Asia Pacific Flexible Digital Video Cystoscopes Market

Market Size in USD Million

CAGR :

%

USD

230.00 Million

USD

404.13 Million

2025

2033

USD

230.00 Million

USD

404.13 Million

2025

2033

| 2026 –2033 | |

| USD 230.00 Million | |

| USD 404.13 Million | |

|

|

|

|

Asia-Pacific Flexible Digital Video Cystoscopes Market Size

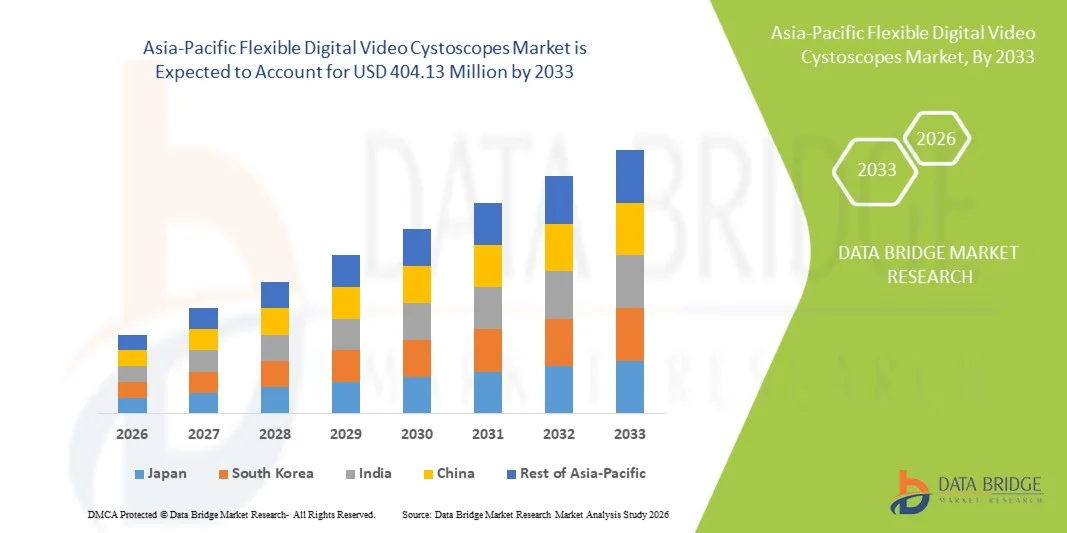

- The Asia-Pacific flexible digital video cystoscopes market size was valued at USD 230.00 million in 2025 and is expected to reach USD 404.13 million by 2033, at a CAGR of 7.30% during the forecast period

- The market growth is largely driven by increasing prevalence of urological disorders, rising healthcare expenditure, and advancements in minimally invasive diagnostic technologies across the region

- Furthermore, growing adoption of digital and high-definition imaging cystoscopes by hospitals and specialty clinics is enhancing procedural efficiency and patient outcomes. These converging factors are accelerating the uptake of flexible digital video cystoscopes, thereby significantly boosting the industry's growth

Asia-Pacific Flexible Digital Video Cystoscopes Market Analysis

- Flexible digital video cystoscopes, providing high-definition imaging for minimally invasive urological diagnostics, are becoming essential tools in both hospitals and specialty clinics across Asia-Pacific due to their enhanced visualization, procedural efficiency, and improved patient comfort

- The increasing demand for flexible digital video cystoscopes is primarily driven by rising prevalence of urological disorders, growing healthcare expenditure, and technological advancements in digital endoscopy devices

- China dominated the Asia-Pacific flexible digital video cystoscopes market with the largest revenue share of 37.1% in 2025, characterized by rapid healthcare infrastructure expansion, increasing number of hospitals and specialty clinics, and strong government initiatives to adopt advanced medical devices

- India is expected to be the fastest-growing country in the Asia-Pacific market during the forecast period due to improving healthcare access, rising patient awareness, and adoption of advanced medical technologies in urban and semi-urban hospitals

