Asia Pacific Emollient Esters Market

Market Size in USD Million

CAGR :

%

USD

202.55 Million

USD

296.00 Million

2024

2032

USD

202.55 Million

USD

296.00 Million

2024

2032

| 2025 –2032 | |

| USD 202.55 Million | |

| USD 296.00 Million | |

|

|

|

|

Asia-Pacific Emollient Esters Market Analysis

Asia-Pacific emollient esters market includes the production and use of esters derived from fatty acids and alcohols that are primarily used in personal care and cosmetic products to improve skin feel, texture, and moisture retention. These emollient esters are also utilized in hair care products, sunscreens, and makeup for their ability to soften and condition the skin and hair. The demand for emollient esters is rising due to the growing consumer preference for natural and sustainable beauty products. The market is primarily driven by the increasing demand for high-quality, multifunctional, and eco-friendly formulations. Key trends include the shift towards bio-based emollient esters, and the growing adoption of these ingredients in premium and organic cosmetic products, as well as the development of multi-functional esters that offer both emollient and skin-conditioning properties.

Asia-Pacific Emollient Esters Market Size

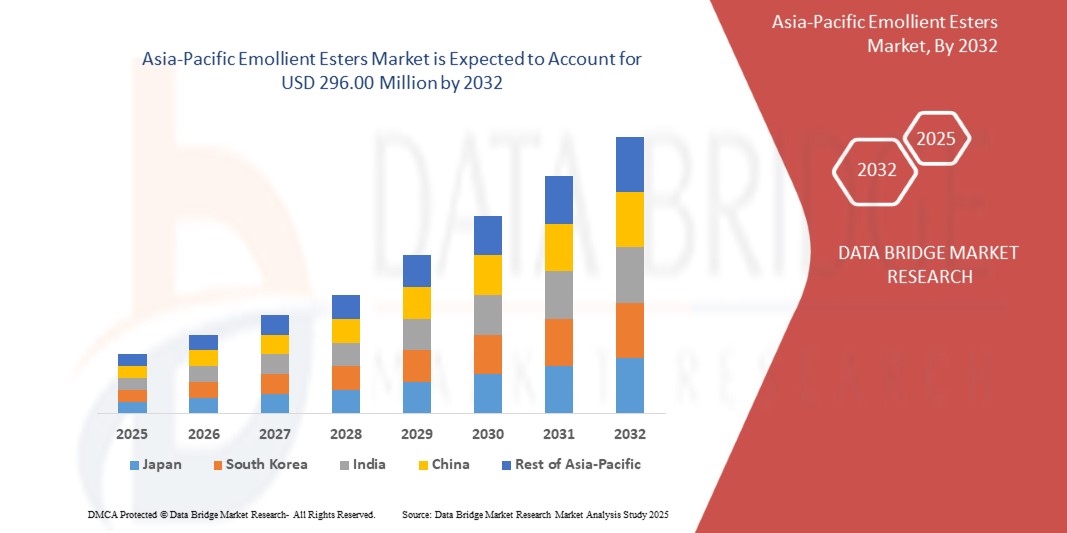

The Asia-Pacific emollient esters market is expected to reach USD 296.00 million by 2032 from USD 202.55 million in 2024, growing with a substantial CAGR of 4.96% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Asia-Pacific Emollient Esters Market Trends

“Expanding Pharmaceutical and Dermatology Applications”

Pharmaceutical companies are using emollient esters in topical medications, wound care products, and transdermal drug delivery systems. They enhance the spreadability and penetration of active ingredients, making treatments more effective. In dermatology, these esters are found in creams, lotions, and serums, offering benefits such as long-lasting moisturization and skin barrier protection. These ingredients help improve the texture and absorption of skincare and medical formulations. Their ability to provide hydration and a smooth feel makes them valuable in products for dry skin, eczema, and other skin conditions.

The demand for natural and sustainable ingredients is also driving the use of bio-based emollient esters. These eco-friendly options appeal to consumers looking for safer and greener skincare solutions. As a result, manufacturers are focusing on plant-derived esters that provide the same benefits as synthetic alternatives.

For instance,

- Hydrofil Emollient, available on 1mg, is a paraben-free moisturizer designed to provide deep hydration and improve skin barrier function. Its emollient ester-based formulation enhances spreadability and absorption, making it effective for dry skin conditions

Overall, the growing demand for polyester in the American apparel and textile industries is driven by its versatility, affordability, and ability to adapt to changing consumer preferences. This trend positions polyester as a critical material in supporting innovation and growth within the Asia-Pacific emollient esters market.

Report Scope and Market Segmentation

|

Attributes |

Emollient Esters Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

China, Japan, India, South Korea, Indonesia, Malaysia, Thailand, Australia, Singapore, New Zealand, Philippines, Taiwan, Hong Kong, and Rest of Asia-Pacific |

|

Key Market Players |

Kao Corporation (Japan), Hefei TNJ Chemical Industry Co., Ltd. (China), PHOENIX CHEMICAL, INC (U.S.), ZhiShang Chemical (China), Rxchemicals.com (U.S.), Suriachem Sdn. Bhd. (Malaysia), Haihang Industry (China), ATAMAN KIMYA (Turkey), Matangi Industries (India), EMCO DYESTUFF (India), SIHAULI CHEMICALS PRIVATE LIMITED (India), Baoran (China), Mohini Organics Pvt. Ltd. (India), and Gravity Chemicals (India) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Emollient Esters Market Definition

The emollient esters market includes the production and use of esters derived from fatty acids and alcohols that are primarily used in personal care and cosmetic products to improve skin feel, texture, and moisture retention. These emollient esters are also utilized in hair care products, sunscreens, and makeup for their ability to soften and condition the skin and hair.

Asia-Pacific Emollient Esters Market Dynamics

Drivers

- Expanding Pharmaceutical and Dermatology Applications

Pharmaceutical companies are using emollient esters in topical medications, wound care products, and transdermal drug delivery systems. They enhance the spreadability and penetration of active ingredients, making treatments more effective. In dermatology, these esters are found in creams, lotions, and serums, offering benefits such as long-lasting moisturization and skin barrier protection. These ingredients help improve the texture and absorption of skincare and medical formulations. Their ability to provide hydration and a smooth feel makes them valuable in products for dry skin, eczema, and other skin conditions.

