Asia Pacific Electronic Medical Records Emr Market

Market Size in USD Billion

CAGR :

%

USD

2.38 Billion

USD

6.13 Billion

2025

2033

USD

2.38 Billion

USD

6.13 Billion

2025

2033

| 2026 –2033 | |

| USD 2.38 Billion | |

| USD 6.13 Billion | |

|

|

|

|

Asia-Pacific Electronic Medical Records (EMR) Market Size

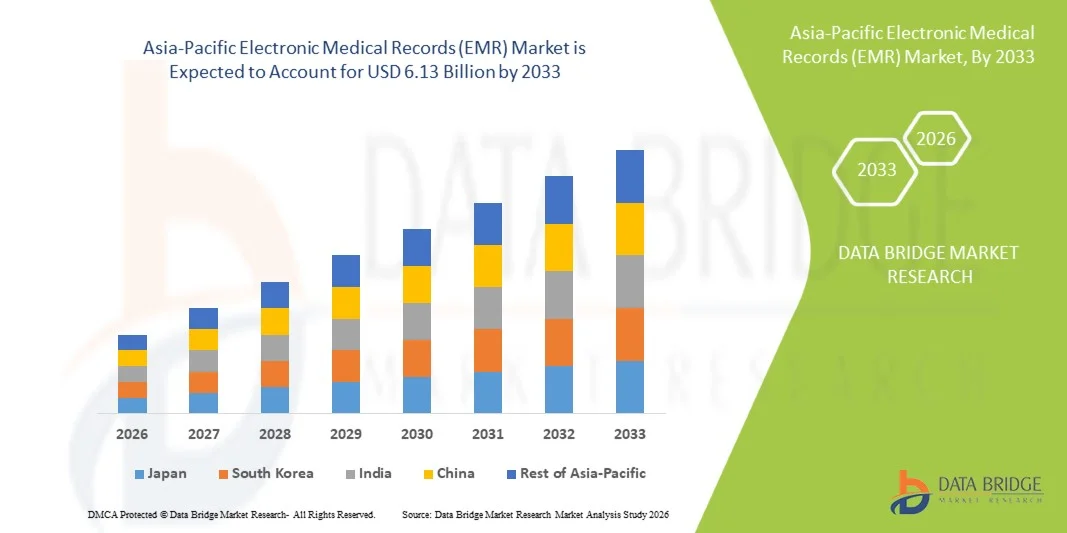

- The Asia-Pacific Electronic Medical Records (EMR) Market is expected to reach USD 2.38 Billion by 2025 from USD 6.13 Billion in 2033 growing with a CAGR of 5.5% in the forecast period of 2026 to 2033.

- The Asia-Pacific Electronic Medical Records (EMR) Market is experiencing steady growth, driven by the increasing digitalization of healthcare systems across hospitals, clinics, and specialty care centers. Rising patient volumes, growing demand for efficient data management, and the need for improved clinical workflows are accelerating EMR adoption across both public and private healthcare sectors.

- Continuous advancements in EMR technologies, including cloud-based platforms, AI-enabled clinical decision support, interoperability solutions, and mobile health integration, are facilitating wider adoption of advanced EMR systems. These innovations enhance data accuracy, streamline administrative processes, support population health management, and improve overall quality of patient care.

- Supportive government initiatives and regulatory frameworks promoting healthcare IT adoption, combined with increasing focus on data security, standardization, and compliance with health information regulations, are encouraging healthcare providers to transition from paper-based records to EMR systems. This shift supports improved care coordination, operational efficiency, and long-term sustainability of healthcare delivery across the region..

Asia-Pacific Electronic Medical Records (EMR) Market Analysis

- The Asia-Pacific Electronic Medical Records (EMR) Market serves a wide range of industries, including textiles, paper, resins, pharmaceuticals, cosmetics, and water treatment. Demand is primarily driven by its robust crosslinking capabilities and its role as a critical intermediate in specialty and high-performance chemical formulations.

- The Asia-Pacific Electronic Medical Records (EMR) Market caters to similar sectors, including textiles, paper, resins, pharmaceuticals, cosmetics, and water treatment. Its adoption is fueled by strong functional properties and its importance as an intermediate in specialty and performance chemical applications.

- In 2025, the Software segment is projected to dominate the electronic medical records (EMR) market with an 59.77% share, owing to the increasing preference of healthcare providers for integrated, scalable, and user-friendly digital record systems over paper-based or fragmented clinical documentation. EMR software solutions enable efficient management of patient data, clinical workflows, and administrative processes, making them a critical component of hospital and clinic digitalization initiatives across the region.

- In 2026, China is expected to dominate the Asia-Pacific Electronic Medical Records (EMR) Market with a share of 27.74%, due to its rapidly advancing healthcare infrastructure, strong government support for digital health initiatives, and widespread adoption of health IT technologies. The country benefits from a vast network of hospitals and clinics investing heavily in EMR systems to improve clinical efficiency and patient care

- The China is anticipated to grow at a CAGR of around 7.1% from 2026 to 2033, driven by rapid digital transformation in healthcare, rising patient volumes, and increasing demand for efficient clinical data management across hospitals and outpatient facilities. Expanding healthcare infrastructure and growing private sector participation further support market expansion.

Report Scope and Asia-Pacific Electronic Medical Records (EMR) Market Segmentation

|

Attributes |

Asia-Pacific Electronic Medical Records (EMR) Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Asia-Pacific Electronic Medical Records (EMR) Market Trends

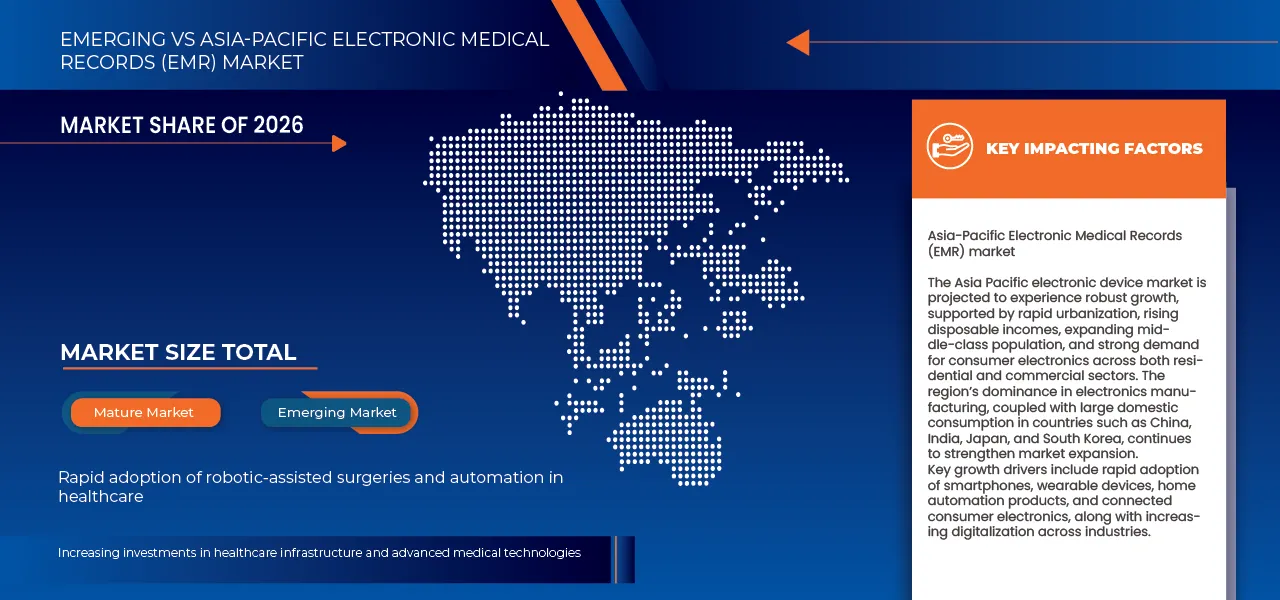

“Rapid Adoption Of Robotic-Assisted Surgeries And Automation In Healthcare”

