Asia Pacific Electronic Drug Delivery Systems Market

Market Size in USD Billion

CAGR :

%

USD

1.83 Billion

USD

4.14 Billion

2024

2032

USD

1.83 Billion

USD

4.14 Billion

2024

2032

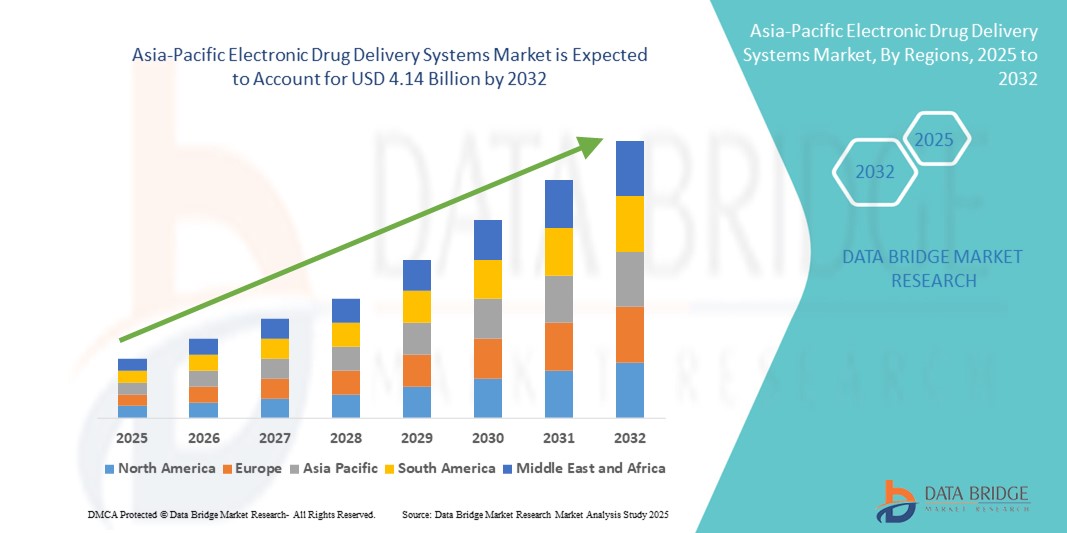

| 2025 –2032 | |

| USD 1.83 Billion | |

| USD 4.14 Billion | |

|

|

|

|

Asia-Pacific Electronic Drug Delivery Systems Market Size

- The Asia-Pacific electronic drug delivery systems market size was valued at USD 1.83 billion in 2024 and is expected to reach USD 4.14 billion by 2032, at a CAGR of 10.70% during the forecast period

- The market growth is primarily driven by the rising adoption of digital healthcare technologies, increasing prevalence of chronic diseases, and ongoing innovations in drug delivery devices such as smart injectors, connected inhalers, and wearable delivery systems

- In addition, growing demand for patient-centric, precise, and convenient therapeutic solutions in hospitals, clinics, and homecare settings is positioning electronic drug delivery systems as essential tools in modern healthcare management. These combined trends are accelerating market penetration, thereby substantially propelling industry growth

Asia-Pacific Electronic Drug Delivery Systems Market Analysis

- Electronic drug delivery systems, including smart injectors, wearable infusion pumps, connected inhalers, and electronic auto-injectors, are increasingly critical components of modern healthcare solutions in both hospital and homecare settings due to their enhanced dosing accuracy, real-time monitoring capabilities, and integration with digital health platforms

- The rising adoption of electronic drug delivery systems is primarily fueled by the increasing prevalence of chronic diseases, growing demand for patient-centric therapies, and the push for remote healthcare monitoring and management

- Japan dominated the Asia-Pacific electronic drug delivery systems market with the largest revenue share of 28.3% in 2024, supported by advanced healthcare infrastructure, strong R&D in medical devices, and high adoption of digital health technologies, with significant uptake in smart injectors and connected inhalers driven by domestic and multinational medtech companies

- China is expected to be the fastest-growing country in the Asia-Pacific electronic drug delivery systems market during the forecast period due to rising healthcare awareness, expanding medical infrastructure, increasing disposable incomes, and government initiatives supporting digital health adoption

- Wearable infusion pumps segment dominated the Asia-Pacific electronic drug delivery systems market with a market share of 42% in 2024, driven by their convenience, precise dosing capabilities, and compatibility with patient monitoring and mobile health applications

