Asia Pacific Diabetes Care Devices Market

Market Size in USD Billion

CAGR :

%

USD

23.62 Billion

USD

42.44 Billion

2024

2032

USD

23.62 Billion

USD

42.44 Billion

2024

2032

| 2025 –2032 | |

| USD 23.62 Billion | |

| USD 42.44 Billion | |

|

|

|

|

Asia-Pacific Diabetes Care Devices Market Size

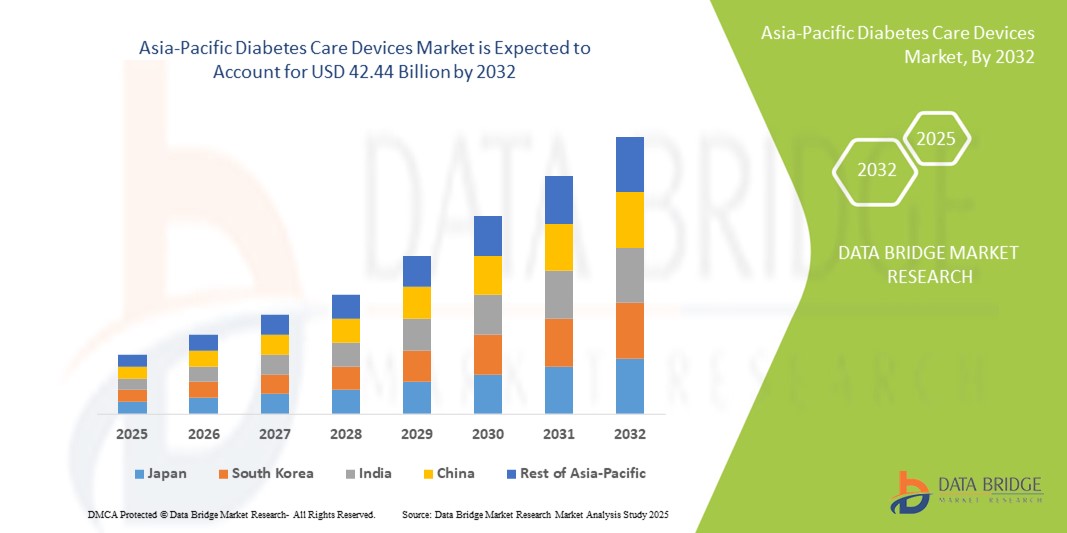

- The Asia-Pacific diabetes care devices market size was valued at USD 23.62 billion in 2024 and is expected to reach USD 42.44 billion by 2032, at a CAGR of 7.60% during the forecast period

- This robust growth is primarily driven by the increasing prevalence of diabetes in the region, advancements in diabetes care technologies, and significant investments from both public and private sectors aimed at improving diabetes management

- In addition, the rising demand for cost-effective and user-friendly diabetes care solutions is establishing these devices as essential tools for managing diabetes in both residential and clinical settings

Asia-Pacific Diabetes Care Devices Market Analysis

- Diabetes care devices, including insulin pumps, insulin pens, insulin syringes, jet injectors, self-monitoring blood glucose (SMBG) devices, and continuous glucose monitoring (CGM) systems, are becoming increasingly vital for effective diabetes management in both clinical and home settings due to their precision, convenience, and integration with digital health platforms

- The rising demand for diabetes care devices is primarily fueled by the growing prevalence of diabetes in countries such as China, India, and Japan, increasing awareness about proper disease management, and a preference for technologically advanced, user-friendly, and minimally invasive solutions

- China dominated the Asia-Pacific diabetes care devices market in 2024 with a revenue share of 38.5%, driven by the largest diabetic population in the region, expanding healthcare infrastructure, government initiatives promoting diabetes management, and high adoption of advanced monitoring and insulin delivery devices

- India is expected to be the fastest-growing country in the Asia-Pacific diabetes care devices market during the forecast period, supported by rising disposable incomes, improving healthcare accessibility, and increased awareness of self-monitoring and home-based diabetes management solutions

- Self-monitoring blood glucose (SMBG) devices dominated the Asia-Pacific diabetes care devices market in 2024 with a market share of 52.5%, driven by their ease of use, affordability, and adoption across hospitals, clinics, and home/personal settings

Report Scope and Asia-Pacific Diabetes Care Devices Market Segmentation

|

Attributes |

Asia-Pacific Diabetes Care Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Diabetes Care Devices Market Trends

