Asia Pacific Endoscopic Hemostasis Market

Market Size in USD Million

CAGR :

%

USD

574.61 Million

USD

1,076.77 Million

2025

2033

USD

574.61 Million

USD

1,076.77 Million

2025

2033

| 2026 –2033 | |

| USD 574.61 Million | |

| USD 1,076.77 Million | |

|

|

|

|

Asia-Pacific Endoscopic Hemostasis Market Size

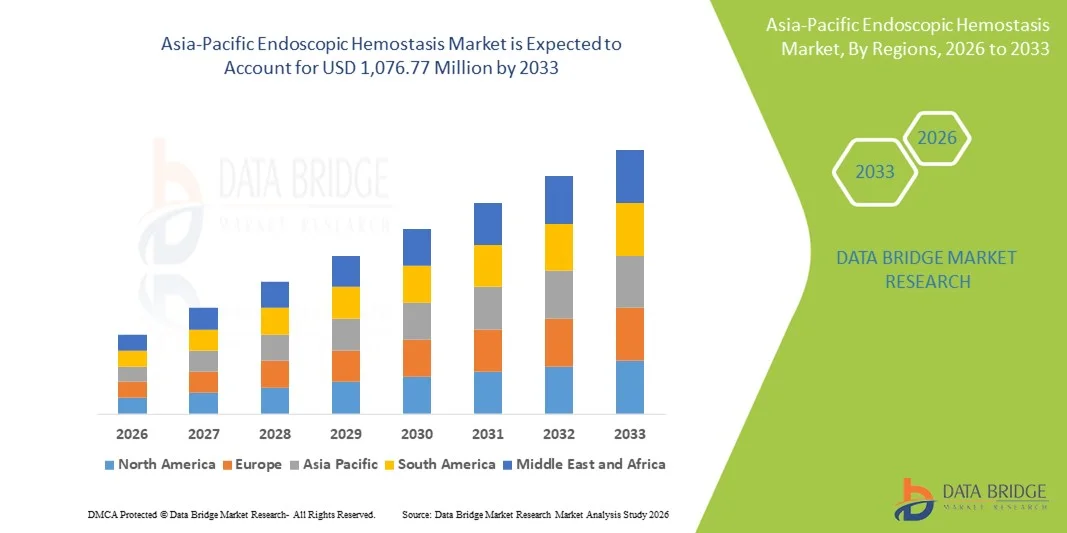

- The Asia-Pacific endoscopic hemostasis market is expected to reach USD 1,076.77 million by 2033 from USD 574.61 million in 2025, growing with a substantial CAGR of 8.6% in the forecast period of 2026 to 2033

- The Asia-Pacific endoscopic hemostasis market is witnessing steady and robust growth, driven by the rising prevalence of gastrointestinal disorders, increasing incidence of colorectal cancer, peptic ulcers, and gastrointestinal bleeding, and the growing adoption of minimally invasive endoscopic procedures across the region..

- Market growth is further supported by stringent clinical guidelines, a strong focus on patient safety and procedural efficacy, and rising demand for advanced hemostatic technologies that improve procedural outcomes and reduce complication rates. Continuous advancements in endoscopic device design, including improved clips, coagulation systems, sprays, and combination therapies, are enhancing precision, ease of use, and clinical effectiveness. Moreover, increasing investments in medical device R&D, technological innovation, and the integration of next-generation materials and energy-based systems are driving product innovation and supporting the long-term growth of the Asia-Pacific endoscopic hemostasis market.

Asia-Pacific Endoscopic Hemostasis Market Analysis

- Endoscopic Hemostasis products are becoming increasingly critical across the Asia-Pacific healthcare ecosystem, enabling clinicians to effectively manage gastrointestinal bleeding during diagnostic and therapeutic endoscopic procedures. These devices play a vital role in improving procedural safety, clinical outcomes, and patient recovery by ensuring rapid and reliable bleeding control. Endoscopic hemostasis solutions are widely used across key clinical settings, including hospitals, specialty clinics, and ambulatory surgical centers, for applications such as peptic ulcer bleeding, colorectal procedures, post-polypectomy bleeding, and tumor-related hemorrhage.

- Expanding healthcare infrastructure, rising volumes of endoscopic procedures, and increasing adoption of minimally invasive treatment approaches are fueling strong demand for endoscopic hemostasis devices in Asia-Pacific. Healthcare providers are increasingly incorporating advanced hemostatic technologies to improve procedural efficiency, reduce complication rates, shorten hospital stays, and enhance overall patient outcomes, thereby supporting sustained market growth.

- China is projected to lead the Asia-Pacific endoscopic hemostasis market in 2026, accounting for 26.61% of the regional market share. This leadership is supported by the country’s well-established healthcare infrastructure, high volume of endoscopic procedures, strong adoption of advanced medical technologies, and presence of leading medical device manufacturers. Favorable reimbursement frameworks, a skilled clinical workforce, and continuous investments in healthcare innovation further strengthen China’s dominant position within the Asia-Pacific market.

- India is the fastest-growing country in the Europe endoscopic hemostasis market, supported by early adoption of digital health and advanced endoscopy platforms, strong integration of AI-assisted diagnostics and image-guided endoscopic procedures, and a high level of clinical research participation in gastrointestinal and interventional endoscopy. The country’s well-structured referral pathways, emphasis on day-care and outpatient endoscopic treatments, and rapid commercial uptake of next-generation hemostatic devices by clinicians further accelerate procedural volumes. In addition, collaborations between hospitals, academic institutions, and medical device manufacturers, along with streamlined regulatory approval timelines for innovative technologies, continue to position Denmark as a leading early-adopter market, driving faster growth compared to other Asia Pacific countries.

- The Mechanical Hemostasis Devices segment is dominating the Asia-Pacific endoscopic hemostasis market, accounting for 45.48% market share in 2025. This dominance is driven by the widespread clinical adoption of endoscopic clips and band ligation devices due to their proven efficacy, ease of deployment, cost-effectiveness, and suitability for a broad range of gastrointestinal bleeding indications. Their strong safety profile and compatibility with standard endoscopic procedures continue to support sustained demand across healthcare settings.

Report Scope and Asia-Pacific Endoscopic Hemostasis Market Segmentation

|

Attributes |

Asia-Pacific Endoscopic Hemostasis Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include Vendor Selection Criteria, Technological Advancement, Patent Analysis, regulatory framework, Innovation Tracker and strategic analysis Tariffs and Impact on the market. |

Asia-Pacific Endoscopic Hemostasis Market Trends

Increasing Adoption of Advanced Minimally Invasive Endoscopic Hemostasis Technologies

- The steady expansion of endoscopic and minimally invasive procedures across Asia-Pacific is a major factor driving the increased adoption of endoscopic hemostasis devices. As the incidence of gastrointestinal bleeding, colorectal disorders, and related conditions continues to rise, healthcare providers increasingly rely on advanced hemostasis solutions to ensure effective bleeding control, procedural safety, and improved patient outcomes across high-volume clinical environments.

- Endoscopic hemostasis devices play a critical role in ensuring clinical efficacy, patient safety, and procedural reliability throughout diagnostic and therapeutic endoscopy. By enabling rapid bleeding control, reducing complication risks, and supporting minimally invasive treatment approaches, these devices help optimize procedural workflows while improving recovery times and overall quality of care across healthcare facilities.

- The growing adoption of advanced endoscopic technologies, including high-definition imaging, therapeutic endoscopy, and combination hemostasis techniques, has increased demand for high-performance hemostatic solutions. Innovations in mechanical clips, thermal coagulation systems, injection therapies, and topical hemostatic agents are enhancing procedural precision, treatment success rates, and clinician confidence while supporting evolving clinical practices.

