Asia Pacific Dermatology Diagnostic Devices Market

Market Size in USD Million

CAGR :

%

USD

978.30 Million

USD

2,664.00 Million

2024

2032

USD

978.30 Million

USD

2,664.00 Million

2024

2032

| 2025 –2032 | |

| USD 978.30 Million | |

| USD 2,664.00 Million | |

|

|

|

|

Dermatology Diagnostic Devices Market Size

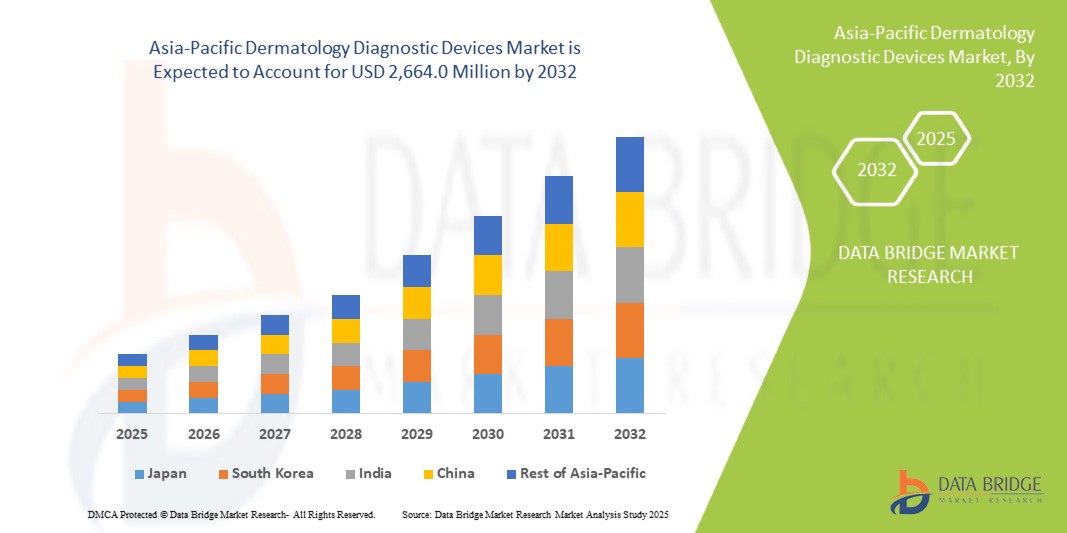

- The Asia-Pacific Dermatology Diagnostic Devices Market was valued at USD 978.3 million in 2024 and is expected to reach USD 2,664.0 million by 2032, at a CAGR of 13.34% during the forecast period.

- The growth of the Asia-Pacific Dermatology Diagnostic Devices Market is driven by several critical factors. One of the primary drivers is the increasing incidence of skin diseases, such as skin cancer, acne, and psoriasis, which has led to a higher demand for advanced dermatology diagnostic devices. Additionally, the rising awareness of skin health, along with growing disposable incomes and access to healthcare, has encouraged the adoption of diagnostic tools for early detection and treatment.

Asia-Pacific Dermatology Diagnostic Devices Market Analysis

- The Asia-Pacific Dermatology Diagnostic Devices Market is witnessing robust growth due to increasing awareness of skin health, rising prevalence of dermatological disorders, and the growing demand for early diagnosis and treatment. Dermatology diagnostic devices are critical tools in detecting and monitoring skin conditions such as skin cancer, acne, psoriasis, eczema, and other skin infections. The market includes a wide range of devices, including imaging systems, diagnostic equipment, and handheld devices, which are increasingly being adopted in clinical settings, dermatology clinics, and hospitals across the region

- China is expected to be the fastest-growing country in the asia-pacific dermatology diagnostic devices market during the forecast period, driven by rapid expansion in healthcare infrastructure, increasing awareness of skin diseases, and rising demand for early diagnosis of dermatological conditions. The growing adoption of telemedicine and teledermatology services, along with increasing healthcare investments, are boosting market growth in countries such as China, India, and Japan.

- China is expected to dominate the dermatology diagnostic devices market with a share of 36.4%, attributed to its well-established healthcare infrastructure, high adoption of advanced diagnostic technologies like AI-powered systems, and the presence of major market players. The region’s increasing focus on skin cancer prevention and treatment, coupled with favorable reimbursement policies, supports its strong market position.

- Dermatoscope segment is expected to dominate the market with a market share of 34.5%, due to its widespread clinical adoption, cost-effectiveness, and procedural familiarity among dermatologists. Despite the rise of more advanced technologies such as optical coherence tomography and confocal microscopy, dermatoscopes remain the standard tool in many clinical settings due to their ease of use, portability, and effectiveness in diagnosing skin conditions like melanoma. Their long-standing track record in early detection and their ability to offer non-invasive diagnostics further strengthens their market-leading position.

