Asia Pacific Dental Silver Diamine Fluoride Sdf Market

Market Size in USD Million

CAGR :

%

USD

24.93 Million

USD

36.84 Million

2025

2033

USD

24.93 Million

USD

36.84 Million

2025

2033

| 2026 –2033 | |

| USD 24.93 Million | |

| USD 36.84 Million | |

|

|

|

|

Asia-Pacific Dental Silver Diamine Fluoride (SDF) Market Size

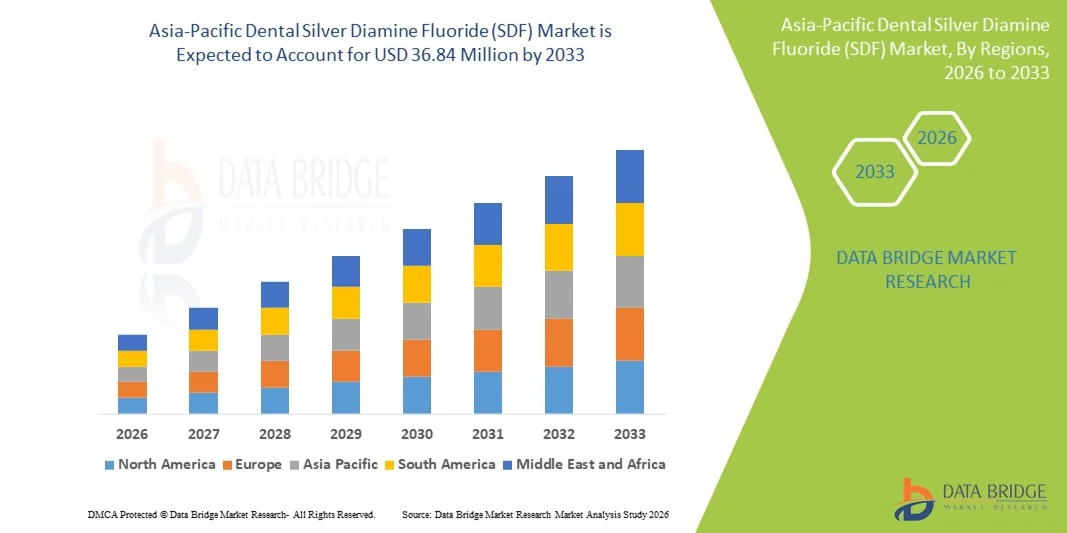

- The Asia-Pacific Dental Silver Diamine Fluoride (SDF) market size was valued at USD 24.93 million in 2025 and is expected to reach USD 36.84 million by 2033, at a CAGR of 5.0% during the forecast period

- The market growth is largely fueled by increasing awareness of minimally invasive dentistry and the rising prevalence of dental caries across both children and adults in the region, driving adoption of SDF as a preventive and therapeutic solution

- Furthermore, the growing focus on cost-effective dental care, coupled with government initiatives promoting oral health, is encouraging the integration of SDF in both clinical and community settings. These factors are accelerating the uptake of SDF solutions, thereby significantly boosting the industry's growth

Asia-Pacific Dental Silver Diamine Fluoride (SDF) Market Analysis

- Dental Silver Diamine Fluoride (SDF), a minimally invasive treatment for dental caries, is increasingly being adopted in both pediatric and adult dentistry across Asia-Pacific countries such as China, India, and Japan due to its effectiveness in arresting tooth decay and ease of application in clinical and community settings

- The rising demand for Dental Silver Diamine Fluoride (SDF) market is primarily fueled by growing awareness of preventive oral care, the increasing prevalence of dental caries, and the growing preference for non-invasive, cost-effective dental treatments suitable for both primary and secondary teeth

- China dominated the Asia-Pacific Dental Silver Diamine Fluoride (SDF) market with the largest revenue share of 24.8% in 2025, driven by high adoption in dental hospitals and clinics, expanding research initiatives in academic institutions, and government oral health programs focusing on caries prevention and dentin desensitization

- India is expected to be the fastest-growing country in the Asia-Pacific Dental Silver Diamine Fluoride (SDF) market during the forecast period due to rising urbanization, higher disposable incomes, and increasing access to both online and offline distribution channels for SDF products