- Healthcare providers across the care continuum are increasingly adopting endoscopic hemostasis devices to meet rising regulatory, safety, and clinical performance standards. Stringent clinical guidelines, growing emphasis on patient safety and outcome-based care, and increasing demand for minimally invasive interventions are encouraging hospitals and clinics to integrate advanced hemostasis technologies that ensure consistency, compliance, and high-quality care delivery.

- Overall, the expanding scale of endoscopic procedures, clinical innovation, and healthcare infrastructure development positions endoscopic hemostasis devices as an essential component of modern gastrointestinal care. These solutions support procedural efficiency, patient safety, regulatory compliance, and sustainable growth across Asia-Pacific’s evolving endoscopy landscape, making this insight readily reusable across regions by adapting healthcare system dynamics and adoption patterns.

Asia-Pacific Endoscopic Hemostasis Market Dynamics

Driver

Rise in Gastrointestinal Bleeding Cases

- The rising incidence of gastrointestinal bleeding has been established as a foundational force propelling growth in the Asia-Pacific endoscopic hemostasis market. As the prevalence of upper and lower gastrointestinal bleeding conditions increases worldwide, demand for minimally invasive, endoscopy-based therapeutic interventions has been intensified. Endoscopic hemostasis offers critical clinical advantages, including rapid bleeding control, reduced need for surgical intervention, lower transfusion requirements, and shorter hospital stays, thereby positioning it as a first-line treatment modality in acute and chronic gastrointestinal bleeding management. Consequently, the escalation in gastrointestinal bleeding cases—driven by aging populations, higher prevalence of liver disease, anticoagulant use, and delayed care access during systemic healthcare disruptions—has translated into higher procedural volumes and broader adoption of advanced endoscopic hemostasis devices across hospitals and endoscopy centers globally.

- For instances,

- In September 2021, Medscape reported that upper gastrointestinal bleeding occurred at an incidence of approximately 100 cases per 100,000 population annually and remained one of the most common causes of emergency hospital admissions, underscoring a persistently high disease burden requiring endoscopic intervention.

- In June2023, Gastroenterology Research journal reported that mortality related to upper gastrointestinal bleeding in the U.S. increased between 2012 and 2021, with steeper increases observed toward the later years, indicating worsening clinical outcomes and intensified treatment requirements.

- In June 2023, StatPearls Publishing stated that gastrointestinal bleeding continues to represent a frequent global medical emergency, with urgent endoscopic diagnosis and hemostatic treatment remaining critical to reducing mortality and morbidity.

- In January 2025, the Journal of Clinical Medicine reported that patients with advanced liver disease exhibited significantly higher incidence of massive gastrointestinal bleeding episodes, reinforcing the link between chronic disease prevalence and increased need for endoscopic hemostasis.

- In September 2025, PubMed Central highlighted that upper gastrointestinal bleeding remained a life-threatening complication among chronic liver disease populations, sustaining elevated demand for endoscopic therapeutic procedures.

- The global escalation in gastrointestinal bleeding incidence is being firmly established as a permanent structural growth engine for the endoscopic hemostasis market. The continuous rise in acute bleeding events, combined with expanding populations affected by chronic liver disease, antithrombotic medication use, and age-related gastrointestinal pathology, is creating a sustained and non-cyclical requirement for endoscopic bleeding control. As clinical guidelines increasingly prioritize endoscopic therapy as first-line management, reliance on hemostasis technologies for emergency intervention, recurrence prevention, and complication management is being structurally reinforced. Furthermore, improving survival rates are extending patient monitoring and repeat intervention cycles, thereby multiplying lifetime procedural demand. This dynamic is anchoring endoscopic hemostasis adoption closely to global epidemiological trends, positioning this driver as a long-term foundational pillar for market expansion across developed and emerging healthcare systems.

Restraint/Challenge

High Cost and Technical Complexity of Endoscopic Hemostasis Devices

- Despite growing clinical adoption, the Asia-Pacific endoscopic hemostasis market continues to face structural restraint due to the high cost and technical complexity of advanced endoscopic hemostasis devices. These technologies often require significant upfront capital investment for equipment procurement, continuous expenditure on consumables, and specialized maintenance. In addition, effective use of hemostatic endoscopic devices demands advanced physician training, skilled support staff, and sophisticated hospital infrastructure, limiting adoption in cost-sensitive healthcare systems. Public hospitals in low- and middle-income countries, and even budget-constrained facilities in developed regions, frequently encounter barriers related to affordability, reimbursement gaps, and workforce readiness. As a result, uneven access and slower penetration of advanced endoscopic hemostasis technologies persist, constraining broader market expansion.

- For Instance,

- In November 2022, according to the high cost of gastrointestinal endoscopy procedures and equipment is a major restraint. For example, TNE costs Euro 125.90 per procedure, while oral endoscopy costs Euro 184.10 and MACE costs Euro 407.10. Additionally, equipment maintenance and reprocessing add to the cost, with flexible endoscopes costing around Euro 79,330, making procedures expensive overall.

- In June 2024, Science direct highlighted that the high cost of gastrointestinal endoscopy is exacerbated in low-income and middle-income countries (LICs and LMICs) due to the lack of local maintenance and repair facilities. Scopes requiring repairs must be shipped abroad, incurring significant costs and delays. Additionally, cheaper second-hand and Chinese-manufactured endoscopes often lack adequate service and maintenance support.

- In October 2025, BMJ Open Gastroenterology published a micro-costing study showing that in a UK National Health Service hospital, the total per-procedure cost of reusable gastrointestinal endoscopes was an estimated GBP107.34, with capital and maintenance costs as major cost drivers, highlighting economic barriers to wide adoption of endoscopic equipment in public health settings.

- In August 2024, a ScienceDirect narrative review reported that purchase, maintenance, and associated logistics costs of endoscopy equipment remain a major barrier to developing and sustaining endoscopy services in low- and middle-income countries, due to high device cost and lack of infrastructure.

- In February 2025, as per science direct the high cost of gastrointestinal endoscopy is evident in various studies, especially for screening and surveillance. For instance, while general population screenings may not be cost-effective in Western regions, targeted surveillance for high-risk groups, such as those with gastric intestinal metaplAsia, can still be cost-effective, with ICERs ranging from USD 20,739.1 to 98,402.2 per QALY.

- The compiled evidence clearly indicates that the high cost and technical complexity associated with gastrointestinal endoscopy and endoscopic hemostasis devices represent a persistent restraint on market growth. Substantial capital investment for equipment procurement, elevated per-procedure costs, and ongoing expenses related to maintenance, reprocessing, and repair significantly increase the overall cost burden on healthcare systems. These challenges are further intensified in low- and middle-income regions where limited technical infrastructure and lack of local servicing capabilities delay adoption and restrict procedural capacity. Even in developed healthcare systems, cost-effectiveness considerations influence screening strategies and limit widespread implementation. Collectively, these economic and operational constraints slow penetration of advanced endoscopic hemostasis technologies, reinforcing affordability and technical complexity as structural barriers to broader market expansion

Asia-Pacific Endoscopic Hemostasis Market Scope

The Asia-Pacific endoscopic hemostasis market is categorized into five key segments: product type, procedure, application, end user, and distribution channel.

- By product type

On the basis of product type, the Asia-Pacific endoscopic hemostasis market is segmented into mechanical hemostasis devices, thermal devices, topical agents and injectables, and others. In 2026, the mechanical hemostasis devices segment is projected to dominate the Asia-Pacific endoscopic hemostasis market with the largest market share of 45.50%, owing to its widespread clinical preference for achieving immediate, controlled, and durable bleeding cessation during endoscopic interventions. Mechanical solutions such as clips and banding devices are routinely favored for their ability to provide precise vessel closure without inducing thermal tissue damage, thereby lowering rebleeding rates and post-procedure complications. Their applicability across a broad spectrum of bleeding scenarios, including peptic ulcers, variceal hemorrhage, and post-polypectomy bleeding, has resulted in consistently high utilization in both emergency and elective endoscopic settings. The strong reliance on mechanical hemostasis as a first-line therapeutic approach underscores its substantial contribution to overall market revenues and reinforces its dominant position within the product type landscape throughout the forecast period.

