Asia Pacific Digital Lending Platform Market

Market Size in USD Billion

CAGR :

%

USD

3.01 Billion

USD

13.19 Billion

2024

2032

USD

3.01 Billion

USD

13.19 Billion

2024

2032

| 2025 –2032 | |

| USD 3.01 Billion | |

| USD 13.19 Billion | |

|

|

|

|

Digital Lending Platform Market Size

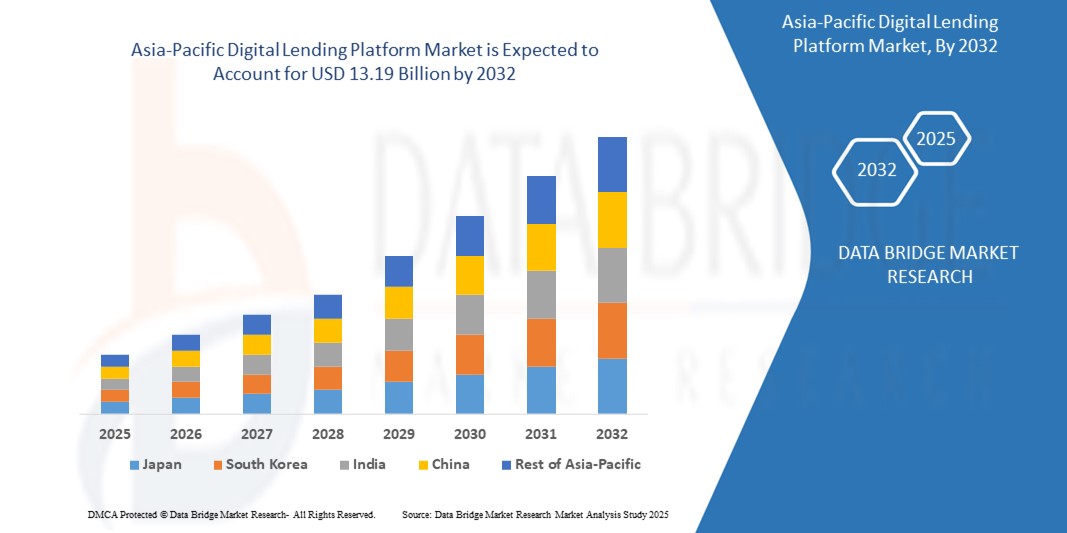

- The Asia-Pacific digital lending platform market size was valued at USD 3.01 billion in 2024 and is expected to reach USD 13.19 billion by 2032, at a CAGR of 20.3% during the forecast period

- The market growth is primarily driven by the rapid adoption of digital banking, increasing smartphone penetration, and advancements in fintech technologies, fostering greater financial inclusion across the region

- In addition, growing demand for quick, accessible, and transparent lending solutions among consumers and small businesses is positioning digital lending platforms as the preferred choice for modern credit access, significantly accelerating industry expansion

Digital Lending Platform Market Analysis

- Digital lending platforms, leveraging technology to streamline loan origination, underwriting, and disbursement, are becoming integral to the financial ecosystem in Asia-Pacific, offering enhanced accessibility, speed, and integration with digital banking services

- The surge in demand is fueled by rising internet penetration, increasing financial literacy, and a preference for seamless, paperless loan processes, particularly among millennials and Gen Z

- China dominated the Asia-Pacific digital lending platform market with the largest revenue share of 45.12% in 2024, driven by widespread digital payment adoption, a robust fintech ecosystem, and significant investments in AI-driven lending solutions

- Japan is expected to be the fastest-growing country in the digital lending platform market during the forecast period, propelled by rapid digital transformation in financial services and supportive government policies promoting fintech innovation

- The solutions segment dominated the largest market revenue share of 63% in 2024, driven by its comprehensive software applications that streamline loan origination, decision automation, risk management, and compliance

Report Scope and Digital Lending Platform Market Segmentation

|

Attributes |

Digital Lending Platform Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Digital Lending Platform Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The Asia-Pacific digital lending platform market is experiencing a notable trend toward the integration of Artificial Intelligence (AI) and Big Data analytics

- These technologies facilitate advanced data processing, enabling deeper insights into borrower creditworthiness, repayment behavior, and fraud detection

- AI-powered lending platforms support proactive decision-making by identifying potential loan defaults or risks before they escalate, improving portfolio management

- For instances, companies in the region are leveraging AI-driven platforms to assess alternative credit data, such as mobile usage or e-commerce transactions, to offer personalized loan products or optimize loan approval processes

- This trend enhances the efficiency and appeal of digital lending platforms, attracting both individual borrowers and small businesses

- AI algorithms analyze diverse borrower behaviors, including spending patterns, repayment history, and digital footprints, to tailor loan terms and interest rates

Digital Lending Platform Market Dynamics

Driver

“Rising Demand for Financial Inclusion and Digital Banking Services”

- The growing demand for accessible financial services, particularly among unbanked and underbanked populations in countries such as China and India, is a key driver for the Asia-Pacific digital lending platform market

- Digital lending platforms enhance financial inclusion by offering features such as instant loan approvals, paperless applications, and flexible repayment options