- The Asia-Pacific (APAC) region is experiencing a significant transformation in healthcare delivery through the rapid adoption of robotic-assisted surgeries and automation technologies. Factors such as rising healthcare expenditures, increasing demand for minimally invasive procedures, and the need to improve surgical precision and patient outcomes are driving this trend. Countries including Japan, China, South Korea, and India are actively integrating advanced Electro-Medical Robotics (EMR) systems across hospitals and specialized medical centers, enabling surgeons to perform complex procedures with higher accuracy, reduced recovery times, and fewer complications.

- Hospitals and healthcare providers in APAC are investing heavily in robotic surgical platforms to enhance efficiency, reduce human error, and optimize resource utilization. Robotic systems are being deployed not only for general surgery but also for specialties like orthopedics, cardiology, urology, and neurosurgery. Furthermore, automation technologies such as AI-assisted diagnostics, robotic drug delivery, and teleoperated surgical devices are contributing to the digitalization and modernization of healthcare infrastructure in the region.

- For instance, In March 2025, Japan’s Ministry of Health, Labour and Welfare reported that more than 500 hospitals had integrated robotic-assisted surgery systems for procedures such as prostatectomies and cardiac interventions. Companies like Intuitive Surgical and Hitachi are actively collaborating with hospitals to deploy AI-enabled robotic platforms, improving surgical outcomes and patient safety.

- The rapid adoption of robotic-assisted surgeries and healthcare automation is not only improving clinical outcomes but also addressing challenges such as surgeon shortages, high patient volumes, and the need for consistent surgical precision

Asia-Pacific Electronic Medical Records (EMR) Market Dynamics

Driver

“Increasing Investments In Healthcare Infrastructure And Advanced Medical Technologies”

- The Asia-Pacific (APAC) region is witnessing a surge in investments in healthcare infrastructure and advanced medical technologies, which is significantly driving the growth of the Electro-Medical Robotics (EMR) market.

- Governments and private healthcare providers are allocating substantial budgets to modernize hospitals, expand surgical facilities, and integrate state-of-the-art medical equipment.

- These investments are motivated by rising population demands, increasing prevalence of chronic diseases, and the need for high-quality patient care, especially in countries like China, India, Japan, and South Korea.

- The expansion of healthcare infrastructure is complemented by the adoption of advanced medical technologies, including robotic-assisted surgery systems, automated diagnostics, telemedicine platforms, and AI-enabled patient monitoring.

- This modernization enhances surgical precision, reduces human error, and enables minimally invasive procedures, which in turn increases hospital efficiency and patient throughput. The push toward digital healthcare and smart hospital initiatives also encourages the deployment of EMR solutions, creating strong demand for robotics in clinical and surgical settings.

- For instance, In February 2025, China’s National Health Commission announced aUSD10 billion investment plan to upgrade tertiary care hospitals and implement smart medical systems, including robotic-assisted surgical platforms and AI-driven diagnostics

- The increasing investments in healthcare infrastructure and advanced technologies are not only expanding the EMR market’s reach but also creating opportunities for innovation and adoption of next-generation robotic systems

Restraint/Challenge

“High Initial Costs Of Emr Systems And Maintenance”

- The adoption of Electronic Medical Record (EMR) systems in healthcare facilities across the Asia-Pacific region faces a significant barrier due to the high upfront costs associated with procurement, implementation, and ongoing maintenance.

- Deploying a modern EMR system typically involves purchasing licensed software, upgrading existing IT infrastructure, acquiring high-performance servers, ensuring robust cybersecurity measures, and integrating with other digital health platforms such as laboratory information systems (LIS) and radiology information systems (RIS). These initial investments are often prohibitive for smaller clinics, community hospitals, and healthcare providers in developing countries.

- In emerging markets such as India, Indonesia, and Vietnam, healthcare budgets are frequently focused on expanding access to basic medical services, constructing new facilities, and improving medical staffing, leaving limited capital for digital health transformation.

- Even in more developed healthcare systems like Japan and Australia, transitioning from legacy paper-based records or outdated digital systems to fully integrated EMRs involves considerable investment in both technology and human resources. Costs are further compounded by the need for staff training, workflow redesign, system customization, and compliance with national healthcare regulations and patient privacy standards.

- The high initial investment and recurring maintenance costs, therefore, act as a major barrier to EMR adoption, particularly for smaller hospitals, clinics, and rural healthcare facilities. Although EMR systems offer long-term benefits such as improved patient care, reduced medical errors, and streamlined administrative processes, the substantial upfront financial requirements slow down widespread implementation