- Reusable flexible digital video cystoscopes segment dominated the market with a market share of 46.7% in 2025, driven by cost-effectiveness over multiple procedures, established adoption in hospitals, and continuous improvements in sterilization and imaging technologies

Report Scope and Asia-Pacific Flexible Digital Video Cystoscopes Market Segmentation

|

Attributes |

Asia-Pacific Flexible Digital Video Cystoscopes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Flexible Digital Video Cystoscopes Market Trends

“Advancements in High-Definition Imaging and AI-Assisted Diagnostics”

- A significant and accelerating trend in the Asia-Pacific flexible digital video cystoscopes market is the integration of high-definition (HD) imaging with AI-assisted diagnostic tools, enhancing visualization and procedural accuracy in urological procedures

- For instance, the FUJIFILM Eluxeo system combines HD imaging with AI-based lesion detection, allowing urologists to identify abnormalities with higher precision during cystoscopy procedures

- AI integration in flexible cystoscopes enables features such as automated lesion detection, real-time image enhancement, and predictive analytics for patient outcomes. For instance, some Olympus models utilize AI to flag potential malignancies and assist clinicians in decision-making

- The combination of advanced imaging and AI-based diagnostics facilitates minimally invasive procedures, reducing procedural time and improving patient safety. Through a single system, clinicians can manage imaging, lesion detection, and documentation efficiently

- This trend towards more intelligent, precise, and integrated diagnostic tools is reshaping expectations for urological care. Consequently, companies such as Boston Scientific are developing AI-enabled flexible cystoscopes with features such as real-time image analysis and lesion annotation

- Telemedicine-enabled cystoscopy solutions are emerging, allowing remote consultation and real-time collaboration with specialists. For instance, some Karl Storz devices support cloud-based image sharing for expert review during procedures

- The demand for flexible digital video cystoscopes with AI-assisted imaging is growing rapidly across hospitals and specialty clinics, as healthcare providers increasingly prioritize diagnostic accuracy and procedural efficiency

Asia-Pacific Flexible Digital Video Cystoscopes Market Dynamics

Driver

“Rising Prevalence of Urological Disorders and Technological Adoption”

- The increasing prevalence of urological disorders, coupled with the rapid adoption of advanced endoscopic technologies, is a significant driver for the heightened demand for flexible digital video cystoscopes

- For instance, in March 2025, Olympus launched a next-generation flexible cystoscope in India, emphasizing improved HD imaging and durability, aimed at enhancing procedural outcomes in hospitals and clinics

- As healthcare providers focus on improving patient care, flexible digital cystoscopes offer advanced features such as high-resolution imaging, maneuverability, and compatibility with digital records, providing a compelling alternative to rigid endoscopes

- Furthermore, rising investments in hospital infrastructure and expansion of specialty clinics are making flexible cystoscopes a critical tool for diagnostic and therapeutic procedures, particularly in urban and semi-urban centers

- The growing preference for minimally invasive procedures, improved patient comfort, and faster recovery times are key factors propelling the adoption of flexible digital video cystoscopes in both public and private healthcare facilities

- The trend towards upgrading traditional endoscopy systems with high-definition digital solutions further contributes to market growth

- Government initiatives to upgrade healthcare facilities with modern diagnostic equipment in countries such as China and India are supporting rapid adoption. For instance, hospital modernization schemes include digital endoscopy procurement guidelines

Restraint/Challenge

“High Device Cost and Limited Skilled Workforce”

- The relatively high cost of flexible digital video cystoscopes compared to traditional rigid cystoscopes poses a significant challenge to broader market penetration, particularly in developing countries

- For instance, high procurement costs of premium models from brands such as Karl Storz can make adoption difficult for smaller clinics and hospitals with limited budgets

- Addressing cost concerns through reusable devices, leasing options, and mid-range models is crucial for expanding market reach. Limited availability of trained urologists and technicians to operate advanced cystoscopy systems also hinders adoption in some regions