The demand for natural and sustainable ingredients is also driving the use of bio-based emollient esters. These eco-friendly options appeal to consumers looking for safer and greener skincare solutions. As a result, manufacturers are focusing on plant-derived esters that provide the same benefits as synthetic alternatives.

With ongoing research and innovation, emollient esters are being developed for new applications, including anti-aging treatments and advanced drug formulations. Their role in improving product performance and consumer experience ensures continued growth in the pharmaceutical and dermatology sectors.

India's pharmaceutical industry, the world's largest generic drug provider, is projected to reach US$ 130 billion by 2030. It supplies over 50% of Asia-Pacific vaccine demand and 40% of generic demand in the US. The sector has grown at a 9.43% CAGR over nine years.

For instance,

Hydrofil Emollient, available on 1mg, is a paraben-free moisturizer designed to provide deep hydration and improve skin barrier function. Its emollient ester-based formulation enhances spreadability and absorption, making it effective for dry skin conditions

Esteem Industries highlights the role of emollients and conditioners in personal care formulations. Their emollient esters enhance moisturization, texture, and spreadability in skincare and haircare products. These ingredients improve absorption and provide a smooth, non-greasy feel, showcasing their importance in dermatological and cosmetic applications for enhanced consumer experience

Emollient esters enhance skincare and pharmaceutical formulations by improving hydration, absorption, and texture. They are widely used in topical medications, wound care, and dermatology products. Growing demand for natural, sustainable ingredients is driving innovation in bio-based esters. Their expanding applications ensure continued growth in pharmaceutical and dermatology industries.

- Growing Demand for Personal Care and Cosmetics

One major driver is the increasing preference for natural and sustainable ingredients. Many brands are switching to bio-based emollient esters to meet eco-conscious consumer expectations. In addition, the rise of skincare trends such as "skinimalism" (minimalist skincare) and clean beauty has fueled demand for lightweight and multifunctional ingredients, making emollient esters essential in product formulations. These key ingredients help make skincare and beauty products smoother, softer, and more luxurious. As consumers seek high-performance, non-greasy, and long-lasting formulations, the demand for emollient esters is rising.

The booming e-commerce sector is also playing a role in expanding access to personal care products worldwide. With influencers and beauty bloggers driving consumer choices, products with superior texture and skin feel—achieved using emollient esters—are gaining popularity. Moreover, as awareness of skin health increases, consumers are looking for products with moisturizing and barrier-enhancing properties, which emollient esters provide.

In regions such as Asia-Pacific, where beauty and skincare routines are deeply ingrained in culture, demand for innovative, fast-absorbing, and high-performance formulations continues to grow. In addition, the male grooming sector is expanding, further driving demand for lightweight, non-greasy products, where emollient esters excel.

With rising disposable incomes, evolving beauty trends, and a shift toward sustainable formulations, the demand for emollient esters in personal care and cosmetics will continue its upward trajectory.

India's cosmetics industry is projected to reach US$ 20 billion by 2025, growing at a 25% CAGR. This surge is driven by rising disposable incomes, urbanization, and a shift towards specialized products such as organic and herbal cosmetics. International brands are expanding their presence, intensifying market competition.

For instance,

In February 2025 an article published by NYP Holdings, Inc. highlighted the growing demand for emollient esters in luxury skincare, as seen in Guerlain Abeille Royale Youth Watery Oil Serum. This product reflects consumer preference for lightweight, nourishing formulations with superior absorption, reinforcing the market shift toward high-performance, sustainable, and non-greasy ingredients

In February 2025 an article published by NYP Holdings, Inc. highlighted the rising demand for emollient esters in premium skincare, as seen in Medik8 products, which are known for their lightweight, hydrating formulas. Consumers increasingly seek high-performance, non-greasy ingredients for superior skin nourishment, driving market growth

The growing personal care and cosmetics industry is driving demand for emollient esters, valued for their smooth, non-greasy feel. trends such as clean beauty, skinimalism, and e-commerce growth fuel this rise. increasing sustainability focus, expanding male grooming, and Asia-Pacific's beauty culture further boost market growth, ensuring continued demand.

Opportunities

- Rising Demand for Biodegradable and Sustainable Cosmetic Ingredients

The emollient esters market is experiencing strong growth due to the rising demand for biodegradable and sustainable cosmetic ingredients such as LexFeel N5 INOLEX, Sensolene Hallstar and Lipex SheaLight AAK. Consumers are increasingly looking for eco-friendly skincare and personal care products as awareness of environmental issues grows. This shift is driving cosmetic manufacturers to replace synthetic ingredients with natural, plant-based alternatives that are biodegradable and sustainable.

Emollient esters, known for their moisturizing and skin-softening properties, are widely used in lotions, creams, serums, and sunscreens. With stricter regulatory guidelines and bans on certain synthetic compounds, companies are innovating bio-based emollients that offer the same performance while being environmentally friendly. Ingredients derived from coconut oil, jojoba oil, and shea butter are gaining popularity.

In addition to environmental concerns, clean beauty trends are also influencing market growth. Consumers prefer paraben-free, sulfate-free, and silicone-free formulations, further boosting demand for plant-derived emollients. Brands that emphasize transparency, sustainability, and ethical sourcing are gaining a competitive edge.

Moreover, major cosmetic companies such as L’Oréal, Unilever, Estée Lauder and Procter & Gamble are investing in green chemistry to develop high-performance, biodegradable esters that ensure product stability and luxurious skin feel without harming the ecosystem. This trend is expanding the market scope, encouraging collaborations between cosmetic brands and raw material suppliers.

As sustainability remains a key priority, the emollient esters market is set for continuous growth, driven by evolving consumer preferences, regulatory pressures, and technological innovations in natural ingredient formulation.

For instance,

- According to C and A Healthcare Pvt Ltd, Possum's Body Lotion - Coconut & Vanilla contains shea butter, coconut oil, and vitamin E, highlighting the growing trend of bio-based emollients in skincare. This product exemplifies the shift towards natural, eco-friendly formulations, aligning with the increasing consumer demand for sustainable and moisturizing ingredients in lotions, creams, and personal care products

- According to Vanalaya, its Cocoa Butter & Shea Butter Moisturizing Lotion contains shea butter, coconut oil, and vitamin E, reflecting the growing demand for bio-based emollients in skincare. This product showcases the shift toward natural, eco-friendly formulations, catering to consumers seeking sustainable, deeply moisturizing ingredients in personal care products

In September 2024, a story published by Condé Nast highlighted the rise of upcycled beauty products, which use ingredients such as apple peels and coffee grounds, reflecting the growing demand for biodegradable and sustainable cosmetics. This trend is driving brands to adopt eco-friendly formulations, aligning with consumer preferences for natural, plant-based alternatives in skincare and personal care products

The emollient esters market is growing due to rising demand for biodegradable, plant-based cosmetic ingredients. Consumers prefer eco-friendly, clean beauty products, driving innovation in bio-based emollients from sources such as coconut and jojoba oil. Regulatory pressures and green chemistry advancements further boost market expansion and industry collaborations.

