Asia Pacific Electric Vehicle Market

Market Size in USD Billion

CAGR :

%

USD

101.81 Billion

USD

576.45 Billion

2021

2029

USD

101.81 Billion

USD

576.45 Billion

2021

2029

| 2022 –2029 | |

| USD 101.81 Billion | |

| USD 576.45 Billion | |

|

|

|

Asia-Pacific Electric Vehicle Market Analysis and Size

In recent years, electric vehicles have been used to replace traditional modes of transportation in order to reduce pollution. It has grown in importance as a result of technological advancements such as low carbon emission and maintenance, smoother driving, reduced engine noise, and higher fuel economy.

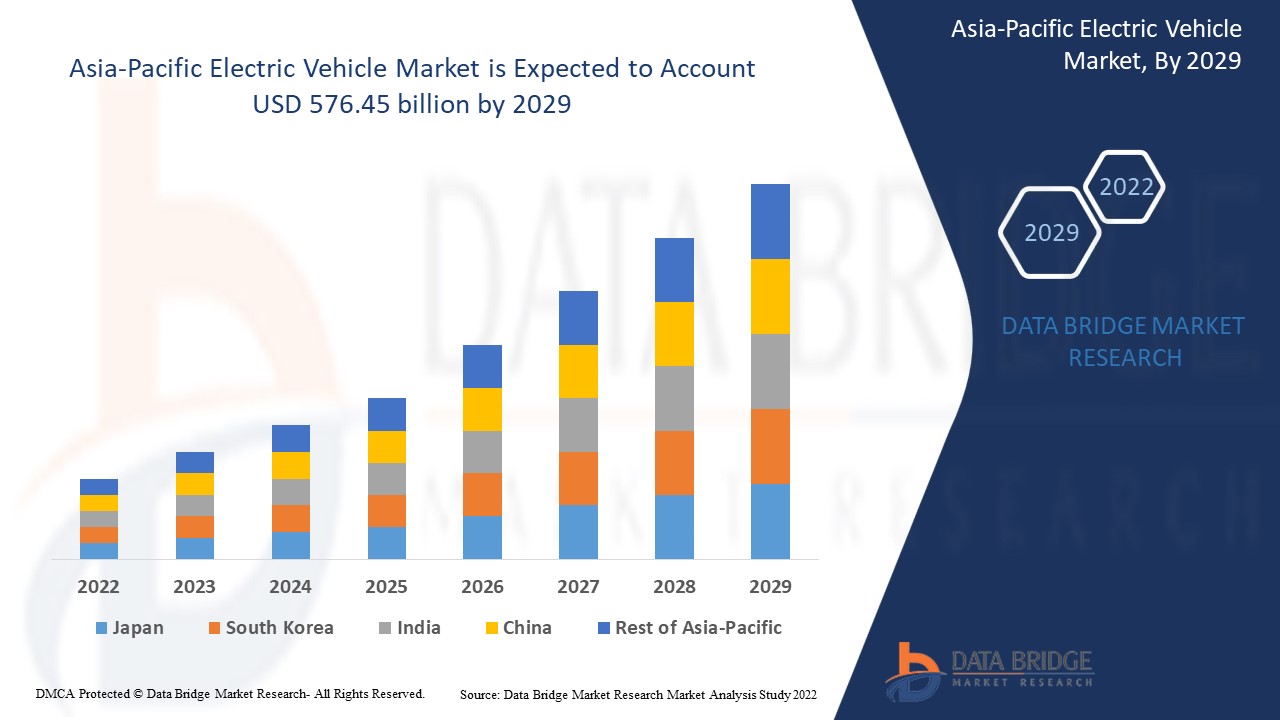

Data Bridge Market Research analyses that the electric vehicle market was valued at USD 101.81 billion in 2021 and is expected to reach the value of USD 576.45 billion by 2029, at a CAGR of 24.20% during the forecast period of 2022-2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Asia-Pacific Electric Vehicle Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Component (Battery Cells & Packs, On-Board Charger, Infotainment System, Others), Propulsion Type {(Plug-In Hybrid Electric Vehicles (PHEVs), Battery Electric Vehicles (BEVs), hybrid electric vehicles (HEVs), and fuel cell electric vehicles (FCEVs)}, Charging Station Type (Normal Charging, Super Charging), Class (Mid-Priced, Luxury), Power Train (Parallel Hybrid, Series Hybrid, Combined Hybrid), Vehicle Type (Passenger Cars, Two Wheelers, Commercial Vehicles), |