Integration of Smart Monitoring and Mobile Health Platforms

- A key trend in the Asia-Pacific diabetes care devices market is the increasing integration of devices with mobile health (mHealth) applications and cloud-based platforms, enhancing real-time monitoring and management of diabetes for both patients and healthcare providers

- For instance, CGM devices such as Dexcom G6 and Abbott FreeStyle Libre provide seamless connectivity with smartphone apps, allowing users to track glucose levels, receive alerts, and share data with clinicians remotely

- Mobile app integration enables personalized insights, trend analysis, and predictive alerts for hyperglycemia or hypoglycemia, improving patient adherence and proactive disease management

- The convergence of diabetes care devices with mHealth platforms facilitates centralized management of patient data, helping clinicians monitor multiple patients simultaneously and enabling timely interventions

- This trend towards connected, intelligent, and patient-centric diabetes care solutions is transforming expectations for home-based disease management, with companies such as Medtronic and Roche developing mobile-enabled insulin pumps and CGM systems

- The demand for integrated, app-connected devices is growing rapidly across hospitals, clinics, and home settings, as patients and healthcare providers increasingly prioritize convenience, data-driven insights, and remote management

Asia-Pacific Diabetes Care Devices Market Dynamics

Driver

Rising Prevalence of Diabetes and Awareness of Disease Management

- The increasing prevalence of diabetes across countries such as China, India, and Japan, combined with rising awareness about disease management, is a key driver for the adoption of diabetes care devices in the Asia-Pacific region

- For instance, the growing number of diagnosed diabetes cases has prompted governments and healthcare providers to promote early detection and monitoring programs, leading to higher demand for SMBG devices and insulin delivery systems

- Patients are seeking accurate, reliable, and user-friendly devices for self-monitoring and insulin administration, driving uptake of advanced CGM systems, insulin pens, and pumps

- Furthermore, the expanding healthcare infrastructure and increased insurance coverage in urban areas enable wider access to diabetes care devices, supporting both residential and clinical adoption

- The rising focus on preventive care and home-based monitoring solutions is making diabetes care devices essential tools for managing glycemic levels effectively, reducing complications, and improving quality of life

- Technological advancements such as connected insulin pens, AI-based insulin dosing recommendations, and integration with mobile apps further accelerate market growth and patient engagement

Restraint/Challenge

High Cost and Limited Awareness in Rural Areas

- The relatively high cost of advanced diabetes care devices, including CGM systems and insulin pumps, poses a challenge to adoption, especially among price-sensitive populations in developing Asia-Pacific countries

- For instance, many rural patients and low-income households continue to rely on manual glucose monitoring and syringes due to affordability constraints, limiting penetration of technologically advanced devices

- Cost barriers are compounded by limited awareness and education regarding proper device usage, self-monitoring, and disease management practices in semi-urban and rural regions

- Healthcare providers and device manufacturers must invest in patient education programs, affordable product lines, and distribution networks to overcome these adoption barriers

- Without targeted interventions, disparities in device accessibility and usage may persist, slowing the market’s full growth potential despite rising urban demand

- Addressing affordability and awareness gaps through government initiatives, subsidies, and awareness campaigns is crucial for driving sustained adoption across diverse Asia-Pacific populations

Asia-Pacific Diabetes Care Devices Market Scope

The market is segmented on the basis of management devices, monitoring devices, end user, and distribution channel.

- By Management Devices

On the basis of management devices, the market is segmented into insulin pumps, insulin pens, insulin syringes, and jet injectors. The insulin pen segment dominated the market with the largest revenue share of 25% in 2024, driven by its convenience, ease of use, and portability compared to traditional syringes. Insulin pens allow accurate dosing, reduce injection discomfort, and are widely preferred by patients for daily insulin administration. The segment also benefits from compatibility with digital dose tracking applications and rising adoption in home and clinical settings. Growing awareness of diabetes self-management and preference for user-friendly solutions further support insulin pen dominance. In addition, insulin pens are increasingly adopted in hospitals and clinics due to their reliability and reduced risk of dosing errors.

