Asia Pacific Dental Membrane And Bone Graft Substitute Market

Market Size in USD Million

CAGR :

%

USD

156.51 Million

USD

358.09 Million

2022

2030

USD

156.51 Million

USD

358.09 Million

2022

2030

| 2023 –2030 | |

| USD 156.51 Million | |

| USD 358.09 Million | |

|

|

|

|

Asia-Pacific Dental Membrane and Bone Graft Substitute Market Analysis and Size

According to data from the Centers for Disease Control and Prevention, 47.2% of adults 30 and older have periodontal disease. Age is a factor in the development of this condition; 70.1% of those 65 and older have periodontal disease. Thus the bone graft substitutes are used for preventing the gums from expanding into bones during healing and it acts as a barrier. Other factors anticipated to propel the global dental membrane and bone graft substitutes market during the forecast period include rising oral health awareness, an increase in oral disease, increased research and development (R&D) activities and increased use of resorbable dental membranes and bone graft biomaterials.

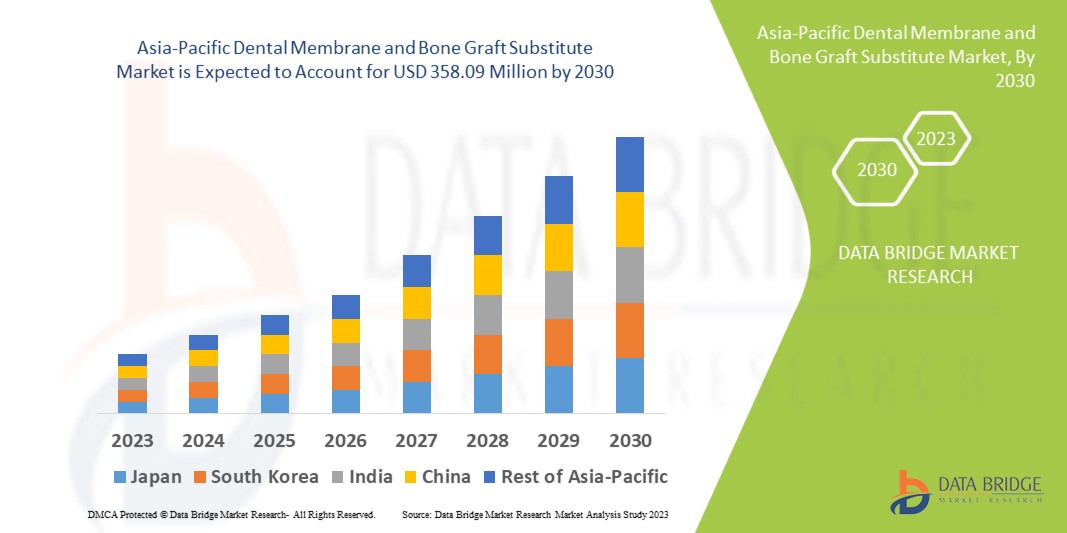

Data Bridge Market Research analyses that the dental membrane and bone graft substitute market which was USD 156.51 million in 2022, is expected to reach USD 358.09 million by 2030, at a CAGR of 10.9% during the forecast period 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Asia-Pacific Dental Membrane and Bone Graft Substitute Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product Type (Dental Membranes, Dental Bone Grafts, Bio OSS, Osteograf, and Grafton), Material (Hydrogel, Collagen, Human Cells Source, Hydroxyapatite, Tricalcium Phosphate, Polytetrafluroethylene), Application (Ridge Augmentation, Socket Preservation, Periodontal Defect Regeneration, Implant Bone Regeneration, Sinus Lift, Others), End Use (Hospitals, Dental Clinics, Ambulatory Surgical Centers) |

|

Countries Covered |

China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC) |

|

Market Players Covered |

Zimmer Biomet (U.S.), Bioventus (U.S.), Synergy Orthopedics (U.S.), Ito Co., Ltd. (Japan), Boston Scientific Corporation (U.S.), BTL (Canada), Cyberonics, Inc. (U.S.), DJO LLC (U.S.), Medtronic (Ireland), Nevro Corp (U.S.), NeuroMetrix, Inc (U.S.), Abbott (U.S.), Uroplasty Inc (U.S.), Cogentix Medical (U.S.), Aleva Neurotherapeutics (Switzerland), NeuroPace Inc (U.S.), AxioBionics (U.S.), Beurer GmbH (Germany), Omron Healthcare, Inc (Japan), RS Medical (Japan), Stryker (U.S.) |

|

Market Opportunities |

|

Market Definition

Dental membranes and bone graft substitutes which are used in dental bone regeneration procedures for oral cancer patients and periodontal disease. Dental membranes are used in conjunction along with dental bone grafts to help in the cell proliferation during the regeneration process. A bone graft is a material that can be implanted and used to promote bone formation, bone healing, osseous reconstruction, and other procedures. These bone graft materials are used in bone grafting surgical procedures to replace damaged or missing bone (bone graft).

