCHELL SYSTEMS

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENTS

19.16 L'OCCITANE EN PROVENCE INTERNATIONAL SA. (A SUBSIDIARY OF GROUPE L'OCCITANE)

19.16.1 COMPANY SNAPSHOT

19.16.2 REVENUE ANALYSIS

19.16.3 PRODUCT PORTFOLIO

19.16.4 RECENT DEVELOPMENTS

19.17 M.M. AYURVEDIC (P) LTD.

19.17.1 COMPANY SNAPSHOT

19.17.2 PRODUCT PORTFOLIO

19.17.3 RECENT DEVELOPMENT

19.18 NIKOLE KOZMETICS

19.18.1 COMPANY SNAPSHOT

19.18.2 PRODUCT PORTFOLIO

19.18.3 RECENT DEVELOPMENT

19.19 PHILIP KINGSLEY PRODUCTS LTD.

19.19.1 COMPANY SNAPSHOT

19.19.2 PRODUCT PORTFOLIO

19.19.3 RECENT DEVELOPMENTS

19.2 PHYTO

19.20.1 COMPANY SNAPSHOT

19.20.2 PRODUCT PORTFOLIO

19.20.3 RECENT DEVELOPMENT

19.21 SEBAPHARMA GMBH & CO. KG

19.21.1 COMPANY SNAPSHOT

19.21.2 PRODUCT PORTFOLIO

19.21.3 RECENT DEVELOPMENT

19.22 SOVEREIGN CHEMICALS & COSMETICS

19.22.1 COMPANY SNAPSHOT

19.22.2 PRODUCT PORTFOLIO

19.22.3 RECENT DEVELOPMENT

19.23 VYOME THERAPEUTICS INC.

19.23.1 COMPANY SNAPSHOT

19.23.2 PRODUCT PORTFOLIO

19.23.3 RECENT DEVELOPMENTS

19.24 VIENCEE PHARMA SCIENCE

19.24.1 COMPANY SNAPSHOT

19.24.2 PRODUCT PORTFOLIO

19.24.3 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

List of Table

LIST OF TABLES

TABLE 1 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 2 ASIA-PACIFIC FUNGAL DANDRUFF IN DANDRUFF TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 3 ASIA-PACIFIC DRY SKIN-RELATED DANDRUFF IN DANDRUFF TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 4 ASIA-PACIFIC OILY SCALP-RELATED IN DANDRUFF TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 5 ASIA-PACIFIC DISEASE RELATED IN DANDRUFF TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 6 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY MODE OF PRESCRIPTION, 2019-2028 (USD MILLION)

TABLE 7 ASIA-PACIFIC OVER-THE-COUNTER IN DANDRUFF TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 8 ASIA-PACIFIC PRESCRIPTION IN DANDRUFF TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 9 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY TYPE, 2018-2028 (USD MILLION)

TABLE 10 ASIA-PACIFIC NON- MEDICATED IN DANDRUFF TREATMENT MARKET, BY REGION, 2017-2027 (USD MILLION)

TABLE 11 ASIA-PACIFIC NON-MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 12 ASIA-PACIFIC SHAMPOO IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 13 ASIA-PACIFIC ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 14 ASIA-PACIFIC NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 15 ASIA-PACIFIC OILS IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 16 ASIA-PACIFIC SERUM IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 17 ASIA-PACIFIC HAIR MASK IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 18 ASIA-PACIFIC MEDICATED IN DANDRUFF TREATMENT MARKET, BY REGION, 2017-2027 (USD MILLION)

TABLE 19 ASIA-PACIFIC MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 20 ASIA-PACIFIC SHAMPOO IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 21 ASIA-PACIFIC ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 22 ASIA-PACIFIC NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 23 ASIA-PACIFIC DRY SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 24 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 25 ASIA-PACIFIC BRANDED IN DANDRUFF TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 26 ASIA-PACIFIC GENERICS IN DANDRUFF TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 27 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY AGE GROUP, 2019-2028 (USD MILLION)