Report Scope Dermatology Diagnostic Devices Market Segmentation

|

Attributes |

Dermatology Diagnostic Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dermatology Diagnostic Devices Market Trends

“Innovations in Diagnostic Technologies and the Shift Toward Digital Health Integration”

- The Asia-Pacific dermatology diagnostic devices market is experiencing a significant transformation with the introduction of cutting-edge technologies, such as AI-powered diagnostic tools, high-resolution imaging systems, and teledermatology solutions. These innovations are improving the precision, efficiency, and accessibility of skin health diagnostics. AI algorithms, in particular, are being integrated into devices for faster, more accurate detection of conditions like skin cancer, acne, and psoriasis.

- With the growing adoption of digital health solutions, there is a noticeable trend toward integrating dermatology diagnostic devices with digital health platforms. These platforms provide real-time access to diagnostic results, enabling patients to track their skin health over time. Telemedicine and mobile health apps are playing an increasingly important role, especially in remote and underserved areas, by offering dermatological consultations and diagnostics through virtual platforms.

- For instance, In China, Beijing-based startup DXY is integrating AI-driven analytics with telehealth platforms to revolutionize dermatology diagnostics. The company developed an AI-powered mobile app that allows users to take pictures of their skin conditions and get instant, accurate diagnostics. The app uses machine learning algorithms to analyze images of skin lesions, offering insights into potential conditions such as acne, eczema, and skin cancer.

- Teledermatology services are expanding rapidly, particularly in rural and remote areas where access to dermatologists is limited. This is creating an opportunity for diagnostic device manufacturers to provide tools that can be used in telehealth settings, enabling dermatologists to remotely analyze skin images and provide diagnoses. This trend is expected to grow significantly, especially in countries with large rural populations like India and Indonesia.

Dermatology Diagnostic Devices Market Dynamics

Driver

“Growing Skin Health Awareness and Technological Innovations in Dermatology Diagnostics”

- The Asia-Pacific dermatology diagnostic devices market is significantly driven by the increasing prevalence of skin diseases, such as skin cancer, acne, psoriasis, and eczema, alongside rising public awareness about the importance of early diagnosis and prevention. This growing concern for skin health, combined with rising healthcare spending, is creating heightened demand for advanced diagnostic tools, particularly those that offer non-invasive and real-time monitoring capabilities.

- The adoption of AI-driven diagnostic technologies, such as machine learning algorithms and image recognition systems, is transforming the dermatology landscape across the region. Countries like Japan, South Korea, and China are leading the way in adopting these innovations, which enable faster, more accurate diagnoses of skin conditions. AI-powered tools can analyze images of skin lesions, detect early signs of skin cancer, and track the progression of chronic conditions like acne and psoriasis. These technologies are helping dermatologists provide better care and improving patient outcomes.

For instance,

- In 2019, Mindray Medical International Limited (China) launched a high-resolution imaging system that combines artificial intelligence with skin diagnostics, particularly for the early detection of melanoma and other skin cancers. This device, used widely in hospitals and dermatology clinics across China, offers enhanced accuracy in identifying skin lesions. Mindray’s innovative product is revolutionizing how dermatologists detect skin cancers, helping them deliver early interventions and reducing the risk of late-stage diagnoses.

- For instance, according to the World Health Organization, over 2 million new cases of non-melanoma skin cancer are diagnosed annually in the Asia-Pacific region. In response, China’s AI-powered dermatology diagnostics market has grown by over 25% annually since 2020, with platforms like Ping An Good Doctor and Alibaba Health leveraging AI algorithms to assist in dermatological evaluations. Moreover, South Korea’s Ministry of Health and Welfare reported a 40% increase in dermatology AI integration in hospitals between 2020 and 2023, enhancing diagnostic efficiency and reducing time-to-treatment for patients.

- Consumer demand for preventive dermatology is also increasing, with more people seeking early screening tools for skin cancer, especially in regions with high sun exposure like Australia and Southeast Asia. Advanced imaging systems, digital dermatoscopes, and portable diagnostic tools are enabling individuals to monitor their skin health proactively, driving market growth.

Opportunity

“Rising Demand for Non-invasive, Ethical, and Personalized Dermatology Solutions”

- The growing demand for non-invasive, clean-label, and ethically produced dermatology diagnostic devices is creating significant opportunities for manufacturers in the Asia-Pacific region. Consumers are increasingly seeking diagnostic solutions that prioritize transparency, safety, and high-quality, scientifically backed technology. In particular, there is rising demand for devices that do not require invasive procedures, providing a more ethical approach to skin health management. This trend is being driven by growing health consciousness and the preference for solutions that align with the region’s ethical values, particularly in countries like Japan, South Korea, and Australia.