Asia-Pacific Dental Membrane and Bone Graft Substitute Market Dynamics

Drivers

- High incidence of periodontal disorders

The growing incidence of oral health disorders such as oral cancer and periodontal disease is expected to propel the dental membranes and bone graft substitute market forward. For instance, according to the article Assessment of the Status of National Oral Health Policy in India, published in 2015 by the National Center for Biotechnology Information (NCBI). The prevalence of oral diseases in India is very high, with dental caries being the most common. In people aged 5, 12, 15, 35-44, and 65-74, the prevalence is 50.0%, 52.5%, 61.4%, 79.2%, and 84.7%, respectively.

- Increased product development

Most of the manufacturers focused on the development of new products and meet the demand for effective therapeutics which is going to drive the market growth during the forecast period.

For instance, the National Oral Health Survey of India found that the prevalence of periodontal diseases was around 79.9% in people aged 65 to 74 years, while the incidence of oral cancer in India was around 12.6 per 100,000 people in 2016-2017.

Opportunities

- Increasing Elderly Population

Around the World - The World Bank estimates that there were 747,238,580 people over 60 in the world as of the end of 2021. In the upcoming years, the quantity is anticipated to rise. Older persons are more likely to experience oral health issues. Dental conditions such as edentulism are more common in older adults. Therefore, it is anticipated that throughout the forecast period, the global market for dental membrane and bone graft substitutes will rise due to the increasing acceptance of dental implants among the growing older population.

Restraints/Challenges

- Higher Cost Associated with Bone Graft Surgeries

Autografts are mainly utilized for extremely small bone defects due to their higher surgical costs and increased surgical risks, such as excessive bleeding, infection, inflammation, and discomfort. By 2021, it is estimated that 2.2 million bone transplant surgeries performed worldwide at an estimated cost of USD 664 million, with the number of operations to cure bony anomalies expected to rise by about 13% annually.

This dental membrane and bone graft substitute market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the dental membrane and bone graft substitute market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on the Dental Membrane and Bone Graft Substitute Market

The COVID-19 had a negative effect on the market for dental membrane and bone graft substitute market. Companies are experiencing a setback lockdown, causing disruptions in supply chain activities all over the world. Patient visits have decreased as a result of the worldwide implementation of lockdown restrictions. However, the situation is expected to improve as governments around the world relax regulations for resuming business operations. Furthermore, as elective surgeries and procedures resume in the near future, the demand for dental membrane and bone graft substitute is expected to rise.

Recent Developments

- In 2021, Nobel Biocare introduced the GalvoSurge Dental Implant Cleaning System, which removes biofilm from bacteria-infected titanium implants completely. It removes biofilm from inaccessible areas of any bacteria-infected titanium implant surface.

- In 2021, Datum Dental, Ltd. and its extensive portfolio of OSSIX biomaterials has been acquired by Dentsply Sirona. Datum Dental, headquartered in Israel, is well-known for its innovative dental regeneration solutions, which include the clinically superior GLYMATRIX unique technology.

Asia-Pacific Dental Membrane and Bone Graft Substitute Market Scope

The dental membrane and bone graft substitute market is segmented on the basis of product type, material, application and end-use. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Dental Membranes

- Resorbable

- Non-resorbable

- Dental Bone Grafts

- Autograft

- Allograft

- Demineralized bone matrix

- Xenograft

- Synthetic bone graft substitutes

- Bio OSS

- Osteograf

- Grafton

Material

- Hydrogel

- Collagen

- Human Cells Source

- Hydroxyapatite

- Tricalcium Phosphate

- Polytetrafluroethylene

Application

- Ridge Augmentation

- Socket Preservation

- Periodontal Defect Regeneration

- Implant Bone Regeneration

- Sinus Lift

- Others

End Use

- Hospitals

- Dental Clinics

- Ambulatory Surgical Centers

Asia-Pacific Dental Membrane and Bone Graft Substitute Market Regional Analysis/Insights

The dental membrane and bone graft substitute market is analyzed and market size insights and trends are provided by country, product type, material, application and end-use as referenced above.