Asia-Pacific Electronic Medical Records (EMR) Market Scope

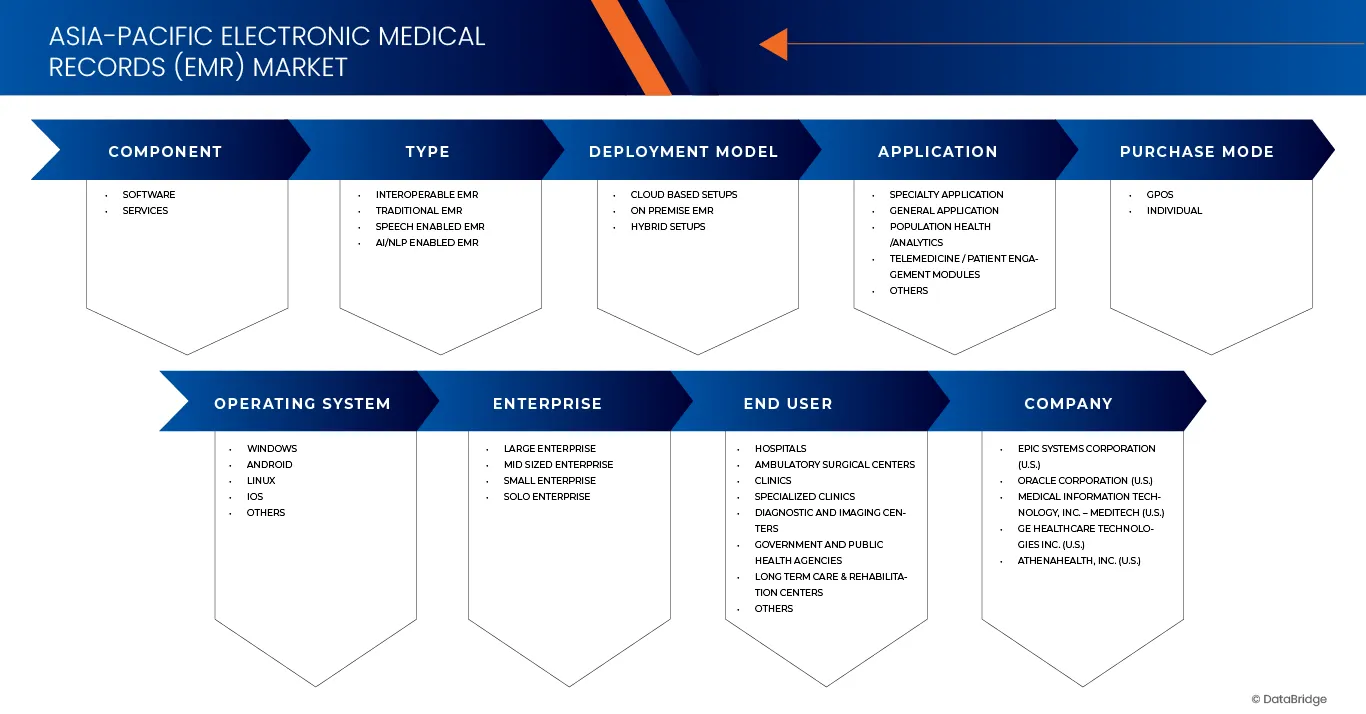

The Asia-Pacific Electronic Medical Records (EMR) market is segmented into eight notable segments which are based on Component, Type, Deployment model, Application, Purchase mode, Operating System, Enterprise, End User.

By Component

On the basis of Component, Asia-Pacific Electronic Medical Records (EMR) market is segmented into Software, Services.

In 2026, the Software segment is expected to dominate the Asia-Pacific Electronic Medical Records (EMR) market, accounting for the highest share of 89.04%, due to the increasing preference of healthcare providers for integrated, scalable, and user-friendly digital record systems over paper-based or fragmented clinical documentation. EMR software solutions enable efficient management of patient data, clinical workflows, and administrative processes, making them a critical component of hospital and clinic digitalization initiatives across the region.

By Type

On the basis of type, the market is segmented into Interoperable EMR, Traditional EMR, Speech Enabled EMR, AI/NLP Enabled EMR, Others

In 2026, the Interoperable EMR segment is expected to dominate the Asia-Pacific Electronic Medical Records (EMR) market, accounting for the highest share of 15.85%, due to its critical role in enabling seamless, accurate, and secure exchange of patient health information across multiple healthcare systems and providers. Interoperable EMR platforms allow hospitals, clinics, laboratories, pharmacies, and diagnostic centers to access and share real-time patient data, supporting coordinated care, continuity of treatment, and informed clinical decision-making across diverse care settings.

By Deployment model

On the basis of Deployment model, the market is segmented into Conventional Soil Management, Integrated Soil Fertility Management (ISFM), Precision Electronic medical records (EMR) Management, Regenerative Agriculture Practices, Others

In 2026, the Cloud Based Setups segment is expected to dominate the Asia-Pacific Electronic Medical Records (EMR) market, accounting for the highest share of 32.11%, driven by its widespread adoption, scalability, and strong alignment with the region’s growing demand for flexible, cost-effective digital health solutions. Cloud-based EMR systems offer healthcare providers—ranging from large hospitals to smaller clinics—secure, real-time access to patient data without the need for extensive on-premise infrastructure, making them particularly suitable for diverse healthcare environments across APAC.

By Application

On the basis of Application, Asia-Pacific Electronic Medical Records (EMR) market is segmented into Specialty Application, General Application, Population health /Analytics, Telemedicine / patient engagement modules, others

In 2026, the Specialty Application segment is expected to dominate the market, accounting for the highest share of 70.13%, driven by the increasing demand from healthcare providers for integrated, scalable, and user-friendly digital record systems customized for specific medical specialties. These specialty-focused EMR solutions enable efficient management of patient data, streamline clinical workflows, and simplify administrative tasks within departments such as cardiology, oncology, orthopedics, and pediatrics, effectively addressing their unique documentation and treatment needs.

By Purchase mode

On the basis of Purchase mode, the market is segmented into GPOS, Individual

In 2026, the GPOS segment is expected to dominate the market, accounting for the highest share of 53.26%, driven by its high prevalence, broad clinical applicability, and strong suitability for routine patient care management. General practice clinics and outpatient facilities represent the first point of contact for a large proportion of patients across APAC, driving consistent demand for efficient digital record systems to manage high patient volumes, repeat visits, and longitudinal health data.

By Operating system

On the basis of Operating system, the market is segmented into Windows, android, Linux, IOS, Others.

In 2026, the Windows segment is expected to dominate the market, accounting for the highest share of 70.01%, due to its widespread adoption, compatibility, and strong presence in healthcare IT infrastructure across the region. Windows-based EMR solutions benefit from a mature ecosystem, extensive software support, and familiarity among healthcare IT professionals, making them a preferred choice for hospitals, clinics, and specialty care centers.

By End User

On the basis of End User, the market is segmented into Hospitals, Ambulatory Surgical Centers, Clinics, Specialized Clinics, Diagnostic and imaging centers, Government and public health agencies, Long term care & rehabilitation centers, Others.

In 2026, the Hospitals segment is expected to dominate the market, accounting for the highest share of 70.01%, due to healthcare providers’ strong preference for centralized, facility-based digital solutions that enhance clinical workflow efficiency and patient data management. Hospitals, being the primary hubs for complex patient care, require robust EMR systems to support large patient volumes, multidisciplinary coordination, and regulatory compliance.

Asia-Pacific Electronic Medical Records (EMR) Market Regional Analysis

- In 2025, the China represents the largest share of the Asia-Pacific Electronic Medical Records (EMR) Market, accounting for 27.74% of Middle East and Africa demand. With a projected CAGR of 7.1%, growth due to its rapidly advancing healthcare infrastructure, strong government support for digital health initiatives, and widespread adoption of health IT technologies. The country benefits from a vast network of hospitals and clinics investing heavily in EMR systems to improve clinical efficiency and patient care.

- The broader Asia-Pacific region benefits from expanding healthcare infrastructure, supportive government digitization initiatives, and rising investments in health IT modernization. Increasing adoption of cloud-based EMR platforms, interoperability standards, and AI-enabled clinical tools across hospitals, ambulatory care centers, and specialty clinics continues to support strong market penetration and long-term growth potential across both developed and emerging economies in the region.

China Electronic Medical Records (EMR) Market Insight

The China Electronic Medical Records (EMR) market is experiencing strong growth, driven by rapid healthcare digitization, large-scale hospital modernization, and strong government support for national health IT initiatives. Widespread adoption of EMR systems across public hospitals, increasing use of cloud-based platforms, and integration of AI-enabled clinical decision tools are enhancing care coordination and operational efficiency. Ongoing investments in smart hospitals and interoperability standards continue to position China as the largest EMR market in the Asia-Pacific region.

Japan Electronic Medical Records (EMR) Market Insight

The Japan Electronic Medical Records (EMR) market is expanding steadily, supported by a highly developed healthcare system, aging population, and strong emphasis on data-driven clinical care. High penetration of EMR solutions in hospitals and specialty clinics, combined with government-led healthcare digitalization programs, is driving system upgrades and interoperability improvements. Japan’s focus on precision medicine, workflow optimization, and regulatory compliance continues to sustain long-term EMR adoption.