|

Countries Covered |

China, India, Japan, South Korea, Australia, Singapore, Indonesia, Thailand, Malaysia, Philippines and Rest of Asia-Pacific |

|

Market Players Covered |

Ford Motor Company (U.S.), General Motors (U.S.), AUDI AG (Germany), Kia Motors Corporation (South Korea), Groupe Renault (France), Groupe PSA (France), SAIC Motor Corporation Limited (China), Tesla (U.S.), Daimler AG (Germany), BMW AG (Germany), Hyundai Motor Company (South Korea), BYD Company Ltd. (China), Continental AG (Germany), TOYOTA MOTOR CORPORATION (Japan), Nissan Motor Co., LTD. (Japan), Volkswagen AG (Germany), AB Volvo (Sweden), Honda Motor Co., Ltd. (Japan), among others |

|

Market Opportunities |

|

Market Definition

A vehicle propelled by one or more electric motors is known as an electric vehicle (EV). It can be powered by a collection system, extravehicular sources of electricity, or a self-contained battery (sometimes charged by solar panels, or by converting fuel to electricity using fuel cells or a generator). Electric vehicles have several advantages over conventional fuel-powered vehicles, including low operating costs, zero carbon emissions, and others because they are powered by electricity. Consumers' changing attitudes toward electric vehicles are boosting market growth as they become more concerned about environmental pollution.

Drivers

- Favourable government policies and investments

Governments around the world are increasing their investments in electric mobility. Government regulations to phase out fossil-fuel-powered vehicles, government investments to improve public EV charging infrastructure, and initiatives in the form of subsidies and tax rebates to encourage EV adoption are expected to support market growth. Governments are investing in charging infrastructure, either directly in public charging stations or indirectly through subsidies for private charging stations at homes and workplaces.

- Growth in vehicle sales globally

One of the major factors driving the growth of the electric vehicle market is the increase in EV sales around the world. Due to the rising environmental consciousness, consumer preference is rapidly shifting toward passenger and commercial electric vehicles (EV). The increase in production and sales of luxury cars around the world as a result of rising disposable income accelerates market growth. The increased demand for these improved vehicles drives up vehicle production.

Opportunities

- High adoption from transportation sector

High demand for electric vehicles in the automotive and transportation sectors creates profitable opportunities for market participants from 2022 to 2029. Furthermore, government initiatives pertaining to EVs will accelerate the growth of the electric vehicle market.

Restraints

- High initial investments will challenge the growth

The high initial investment required to install EV fast charging infrastructure, as well as a lack of sufficient EV charging infrastructure, are expected to stymie market growth. Furthermore, high vehicle costs and insufficient standardisation of EV charging infrastructure are expected to be challenges for the electric vehicle market during the forecast period.

This electric vehicle market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the electric vehicle market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Electric Vehicle Market

The COVID-19 had a negative impact on the electric vehicle market due to the strict lockdowns and social distancing implemented to contain the virus's spread. Economic uncertainty, a partial business shutdown, and low consumer confidence all had an impact on the demand for electric vehicles. During the pandemic, the supply chain was hampered, as were logistics activities. However, due to the relaxation of restrictions, the electric vehicle market is expected to pick up speed in the post-pandemic scenario.

Recent Development

- In April 2021, BYD launched four new electric vehicle models equipped with Blade batteries in Chongqing. The new vehicle models with advanced battery safety features are the Qin plus EV, E2 2021, Tang EV, and Song plus EV.

- In April 2021 Volkswagen debuted the 7-seater EV ID.6 Crozz and ID.6 X in China, alongside FAW and SAIC. The vehicles are available in two battery sizes, 58 kWh and 77 kWh, as well as four powertrain configurations.