TABLE 28 ASIA-PACIFIC ADULTS IN DANDRUFF TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 29 ASIA-PACIFIC PEDIATRICS IN DANDRUFF TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 30 ASIA-PACIFIC NEONATES IN DANDRUFF TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 31 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY GENDER, 2019-2028 (USD MILLION)

TABLE 32 ASIA-PACIFIC MALE IN DANDRUFF TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 33 ASIA-PACIFIC FEMALE IN DANDRUFF TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 34 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 35 ASIA-PACIFIC HOMECARE IN DANDRUFF TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 36 ASIA-PACIFIC DERMATOLOGY CENTERS IN DANDRUFF TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 37 ASIA-PACIFIC SPECIALTY CLINICS IN DANDRUFF TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 38 ASIA-PACIFIC OTHERS IN DANDRUFF TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 39 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY DISTRIBUTION TYPE, 2019-2028 (USD MILLION)

TABLE 40 ASIA-PACIFIC SUPERMARKETS /HYPERMARKETS IN DANDRUFF TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 41 ASIA-PACIFIC CONVENIENCE STORES IN DANDRUFF TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 42 ASIA-PACIFIC PHARMACIES IN DANDRUFF TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 43 ASIA-PACIFIC RETAIL STORES IN DANDRUFF TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 44 ASIA-PACIFIC ONLINE STORES IN DANDRUFF TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 45 ASIA-PACIFIC OTHERS IN DANDRUFF TREATMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 46 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 47 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 48 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY MODE OF PRESCRIPTION, 2019-2028 (USD MILLION)

TABLE 49 SIA-PACIFIC DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 50 ASIA-PACIFIC NON-MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 51 ASIA-PACIFIC SHAMPOO IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 52 ASIA-PACIFIC ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 53 ASIA-PACIFIC NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 54 ASIA-PACIFIC OILS IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 55 ASIA-PACIFIC SERUM IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 56 ASIA-PACIFIC HAIR MASK IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 57 ASIA-PACIFIC MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 58 ASIA-PACIFIC SHAMPOO IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 59 ASIA-PACIFIC ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 60 ASIA-PACIFIC DRY SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 61 ASIA-PACIFIC NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 62 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 63 ASIA-PACIFIC MEDICATED IN DANDRUFF TREATMENT MARKET, BY AGE GROUP, 2019-2028 (USD MILLION)

TABLE 64 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY GENDER, 2019-2028 (USD MILLION)

TABLE 65 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 66 ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY DISTRIBUTION TYPE, 2019-2028 (USD MILLION)

TABLE 67 CHINA DANDRUFF TREATMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 68 CHINA DANDRUFF TREATMENT MARKET, BY MODE OF PRESCRIPTION, 2019-2028 (USD MILLION)

TABLE 69 CHINA DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 70 CHINA NON-MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 71 CHINA SHAMPOO IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 72 CHINA ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 73 CHINA NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 74 CHINA OILS IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 75 CHINA SERUM IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 76 CHINA HAIR MASK IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 77 CHINA MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 78 CHINA SHAMPOO IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 79 CHINA ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 80 CHINA DRY SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 81 CHINA NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 82 CHINA DANDRUFF TREATMENT MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 83 CHINA MEDICATED IN DANDRUFF TREATMENT MARKET, BY AGE GROUP, 2019-2028 (USD MILLION)

TABLE 84 CHINA DANDRUFF TREATMENT MARKET, BY GENDER, 2019-2028 (USD MILLION)

TABLE 85 CHINA DANDRUFF TREATMENT MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 86 CHINA DANDRUFF TREATMENT MARKET, BY DISTRIBUTION TYPE, 2019-2028 (USD MILLION)

TABLE 87 JAPAN DANDRUFF TREATMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 88 JAPAN DANDRUFF TREATMENT MARKET, BY MODE OF PRESCRIPTION, 2019-2028 (USD MILLION)