The topical agents and injectables segment is the fastest-growing segment in the endoscopic hemostasis market, with a CAGR of 9.0%. Growth is driven by the increasing incidence of gastrointestinal bleeding, widespread adoption of minimally invasive endoscopic procedures, and strong clinical demand for rapid-acting, easy-to-administer hemostatic solutions. Continuous advancements in formulation effectiveness, safety, and procedural efficiency are expected to sustain segment growth during the forecast period.

- By procedure

On the basis of procedure, the market is segmented into upper gastrointestinal endoscopy, lower gastrointestinal endoscopy, bronchoscopic hemostasis, and others. In 2026, the upper gastrointestinal endoscopy segment is projected to dominate the Asia-Pacific endoscopic hemostasis market with a market share of 45.24%, due to its extensive clinical adoption as the frontline procedural approach for managing acute and recurrent gastrointestinal bleeding. Upper GI endoscopy is widely relied upon for the diagnosis and immediate therapeutic control of bleeding ulcers, variceal hemorrhage, and Dieulafoy lesions, where rapid hemostatic intervention is clinically critical. The high procedural frequency in emergency departments and tertiary-care hospitals, combined with strong guideline support for early endoscopic intervention, is expected to sustain its leading market position. Its continued dominance is reflected in its substantial market share and steady growth trajectory through 2033, indicating persistent demand across both developed and emerging healthcare systems.

The lower gastrointestinal endoscopy segment is the fastest-growing application segment in the endoscopic hemostasis market, registering a CAGR of 9.0%. This growth is supported by rising prevalence of lower gastrointestinal bleeding conditions, increasing volumes of diagnostic and therapeutic colonoscopy procedures, and improved detection of colorectal disorders. Ongoing technological advancements in endoscopic hemostasis devices and growing emphasis on early diagnosis are expected to further drive adoption during the forecast period.

- By application

On the basis of application, the market is segmented into gastrointestinal bleeding, non-gastrointestinal bleeding, trauma management, and others. In 2026, the gastrointestinal bleeding segment is projected to dominate the Asia-Pacific endoscopic hemostasis market with a market share of 72.39%, owing to the high global prevalence of peptic ulcers, esophageal varices, and colorectal malignancies requiring endoscopic bleeding control. Gastrointestinal bleeding remains the most common indication for endoscopic hemostasis procedures, driving consistent utilization of mechanical, thermal, and topical hemostatic solutions across hospital and ambulatory care settings. The critical need for rapid bleeding control to reduce morbidity, hospital length of stay, and mortality is expected to reinforce sustained demand within this application segment. Its large share of total market value highlights the central role of gastrointestinal indications in shaping overall market dynamics during the forecast period.

The trauma management segment is the fastest-growing segment in the endoscopic hemostasis market, with a CAGR of 9.3%. Growth is driven by the increasing occurrence of acute bleeding associated with traumatic injuries and a growing preference for minimally invasive techniques that enable rapid bleeding control. Improved clinical outcomes, reduced surgical intervention rates, and advancements in emergency endoscopic hemostasis technologies are expected to support continued expansion of this segment over the forecast period.

- By end user

On the basis of end user, the market is segmented into hospitals, ambulatory surgery centers, specialty clinics, and others. In 2026, the hospitals segment is projected to dominate the Asia-Pacific endoscopic hemostasis market with the largest market share of 54.11%, due to the concentration of advanced endoscopy infrastructure, skilled gastroenterologists, and emergency care capabilities within hospital settings. Complex bleeding cases, including severe upper and lower gastrointestinal hemorrhage, are predominantly managed in public and private hospitals where comprehensive diagnostic and interventional resources are available. Higher patient inflow, greater procedural volumes, and established procurement frameworks further strengthen hospital demand for endoscopic hemostasis devices and consumables. This structural dependence on hospital-based care is expected to maintain the segment’s leading position through 2033 despite gradual growth in outpatient settings.

The ambulatory surgery centers segment is the fastest-growing end-user segment in the endoscopic hemostasis market, recording a CAGR of 9.0%. Growth is driven by the increasing shift toward outpatient endoscopic procedures, demand for cost-effective healthcare delivery, and shorter patient recovery times. Advancements in compact, efficient hemostasis devices suitable for outpatient settings are expected to further accelerate adoption during the forecast period.

- By distribution channel

On the basis of distribution channel, the market is segmented into direct sales and indirect sales, with indirect sales further segmented into online and offline channels. In 2026, the indirect sales segment is projected to dominate the Asia-Pacific endoscopic hemostasis market with the largest market share of 59.72% as procurement is largely conducted through distributors, group purchasing organizations, and regional medical supply networks. Indirect channels are widely preferred due to their ability to offer bundled products, inventory management support, and broader geographic reach, particularly in emerging markets and decentralized healthcare systems. Hospitals and ambulatory centers frequently rely on distributor-led sourcing to ensure consistent availability of critical hemostasis devices while optimizing procurement costs. This distribution structure is expected to continue driving higher adoption of indirect sales channels throughout the forecast period.

The indirect sales segment is the fastest-growing distribution channel in the endoscopic hemostasis market, with a CAGR of 8.8%. This growth is supported by the expanding role of distribution partners and group purchasing networks in enhancing product accessibility and supply efficiency. Increasing reliance on centralized procurement models, bundled purchasing agreements, and regional distributor expertise is expected to continue driving growth of the indirect sales channel throughout the forecast period.

Asia-Pacific Endoscopic Hemostasis Market Regional Analysis

- China represents one of the most important markets for endoscopic hemostasis devices, supported by its advanced healthcare infrastructure, strong medical device manufacturing base, and high adoption of minimally invasive endoscopic procedures. Continuous clinical innovation in gastroenterology, a high volume of diagnostic and therapeutic endoscopies, and strict clinical and regulatory standards are driving steady adoption of advanced mechanical, thermal, and topical hemostasis solutions across hospitals and specialty care centers.

- The India. is witnessing growing demand for endoscopic hemostasis technologies as increasing prevalence of gastrointestinal disorders, an aging population, and rising emphasis on minimally invasive treatment approaches reshape clinical practice. Healthcare providers are increasingly focused on improving patient safety, reducing procedure-related complications, and enhancing clinical efficiency, which is accelerating the adoption of reliable and cost-effective hemostasis devices across public and private healthcare settings.

- Japan continues to emerge as a key growth hub for the endoscopic hemostasis market, driven by strong clinical expertise in gastroenterology, expanding access to advanced endoscopic services, and increasing focus on patient-centered and outcome-driven care. The country’s emphasis on clinical quality, safety, and technological innovation is encouraging healthcare institutions to adopt advanced hemostasis solutions that improve procedural outcomes, support minimally invasive interventions, and comply with evolving regulatory and healthcare standards.

China Endoscopic Hemostasis Market Insight

The China Endoscopic Hemostasis Market is gaining strong traction due to the country’s high volume of gastrointestinal endoscopic procedures and early adoption of advanced therapeutic endoscopy techniques. China’s hospitals and specialty clinics place strong emphasis on clinical precision, procedural reliability, and evidence-based device selection, driving consistent demand for high-performance mechanical and energy-based hemostasis solutions. In addition, the presence of leading medical device manufacturers, well-established clinical training programs, and strict regulatory and quality standards is fostering rapid uptake of technologically advanced hemostasis devices. China’s focus on procedural standardization, patient safety, and outcome optimization reinforces its position as a technology-led and innovation-driven market within Asia-Pacific.

