Asia Pacific Exocrine Pancreatic Insufficiency Epi Therapeutics And Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

1.41 Billion

USD

2.68 Billion

2024

2032

USD

1.41 Billion

USD

2.68 Billion

2024

2032

| 2025 –2032 | |

| USD 1.41 Billion | |

| USD 2.68 Billion | |

|

|

|

|

Asia-Pacific Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Size

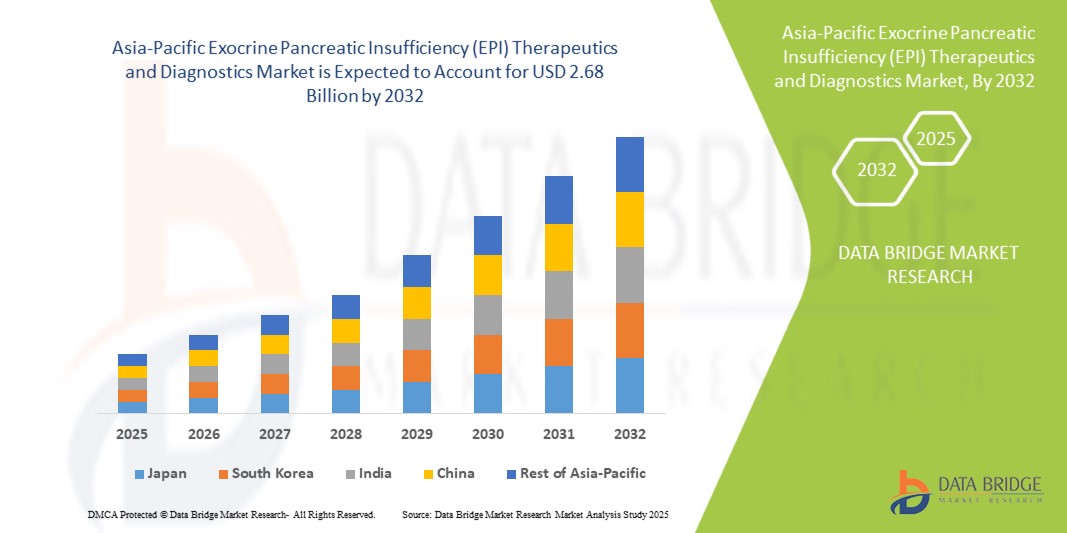

- The Asia-Pacific exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market size was valued at USD 1.41 billion in 2024 and is expected to reach USD 2.68 billion by 2032, at a CAGR of 8.30% during the forecast period

- The market growth is largely fueled by the increasing prevalence of digestive disorders, growing awareness of pancreatic health, and rising adoption of advanced therapeutic and diagnostic solutions for exocrine pancreatic insufficiency (EPI), leading to improved patient outcomes across healthcare settings

- Furthermore, rising demand for early diagnosis, personalized treatment plans, and minimally invasive diagnostic techniques is establishing EPI therapeutics and diagnostics as essential components of gastrointestinal healthcare. These converging factors are accelerating the adoption of EPI solutions, thereby significantly boosting the industry's growth

Asia-Pacific Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Analysis

- Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics, offering advanced enzyme replacement therapies and diagnostic solutions, are increasingly vital components of modern digestive health management in both hospitals and specialty clinics due to their efficacy, precision in diagnosis, and ability to improve patient quality of life

- The escalating prevalence of exocrine pancreatic insufficiency (EPI), coupled with increasing awareness about digestive health, is driving the growing demand for therapeutics and diagnostics solutions in Asia-Pacific. The rising incidence of chronic pancreatitis, cystic fibrosis, and other pancreatic disorders is further fueling the need for early diagnosis and effective management options

- China dominated the Asia-Pacific exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market with the largest revenue share of 37.5% in 2024, attributed to its large patient population, rising healthcare awareness, strong government support for pancreatic disorder management programs, and the presence of leading domestic and international pharmaceutical companies. Increasing physician recommendations and expanding over-the-counter availability of enzyme therapies further reinforce China’s market leadership