- Innovation in Multifunctional Esters

As consumers demand high-performance skincare products moisturizer, sunscreen and cleanser others, cosmetic brands such as L’Oréal, Unilever, Estée Lauder and Procter & Gamble are incorporating versatile emollient esters that provide moisturization, texture enhancement, and sensory appeal in a single ingredient.

Multifunctional esters improve skin hydration, spreadability, and product stability, making them essential in lotions, serums, sunscreens, and hair care formulations. Manufacturers are developing bio-based esters that not only replace synthetic alternatives but also deliver antioxidant, anti-aging, and UV protection properties. This innovation allows brands to create clean-label, high-efficacy products that meet growing consumer expectations for sustainable and multifunctional beauty solutions.

In addition, the rise of hybrid skincare and makeup products has further fueled demand for multifunctional esters. LexFeel N5 INOLEX, Sensolene (Hallstar, Lipex SheaLight AAK, ECOCERT-Certified Coco-Caprylate/Caprate and Heliofeel Lucas Meyer Cosmetics esters help in formulating long-lasting, lightweight, and non-greasy products while maintaining natural, eco-friendly credentials. With increasing regulatory restrictions on silicones and petrochemical-based emollients, green chemistry advancements are driving the adoption of plant-derived, biodegradable esters that offer similar or superior performance.

The ongoing R&D in ester technology is expanding market potential by enabling customized formulations tailored to specific skin types and consumer needs. As innovation continues, multifunctional emollient esters are set to play a key role in shaping the future of sustainable, high-performance personal care products, making them a lucrative opportunity for industry growth.

For instance,

- In April 2024, an article published by Advancion Corporation stated that its new bio-based multifunctional amino alcohol enhances skin hydration, spreadability, and product stability in lotions, serums, sunscreens, and hair care products. With antioxidant, anti-aging, and UV protection properties, this innovation supports clean-label, high-efficacy formulations, meeting consumer demand for sustainable and multifunctional beauty solutions in personal care products

- In February 2025, an article published by Dotdash Meredith stated that Versed Skincare launched the Skin Solution Multi-Serum Skin Tint, a hybrid product combining serum, foundation, and SPF 40. This innovation reflects the growing demand for multifunctional esters, enabling long-lasting, lightweight, and eco-friendly formulations that align with consumer preferences for sustainable, high-performance beauty products

According to Ruby’s Organics, its Moisturizing Primer features a silicone-free, antioxidant-rich formula with hyaluronic acid and bakuchiol, providing hydration while prolonging makeup wear. This product exemplifies the shift toward plant-derived, biodegradable esters, catering to consumer demand for eco-friendly, multifunctional beauty solutions in skincare and makeup formulations

The emollient esters market is growing due to multifunctional esters that enhance moisturization, stability, and sensory appeal in cosmetics. Rising demand for sustainable, high-performance formulations is driving innovation in bio-based, biodegradable esters. Advancements in green chemistry and hybrid skincare trends are expanding market opportunities for eco-friendly personal care products.

Restraints/Challenges

- Intense Competition From Alternative Emollients

As the demand for natural, sustainable, and high-performance skincare ingredients grows, various alternative emollients such as plant-based oils, butters, and silicone substitutes are gaining traction in the beauty and personal care industry.

Many cosmetic brands such as L’Oréal, Unilever, Estée Lauder and Procter & Gamble are experimenting with bio-based oils such as argan, jojoba, and coconut oil, which offer similar moisturizing and skin-conditioning properties as emollient esters. In addition, new-age plant-derived silicones and synthetic-free emollients are emerging as viable replacements for traditional ester-based formulations, appealing to brands focused on clean beauty and transparency.

Another challenge comes from cost-effectiveness and performance efficiency. Some alternative emollients provide enhanced stability, improved skin feel, and better penetration, making them attractive options for formulators. Moreover, with regulatory restrictions on certain ester compounds and growing consumer awareness about ingredient safety, brands are actively looking for non-toxic, allergen-free alternatives.

To maintain market relevance, emollient ester manufacturers are investing in research and innovation, focusing on biodegradable, multifunctional esters that provide better absorption, longevity, and eco-friendly benefits. Strategic collaborations with cosmetic brands, alongside the development of customized solutions for different skin types, can help counterbalance the competitive pressure.

As alternative emollients continue to evolve, the emollient esters market must adapt by enhancing performance, sustainability, and versatility to secure long-term market growth.

For instance,

- In February 2025, an article published by Dotdash, Meredith highlighted that Sofie Pavitt’s Omega Rich Moisturizer features argan and jojoba oils, offering deep hydration while remaining non-comedogenic. This product exemplifies the growing use of bio-based oils as alternatives to emollient esters, aligning with the clean beauty trend and consumer demand for natural, skin-conditioning ingredients in skincare formulations

- According to SOCRI S.r.l., SILGREEN is a 100% plant-derived silicone alternative that offers a dry, silky texture without synthetic silicones. This innovation reflects the rising demand for synthetic-free emollients, providing a sustainable, eco-friendly solution for cosmetic formulations while aligning with the clean beauty movement and consumer preference for natural ingredients

The emollient esters market faces growing competition from alternative emollients such as plant-based oils and silicone substitutes, affecting market share. With cost-efficiency, performance advantages, and regulatory shifts, brands seek non-toxic, sustainable alternatives. To stay competitive, manufacturers focus on biodegradable, multifunctional esters, innovation, and strategic collaborations for long-term growth.

- Complex Regulatory Compliance

The emollient esters market faces a significant challenge due to complex regulatory compliance, which creates high barriers for new entrants. Governments and regulatory bodies worldwide have strict guidelines on ingredient safety, environmental impact, and product labeling, making it difficult for new companies to enter the market.

One of the biggest hurdles is ingredient approval. Emollient esters used in skincare and personal care products must meet stringent safety standards set by organizations such as the FDA (U.S.), REACH (Europe), and other Asia-Pacific regulatory agencies. These approvals require extensive testing, documentation, and compliance with evolving regulations, leading to delays and increased costs for new businesses.