India Electronic Medical Records (EMR) Market Insight

The India Electronic Medical Records (EMR) market is witnessing rapid growth, fueled by expanding healthcare infrastructure, rising private hospital investments, and national digital health initiatives such as the Ayushman Bharat Digital Mission. Increasing adoption of cloud-based and cost-effective EMR platforms among hospitals, diagnostic centers, and outpatient clinics is improving accessibility and care continuity. Growing awareness of data standardization, telemedicine integration, and health analytics further strengthens market momentum.

South Korea Electronic Medical Records (EMR) Market Insight

The South Korea Electronic Medical Records (EMR) market is growing robustly, supported by advanced healthcare IT infrastructure, high digital literacy, and strong government backing for smart healthcare systems. Widespread use of EMR solutions integrated with AI, big data analytics, and telehealth platforms is enhancing clinical efficiency and patient engagement. Continuous innovation, cybersecurity investments, and interoperability development position South Korea as a technologically advanced EMR market within the Asia-Pacific region.

Asia-Pacific Electronic Medical Records (EMR) Market Share

The Electronic medical records (EMR) is primarily led by well-established companies, including:

- Medical Information Technology, Inc. (United States)

- Epic Systems (United States)

- Oracle (United States)

- GE HealthCare (United States)

- Athenahealth (United States)

- McKesson (United States)

- eClinicalWorks (United States)

- Napier Healthcare Solutions (Singapore)

- HealthPlix (India)

- CureMD (United States)

- Veradigm (United States)

- Practo (India)

- Greenway Health (United States)

- WebPT (United States)

- DocEngage (India)

Latest Developments in Asia-Pacific Electronic Medical Records (EMR) Market

- In September 2025, MEDITECH announced new artificial intelligence initiatives for its Expanse EHR at MEDITECH LIVE 2025, introducing AI tools that assist clinicians, patients, and administrators within their native workflows. Features include the MyHealth patient portal assistant, clinician chatbots, voice-enabled mobile apps, and AI-powered operational tools like automated discharge summaries and claim support. These innovations aim to enhance care delivery, improve efficiency, reduce clinician workload, and support personalized, data-driven healthcare.

- In November 2024, Humana is partnering with Epic to introduce new data-sharing capabilities that support forthcoming federal interoperability requirements. The insurer is deploying Epic’s Coverage Finder and Digital Insurance Card Exchange tools for its Medicare Advantage members, streamlining insurance verification and minimizing manual check-in tasks. The initial rollout will cover roughly 800,000 members across 120 health systems, with plans to expand to millions more as additional providers implement the technology.

- In February 2024, Oracle has made WebCenter Content, Imaging, and Enterprise Capture 12.2.1.4 available through the Oracle Cloud Marketplace, enabling organizations to deploy these content management solutions directly on Oracle Cloud Infrastructure (OCI). This cloud-based access simplifies implementation, supports hybrid models, and leverages OCI-native tools for enhanced scalability and performance.

- In January 2025, GE HealthCare announced a US $138 million investment to expand its contrast media manufacturing facility in Cork, Ireland, which will increase annual production capacity by an additional 25 million patient doses by the end of 2027 to meet growing global demand for imaging agents.

- In December 2025, athenahealth, a leading provider of network-enabled healthcare software, has partnered with Microsoft to integrate Microsoft Dragon Copilot into athenaOne’s Ambient Notes platform. Launching in the first half of 2026, this AI-driven solution will allow ambulatory clinicians to select their preferred ambient model for documentation within a single contract. The collaboration enhances athenahealth’s open, flexible ecosystem, offering choice-driven tools tailored to individual practice styles. Clinicians will benefit from streamlined documentation, reduced administrative burden, and more time to focus on patient care, reinforcing athenahealth’s commitment to improving workflow efficiency.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTE PRODUCTS

4.2.5 INDUSTRY RIVALRY

4.2.6 CONCLUSION

4.3 INDUSTRY INSIGHTS – GLOBAL INTEROPERABILITY MARKET

4.3.1 MICRO AND MACRO ECONOMIC FACTORS

4.3.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.3.3 KEY PRICING STRATEGIES

4.3.4 INTERVIEWS WITH SPECIALISTS

4.3.5 ANALYSIS AND RECOMMENDATION

5 HEALTHCARE TARIFFS IMPACT ANALYSIS

5.1 OVERVIEW

5.2 TARIFF STRUCTURES

5.2.1 GLOBAL VS. REGIONAL TARIFF STRUCTURES

5.2.2 UNITED STATES: MEDICARE/MEDICAID TARIFF POLICIES, CMS PRICING MODELS

5.2.3 EUROPEAN UNION: CROSS-BORDER TARIFF REGULATIONS, REIMBURSEMENT POLICIES

5.2.4 ASIA-PACIFIC: GOVERNMENT-IMPOSED TARIFFS ON IMPORTED MEDICAL PRODUCTS

5.2.5 EMERGING MARKETS: CHALLENGES IN TARIFF IMPLEMENTATION

5.3 PHARMACEUTICAL TARIFFS AND TRADE BARRIERS

5.3.1 IMPORT DUTIES ON PRESCRIPTION DRUGS VS. GENERICS

5.3.2 IMPACT ON DRUG AFFORDABILITY AND ACCESS

5.3.3 KEY TRADE AGREEMENTS AFFECTING PHARMACEUTICAL TARIFFS

5.4 IMPACT OF HEALTHCARE TARIFFS ON PROVIDERS AND PATIENTS

5.4.1 COST BURDEN ON HOSPITALS AND HEALTHCARE FACILITIES

5.4.2 EFFECT ON PATIENT AFFORDABILITY AND INSURANCE COVERAGE

5.4.3 TARIFFS AND THEIR ROLE IN MEDICAL TOURISM

5.5 TRADE AGREEMENTS AND HEALTHCARE TARIFFS

5.5.1 WTO REGULATIONS ON HEALTHCARE TARIFFS

5.5.2 IMPACT OF TRADE WARS ON THE HEALTHCARE SUPPLY CHAIN

5.5.3 ROLE OF FREE TRADE AGREEMENTS (FTAS) IN REDUCING TARIFFS

5.6 IMPACT OF TARIFFS ON HEALTHCARE COSTS AND ACCESSIBILITY

5.7 IMPORTANCE OF TARIFFS IN THE HEALTHCARE SECTOR

6 REGULATORY COVERAGE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RAPID ADOPTION OF ROBOTIC-ASSISTED SURGERIES AND AUTOMATION IN HEALTHCARE

7.1.2 INCREASING INVESTMENTS IN HEALTHCARE INFRASTRUCTURE AND ADVANCED MEDICAL TECHNOLOGIES

7.1.3 GROWING AWARENESS OF ADVANCED MEDICAL ROBOTICS AMONG HOSPITALS AND CLINICIANS

7.2 RESTRAINTS

7.2.1 HIGH INITIAL COSTS OF EMR SYSTEMS AND MAINTENANCE

7.2.2 LIMITED AVAILABILITY OF SKILLED PERSONNEL TO OPERATE AND MAINTAIN ROBOTICS

7.3 OPPORTUNITIES

7.3.1 INCREASING COLLABORATIONS BETWEEN ROBOTICS MANUFACTURERS AND HEALTHCARE PROVIDERS

7.3.2 EXPANDING GERIATRIC POPULATION DRIVING DEMAND FOR ADVANCED HEALTHCARE SOLUTIONS

7.3.3 GROWING MEDICAL TOURISM IN APAC BOOSTING DEMAND FOR HIGH-TECH MEDICAL PROCEDURES

7.4 CHALLENGES

7.4.1 INCONSISTENT ADOPTION RATES ACROSS URBAN AND RURAL AREAS

7.4.2 HIGH COMPETITION AMONG GLOBAL AND LOCAL ROBOTICS MANUFACTURERS

8 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2018-2033 (USD THOUSANDS)