- India is expected to be the fastest-growing country in the Asia-Pacific exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market, registering a CAGR of 11.2% from 2025 to 2032. growth is supported by rising disposable incomes, expansion of specialized gastroenterology centers, increased access to enzyme replacement therapy, awareness campaigns about digestive health, and development of retail and online distribution channels

- The Branded Drugs segment dominated the Asia-Pacific exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market with a revenue share of 53.6% in 2024, supported by strong physician trust, clinical evidence of efficacy, and consistent product quality. Branded formulations are widely adopted in hospitals and specialty clinics due to regulatory compliance and standardized dosing

Report Scope and Asia-Pacific Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Segmentation

|

Attributes |

Asia-Pacific Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Trends

Rising Awareness and Accessibility Driving EPI Therapeutics and Diagnostics Adoption

- The increasing prevalence of pancreatic disorders, including chronic pancreatitis, cystic fibrosis, and post-surgical pancreatic insufficiency, is a significant driver for the heightened demand for EPI therapeutics and diagnostics. Growing awareness among healthcare providers and patients about the importance of early diagnosis and enzyme replacement therapy is encouraging adoption across hospitals and specialty clinics

- For instance, in March 2024, Abbott Laboratories (U.S.) expanded its portfolio of EPI enzyme replacement therapies in key Asia-Pacific markets, introducing new oral formulations designed for easier administration and improved patient compliance. Such product innovations and expansions by leading companies are expected to drive industry growth in the forecast period

- As patients become more aware of digestive health complications and seek effective treatment solutions, the adoption of EPI therapeutics is rising. The availability of over-the-counter enzyme supplements alongside prescription therapies ensures broader access to care for a wider patient base

- Furthermore, the growing availability of diagnostic solutions such as fecal elastase testing, imaging techniques, and nutritional biomarker assays is making early detection and ongoing monitoring of EPI more accessible. This ensures timely intervention and improved patient outcomes.

- The expansion of educational programs and awareness campaigns by healthcare organizations, highlighting the importance of pancreatic health and digestive enzyme supplementation, is further boosting adoption. In addition, government health initiatives promoting better gastrointestinal care are guiding clinicians and patients toward safer and more effective EPI management options

- Integration of diagnostics and therapeutics into standardized care pathways at hospitals and specialized clinics ensures consistent and reliable patient management, reinforcing the demand for high-quality EPI solutions

- Patient-centric packaging, dosage flexibility, and improved palatability of enzyme replacement therapies are also enhancing adherence, making these products increasingly preferred across both adult and pediatric patient populations

- Overall, these converging factors—rising disease awareness, improved accessibility of treatments and diagnostics, and product innovations—are expected to significantly propel the growth of the Asia-Pacific Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics market over the forecast period

Asia-Pacific Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Dynamics

Driver

Growing Need Due to Rising Awareness of Digestive Health and Early Diagnosis

- The increasing prevalence of pancreatic disorders, including chronic pancreatitis and cystic fibrosis, coupled with the growing awareness of digestive health, is a significant driver for the heightened demand for Exocrine Pancreatic Insufficiency (EPI) therapeutics and diagnostics

- For instance, in April 2024, Digestive Care, Inc. announced advancements in patient-friendly Pancreatic Enzyme Replacement Therapy (PERT) formulations, aiming to improve compliance and clinical outcomes for EPI patients. Such strategies by key companies are expected to drive the EPI therapeutics and diagnostics industry growth in the forecast period

- As patients and healthcare providers become more aware of the impact of undiagnosed or poorly managed EPI on nutrition and overall health, there is growing demand for early detection tools such as pancreatic function tests and imaging techniques, offering a more targeted approach to treatment

- Furthermore, the expansion of diagnostic infrastructure and adoption of minimally invasive testing methods are making EPI diagnostics an integral part of gastrointestinal healthcare, enabling better patient management and monitoring

- The convenience of accessible treatments, personalized therapy plans, and combination approaches such as nutritional management with enzyme replacement are key factors propelling the adoption of EPI therapeutics in hospitals, specialty clinics, and homecare settings. The trend towards patient-centric care and increasing availability of user-friendly diagnostic and therapeutic options further contribute to market growth