Another challenge is sustainability and environmental impact regulations. Many countries are enforcing restrictions on synthetic ingredients, microplastics, and non-biodegradable compounds, pushing companies to invest in eco-friendly alternatives. However, developing biodegradable, plant-based esters that meet performance standards while complying with regulations requires significant research and development (R&D) investments, making it harder for smaller players to compete.

In addition, regulations related to labeling, marketing claims, and product transparency are becoming stricter. Brands must accurately disclose ingredients, sustainability claims, and product efficacy, ensuring compliance with clean beauty standards and consumer safety laws. Any non-compliance can lead to product recalls, fines, or bans, posing a risk to new entrants.

For instances,

- In February 2022, according to the U.S. FDA, cosmetic products and ingredients (except color additives) do not require premarket approval. However, companies must ensure product safety, meeting stringent standards. This regulatory requirement increases testing, documentation, and compliance costs, posing challenges for new businesses entering the emollient esters market and the broader skincare industry

- According to an article published by the Financial Times, the European Chemicals Agency (ECHA) found that many cosmetics sold in the European Union contain toxic substances such as PFAS, leading to stricter regulations. This shift forces companies to invest in biodegradable, plant-based alternatives, increasing R&D costs and making market entry more challenging for smaller players

Strict regulatory compliance in the emollient esters market creates high barriers for new entrants. Ingredient approvals, sustainability regulations, and strict labeling laws demand extensive testing and R&D investments. Non-compliance risks fines or bans, making it crucial for companies to prioritize regulatory expertise, eco-friendly innovation, and transparency to compete effectively.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Asia-Pacific Emollient Esters Market Scope

The market is segmented on the basis of product, purity, form, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Isopropyl Myristate

- Isopropyl Myristate, By Grade

- Cosmetic Grade

- Pharmaceutical Grade

- Industrial Grade

- Isopropyl Myristate, By Grade

- Isopropyl Palmitate

- Isopropyl Palmitate, By Grade

- Cosmetic Grade

- Pharmaceutical Grade

- Industrial Grade

- Isopropyl Palmitate, By Grade

- Methyl Myristate

- Methyl Myristate, By Grade

- Cosmetic Grade

- Pharmaceutical Grade

- Industrial Grade

- Methyl Myristate, By Grade

- Methyl Palmitate

- Methyl Palmitate, By Grade

- Cosmetic Grade

- Pharmaceutical Grade

- Industrial Grade

- Methyl Palmitate, By Grade

- Methyl Laurate

- Methyl Laurate, By Grade

- Cosmetic Grade

- Pharmaceutical Grade

- Industrial Grade

- Methyl Laurate, By Grade

- Myristyl Myristate

- Methyl Myristate, By Grade

- Cosmetic Grade

- Pharmaceutical Grade

- Industrial Grade

- Methyl Myristate, By Grade

- Caprylic / Capric Triglyceride

- Caprylic / Capric Triglyceride, By Grade

- Cosmetic Grade

- Pharmaceutical Grade

- Industrial Grade

- Caprylic / Capric Triglyceride, By Grade

- Octyl Myristate

- Octyl Myristate, By Grade

- Cosmetic Grade

- Pharmaceutical Grade

- Industrial Grade

- Octyl Myristate, By Grade

- Octyl Palmitate

- Octyl Palmitate, By Grade

- Cosmetic Grade

- Pharmaceutical Grade

- Industrial Grade

- Octyl Palmitate, By Grade

- Other

- Other, By Grade

- Cosmetic Grade

- Pharmaceutical Grade

- Industrial Grade

- Other, By Grade

Purity

- Less Than 99%

- Greater Than 99%

Form

- Liquid

- Dry

Application

- Cosmetics and Personal Care

- Cosmetics and Personal Care, By Application

- Lotions

- Sun Cream

- Makeup

- Body Washes

- Deodorants

- Others

- Cosmetics And Personal Care, By Product

- Isopropyl Myristate

- Caprylic / Capric Triglyceride

- Isopropyl Palmitate

- Octyl Palmitate

- Octyl Myristate

- Methyl Laurate

- Methyl Palmitate

- Methyl Myristate

- Myristyl Myristate

- Other

- Cosmetics and Personal Care, By Application

- Hair Care Products

- Hair Care Products, By Application

- Shampoos

- Conditioners

- Serums

- Hair Masks

- Others

- Hair Care Products, By Product

- Caprylic / Capric Triglyceride

- Isopropyl Myristate

- Isopropyl Palmitate

- Octyl Palmitate

- Octyl Myristate

- Methyl Laurate

- Methyl Palmitate

- Methyl Myristate

- Myristyl Myristate

- Other

- Hair Care Products, By Application

- Pharmaceuticals

- Pharmaceuticals, By Application

- Topical Medications

- Oral Pharmaceuticals

- Pharmaceuticals, By Product

- Caprylic / Capric Triglyceride

- Isopropyl Myristate

- Caprylic / Capric Triglyceride

- Isopropyl Palmitate

- Methyl Laurate

- Octyl Palmitate

- Octyl Myristate

- Methyl Myristate

- Methyl Palmitate

- Myristyl Myristate

- Other

- Pharmaceuticals, By Application

- Food Industry

- Food Industry, By Application

- Emulsifyers

- Flavouring Agents

- Food Preservatives

- Enzymes

- Nutraceuticals

- Probiotics

- Others

- Food Industry, By Product

- Caprylic / Capric Triglyceride

- Isopropyl Myristate

- Methyl Laurate

- Octyl Palmitate

- Methyl Palmitate

- Methyl Myristate

- Octyl Myristate

- Isopropyl Palmitate

- Myristyl Myristate

- Other

- Food Industry, By Application

- Others

- Others, By Product

- Caprylic / Capric Triglyceride

- Isopropyl Myristate

- Isopropyl Palmitate

- Octyl Palmitate

- Octyl Myristate

- Methyl Laurate

- Methyl Palmitate

- Methyl Myristate

- Myristyl Myristate

- Other

- Others, By Product

Asia-Pacific Emollient Esters Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, product, purity, form, and application as referenced above.

The countries covered in the market are China, Japan, India, South Korea, Indonesia, Malaysia, Thailand, Australia, Singapore, New Zealand, Philippines, Taiwan, Hong Kong, and Rest of Asia-Pacific.

