Asia Pacific Electric Vehicle Charging Stations Market

Market Size in USD Billion

CAGR :

%

USD

1,199.42 Billion

USD

31,569.31 Billion

2022

2030

USD

1,199.42 Billion

USD

31,569.31 Billion

2022

2030

| 2023 –2030 | |

| USD 1,199.42 Billion | |

| USD 31,569.31 Billion | |

|

|

|

Asia-Pacific Electric Vehicle Charging Stations Market Analysis and Size

There is a growing demand for EVs; thus, the market for electronic charging is also expanding. The installation of the charging stations is partly funded by governments worldwide. Government agencies will likely actively support the level 3 charging station market during the forecast period. Electric vehicles (EVs) are becoming increasingly popular on a global scale. Additionally, the growing popularity of sustainable fuel sources will support the growth trajectory of electric vehicle charging stations. As more electric charging stations and low-emission vehicles are used, residential buildings close to transportation hubs are at increased risk from vehicle emissions linked to cardiac and respiratory issues.

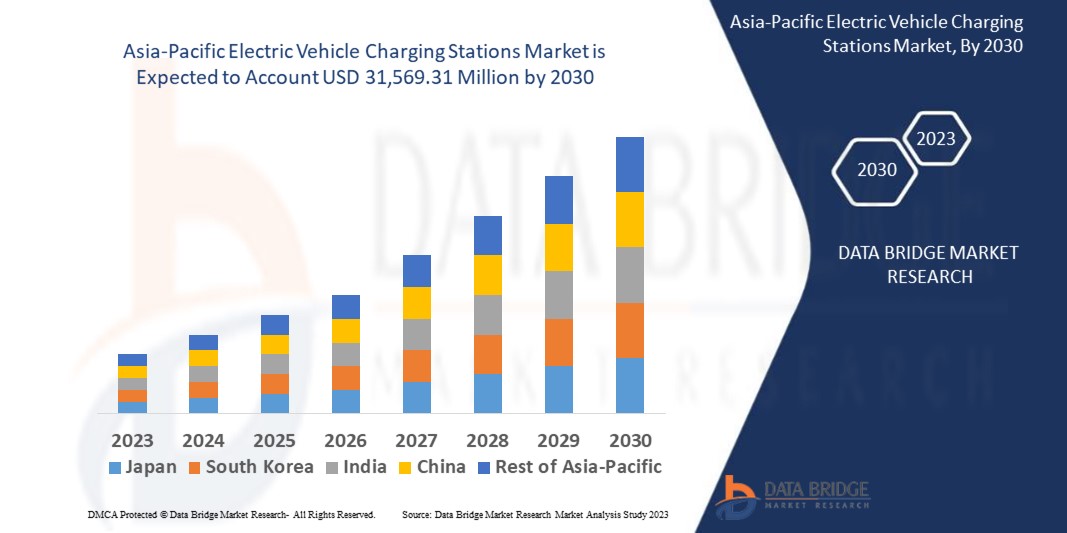

Data Bridge Market Research analyses that the electric vehicle charging stations market, valued at USD 1,199.42 million in 2022, will reach USD 31,569.31 million by 2030, growing at a CAGR of 50.5% during the forecast period of 2023 to 2030. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Asia-Pacific Electric Vehicle Charging Stations Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Charging Stations (AC Charging/ Normal Charging Station, DC Charging/ Super Charging Station, Others), Charger Type (Portable Charger, Fixed Charger), Charging Type (Off Board Top Down Pantograph, On Board Bottom Up Pantograph, Charging Via Conector), Charging Services (EV Charging Services, Battery Swapping Service), Mode Of Charging (Plug In Charging, Wireless Charging), Connectivity Type (Non-Connected Charging Stations, Smart Connected Charging Stations, Pantograph, Connectors, Combined Charging Systems, Chademo, Others), Charging Infrastructure (Normal Charging, Type 2, CCS, Chademo, Tesla SC, GB/T Fast), Vehicle Type (Passengers Cars, Commercial Cars, Battery Electric Vehicle (BEV), Plug-In Hybrid Electric Vehicles (PHEV), Two Wheelers and Scooters, Hybrid Electric Vehicles (HEV)), Installation Type (Individual Houses, Commercial, Apartments, Others), Connecting Phase (Single Phase, Three Phase), Technology (Level 1, Level 2, Level 3), Operations (Mode 1, Mode 2, Mode 3, Mode 4), Components (Hardware, Software, Services), Application (Public, Semi-Public, Private), End User (Residential, Commercial) |

