Asia Pacific Digital Diabetes Management Market

Market Size in USD Billion

CAGR :

%

USD

2.95 Billion

USD

10.74 Billion

2024

2032

USD

2.95 Billion

USD

10.74 Billion

2024

2032

| 2025 –2032 | |

| USD 2.95 Billion | |

| USD 10.74 Billion | |

|

|

|

|

Asia-Pacific Digital Diabetes Management Market Size

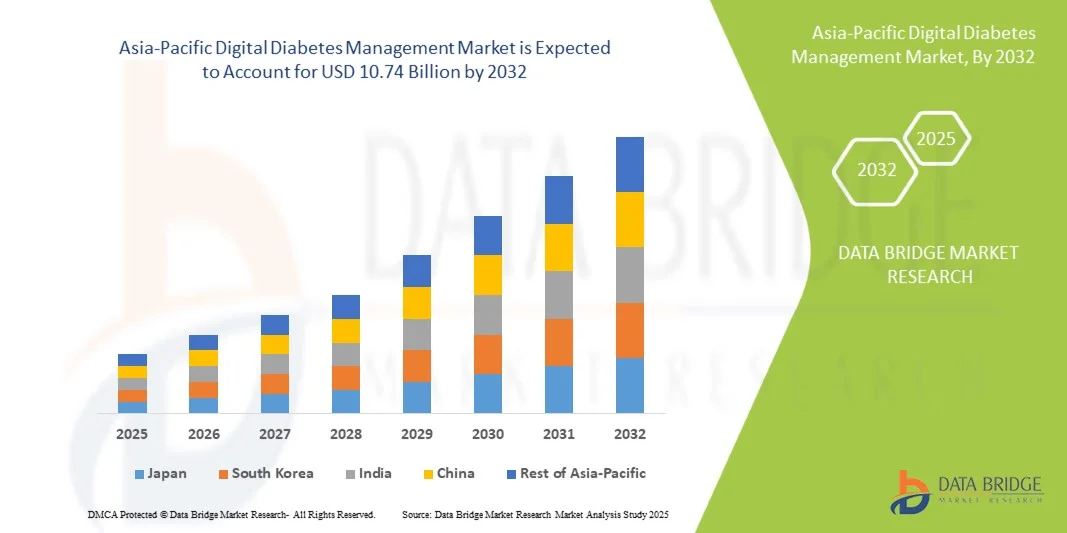

- The Asia-Pacific digital diabetes management market size was valued at USD 2.95 billion in 2024 and is expected to reach USD 10.74 billion by 2032, at a CAGR of 17.5% during the forecast period

- The market growth is primarily driven by the rising prevalence of diabetes across the region, coupled with increasing adoption of advanced digital health technologies such as continuous glucose monitoring, mobile health apps, and smart insulin delivery systems

- In addition, growing awareness regarding self-management of diabetes, expanding healthcare digitalization initiatives, and strong government support for telemedicine and remote patient monitoring are fostering the widespread adoption of digital diabetes management solutions, thereby propelling the market’s expansion

Asia-Pacific Digital Diabetes Management Market Analysis

- Digital diabetes management solutions, including connected devices, mobile health applications, and cloud-based platforms, are becoming essential in diabetes care across Asia-Pacific due to their ability to provide continuous glucose monitoring, enhance patient engagement, and support data-driven treatment decisions

- The market growth is largely driven by the rising diabetes burden, increasing smartphone and wearable device penetration, and expanding government initiatives to integrate digital health technologies into national healthcare systems

- China dominated the Asia-Pacific digital diabetes management market with the largest revenue share of 36.8% in 2024, supported by its large diabetic population, strong health-tech ecosystem, and extensive government investments in AI-enabled and remote monitoring solutions

- India is projected to be the fastest-growing country during the forecast period, driven by rapid digital transformation in healthcare, growing awareness of self-monitoring, and increasing partnerships between technology providers and healthcare institutions

- The Devices segment dominated the market the market with the largest market share of 41.7% in 2024, attributed to the widespread use of wearable and handheld monitoring systems that deliver real-time glucose tracking, greater accuracy, and seamless integration with digital diabetes management apps and data platforms

Report Scope and Asia-Pacific Digital Diabetes Management Market Segmentation

|

Attributes |

Asia-Pacific Digital Diabetes Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Digital Diabetes Management Market Trends

“Integration of AI and IoT for Personalized Diabetes Care”