Restraint/Challenge

Concerns Regarding High Treatment Costs and Limited Awareness

- High costs associated with advanced EPI therapeutics, including branded pancreatic enzyme replacement therapies and specialized nutritional products, pose a significant challenge to broader market adoption, particularly in developing regions

- For instance, the relatively higher price of branded PERT formulations compared to generic alternatives can limit access for price-sensitive patients, delaying timely treatment initiation

- Limited awareness among patients and some healthcare providers regarding the symptoms and long-term impact of EPI further constrains market growth. Misdiagnosis or late diagnosis can reduce the effectiveness of available treatments and limit adoption of newer diagnostic tools

- Addressing these challenges through patient education programs, awareness campaigns, and development of more cost-effective therapeutics and diagnostics will be crucial for expanding the market. Companies such as Abbott and Metagenics are emphasizing patient support programs and educational initiatives to improve treatment adherence and uptake

- While costs may gradually decrease with increased generic competition, perceived expense and lack of familiarity with EPI management can still hinder widespread adoption, especially in regions with limited healthcare infrastructure

- Overcoming these challenges through increased healthcare provider awareness, insurance coverage expansion, and more affordable therapeutic options will be vital for sustained growth in the EPI therapeutics and diagnostics market

Asia-Pacific Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Scope

The market is segmented on the basis of diagnosis, treatment, drug type, end user, and distribution channel.

- By Diagnosis

On the basis of diagnosis, the exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is segmented into imaging tests and pancreatic function tests. The pancreatic function tests segment dominated the market with a revenue share of 44.5% in 2024, driven by its ability to accurately assess exocrine pancreatic insufficiency and enzyme activity in patients. This diagnostic method is highly preferred in hospitals and specialty clinics due to its clinical reliability and minimally invasive nature. Physicians rely on these tests for early detection, monitoring disease progression, and adjusting treatment regimens. The growing prevalence of EPI, particularly in populations with chronic pancreatitis or cystic fibrosis, further reinforces adoption. Technological improvements and integration into hospital laboratories enhance accuracy and efficiency. Increasing awareness among healthcare professionals about standardized testing protocols also supports sustained market demand.

The imaging tests segment is expected to witness the fastest CAGR of 12.3% from 2025 to 2032, driven by rising adoption of advanced imaging modalities such as MRI and CT scans for pancreatic structure evaluation. Imaging tests allow detailed visualization of pancreatic morphology, assisting in the identification of structural anomalies and obstructions. Growing incidence of pancreatic diseases and the need for precise disease staging increase their clinical adoption. Hospitals and diagnostic centers are investing in advanced imaging infrastructure. Integration with digital imaging and automated analysis tools further enhances utility. Expansion of healthcare facilities across Asia-Pacific countries such as India, Japan, and China boosts accessibility.

- By Treatment

On the basis of treatment, the exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is segmented into nutritional management and pancreatic enzyme replacement therapy (PERT). The Pancreatic Enzyme Replacement Therapy (PERT) segment dominated with a revenue share of 51.2% in 2024, owing to its proven effectiveness in improving nutrient absorption, reducing malnutrition, and enhancing patient quality of life. PERT is widely prescribed in hospitals and specialty clinics due to established dosing guidelines and predictable therapeutic outcomes. Its adoption is supported by physician familiarity and patient adherence programs. Hospitals benefit from bulk procurement, ensuring consistent supply. The segment also experiences growth from increasing EPI diagnosis rates and rising chronic pancreatitis prevalence. Ongoing research and clinical studies demonstrating PERT efficacy further reinforce adoption. Patient education programs for correct enzyme usage strengthen sustained utilization.