Japan Endoscopic Hemostasis Market Insight

The Japan Endoscopic Hemostasis Market continues to expand as healthcare providers prioritize minimally invasive treatment pathways, efficiency in endoscopy units, and reduction of procedure-related complications. Rising incidence of gastrointestinal bleeding conditions, combined with increasing demand on NHS endoscopy services, is accelerating adoption of cost-effective, easy-to-use hemostasis devices that support high procedural throughput. Strong emphasis on clinical guidelines, value-based care, and standardized treatment protocols is shaping purchasing decisions, while growing use of ambulatory and day-care endoscopy settings is further supporting demand. These factors collectively position the Japan market as one driven by access, efficiency, and scalable clinical adoption rather than device manufacturing concentration.

Asia-Pacific Endoscopic Hemostasis Market Share

The Specialty Food Ingredients industry is primarily led by well-established companies, including:

- Micro-Tech Endoscopy (China)

- Taewoong Medical Co., Ltd. (South Korea)

- Ovesco Endoscopy AG (China)

- Apollo Endosurgery, Inc. (U.S.)

- Argon Medical Devices, Inc. (U.S.)

- Olympus Corporation (Japan)

- Boston Scientific Corporation (U.S.)

- CONMED Corporation (U.S.)

- Medtronic (Ireland)

- Cook (U.S.)

- ERBE Elektromedizin GmbH (China)

- Karl Storz SE & Co. KG (China)

- Pentax Medical (Japan)

- Endoskopie Technik Gerhard (China)

- Merit Medical Systems, Inc. (U.S.)

- Diversatek, Inc. (U.S.)

- STERIS plc (JAPAN)

- B. Braun SE (China)

- Duomed Group (Belgium)

Latest Developments in the Asia-Pacific Endoscopic Hemostasis Market

- In December 2025, Olympus tripled its corporate venture capital fund commitment by launching Olympus Innovation Ventures Fund II with an additional $150 million to invest in MedTech startups focused on endoscopy, diagnostics, digital health, and related innovation fields to reinforce long-term growth and technological leadership.

- In October 2025, Boston Scientific announced an agreement to acquire Nalu Medical, Inc., a privately held medical device company focused on implantable neurostimulation technologies for chronic pain. The acquisition was positioned to strengthen Boston Scientific’s neuromodulation portfolio, accelerate innovation in pain management, and expand treatment options for patients with chronic pain conditions.

- In October 2025, CONMED Corporation announced a strategic exit from its gastroenterology business, divesting its GI product lines and related assets as part of a portfolio realignment to concentrate on core surgical and orthopaedic solutions. The move was positioned to streamline the company’s product focus, sharpen investment in high-growth procedural areas, and improve long-term revenue and margin profiles by reallocating resources toward CONMED’s flagship device platforms and emerging technologies.

- In August 2025, the U.S. Food and Drug Administration (FDA) approved the first-of-its-kind IDE clinical study of Cook Medical’s ADVANCE EVERO 18 everolimus-coated PTA balloon catheter, enabling evaluation of its safety and effectiveness in treating symptomatic peripheral arterial disease. The decision marked a milestone for drug-coated balloon technology, supporting Cook’s advancement of next-generation endovascular therapies aimed at reducing restenosis and improving long-term vessel patency in patients with lower-extremity arterial disease..

- In July, ESGE guidelines on topical hemostatic agents reported Ankaferd Blood Stopper with 73%-100% hemostasis rates for GI bleeding sources like peptic ulcers and malignancies in endoscopic use.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC ENDOSCOPIC HEMOSTASIS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES ANALYSIS

4.2 BRAND OUTLOOK

4.2.1 BRAND COMPARATIVE ANALYSIS OF KEY ASIA-PACIFIC PLAYERS

4.2.1.1 BRAND COMPARATIVE NARRATIVE (ANALYTICAL OVERVIEW)

4.2.2 PRODUCT VS BRAND OVERVIEW — ASIA-PACIFIC ENDOSCOPIC HEMOSTASIS MARKET

4.2.2.1 PRODUCT OVERVIEW — ENDOSCOPIC HEMOSTASIS DEVICES

4.2.2.2 BRAND OVERVIEW — INFLUENCE ON ASIA-PACIFIC CLINICAL ADOPTION

4.3 CONSUMER BUYING BEHAVIOUR

4.3.1 CLINICAL EFFECTIVENESS AND PATIENT OUTCOMES

4.3.2 COST AND VALUE CONSIDERATIONS

4.3.3 COMPATIBILITY AND INTEGRATION

4.3.4 TRAINING REQUIREMENTS AND EASE OF USE

4.3.5 REIMBURSEMENT AND HEALTHCARE POLICY ALIGNMENT

4.3.6 PROCUREMENT PROCESSES AND BULK AGREEMENTS

4.3.7 INFLUENCE OF CLINICAL STAKEHOLDERS

4.3.8 TRENDS IN BUYER BEHAVIOUR

4.3.9 CONCLUSION

4.4 PATENT ANALYSIS

4.4.1 PATENT QUALITY AND STRENGTH – ASIA-PACIFIC ENDOSCOPIC HEMOSTASIS MARKET

4.4.2 COUNTRY PATENT LANDSCAPE

4.4.3 IP STRATEGY AND MANAGEMENT

4.4.4 LICENSING AND COLLABORATION

4.5 RAW MATERIAL COVERAGE

4.5.1 METALLIC COMPONENTS AND ALLOY SYSTEMS

4.5.2 POLYMERIC AND SYNTHETIC MATERIALS

4.5.3 NATURAL AND BIOCOMPATIBLE MATERIALS

4.5.4 ELECTRICAL AND THERMAL MATERIAL SYSTEMS

4.5.5 EXPENDABLE ACCESSORIES AND SINGLE-USE MATERIALS

4.6 TECHNOLOGICAL ADVANCEMENTS IN ASIA-PACIFIC ENDOSCOPIC HEMOSTASIS MARKET

4.6.1 ENHANCED MECHANICAL HEMOSTASIS TOOLS

4.6.2 ADVANCED THERMAL COAGULATION AND ENERGY-BASED SYSTEMS

4.6.3 NOVEL TOPICAL HEMOSTATIC AGENTS

4.6.4 INTEGRATION WITH ADJUNCTIVE DIAGNOSTIC TECHNOLOGIES

4.6.5 DEVELOPMENT OF MULTIFUNCTIONAL AND COMBINATION DEVICES

4.6.6 IMPROVED USER ERGONOMICS AND DEVICE DEPLOYMENT SYSTEMS

4.6.7 CONCLUSION

4.7 VALUE CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 RAW MATERIALS & COMPONENTS

4.7.3 DEVICE DESIGN, R&D & MANUFACTURING

4.7.4 PROCESSING, FINISHING & STERILIZATION

4.7.5 PACKAGING & LABELING

4.7.6 LOGISTICS, DISTRIBUTION & COMMERCIALIZATION

4.7.7 CONCLUSION

4.8 VENDOR SELECTION CRITERIA

4.8.1 CLINICAL PERFORMANCE

4.8.2 REGULATORY COMPLIANCE AND APPROVALS

4.8.3 COST AND TOTAL VALUE PROPOSITION

4.8.4 SUPPLY CHAIN ROBUSTNESS AND LOGISTICS

4.8.5 SUPPORT, TRAINING AND CLINICAL EDUCATION

4.8.6 QUALITY SYSTEMS AND REPROCESSING GUIDANCE

4.8.7 REPUTATION, PEER ACCEPTANCE AND POST-MARKET PERFORMANCE

4.8.8 INNOVATION AND FUTURE-READINESS

4.9 COMPANY EVALUATION QUADRANT

4.1 PROFIT MARGIN SCENARIO

4.10.1 MARGIN IMPROVEMENT DRIVERS

4.10.2 COST PRESSURE

4.10.3 REGIONAL VARIATIONS

4.10.4 FUTURE SCENARIOS

4.11 CLIMATE CHANGE SCENARIO

4.11.1 ENVIRONMENTAL CONCERNS

4.11.2 INDUSTRY RESPONSE

4.11.3 GOVERNMENT’S ROLE

4.11.4 ANALYST RECOMMENDATIONS

4.12 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.12.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.12.1.1 JOINT VENTURES