The insulin pump segment is anticipated to witness the fastest growth rate of 18% from 2025 to 2032, fueled by increasing adoption of continuous insulin delivery systems for type 1 and type 2 diabetes patients. Pumps provide precise, programmable insulin doses and can integrate with CGM systems for automated glucose management. Advances in AI-enabled pumps allow predictive insulin delivery and enhanced patient convenience. Rising patient preference for improved quality of life, reduced injections, and integration with mobile applications also contribute to rapid growth. Healthcare providers are increasingly recommending insulin pumps for intensive diabetes management, further driving the segment.

- By Monitoring Devices

On the basis of monitoring devices, the market is segmented into self-monitoring blood glucose (SMBG) devices and continuous glucose monitoring (CGM) systems. The SMBG segment dominated the market with a revenue share of 52.5% in 2024, owing to its affordability, ease of use, and widespread adoption across hospitals, clinics, and home/personal settings. SMBG devices provide instant feedback for patients to monitor daily glucose fluctuations and adjust insulin doses or diet accordingly. Their portability, minimal training requirement, and compatibility with telemedicine programs make them the first choice for many diabetic patients. The segment benefits from government and NGO programs promoting diabetes self-management, especially in emerging Asia-Pacific countries. High patient trust and established market presence support continued dominance of SMBG devices.

The CGM segment is expected to witness the fastest CAGR of 19% from 2025 to 2032, driven by technological advancements and rising demand for real-time glucose monitoring. CGM devices provide continuous data, trend alerts, and automated notifications for hypo- and hyperglycemia, improving disease management outcomes. Integration with mobile applications, cloud platforms, and insulin pumps enhances patient convenience and clinical decision-making. Growing awareness of the benefits of continuous monitoring and increasing adoption in home care and hospital settings contribute to rapid growth. Rising patient willingness to invest in proactive and preventive care also supports CGM adoption.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, and home/personal settings. The hospital segment dominated the market with a share of 45% in 2024, owing to the high demand for professional diabetes management services and frequent use of advanced monitoring and insulin delivery devices. Hospitals offer structured care, patient education, and access to technologically advanced devices, making them the primary channel for device usage. Increasing hospitalization rates of diabetic patients and adoption of SMBG and CGM devices in inpatient care drive the segment’s dominance. Hospitals also support training for home-based self-management, indirectly boosting patient adherence to device usage.

The home/personal segment is expected to witness the fastest growth rate of 16% from 2025 to 2032, fueled by rising awareness of diabetes self-care, telemedicine adoption, and convenient access to SMBG, CGM, and insulin pens. Increasing patient preference for home-based monitoring and management, combined with user-friendly, mobile-connected devices, is expanding this segment rapidly. The convenience of remote monitoring and integration with digital health platforms enhances patient engagement and adherence. Home-based care reduces dependency on hospital visits and empowers patients to manage their condition proactively, driving growth in the segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into institutional sales and retail sales. The institutional sales segment dominated the market in 2024, with a share of 60%, supported by bulk purchases by hospitals, clinics, and healthcare organizations for patient management and institutional programs. Institutional channels also facilitate device training, maintenance, and integration with hospital IT systems. Partnerships with government programs and NGOs for diabetes care further strengthen the institutional channel dominance.

The retail sales segment is expected to witness the fastest CAGR of 17% from 2025 to 2032, driven by the growing availability of devices through pharmacies, online platforms, and specialty diabetes stores. Retail channels provide convenient access to devices for home use, especially SMBG devices, insulin pens, and CGM systems. Rising e-commerce penetration in Asia-Pacific, coupled with increased consumer awareness and affordability programs, is accelerating retail growth. Retail sales also cater to self-management trends and telemedicine integration, making them a rapidly expanding channel.

Asia-Pacific Diabetes Care Devices Market Regional Analysis

- China dominated the Asia-Pacific diabetes care devices market in 2024 with a revenue share of 38.5%, driven by the largest diabetic population in the region, expanding healthcare infrastructure, government initiatives promoting diabetes management, and high adoption of advanced monitoring and insulin delivery devices

- Patients and healthcare providers in the region highly value the accuracy, ease of use, and real-time monitoring capabilities offered by advanced devices such as SMBG systems, CGM devices, and insulin pens, which support effective diabetes management at both home and clinical settings

- This widespread adoption is further supported by rising disposable incomes, growing awareness of diabetes management, and the increasing preference for connected, app-integrated devices, establishing diabetes care devices as essential tools across hospitals, clinics, and home/personal settings in Asia-Pacific

The China Diabetes Care Devices Market Insight

China dominated the Asia-Pacific diabetes care devices market in 2024, with the largest revenue share of 38.5%, driven by the country’s vast diabetic population and rising awareness of disease management. Hospitals and clinics are increasingly adopting SMBG devices, CGM systems, and insulin pens to improve patient care. Government initiatives promoting early diagnosis, prevention programs, and reimbursement policies are boosting accessibility. Urbanization, rising disposable incomes, and integration of devices with mobile health platforms further support adoption. Domestic manufacturing of affordable devices also expands reach to semi-urban and rural populations.