- Furthermore, ongoing maintenance, sterilization requirements, and calibration of advanced digital cystoscopes add operational challenges, particularly in smaller healthcare facilities. While training programs and workshops exist, gaps in skill levels persist across emerging markets

- Inconsistent regulatory frameworks and device approval timelines across Asia-Pacific countries slow market entry for new technologies. For instance, delays in clinical trial approvals for single-use cystoscopes can impact adoption schedules

- Supply chain constraints and import dependency for high-end cystoscopy equipment create logistical challenges and increase lead times for hospitals in remote areas. For instance, reliance on European and U.S. manufacturers can delay delivery in Southeast Asia

- Overcoming these challenges through training initiatives, affordable device models, and service support networks will be vital for sustained market growth and broader adoption of flexible digital video cystoscopes in Asia-Pacific

Asia-Pacific Flexible Digital Video Cystoscopes Market Scope

The market is segmented on the basis of product, application, end user, and distribution channel.

- By Product

On the basis of product, the market is segmented into reusable flexible digital video cystoscopes and single-use cystoscopes. The Reusable Flexible Digital Video Cystoscopes segment dominated the market with a share of 46.7% in 2025, driven by cost-effectiveness over multiple procedures and established adoption in hospitals. These devices are preferred for their durability, superior imaging capabilities, and compatibility with advanced imaging platforms. Hospitals often prioritize reusable models to manage high patient volumes while maintaining consistent diagnostic quality. The segment also benefits from continuous improvements in sterilization technologies, enhancing patient safety and minimizing cross-contamination risks. In addition, the availability of multiple configurations and features for different clinical requirements supports their strong market presence.

The Single-Use Cystoscope segment is anticipated to witness the fastest growth during the forecast period, driven by rising concerns over infection control and operational efficiency in hospitals and clinics. Single-use cystoscopes eliminate the need for reprocessing, reducing procedure turnaround times and contamination risks. They are increasingly adopted in high-volume centers and outpatient facilities due to their convenience and safety. Manufacturers are focusing on developing cost-effective disposable solutions with high-quality imaging, further accelerating adoption. The segment also aligns with growing regulatory and hospital guidelines emphasizing patient safety and hygiene.

- By Application

On the basis of application, the market is segmented into diagnostic and treatment. The Diagnostic segment dominated the market in 2025 due to the high demand for accurate and early detection of urological disorders such as bladder cancer and urinary tract infections. Diagnostic procedures drive the adoption of high-definition flexible cystoscopes, as hospitals prioritize imaging quality and procedural accuracy. Clinicians prefer advanced digital cystoscopes that offer enhanced visualization, image storage, and integration with hospital information systems. Growing awareness among patients and physicians about early detection is further fueling this segment. The segment’s dominance is also supported by increasing healthcare expenditure and expansion of diagnostic facilities in key Asia-Pacific countries such as China and India.

The Treatment segment is expected to witness the fastest growth during the forecast period, driven by the rising use of cystoscopes for minimally invasive therapeutic procedures. Treatment applications include stone removal, lesion ablation, and other urological interventions, which benefit from the precision and maneuverability of flexible digital cystoscopes. Hospitals and specialty clinics are increasingly integrating these devices into their therapeutic workflows. Technological innovations enabling simultaneous diagnostic and therapeutic capabilities are further propelling growth. The segment is also supported by favorable reimbursement policies and adoption in ambulatory surgery centers and outpatient facilities.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, ambulatory surgery centers, and others. The Hospitals segment dominated the market in 2025 due to large patient volumes and the need for advanced diagnostic and therapeutic urology equipment. Hospitals are investing in high-definition flexible cystoscopes for their durability, imaging quality, and multi-procedure utility. The segment benefits from strong budgets, government healthcare initiatives, and preference for reusable devices to optimize cost-efficiency. Large hospitals often serve as referral centers for complex urological cases, reinforcing the adoption of advanced cystoscopy equipment. Partnerships with manufacturers for training and maintenance also contribute to segment dominance.