4.12.1.2 MERGERS AND ACQUISITIONS

4.12.1.3 LICENSING AND PARTNERSHIP

4.12.1.4 TECHNOLOGY COLLABORATIONS

4.12.2 STRATEGIC DIVESTMENTS

4.12.3 STAGE OF DEVELOPMENT

4.12.4 TIMELINES AND MILESTONES

4.12.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.12.6 RISK ASSESSMENT AND MITIGATION

4.12.7 FUTURE OUTLOOK

4.13 PRICING ANALYSIS

4.13.1 HEMOSTATIC CLIPS AND FORCEPS PRICING

4.13.2 BANDING AND COAGULATION DEVICES

4.13.3 REGULATORY AND REIMBURSEMENT IMPACT

4.14 SUPPLY CHAIN ANALYSIS

4.14.1 OVERVIEW

4.14.2 LOGISTIC COST SCENARIO

4.14.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.14.4 CONCLUSION

5 TARIFFS & IMPACT ON THE MARKET

5.1 OVERVIEW

5.2 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

5.3 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

5.4 VENDOR SELECTION CRITERIA

5.5 IMPACT ON SUPPLY CHAIN

5.5.1 RAW MATERIAL PROCUREMENT

5.5.2 MANUFACTURING AND PRODUCTION

5.5.3 LOGISTICS AND DISTRIBUTION

5.5.4 PRICE PITCHING AND POSITION OF MARKET

5.6 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.6.1 SUPPLY CHAIN OPTIMIZATION

5.6.2 JOINT VENTURE ESTABLISHMENTS

5.7 IMPACT ON PRICES

5.8 REGULATORY INCLINATION

5.8.1 GEOPOLITICAL SITUATION

5.8.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

5.8.2.1 FREE TRADE AGREEMENTS

5.8.2.2 ALLIANCES ESTABLISHMENTS

5.8.3 STATUS ACCREDITATION (INCLUDING MFTN)

5.8.4 DOMESTIC COURSE OF CORRECTION

5.8.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.8.4.2 ESTABLISHMENT OF SEZS/INDUSTRIAL PARKS