TABLE 89 JAPAN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 90 JAPAN NON-MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 91 JAPAN SHAMPOO IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 92 JAPAN ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 93 JAPAN NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 94 JAPAN OILS IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 95 JAPAN SERUM IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 96 JAPAN HAIR MASK IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 97 JAPAN MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 98 JAPAN SHAMPOO IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 99 JAPAN ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 100 JAPAN DRY SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 101 JAPAN NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 102 JAPAN DANDRUFF TREATMENT MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 103 JAPAN MEDICATED IN DANDRUFF TREATMENT MARKET, BY AGE GROUP, 2019-2028 (USD MILLION)

TABLE 104 JAPAN DANDRUFF TREATMENT MARKET, BY GENDER, 2019-2028 (USD MILLION)

TABLE 105 JAPAN DANDRUFF TREATMENT MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 106 JAPAN DANDRUFF TREATMENT MARKET, BY DISTRIBUTION TYPE, 2019-2028 (USD MILLION)

TABLE 107 INDIA DANDRUFF TREATMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 108 INDIA DANDRUFF TREATMENT MARKET, BY MODE OF PRESCRIPTION, 2019-2028 (USD MILLION)

TABLE 109 INDIA DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 110 INDIA NON-MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 111 INDIA SHAMPOO IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 112 INDIA ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 113 INDIA NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 114 INDIA OILS IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 115 INDIA SERUM IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 116 INDIA HAIR MASK IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 117 INDIA MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 118 INDIA SHAMPOO IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 119 INDIA ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 120 INDIA DRY SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 121 INDIA NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 122 INDIA DANDRUFF TREATMENT MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 123 INDIA MEDICATED IN DANDRUFF TREATMENT MARKET, BY AGE GROUP, 2019-2028 (USD MILLION)

TABLE 124 INDIA DANDRUFF TREATMENT MARKET, BY GENDER, 2019-2028 (USD MILLION)

TABLE 125 INDIA DANDRUFF TREATMENT MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 126 INDIA DANDRUFF TREATMENT MARKET, BY DISTRIBUTION TYPE, 2019-2028 (USD MILLION)

TABLE 127 AUSTRALIA DANDRUFF TREATMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 128 AUSTRALIA DANDRUFF TREATMENT MARKET, BY MODE OF PRESCRIPTION, 2019-2028 (USD MILLION)

TABLE 129 AUSTRALIA DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 130 AUSTRALIA NON-MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 131 AUSTRALIA SHAMPOO IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 132 AUSTRALIA ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 133 AUSTRALIA NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 134 AUSTRALIA OILS IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 135 AUSTRALIA SERUM IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 136 AUSTRALIA HAIR MASK IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 137 AUSTRALIA MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 138 AUSTRALIA SHAMPOO IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 139 AUSTRALIA ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 140 AUSTRALIA DRY SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 141 AUSTRALIA NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 142 AUSTRALIA DANDRUFF TREATMENT MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 143 AUSTRALIA MEDICATED IN DANDRUFF TREATMENT MARKET, BY AGE GROUP, 2019-2028 (USD MILLION)

TABLE 144 AUSTRALIA DANDRUFF TREATMENT MARKET, BY GENDER, 2019-2028 (USD MILLION)

TABLE 145 AUSTRALIA DANDRUFF TREATMENT MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 146 AUSTRALIA DANDRUFF TREATMENT MARKET, BY DISTRIBUTION TYPE, 2019-2028 (USD MILLION)

TABLE 147 SOUTH KOREA DANDRUFF TREATMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 148 SOUTH KOREA DANDRUFF TREATMENT MARKET, BY MODE OF PRESCRIPTION, 2019-2028 (USD MILLION)