- The pediatric segment dominated the Asia-Pacific Dental Silver Diamine Fluoride (SDF) market in 2025 with a market share of 35.7%, due to the focus on early preventive dental care, while caries arrest was the leading indication

Report Scope and Asia-Pacific Dental Silver Diamine Fluoride (SDF) Market Segmentation

|

Attributes |

Asia-Pacific Dental Silver Diamine Fluoride (SDF) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Dental Silver Diamine Fluoride (SDF) Market Trends

Rising Adoption of Minimally Invasive and School-Based Programs

- A key and accelerating trend in the Asia-Pacific Dental Silver Diamine Fluoride (SDF) market is the growing adoption of minimally invasive treatments in both pediatric and adult dentistry, especially through school-based oral health programs that enable preventive care on a large scale

- For instance, government-sponsored initiatives in India and China are incorporating SDF treatments into school dental check-ups to arrest caries early and reduce the need for complex restorative procedures

- The use of SDF allows dentists to treat caries non-invasively, reducing the need for drilling and anesthesia, which enhances patient comfort and compliance, particularly among children and geriatric patients

- Integration of SDF treatments in community health programs also facilitates cost-effective oral care delivery, providing an accessible solution for underserved populations and aligning with public health objectives

- This trend toward preventive, minimally invasive, and community-focused dental care is reshaping treatment protocols and increasing awareness among parents, caregivers, and adult patients

- The demand for SDF products with higher concentration strengths and user-friendly application methods is growing rapidly as dental clinics, hospitals, and research institutes seek efficient solutions for caries management across age groups

- Innovations such as pre-filled SDF applicators and combination treatments with fluoride varnish are further enhancing ease of use, allowing for faster treatment times and better patient compliance

- Partnerships between dental product manufacturers and public health programs are increasing the distribution reach of SDF, particularly in rural and semi-urban regions, driving adoption beyond traditional clinic settings

Asia-Pacific Dental Silver Diamine Fluoride (SDF) Market Dynamics

Driver

Rising Prevalence of Dental Caries and Awareness of Preventive Care

- The increasing incidence of dental caries among children and adults in Asia-Pacific countries, coupled with growing awareness of preventive oral care, is a key driver for the Asia-Pacific Dental Silver Diamine Fluoride (SDF) market

- For instance, public health campaigns in Japan and China are promoting the use of SDF to reduce dental decay rates, encouraging clinics and hospitals to integrate it into standard treatment protocols

- As more patients and caregivers understand the benefits of SDF, including non-invasive application and rapid caries arrest, adoption in both clinical and school-based settings is accelerating

- Furthermore, the rising demand for cost-effective treatments and the increasing availability of SDF through online and offline distribution channels are making it accessible to a wider population

- Support from dental academic and research institutes to validate SDF efficacy also boosts confidence among practitioners, encouraging broader adoption in preventive and restorative dentistry

- Increased training programs for dentists and auxiliary staff on SDF application techniques are enhancing market penetration and ensuring proper usage in clinical practice

- The ongoing integration of SDF in government-funded dental health initiatives targeting children and elderly populations is driving steady growth across key Asia-Pacific countries

Restraint/Challenge

Staining and Limited Awareness Among Adults

- The primary challenge for the Asia-Pacific Dental Silver Diamine Fluoride (SDF) market is the black staining on treated teeth, which can cause hesitation among patients and caregivers, particularly for anterior teeth

- For instance, some parents in India and China remain reluctant to use SDF on visible teeth, preferring restorative treatments despite the non-invasive advantages of SDF

- Addressing this challenge requires effective patient education, clear communication of benefits versus cosmetic effects, and the development of improved formulations that minimize staining

- Another restraint is the limited awareness of SDF’s efficacy among adult and geriatric populations, which can reduce adoption in private clinics and hospital settings

- Overcoming these challenges through professional training programs, awareness campaigns, and formulation innovations will be crucial for sustained growth of the Asia-Pacific Dental Silver Diamine Fluoride (SDF) market

- In addition, inconsistent regulatory approvals and variations in reimbursement policies across Asia-Pacific countries can hinder rapid adoption, particularly in private dental practices

- Cultural perceptions and aesthetic concerns related to tooth appearance may limit SDF use in visible teeth, requiring targeted awareness campaigns to educate both patients and caregivers about long-term oral health benefits

Asia-Pacific Dental Silver Diamine Fluoride (SDF) Market Scope

The market is segmented on the basis of strength, indication, type of teeth, site of action, age, distribution channel, and end user.