The Ambulatory Surgery Centers segment is expected to witness the fastest growth during the forecast period, driven by the rising demand for outpatient minimally invasive procedures. These centers prefer compact, portable, and single-use cystoscopes that allow rapid patient turnover and reduce sterilization costs. Increasing awareness of outpatient urological care and cost-effective solutions for minor interventions is boosting adoption. Ambulatory centers also benefit from flexible scheduling and shorter procedure durations with advanced digital cystoscopes. Manufacturers are increasingly targeting this segment with portable and cost-efficient models.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and retailer. The Direct Tender segment dominated the market in 2025 due to the high-value nature of medical equipment purchases by hospitals and government healthcare institutions. Direct tender ensures reliable supply, maintenance support, and compliance with regulatory requirements. Hospitals and specialty clinics prefer direct procurement from manufacturers to ensure authenticity, access to training programs, and after-sales services. Bulk purchasing through tenders also allows institutions to negotiate pricing for multiple units. Strong manufacturer-hospital relationships drive continued dominance of this segment.

The Retailer segment is expected to witness the fastest growth during the forecast period, driven by increasing adoption in smaller clinics, ambulatory centers, and private healthcare setups. Retail distribution allows rapid access to both single-use and reusable cystoscopes without large procurement contracts. Smaller healthcare providers can benefit from flexible purchase options, prompt deliveries, and availability of different product models. E-commerce platforms and specialized medical device distributors are further expanding the reach of cystoscopes in semi-urban and tier-2 cities.

Asia-Pacific Flexible Digital Video Cystoscopes Market Regional Analysis

- China dominated the Asia-Pacific flexible digital video cystoscopes market with the largest revenue share of 37.1% in 2025, characterized by rapid healthcare infrastructure expansion, increasing number of hospitals and specialty clinics, and strong government initiatives to adopt advanced medical devices

- Healthcare providers in the country highly value high-definition imaging, AI-assisted diagnostics, and procedural efficiency offered by flexible digital cystoscopes, which enhance patient outcomes and reduce procedural time

- This widespread adoption is further supported by government healthcare initiatives, increasing number of specialty clinics, and strong investments in modern medical equipment, establishing flexible digital cystoscopes as the preferred solution for hospitals and outpatient facilities across the country

The China Flexible Digital Video Cystoscopes Market Insight

The China flexible digital video cystoscopes market captured the largest revenue share of 37.1% in 2025 within Asia-Pacific, driven by the increasing prevalence of urological disorders, rapid expansion of hospital infrastructure, and adoption of advanced medical technologies. Hospitals and specialty clinics are prioritizing high-definition imaging and AI-assisted diagnostics to improve procedural accuracy and patient outcomes. The growing government initiatives for healthcare modernization, coupled with rising patient awareness, are further propelling market growth. Moreover, Chinese hospitals increasingly invest in reusable and single-use cystoscopes to balance cost, hygiene, and efficiency. Integration with digital hospital systems and endoscopic documentation solutions is also driving the adoption of flexible digital video cystoscopes.

Japan Flexible Digital Video Cystoscopes Market Insight

The Japan flexible digital video cystoscopes market is gaining momentum due to the country’s advanced healthcare infrastructure, high adoption of medical technology, and increasing focus on minimally invasive procedures. Hospitals emphasize precision, procedural efficiency, and patient comfort, driving demand for HD flexible cystoscopes with AI-assisted imaging. Integration with hospital IT systems and telemedicine platforms is enhancing diagnostic accuracy and workflow efficiency. The aging population in Japan also increases the need for regular urological screening and advanced diagnostics. Furthermore, Japanese clinics and hospitals are adopting single-use cystoscopes to reduce cross-contamination risk and improve patient safety.