TABLE 149 SOUTH KOREA DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 150 SOUTH KOREA NON-MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 151 SOUTH KOREA SHAMPOO IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 152 SOUTH KOREA ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 153 SOUTH KOREA NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 154 SOUTH KOREA OILS IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 155 SOUTH KOREA SERUM IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 156 SOUTH KOREA HAIR MASK IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 157 SOUTH KOREA MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 158 SOUTH KOREA SHAMPOO IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 159 SOUTH KOREA ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 160 SOUTH KOREA DRY SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 161 SOUTH KOREA NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 162 SOUTH KOREA DANDRUFF TREATMENT MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 163 SOUTH KOREA MEDICATED IN DANDRUFF TREATMENT MARKET, BY AGE GROUP, 2019-2028 (USD MILLION)

TABLE 164 SOUTH KOREA DANDRUFF TREATMENT MARKET, BY GENDER, 2019-2028 (USD MILLION)

TABLE 165 SOUTH KOREA DANDRUFF TREATMENT MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 166 SOUTH KOREA DANDRUFF TREATMENT MARKET, BY DISTRIBUTION TYPE, 2019-2028 (USD MILLION)

TABLE 167 SINGAPORE DANDRUFF TREATMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 168 SINGAPORE DANDRUFF TREATMENT MARKET, BY MODE OF PRESCRIPTION, 2019-2028 (USD MILLION)

TABLE 169 SINGAPORE DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 170 SINGAPORE NON-MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 171 SINGAPORE SHAMPOO IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 172 SINGAPORE ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 173 SINGAPORE NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 174 SINGAPORE OILS IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 175 SINGAPORE SERUM IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 176 SINGAPORE HAIR MASK IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 177 SINGAPORE MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 178 SINGAPORE SHAMPOO IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 179 SINGAPORE ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 180 SINGAPORE DRY SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 181 SINGAPORE NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 182 SINGAPORE DANDRUFF TREATMENT MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 183 SINGAPORE MEDICATED IN DANDRUFF TREATMENT MARKET, BY AGE GROUP, 2019-2028 (USD MILLION)

TABLE 184 SINGAPORE DANDRUFF TREATMENT MARKET, BY GENDER, 2019-2028 (USD MILLION)

TABLE 185 SINGAPORE DANDRUFF TREATMENT MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 186 SINGAPORE DANDRUFF TREATMENT MARKET, BY DISTRIBUTION TYPE, 2019-2028 (USD MILLION)

TABLE 187 THAILAND DANDRUFF TREATMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 188 THAILAND DANDRUFF TREATMENT MARKET, BY MODE OF PRESCRIPTION, 2019-2028 (USD MILLION)

TABLE 189 THAILAND DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 190 THAILAND NON-MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 191 THAILAND SHAMPOO IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 192 THAILAND ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 193 THAILAND NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 194 THAILAND OILS IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 195 THAILAND SERUM IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 196 THAILAND HAIR MASK IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 197 THAILAND MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 198 THAILAND SHAMPOO IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 199 THAILAND ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 200 THAILAND DRY SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 201 THAILAND NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 202 THAILAND DANDRUFF TREATMENT MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 203 THAILAND MEDICATED IN DANDRUFF TREATMENT MARKET, BY AGE GROUP, 2019-2028 (USD MILLION)

TABLE 204 THAILAND DANDRUFF TREATMENT MARKET, BY GENDER, 2019-2028 (USD MILLION)

TABLE 205 THAILAND DANDRUFF TREATMENT MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 206 THAILAND DANDRUFF TREATMENT MARKET, BY DISTRIBUTION TYPE, 2019-2028 (USD MILLION)

TABLE 207 MALAYSIA DANDRUFF TREATMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 208 MALAYSIA DANDRUFF TREATMENT MARKET, BY MODE OF PRESCRIPTION, 2019-2028 (USD MILLION)