|

Countries Covered |

China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC) |

|

Market Players Covered |

ChargePoint, Inc. (U.S.), ABB (Switzerland), Webasto Group (Germany), Shell International B.V. (Netherlands), Schneider Electric (France), Renault Group (France), Phihong USA Corp. (U.S.), EV Safe Charge Inc. (U.S.), Tesla (U.S.), Mercedes-Benz Group AG. (Germany), Siemens (Germany), TATA Power (India), Magenta EV Solutions Private Limited (India), Fortum (Finland), Volttic EV Charging (India), Ather Energy (India), Infineon Technologies AG (Germany), Amara Raja Group (India), Exicom (India), Griden Technologies Pvt. Ltd. (India) |

|

Market Opportunities |

|

Market Definition

Electric cars, neighborhood electric vehicles, and plug-in hybrids can all be recharged at an electric vehicle charging station, which is a piece of equipment. Features such as smart meters, cellular capability, and network connectivity, while some charging stations are more basic. Under the name "electric vehicle supply equipment" (EVSE), electric utility companies or private businesses provide charging stations in retail shopping areas or public parking lots. These charging stations provide distinctive connectors that follow the various standards for electrical connectors. Plug-in electric vehicles (EVs), such as electric cars, neighborhood EVs, and hybrids, are powered by electric vehicle charging stations, also referred to as electric vehicle supply equipment (EVSE). The power grid is connected to the energy conversion system, software, facility meter, and energy controller the charging stations use.

Electric Vehicle Charging Stations Market Dynamics

Drivers

- Growing governmental initiatives drives the market

Through the growing awareness of the harmful effects of operating fossil fuel-powered vehicles, governments worldwide are taking steps to reduce carbon footprints by promoting the use of electric bikes, vehicles, and bicycles. In addition, putting pressure on automakers to reduce carbon emissions from burning diesel fuel and address greenhouse gas emissions will encourage them to invest in the creation of electric vehicles. To promote the purchase of electric vehicles, tax credits, and other financial incentives are being offered. In addition, electric vehicles are exempt from paying highway tolls in a small number of countries. For instance, the Indian government intends to reduce the GST on e-vehicles from 12% to 5% to hasten the adoption of electric vehicles. The government offers tax credits, subsidies, and incentives to promote the creation and purchase of electric vehicles. The need for electric vehicles grows as a result.

- Rising prices of fuel drive the market for EVs

The cost of fuel has been increasing all over the world, particularly for gasoline. Diesel, which typically costs $5.05 per gallon, is much more expensive. In India, the cost of a liter of gasoline could reach INR 110.04 ($1.47). The battery life of an electric vehicle is at least eight years, and the cost of charging is significantly less than the cost of fuel per month. Through the high taxes, fuel prices in India are already high and may rise further. Industrial fuel vehicles also disrupt the supply because of price increases. India's import bill is also significantly increased by oil imports. The government has already taken steps to promote e-transport by gradually replacing fossil fuel-powered public vehicles with EVs in some cities. Customers are therefore anticipated to switch to EVs as a result of the increase in fuel prices, increasing the need for electric vehicle charging stations.

Opportunities

- The growing adoption of EVs has created lucrative opportunities to grow

Electric vehicles have grown in popularity in recent years through their efficiency and environmental friendliness, which have increased the need for fast-charging infrastructure, and have created lucrative opportunities to grow in the market. For instance, the number of electric vehicle charging stations worldwide in 2019 was 2.1 million. 120 million electric vehicles are projected to be on the road in China, the European Union, and the US collectively by 2030. To charge electric vehicles, approximately 20 billion kilowatt-hours of energy will be required. Long-distance and city commuting with electric vehicles is anticipated. Fast-charging options are necessary because the majority of EVs currently on the market have a range of less than 100 miles.

- Increasing power station technology creates a surge in market expansion.