India Diabetes Care Devices Market Insight

The India diabetes care devices market captured a significant share in 2024, propelled by rapid urbanization, increasing diabetes prevalence, and a growing middle-class population. SMBG devices and insulin pens are widely used across hospitals, clinics, and home settings. Government-led health programs, awareness campaigns, and telemedicine adoption enhance patient access and engagement. Affordable device options from domestic manufacturers and expanding retail and e-commerce channels further accelerate market growth. The push towards smart healthcare infrastructure supports adoption of advanced CGM systems and connected insulin delivery devices.

Japan Diabetes Care Devices Market Insight

The Japan diabetes care devices market is expanding steadily, driven by a high prevalence of diabetes among the aging population and strong healthcare awareness. CGM systems and insulin pumps are increasingly adopted in hospitals, clinics, and home settings for precise glucose management. Integration with mobile applications and telemedicine platforms improves patient monitoring and adherence. The country’s emphasis on innovative, technology-driven healthcare solutions encourages adoption of connected, user-friendly devices. Rising urbanization and lifestyle changes also contribute to the growing demand for home-based diabetes care solutions.

South Korea Diabetes Care Devices Market Insight

The South Korea diabetes care devices market is witnessing significant growth due to rising diabetes prevalence and strong healthcare infrastructure. Hospitals and clinics are major users of SMBG and CGM systems, while insulin pens and pumps are gaining popularity among home users. Government initiatives promoting diabetes awareness, prevention programs, and reimbursement support adoption. The tech-savvy population favors mobile-connected and app-integrated devices, boosting market penetration. Increasing urbanization and high disposable incomes further drive demand for advanced, user-friendly diabetes care solutions.

Asia-Pacific Diabetes Care Devices Market Share

The Asia-Pacific Diabetes Care Devices industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Dexcom, Inc. (U.S.)

- Medtronic (Ireland)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Insulet Corporation (U.S.)

- Senseonics, Inc. (U.S.)

- Ascensia Diabetes Care (Switzerland)

- Ypsomed AG (Switzerland)

- Arkray, Inc. (Japan)

- Sinocare Inc. (China)

- Nipro Corporation (Japan)

- BD (U.S.)

- Novo Nordisk A/S (Denmark)

- Sanofi (France)

- Eli Lilly and Company (U.S.)

- Terumo Corporation (Japan)

- LifeScan, Inc. (U.S.)

- Omron Healthcare Co., Ltd. (Japan)

- B. Braun SE (Germany)

What are the Recent Developments in Asia-Pacific Diabetes Care Devices Market?

- In August 2025, Abbott launched the FreeStyle Libre 2 Plus sensor in India, offering automatic glucose readings every minute via NFC and Bluetooth to a smartphone app, with optional alarms and a 15-day wearable sensor format

- In July 2025, researchers at MNNIT Prayagraj and Dr. Ram Manohar Lohia Institute of Medical Sciences, Lucknow, announced a new non-invasive glucose monitoring device that eliminates the need for finger-pricks by using electromagnetic sensing placed between the thumb and index finger; the projected cost is under ₹500, making it especially accessible for low-income diabetic patients

- In June 2025, Tracky (a healthtech brand of DrStore Healthcare Services) launched India’s first Bluetooth-connected continuous glucose monitor, aimed at real-time, scan-free glucose tracking via smartphone, targeting preventive health and broader accessibility

- In April 2025, Ambrosia introduced India’s first 24×7 real-time glucose & stress monitoring service using wearable sensors, AI analytics, and remote monitoring effectively combining continuous glucose monitoring with stress monitoring in an integrated digital health service

- In July 2024, Danish diabetes company Novo Nordisk signed a memorandum of understanding with Indonesia’s state-owned Bio Farma to begin local insulin manufacturing strengthening regional diabetes treatment supply chains and improving access to insulin therapy in Southeast Asia

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.