The countries covered in the dental membrane and bone graft substitute market report are China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC).

China region is expected to experience the highest CAGR during the forecast period due to the increasing incidence of dental problems. Furthermore, the market is expanding due to an increase in health-care spending and an increase in the number of elderly people. All of these factors are contributing to the market's expansion.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The dental membrane and bone graft substitute market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for dental membrane and bone graft substitute market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the dental membrane and bone graft substitute market. The data is available for historic period 2011-2021.

Competitive Landscape and Dental Membrane and Bone Graft Substitute Market Share Analysis

The dental membrane and bone graft substitute market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to dental membrane and bone graft substitute market.

Some of the major players operating in the dental membrane and bone graft substitute market are:

- Zimmer Biomet (U.S.)

- Bioventus (U.S.)

- Synergy Orthopedics (U.S.)

- Ito Co., Ltd. (Japan)

- Boston Scientific Corporation (U.S.)

- BTL (Canada)

- Cyberonics, Inc. (U.S.)

- DJO LLC (U.S.)

- Medtronic (Ireland)

- Nevro Corp (U.S.)

- NeuroMetrix, Inc (U.S.)

- Abbott (U.S.)

- Uroplasty Inc (U.S.)

- Cogentix Medical (U.S.)

- Aleva Neurotherapeutics (Switzerland)

- NeuroPace Inc (U.S.)

- AxioBionics (U.S.)

- Beurer GmbH (Germany)

- Omron Healthcare, Inc (Japan)

- RS Medical (Japan)

- Stryker (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC DENTAL MEMBRANE AND BONE GRAFT SUBSTITUTE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE ASIA-PACIFIC DENTAL MEMBRANE AND BONE GRAFT SUBSTITUTE MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 ASIA-PACIFIC DENTAL MEMBRANE AND BONE GRAFT SUBSTITUTE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 INSTALLED BASE DATA