TABLE 209 MALAYSIA DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 210 MALAYSIA NON-MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 211 MALAYSIA SHAMPOO IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 212 MALAYSIA ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 213 MALAYSIA NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 214 MALAYSIA OILS IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 215 MALAYSIA SERUM IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 216 MALAYSIA HAIR MASK IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 217 MALAYSIA MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 218 MALAYSIA SHAMPOO IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 219 MALAYSIA ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 220 MALAYSIA DRY SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 221 MALAYSIA NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 222 MALAYSIA DANDRUFF TREATMENT MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 223 MALAYSIA MEDICATED IN DANDRUFF TREATMENT MARKET, BY AGE GROUP, 2019-2028 (USD MILLION)

TABLE 224 MALAYSIA DANDRUFF TREATMENT MARKET, BY GENDER, 2019-2028 (USD MILLION)

TABLE 225 MALAYSIA DANDRUFF TREATMENT MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 226 MALAYSIA DANDRUFF TREATMENT MARKET, BY DISTRIBUTION TYPE, 2019-2028 (USD MILLION)

TABLE 227 INDONESIA DANDRUFF TREATMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 228 INDONESIA DANDRUFF TREATMENT MARKET, BY MODE OF PRESCRIPTION, 2019-2028 (USD MILLION)

TABLE 229 INDONESIA DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 230 INDONESIA NON-MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 231 INDONESIA SHAMPOO IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 232 INDONESIA ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 233 INDONESIA NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 234 INDONESIA OILS IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 235 INDONESIA SERUM IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 236 INDONESIA HAIR MASK IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 237 INDONESIA MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 238 INDONESIA SHAMPOO IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 239 INDONESIA ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 240 INDONESIA DRY SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 241 INDONESIA NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 242 INDONESIA DANDRUFF TREATMENT MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 243 INDONESIA MEDICATED IN DANDRUFF TREATMENT MARKET, BY AGE GROUP, 2019-2028 (USD MILLION)

TABLE 244 INDONESIA DANDRUFF TREATMENT MARKET, BY GENDER, 2019-2028 (USD MILLION)

TABLE 245 INDONESIA DANDRUFF TREATMENT MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 246 INDONESIA DANDRUFF TREATMENT MARKET, BY DISTRIBUTION TYPE, 2019-2028 (USD MILLION)

TABLE 247 PHILIPPINES DANDRUFF TREATMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 248 PHILIPPINES DANDRUFF TREATMENT MARKET, BY MODE OF PRESCRIPTION, 2019-2028 (USD MILLION)

TABLE 249 PHILIPPINES DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 250 PHILIPPINES NON-MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 251 PHILIPPINES SHAMPOO IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 252 PHILIPPINES ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 253 PHILIPPINES NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 254 PHILIPPINES OILS IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 255 PHILIPPINES SERUM IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 256 PHILIPPINES HAIR MASK IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 257 PHILIPPINES MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 258 PHILIPPINES SHAMPOO IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 259 PHILIPPINES ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 260 PHILIPPINES DRY SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 261 PHILIPPINES NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 262 PHILIPPINES DANDRUFF TREATMENT MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 263 PHILIPPINES MEDICATED IN DANDRUFF TREATMENT MARKET, BY AGE GROUP, 2019-2028 (USD MILLION)

TABLE 264 PHILIPPINES DANDRUFF TREATMENT MARKET, BY GENDER, 2019-2028 (USD MILLION)

TABLE 265 PHILIPPINES DANDRUFF TREATMENT MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 266 PHILIPPINES DANDRUFF TREATMENT MARKET, BY DISTRIBUTION TYPE, 2019-2028 (USD MILLION)

TABLE 267 VIETNAM DANDRUFF TREATMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 268 VIETNAM DANDRUFF TREATMENT MARKET, BY MODE OF PRESCRIPTION, 2019-2028 (USD MILLION)