- By Strength

On the basis of strength, the Asia-Pacific Dental Silver Diamine Fluoride (SDF) market is segmented into 38%, 12%, 30%, and others. The 38% strength segment dominated the market in 2025, driven by its proven efficacy in rapidly arresting dental caries in both primary and secondary teeth. Dental hospitals and clinics prefer this concentration for pediatric and geriatric treatments due to faster caries arrest and reduced application frequency. Its strong clinical endorsement and alignment with minimally invasive dentistry guidelines enhance adoption. The segment also benefits from compatibility with various delivery methods such as syringes, drops, and pre-filled applicators, making it convenient for practitioners. In addition, public health initiatives in China, India, and Japan promoting early caries management further strengthen its dominance in the market.

The 12% strength segment is expected to witness the fastest growth from 2026 to 2033, fueled by its suitability for routine preventive care and dentin desensitization. It is especially preferred for children’s anterior teeth and adults sensitive to high fluoride concentrations. The segment is increasingly adopted in school-based programs and online distribution channels due to safety and ease of use. Dental practitioners value this concentration for its mild but effective action, reducing patient discomfort. Growing awareness among caregivers about non-invasive treatments supports its rapid adoption. Furthermore, the availability of user-friendly application kits enhances market penetration in both urban and semi-urban areas.

- By Indication

On the basis of indication, the market is segmented into caries arrest, dentin desensitization, and caries prevention. The caries arrest segment dominated the market in 2025 due to the rising prevalence of dental caries and the proven effectiveness of SDF in halting decay progression. Pediatric and adult dentistry clinics widely use this indication to reduce the need for restorative procedures. Community-based programs and school dental initiatives heavily rely on SDF for early intervention. Government-supported campaigns promoting preventive oral care further reinforce the segment’s position. Academic and research institutions also validate its clinical efficacy, boosting adoption across the region.

The dentin desensitization segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing demand among adults and geriatric patients experiencing tooth hypersensitivity. SDF’s ability to manage sensitivity while preventing caries enhances its appeal. Dental academic research and clinical studies confirm its dual benefits, promoting adoption in hospitals and private clinics. The segment benefits from awareness campaigns highlighting minimally invasive treatments. Manufacturers are also developing formulations tailored for desensitization, further accelerating growth. The expanding adult and geriatric population in Asia-Pacific provides a growing consumer base for this segment.

- By Type of Teeth

On the basis of type of teeth, the market is segmented into primary teeth and secondary teeth. The primary teeth segment dominated in 2025, fueled by the focus on preventive pediatric dentistry and widespread school-based programs. SDF is preferred for children due to non-invasive application, minimal discomfort, and effectiveness in arresting early childhood caries. Clinics and hospitals prioritize this segment to reduce future restorative treatment needs. Government initiatives in India, China, and Japan further strengthen market dominance. In addition, caregivers increasingly prefer SDF for its safety and simplicity compared to traditional drilling procedures.

The secondary teeth segment is expected to witness the fastest growth during the forecast period due to rising adult awareness of minimally invasive treatments. SDF adoption is increasing for posterior teeth in adults and geriatric populations to prevent progression of decay. Private dental clinics are integrating SDF into preventive and restorative protocols. Formulation innovations such as pre-filled applicators aid in effective posterior tooth treatment. The segment also benefits from targeted marketing and professional training programs. Rising disposable incomes and growing access to dental care in urban areas further drive growth.

- By Site of Action

On the basis of site of action, the market is segmented into anterior teeth and posterior teeth. The anterior teeth segment dominated in 2025, driven by preventive care for visible teeth in children and adults. Aesthetic concerns encourage early treatment of anterior teeth to prevent worsening caries. Pediatric clinics and school programs prioritize this site of action for effective intervention. Public health initiatives also emphasize anterior teeth treatment in early childhood. Non-invasive SDF application reduces the need for anesthesia or drilling, increasing acceptance. Training programs for dentists further strengthen adoption of anterior teeth applications.