8.1 OVERVIEW

8.2 SOFTWARE

8.3 SERVICES

8.4 ASIA PACIFIC SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

8.4.1 CORE EMR PLATFORM

8.4.2 SPECIALITY MODULES/ADD ONS

8.5 ASIA PACIFIC SOFTWARE SPECIALITY MODULES/ADD ONS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

8.5.1 CLINICAL DOCUMENTATION AND PROGRESS NOTES

8.5.2 CPOE

8.5.3 E PRESCRIBING

8.5.4 REVENUE CYCLE MANAGEMENT

8.5.5 PATIENT PORTAL/PHR INTERFACE

8.5.6 POPULATION HEALTH MANAGEMENT /ANALYTICS

8.5.7 MOBILE EMR APPS

8.6 ASIA PACIFIC SERVICES IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

8.6.1 IMPLEMENTATION AND INTEGRATION

8.6.2 TRAINING AND CONSULTING

8.6.3 MAINTENANCE AND SUPPORT

9 ASIA PACIFIC SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

9.1 OVERVIEW

9.2 INTEROPERABLE EMR

9.3 TRADITIONAL EMR

9.4 SPEECH ENABLED EMR

9.5 AI/NLP ENABLED EMR

9.6 OTHERS

10 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DEPLOYMENT MODEL, 2018-2033 (USD THOUSANDS)

10.1 OVERVIEW

10.2 CLOUD BASED SETUPS

10.3 ON PREMISE EMR

10.4 HYBRID SETUPS

11 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2018-2033 (USD THOUSANDS)

11.1 OVERVIEW

11.2 SPECIALTY APPLICATION

11.3 GENERAL APPLICATION

11.4 POPULATION HEALTH /ANALYTICS

11.5 TELEMEDICINE / PATIENT ENGAGEMENT MODULES

11.6 OTHERS

11.7 ASIA PACIFIC SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

11.7.1 CARDIOLOGY

11.7.2 OBSTERICS & GYNECOLOGY

11.7.3 ONCOLOGY

11.7.4 DENTISTRY

11.7.5 MENTAL HEALTH

11.7.6 ORTHOPEDICS

11.7.7 OTHERS

11.8 ASIA PACIFIC GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

11.8.1 PRIMARY CARE

11.8.2 OUTPATIENTS CLINICS

11.8.3 GENERAL PHYSICIAN WORKFLOWS

12 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY PURCHASE MODE, 2018-2033 (USD THOUSANDS)

12.1 OVERVIEW

12.2 GPOS

12.3 INDIVIDUAL

13 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY OPERATING SYSTEM, 2018-2033 (USD THOUSANDS)

13.1 OVERVIEW

13.2 WINDOWS

13.3 ANDROID

13.4 LINUX

13.5 IOS

13.6 OTHERS

14 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY ENTERPRISE, 2018-2033 (USD THOUSANDS)

14.1 OVERVIEW

14.2 LARGE ENTERPRISE

14.3 MID SIZED ENTERPRISE

14.4 SMALL ENTERPRISE

14.5 SOLO ENTERPRISE

14.6 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

14.6.1 HOSPITALS

14.6.2 AMBULATORY SURGICAL CENTERS

14.6.3 CLINICS

14.6.4 SPECIALIZED CLINICS

14.6.5 DIAGNOSTIC AND IMAGING CONTERS

14.6.6 GOVERNMENT AND PUBLIC HEALTJ AGENCIES

14.6.7 LONG TERM CARE & REHABILITATION CENTERS

14.6.8 OTHERS

14.7 ASIA PACIFIC HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

14.7.1 PUBLIC

14.7.2 PRIVATE

15 ASIA PACIFIC CLINICS ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

15.1 OVERVIEW

15.2 GENERAL PHYSICIAN CLINICS

15.3 OUTPATIENT CARE CENTERS

15.4 DIAGNOSTIC/ IMAGING CENTERS

15.5 OTHERS

16 ASIA-PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET BY COUNTRIES

16.1 ASIA-PACIFIC

16.1.1 CHINA

16.1.2 JAPAN

16.1.3 INDIA

16.1.4 SOUTH KOREA

16.1.5 AUSTRALIA

16.1.6 INDONESIA

16.1.7 PHILIPPINES

16.1.8 THAILAND

16.1.9 MALAYSIA

16.1.10 SINGAPORE

16.1.11 NEW ZEALAND

16.1.12 HONG KONG

16.1.13 TAIWAN

16.1.14 REST OF ASIA-PACIFIC

17 ASIA-PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, COMPANY LANDSCAPE

17.1 ASIA-PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) COMPANY SHARE ANALYSIS: ASIA-PACIFIC

18 SWOT ANALYSIS

19 COMPANY PROFILES

19.1 MEDITECH

19.1.1 COMPANY SNAPSHOT

19.1.2 PRODUCT PORTFOLIO

19.1.3 RECENT DEVELOPMENT

19.2 EPIC SYSTEMS CORPORATION

19.2.1 COMPANY SNAPSHOT

19.2.2 PRODUCT PORTFOLIO

19.2.3 RECENT DEVELOPMENT

19.3 ORACLE

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 PRODUCT PORTFOLIO

19.3.4 RECENT DEVELOPMENT

19.4 GE HEALTHCARE

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 PRODUCT PORTFOLIO

19.4.4 RECENT DEVELOPMENT

19.5 ATHENAHEALTH, INC.

19.5.1 COMPANY SNAPSHOT

19.5.2 PRODUCT PORTFOLIO

19.5.3 RECENT DEVELOPMENT

19.6 AGFA HEALTHCARE

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT DEVELOPMENT.

19.7 AGILE EMR

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENT

19.8 AOIKUMO

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENT

19.9 AMAZON WEB SERVICES (AWS).

19.9.1 COMPANY SNAPSHOT

19.9.2 REVENUE ANALYSIS

19.9.3 PRODUCT PORTFOLIO

19.9.4 RECENT DEVELOPMENT

19.1 CUREMD HEALTHCARE

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT/SERVICE PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 DOCNGAGE

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT/SERVICE PORTFOLIO

19.11.3 RECENT DEVELOPMENT

19.12 DOCPULSE

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT/SERVICE PORTFOLIO

19.12.3 RECENT DEVELOPMENT

19.13 ECLINICALWORKS

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENT

19.14 GREENWAY HEALTH

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 HALEMIND INC.