TABLE 269 VIETNAM DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 270 VIETNAM NON-MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 271 VIETNAM SHAMPOO IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 272 VIETNAM ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 273 VIETNAM NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (NON-MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 274 VIETNAM OILS IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 275 VIETNAM SERUM IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 276 VIETNAM HAIR MASK IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 277 VIETNAM MEDICATED IN DANDRUFF TREATMENT MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 278 VIETNAM SHAMPOO IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 279 VIETNAM ANTI-DANDRUFF SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 280 VIETNAM DRY SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 281 VIETNAM NORMAL SHAMPOOS IN DANDRUFF TREATMENT MARKET (MEDICATED), BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 282 VIETNAM DANDRUFF TREATMENT MARKET, BY DRUG TYPE, 2019-2028 (USD MILLION)

TABLE 283 VIETNAM MEDICATED IN DANDRUFF TREATMENT MARKET, BY AGE GROUP, 2019-2028 (USD MILLION)

TABLE 284 IETNAM DANDRUFF TREATMENT MARKET, BY GENDER, 2019-2028 (USD MILLION)

TABLE 285 VIETNAM DANDRUFF TREATMENT MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 286 VIETNAM DANDRUFF TREATMENT MARKET, BY DISTRIBUTION TYPE, 2019-2028 (USD MILLION)

TABLE 287 REST OF ASIA-PACIFIC DANDRUFF TREATMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

List of Figure

LIST OF FIGURES

FIGURE 1 ASIA-PACIFIC DANDRUFF TREATMENT MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC DANDRUFF TREATMENT MARKET : DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC DANDRUFF TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC DANDRUFF TREATMENT MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC DANDRUFF TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC DANDRUFF TREATMENT MARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA-PACIFIC DANDRUFF TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC DANDRUFF TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC DANDRUFF TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA-PACIFIC DANDRUFF TREATMENT MARKET: SEGMENTATION

FIGURE 11 INCREASING NUMBER OF MALASSEZIA SPECIES IN ENVIRONMENT AND INCREASING PREVALENCE OF HIV ARE DRIVING THE ASIA-PACIFIC DANDRUFF TREATMENT MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 FUNGAL DANDRUFF TREATMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC DANDRUFF TREATMENT MARKET IN 2021 & 2028

FIGURE 13 ASIA-PACIFIC IS THE FASTEST GROWING MARKET IN ASIA-PACIFIC DANDRUFF TREATMENT MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA-PACIFIC DANDRUFF TREATMENT MARKET

FIGURE 15 HIV INFECTION IN 2018 ACROSS DIFFERENT REGIONS OF WORLD

FIGURE 16 PERCENTAGE OF INTERNET USERS IN 2016 AND 2019

FIGURE 17 ASIA-PACIFIC DANDRUFF TREATMENTMARKET: BY TYPE, 2020

FIGURE 18 ASIA-PACIFIC DANDRUFF TREATMENTMARKET: BY TYPE, 2020-2028 (USD MILLION)

FIGURE 19 ASIA-PACIFIC DANDRUFF TREATMENTMARKET: BY TYPE, CAGR (2021-2028)

FIGURE 20 ASIA-PACIFIC DANDRUFF TREATMENTMARKET: BY TYPE, LIFELINE CURVE

FIGURE 21 ASIA-PACIFIC DANDRUFF TREATMENTMARKET: BY MODE OF PRESCRIPTION, 2020

FIGURE 22 ASIA-PACIFIC DANDRUFF TREATMENTMARKET: BY MODE OF PRESCRIPTION, 2020-2028 (USD MILLION)

FIGURE 23 ASIA-PACIFIC DANDRUFF TREATMENTMARKET: BY MODE OF PRESCRIPTION, CAGR (2021-2028).