- Personalized dermatology is another key opportunity in the market. The application of genetic profiling, AI-based skin health analytics, and metabolic insights is transforming how dermatological conditions are diagnosed and treated. Companies are now offering customized skincare and diagnostic tools based on individual genetic and environmental factors. The integration of AI-powered diagnostic devices that analyze skin conditions and recommend personalized treatments is gaining traction, particularly in high-tech markets like South Korea and Japan.

For instance,

- In 2023, Heine Optotechnik launched a new line of non-invasive digital dermatoscopes in the Asia-Pacific market. These devices are designed to provide high-resolution, real-time skin imaging, with AI integration for faster and more accurate skin cancer detection. The company emphasized the ethical sourcing of materials, sustainable production practices, and a commitment to transparency in the device’s development, which has been well-received in markets like Japan and Australia.

- The launch taps into the growing consumer demand for ethical, non-invasive diagnostic tools that are scientifically validated, marking a significant opportunity in the region’s dermatology diagnostic devices market.

Restraint/Challenge

“Regulatory Complexities and Authenticity Issues Impeding Market Growth”

- The Asia-Pacific dermatology diagnostic devices market is facing significant challenges due to regulatory complexities and varying standards across different countries. The regulatory framework for medical devices, including dermatology diagnostic tools, differs widely across the region, creating hurdles in the approval process, product certifications, and labeling requirements. Countries like China, India, and Japan have distinct regulations, which can lead to delays in product launches, increased compliance costs, and difficulties in marketing devices that meet local standards.

- Concerns regarding product authenticity and efficacy are another challenge in the dermatology diagnostic devices market, particularly with the rise of counterfeit or substandard products. Some unregulated or low-quality devices, often imported or locally manufactured, have failed to meet safety and performance standards, damaging consumer trust in dermatology diagnostic products. This is especially a concern in emerging markets such as India and Southeast Asia, where there is a significant market for both legitimate and illicit devices.

- With the growing emphasis on transparency, clinical validation, and ethical manufacturing in the region, dermatology device manufacturers are under increasing pressure to ensure that their products are clinically validated, third-party certified, and compliant with international standards. This requires substantial investments in testing, certifications, and ongoing monitoring to guarantee product safety and efficacy. While this trend towards higher quality standards is beneficial in the long run, it increases operational costs and can extend development timelines.

For instance,

- In 2022, China's National Medical Products Administration (NMPA) conducted an extensive review and recall of multiple dermatology diagnostic devices that failed to meet safety standards, particularly those used in skin cancer detection. The recall was triggered by concerns over the accuracy of the devices' results and their ability to perform reliably under real-world conditions.

- This not only caused financial setbacks for the manufacturers but also led to a loss of consumer confidence in similar products. The move highlighted the increasing regulatory scrutiny and the challenges companies face in maintaining compliance with stringent product standards in the region.

Dermatology Diagnostic Devices Market Scope

The market is segmented on the basis, Diagnostic device, product type, treatment device, application, and end user

|

Segmentation |

Sub-Segmentation |

|

By Diagnostic Device |

|

|

By Product Type |

|

|

By Treatment Device |

|

|

By Application |

|

|

By End User |

|

In 2025, Skin Cancer is projected to dominate the market with a largest share in application segment

The Skin Cancer segment is expected to dominate the Asia-Pacific Dermatology Diagnostic Devices Market, accounting for the largest share of 32.22% in 2025, driven by the rising incidence of skin cancer, especially in countries with high levels of sun exposure, such as Australia, India, and Southeast Asia. As public awareness of skin cancer increases, there is a growing demand for non-invasive, accurate diagnostic tools that allow for early detection and treatment. Devices such as digital dermatoscopes and AI-powered imaging systems are becoming increasingly popular for skin cancer detection due to their ability to provide high-resolution, detailed images of skin lesions and identify potentially cancerous growths at an early stage. These innovations are gaining traction among dermatologists and healthcare providers due to their efficiency, precision, and ability to facilitate faster diagnoses.

The Electrosurgical is expected to account for the largest share during the forecast period in treatment device market

In 2025, the Electrosurgical segment is projected to dominate the Asia-Pacific Dermatology Diagnostic Devices Market, accounting for the largest share, with an estimated 51.34% of the market. driven by the increasing demand for precise and minimally invasive procedures in dermatological care. These devices are widely used for the removal of skin lesions, treatment of warts, moles, and superficial skin cancers, offering benefits such as reduced bleeding, minimal scarring, and faster recovery times. The rising prevalence of dermatological conditions, coupled with growing awareness of advanced treatment options, is fueling the adoption of electrosurgical technologies. Additionally, advancements in device safety, precision, and integration with other dermatological tools are enhancing their effectiveness and boosting market growth across the region.