Report Scope and Asia-Pacific Electronic Drug Delivery Systems Market Segmentation

|

Attributes |

Asia-Pacific Electronic Drug Delivery Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Electronic Drug Delivery Systems Market Trends

Advancement in Connected and Smart Drug Delivery Devices

- A major and accelerating trend in the Asia-Pacific electronic drug delivery systems market is the integration of smart connectivity features, including Bluetooth Low Energy (BLE), mobile app interfaces, and cloud-based platforms, enabling real-time monitoring of drug administration and adherence

- For instance, smart insulin pumps in Japan and China can communicate with mobile applications to track dosing, send reminders, and alert caregivers or healthcare providers if a dose is missed or administered incorrectly. Similarly, connected inhalers for asthma management allow patients to monitor usage patterns and share data with clinicians remotely

- Integration of AI and analytics in these devices enables predictive alerts, personalized dosage suggestions, and adherence tracking. Some wearable infusion pumps leverage AI to optimize delivery schedules and alert users of potential device malfunctions

- Seamless connectivity allows centralized monitoring of multiple devices and patient data, enabling healthcare providers to manage chronic disease therapy more effectively. Patients benefit from improved convenience and better adherence, while clinicians gain insights for optimizing treatment plans

- This trend toward more intelligent, connected, and patient-centric drug delivery systems is transforming healthcare delivery expectations in Asia-Pacific. Companies such as Terumo and Ypsomed are developing AI-enabled smart injectors and infusion devices with remote monitoring capabilities and mobile health integration

- The demand for connected and automated drug delivery systems is growing rapidly across both hospital and home healthcare sectors, as patients increasingly prioritize convenience, precision, and continuous monitoring

Asia-Pacific Electronic Drug Delivery Systems Market Dynamics

Driver

Rising Chronic Disease Burden and Growing Home Healthcare Adoption

- The increasing prevalence of chronic diseases, such as diabetes, cardiovascular disorders, and respiratory conditions, coupled with the rising preference for home healthcare solutions, is a significant driver of electronic drug delivery systems adoption

- For instance, in March 2024, Ypsomed expanded its smart pen platform in Asia-Pacific, enabling better diabetes management through connected devices and real-time adherence monitoring. Such strategic expansions by key players are expected to propel market growth during the forecast period

- Patients and healthcare providers increasingly seek accurate, convenient, and patient-friendly drug delivery methods that minimize hospital visits while ensuring precise dosing, driving demand for smart infusion pumps, electronic injection pens, and wearable devices

- The growing adoption of telemedicine and digital health platforms in Asia-Pacific further encourages the use of connected drug delivery systems, allowing clinicians to remotely monitor patients and adjust therapy as needed

- Convenience, improved adherence, and real-time monitoring capabilities are key factors propelling the adoption of electronic drug delivery systems in both home and clinical settings

Restraint/Challenge

High Device Cost and Regulatory Compliance Challenges

- The relatively high cost of advanced electronic drug delivery systems compared to traditional devices poses a barrier to widespread adoption, particularly in price-sensitive Asian markets. While basic devices are becoming more affordable, advanced features such as AI-enabled dosing, real-time monitoring, and connectivity often carry a premium

- For instance, smart insulin pumps and wearable infusion devices can be prohibitively expensive for middle-income households, limiting adoption primarily to urban and high-income populations

- Regulatory compliance and approvals across multiple countries in Asia-Pacific also present challenges for manufacturers, as devices must meet stringent safety, quality, and digital health standards before market entry

- Overcoming these challenges requires development of cost-effective devices, clear regulatory pathways, and education of healthcare providers and patients on the benefits and proper use of electronic drug delivery systems

- Addressing these barriers through affordable innovation, robust device validation, and digital training initiatives will be vital for sustained growth in the Asia-Pacific electronic drug delivery systems market

Asia-Pacific Electronic Drug Delivery Systems Market Scope

The market is segmented on the basis of type, component, connectivity, system type, application, and end user.