15 VALUE CHAIN ANALYSIS

16 HEALTHCARE ECONOMY

16.1 HEALTHCARE EXPENDITURE

16.2 CAPITAL EXPENDITURE

16.3 CAPEX TRENDS

16.4 CAPEX ALLOCATION

16.5 FUNDING SOURCES

16.6 INDUSTRY BENCHMARKS

16.7 GDP RATION IN OVERALL GDP

16.8 HEALTHCARE SYSTEM STRUCTURE

16.9 GOVERNMENT POLICIES

16.1 ECONOMIC DEVELOPMENT

17 ASIA-PACIFIC DENTAL MEMBRANE AND BONE GRAFT SUBSTITUTE MARKET, BY TYPE

17.1 OVERVIEW

17.2 DENTAL MEMBRANE

17.2.1 SYNTHETIC

17.2.1.1. METAL AND METAL REINFORCED MEMBRANES

17.2.1.2. BILAYER POLYLACTIC ACID (PLA) MEMBRANE

17.2.1.3. PTFE MEMBRANE

17.2.1.4. OTHERS

17.2.2 NATUAL

17.2.2.1. COLLAGEN MEMBRANE

17.2.2.2. ALLOGRAFT DENTAL MEMBRANES

17.2.2.3. OTHERS

17.2.3 OTHERS

17.3 DENTAL BONE GRAFT SUBSITUTE

17.3.1 SYNTHETIC BONE GRAFT

17.3.1.1. TRICALCIUM PHOSPHATE CERAMICS

17.3.1.2. HYDROXYAPATITE

17.3.1.3. BIOACTIVE GLASS

17.3.1.4. BIPHASIC CALCIUM PHOSPHATE CERAMICS

17.3.1.5. CALCIUM PHOSPHATE CEMENT

17.3.1.6. CALCIUM-PHOSPHOSILICATE

17.3.1.7. METALS

17.3.1.7.1. MAGNESIUM (MG)

17.3.1.7.2. STRONTIUM (SR)

17.3.1.7.3. ZINC (ZN)

17.3.1.7.4. SILICON (SI)

17.3.1.8. POLYMERS

17.3.1.8.1. BY USABILITY

17.3.1.8.1.1 DEGRADABLE

17.3.1.8.1.2 NON-DEGRADABLE

17.3.1.8.2. BY TYPE

17.3.1.8.2.1 POLYLACTIC ACID

17.3.1.8.2.2 POLYGLYCOLIC ACID

17.3.1.8.2.3 POLYΕ-CAPROLACTONE

17.3.1.8.2.4 OTHERS

17.3.1.9. COMPOSITES

17.3.1.9.1. BY TYPE

17.3.1.9.1.1 NANOCRYSTALLINE HA/SILICON DIOXIDE

17.3.1.9.1.2 Β-TCP/CALCIUM SULPHATE

17.3.2 NATURAL BONE GRAFT

17.3.2.1. XENOGRAFT

17.3.2.1.1. BOVINE-DERIVED

17.3.2.1.2. PORCINE-DERIVED

17.3.2.1.3. CHITOSAN DERIVED

17.3.2.1.4. OTHERS

17.3.2.2. ALLOGRAFT

17.3.2.2.1. FRESH OR FRESH-FROZEN BONE

17.3.2.2.1.1 BY TYPE

17.3.2.2.1.1.1. DEMINERALISED BONE ALLOGRAFT

17.3.2.2.1.1.2. OCELLULAR BONE ALLOGRAFTS

17.3.2.2.1.1.3. MACHINED ALLOGRAFTS

17.3.2.2.1.2 BY USABLITY

17.3.2.2.1.2.1. BIO-REABSORBABLE

17.3.2.2.1.2.2. NON BIO-REABSORBABLE

17.3.2.2.2. FREEZE DRIED BONE ALLOGRAFT (FDBA)

17.3.2.2.2.1 BY TYPE

17.3.2.2.2.1.1. DEMINERALISED BONE ALLOGRAFT

17.3.2.2.2.1.2. OCELLULAR BONE ALLOGRAFTS

17.3.2.2.2.1.3. MACHINED ALLOGRAFTS

17.3.2.2.2.2 BY USABILITY

17.3.2.2.2.2.1. BIO-REABSORBABLE

17.3.2.2.2.2.2. NON BIO-REABSORBABLE

17.3.2.3. AUTOGRAFTS

17.3.2.3.1. MANDIBULAR SYMPHYSIS

17.3.2.3.2. MANDIBULAR RAMUS

17.3.2.3.3. EXTERNAL OBLIQUE RIDGE

17.3.2.3.4. ILIAC CREST

17.3.2.3.5. PROXIMAL ULNA

17.3.2.3.6. DISTAL RADIUS

17.3.2.4. PHYTOGENIC MATERIALS

17.3.2.4.1. GUSUIBU

17.3.2.4.2. CORAL-BASED BONE SUBSTITUTES

17.3.2.4.3. MARINE ALGAE

17.3.3 LIVE OSTEOGENIC CELLS BONE SUBSTITUTES

17.3.3.1. BIOSEED-ORAL BONE

17.3.3.2. OSTEOTRANSPLANT DENT

17.3.4 GROWTH FACTORS

17.3.4.1. TRANSFORMING GROWTH FACTOR-BETA (TGF-BETA)