Dermatology Diagnostic Devices Market Regional Analysis

“China is the Dominant Country in the Dermatology Diagnostic Devices Market”

- China is projected to lead the Asia-Pacific Dermatology Diagnostic Devices Market in 2025, capturing the largest market share due to its expanding healthcare infrastructure, rising burden of skin diseases, and increasing investments in dermatological research and technology.

- The country is witnessing a notable rise in dermatological conditions such as acne, eczema, psoriasis, and skin cancer, driven by factors like environmental pollution, changing lifestyles, and higher UV exposure. This has created robust demand for advanced diagnostic tools that enable early detection and effective management of skin disorders.

- Government-backed healthcare initiatives, including the expansion of dermatology departments in public hospitals and increased funding for skin cancer screening programs, are contributing to the broader adoption of dermatology diagnostic devices. Moreover, China’s proactive stance in integrating technology with healthcare is accelerating the uptake of digital dermatoscopes, AI-powered skin analysis systems, and non-invasive imaging tools.

- China is also emerging as a manufacturing and innovation hub for medical and diagnostic devices, offering cost-effective solutions that are rapidly gaining regulatory approvals and being adopted both domestically and across neighboring countries.

- The growing popularity of teledermatology and mobile health platforms is enhancing access to dermatological care, particularly in rural and semi-urban regions. These digital solutions, often equipped with diagnostic imaging capabilities, are expanding the reach of dermatology diagnostics and boosting patient engagement in skin health management.

- Supported by a large population base, rapid technological adoption, and strategic government support, China continues to set the pace for market growth in the Asia-Pacific dermatology diagnostic devices segment.

“India is Projected to Register the Highest Growth Rate”

- India is witnessing a significant rise in dermatological conditions such as acne, fungal infections, eczema, and skin cancers, driven by urban pollution, rising stress levels, poor lifestyle habits, and prolonged sun exposure. This surge in skin-related issues is accelerating demand for early diagnostic tools and effective skin assessment technologies.

- The Indian government is promoting early disease detection and affordable healthcare access through initiatives such as Ayushman Bharat and increased funding for primary health centers—many of which now include dermatology services. These policies are aiding the expansion of dermatology infrastructure and boosting the use of diagnostic devices across both public and private healthcare systems.

- With the growing trend of personalized and preventive healthcare, Indian consumers are increasingly opting for early diagnosis and dermatology screenings, especially in urban regions. This demand is being met through the integration of advanced tools like digital dermatoscopes, optical imaging systems, and AI-powered skin analysis platforms in clinics and wellness centers.

- India’s thriving telemedicine sector and digital health ecosystem are further contributing to dermatology diagnostics access in rural and semi-urban areas. The use of mobile diagnostic devices and cloud-connected skin analysis tools is enhancing early detection and remote consultations, addressing the dermatologist-to-patient ratio gap in the country.

Dermatology Diagnostic Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Canfield Scientific (U.S.)

- Heine Optotechnik (Germany)

- Olympus Corporation (Japan)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- FUJIFILM Holdings Corporation (Japan)

- Canon Medical Systems Corporation (Japan)

- Hitachi, Ltd. (Tokyo, Japan)

- Samsung Medison Co., Ltd. (South Korea)

- Opto Circuits (India) Ltd. (India)

- Arkray, Inc. (Japan)

- Mindray Medical International Limited (China)

Latest Developments in Dermatology Diagnostic Devices Market

- In February 2025, Canfield Scientific partnered with a major dermatology clinic chain in South Korea to deploy its VISIA skin analysis systems across multiple locations. This move enhances diagnostic precision for both aesthetic and medical dermatology, addressing rising consumer demand for AI-integrated skin assessment tools.

- In January 2025, FotoFinder expanded its AI-powered dermoscopy devices into Japan and Australia through strategic partnerships with local distributors. The initiative aims to improve early melanoma detection and diagnostic accuracy for high-risk populations in these regions.

- In March 2025, DermaSensor received regulatory approval in Singapore for its non-invasive handheld device using optical spectroscopy to assist primary care physicians in detecting skin cancer. This approval facilitates better and timely skin diagnostics across Southeast Asia.

- In April 2025, HEINE Optotechnik collaborated with teledermatology startups in India to integrate its dermatoscopes with smartphone-based diagnostic platforms. This partnership aims to address rural accessibility gaps and promote early skin disease diagnosis in underserved areas.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.