China is expected to dominate the market due to its large consumer base, advanced manufacturing capabilities, and significant technological advancements. The government's strategic policies and investments in infrastructure and innovation further solidify its Asia-Pacific market influence. In addition, China's Asia-Pacific trade dominance through initiatives such as the Belt and Road Initiative expands its economic reach.

China is expected to be fastest growing country in the market due to increasing consumer demand for personal care and cosmetic products, driven by rising disposable incomes and a growing middle class. In addition, the shift towards natural and organic ingredients in beauty products is boosting the market. Furthermore, advancements in formulation technologies and the popularity of skincare routines are contributing to market growth.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Asia-Pacific Emollient Esters Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Asia-Pacific Emollient Esters Market Leaders Operating in the Market Are:

- Kao Corporation (Japan)

- Hefei TNJ Chemical Industry Co. Ltd. (China)

- PHOENIX CHEMICAL, INC (U.S.)

- ZhiShang Chemical (China)

- Rxchemicals.com (U.S.)

- Suriachem Sdn. Bhd. (Malaysia)

- Haihang Industry (China)

- ATAMAN KIMYA (Turkey)

- Matangi Industries (India)

- EMCO DYESTUFF (India)

- SIHAULI CHEMICALS PRIVATE LIMITED (India)

- Baoran (China)

- Mohini Organics Pvt. Ltd. (India)

- Gravity Chemicals (India)

Latest Developments in Asia-Pacific Emollient Esters Market

- In February 2023, Kao announces the launch of Bioré UV Aqua Rich Airy Hold Cream, a new skincare product offering high-level UV protection. This cream is designed to protect the skin from sun damage while providing a lightweight, breathable feel, making it ideal for everyday use without heaviness. The key benefit is its ability to deliver effective sun protection while keeping the skin feeling fresh and comfortable. Exclusively available at selected outlets, the product offers an advanced sun care solution that combines both protection and comfort, catering to consumers seeking lightweight, high-performance skincare

- In February 2023, Kao announces a new global campaign for Bioré UV, in collaboration with K-pop group Stray Kids, titled "SUNLIGHT IS YOUR SPOTLIGHT." The campaign aims to raise awareness about the importance of sun protection while promoting Bioré UV products. It encourages people to embrace sun care as part of an active lifestyle, highlighting the brand’s effective UV protection. The key benefit of this campaign is educating consumers on the significance of skincare and UV protection in daily routines, using the influence of Stray Kids to reach a wider, global audience

- In August 2022, Kao announces its acquisition of Bondi Sands, an Australian brand renowned for its self-tanning and sun care products. This acquisition aims to expand Kao’s presence in the global skincare and sun care market, enhancing its portfolio with high-quality tanning solutions. The key benefit of this acquisition is the addition of Bondi Sands’ popular products, allowing Kao to better cater to consumers seeking sun-kissed skin and effective sun protection. This move strengthens Kao's position in the growing self-tanning and sun care segments, providing more options for skincare enthusiasts worldwide

- In November 2023, Haihang Industry participated in Chemspec Europe 2024, held at the Düsseldorf Exhibition Center in Germany from June 19th to 20th. This event marked the 37th International Exhibition for Fine and Specialty Chemicals. At Booth No. C17, Haihang showcased over 60 of their latest chemical products, including cosmetic ingredients, biocide raw materials, pigment and dye raw materials, and intermediate products. During the exhibition, Haihang hosted 89 customers, providing product brochures, souvenirs, and customer gifts to showcase their industry expertise and commitment to quality service, fostering strong business relationships. They engaged with peers from the global chemical industry, exploring the latest market trends and technological advancements