- By Type

On the basis of type, the Asia-Pacific electronic drug delivery systems market is segmented into electronic infusion pumps, wearable infusion pumps, electronic injection pens, inhalers, electronic auto-injectors, electronic inhalers, electronic capsules, and others. Wearable infusion pumps dominated the market with the largest revenue share of 42% in 2024, driven by their convenience, precise dosing capabilities, and compatibility with mobile health applications. These devices allow patients to receive continuous medication while maintaining mobility, making them ideal for home care and chronic disease management. Wearable infusion pumps also integrate with remote monitoring platforms, enabling healthcare providers to track therapy adherence and optimize dosing. They are increasingly preferred for insulin delivery in diabetic patients and other long-term treatments. Their compact design and portability provide greater flexibility compared to traditional infusion pumps.

Electronic injection pens are expected to witness the fastest growth from 2025 to 2032. This growth is fueled by the rising prevalence of diabetes and increased awareness among patients about self-administered therapies. These pens offer precise dosing, user-friendly interfaces, and integration with digital apps for reminders and dose tracking. Patients benefit from reduced injection errors and improved adherence, particularly in chronic therapies. Growing adoption of connected insulin delivery systems and expanding distribution networks across Asia-Pacific are accelerating market expansion. The trend toward patient convenience and safety is a key factor driving demand for electronic injection pens.

- By Component

On the basis of component, the Asia-Pacific electronic drug delivery systems market is segmented into sensors, wireless communicators and antennas, micro pumps and flow regulators, drug reservoirs, microcontrollers, and others. Sensors held the largest market share of 34.2% in 2024, as they play a critical role in ensuring accurate dosing, real-time monitoring, and integration with digital health platforms. Sensors are essential for tracking drug delivery, detecting device malfunctions, and providing alerts to both patients and healthcare providers. They enable personalized therapy adjustments and enhance safety by preventing over- or under-dosing. Continuous advancements in sensor technology are improving sensitivity, miniaturization, and battery efficiency. Sensors are integrated into wearable devices, infusion pumps, and smart inhalers, enhancing patient adherence and overall treatment outcomes.

Wireless communicators and antennas are anticipated to register the fastest growth during the forecast period. The rising demand for connected drug delivery systems capable of transmitting data to mobile and cloud platforms is driving this trend. These components enable real-time data sharing, remote monitoring, and telehealth integration. Hospitals and home care providers increasingly rely on wireless-enabled devices for continuous patient monitoring and proactive intervention. The growth is supported by technological advancements such as low-energy Bluetooth, NB-IoT, and secure Wi-Fi protocols. As digital healthcare ecosystems expand in Asia-Pacific, these components are critical for enabling interoperability and seamless patient management.

- By Connectivity

On the basis of connectivity, the Asia-Pacific electronic drug delivery systems market is segmented into Bluetooth Low Energy (BLE), Wi-Fi, Ethernet, NB-IoT, and others. BLE (Bluetooth Low Energy) dominated the market with a 38.7% share in 2024, due to its low power consumption, ease of integration with mobile applications, and suitability for wearable devices. BLE allows seamless connection with smartphones and tablets, enabling patients to monitor their therapy conveniently. It supports data transmission to cloud-based platforms for remote physician monitoring and telemedicine applications. BLE devices are particularly useful in home healthcare and outpatient settings, where portability and low maintenance are essential. Healthcare providers leverage BLE-enabled devices for real-time adherence tracking, dosing verification, and timely intervention. The widespread availability of BLE-compatible devices accelerates adoption in Asia-Pacific.

NB-IoT and Wi-Fi-enabled devices are expected to witness strong growth from 2025 to 2032. These technologies are critical for hospital and remote monitoring applications requiring wide-area connectivity. NB-IoT ensures reliable, low-energy, long-range communication, suitable for chronic disease management across urban and rural settings. Wi-Fi-enabled devices offer high-speed data transfer and integration with hospital information systems. The expansion of telehealth services in Asia-Pacific is further boosting adoption. Regulatory support and investment in digital health infrastructure are additional drivers of growth for these connectivity technologies.

- By System Type

On the basis of system type, the Asia-Pacific electronic drug delivery systems market is segmented into battery-powered systems and rechargeable systems. Battery-powered systems accounted for the largest share at 52.3% in 2024. Their popularity is attributed to portability, low maintenance, and suitability for home healthcare settings. These systems require minimal charging infrastructure and can be used in remote or resource-limited areas. Patients appreciate the convenience of disposable or replaceable batteries for continuous therapy without interruptions. These devices are also cost-effective and widely available across Asia-Pacific markets. Their reliability, simplicity, and compatibility with various drug delivery platforms make them the preferred choice for home-based care.