Asia-Pacific Electric Vehicle Market Scope

The electric vehicle market is segmented on the basis of component, propulsion type, charging station type, class, power train, and vehicle type. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Battery Cells & Packs

- On-Board Charger

- Infotainment System

- Others

Propulsion Type

- Plug-In Hybrid Electric Vehicles (PHEVs)

- Battery Electric Vehicles (BEVs)

- Hybrid electric vehicles (HEVs)

- Fuel cell electric vehicles (FCEVs)

Charging station type

- Normal Charging

- Super Charging

Class

- Mid-Priced

- Luxury

Power train

- Parallel Hybrid

- Series Hybrid

- Combined Hybrid

Vehicle Type

- Passenger Cars

- Two Wheelers

- Commercial Vehicles

Electric Vehicle Market Regional Analysis/Insights

The electric vehicle market is analysed and market size insights and trends are provided by country of component, propulsion type, charging station type, class, power train, and vehicle type as referenced above.

The countries covered in the electric vehicle market report are China, India, Japan, South Korea, Australia, Singapore, Indonesia, Thailand, Malaysia, Philippines and Rest of Asia-Pacific.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Electric Vehicle Market Share Analysis

The electric vehicle market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to electric vehicle market.

Some of the major players operating in the electric vehicle market are:

- Ford Motor Company (U.S.)

- General Motors (U.S.)

- AUDI AG (Germany)

- Kia Motors Corporation (South Korea)

- Groupe Renault (France)

- Groupe PSA (France)

- SAIC Motor Corporation Limited (China)

- Tesla (U.S.)

- Daimler AG (Germany)

- BMW AG (Germany)

- Hyundai Motor Company (South Korea)

- BYD Company Ltd. (China)

- Continental AG (Germany)

- TOYOTA MOTOR CORPORATION (Japan)

- Nissan Motor Co., LTD. (Japan)

- Volkswagen AG (Germany)

- AB Volvo (Sweden)

- Honda Motor Co., Ltd. (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC ELECTRIC VEHICLE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE ASIA-PACIFIC ELECTRIC VEHICLE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 BRAND POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 ASIA-PACIFIC ELECTRIC VEHICLE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTERS FIVE FORCES MODEL