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENT

19.16 HEALTHPLIX TECHNOLOGIES

19.16.1 COMPANY SNAPSHOT

19.16.2 PRODUCT/SERVICE PORTFOLIO

19.16.3 RECENT DEVELOPMENT

19.17 INFOR HEALTHCARE

19.17.1 COMPANY SNAPSHOT

19.17.2 PRODUCT/SERVICE PORTFOLIO

19.17.3 RECENT DEVELOPMENT

19.18 JVS GROUP

19.18.1 COMPANY SNAPSHOT

19.18.2 PRODUCT PORTFOLIO

19.18.3 RECENT DEVELOPMENT

19.19 MCKESSON CORPORATION

19.19.1 COMPANY SNAPSHOT

19.19.2 REVENUE ANALYSIS

19.19.3 PRODUCT/SERVICE PORTFOLIO

19.19.4 RECENT DEVELOPMENT

19.2 NANO MEDIC CARE SDN. BHD.

19.20.1 COMPANY SNAPSHOT

19.20.2 PRODUCT PORTFOLIO

19.20.3 RECENT DEVELOPMENT

19.21 NAPIER HEALTHCARE SOLUTIONS PTE. LTD.

19.21.1 COMPANY SNAPSHOT

19.21.2 PRODUCT/SERVICE PORTFOLIO

19.21.3 RECENT DEVELOPMENT

19.22 NEXTGEN ESOLUTIONS.

19.22.1 COMPANY SNAPSHOT

19.22.2 PRODUCT PORTFOLIO

19.22.3 RECENT DEVELOPMENT

19.23 OSP.

19.23.1 COMPANY SNAPSHOT

19.23.2 PRODUCT PORTFOLIO

19.23.3 RECENT DEVELOPMENT

19.24 PRACTO TECHNOLOGIES PVT. LTD.

19.24.1 COMPANY SNAPSHOT

19.24.2 PRODUCT/SERVICE PORTFOLIO

19.24.3 RECENT DEVELOPMENT

19.25 PT. MEDIKA INTEGRASI TEKNOLOGI.

19.25.1 COMPANY SNAPSHOT

19.25.2 PRODUCT PORTFOLIO

19.25.3 RECENT DEVELOPMENT

19.26 SUVARNA TECHNOSOFT

19.26.1 COMPANY SNAPSHOT

19.26.2 PRODUCT PORTFOLIO

19.26.3 RECENT DEVELOPMENT

19.27 SYNODUS

19.27.1 COMPANY SNAPSHOT

19.27.2 PRODUCT PORTFOLIO

19.27.3 RECENT DEVELOPMENT

19.28 TEBRA TECHNOLOGIES, INC

19.28.1 COMPANY SNAPSHOT

19.28.2 PRODUCT/SERVICE PORTFOLIO

19.28.3 RECENT DEVELOPMENT

19.29 VERADIGM \ ALLSCRIPTS HEALTHCARE SOLUTIONS

19.29.1 COMPANY SNAPSHOT

19.29.2 PRODUCT PORTFOLIO

19.29.3 RECENT DEVEOPMENT

19.3 WEBPT

19.30.1 COMPANY SNAPSHOT

19.30.2 PRODUCT/SERVICE PORTFOLIO

19.30.3 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

List of Table

TABLE 1 REGULATORY COVERAGE

TABLE 2 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2018-2033 (USD THOUSANDS)

TABLE 3 ASIA PACIFIC SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 4 ASIA PACIFIC SOFTWARE SPECIALITY MODULES/ADD ONS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 5 ASIA PACIFIC SERVICES IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 6 ASIA PACIFIC SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 7 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DEPLOYMENT MODEL, 2018-2033 (USD THOUSANDS)

TABLE 8 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2018-2033 (USD THOUSANDS)

TABLE 9 ASIA PACIFIC SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 10 ASIA PACIFIC GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 11 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY PURCHASE MODE, 2018-2033 (USD THOUSANDS)

TABLE 12 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY OPERATING SYSTEM, 2018-2033 (USD THOUSANDS)

TABLE 13 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY ENTERPRIZE, 2018-2033 (USD THOUSANDS)

TABLE 14 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 15 ASIA PACIFIC HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 16 ASIA PACIFIC CLINICS ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 17 ASIA-PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COUNTRY

TABLE 18 COUNTRY

TABLE 19 CHINA

TABLE 20 ASIA-PACIFIC

TABLE 21 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2018-2033 (USD THOUSANDS)

TABLE 22 ASIA PACIFIC SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 23 ASIA PACIFIC SOFTWARE SPECIALITY MODULES/ADD ONS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 24 ASIA PACIFIC SERVICES IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 25 ASIA PACIFIC SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 26 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DEPLOYMENT MODEL, 2018-2033 (USD THOUSANDS)

TABLE 27 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2018-2033 (USD THOUSANDS)

TABLE 28 ASIA PACIFIC SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 29 ASIA PACIFIC GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 30 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY PURCHASE MODE, 2018-2033 (USD THOUSANDS)

TABLE 31 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY OPERATING SYSTEM, 2018-2033 (USD THOUSANDS)

TABLE 32 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY ENTERPRIZE, 2018-2033 (USD THOUSANDS)

TABLE 33 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 34 ASIA PACIFIC HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 35 ASIA PACIFIC CLINICS ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 36 CHINA

TABLE 37 CHINA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2018-2033 (USD THOUSANDS)

TABLE 38 CHINA SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 39 CHINA SOFTWARE SPECIALITY MODULES/ADD ONS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 40 CHINA SERVICES IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 41 CHINA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 42 CHINA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DEPLOYMENT MODEL, 2018-2033 (USD THOUSANDS)

TABLE 43 CHINA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2018-2033 (USD THOUSANDS)

TABLE 44 CHINA SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 45 CHINA GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 46 CHINA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY PURCHASE MODE, 2018-2033 (USD THOUSANDS)

TABLE 47 CHINA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY OPERATING SYSTEM, 2018-2033 (USD THOUSANDS)

TABLE 48 CHINA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY ENTERPRIZE, 2018-2033 (USD THOUSANDS)

TABLE 49 CHINA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 50 CHINA HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 51 CHINA CLINICS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 52 JAPAN

TABLE 53 JAPAN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2018-2033 (USD THOUSANDS)

TABLE 54 JAPAN SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 55 JAPAN SOFTWARE SPECIALITY MODULES/ADD ONS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 56 JAPAN SERVICES IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 57 JAPAN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 58 JAPAN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DEPLOYMENT MODEL, 2018-2033 (USD THOUSANDS)

TABLE 59 JAPAN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2018-2033 (USD THOUSANDS)

TABLE 60 JAPAN SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 61 JAPAN GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 62 JAPAN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY PURCHASE MODE, 2018-2033 (USD THOUSANDS)

TABLE 63 JAPAN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY OPERATING SYSTEM, 2018-2033 (USD THOUSANDS)

TABLE 64 JAPAN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY ENTERPRIZE, 2018-2033 (USD THOUSANDS)

TABLE 65 JAPAN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 66 JAPAN HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 67 JAPAN CLINICS ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 68 INDIA

TABLE 69 INDIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2018-2033 (USD THOUSANDS)

TABLE 70 INDIA SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 71 INDIA SOFTWARE SPECIALITY MODULES/ADD ONS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 72 INDIA SERVICES IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 73 INDIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 74 INDIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DEPLOYMENT MODEL, 2018-2033 (USD THOUSANDS)

TABLE 75 INDIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2018-2033 (USD THOUSANDS)

TABLE 76 INDIA SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 77 INDIA GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 78 INDIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY PURCHASE MODE, 2018-2033 (USD THOUSANDS)

TABLE 79 INDIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY OPERATING SYSTEM, 2018-2033 (USD THOUSANDS)

TABLE 80 INDIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY OPERATING SYSTEM, 2018-2033 (USD THOUSANDS)