Quick-charging technologies are constantly being developed with funding from electric mobility companies. Public fast-charging stations may be the most effective way to encourage the widespread use of battery-electric vehicles in Europe and China. Leading network operators for charging systems have announced plans to install fast charging stations. Compared to Level 2 public charging stations, rapid charging stations can accommodate more battery-electric vehicles. To meet the needs of EV drivers who do not have designated chargers and rely on public charging stations, for instance, major cities in China are deploying fast-charging stations, such as Level 2 chargers. The growing share of battery electric vehicles in global new vehicle sales has a knock-on effect on the demand for fast-charging stations.

Restraints/Challenges

- Lack of standardization hinders the expansion of the market

Governments must standardize charging infrastructure to foster a favorable environment and increase the sales of electric vehicles. Even though this mandate increased the cost of installing charging stations, the government changed the rules and allowed charging station developers to use the strategy. The high-performance superchargers used by Tesla, an American electric vehicle manufacturer, are unique to Tesla and incompatible with other electric vehicles. As a result, a lack of uniformity among countries may hinder the installation of charging stations and limit the growth of the market for them.

- Reliance on fossil fuels and their limited availability restricts the market

The reliance on fossil fuels for the production of electricity could have an impact on the growth of EVs. The power sources that are used to charge EVs still have an impact on their environmental benefits. In regions with a high reliance on fossil fuels for electricity generation, the environmental benefits of EVs might be restricted. This might prevent the market for EV charging stations from growing and make consumer interest in EV adoption more distinctive.

- The initial cost of building charging stations for electric vehicles limits the market growth

A significant barrier to this market's growth is the high initial cost of building electric vehicle charging stations and the related components. Transformers, subsequent substations, cable, and auxiliary equipment for metering/termination are required for EV charging stations. Additionally, they must have enough room for electric vehicle entry, parking, and exit as well as enough electric charging stations to simultaneously charge several vehicles. A significant barrier for manufacturers of electric vehicles is local certifications based on state requirements. The cost of creating the infrastructure needed for electric vehicle charging is also very high. Electric vehicle (EV) charging stations are the only places where additional equipment, such as electric chargers, can be used to frequently and quickly recharge an EV's battery. Electric vehicles are more expensive than conventional internal combustion engine (ICE) vehicles due to the cost of the battery, charger, and charger installation. As a result, installing an EV charging station requires a sizable initial investment, which will restrain the market.

This electric vehicle charging stations market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the electric vehicle charging stations market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In 2023, At CES 2023, the premier technology trade show in the world, ABB E-mobility debuted its ground-breaking terra home charging solution. With its distinctive design and ability to enable users to optimize their use of renewable energy, terra homes will likely be available for purchase by the middle.

- In 2022, A leading supplier of charging infrastructure solutions for commercial electric vehicles, Schaltbau Holding AG, completed the acquisition of SBRS GmbH, a wholly-owned subsidiary of Shell Deutschland GmbH, a wholly-owned subsidiary of Shell. The acquisition expands Shell's portfolio of lower-carbon solutions for fleet solutions and commercial road transport customers by adding significant expertise in electric bus charging and a substantial pipeline in electric truck charging.

- In 2022, Launch of Mobilize Fast Charge, an ultrafast charging network, was announced by Mobilize and Renault dealerships. Most of the stations will be at Renault dealerships that are no more than five minutes' drive from an exit on an expressway or highway.

- In 2022, The E- Superior Electric Cargo Loader, E- Supreme Electric Delivery Van, and E- Smart Electric Passenger Vehicle three-wheeled auto in the L5 category, as well as EV charging stations, have all been introduced, according to Erisha E Mobility, a subsidiary of Rana Group.

- In 2022, In order to ensure accurate sighting of EV charging stations, the Delhi Government and MapmyIndia Mappls signed an agreement to create a web application that will act as a geospatial decision-making tool. A citywide network of connected and accessible EV charging stations will be planned and implemented with the help of the tool.

- In 2022, In order to broaden its selection of user-friendly energy management technologies, ABB formed a strategic partnership with Tallarna ltd. The solution uses AI-powered data analytics to make decarbonization projects for sizable real estate portfolios and performance infrastructure more manageable.

- In 2022, The CP6000 charger was launched by hunger point. This all-encompassing charging solution meets the requirements of fleets and businesses in Europe and gives them the resources they need to switch to electric mobility. To provide a seamless experience, it combines station and hardware, network software, and customer support. The Cpc6000 is built to be scalable, flexible, trustworthy, and to deliver an excellent experience.