India Flexible Digital Video Cystoscopes Market Insight

The India flexible digital video cystoscopes market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, rising healthcare expenditure, and growing awareness of urological disorders. The country is witnessing expansion in both public and private hospitals, driving demand for advanced diagnostic tools such as flexible digital cystoscopes. The government’s push for modernized healthcare infrastructure, coupled with increasing adoption of single-use cystoscopes for infection control, is supporting market growth. Rising patient preference for minimally invasive procedures and better post-procedure outcomes is further encouraging adoption. In addition, strong domestic and international device manufacturers are expanding availability and affordability across urban and semi-urban healthcare facilities.

South Korea Flexible Digital Video Cystoscopes Market Insight

The South Korea flexible digital video cystoscopes market is expected to grow at a robust CAGR during the forecast period due to the country’s focus on advanced medical technologies and digital healthcare solutions. Hospitals are increasingly adopting flexible cystoscopes with AI-enabled imaging for early detection of urological disorders and improved procedural precision. Integration with hospital management systems and electronic medical records enhances workflow efficiency. Strong government support for healthcare innovation and rising patient demand for minimally invasive procedures are key growth drivers. The adoption of single-use cystoscopes in high-volume centers is also accelerating market penetration.

Asia-Pacific Flexible Digital Video Cystoscopes Market Share

The Asia-Pacific Flexible Digital Video Cystoscopes industry is primarily led by well-established companies, including:

- Olympus Corporation (Japan)

- PENTAX (Japan)

- FUJIFILM Holdings Corporation (Japan)

- Karl Storz SE & Co. KG (Germany)

- Richard Wolf GmbH (Germany)

- Ambu A/S (Denmark)

- Boston Scientific Corporation (U.S.)

- Cook (U.S.)

- Medtronic (U.S.)

- Stryker (U.S.)

- Hoya Corporation (Japan)

- Cogentix Medical (U.S.)

- CONMED Corporation (U.S.)

- EndoChoice Inc. (U.S.)

- Prosurg Inc. (U.S.)

- Rocamed (France)

- Vimex Sp. z o.o. (Poland)

- Advanced Endoscopy Devices (U.S.)

- Smart Medical Systems Ltd. (Israel)

- Schölly Fiberoptic GmbH (Germany)

What are the Recent Developments in Asia-Pacific Flexible Digital Video Cystoscopes Market?

- In December 2024, Hunan Vathin Medical Instrument Co. Ltd. obtained 510(k) clearance from the U.S. FDA for its Single Use Flexible Cystoscope and Digital Video Monitor System (K242535). Although the clearance was in the U.S., the device is manufactured in China and represents upstream innovation in the Asia Pacific region, signaling increasing regional capability in advanced cystoscopy solutions

- In September 2024, Olympus launched a new 4K camera head model (CH S700 08 LB) for urological endoscopic procedures including those involving flexible digital video cystoscopes offering significantly enhanced image clarity. The camera head provides four times the pixel count of a conventional HD camera head and supports 4K white light imaging, 4K Narrow Band Imaging (NBI), and Blue Light (BL) observation modes in a single device

- In December 2023, Vesica AI, a medical start up from Japan, was selected as the winner of the inaugural Olympus Corporation Asia Pacific Innovation Program (OAIP). The OAIP was launched by Olympus in 2023 to identify visionary startups in the Asia Pacific region with technologies enhancing minimally invasive care

- In June 2023, sustainability and environmental‑impact research around single‑use versus reusable flexible cystoscopes has gained prominence in the Asia‑Pacific and global context, influencing device procurement and market dynamics. Though initial impressions suggested single‑use might always be greener, the data show that reprocessing energy and waste management are significant factors

- In August 2021, global endoscopy market coverage reported that Ambu A/S planned to launch a novel high‑resolution single‑use digital flexible cystoscope in 2022, targeting growth in Asia‑Pacific and other regions. The announced device focused on single‑use digital flexible cystoscopy combining flexible scope mechanics with video imaging and disposability addressing key Asia‑Pacific adoption drivers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.