TABLE 81 INDIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 82 INDIA HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 83 INDIA CLINICS ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 84 SOUTH KOREA

TABLE 85 SOUTH KOREA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2018-2033 (USD THOUSANDS)

TABLE 86 SOUTH KOREA SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 87 SOUTH KOREA SOFTWARE SPECIALITY MODULES/ADD ONS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 88 SOUTH KOREA SERVICES IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 89 SOUTH KOREA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 90 SOUTH KOREA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DEPLOYMENT MODEL, 2018-2033 (USD THOUSANDS)

TABLE 91 SOUTH KOREA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2018-2033 (USD THOUSANDS)

TABLE 92 SOUTH KOREA SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 93 SOUTH KOREA GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 94 SOUTH KOREA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY PURCHASE MODE, 2018-2033 (USD THOUSANDS)

TABLE 95 SOUTH KOREA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY OPERATING SYSTEM, 2018-2033 (USD THOUSANDS)

TABLE 96 SOUTH KOREA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY ENTERPRIZE, 2018-2033 (USD THOUSANDS)

TABLE 97 SOUTH KOREA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 98 SOUTH KOREA HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 99 SOUTH KOREA CLINICS ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 100 AUSTRALIA

TABLE 101 AUSTRALIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2018-2033 (USD THOUSANDS)

TABLE 102 AUSTRALIA SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 103 AUSTRALIA SOFTWARE SPECIALITY MODULES/ADD ONS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 104 AUSTRALIA SERVICES IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 105 AUSTRALIA SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 106 AUSTRALIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DEPLOYMENT MODEL, 2018-2033 (USD THOUSANDS)

TABLE 107 AUSTRALIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2018-2033 (USD THOUSANDS)

TABLE 108 AUSTRALIA SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 109 AUSTRALIA GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 110 AUSTRALIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY PURCHASE MODE, 2018-2033 (USD THOUSANDS)

TABLE 111 AUSTRALIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY OPERATING SYSTEM, 2018-2033 (USD THOUSANDS)

TABLE 112 AUSTRALIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY ENTERPRIZE, 2018-2033 (USD THOUSANDS)

TABLE 113 AUSTRALIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 114 AUSTRALIA HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 115 AUSTRALIA CLINICS ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 116 INDONESIA

TABLE 117 INDONESIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2018-2033 (USD THOUSANDS)

TABLE 118 INDONESIA SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 119 INDONESIA SOFTWARE SPECIALITY MODULES/ADD ONS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 120 INDONESIA SERVICES IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 121 INDONESIA SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 122 INDONESIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DEPLOYMENT MODEL, 2018-2033 (USD THOUSANDS)

TABLE 123 INDONESIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2018-2033 (USD THOUSANDS)

TABLE 124 INDONESIA SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 125 INDONESIA GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 126 INDONESIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY PURCHASE MODE, 2018-2033 (USD THOUSANDS)

TABLE 127 INDONESIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY OPERATING SYSTEM, 2018-2033 (USD THOUSANDS)

TABLE 128 INDONESIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY ENTERPRIZE, 2018-2033 (USD THOUSANDS)

TABLE 129 INDONESIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 130 INDONESIA HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 131 INDONESIA CLINICS ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 132 PHILIPPINES

TABLE 133 PHILIPPINES ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2018-2033 (USD THOUSANDS)

TABLE 134 PHILIPPINES SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 135 PHILIPPINES SOFTWARE SPECIALITY MODULES/ADD ONS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 136 PHILIPPINES SERVICES IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 137 PHILIPPINES SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 138 PHILIPPINES ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DEPLOYMENT MODEL, 2018-2033 (USD THOUSANDS)

TABLE 139 PHILIPPINES ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2018-2033 (USD THOUSANDS)

TABLE 140 PHILIPPINES SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 141 PHILIPPINES GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 142 PHILIPPINES ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY PURCHASE MODE, 2018-2033 (USD THOUSANDS)

TABLE 143 PHILIPPINES ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY OPERATING SYSTEM, 2018-2033 (USD THOUSANDS)

TABLE 144 PHILIPPINES ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY ENTERPRIZE, 2018-2033 (USD THOUSANDS)

TABLE 145 PHILIPPINES ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 146 PHILIPPINES HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 147 PHILIPPINES CLINICS ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 148 THAILAND

TABLE 149 THAILAND ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2018-2033 (USD THOUSANDS)

TABLE 150 THAILAND SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 151 THAILAND SOFTWARE SPECIALITY MODULES/ADD ONS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 152 THAILAND SERVICES IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 153 THAILAND SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 154 THAILAND ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DEPLOYMENT MODEL, 2018-2033 (USD THOUSANDS)

TABLE 155 THAILAND ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2018-2033 (USD THOUSANDS)

TABLE 156 THAILAND SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 157 THAILAND GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 158 THAILAND ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY PURCHASE MODE, 2018-2033 (USD THOUSANDS)

TABLE 159 THAILAND ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY OPERATING SYSTEM, 2018-2033 (USD THOUSANDS)

TABLE 160 THAILAND ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY ENTERPRIZE, 2018-2033 (USD THOUSANDS)

TABLE 161 THAILAND ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 162 THAILAND HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 163 THAILAND CLINICS ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 164 MALAYSIA

TABLE 165 MALAYSIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2018-2033 (USD THOUSANDS)

TABLE 166 MALAYSIA SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 167 MALAYSIA SOFTWARE SPECIALITY MODULES/ADD ONS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 168 MALAYSIA SERVICES IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 169 MALAYSIA SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 170 MALAYSIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DEPLOYMENT MODEL, 2018-2033 (USD THOUSANDS)

TABLE 171 MALAYSIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2018-2033 (USD THOUSANDS)

TABLE 172 MALAYSIA SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 173 MALAYSIA GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 174 MALAYSIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY PURCHASE MODE, 2018-2033 (USD THOUSANDS)

TABLE 175 MALAYSIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY OPERATING SYSTEM, 2018-2033 (USD THOUSANDS)

TABLE 176 MALAYSIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY ENTERPRIZE, 2018-2033 (USD THOUSANDS)

TABLE 177 MALAYSIA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 178 MALAYSIA HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 179 MALAYSIA CLINICS ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 180 SINGAPORE

TABLE 181 SINGAPORE ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2018-2033 (USD THOUSANDS)

TABLE 182 SINGAPORE SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 183 SINGAPORE SOFTWARE SPECIALITY MODULES/ADD ONS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 184 SINGAPORE SERVICES IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 185 SINGAPORE SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 186 SINGAPORE ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DEPLOYMENT MODEL, 2018-2033 (USD THOUSANDS)

TABLE 187 SINGAPORE ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2018-2033 (USD THOUSANDS)

TABLE 188 SINGAPORE SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 189 SINGAPORE GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 190 SINGAPORE ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY PURCHASE MODE, 2018-2033 (USD THOUSANDS)

TABLE 191 SINGAPORE ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY OPERATING SYSTEM, 2018-2033 (USD THOUSANDS)

TABLE 192 SINGAPORE ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY ENTERPRIZE, 2018-2033 (USD THOUSANDS)

TABLE 193 SINGAPORE ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 194 SINGAPORE HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 195 SINGAPORE CLINICS ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 196 NEW ZEALAND

TABLE 197 NEW ZEALAND ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2018-2033 (USD THOUSANDS)