- A significant and accelerating trend in the Asia-Pacific digital diabetes management market is the growing integration of artificial intelligence (AI) and Internet of Things (IoT) technologies into diabetes care ecosystems, enabling real-time monitoring, predictive insights, and personalized treatment recommendations

- For instance, Chinese health-tech companies such as Ping An Good Doctor and Tencent HealthCare are incorporating AI-driven algorithms to analyze continuous glucose data and provide customized alerts for patients and physicians. Similarly, Indian startups such as BeatO and HealthifyMe are developing app-based platforms that connect glucose meters with smartphones for intelligent tracking and guidance

- AI integration in digital diabetes management enhances accuracy and clinical decision support by learning user behavior, predicting glucose fluctuations, and offering proactive interventions to prevent hypoglycemic or hyperglycemic events. For instance, some wearable insulin management systems utilize AI-based analytics to recommend optimized dosage adjustments based on historical trends. Furthermore, IoT connectivity enables seamless data sharing between patients, caregivers, and clinicians, fostering a more coordinated care environment

- The combination of AI, IoT, and mobile technology allows users to manage glucose levels, dietary intake, and physical activity through a single digital interface, creating a unified and data-rich ecosystem for continuous diabetes care. Through connected apps and cloud-based dashboards, patients and healthcare professionals can access real-time insights, improving engagement and adherence

- This trend toward intelligent, connected, and personalized diabetes management solutions is transforming the way chronic care is delivered across Asia-Pacific. Consequently, companies such as Roche Diabetes Care and Medtronic are expanding AI-enabled digital platforms designed for regional markets to enhance patient outcomes through predictive analytics and cloud-based connectivity.

- • The rising demand for digital diabetes solutions that combine AI-driven insights, IoT integration, and personalized recommendations is growing rapidly across both urban and rural populations, as patients increasingly prioritize convenience, real-time feedback, and improved disease control

Asia-Pacific Digital Diabetes Management Market Dynamics

Driver

“Growing Diabetes Prevalence and Government Push for Digital Health Adoption”

- The escalating prevalence of diabetes across Asia-Pacific, combined with strong government initiatives to advance digital healthcare and telemedicine infrastructure, is a major driver accelerating the adoption of digital diabetes management solutions

- For instance, in February 2024, India’s Ministry of Health and Family Welfare launched initiatives under the Ayushman Bharat Digital Mission to promote remote diabetes monitoring and data-driven care platforms. Such programs are expected to boost demand for connected glucose monitoring systems and mobile health apps across emerging markets

- As healthcare systems face increasing burdens from chronic disease management, digital solutions offering real-time monitoring, analytics, and patient engagement are becoming essential for effective diabetes care. They offer both convenience and scalability, enabling better disease tracking and early intervention

- Furthermore, the rise in smartphone ownership and internet connectivity across China, India, Japan, and Southeast Asia has made app-based glucose tracking and cloud-linked insulin management systems more accessible, supporting large-scale digital health transformation

- The convenience of continuous glucose monitoring, remote consultations, and AI-based recommendations is propelling widespread adoption among both patients and healthcare providers, making digital diabetes management an integral part of modern chronic disease treatment

- The trend toward patient-centric care and increasing collaboration between tech firms and healthcare institutions further strengthens market growth

Restraint/Challenge

“Data Privacy Concerns and Limited Affordability in Developing Economies”

- Concerns regarding data security, privacy breaches, and interoperability among digital health platforms present a significant challenge to the broader adoption of digital diabetes management solutions across Asia-Pacific. As these systems rely on cloud-based data storage and wireless connectivity, they are vulnerable to unauthorized access and misuse of sensitive health information

- For instance, reports of cybersecurity vulnerabilities in mobile health applications have raised concerns among both patients and healthcare providers, leading to hesitancy in fully embracing connected diabetes management platforms

- Addressing these data privacy concerns through strict regulatory frameworks, secure encryption protocols, and transparent consent processes is crucial for building patient trust and ensuring compliance with regional data protection laws such as China’s Personal Information Protection Law and India’s Digital Personal Data Protection Act. In addition, the relatively high cost of advanced digital monitoring devices and subscription-based apps remains a barrier for patients in lower-income segments

- While technological advancements and local manufacturing are gradually reducing costs, the affordability gap persists, especially in rural areas where access to connected healthcare devices is limited. Bridging this gap through public-private partnerships, insurance inclusion, and government subsidies will be essential for inclusive adoption across diverse income groups

- Overcoming these challenges through enhanced cybersecurity frameworks, patient education on digital literacy, and expansion of cost-effective connected device ecosystems will be vital to sustain long-term market growth

Asia-Pacific Digital Diabetes Management Market Scope

The market is segmented on the basis of product and services, type, and end user.