- Government initiatives, such as China’s push for fintech innovation and Japan’s digital transformation policies, are accelerating the adoption of digital lending solutions

- The proliferation of mobile internet and 5G technology across the region enables faster data processing and seamless user experiences, supporting advanced lending applications

- Financial institutions and fintech companies are increasingly offering integrated digital lending solutions to meet consumer expectations and expand market reach

- China dominates the market due to its robust banking sector and widespread adoption of digital financial services, while Japan is the fastest-growing country, driven by rapid technological advancements and supportive regulations

Restraint/Challenge

“High Implementation Costs and Data Privacy Concerns”

- The significant initial investment required for developing and integrating digital lending platforms, including software, infrastructure, and compliance systems, poses a barrier to adoption, particularly for smaller players in emerging markets

- Integrating digital lending solutions with legacy banking systems can be complex and costly

- Data security and privacy concerns are a major challenge, as digital lending platforms collect and process sensitive borrower data, raising risks of breaches, misuse, or non-compliance with regulations such as China’s Personal Information Protection Law (PIPL)

- The varied regulatory frameworks across Asia-Pacific countries, such as Japan’s stringent data protection laws, complicate operations for cross-border providers

- These factors can deter potential adopters and limit market growth, especially in regions with high cost sensitivity or strong privacy awareness

Digital Lending Platform market Scope

The market is segmented on the basis of component, deployment model, loan amount size, subscription type, loan type, and vertical.

- By Component

On the basis of component, the Asia-Pacific digital lending platform market is segmented into solutions and services. The solutions segment dominated the largest market revenue share of 63% in 2024, driven by its comprehensive software applications that streamline loan origination, decision automation, risk management, and compliance. These solutions leverage advanced technologies such as AI, machine learning, and data analytics to enhance efficiency and accuracy in lending operations.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by increasing demand for support, customization, and integration services. As financial institutions adopt digital lending platforms, the need for tailored services to optimize platform performance and ensure regulatory compliance is driving this segment’s growth, particularly in Japan, where fintech innovation is accelerating.

- By Deployment Model

On the basis of deployment model, the Asia-Pacific digital lending platform market is segmented into on-premises and cloud. The on-premises segment dominated with a 67.7% market revenue share in 2024, owing to its appeal for institutions prioritizing data control and security, especially in China, where stringent data privacy regulations encourage localized infrastructure. On-premises solutions allow for customized workflows, reducing reliance on external networks.

The cloud segment is projected to experience the fastest growth rate of 21.1% from 2025 to 2032, driven by its scalability, flexibility, and cost-effectiveness. Japan’s rapid adoption of cloud-based platforms, fueled by increasing internet penetration and supportive regulatory frameworks, is accelerating this segment’s growth, enabling real-time data processing and seamless updates.

- By Loan Amount Size

On the basis of loan amount size, the Asia-Pacific digital lending platform market is segmented into less than USD 7,000, USD 7,001 to USD 20,000, and more than USD 20,001. The less than USD 7,000 segment held the largest market revenue share of 44.65% in 2024, as consumers, particularly in China, prefer smaller loans for personal and micro-financing needs through digital platforms, driven by quick approvals and accessibility.

The USD 7,001 to USD 20,000 segment is anticipated to grow at the fastest rate from 2025 to 2032, with a CAGR of 22.12%. This growth is driven by increasing trust in digital lending platforms and rising demand for mid-sized loans for SMEs and personal financing, especially in Japan, where digital lending adoption is surging.

- By Subscription Type

On the basis of subscription type, the Asia-Pacific digital lending platform market is segmented into free and paid. The free subscription segment dominated with a 60% market revenue share in 2024, as small enterprises and startups in China opt for cost-effective solutions to access digital lending services, reducing operational costs.

The paid subscription segment is expected to witness the fastest growth from 2025 to 2032, driven by the increasing adoption of premium features such as advanced analytics, enhanced security, and personalized loan offerings. Japan’s growing fintech ecosystem and demand for sophisticated lending solutions are key contributors to this segment’s rapid expansion.

- By Loan Type

On the basis of loan type, the Asia-Pacific digital lending platform market is segmented into automotive loan, SME finance loan, personal loan, home loan, consumer durable, and others. The automotive loan segment held the largest market revenue share of 32% in 2024, driven by growing vehicle sales on instalment basis, particularly in China, where digital platforms facilitate seamless loan processing for car purchases.

The personal loan segment is projected to experience the fastest growth from 2025 to 2032, fueled by rising consumer demand for quick, flexible financing options. Japan’s increasing smartphone penetration and relaxed regulatory policies are enabling platforms to offer tailored personal loan products, enhancing financial inclusion.

- By Vertical

On the basis of vertical, the Asia-Pacific digital lending platform market is segmented into banking, financial services, insurance companies, P2P (peer-to-peer) lenders, credit unions, and saving and loan associations. The banking segment dominated with a 42% market revenue share in 2024, driven by China’s robust banking sector, extensive user base, and adoption of digital lending platforms to streamline loan origination and enhance customer experience.