6 REGULATION COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.3.1 MATERIAL HANDLING & STORAGE

6.3.2 TRANSPORT & PRECAUTIONS

6.3.3 HAZARD IDENTIFICATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN GASTROINTESTINAL BLEEDING CASES

7.1.2 AGING POPULATION DRIVING INCREASED DEMAND FOR GI DISORDERS

7.1.3 ADOPTION OF MINIMALLY INVASIVE ENDOSCOPIC PROCEDURES

7.1.4 RISING AWARENESS AND EXPANDED SCREENING PROGRAMS FOR GASTROINTESTINAL ENDOSCOPY

7.2 RESTRAINTS

7.2.1 HIGH COST AND TECHNICAL COMPLEXITY OF ENDOSCOPIC HEMOSTASIS DEVICES

7.2.2 LIMITED AWARENESS IN LOW-INCOME COUNTRIES

7.3 OPPORTUNITIES

7.3.1 TECHNOLOGICAL ADVANCEMENTS IN HEMOSTASIS DEVICES

7.3.2 EXPANSION IN EMERGING MARKETS (ASIA-PACIFIC, LATIN AMERICA)

7.3.3 GROWING ADOPTION OF HOME-BASED AND CAPSULE ENDOSCOPY SOLUTIONS

7.4 CHALLENGES

7.4.1 REIMBURSEMENT ISSUES FOR ENDOSCOPIC PROCEDURES

7.4.2 COMPLEXITIES IN ENDOSCOPE REPROCESSING AND STERILIZATION PROCESSES

8 ASIA-PACIFIC ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 MECHANICAL HEMOSTASIS DEVICES

8.2.1 MECHANICAL HEMOSTASIS DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE

8.2.1.1 HEMOSTATIC CLIPS

8.2.1.1.1 HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE

8.2.1.1.1.1 THROUGH-THE-SCOPE (TTS) CLIPS

8.2.1.1.1.2 OVER-THE-SCOPE (OTS) CLIPS

8.2.1.1.2 HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY MATERIAL

8.2.1.1.2.1 STAINLESS STEEL

8.2.1.1.2.2 TITANIUM

8.2.1.2 BANDING DEVICES

8.2.1.2.1 BANDING DEVICES IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE

8.2.1.2.1.1 VARICEAL BANDING KITS

8.2.1.2.1.2 OESOPHAGEAL BANDING DEVICES

8.2.1.3 HEMOSTATIC FORCEPS

8.2.1.4 OTHERS

8.2.2 MECHANICAL HEMOSTASIS DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION

8.2.2.1 NORTH AMERICA

8.2.2.2 EUROPE

8.2.2.3 ASIA-PACIFIC

8.2.2.4 SOUTH AMERICA

8.2.2.5 MIDDLE EAST & AFRICA

8.3 THERMAL DEVICES

8.3.1 THERMAL DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE

8.3.1.1 ARGON PLASMA COAGULATORS

8.3.1.2 HEATER PROBES

8.3.1.3 BIPOLAR COAGULATION DEVICES

8.3.1.3.1 BIPOLAR COAGULATION IN THERMAL DEVICES MARKET, BY ENERGY TYPE

8.3.1.3.1.1 MONOPOLAR

8.3.1.3.1.2 BIPOLAR

8.3.1.3.2 BIPOLAR COAGULATION IN THERMAL DEVICES MARKET, BY APPLICATION

8.3.1.3.2.1 UPPER GI BLEEDING

8.3.1.3.2.2 LOWER GI BLEEDING

8.3.1.4 OTHERS

8.3.2 THERMAL DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION

8.3.2.1 NORTH AMERICA

8.3.2.2 EUROPE

8.3.2.3 ASIA-PACIFIC

8.3.2.4 SOUTH AMERICA

8.3.2.5 MIDDLE EAST & AFRICA

8.4 TOPICAL AGENTS AND INJECTABLES

8.4.1 TOPICAL AGENTS & INJECTIBLES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE

8.4.1.1 EPINEPHRINE INJECTION

8.4.1.2 HEMOSTATIC SPRAY (POWDER)

8.4.1.3 HEMOSTATIC GELS

8.4.1.4 FIBRIN SEALANTS

8.4.1.5 SCLEROSING AGENTS

8.4.2 TOPICAL AGENTS AND INJECTABLES IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION

8.4.2.1 NORTH AMERICA

8.4.2.2 EUROPE

8.4.2.3 ASIA-PACIFIC

8.4.2.4 SOUTH AMERICA

8.4.2.5 MIDDLE EAST & AFRICA

8.5 OTHERS

8.5.1 OTHERS IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION

8.5.1.1 NORTH AMERICA

8.5.1.2 EUROPE

8.5.1.3 ASIA-PACIFIC

8.5.1.4 SOUTH AMERICA

8.5.1.5 MIDDLE EAST & AFRICA

9 ASIA-PACIFIC ENDOSCOPIC HEMOSTASIS MARKET, BY PROCEDURE TYPE

9.1 OVERVIEW

9.2 UPPER GASTROINTESTINAL ENDOSCOPY

9.2.1 UPPER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE

9.2.1.1 BLEEDING ULCER MANAGEMENT

9.2.1.2 VARICEAL BLEEDING

9.2.1.3 DIEULAFOY LESION

9.2.2 UPPER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION

9.2.2.1 NORTH AMERICA

9.2.2.2 EUROPE

9.2.2.3 ASIA-PACIFIC

9.2.2.4 SOUTH AMERICA

9.2.2.5 MIDDLE EAST & AFRICA

9.3 LOWER GASTROINTESTINAL ENDOSCOPY

9.3.1 LOWER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE

9.3.1.1 COLONIC BLEEDING

9.3.1.2 DIVERTICULAR BLEEDING

9.3.2 LOWER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION

9.3.2.1 NORTH AMERICA

9.3.2.2 EUROPE

9.3.2.3 ASIA-PACIFIC

9.3.2.4 SOUTH AMERICA

9.3.2.5 MIDDLE EAST & AFRICA

9.4 BRONCHOSCOPIC HEMOSTASIS

9.4.1 BRONCHOSCOPIC HEMOSTASIS IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION

9.4.1.1 NORTH AMERICA

9.4.1.2 EUROPE

9.4.1.3 ASIA-PACIFIC

9.4.1.4 SOUTH AMERICA

9.4.1.5 MIDDLE EAST & AFRICA

9.5 OTHERS

9.5.1 OTHERS IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION

9.5.1.1 NORTH AMERICA

9.5.1.2 EUROPE

9.5.1.3 ASIA-PACIFIC

9.5.1.4 SOUTH AMERICA

9.5.1.5 MIDDLE EAST & AFRICA

10 ASIA-PACIFIC ENDOSCOPIC HEMOSTASIS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 GASTROINTESTINAL BLEEDING

10.2.1 GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE

10.2.1.1 PEPTIC ULCER BLEEDING

10.2.1.2 ESOPHAGEAL VARICES

10.2.1.3 COLORECTAL CANCERS

10.2.2 GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE

10.2.2.1 MECHANICAL HEMOSTASIS DEVICES

10.2.2.2 THERMAL DEVICES

10.2.2.3 TOPICAL AGENTS AND INJECTABLES

10.2.2.4 OTHERS

10.2.3 GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION

10.2.3.1 NORTH AMERICA

10.2.3.2 EUROPE

10.2.3.3 ASIA-PACIFIC

10.2.3.4 SOUTH AMERICA

10.2.3.5 MIDDLE EAST & AFRICA

10.3 NON-GASTROINTESTINAL BLEEDING

10.3.1 NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE

10.3.1.1 NASAL BLEEDING (EPISTAXIS)

10.3.1.2 POST-SURGICAL BLEEDING

10.3.2 NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE

10.3.2.1 MECHANICAL HEMOSTASIS DEVICES

10.3.2.2 THERMAL DEVICES

10.3.2.3 TOPICAL AGENTS & INJECTABLES

10.3.2.4 OTHERS

10.3.3 NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION, 2018-2033, (USD THOUSAND)

10.3.3.1 NORTH AMERICA

10.3.3.2 EUROPE

10.3.3.3 ASIA-PACIFIC

10.3.3.4 SOUTH AMERICA

10.3.3.5 MIDDLE EAST & AFRICA

10.4 TRAUMA MANAGEMENT

10.4.1 TRAUMA MANAGEMENT IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE

10.4.1.1 MECHANICAL HEMOSTASIS DEVICES

10.4.1.2 THERMAL DEVICES

10.4.1.3 TOPICAL AGENTS & INJECTABLES

10.4.1.4 OTHERS

10.4.2 TRAUMA MANAGEMENT IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION

10.4.2.1 NORTH AMERICA

10.4.2.2 EUROPE

10.4.2.3 ASIA-PACIFIC

10.4.2.4 SOUTH AMERICA

10.4.2.5 MIDDLE EAST & AFRICA

10.5 OTHERS

10.5.1 OTHERS IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION

10.5.1.1 NORTH AMERICA

10.5.1.2 EUROPE

10.5.1.3 ASIA-PACIFIC

10.5.1.4 SOUTH AMERICA

10.5.1.5 MIDDLE EAST & AFRICA

11 ASIA-PACIFIC ENDOSCOPIC HEMOSTASIS MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.2.1 HOSPITALS IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE

11.2.1.1 PUBLIC

11.2.1.2 PRIVATE

11.2.2 HOSPITALS IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION

11.2.2.1 NORTH AMERICA

11.2.2.2 EUROPE

11.2.2.3 ASIA-PACIFIC

11.2.2.4 SOUTH AMERICA

11.2.2.5 MIDDLE EAST & AFRICA

11.3 AMBULATORY SURGERY CENTERS

11.3.1 AMBULATORY SURGERY CENTERS IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION

11.3.1.1 NORTH AMERICA

11.3.1.2 EUROPE

11.3.1.3 ASIA-PACIFIC

11.3.1.4 SOUTH AMERICA

11.3.1.5 MIDDLE EAST & AFRICA

11.4 SPECIALTY CLINICS

11.4.1 SPECIALTY CLINICS IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION

11.4.1.1 NORTH AMERICA

11.4.1.2 EUROPE

11.4.1.3 ASIA-PACIFIC

11.4.1.4 SOUTH AMERICA

11.4.1.5 MIDDLE EAST & AFRICA

11.5 OTHERS

11.5.1 OTHERS IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION

11.5.1.1 NORTH AMERICA

11.5.1.2 EUROPE

11.5.1.3 ASIA-PACIFIC

11.5.1.4 SOUTH AMERICA

11.5.1.5 MIDDLE EAST & AFRICA

12 ASIA-PACIFIC ENDOSCOPIC HEMOSTASIS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 INDIRECT SALES

12.2.1 INDIRECT SALES IN ENDOSCOPIC HEMOSTASIS, BY TYPE

12.2.1.1 OFFLINE

12.2.1.2 ONLINE

12.2.2 INDIRECT SALES IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION

12.2.2.1 NORTH AMERICA

12.2.2.2 EUROPE

12.2.2.3 ASIA-PACIFIC

12.2.2.4 SOUTH AMERICA

12.2.2.5 MIDDLE EAST & AFRICA

12.3 DIRECT SALES

12.3.1 DIRECT SALES IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION

12.3.1.1 NORTH AMERICA

12.3.1.2 EUROPE

12.3.1.3 ASIA-PACIFIC

12.3.1.4 SOUTH AMERICA

12.3.1.5 MIDDLE EAST & AFRICA

13 ASIA-PACIFIC ENDOSCOPIC HEMOSTASIS MARKET, BY REGION

13.1 ASIA PACIFIC

13.1.1 CHINA

13.1.2 JAPAN

13.1.3 INDIA

13.1.4 SOUTH KOREA

13.1.5 AUSTRALIA

13.1.6 INDONESIA

13.1.7 THAILAND

13.1.8 MALAYSIA

13.1.9 SINGAPORE

13.1.10 PHILIPPINES

13.1.11 NEW ZEALAND

13.1.12 HONG KONG

13.1.13 TAIWAN

13.1.14 REST OF ASIA-PACIFIC

14 ASIA-PACIFIC ENDOSCOPIC HEMOSTASIS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 COMPANY PROFILES MANUFACTURERS

16.1 OLYMPUS CORPORATION

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 BOSTON SCIENTIFIC CORPORATION

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 CONMED CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 MEDTRONIC

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 COOK

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 ANKAFERD

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVEOPMENT

16.7 B. BRAUN SE

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVEOPMENT

16.8 CREO MEDICAL GMBH

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 DIVERSATEK, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVEOPMENT

16.1 DUOMED GROUP

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVEOPMENT

16.11 ENDOCLOT PLUS, INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVEOPMENT

16.12 ERBE ELEKTROMEDIZIN GMBH

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 FUJIFILM HOLDINGS CORPORATION