- By Product and Services

On the basis of product and services, the Asia-Pacific digital diabetes management market is segmented into devices, digital diabetes management apps, data management software and platforms, and services. The Devices segment dominated the market with the largest revenue share of 41.7% in 2024, driven by the increasing adoption of wearable and handheld glucose monitoring devices that provide accurate, real-time data and integrate seamlessly with smartphones and cloud platforms. Growing demand for continuous glucose monitoring (CGM) systems and smart insulin pens across China, Japan, and India has reinforced device leadership in the region. These devices enhance patient autonomy by enabling 24/7 tracking and reducing the need for frequent clinical visits. In addition, technological advancements in sensors and wireless data transmission have made devices more compact and affordable, broadening their adoption among diabetic patients. The expansion of local manufacturing and partnerships between device makers and digital health platforms further support this segment’s dominance.

The Digital Diabetes Management Apps segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rapid smartphone penetration, digital literacy, and growing awareness of self-management tools among diabetic patients. These apps allow users to log glucose readings, track meals and activities, and receive AI-based insights for better disease management. Integration of apps with wearable devices and cloud-based health records is driving their popularity, particularly in emerging economies such as India and Indonesia. Moreover, government-backed initiatives promoting mobile health (mHealth) and remote monitoring programs are expected to accelerate the segment’s expansion.

- By Type

On the basis of type, the Asia-Pacific digital diabetes management market is segmented into wearable devices and handheld devices. The Wearable Devices segment dominated the market with the largest revenue share in 2024, driven by the widespread adoption of continuous glucose monitors (CGMs), smart insulin patches, and connected fitness wearables that provide real-time tracking of glucose levels and vital parameters. These devices enable round-the-clock monitoring and offer greater convenience, reducing the need for traditional finger-prick tests. Their seamless data integration with mobile apps and cloud platforms enhances personalized care, making them increasingly preferred among both patients and healthcare professionals. The proliferation of health-conscious consumers and the availability of technologically advanced wearable devices from companies such as Abbott, Dexcom, and Medtronic further strengthen segment growth.

The Handheld Devices segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the affordability and accessibility of portable glucometers and smart insulin pens. These devices are particularly favored in developing economies such as India and Vietnam, where cost-effectiveness and portability are key purchasing factors. Manufacturers are introducing Bluetooth-enabled glucometers that sync with mobile apps to provide detailed reports and alerts, promoting better glucose management. In addition, the rise of point-of-care testing and home-based monitoring during and after the COVID-19 pandemic has further accelerated the adoption of handheld digital solutions across urban and rural markets.

- By End User

On the basis of end user, the Asia-Pacific digital diabetes management market is segmented into home care settings, diabetes clinics, academic and research institutes, and others. The Home Care Settings segment dominated the market with the largest revenue share in 2024, attributed to the increasing preference for remote monitoring, self-management, and convenience-driven healthcare solutions among diabetic patients. The growth of home-based glucose monitoring and the availability of connected devices that transmit data directly to healthcare professionals are transforming diabetes care across China, Japan, and South Korea. The rising geriatric population, along with greater awareness of preventive and continuous disease management, has fueled adoption within home environments. Moreover, the cost savings associated with home monitoring, compared to frequent clinical visits, have encouraged both patients and healthcare systems to support this mode of care.

The Diabetes Clinics segment is anticipated to record the fastest growth rate from 2025 to 2032, supported by increasing integration of digital diabetes management platforms into clinical practice. Clinics are adopting connected glucose monitoring and cloud-based patient data systems to enhance treatment precision and continuity of care. For instance, clinics in Singapore and Japan are leveraging AI-based analytics to personalize insulin regimens and dietary recommendations. Growing collaboration between endocrinologists and technology providers, along with investments in digital infrastructure across hospitals and specialty centers, is expected to further strengthen the clinic-based adoption of digital diabetes solutions throughout the forecast period.