The posterior teeth segment is expected to witness the fastest growth from 2026 to 2033, fueled by the prevalence of posterior caries in adult and geriatric populations. Dental hospitals and private clinics increasingly adopt SDF for molars and premolars. Application tools and techniques are improving to facilitate posterior tooth treatment. Awareness campaigns are educating patients on the benefits of non-invasive posterior interventions. Academic research supports efficacy in posterior teeth, encouraging adoption. Rising demand in urban and semi-urban areas also drives segment growth.

- By Age

On the basis of age, the market is segmented into pediatric, adult, and geriatric. The pediatric segment dominated in 2025 with a market share of 35.7% due to high incidence of dental caries among children and widespread integration of SDF in school programs. Pediatric dentistry programs rely on SDF for non-invasive, cost-effective, and efficient treatment. Clinics and hospitals value its safety and minimal discomfort. Public health initiatives further strengthen its adoption. Academic and research institutions support clinical validation. Caregivers increasingly prefer SDF over traditional restorative treatments, reinforcing dominance.

The adult segment is expected to witness the fastest growth during the forecast period, fueled by rising awareness of minimally invasive treatment options. Adults increasingly seek SDF for dentin desensitization and caries prevention. Private clinics are promoting its dual benefits of sensitivity reduction and decay arrest. Academic studies validate its effectiveness, encouraging adoption. Awareness campaigns and professional training programs support rapid uptake. Growing geriatric population adds to the potential consumer base for adult applications.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into online and offline. The offline segment dominated in 2025, driven by strong presence of dental hospitals, clinics, and pharmacies. Direct sales ensure proper handling, application, and practitioner training. Hospitals and clinics prefer offline channels for bulk procurement and program-based distribution. Trust in established suppliers supports continued dominance. Offline channels are also critical for rural and semi-urban market penetration. Government-supported programs rely on offline distribution for school and community initiatives.

The online segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising e-commerce penetration in Asia-Pacific countries. Online platforms provide convenient access for dental practitioners and hospitals. Bulk purchases for school and community programs are increasingly done online. Rising awareness among caregivers and adult consumers supports online adoption. Online channels facilitate the introduction of innovative SDF formulations and applicators. Ease of access and competitive pricing drive growth in urban and semi-urban regions.

- By End User

On the basis of end user, the market is segmented into dental hospitals & clinics, dental academic & research institutes, and others. The dental hospitals & clinics segment dominated in 2025, driven by high adoption for routine clinical procedures, preventive care, and pediatric dentistry. Hospitals and clinics value SDF’s ease of use, cost-effectiveness, and efficacy in caries management. Adoption is further supported by government programs and insurance coverage in some countries. Practitioner familiarity and training programs reinforce dominance. Integration in public and private dental programs strengthens market position. Clinical validation ensures continued trust and use.

The dental academic & research institutes segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing research studies, clinical trials, and adoption in teaching hospitals. Academic programs are promoting SDF training for future dentists. Research initiatives are validating improved formulations and application techniques. Collaborations with manufacturers enhance product development and clinical adoption. Awareness campaigns targeting students and practitioners further accelerate uptake. Growing focus on evidence-based dentistry supports segment expansion across Asia-Pacific countries.

Asia-Pacific Dental Silver Diamine Fluoride (SDF) Market Regional Analysis

- China dominated the Asia-Pacific Dental Silver Diamine Fluoride (SDF) market with the largest revenue share of 24.8% in 2025, driven by high adoption in dental hospitals and clinics, expanding research initiatives in academic institutions, and government oral health programs focusing on caries prevention and dentin desensitization

- Consumers and caregivers in the region highly value the non-invasive, cost-effective, and easy-to-apply nature of SDF, particularly for children’s primary teeth and adults experiencing dentin hypersensitivity

- This widespread adoption is further supported by the presence of well-established dental hospitals and clinics, growing awareness of preventive oral care, and integration of SDF in school-based and community oral health programs, establishing SDF as a preferred solution for both clinical and public health dental care in Asia-Pacific

The China Dental Silver Diamine Fluoride (SDF) Market Insight

China dominated the Asia-Pacific Dental SDF market with the largest revenue share in 2025, fueled by government-supported pediatric dental programs, widespread adoption in dental hospitals and clinics, and growing awareness among caregivers regarding non-invasive caries management. The prevalence of dental caries among children and adults is a key driver, along with the integration of SDF treatments into school-based oral health check-ups. Moreover, dental academic research and public health campaigns promoting minimally invasive dentistry are contributing to sustained growth in China.