FIGURE 24 ASIA-PACIFIC DANDRUFF TREATMENTMARKET: BY MODE OF PRESCRIPTION, LIFELINE CURVE

FIGURE 25 ASIA-PACIFIC DANDRUFF TREATMENT MARKET: BY TYPE, 2020

FIGURE 26 ASIA-PACIFIC DANDRUFF TREATMENT MARKET: BY TYPE, 2020-2028 (USD MILLION)

FIGURE 27 ASIA-PACIFIC DANDRUFF TREATMENT MARKET: BY TYPE, CAGR (2021-2028)

FIGURE 28 ASIA-PACIFIC DANDRUFF TREATMENT MARKET: BY TYPE, LIFELINE CURVE

FIGURE 29 ASIA-PACIFIC DANDRUFF TREATMENTMARKET: BY DRUG TYPE, 2020

FIGURE 30 ASIA-PACIFIC DANDRUFF TREATMENTMARKET: BY DRUG TYPE, 2020-2028 (USD MILLION)

FIGURE 31 ASIA-PACIFIC DANDRUFF TREATMENTMARKET: BY DRUG TYPE, CAGR (2021-2028)

FIGURE 32 ASIA-PACIFIC DANDRUFF TREATMENTMARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 33 ASIA-PACIFIC DANDRUFF TREATMENTMARKET: BY AGE GROUP, 2020

FIGURE 34 ASIA-PACIFIC DANDRUFF TREATMENTMARKET: BY AGE GROUP, 2020-2028 (USD MILLION)

FIGURE 35 ASIA-PACIFIC DANDRUFF TREATMENTMARKET: BY AGE GROUP, CAGR (2021-2028)

FIGURE 36 ASIA-PACIFIC DANDRUFF TREATMENTMARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 37 ASIA-PACIFIC DANDRUFF TREATMENTMARKET: BY GENDER, 2020

FIGURE 38 ASIA-PACIFIC DANDRUFF TREATMENTMARKET: BY GENDER, 2020-2028 (USD MILLION)

FIGURE 39 ASIA-PACIFIC DANDRUFF TREATMENTMARKET: BY GENDER, CAGR (2021-2028)

FIGURE 40 ASIA-PACIFIC DANDRUFF TREATMENTMARKET: BY GENDER, LIFELINE CURVE

FIGURE 41 ASIA-PACIFIC DANDRUFF TREATMENT MARKET: BY END USER, 2020

FIGURE 42 ASIA-PACIFIC DANDRUFF TREATMENT MARKET: BY END USER, 2020-2028 (USD MILLION)

FIGURE 43 ASIA-PACIFIC DANDRUFF TREATMENT MARKET: BY END USER, CAGR (2021-2028)

FIGURE 44 ASIA-PACIFIC DANDRUFF TREATMENT MARKET: BY END USER, LIFELINE CURVE

FIGURE 45 ASIA-PACIFIC DANDRUFF TREATMENTMARKET: BY DISTRIBUTION TYPE, 2020

FIGURE 46 ASIA-PACIFIC DANDRUFF TREATMENTMARKET: BY DISTRIBUTION TYPE, 2020-2028 (USD MILLION)

FIGURE 47 ASIA-PACIFIC DANDRUFF TREATMENTMARKET: BY DISTRIBUTION TYPE, CAGR (2021-2028)

FIGURE 48 ASIA-PACIFIC DANDRUFF TREATMENTMARKET: BY DISTRIBUTION TYPE, LIFELINE CURVE

FIGURE 49 ASIA-PACIFIC DANDRUFF TREATMENT MARKET: SNAPSHOT (2020)

FIGURE 50 ASIA-PACIFIC DANDRUFF TREATMENT MARKET: BY COUNTRY (2020)

FIGURE 51 ASIA-PACIFIC DANDRUFF TREATMENT MARKET: BY COUNTRY (2021 & 2028)

FIGURE 52 ASIA-PACIFIC DANDRUFF TREATMENT MARKET: BY COUNTRY (2020 & 2028)

FIGURE 53 ASIA-PACIFIC DANDRUFF TREATMENT MARKET: BY TYPE (2021-2028)

FIGURE 54 ASIA-PACIFIC DANDRUFF TREATMENT MARKET: COMPANY SHARE 2020 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.