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENT

16.14 JOHNSON & JOHNSON (ETHICON)

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVEOPMENT

16.15 KARL STORZ SE & CO. KG, TUTTLINGEN

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVEOPMENT

16.16 MEDITALIA S.R.L.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 MICRO-TECH ENDOSCOPY

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 MTW ENDOSKOPIE MANUFAKTU

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVEOPMENT

16.19 OVESCO ENDOSCOPY AG

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVEOPMENT

16.2 PENTAX MEDICAL

16.20.1 COMPANY SNAPSHOT

16.20.2 SOLUTION PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 STERIS

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENT

17 COMPANY PROFILES DISTRIBUTOR

17.1 BOSTON IVY HEALTHCARE SOLUTIONS PRIVATE LIMITED

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENT

17.2 CARDINAL HEALTH

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVEOPMENT

17.3 HENRY SCHEIN, INC.

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVEOPMENT

17.4 MCKESSON MEDICAL-SURGICAL INC.

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVEOPMENT

17.5 MFI MEDICAL

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVEOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 ASIA-PACIFIC ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 2 ASIA-PACIFIC MECHANICAL HEMOSTASIS DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC BANDING DEVICES IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC MECHANICAL HEMOSTASIS DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 7 ASIA-PACIFIC THERMAL DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC BIPOLAR COAGULATION IN THERMAL DEVICES MARKET, BY ENERGY TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC BIPOLAR COAGULATION IN THERMAL DEVICES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC THERMAL DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 11 ASIA-PACIFIC TOPICAL AGENTS & INJECTABLES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC TOPICAL AGENTS AND INJECTABLES IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 13 ASIA-PACIFIC OTHERS IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 14 ASIA-PACIFIC ENDOSCOPIC HEMOSTASIS MARKET, BY PROCEDURE, 2018-2033 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC UPPER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC UPPER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 17 ASIA-PACIFIC LOWER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC LOWER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 19 ASIA-PACIFIC BRONCHOSCOPIC HEMOSTASIS IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 20 ASIA-PACIFIC OTHERS IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 21 ASIA-PACIFIC ENDOSCOPIC HEMOSTASIS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 25 ASIA-PACIFIC NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 28 ASIA-PACIFIC TRAUMA MANAGEMENT IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC TRAUMA MANAGEMENT IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 30 ASIA-PACIFIC OTHERS IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 31 ASIA-PACIFIC ENDOSCOPIC HEMOSTASIS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC HOSPITALS IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC HOSPITALS IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 34 ASIA-PACIFIC AMBULATORY SURGERY CENTERS IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 35 ASIA-PACIFIC SPECIALTY CLINICS IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 36 ASIA-PACIFIC OTHERS IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 37 ASIA-PACIFIC ENDOSCOPIC HEMOSTASIS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC INDIRECT SALES IN ENDOSCOPIC HEMOSTASIS, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC INDIRECT SALES IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 40 ASIA-PACIFIC DIRECT SALES IN ENDOSCOPIC HEMOSTASIS MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 41 ASIA-PACIFIC ENDOSCOPIC HEMOSTASIS MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC MECHANICAL HEMOSTASIS DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC BANDING DEVICES IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC THERMAL DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC BIPOLAR COAGULATION IN THERMAL DEVICES MARKET, BY ENERGY TYPE, 2018-2033 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC BIPOLAR COAGULATION IN THERMAL DEVICES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC TOPICAL AGENTS & INJECTIBLES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC ENDOSCOPIC HEMOSTASIS MARKET, BY PROCEDURE, 2018-2033 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC UPPER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC LOWER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC ENDOSCOPIC HEMOSTASIS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 ASIA-PACIFIC TRAUMA MANAGEMENT IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC ENDOSCOPIC HEMOSTASIS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC HOSPITALS IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC ENDOSCOPIC HEMOSTASIS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC INDIRECT SALES IN ENDOSCOPIC HEMOSTASIS, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 CHINA ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 CHINA MECHANICAL HEMOSTASIS DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 66 CHINA HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 CHINA HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 68 CHINA BANDING DEVICES IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 69 CHINA THERMAL DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 CHINA BIPOLAR COAGULATION IN THERMAL DEVICES MARKET, BY ENERGY TYPE, 2018-2033 (USD THOUSAND)

TABLE 71 CHINA BIPOLAR COAGULATION IN THERMAL DEVICES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 72 CHINA TOPICAL AGENTS & INJECTIBLES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 CHINA ENDOSCOPIC HEMOSTASIS MARKET, BY PROCEDURE, 2018-2033 (USD THOUSAND)

TABLE 74 CHINA UPPER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 CHINA LOWER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 76 CHINA ENDOSCOPIC HEMOSTASIS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 77 CHINA GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 CHINA GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 CHINA NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 CHINA NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 CHINA TRAUMA MANAGEMENT IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 82 CHINA ENDOSCOPIC HEMOSTASIS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 83 CHINA HOSPITALS IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 84 CHINA ENDOSCOPIC HEMOSTASIS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 85 CHINA INDIRECT SALES IN ENDOSCOPIC HEMOSTASIS, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 JAPAN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 87 JAPAN MECHANICAL HEMOSTASIS DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 88 JAPAN HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 89 JAPAN HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 90 JAPAN BANDING DEVICES IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 91 JAPAN THERMAL DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 JAPAN BIPOLAR COAGULATION IN THERMAL DEVICES MARKET, BY ENERGY TYPE, 2018-2033 (USD THOUSAND)

TABLE 93 JAPAN BIPOLAR COAGULATION IN THERMAL DEVICES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 94 JAPAN TOPICAL AGENTS & INJECTIBLES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 JAPAN ENDOSCOPIC HEMOSTASIS MARKET, BY PROCEDURE, 2018-2033 (USD THOUSAND)

TABLE 96 JAPAN UPPER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 JAPAN LOWER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 JAPAN ENDOSCOPIC HEMOSTASIS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 99 JAPAN GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 JAPAN GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 101 JAPAN NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 JAPAN NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 JAPAN TRAUMA MANAGEMENT IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 JAPAN ENDOSCOPIC HEMOSTASIS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 105 JAPAN HOSPITALS IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 JAPAN ENDOSCOPIC HEMOSTASIS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 107 JAPAN INDIRECT SALES IN ENDOSCOPIC HEMOSTASIS, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 INDIA ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 109 INDIA MECHANICAL HEMOSTASIS DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 INDIA HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 111 INDIA HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 112 INDIA BANDING DEVICES IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 113 INDIA THERMAL DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 114 INDIA BIPOLAR COAGULATION IN THERMAL DEVICES MARKET, BY ENERGY TYPE, 2018-2033 (USD THOUSAND)

TABLE 115 INDIA BIPOLAR COAGULATION IN THERMAL DEVICES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 116 INDIA TOPICAL AGENTS & INJECTIBLES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 INDIA ENDOSCOPIC HEMOSTASIS MARKET, BY PROCEDURE, 2018-2033 (USD THOUSAND)

TABLE 118 INDIA UPPER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 119 INDIA LOWER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 120 INDIA ENDOSCOPIC HEMOSTASIS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 121 INDIA GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 122 INDIA GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 INDIA NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 124 INDIA NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 INDIA TRAUMA MANAGEMENT IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 126 INDIA ENDOSCOPIC HEMOSTASIS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 127 INDIA HOSPITALS IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 INDIA ENDOSCOPIC HEMOSTASIS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 129 INDIA INDIRECT SALES IN ENDOSCOPIC HEMOSTASIS, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 SOUTH KOREA ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 131 SOUTH KOREA MECHANICAL HEMOSTASIS DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 SOUTH KOREA HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 SOUTH KOREA HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 134 SOUTH KOREA BANDING DEVICES IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 SOUTH KOREA THERMAL DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 136 SOUTH KOREA BIPOLAR COAGULATION IN THERMAL DEVICES MARKET, BY ENERGY TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 SOUTH KOREA BIPOLAR COAGULATION IN THERMAL DEVICES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 138 SOUTH KOREA TOPICAL AGENTS & INJECTIBLES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 139 SOUTH KOREA ENDOSCOPIC HEMOSTASIS MARKET, BY PROCEDURE, 2018-2033 (USD THOUSAND)