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INTERNAL COMPETITION

4.3 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 VALUE CHAIN ANALYSIS: ASIA-PACIFIC EMOLLIENT ESTERS MARKET

4.6 VENDOR SELECTION CRITERIA

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.2 INDUSTRY RESPONSE

4.7.3 GOVERNMENT’S ROLE

4.7.4 ANALYST RECOMMENDATIONS

4.8 GO TO MARKET STRATEGY

4.9 IMPORT EXPORT SCENARIO

4.9.1 OVERVIEW

4.9.2 PRODUCTION AND EXPORT DYNAMICS

4.9.2.1 ASIA-PACIFIC: THE PRODUCTION HUB

4.9.2.2 EXPORT TRENDS

4.9.3 CONSUMPTION AND IMPORT DYNAMICS

4.9.3.1 NORTH AMERICA AND EUROPE: THE MAJOR CONSUMERS

4.9.3.2 IMPORT TRENDS

4.9.4 KEY TRADE FLOWS

4.9.5 CHALLENGES AND OPPORTUNITIES

4.9.5.1 CHALLENGES

4.9.5.2 OPPORTUNITIES

4.9.6 CONCLUSION

4.1 IMPACT OF TRADE POLICIES ON THE EMOLLIENT ESTERS MARKET

4.10.1 COMPLEX SUPPLY CHAINS AND ASIA-PACIFIC TRADE DEPENDENCIES

4.10.1.1 TARIFFS, IMPORT DUTIES, AND THEIR IMPLICATIONS

4.10.1.2 REGULATORY CHALLENGES AND ENVIRONMENTAL COMPLIANCE

4.10.1.3 SHIFTING CONSUMER PREFERENCES AND MARKET ADAPTATION

4.10.1.4 STRATEGIC RESPONSES AND COMPETITIVE LANDSCAPE

4.10.2 FUTURE OUTLOOK AND CONCLUSION

4.11 IMPACT OF TRADE POLICIES ON THE EMOLLIENT ESTERS MARKET

4.11.1 COMPLEX SUPPLY CHAINS AND ASIA-PACIFIC TRADE DEPENDENCIES

4.11.2 TARIFFS, IMPORT DUTIES, AND THEIR IMPLICATIONS

4.11.3 REGULATORY CHALLENGES AND ENVIRONMENTAL COMPLIANCE

4.11.4 SHIFTING CONSUMER PREFERENCES AND MARKET ADAPTATION

4.11.5 STRATEGIC RESPONSES AND COMPETITIVE LANDSCAPE

4.11.6 FUTURE OUTLOOK AND CONCLUSION

4.12 MANUFACTURING PATTERNS IN THE ASIA-PACIFIC EMOLLIENT ESTERS MARKET: TRENDS, CHALLENGES, AND INNOVATIONS

4.12.1 INTRODUCTION

4.12.1.1 ASIA-PACIFIC MANUFACTURING LANDSCAPE: KEY REGIONS AND PLAYERS

4.12.2 MANUFACTURING PROCESSES AND TECHNOLOGIES

4.12.3 RAW MATERIAL SOURCING AND SUPPLY CHAIN DYNAMICS

4.12.4 INNOVATIONS AND MARKET TRENDS

4.12.5 CONCLUSION

4.13 PRICING ANALYSIS

4.14 PROFIT MARGIN ANALYSIS

4.14.1 MARKET SIZE AND GROWTH

4.14.2 REVENUE STREAMS

4.14.3 COST STRUCTURE

4.14.4 REGIONAL PROFITABILITY

4.14.5 COMPETITIVE LANDSCAPE

4.14.6 REGULATORY IMPACT

4.15 RAW MATERIAL COVERAGE OF EMOLLIENT ESTERS

4.16 SUPPLY CHAIN ANALYSIS

4.16.1 OVERVIEW

4.16.2 LOGISTIC COST SCENARIO

4.16.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.17 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS IN EMOLLIENT ESTERS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 EXPANDING PHARMACEUTICAL & DERMATOLOGY APPLICATIONS

6.1.2 GROWING DEMAND FOR PERSONAL CARE & COSMETICS

6.1.3 RISING DISPOSABLE INCOME & CHANGING LIFESTYLES

6.2 RESTRAINTS

6.2.1 VARIATIONS IN RAW MATERIAL PRICES AFFECT THE STABILITY OF PRODUCTION COSTS

6.2.2 STRINGENT REGULATORY POLICIES RESTRICT PRODUCT FORMULATIONS AND APPROVALS

6.3 OPPORTUNITIES

6.3.1 RISING DEMAND FOR BIODEGRADABLE AND SUSTAINABLE COSMETIC INGREDIENTS

6.3.2 INNOVATION IN MULTIFUNCTIONAL ESTERS ENHANCES MARKET GROWTH POTENTIAL

6.4 CHALLENGES

6.4.1 INTENSE COMPETITION FROM ALTERNATIVE EMOLLIENTS AFFECTS MARKET SHARE

6.4.2 COMPLEX REGULATORY COMPLIANCE INCREASES BARRIERS FOR NEW ENTRANTS

7 ASIA-PACIFIC EMOLLIENT ESTERS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 ISOPROPYL MYRISTATE

7.2.1 ISOPROPYL MYRISTATE, BY GRADE

7.3 ISOPROPYL PALMITATE

7.3.1 ISOPROPYL PALMITATE, BY GRADE

7.4 METHYL MYRISTATE

7.4.1 METHYL MYRISTATE, BY GRADE

7.5 METHYL PALMITATE

7.5.1 METHYL PALMITATE, BY GRADE

7.6 METHYL LAURATE

7.6.1 METHYL LAURATE, BY GRADE

7.7 MYRISTYL MYRISTATE

7.7.1 MYRISTYL MYRISTATE, BY GRADE

7.8 CAPRYLIC / CAPRIC TRIGLYCERIDE

7.8.1 CAPRYLIC / CAPRIC TRIGLYCERIDE, BY GRADE

7.9 OCTYL MYRISTATE

7.9.1 OCTYL MYRISTATE, BY GRADE

7.1 OCTYL PALMITATE

7.10.1 OCTYL PALMITATE, BY GRADE

7.11 OTHERS

7.11.1 OTHERS, BY GRADE

8 ASIA-PACIFIC EMOLLIENT ESTERS MARKET, BY PURITY

8.1 OVERVIEW

8.2 LESS THAN 99%

8.3 GREATER THAN 99%

9 ASIA-PACIFIC EMOLLIENT ESTERS MARKET, BY FORM

9.1 OVERVIEW

9.2 LIQUID

9.3 DRY

10 ASIA-PACIFIC EMOLLIENT ESTERS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 COSMETICS AND PERSONAL CARE

10.3 HAIR CARE PRODUCTS

10.4 PHARMACEUTICALS

10.5 FOOD INDUSTRY

10.6 OTHERS

11 ASIA-PACIFIC EMOLLIENT ESTERS MARKET, BY REGION

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 JAPAN

11.1.3 INDIA

11.1.4 SOUTH KOREA

11.1.5 INDONESIA

11.1.6 MALAYSIA

11.1.7 MALAYSIA

11.1.8 THAILAND

11.1.9 AUSTRALIA

11.1.10 SINGAPORE

11.1.11 NEW ZEALAND

11.1.12 PHILIPPINES

11.1.13 TAIWAN

11.1.14 HONG KONG

11.1.15 REST OF ASIA-PACIFIC

12 EMOLLIENT ESTERS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 KAO CORPORATION

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 HEFEI TNJ CHEMICAL INDUSTRY CO.,LTD.

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 PHOENIX CHEMICAL, INC

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 ZHISHANGCHEM

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 RXCHEMICALS.COM

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 ATAMAN KIMYA

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 BAORANCHEMICAL

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 EMCO DYESTUFF

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 ESTEEM INDUSTRIES PRIVATE LIMIT

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 GRAVITY CHEMICALS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 HAIHANG INDUSTRY

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT NEWS

14.12 MOHINI ORGANICS PVT. LTD.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 MATANGI INDUSTRIES

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 SIHAULI CHEMICALS PRIVATE LIMITED.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 SURIACHEM SDN.BHD.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 TABLE 1 ASIA-PACIFIC EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 2 REGULATORY COVERAGE

TABLE 3 ASIA-PACIFIC EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 4 ASIA-PACIFIC EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 5 ASIA-PACIFIC ISOPROPYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 6 ASIA-PACIFIC ISOPROPYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 7 ASIA-PACIFIC ISOPROPYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 8 ASIA-PACIFIC ISOPROPYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 9 ASIA-PACIFIC ISOPROPYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 10 ASIA-PACIFIC ISOPROPYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 11 ASIA-PACIFIC METHYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 12 ASIA-PACIFIC METHYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 13 ASIA-PACIFIC METHYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 14 ASIA-PACIFIC METHYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 15 ASIA-PACIFIC METHYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 16 ASIA-PACIFIC METHYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 17 ASIA-PACIFIC METHYL LAURATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 18 ASIA-PACIFIC METHYL LAURATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 19 ASIA-PACIFIC METHYL LAURATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 20 ASIA-PACIFIC MYRISTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 21 ASIA-PACIFIC MYRISTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 22 ASIA-PACIFIC MYRISTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 23 ASIA-PACIFIC CAPRYLIC / CAPRIC TRIGLYCERIDE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 24 ASIA-PACIFIC CAPRYLIC / CAPRIC TRIGLYCERIDE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 25 ASIA-PACIFIC CAPRYLIC / CAPRIC TRIGLYCERIDE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 26 ASIA-PACIFIC OCTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 27 ASIA-PACIFIC OCTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 28 ASIA-PACIFIC OCTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 29 ASIA-PACIFIC OCTYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 30 ASIA-PACIFIC OCTYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 31 ASIA-PACIFIC OCTYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 32 ASIA-PACIFIC OTHERS IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 33 ASIA-PACIFIC OTHER IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 34 ASIA-PACIFIC OTHERS IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 35 ASIA-PACIFIC EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (USD)