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL ADVANCEMENT

5.3.1 CHARGING TECHNOLOGY

5.3.2 AUTONOMOUS DRIVING

5.3.3 BATTERY TECHNOLOGY

5.4 SUPPLY CHAIN ANALYSIS

5.5 CASE STUDY ANALYSIS

5.6 COMPANY/BRAND COMPARITIVE ANALYSIS

5.7 RAW MATERIAL PRODUCTION COVERAGE

5.8 SCENARIO BASED ON PRODUCT ADOPTION

5.9 CONSUMER BEHAVIOUR PATTERN

5.1 MARKETING STRAGETY OF MAJOR PLAYERS

5.11 GOVERNMENT INCENTIVES TOWARDS ELECTRIC VEHICLE

5.12 TOP SELLING EV MODEL SALES IN 2022

6 ASIA-PACIFIC ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS

6.1 OVERVIEW

6.2 MID-PRICED

6.3 LUXURY

7 MIDDLE-EAST & AFRICA ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE

7.1 OVERVIEW

7.2 FWD

7.3 AWD

7.4 RWD

8 ASIA-PACIFIC ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE

8.1 OVERVIEW

8.2 DC MOTORS

8.3 BRUSHLESS DC MOTORS

8.4 PERMANENT MAGNET SYNCHRONOUS MOTORS

8.5 THREE PHASE INDUCTION MOTORS

9 ASIA-PACIFIC ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED

9.1 OVERVIEW

9.2 LESS THAN 100 MPH

9.3 100 TO 125 MPH

9.4 MORE THAN 125 MPH

10 ASIA-PACIFIC ELECTRIC VEHICLE MARKET, BY CHARGING STATION

10.1 OVERVIEW

10.2 NORMAL CHARGING

10.2.1 LEVEL 1

10.2.2 LEVEL 2

10.2.3 LEVEL 3

10.3 SUPER CHARGING

10.3.1 LEVEL 1

10.3.2 LEVEL 2

10.3.3 LEVEL 3

11 ASIA-PACIFIC ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE

11.1 OVERVIEW

11.2 LESS THAN 48 VOLT

11.3 MORE THAN 48 VOLT

12 ASIA-PACIFIC ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE

12.1 OVERVIEW

12.2 V2X

12.3 V2G

12.4 V2B OR V2H

12.5 V2V

13 ASIA-PACIFIC ELECTRIC VEHICLE MARKET, BY POWER OUTPUT

13.1 OVERVIEW

13.2 LESS THAN 100 KW

13.3 100 TO 250 KW

13.4 MORE THAN 25O KW

14 ASIA-PACIFIC ELECTRIC VEHICLE MARKET, BY BATTERY TYPE

14.1 OVERVIEW

14.2 LITHIUM ION

14.3 LEAD ACID

14.4 SOLID STATE

14.5 NICKEL METAL HYDRIDE

14.6 SODIUM ION BATTERY

15 ASIA-PACIFIC ELECTRIC VEHICLE MARKET, BY BATTERY FORM

15.1 OVERVIEW

15.2 CYLINDRICAL

15.3 POUCH

15.4 PRISMATIC

16 ASIA-PACIFIC ELECTRIC VEHICLE MARKET, BY POWERTRAIN

16.1 OVERVIEW

16.2 PARALLEL HYBRID

16.3 SERIES HYBRID

16.4 COMBINED HYBRID

17 ASIA-PACIFIC ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE

17.1 OVERVIEW

17.2 BATTERY ELECTRIC VEHICLE (BEV)

17.2.1 LESS THAN 100 KW

17.2.2 100 TO 250 KW

17.2.3 MORE THAN 25O KW

17.3 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

17.3.1 LESS THAN 100 KW

17.3.2 100 TO 250 KW

17.3.3 MORE THAN 25O KW

17.4 FUEL CELL ELECTRIC VEHICLE (FCEV)

17.4.1 LESS THAN 100 KW

17.4.2 100 TO 250 KW

17.4.3 MORE THAN 25O KW

17.5 ICE AND MICRO HYBRID VEHICLE

17.5.1 LESS THAN 100 KW

17.5.2 100 TO 250 KW

17.5.3 MORE THAN 25O KW

18 ASIA-PACIFIC ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE

18.1 OVERVIEW

18.2 PASSENGER CARS

18.2.1 HATCHBACK

18.2.2 SEDAN

18.2.3 SUV

18.2.4 COUPE

18.2.5 MUV

18.2.6 SPORT CAR

18.2.7 CONVERTIBLE

18.2.8 OTHERS

18.3 COMMERCIAL VEHICLE

18.3.1 LIGHT COMMERCIAL VEHICLE (LCV)

18.3.1.1. VANS

18.3.1.2. PICK UP TRUCKS

18.3.1.3. MINI BUS

18.3.1.4. OTHERS

18.3.2 HEAVY COMMERCIAL VEHICLE (HCV)

18.3.2.1. BUS

18.3.2.2. TRUCKS

18.4 TWO WHEELER

19 ASIA-PACIFIC ELECTRIC VEHICLE MARKET, BY SALES CHANNEL

19.1 OVERVIEW

19.2 OEM

19.3 AFTERMARKET

20 MIDDLE EAST AFRICA ELECTRIC VEHICLE MARKET, BY COUNTRY

ASIA-PACIFIC ELECTRIC VEHICLE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