Rechargeable systems are expected to grow steadily during the forecast period. Growth is driven by increasing adoption in hospitals and clinical settings, where high-frequency usage demands sustainable power solutions. Rechargeable systems reduce dependency on disposable batteries, lowering operating costs and environmental impact. They are suitable for devices with higher power requirements, such as connected infusion pumps and wearable drug delivery systems. Technological advancements are improving battery life, charging speed, and durability. The rising focus on eco-friendly healthcare solutions and long-term cost efficiency supports the expansion of this segment.

- By Application

On the basis of application, the Asia-Pacific electronic drug delivery systems market is segmented into diabetes, asthma and chronic obstructive pulmonary disease (COPD), multiple sclerosis, growth hormone therapy, immunodeficiency disease, cardiovascular disease, thalassemia, and others. Diabetes dominated the market with a 43.8% share in 2024 due to the high prevalence of diabetes in Asia-Pacific and the widespread adoption of insulin pumps and connected injection pens. Diabetes management relies heavily on precision drug delivery to maintain glycemic control and prevent complications. Connected insulin delivery systems and mobile health applications improve adherence and dosing accuracy. Rising awareness of diabetes self-management and government initiatives promoting digital healthcare contribute to market growth. The increasing availability of wearable and user-friendly devices enhances patient convenience. Healthcare providers are increasingly recommending electronic delivery systems to optimize treatment outcomes.

Asthma and COPD applications are expected to witness the fastest growth during the forecast period. This is driven by the rising prevalence of respiratory diseases in Asia-Pacific, increasing awareness about proper disease management, and growing adoption of connected inhalers and smart drug delivery devices. These devices enable accurate dosing, remote monitoring, and improved patient adherence. Integration with mobile apps allows tracking of medication usage and environmental triggers. Hospitals and clinics are adopting these solutions for both acute and chronic care. Government programs and public health initiatives are encouraging the use of smart inhalers to reduce hospitalization rates and improve quality of life.

- By End User

On the basis of end user, the Asia-Pacific electronic drug delivery systems market is segmented into home healthcare, hospitals, clinics, ambulatory centers, and others. Home healthcare held the largest market share of 46.1% in 2024, driven by the growing preference for self-administration, remote monitoring, and patient-centric therapy management. Home-based devices reduce hospital visits and improve convenience for chronic disease patients. Integration with mobile applications and cloud platforms enables real-time monitoring and timely physician intervention. The rising trend of telemedicine and homecare programs across Asia-Pacific is further supporting growth. Patients increasingly prefer wearable and portable devices for their flexibility and ease of use. Awareness campaigns and support from healthcare providers contribute to increasing adoption of home healthcare drug delivery systems.

Hospitals and clinics are expected to register significant growth. This is fueled by the adoption of advanced electronic drug delivery systems for acute care, chronic disease management, and high-precision dosing requirements. Hospitals benefit from connected systems that enable real-time monitoring of multiple patients, data collection, and integration with electronic medical records. Clinics and ambulatory centers are incorporating these solutions to improve efficiency, reduce errors, and enhance patient safety. Investments in healthcare infrastructure and training programs are supporting adoption. The trend toward centralized and digitally connected hospital systems further drives demand for these advanced delivery devices.

Asia-Pacific Electronic Drug Delivery Systems Market Regional Analysis

- Japan dominated the Asia-Pacific electronic drug delivery systems market with the largest revenue share of 28.3% in 2024, supported by advanced healthcare infrastructure, strong R&D in medical devices, and high adoption of digital health technologies, with significant uptake in smart injectors and connected inhalers driven by domestic and multinational medtech companies

- Patients and healthcare providers in the region increasingly value the convenience, dosing accuracy, and real-time monitoring capabilities offered by electronic drug delivery systems, including wearable infusion pumps, smart injectors, and connected inhalers

- This widespread adoption is further supported by rising chronic disease prevalence, increasing disposable incomes, growing awareness of home healthcare solutions, and government initiatives promoting digital health, establishing electronic drug delivery systems as a preferred solution for both hospital and home-based therapy management

The China Electronic Drug Delivery Systems Market Insight

The China electronic drug delivery systems market accounted for a significant revenue share in Asia-Pacific in 2024, driven by rising prevalence of chronic diseases, expanding healthcare infrastructure, and increasing disposable incomes. Patients and healthcare providers are adopting wearable infusion pumps, smart injectors, and connected inhalers for home healthcare and hospital use. Government initiatives promoting digital health and telemedicine, along with growing awareness of patient-centric therapy management, are further boosting market growth.