- In 2022, Eaton expanded its contracts with the general service administration to cover electric vehicle supply equipment (EVSE) related services. This more s crucial in achieving the U.S. goal of reaching net zero emissions by 2050 and advancing the development of EV charging infrastructure.

- In May 2022, Tata Power and Hyundai entered into a strategic partnership to establish a strong EV charging infrastructure and hasten the adoption of EVs throughout India.

Asia-Pacific Electric Vehicle Charging Stations Market Scope

The electric vehicle charging stations market is segmented on the basis of charging stations, charger type, charging type, charging services, mode of charging, connectivity type, charging infrastructure, vehicle type, installation type, connecting phase, technology, operations, components, applications and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Charging Stations

- AC Charging/ Normal Charging Station

- DC Charging/ Super Charging Station

- Slow DC (<49 KW)

- Fast DC (50-149 KW)

- Level 1 Ultra-Fast DC (150-349 KW)

- Level 2 Ultra-Fast DC (<349 KW)

- Inductive Charging Station

- Others

- Wall Mount

- Pedestal Mount

- Ceiling Mount

Charger Type

- Portable Charger

- Fixed Charger

Charging Type

- Off Board Top Down Pantograph

- On Board Bottom Up Pantograph

- Charging via Conector

Charging Services

- EV Charging Services

- Battery Swapping Service

Mode of Charging

- Plug in Charging

- Wireless Charging

- Static Wireless EV Charging

- Dynamic Wireless EV Charging

Connectivity Type

- Non-Connected Charging Stations

- Smart Connected Charging Stations

- Pantograph

- Connectors

- Combined Charging Systems

- Chademo

- Others

Charging Infrastructure

- Normal Charging

- Type 2

- IEC 621196

- CCS

- CHAdeMO

- Tesla SC

- GB/T Fast

Vehicle Type

- Passengers Cars

- Commercial Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Battery Electric Vehicle (BEV)

- Plug-In Hybrid Electric Vehicles (PHEV)

- Two Wheelers and Scooters

- Hybrid Electric Vehicles (HEV)

Installation Type

- Individual Houses

- Commercial

- Commercial Public EV Charging Stations

- On-Road Charging

- Parking Spaces

- Destination Chargers

- Commercial Private EV Charging Stations

- Fleet Charging

- Captive Charging

- Apartments

- Others

Connecting Phase

- Single Phase

- Three Phase

Technology

- Level 1

- Level 2

- Level 3

Operations

- Mode 1

- Mode 2

- Mode 3

- Mode 4

Components

- Hardware

- Electric Vehicle Supply Equipment (EVSE)

- Electrical Distribution Systems

- Cable Management Systems

- Software

- Charging Station Management Systems (CSMS)

- Interoperability Solutions

- Open Charge Point Protocol (OCPP)

- Smartphone Applications

- Services

- Maintenance Services

- Systems Integration and Installation Services

Application

- Public

- Semi-Public

- Private

End User

- Residential

- Commercial

Asia-Pacific Electric Vehicle Charging Stations Market Regional Analysis/Insights

The electric vehicle charging stations market is analysed and market size insights and trends are provided by charging stations, charger type, charging type, charging services, mode of charging, connectivity type, charging infrastructure, vehicle type, installation type, connecting phase, technology, operations, components, applications and end user as referenced above.

The countries covered in the electric vehicle charging stations market report are China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, and Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC)

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Electric Vehicle Charging Stations Market Share Analysis

The electric vehicle charging stations market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to electric vehicle charging stations market.

Some of the major players operating in the electric vehicle charging stations market are:

- ChargePoint, Inc. (U.S.)

- ABB (Switzerland)

- Webasto Group (Germany)

- Shell International B.V. (Netherlands)

- Schneider Electric (France)

- Renault Group (France)

- Phihong USA Corp. (U.S.)

- EV Safe Charge Inc. (U.S.)

- Tesla (U.S.)

- Mercedes-Benz Group AG. (Germany)

- Siemens (Germany)

- TATA Power (India)

- Magenta EV Solutions Private Limited (India)

- Fortum (Finland)

- Volttic EV Charging (India)

- Ather Energy (India)

- Infineon Technologies AG (Germany)

- Amara Raja Group (India)

- Exicom (India)

- Griden Technologies Pvt. Ltd. (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.