TABLE 36 ASIA-PACIFIC EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 37 ASIA-PACIFIC LESS THAN 99% IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 38 ASIA-PACIFIC LESS THAN 99% IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 39 ASIA-PACIFIC GREATER THAN 99% IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 40 ASIA-PACIFIC GREATER THAN 99% IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 41 ASIA-PACIFIC EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 42 ASIA-PACIFIC EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (TONS)

TABLE 43 ASIA-PACIFIC LIQUID IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 44 ASIA-PACIFIC LIQUID IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 45 ASIA-PACIFIC LIQUID IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 46 ASIA-PACIFIC DRY IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 47 ASIA-PACIFIC DRY IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 48 ASIA-PACIFIC DRY IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 49 ASIA-PACIFIC EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 50 ASIA-PACIFIC EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 51 ASIA-PACIFIC COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 52 ASIA-PACIFIC COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 53 ASIA-PACIFIC COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 54 ASIA-PACIFIC COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 55 ASIA-PACIFIC COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 56 ASIA-PACIFIC COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 57 ASIA-PACIFIC HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 58 ASIA-PACIFIC HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 59 ASIA-PACIFIC HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 60 ASIA-PACIFIC HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 61 ASIA-PACIFIC HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 62 ASIA-PACIFIC HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 63 ASIA-PACIFIC PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 64 ASIA-PACIFIC PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 65 ASIA-PACIFIC PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 66 ASIA-PACIFIC PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 67 ASIA-PACIFIC PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 68 ASIA-PACIFIC PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 69 ASIA-PACIFIC FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 70 ASIA-PACIFIC FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 71 ASIA-PACIFIC FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 72 ASIA-PACIFIC FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 73 ASIA-PACIFIC FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 74 ASIA-PACIFIC FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 75 ASIA-PACIFIC OTHERS IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 76 ASIA-PACIFIC OTHERS IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 77 ASIA-PACIFIC OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 78 ASIA-PACIFIC OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 79 ASIA-PACIFIC EMOLLIENT ESTERS MARKET, BY COUNTRY, 2018-2032 (USD)

TABLE 80 ASIA-PACIFIC EMOLLIENT ESTERS MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 81 ASIA-PACIFIC EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 82 ASIA-PACIFIC EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 83 ASIA-PACIFIC ISOPROPYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 84 ASIA-PACIFIC ISOPROPYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 85 ASIA-PACIFIC METHYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 86 ASIA-PACIFIC METHYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 87 ASIA-PACIFIC METHYL LAURATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 88 ASIA-PACIFIC MYRISTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 89 ASIA-PACIFIC CAPRYLIC / CAPRIC TRIGLYCERIDE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 90 ASIA-PACIFIC OCTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 91 ASIA-PACIFIC OCTYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 92 ASIA-PACIFIC OTHER IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 93 ASIA-PACIFIC EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (USD)

TABLE 94 ASIA-PACIFIC EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 95 ASIA-PACIFIC EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 96 ASIA-PACIFIC EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (TONS)

TABLE 97 ASIA-PACIFIC LIQUID IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 98 ASIA-PACIFIC DRY IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 99 ASIA-PACIFIC EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 100 ASIA-PACIFIC EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 101 ASIA-PACIFIC COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 102 ASIA-PACIFIC COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 103 ASIA-PACIFIC COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 104 ASIA-PACIFIC COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 105 ASIA-PACIFIC HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 106 ASIA-PACIFIC HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 107 ASIA-PACIFIC HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 108 ASIA-PACIFIC HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 109 ASIA-PACIFIC PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 110 ASIA-PACIFIC PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 111 ASIA-PACIFIC PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 112 ASIA-PACIFIC PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 113 ASIA-PACIFIC FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 114 ASIA-PACIFIC FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 115 ASIA-PACIFIC FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 116 ASIA-PACIFIC FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 117 ASIA-PACIFIC OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 118 ASIA-PACIFIC OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 119 CHINA EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 120 CHINA EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 121 CHINA ISOPROPYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 122 CHINA ISOPROPYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 123 CHINA METHYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 124 CHINA METHYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 125 CHINA METHYL LAURATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 126 CHINA MYRISTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 127 CHINA CAPRYLIC / CAPRIC TRIGLYCERIDE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 128 CHINA OCTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 129 CHINA OCTYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 130 CHINA OTHER IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 131 CHINA EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (USD)

TABLE 132 CHINA EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 133 CHINA EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 134 CHINA EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (TONS)

TABLE 135 CHINA LIQUID IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 136 CHINA DRY IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 137 CHINA EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 138 CHINA EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 139 CHINA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 140 CHINA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 141 CHINA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 142 CHINA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 143 CHINA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 144 CHINA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 145 CHINA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 146 CHINA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 147 CHINA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 148 CHINA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 149 CHINA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 150 CHINA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 151 CHINA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 152 CHINA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 153 CHINA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 154 CHINA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 155 CHINA OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 156 CHINA OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 157 JAPAN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 158 JAPAN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 159 JAPAN ISOPROPYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 160 JAPAN ISOPROPYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 161 JAPAN METHYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 162 JAPAN METHYL LAURATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 163 JAPAN MYRISTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 164 JAPAN CAPRYLIC / CAPRIC TRIGLYCERIDE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 165 JAPAN OCTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 166 JAPAN OCTYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 167 JAPAN OTHER IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 168 JAPAN EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (USD)

TABLE 169 JAPAN EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 170 JAPAN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 171 JAPAN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (TONS)