TABLE 140 SOUTH KOREA UPPER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 SOUTH KOREA LOWER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 SOUTH KOREA ENDOSCOPIC HEMOSTASIS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 143 SOUTH KOREA GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 SOUTH KOREA GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 145 SOUTH KOREA NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 146 SOUTH KOREA NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 147 SOUTH KOREA TRAUMA MANAGEMENT IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 SOUTH KOREA ENDOSCOPIC HEMOSTASIS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 149 SOUTH KOREA HOSPITALS IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 150 SOUTH KOREA ENDOSCOPIC HEMOSTASIS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 151 SOUTH KOREA INDIRECT SALES IN ENDOSCOPIC HEMOSTASIS, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 152 AUSTRALIA ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 153 AUSTRALIA MECHANICAL HEMOSTASIS DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 AUSTRALIA HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 AUSTRALIA HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 156 AUSTRALIA BANDING DEVICES IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 157 AUSTRALIA THERMAL DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 AUSTRALIA BIPOLAR COAGULATION IN THERMAL DEVICES MARKET, BY ENERGY TYPE, 2018-2033 (USD THOUSAND)

TABLE 159 AUSTRALIA BIPOLAR COAGULATION IN THERMAL DEVICES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 160 AUSTRALIA TOPICAL AGENTS & INJECTIBLES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 161 AUSTRALIA ENDOSCOPIC HEMOSTASIS MARKET, BY PROCEDURE, 2018-2033 (USD THOUSAND)

TABLE 162 AUSTRALIA UPPER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 163 AUSTRALIA LOWER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 AUSTRALIA ENDOSCOPIC HEMOSTASIS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 165 AUSTRALIA GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 166 AUSTRALIA GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 AUSTRALIA NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 168 AUSTRALIA NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 AUSTRALIA TRAUMA MANAGEMENT IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 AUSTRALIA ENDOSCOPIC HEMOSTASIS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 171 AUSTRALIA HOSPITALS IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 AUSTRALIA ENDOSCOPIC HEMOSTASIS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 173 AUSTRALIA INDIRECT SALES IN ENDOSCOPIC HEMOSTASIS, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 174 INDONESIA ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 175 INDONESIA MECHANICAL HEMOSTASIS DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 176 INDONESIA HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 INDONESIA HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 178 INDONESIA BANDING DEVICES IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 179 INDONESIA THERMAL DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 180 INDONESIA BIPOLAR COAGULATION IN THERMAL DEVICES MARKET, BY ENERGY TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 INDONESIA BIPOLAR COAGULATION IN THERMAL DEVICES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 182 INDONESIA TOPICAL AGENTS & INJECTIBLES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 INDONESIA ENDOSCOPIC HEMOSTASIS MARKET, BY PROCEDURE, 2018-2033 (USD THOUSAND)

TABLE 184 INDONESIA UPPER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 185 INDONESIA LOWER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 INDONESIA ENDOSCOPIC HEMOSTASIS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 187 INDONESIA GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 188 INDONESIA GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 189 INDONESIA NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 190 INDONESIA NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 191 INDONESIA TRAUMA MANAGEMENT IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 192 INDONESIA ENDOSCOPIC HEMOSTASIS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 193 INDONESIA HOSPITALS IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 194 INDONESIA ENDOSCOPIC HEMOSTASIS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 195 INDONESIA INDIRECT SALES IN ENDOSCOPIC HEMOSTASIS, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 196 THAILAND ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 197 THAILAND MECHANICAL HEMOSTASIS DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 THAILAND HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 199 THAILAND HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 200 THAILAND BANDING DEVICES IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 201 THAILAND THERMAL DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 202 THAILAND BIPOLAR COAGULATION IN THERMAL DEVICES MARKET, BY ENERGY TYPE, 2018-2033 (USD THOUSAND)

TABLE 203 THAILAND BIPOLAR COAGULATION IN THERMAL DEVICES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 204 THAILAND TOPICAL AGENTS & INJECTIBLES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 205 THAILAND ENDOSCOPIC HEMOSTASIS MARKET, BY PROCEDURE, 2018-2033 (USD THOUSAND)

TABLE 206 THAILAND UPPER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 207 THAILAND LOWER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 208 THAILAND ENDOSCOPIC HEMOSTASIS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 209 THAILAND GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 THAILAND GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 211 THAILAND NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 212 THAILAND NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 THAILAND TRAUMA MANAGEMENT IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 214 THAILAND ENDOSCOPIC HEMOSTASIS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 215 THAILAND HOSPITALS IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 THAILAND ENDOSCOPIC HEMOSTASIS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 217 THAILAND INDIRECT SALES IN ENDOSCOPIC HEMOSTASIS, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 218 MALAYSIA ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 219 MALAYSIA MECHANICAL HEMOSTASIS DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 220 MALAYSIA HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 221 MALAYSIA HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 222 MALAYSIA BANDING DEVICES IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 223 MALAYSIA THERMAL DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 224 MALAYSIA BIPOLAR COAGULATION IN THERMAL DEVICES MARKET, BY ENERGY TYPE, 2018-2033 (USD THOUSAND)

TABLE 225 MALAYSIA BIPOLAR COAGULATION IN THERMAL DEVICES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 226 MALAYSIA TOPICAL AGENTS & INJECTIBLES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 227 MALAYSIA ENDOSCOPIC HEMOSTASIS MARKET, BY PROCEDURE, 2018-2033 (USD THOUSAND)

TABLE 228 MALAYSIA UPPER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 229 MALAYSIA LOWER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 230 MALAYSIA ENDOSCOPIC HEMOSTASIS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 231 MALAYSIA GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 232 MALAYSIA GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 233 MALAYSIA NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 234 MALAYSIA NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 235 MALAYSIA TRAUMA MANAGEMENT IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 236 MALAYSIA ENDOSCOPIC HEMOSTASIS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 237 MALAYSIA HOSPITALS IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 238 MALAYSIA ENDOSCOPIC HEMOSTASIS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 239 MALAYSIA INDIRECT SALES IN ENDOSCOPIC HEMOSTASIS, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 240 SINGAPORE ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 241 SINGAPORE MECHANICAL HEMOSTASIS DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 242 SINGAPORE HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 243 SINGAPORE HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 244 SINGAPORE BANDING DEVICES IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 245 SINGAPORE THERMAL DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 246 SINGAPORE BIPOLAR COAGULATION IN THERMAL DEVICES MARKET, BY ENERGY TYPE, 2018-2033 (USD THOUSAND)

TABLE 247 SINGAPORE BIPOLAR COAGULATION IN THERMAL DEVICES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 248 SINGAPORE TOPICAL AGENTS & INJECTIBLES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 249 SINGAPORE ENDOSCOPIC HEMOSTASIS MARKET, BY PROCEDURE, 2018-2033 (USD THOUSAND)

TABLE 250 SINGAPORE UPPER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 251 SINGAPORE LOWER GASTROINTESTINAL ENDOSCOPY IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 252 SINGAPORE ENDOSCOPIC HEMOSTASIS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 253 SINGAPORE GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 254 SINGAPORE GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 255 SINGAPORE NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 256 SINGAPORE NON-GASTROINTESTINAL BLEEDING IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 257 SINGAPORE TRAUMA MANAGEMENT IN ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 258 SINGAPORE ENDOSCOPIC HEMOSTASIS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 259 SINGAPORE HOSPITALS IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 260 SINGAPORE ENDOSCOPIC HEMOSTASIS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 261 SINGAPORE INDIRECT SALES IN ENDOSCOPIC HEMOSTASIS, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 262 PHILIPPINES ENDOSCOPIC HEMOSTASIS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 263 PHILIPPINES MECHANICAL HEMOSTASIS DEVICES IN ENDOSCOPIC HEMOSTASIS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 264 PHILIPPINES HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 265 PHILIPPINES HEMOSTATIC CLIPS IN MECHANICAL HEMOSTASIS DEVICES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)