17.3.4.2. PLATELET-DERIVED GROWTH FACTOR (PDGF)

17.3.4.3. FIBROBLAST GROWTH FACTORS (FGF)

17.3.4.4. BONE MORPHOGENEIC PROTEIN (BMP)

17.3.4.5. OTHERS

18 ASIA-PACIFIC DENTAL MEMBRANE AND BONE GRAFT SUBSTITUTE MARKET, BY APPLICATION

18.1 OVERVIEW

18.2 RIDGE AUGMENTATION

18.2.1 BY TYPE

18.2.1.1. DENTAL MEMBRANE

18.2.1.2. DENTAL BONE GRAFT SUBSTITUTE

18.2.2 BY SOURCE

18.2.2.1. NATURAL

18.2.2.2. SYNTHETIC

18.3 SOCKET PRESERVATION

18.3.1 BY TYPE

18.3.1.1. DENTAL MEMBRANE

18.3.1.2. DENTAL BONE GRAFT SUBSTITUTE

18.3.2 BY SOURCE

18.3.2.1. NATURAL

18.3.2.2. SYNTHETIC

18.4 PERIODONTAL DEFECT REGENERATION

18.4.1 BY TYPE

18.4.1.1. DENTAL MEMBRANE

18.4.1.2. DENTAL BONE GRAFT SUBSTITUTE

18.4.2 BY SOURCE

18.4.2.1. NATURAL

18.4.2.2. SYNTHETIC

18.5 IMPLANT BONE REGENERATION

18.5.1 BY TYPE

18.5.1.1. DENTAL MEMBRANE

18.5.1.2. DENTAL BONE GRAFT SUBSTITUTE

18.5.2 BY SOURCE

18.5.2.1. NATURAL

18.5.2.2. SYNTHETIC

18.6 SINUS LIFT

18.6.1 BY TYPE

18.6.1.1. DENTAL MEMBRANE

18.6.1.2. DENTAL BONE GRAFT SUBSTITUTE

18.6.2 BY SOURCE

18.6.2.1. NATURAL

18.6.2.2. SYNTHETIC

18.7 OTHERS

19 ASIA-PACIFIC DENTAL MEMBRANE AND BONE GRAFT SUBSTITUTE MARKET, BY SOURCE

19.1 OVERVIEW

19.2 NATURAL

19.3 SYNTHETIC

20 ASIA-PACIFIC DENTAL MEMBRANE AND BONE GRAFT SUBSTITUTE MARKET, BY USABILITY

20.1 OVERVIEW

20.2 RESORBABLE

20.3 NON-RESORBABLE

21 ASIA-PACIFIC DENTAL MEMBRANE AND BONE GRAFT SUBSTITUTE MARKET, BY MECHANISM

21.1 OVERVIEW

21.2 OSTEOCONDUCTION

21.3 OSTEOINDUCTION

21.4 OSTEOPROMOTION

21.5 OSTEOGENESIS

22 ASIA-PACIFIC DENTAL MEMBRANE AND BONE GRAFT SUBSTITUTE MARKET, BY AGE

22.1 OVERVIEW

22.2 PEDIATRICS

22.3 ADULT

22.4 GERIATRIC

23 ASIA-PACIFIC DENTAL MEMBRANE AND BONE GRAFT SUBSTITUTE MARKET, BY POPULATION TYPE

23.1 OVERVIEW

23.2 MALE

23.3 FEMALE

24 ASIA-PACIFIC DENTAL MEMBRANE AND BONE GRAFT SUBSTITUTE MARKET, BY END USER

24.1 OVERVIEW

24.2 HOSPITALS

24.3 DENTAL CLINICS

24.4 AMBULATORY SURGICAL CENTERS

24.5 RESEARCH AND DENTAL LABORATORIES

24.6 OTHERS

25 ASIA-PACIFIC DENTAL MEMBRANE AND BONE GRAFT SUBSTITUTE MARKET, BY DISTRIBUTION CHANNEL

25.1 OVERVIEW

25.2 DIRECT TENDER

25.3 RETAIL SALES

25.3.1 HOSPITAL PHARMACY

25.3.2 RETAIL PHARMACY

25.3.3 ONLINE PHARMACY

25.4 OTHERS

26 ASIA-PACIFIC DENTAL MEMBRANE AND BONE GRAFT SUBSTITUTE MARKET, SWOT AND DBMR ANALYSIS

27 ASIA-PACIFIC DENTAL MEMBRANE AND BONE GRAFT SUBSTITUTE MARKET, COMPANY LANDSCAPE

27.1 COMPANY SHARE ANALYSIS: GLOBAL

27.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

27.3 COMPANY SHARE ANALYSIS: EUROPE

27.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

27.5 MERGERS & ACQUISITIONS

27.6 NEW PRODUCT DEVELOPMENT & APPROVALS

27.7 EXPANSIONS

27.8 REGULATORY CHANGES

27.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