TABLE 198 NEW ZEALAND SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 199 NEW ZEALAND SOFTWARE SPECIALITY MODULES/ADD ONS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 200 NEW ZEALAND SERVICES IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 201 NEW ZEALAND SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 202 NEW ZEALAND ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DEPLOYMENT MODEL, 2018-2033 (USD THOUSANDS)

TABLE 203 NEW ZEALAND ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2018-2033 (USD THOUSANDS)

TABLE 204 NEW ZEALAND SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 205 NEW ZEALAND GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 206 NEW ZEALAND ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY PURCHASE MODE, 2018-2033 (USD THOUSANDS)

TABLE 207 NEW ZEALAND ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY OPERATING SYSTEM, 2018-2033 (USD THOUSANDS)

TABLE 208 NEW ZEALAND ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY ENTERPRIZE, 2018-2033 (USD THOUSANDS)

TABLE 209 NEW ZEALAND ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 210 NEW ZEALAND HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 211 NEW ZEALAND CLINICS ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 212 HONG KONG

TABLE 213 HONG KONG ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2018-2033 (USD THOUSANDS)

TABLE 214 HONG KONG SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 215 HONG KONG SOFTWARE SPECIALITY MODULES/ADD ONS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 216 HONG KONG SERVICES IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 217 HONG KONG SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 218 HONG KONG ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DEPLOYMENT MODEL, 2018-2033 (USD THOUSANDS)

TABLE 219 HONG KONG ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2018-2033 (USD THOUSANDS)

TABLE 220 HONG KONG SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 221 HONG KONG GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 222 HONG KONG ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY PURCHASE MODE, 2018-2033 (USD THOUSANDS)

TABLE 223 HONG KONG ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY OPERATING SYSTEM, 2018-2033 (USD THOUSANDS)

TABLE 224 HONG KONG ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY ENTERPRIZE, 2018-2033 (USD THOUSANDS)

TABLE 225 HONG KONG ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 226 HONG KONG HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 227 HONG KONG CLINICS ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 228 TAIWAN

TABLE 229 TAIWAN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2018-2033 (USD THOUSANDS)

TABLE 230 TAIWAN SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 231 TAIWAN SOFTWARE SPECIALITY MODULES/ADD ONS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 232 TAIWAN SERVICES IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 233 TAIWAN SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 234 TAIWAN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DEPLOYMENT MODEL, 2018-2033 (USD THOUSANDS)

TABLE 235 TAIWAN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2018-2033 (USD THOUSANDS)

TABLE 236 TAIWAN SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 237 TAIWAN GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 238 TAIWAN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY PURCHASE MODE, 2018-2033 (USD THOUSANDS)

TABLE 239 TAIWAN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY OPERATING SYSTEM, 2018-2033 (USD THOUSANDS)

TABLE 240 TAIWAN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY ENTERPRIZE, 2018-2033 (USD THOUSANDS)

TABLE 241 TAIWAN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 242 TAIWAN HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 243 TAIWAN CLINICS ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 244 REST OF ASIA-PACIFIC

TABLE 245 REST OF ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2018-2033 (USD THOUSANDS)

TABLE 246 REST OF ASIA PACIFIC SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 247 REST OF ASIA PACIFIC SOFTWARE SPECIALITY MODULES/ADD ONS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 248 REST OF ASIA PACIFIC SERVICES IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 249 REST OF ASIA PACIFIC SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 250 REST OF ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DEPLOYMENT MODEL, 2018-2033 (USD THOUSANDS)

TABLE 251 REST OF ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2018-2033 (USD THOUSANDS)

TABLE 252 REST OF ASIA PACIFIC SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 253 REST OF ASIA PACIFIC GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 254 REST OF ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY PURCHASE MODE, 2018-2033 (USD THOUSANDS)

TABLE 255 REST OF ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY OPERATING SYSTEM, 2018-2033 (USD THOUSANDS)

TABLE 256 REST OF ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY ENTERPRIZE, 2018-2033 (USD THOUSANDS)

TABLE 257 REST OF ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

TABLE 258 REST OF ASIA PACIFIC HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2018-2033 (USD THOUSANDS)

TABLE 259 REST OF ASIA PACIFIC CLINICS ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2018-2033 (USD THOUSANDS)

List of Figure

FIGURE 1 ASIA-PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET: GLOBAL VS REGIONAL ANALYSIS

FIGURE 5 ASIA-PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 ASIA-PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET : VENDOR SHARE ANALYSIS

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 STRATEGIC DECISIONS

FIGURE 12 ASIA-PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET: SEGMENTATION

FIGURE 13 RAPID DIGITALIZATION OF HEALTHCARE SYSTEMS EXPECTED TO DRIVE THE ASIA-PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 14 SOFTWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET IN 2026 & 2033

FIGURE 15 CHINA IS EXPECTED TO DOMINATE THE ASIA-PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 16 PORTER’S FIVE FORCES

FIGURE 17 DROC ANALYSIS

FIGURE 18 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2025

FIGURE 19 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2026-2033 (USD THOUSANDS)

FIGURE 20 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, CAGR, 2026-2033

FIGURE 21 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, LIFELINE CURVE

FIGURE 22 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2025

FIGURE 23 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2026-2033 (USD THOUSANDS)

FIGURE 24 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, CAGR, 2026-2033

FIGURE 25 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, LIFELINE CURVE

FIGURE 26 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DEPLOYMENT MODEL, 2025

FIGURE 27 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DEPLOYMENT MODEL, 2026-2033 (USD THOUSANDS)

FIGURE 28 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DEPLOYMENT MODEL, CAGR, 2026-2033

FIGURE 29 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DEPLOYMENT MODEL, LIFELINE CURVE

FIGURE 30 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPICATION, 2025

FIGURE 31 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2026-2033 (USD THOUSANDS)

FIGURE 32 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, CAGR, 2026-2033

FIGURE 33 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, LIFELINE CURVE

FIGURE 34 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY PURCHASE MODE, 2025

FIGURE 35 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY PURCHASE MODE, 2026-2033 (USD THOUSANDS)

FIGURE 36 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY PURCHASE MODE, CAGR, 2026-2033

FIGURE 37 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY PURCHASE MODE, LIFELINE CURVE

FIGURE 38 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY OPERATING SYSTEM, 2025

FIGURE 39 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY OPERATING SYSTEM, 2026-2033 (USD THOUSANDS)

FIGURE 40 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY OPERATING SYSTEM, CAGR, 2026-2033

FIGURE 41 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY OPERATING SYSTEM, LIFELINE CURVE

FIGURE 42 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY ENTERPRIZE, 2025

FIGURE 43 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY ENTERPRIZE, 2026-2033 (USD THOUSANDS)

FIGURE 44 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY ENTERPRISE, CAGR, 2026-2033

FIGURE 45 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY ENTERPRISE, LIFELINE CURVE

FIGURE 46 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2025

FIGURE 47 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2026-2033 (USD THOUSANDS)

FIGURE 48 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, CAGR, 2026-2033

FIGURE 49 ASIA PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, LIFELINE CURVE

FIGURE 50 ASIA-PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET, SNAPSHOTS

FIGURE 51 ASIA-PACIFIC ELECTRONIC MEDICAL RECORDS (EMR) MARKET: COMPANY SHARE 2025 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.