TABLE 172 JAPAN LIQUID IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 173 JAPAN DRY IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 174 JAPAN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 175 JAPAN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 176 JAPAN COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 177 JAPAN COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 178 JAPAN COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 179 JAPAN COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 180 JAPAN HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 181 JAPAN HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 182 JAPAN HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 183 JAPAN HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 184 JAPAN PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 185 JAPAN PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 186 JAPAN PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 187 JAPAN PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 188 JAPAN FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 189 JAPAN FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 190 JAPAN FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 191 JAPAN FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 192 JAPAN OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 193 JAPAN OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 194 INDIA EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 195 INDIA EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 196 INDIA ISOPROPYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 197 INDIA ISOPROPYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 198 INDIA METHYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 199 INDIA METHYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 200 INDIA METHYL LAURATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 201 INDIA MYRISTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 202 INDIA CAPRYLIC / CAPRIC TRIGLYCERIDE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 203 INDIA OCTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 204 INDIA OCTYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 205 INDIA OTHER IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 206 INDIA EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (USD)

TABLE 207 INDIA EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 208 INDIA EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 209 INDIA EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (TONS)

TABLE 210 INDIA LIQUID IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 211 INDIA DRY IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 212 INDIA EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 213 INDIA EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 214 INDIA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 215 INDIA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 216 INDIA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 217 INDIA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 218 INDIA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 219 INDIA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 220 INDIA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 221 INDIA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 222 INDIA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 223 INDIA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 224 INDIA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 225 INDIA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 226 JAPAN FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 227 JAPAN FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 228 INDIA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 229 INDIA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 230 INDIA OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 231 INDIA OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 232 SOUTH KOREA EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 233 SOUTH KOREA EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 234 SOUTH KOREA ISOPROPYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 235 SOUTH KOREA ISOPROPYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 236 SOUTH KOREA METHYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 237 SOUTH KOREA METHYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 238 SOUTH KOREA METHYL LAURATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 239 SOUTH KOREA MYRISTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 240 SOUTH KOREA CAPRYLIC / CAPRIC TRIGLYCERIDE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 241 SOUTH KOREA OCTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 242 SOUTH KOREA OCTYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 243 SOUTH KOREA OTHER IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 244 SOUTH KOREA EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (USD)

TABLE 245 SOUTH KOREA EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 246 SOUTH KOREA EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 247 SOUTH KOREA EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (TONS)

TABLE 248 SOUTH KOREA LIQUID IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 249 SOUTH KOREA DRY IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 250 SOUTH KOREA EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 251 SOUTH KOREA EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 252 SOUTH KOREA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 253 SOUTH KOREA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 254 SOUTH KOREA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 255 SOUTH KOREA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 256 SOUTH KOREA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 257 SOUTH KOREA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 258 SOUTH KOREA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 259 SOUTH KOREA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 260 SOUTH KOREA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 261 SOUTH KOREA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 262 SOUTH KOREA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 263 SOUTH KOREA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 264 SOUTH KOREA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 265 SOUTH KOREA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 266 SOUTH KOREA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 267 SOUTH KOREA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 268 SOUTH KOREA OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 269 SOUTH KOREA OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 270 INDONESIA EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 271 INDONESIA EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 272 INDONESIA ISOPROPYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 273 INDONESIA ISOPROPYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 274 INDONESIA METHYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 275 INDONESIA METHYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 276 INDONESIA METHYL LAURATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 277 INDONESIA MYRISTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 278 INDONESIA CAPRYLIC / CAPRIC TRIGLYCERIDE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 279 INDONESIA OCTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 280 INDONESIA OCTYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 281 INDONESIA OTHER IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 282 INDONESIA EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (USD)

TABLE 283 INDONESIA EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 284 INDONESIA EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 285 INDONESIA EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (TONS)

TABLE 286 INDONESIA LIQUID IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 287 INDONESIA DRY IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 288 INDONESIA EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 289 INDONESIA EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 290 INDONESIA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 291 INDONESIA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 292 INDONESIA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 293 INDONESIA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 294 INDONESIA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 295 INDONESIA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 296 INDONESIA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 297 INDONESIA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 298 INDONESIA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 299 INDONESIA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 300 INDONESIA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 301 INDONESIA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 302 INDONESIA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 303 INDONESIA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 304 INDONESIA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 305 INDONESIA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 306 INDONESIA OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 307 INDONESIA OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 308 MALAYSIA EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 309 MALAYSIA EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 310 MALAYSIA ISOPROPYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 311 MALAYSIA ISOPROPYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 312 MALAYSIA METHYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 313 MALAYSIA METHYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 314 MALAYSIA METHYL LAURATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 315 MALAYSIA MYRISTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 316 MALAYSIA CAPRYLIC / CAPRIC TRIGLYCERIDE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 317 MALAYSIA OCTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 318 MALAYSIA OCTYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 319 MALAYSIA OTHER IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 320 MALAYSIA EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (USD)

TABLE 321 MALAYSIA EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 322 MALAYSIA EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 323 MALAYSIA EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (TONS)

TABLE 324 MALAYSIA LIQUID IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 325 MALAYSIA DRY IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 326 MALAYSIA EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 327 MALAYSIA EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 328 MALAYSIA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 329 MALAYSIA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 330 MALAYSIA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 331 MALAYSIA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 332 MALAYSIA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 333 MALAYSIA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 334 MALAYSIA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 335 MALAYSIA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 336 MALAYSIA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 337 MALAYSIA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 338 MALAYSIA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 339 MALAYSIA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 340 MALAYSIA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 341 MALAYSIA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 342 MALAYSIA OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 343 MALAYSIA OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 344 THAILAND EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 345 THAILAND EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 346 THAILAND ISOPROPYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 347 THAILAND ISOPROPYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 348 THAILAND METHYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 349 THAILAND METHYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 350 THAILAND METHYL LAURATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 351 THAILAND MYRISTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 352 THAILAND CAPRYLIC / CAPRIC TRIGLYCERIDE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 353 THAILAND OCTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 354 THAILAND OCTYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 355 THAILAND OTHER IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 356 THAILAND EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (USD)

TABLE 357 THAILAND EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 358 THAILAND EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 359 THAILAND EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (TONS)

TABLE 360 THAILAND LIQUID IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 361 THAILAND DRY IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 362 THAILAND EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 363 THAILAND EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 364 THAILAND COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 365 THAILAND COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 366 THAILAND COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 367 THAILAND COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)