Japan Dental Silver Diamine Fluoride (SDF) Market Insight

The Japan Dental SDF market is gaining momentum due to the country’s high emphasis on preventive care, a growing geriatric population, and increasing adoption of minimally invasive dental procedures. Dental practitioners in Japan are incorporating SDF into routine pediatric and adult treatments to manage caries efficiently while reducing patient discomfort. Integration of SDF in public health programs and dental clinics, coupled with awareness campaigns, is fueling market expansion. The focus on high-quality oral care and technology-driven dentistry also encourages adoption in both clinical and community settings.

India Dental Silver Diamine Fluoride (SDF) Market Insight

The India Dental SDF market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising dental caries prevalence, expanding middle-class population, and increased focus on preventive oral care. School-based and community dental programs are promoting early childhood caries management using SDF. Affordable formulations, growing availability of online and offline distribution channels, and domestic manufacturing of dental care products further support adoption. In addition, increasing awareness among caregivers and integration of SDF in public health initiatives are key factors driving market growth in India.

South Korea Dental Silver Diamine Fluoride (SDF) Market Insight

The South Korea Dental SDF market is expanding due to increased adoption in pediatric and geriatric dentistry, growing awareness of preventive dental care, and supportive government oral health programs. Clinics and hospitals are integrating SDF into routine care for early caries arrest and dentin desensitization. The country’s strong focus on technology-driven healthcare solutions is encouraging the use of advanced SDF formulations. Public health campaigns and educational programs targeting caregivers and adult patients further enhance market growth. Rising disposable incomes and urbanization also contribute to increased accessibility and adoption of SDF solutions.

Asia-Pacific Dental Silver Diamine Fluoride (SDF) Market Share

The Asia-Pacific Dental Silver Diamine Fluoride (SDF) industry is primarily led by well-established companies, including:

- SDI Limited (Australia)

- Elevate Oral Care, LLC (U.S.)

- Tedequim Srl (Italy)

- Bensons Surgico (India)

- Creighton Dental Silver Fluoride (Australia)

- Bee Brand Medico Dental Co., Ltd. (Japan)

- Dental Medrano (Philippines)

- DengenDental.com, Inc. (U.S.)

- DentaLife Australia (Australia)

- Centrix, Inc. (U.S.)

- Church & Dwight Co., Inc. (U.S.)

- GC Corporation (Japan)

- Shofu Inc. (Japan)

- Nissin Dental Products Inc. (Japan)

- Kuraray Noritake Dental Inc. (Japan)

- 3M (U.S.)

- VOCO GmbH (Germany)

- Ivoclar Vivadent AG (Liechtenstein)

- Dentsply Sirona (U.S.)

What are the Recent Developments in Asia-Pacific Dental Silver Diamine Fluoride (SDF) Market?

- In November 2024, A randomized, split-mouth clinical trial in Maharashtra, India, showed that repeated (double) applications of 38% SDF in children’s primary teeth had a significantly higher tooth survival rate (94%) after 12 months, compared to single application (58%). This trial provides real-world clinical evidence supporting multiple SDF applications for better long-term outcomes

- In September 2024, a randomized clinical trial published in BMC Oral Health from community dental clinics in the Asia‑Pacific region (children in Australia) showed that twice‑application of 38% SDF combined with 5% sodium fluoride varnish resulted in very high arrest rates for early childhood caries, highlighting optimal regimens for use in preventive community settings

- In December 2023, In Japan, a cross-sectional survey among dental students and trainee dentists found that only ~21.7% had used SDF in clinical practice. The survey highlighted significant gaps in knowledge: students without SDF experience had markedly lower understanding of its benefits

- In October 2023, A study published in BMC Oral Health examined how SDF is being taught in Southeast Asian dental schools, revealing that many institutions are now incorporating SDF education in undergraduate curriculum to manage caries and hypersensitivity

- In July 2022, A mixed-methods study of Japanese dentists (published in International Journal of Environmental Research and Public Health) found nearly all (98%) agreed that SDF application is “simple and quick,” and 100% considered it effective for arresting caries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.