Japan Electronic Drug Delivery Systems Market Insight

The Japan electronic drug delivery systems market is gaining momentum due to advanced healthcare infrastructure, high technological adoption, and an aging population requiring easy-to-use, precise drug delivery solutions. Adoption is driven by increasing chronic disease prevalence and demand for connected devices that integrate with digital health platforms. Wearable infusion pumps and smart injectors are increasingly used in home healthcare and hospital settings. Integration with monitoring systems and AI-enabled adherence tracking is further fueling market growth.

India Electronic Drug Delivery Systems Market Insight

The India electronic drug delivery systems market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, rising chronic disease prevalence, and a growing middle-class population. High adoption rates of digital health technologies, government initiatives promoting home healthcare, and availability of cost-effective smart injectors and infusion devices are key factors propelling market growth. Increasing awareness of connected and patient-centric therapy management is driving demand across residential, clinical, and hospital applications.

Australia Electronic Drug Delivery Systems Market Insight

The Australia electronic drug delivery systems market is expected to grow steadily during the forecast period, driven by rising prevalence of chronic diseases such as diabetes and cardiovascular disorders, and increasing adoption of home healthcare solutions. Patients increasingly prefer wearable infusion pumps and connected injectors for accurate dosing and remote monitoring. Government support for digital health initiatives and high awareness among healthcare providers are contributing to the adoption of electronic drug delivery systems.

Asia-Pacific Electronic Drug Delivery Systems Market Share

The Asia-Pacific electronic drug delivery systems industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Insulet Corporation (U.S.)

- Novo Nordisk A/S (Denmark)

- Bayer AG (Germany)

- Gerresheimer AG (Germany)

- Elcam Medical (Israel)

- BD (U.S.)

- Sanofi (France)

- United Therapeutics Corporation (U.S.)

- Tandem Diabetes Care, Inc. (U.S.)

- Ypsomed AG (Switzerland)

- B. Braun SE (Germany)

- Smiths Group plc (U.K.)

- Terumo Corporation (Japan)

- Nipro Corporation (Japan)

- Shinva Medical Instrument Co., Ltd. (China)

- Jiangsu Yuyue Medical Equipment & Supply Co., Ltd. (China)

- SiBiono GeneTech (China)

- Unilife Corporation (U.S.)

- Fresenius Kabi (Germany)

What are the Recent Developments in Asia-Pacific Electronic Drug Delivery Systems Market?

- In March 2025, Insulet Corporation announced the commercial launch of its Omnipod 5 Automated Insulin Delivery (AID) System in Australia. The tubeless, wearable system is the first of its kind in Australia to integrate with a continuous glucose monitor (CGM) to automatically adjust insulin delivery based on predicted glucose levels. This development provides people with type 1 diabetes a new, advanced tool for managing their condition without the need for multiple daily injections

- In October 2024, Samsung Biologics launched the S-HiCon high-concentration formulation platform to accelerate the development of high-dose biologic drugs. This platform aims to enhance drug delivery efficiency and stability, supporting the growing demand for subcutaneous administration of biologics

- In May 2023, Medtronic announced the acquisition of EOFlow Co. Ltd., a South Korean company known for its EOPatch—a tubeless, wearable, and fully disposable insulin delivery device. This acquisition underscores Medtronic's commitment to expanding its portfolio in wearable drug delivery solutions

- In January 2023, China's National Medical Products Administration (NMPA) issued a comprehensive set of new guidelines aimed at promoting innovation and strengthening post-market surveillance of medical devices, including electronic drug delivery systems. The updated regulations provide a clearer and more stringent framework for product approval and registration, which has a direct impact on how companies operate and bring new electronic drug delivery devices to the Chinese market

- In November 2022, Medtronic introduced the world's first insulin infusion set compatible with its MiniMed insulin pumps that can be worn for up to seven days. This innovation aims to reduce insulin waste and plastic usage, enhancing patient convenience and environmental sustainability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.