The P2P (peer-to-peer) lenders segment is anticipated to witness the fastest growth rate of 23.72% from 2025 to 2032, driven by Japan’s surge in finfet innovation and consumer preference for direct lending platforms that bypass traditional intermediaries. The rise in mobile payments and data-driven credit assessments further accelerates this segment’s growth.

Digital Lending Platform Market Regional Analysis

- China dominated the Asia-Pacific digital lending platform market with the largest revenue share of 45.12% in 2024, driven by widespread digital payment adoption, a robust fintech ecosystem, and significant investments in AI-driven lending solutions

- Japan is expected to be the fastest-growing country in the digital lending platform market during the forecast period, propelled by rapid digital transformation in financial services and supportive government policies promoting fintech innovation

China Digital Lending Platform Market Insight

China dominated the Asia-Pacific digital lending platform market with the highest revenue share of 76.9% in 2024, fueled by its expanding banking sector, rapid urbanization, and widespread adoption of digital financial services. The trend towards financial inclusion and increasing regulations promoting secure digital lending standards further boost market expansion. The integration of digital lending solutions by major banks and fintech firms complements the growing demand for SME and personal loans, creating a robust market ecosystem.

Japan Digital Lending Platform Market Insight

Japan’s digital lending platform market is expected to witness the fastest growth rate, driven by strong consumer preference for high-quality, technologically advanced lending solutions that enhance accessibility and security. The presence of major financial institutions and the integration of digital lending platforms in both traditional and fintech sectors accelerate market penetration. Rising interest in customized loan products, such as automotive and personal loans, also contributes to growth.

Digital Lending Platform Market Share

The digital lending platform industry is primarily led by well-established companies, including:

- General Electric (U.S.)

- IBM Corporation (U.S.)

- PTC (U.S.)

- Microsoft (U.S.)

- Siemens AG (Germany)

- ANSYS, Inc. (U.S.)

- SAP SE (Germany)

- Oracle (U.S.)

- Robert Bosch GmbH (Germany)

- Swim.ai, Inc. (U.S.).

- Atos S.E. (France)

- ABB (Switzerland)

- KELLTON TECH (India)

- AVEVA Group plc (U.K.)

- DXC Technology Company (U.S.)

- Altair Engineering, Inc. (U.S.)

- NTT DATA, Inc. (Japan)

- TIBCO Software Inc. (U.S.)

What are the Recent Developments in Asia-Pacific Digital Lending Platform Market?

- In August 2024, KMS Solutions partnered with Kuliza to introduce Lend.In, a next-generation Digital Lending platform, to the Vietnamese market. Designed as an end-to-end solution, Lend.In empowers banks to fully digitize their lending processes—spanning consumer, SME, and commercial lending. The platform integrates AI, Machine Learning, and Data Analytics to streamline operations, reduce time-to-market, and enhance customer experience. With features such as low-code configurability and ready-built architecture, Lend.In enables financial institutions to launch new loan products rapidly and stay competitive in a fast-evolving digital landscape

- In June 2024, Salesforce India unveiled its Digital Lending for India platform, a purpose-built solution designed to transform the country’s lending ecosystem. Built on the Financial Services Cloud, the platform integrates AI, automation, and India-specific features such as Aadhaar authentication and Video KYC to streamline loan origination, underwriting, and pre-disbursement processes. It supports home, auto, and personal loans, offering a unified view of customer data to accelerate approvals and reduce operational costs

- In June 2024, Bandhan Bank launched a new service for the online collection of direct taxes, enabling both customers and non-customers across India to pay taxes seamlessly. As an RBI-appointed agency bank, Bandhan Bank is now live on the TIN 2.0 platform of the Income Tax Department. The service is accessible via Retail and Corporate Internet Banking, as well as through payment gateways using debit/credit cards and net banking. In addition, offline payments are accepted at over 1,700 branches nationwide. This move reflects the broader digital transformation in financial services, paving the way for more integrated digital banking and lending ecosystems

- In May 2024, Visa introduced a suite of innovative products and strategic partnerships across Asia-Pacific to enhance digital payment flexibility, security, and acceptance. Key initiatives include the expansion of stablecoin-backed cards in collaboration with partners such as StraitsX and DCS Singapore, enabling seamless crypto-to-fiat transactions. Visa also launched the Visa Tokenised Asset Platform (VTAP) to support programmable financing and tokenized asset trading across public and private blockchains. In addition, Visa Pay was introduced to connect any participating digital wallet with Visa-accepting merchants globally, streamlining payments and supporting the region’s growing digital lending ecosystem

- In February 2024, SCBX, the financial technology arm of Thailand’s Siam Commercial Bank, signed a definitive agreement to acquire 100% of Home Credit Vietnam for approximately VND 20,973 billion (around USD 860 million). This strategic move marks SCBX’s entry into Vietnam’s fast-growing consumer finance market and underscores the broader trend of consolidation in the fintech sector. With Home Credit Vietnam’s strong digital infrastructure, 15 million customers, and 14,000 point-of-sale locations, the acquisition enhances SCBX’s regional footprint and digital lending capabilities, positioning it to capitalize on Southeast Asia’s expanding middle class and increasing demand for accessible financial services

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.