The nutritional management segment is expected to witness the fastest CAGR of 11.8% from 2025 to 2032, driven by rising awareness of diet-based interventions and the role of targeted nutrition in EPI management. The segment includes specialized supplements, high-calorie formulas, and dietary plans designed to optimize digestive efficiency. Healthcare providers are increasingly recommending nutritional management alongside PERT to improve outcomes. Rising adoption of outpatient care and home-based therapy further fuels growth. Urbanization and increased access to nutritional products in countries such as India and China boost market penetration. Consumer preference for non-invasive therapy options enhances adoption. Public health campaigns promoting nutrition for digestive health also support market expansion.

- By Drug Type

On the basis of drug type, the exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is segmented into generic and branded formulations. The Branded Drugs segment held the largest revenue share of 53.6% in 2024, supported by strong physician trust, clinical evidence of efficacy, and consistent product quality. Branded formulations are widely adopted in hospitals and specialty clinics due to regulatory compliance and standardized dosing. Pharmaceutical companies actively promote these products through education programs and partnerships with healthcare providers. Hospitals rely on branded drugs for predictable patient outcomes and inventory management. Marketing campaigns and physician detailing drive brand loyalty. Availability across major Asia-Pacific countries ensures market dominance. Research and development investments by key players continuously improve formulations and delivery systems.

The generic drugs segment is expected to witness the fastest CAGR of 13.5% from 2025 to 2032, driven by affordability, increasing healthcare access, and government initiatives promoting cost-effective treatments. Generic PERT products are gaining acceptance in emerging markets such as India, Thailand, and Indonesia. Lower pricing enables wider adoption in both urban and rural areas. Expansion of domestic pharmaceutical manufacturing supports production scalability. Insurance coverage and reimbursement schemes further encourage adoption. Hospitals and clinics increasingly use generics to manage costs without compromising patient outcomes. Rising awareness among healthcare professionals about equivalence to branded drugs strengthens market penetration.

- By End User

On the basis of end user, the exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is segmented into hospitals, specialty clinics, homecare, diagnostic centers, research & academic institutes, and others. Hospitals dominated with a revenue share of 49.8% in 2024, driven by large patient volumes, structured treatment protocols, and standardized procurement channels. Hospitals offer comprehensive EPI management, combining diagnostics, therapy, and follow-up care. They benefit from bulk purchasing, healthcare tenders, and consistent supply agreements. Adoption is reinforced by the presence of trained specialists and advanced clinical infrastructure. Hospitals in countries such as China, Japan, and South Korea lead market revenue. Clinical programs and patient management initiatives further sustain demand. Partnerships with pharmaceutical suppliers ensure reliable access to both PERT and nutritional management products.

Homecare is expected to witness the fastest CAGR of 12.7% from 2025 to 2032, driven by patient preference for at-home enzyme therapy and telehealth monitoring. Homecare enables patients to self-administer PERT with guidance from digital platforms and remote consultations. Growing availability of patient-friendly devices and formulations supports adoption. Awareness campaigns educate patients and caregivers about safe home treatment. Expanding e-commerce and retail pharmacy channels facilitate access to products. Countries such as India and Australia are witnessing rapid homecare uptake. Convenience, cost-effectiveness, and improved quality of life further accelerate adoption.

- By Distribution Channel

On the basis of distribution channel, the exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is segmented into direct tender, retail pharmacy, third party distributors, and others. the direct tender segment dominated with a revenue share of 47.9% in 2024, due to bulk procurement by hospitals, government healthcare programs, and large specialty clinics. Efficient supply chains and long-term supplier agreements ensure availability and reliability. Hospitals and clinics prefer direct tender for cost efficiency and consistent quality. Government initiatives supporting essential therapeutics reinforce this channel. Large-scale distribution networks in countries such as China, Japan, and India further consolidate dominance. Contracts often include pricing discounts and service agreements, enhancing adoption.

The Retail Pharmacy segment is expected to witness the fastest CAGR of 11.2% from 2025 to 2032, driven by increased consumer access, urban and semi-urban pharmacy expansion, and the growing trend of self-medication. Retail pharmacies and online platforms improve product reach and convenience. Patients increasingly prefer retail outlets for over-the-counter enzyme formulations and nutritional supplements. Expansion in India, China, and Southeast Asia boosts market growth. Education campaigns for EPI management promote retail uptake. The availability of branded and generic products through retail ensures adoption by diverse patient groups.