Asia-Pacific Digital Diabetes Management Market Regional Analysis

- China dominated the Asia-Pacific digital diabetes management market with the largest revenue share of 36.8% in 2024, supported by its large diabetic population, strong health-tech ecosystem, and extensive government investments in AI-enabled and remote monitoring solutions

- Consumers across major economies such as China, India, Japan, and South Korea are increasingly embracing digital diabetes solutions that offer convenience, real-time glucose tracking, and integration with mobile health applications and wearable devices

- This accelerating adoption is further supported by government-led digital health initiatives, expanding smartphone and internet penetration, and rising awareness about self-management of chronic diseases, positioning Asia-Pacific as a key growth hub for digital diabetes management across both home care and clinical settings

The China Digital Diabetes Management Market Insight

The China digital diabetes management market captured the largest revenue share in Asia-Pacific in 2024, supported by the country’s large diabetic population, strong government healthcare digitalization policies, and increasing investment in AI-powered health solutions. High smartphone penetration and widespread use of mobile health apps are enhancing accessibility, while growing consumer awareness of diabetes self-management is further boosting adoption across both home and clinical settings.

Japan Digital Diabetes Management Market Insight

The Japan market is witnessing strong growth due to its technologically advanced healthcare infrastructure, aging population, and high demand for convenience in chronic disease management. Integration of digital diabetes devices with connected health platforms, including hospital information systems and remote patient monitoring, is enhancing patient engagement and clinical efficiency. Moreover, wearable CGMs and AI-based predictive analytics are driving adoption in both home care and clinical environments.

India Digital Diabetes Management Market Insight

The India digital diabetes management market accounted for a significant revenue share in 2024, fueled by rising diabetes prevalence, rapid digital adoption, and expanding telemedicine infrastructure. The growing middle-class population and government initiatives under programs such as the Ayushman Bharat Digital Mission are increasing the availability and accessibility of digital diabetes solutions. Affordable connected devices and mobile app-based management platforms are supporting adoption across both urban and semi-urban regions.

Australia Digital Diabetes Management Market Insight

The Australia market is growing steadily due to strong government support for telehealth, high disposable incomes, and widespread adoption of digital health technologies. Integration of digital diabetes management platforms with home-based monitoring and hospital systems enhances patient adherence and enables real-time physician intervention. High consumer awareness and robust healthcare infrastructure are supporting consistent growth in both residential and clinical applications.

Asia-Pacific Digital Diabetes Management Market Share

The Asia-Pacific Digital Diabetes Management industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Medtronic (Ireland)

- F. Hoffmann La Roche Ltd. (Switzerland)

- Dexcom, Inc. (U.S.)

- Novo Nordisk A/S (Denmark)

- Bayer AG (Germany)

- Ascensia Diabetes Care Holdings AG (Switzerland)

- Terumo Corporation (Japan)

- ACON Laboratories, Inc. (U.S.)

- B. Braun SE (Germany)

- Glooko, Inc. (U.S.)

- Health2Sync Co., Ltd. (Taiwan)

- Kakao Healthcare Corp. (South Korea)

- Health Arx Technologies Pvt. Ltd. (India)

- Apollo Hospitals (India)

- Practo Technologies Private Limited (India)

- LifeScan, Inc. (U.S.)

- Tandem Diabetes Care, Inc. (U.S.)

- Ypsomed Holding AG (Switzerland)

What are the Recent Developments in Asia-Pacific Digital Diabetes Management Market?

- In September 2025, in an interview published by Express Healthcare, Abbott emphasised the role of partnerships (with hospitals, clinics) to embed CGM use into clinical workflows in India, thereby strengthening patient‑care connectivity and data sharing between patients, caregivers and HCPs

- In August 2025, Abbott Laboratories launched its next‑generation CGM sensor, the FreeStyle Libre® 2 Plus, in India. The device offers glucose readings every minute, with optional alarms for high/low glucose levels and built‑in NFC/Bluetooth connectivity that links to smartphones

- In November 2024, Health2Sync (Taiwan) partnered with Health Promotion Board (Singapore) and Abbott Laboratories to launch the “DigiCoach” pilot programme, which uses CGM devices and the Health2Sync mobile app to help individuals with pre‑diabetes or elevated BMI track diet, activity and glucose trends for preventive management

- In June 2024, Actxa Pte Ltd (Singapore) signed an MoU with Diabetes & Hypertension Clinic (India) to collaborate on AI‑driven non‑invasive diabetic risk assessment technology — their solution uses Photoplethysmography (PPG) sensors in wearables to assess diabetes risk, marking a strategic move into India’s large diabetes population

- In June 2024, SinoCare held its first “Diabetes Digital Management Conference” where it showcased an integrated diabetes management system combining four devices blood glucose monitoring (BGM), continuous glucose monitoring (CGM), continuous subcutaneous insulin infusion (CSII), and a patient education platform (PEP). The system is designed for both clinical (in‑hospital) and home care settings, leveraging AI for big‑data analysis and pattern recognition to improve monitoring accuracy and timeliness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.