20.1 ASIA-PACIFIC

20.1.1 JAPAN

20.1.2 CHINA

20.1.3 SOUTH KOREA

20.1.4 INDIA

20.1.5 AUSTRALIA

20.1.6 SINGAPORE

20.1.7 THAILAND

20.1.8 MALAYSIA

20.1.9 INDONESIA

20.1.10 PHILIPPINES

20.1.11 TAIWAN

20.1.12 VIETNAM

20.1.13 NEW ZEALAND

20.1.14 REST OF ASIA PACIFIC

20.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

21 ASIA-PACIFIC ELECTRIC VEHICLE MARKET, COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

21.2 MERGERS & ACQUISITIONS

21.3 NEW PRODUCT DEVELOPMENT AND APPROVALS

21.4 EXPANSIONS

21.5 REGULATORY CHANGES

21.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

22 ASIA-PACIFIC ELECTRIC VEHICLE MARKET, SWOT & DBMR ANALYSIS

23 ASIA-PACIFIC ELECTRIC VEHICLE MARKET, COMPANY PROFILE

23.1 TESLA

23.1.1 COMPANY SNAPSHOT

23.1.2 REVENUE ANALYSIS

23.1.3 PRODUCT PORTFOLIO

23.1.4 RECENT DEVELOPMENTS

23.2 TOYOTA MOTOR CORPORATION

23.2.1 COMPANY SNAPSHOT

23.2.2 REVENUE ANALYSIS

23.2.3 PRODUCT PORTFOLIO

23.2.4 RECENT DEVELOPMENTS

23.3 FORD MOTOR COMPANY

23.3.1 COMPANY SNAPSHOT

23.3.2 REVENUE ANALYSIS

23.3.3 PRODUCT PORTFOLIO

23.3.4 RECENT DEVELOPMENTS

23.4 VOLKSWAGEN AG

23.4.1 COMPANY SNAPSHOT

23.4.2 REVENUE ANALYSIS

23.4.3 PRODUCT PORTFOLIO

23.4.4 RECENT DEVELOPMENTS

23.5 MERCEDES-BENZ GROUP AG

23.5.1 COMPANY SNAPSHOT

23.5.2 REVENUE ANALYSIS

23.5.3 PRODUCT PORTFOLIO

23.5.4 RECENT DEVELOPMENTS

23.6 ASHOK LEYLAND

23.6.1 COMPANY SNAPSHOT

23.6.2 REVENUE ANALYSIS

23.6.3 PRODUCT PORTFOLIO

23.6.4 RECENT DEVELOPMENTS

23.7 GEELY AUTOMOBILE HOLDINGS LIMITED

23.7.1 COMPANY SNAPSHOT

23.7.2 REVENUE ANALYSIS

23.7.3 PRODUCT PORTFOLIO

23.7.4 RECENT DEVELOPMENTS

23.8 AB VOLVO

23.8.1 COMPANY SNAPSHOT

23.8.2 REVENUE ANALYSIS

23.8.3 PRODUCT PORTFOLIO

23.8.4 RECENT DEVELOPMENTS

23.9 BMW AG

23.9.1 COMPANY SNAPSHOT

23.9.2 REVENUE ANALYSIS

23.9.3 PRODUCT PORTFOLIO

23.9.4 RECENT DEVELOPMENTS

23.1 HYUNDAI MOTOR COMPANY

23.10.1 COMPANY SNAPSHOT

23.10.2 REVENUE ANALYSIS

23.10.3 PRODUCT PORTFOLIO

23.10.4 RECENT DEVELOPMENTS

23.11 BYD MOTORS INC.

23.11.1 COMPANY SNAPSHOT

23.11.2 REVENUE ANALYSIS

23.11.3 PRODUCT PORTFOLIO

23.11.4 RECENT DEVELOPMENTS

23.12 NISSAN MOTOR CO., LTD.

23.12.1 COMPANY SNAPSHOT

23.12.2 REVENUE ANALYSIS

23.12.3 PRODUCT PORTFOLIO

23.12.4 RECENT DEVELOPMENTS

23.13 MITSUBISHI MOTORS CORPORATION

23.13.1 COMPANY SNAPSHOT

23.13.2 REVENUE ANALYSIS

23.13.3 PRODUCT PORTFOLIO

23.13.4 RECENT DEVELOPMENTS

23.14 MAHINDRA ELECTRIC MOBILITY LIMITED

23.14.1 COMPANY SNAPSHOT

23.14.2 REVENUE ANALYSIS

23.14.3 PRODUCT PORTFOLIO

23.14.4 RECENT DEVELOPMENTS

23.15 TATA MOTORS

23.15.1 COMPANY SNAPSHOT

23.15.2 REVENUE ANALYSIS

23.15.3 PRODUCT PORTFOLIO

23.15.4 RECENT DEVELOPMENTS

23.16 MG MOTOR

23.16.1 COMPANY SNAPSHOT

23.16.2 REVENUE ANALYSIS

23.16.3 PRODUCT PORTFOLIO

23.16.4 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

24 CONCLUSION

25 RELATED REPORTS

26 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.