Asia-Pacific Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Regional Analysis

- The Asia-Pacific exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India

- The region’s growing healthcare infrastructure, expansion of specialized gastroenterology centers, and rising awareness of digestive health are driving the adoption of advanced EPI therapeutics and diagnostics

- Furthermore, as APAC emerges as a manufacturing hub for EPI components and systems, the affordability and accessibility of treatments and diagnostic solutions are expanding to a wider patient base

Japan Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Insight

The Japan exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is gaining momentum due to the country’s advanced healthcare infrastructure, rapid urbanization, and high demand for convenient and effective patient care solutions. The market emphasizes early diagnosis and treatment of pancreatic disorders, with widespread adoption of pancreatic enzyme replacement therapies (PERT), nutritional management strategies, and advanced diagnostic tests such as imaging and pancreatic function assessments. Japan’s aging population further fuels the demand for easier-to-use therapeutics and diagnostics in both clinical and homecare settings. The market growth is also supported by increasing awareness among healthcare providers and patients regarding digestive health and pancreatic insufficiency management.

China Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Insight

The China exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market dominated the Asia-Pacific market with the largest revenue share of 37.5% in 2024. This dominance is attributed to the country’s large patient population, rising healthcare awareness, strong government initiatives supporting pancreatic disorder management programs, and the presence of leading domestic and international pharmaceutical companies. Increasing physician recommendations, expanding over-the-counter availability of enzyme therapies, and growing investments in healthcare infrastructure further strengthen China’s market leadership. The market benefits from rapid urbanization and technological adoption in medical facilities, enabling broader access to both diagnostics and therapeutics for EPI patients.

India Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Insight

The India exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is expected to be the fastest-growing country in the Asia-Pacific market, registering a CAGR of 11.2% from 2025 to 2032. Market growth is supported by rising disposable incomes, the expansion of specialized gastroenterology centers, improved access to enzyme replacement therapy, and increasing awareness campaigns about digestive health. The development of retail and online distribution channels also enhances the accessibility of EPI therapeutics and diagnostics to a wider population. In addition , growing healthcare infrastructure and government support for pancreatic health initiatives are expected to further accelerate market adoption across India.

Asia-Pacific Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Share

The exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics industry is primarily led by well-established companies, including:

- EagleBio (U.S.)

- AbbVie Inc. (U.S.)

- Nordmark Arzneimittel GmbH (Germany)

- Digestive Care, Inc. (U.S.)

- Alcresta Therapeutics, Inc. (U.S.)

- ChiRhoClin (U.S.)

- Abbott (U.S.)

- Bioserv Diagnostics (Germany)

- Laboratory Corporation of America (U.S.)

- Organon Group of Companies (U.S.)

- Metagenics LLC (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- Nestlé (Switzerland)

- VIVUS LLC (U.S.)

- ScheBo Biotech AG (Germany)

Latest Developments in Asia-Pacific Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market

- In February 2023, Codexis, Inc. and Nestlé Health Science announced the interim findings from a Phase 1 trial examining the safety, tolerability, pharmacokinetics (PK), and pharmacodynamics of CDX-7108. A lipase variation called CDX-7108 was created expressly to get around the drawbacks of the current pancreatic enzyme replacement treatment (PERT). This has aided the business in marketing the product

- In August 2022, AzurRx Biopharma announced positive Phase 2 clinical trial results for its EPI treatment candidate, demonstrating significant efficacy in improving pancreatic function in patients with EPI. This advancement underscores the company's commitment to developing innovative therapies for digestive health disorders

- In July 2021, AbbVie launched a new formulation of its pancreatic enzyme replacement therapy (PERT) product, designed to enhance the bioavailability and stability of enzymes, thereby improving patient outcomes in EPI management. This launch reflects AbbVie's ongoing efforts to provide effective solutions for gastrointestinal disorders

- In August 2021, AzurRx announced that it had engaged in the development of yeast-derived lipase, MS1819, which has been engineered to have superior enzymatic activity as compared to current treatments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.