28 ASIA-PACIFIC DENTAL MEMBRANE AND BONE GRAFT SUBSTITUTE MARKET, BY REGION

ASIA-PACIFIC DENTAL MEMBRANE AND BONE GRAFT SUBSTITUTE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

28.1 ASIA-PACIFIC

28.1.1 JAPAN

28.1.2 CHINA

28.1.3 SOUTH KOREA

28.1.4 INDIA

28.1.5 SINGAPORE

28.1.6 THAILAND

28.1.7 INDONESIA

28.1.8 MALAYSIA

28.1.9 PHILIPPINES

28.1.10 AUSTRALIA

28.1.11 NEW ZEALAND

28.1.12 VIETNAM

28.1.13 TAIWAN

28.1.14 REST OF ASIA-PACIFIC

28.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

29 ASIA-PACIFIC DENTAL MEMBRANE AND BONE GRAFT SUBSTITUTE MARKET, COMPANY PROFILE

29.1 BIOHORIZONS

29.1.1 COMPANY OVERVIEW

29.1.2 REVENUE ANALYSIS

29.1.3 GEOGRAPHIC PRESENCE

29.1.4 PRODUCT PORTFOLIO

29.1.5 RECENT DEVELOPMENTS

29.2 DENTSPLY SIRONA

29.2.1 COMPANY OVERVIEW

29.2.2 REVENUE ANALYSIS

29.2.3 GEOGRAPHIC PRESENCE

29.2.4 PRODUCT PORTFOLIO

29.2.5 RECENT DEVELOPMENTS

29.3 ZIMVIE INC.

29.3.1 COMPANY OVERVIEW

29.3.2 REVENUE ANALYSIS

29.3.3 GEOGRAPHIC PRESENCE

29.3.4 PRODUCT PORTFOLIO

29.3.5 RECENT DEVELOPMENTS

29.4 OSTEOGENICS BIOMEDICAL

29.4.1 COMPANY OVERVIEW

29.4.2 REVENUE ANALYSIS

29.4.3 GEOGRAPHIC PRESENCE

29.4.4 PRODUCT PORTFOLIO

29.4.5 RECENT DEVELOPMENTS

29.5 GEISTLICH PHARMA AG

29.5.1 COMPANY OVERVIEW

29.5.2 REVENUE ANALYSIS

29.5.3 GEOGRAPHIC PRESENCE

29.5.4 PRODUCT PORTFOLIO

29.5.5 RECENT DEVELOPMENTS

29.6 MEDTRONIC

29.6.1 COMPANY OVERVIEW

29.6.2 REVENUE ANALYSIS

29.6.3 GEOGRAPHIC PRESENCE

29.6.4 PRODUCT PORTFOLIO

29.6.5 RECENT DEVELOPMENTS

29.7 MAXIGEN BIOTECH INC.

29.7.1 COMPANY OVERVIEW

29.7.2 REVENUE ANALYSIS

29.7.3 GEOGRAPHIC PRESENCE

29.7.4 PRODUCT PORTFOLIO

29.7.5 RECENT DEVELOPMENTS

29.8 INSTITUT STRAUMANN AG

29.8.1 COMPANY OVERVIEW

29.8.2 REVENUE ANALYSIS

29.8.3 GEOGRAPHIC PRESENCE

29.8.4 PRODUCT PORTFOLIO

29.8.5 RECENT DEVELOPMENTS

29.9 DENTIUM

29.9.1 COMPANY OVERVIEW

29.9.2 REVENUE ANALYSIS

29.9.3 GEOGRAPHIC PRESENCE

29.9.4 PRODUCT PORTFOLIO

29.9.5 RECENT DEVELOPMENTS

29.1 BOTISS BIOMATERIALS GMBH

29.10.1 COMPANY OVERVIEW

29.10.2 REVENUE ANALYSIS

29.10.3 GEOGRAPHIC PRESENCE

29.10.4 PRODUCT PORTFOLIO

29.10.5 RECENT DEVELOPMENTS

29.11 NOVABONE

29.11.1 COMPANY OVERVIEW

29.11.2 REVENUE ANALYSIS

29.11.3 GEOGRAPHIC PRESENCE

29.11.4 PRODUCT PORTFOLIO

29.11.5 RECENT DEVELOPMENTS

29.12 CGBIO

29.12.1 COMPANY OVERVIEW

29.12.2 REVENUE ANALYSIS

29.12.3 GEOGRAPHIC PRESENCE

29.12.4 PRODUCT PORTFOLIO

29.12.5 RECENT DEVELOPMENTS

29.13 NOBEL BIOCARE SERVICES AG

29.13.1 COMPANY OVERVIEW

29.13.2 REVENUE ANALYSIS

29.13.3 GEOGRAPHIC PRESENCE

29.13.4 PRODUCT PORTFOLIO

29.13.5 RECENT DEVELOPMENTS

30 RELATED REPORTS

31 CONCLUSION

32 QUESTIONNAIRE

33 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.