Asia Pacific Flow Chemistry Market

Market Size in USD Million

CAGR :

%

USD

672.74 Million

USD

1,726.10 Million

2024

2032

USD

672.74 Million

USD

1,726.10 Million

2024

2032

| 2025 –2032 | |

| USD 672.74 Million | |

| USD 1,726.10 Million | |

|

|

|

|

Asia-Pacific Flow Chemistry Market Size

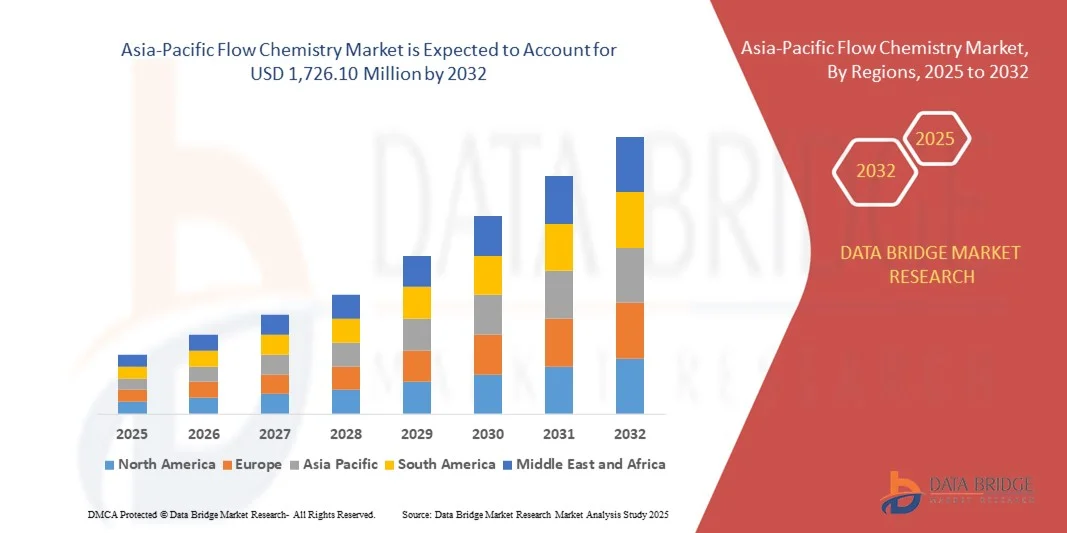

- The Asia-Pacific flow chemistry market size was valued at USD 672.74 million in 2024 and is expected to reach USD 1,726.10 million by 2032, at a CAGR of 12.50% during the forecast period

- The market growth is primarily driven by increasing demand for continuous processing in pharmaceuticals, fine chemicals, and agrochemicals, which offers improved efficiency, safety, and scalability over traditional batch methods

- Additionally, advancements in microreactor technology and rising investments in R&D by key industry players are propelling the adoption of flow chemistry solutions across the region, further fueling market expansion

Asia-Pacific Flow Chemistry Market Analysis

- Flow chemistry, involving the continuous flow of reactants through a reactor for chemical synthesis, is becoming an essential technology in pharmaceutical, chemical, and specialty material manufacturing due to its enhanced reaction control, improved safety, and scalability benefits in both research and industrial applications.

- The rising demand for flow chemistry is primarily driven by the growing need for process intensification, increasing focus on sustainable and green chemistry practices, and the push for higher efficiency and productivity in chemical manufacturing.

- China dominated the flow chemistry market with the largest revenue share of 39.7% in 2024, supported by rapid industrialization, expanding pharmaceutical and chemical manufacturing sectors, and increasing investments in advanced manufacturing technologies, with China, Japan, and India leading the growth through adoption of automated and continuous processing systems.

- India is expected to be the fastest growing region in the flow chemistry market during the forecast period due to significant R&D investments, strong presence of key market players, and growing adoption of flow chemistry in drug discovery and fine chemical production.

- The gas-based flow chemistry segment dominated the market with the largest revenue share of 44.5% in 2024, driven by its extensive application in fine chemicals and pharmaceutical synthesis.

Report Scope and Asia-Pacific Flow Chemistry Market Segmentation

|

Attributes |

Flow Chemistry Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Flow Chemistry Market Trends

Enhanced Process Efficiency Through AI and Automation Integration

- A significant and accelerating trend in the Asia-Pacific Flow Chemistry Market is the deepening integration of artificial intelligence (AI) and automation technologies within continuous flow systems. This fusion is dramatically improving reaction optimization, process control, and scalability in both pharmaceutical and chemical manufacturing sectors.

- For instance, companies like Syrris and Vapourtec are developing flow chemistry platforms equipped with AI-driven process monitoring and control capabilities, enabling real-time adjustments to reaction parameters for improved yield and safety. Automated systems can now execute complex multistep syntheses with minimal human intervention, reducing errors and increasing throughput.

- AI integration in flow chemistry facilitates predictive analytics to optimize reaction conditions, anticipate maintenance needs, and reduce waste. Some platforms employ machine learning algorithms to analyze reaction data and suggest process improvements, enhancing overall operational efficiency. Additionally, automation enables remote operation and monitoring of reactors, supporting flexible manufacturing and rapid scaling.

- The seamless integration of flow chemistry systems with digital manufacturing platforms and Industry 4.0 ecosystems allows centralized control over the entire chemical synthesis process. Users can manage multiple reactors, analytical instruments, and data workflows from a single interface, creating a unified and highly automated production environment.

- This trend towards more intelligent, automated, and interconnected flow chemistry solutions is fundamentally transforming expectations for chemical manufacturing efficiency and sustainability. Consequently, key players like Chemtrix and Biotage are innovating with AI-enabled flow reactors that support real-time process optimization and remote operability.

- The demand for flow chemistry systems with advanced AI and automation integration is rapidly growing across pharmaceutical, specialty chemicals, and fine chemicals sectors in Asia-Pacific, as manufacturers seek higher efficiency, reduced costs, and greener production methods.

Asia-Pacific Flow Chemistry Market Dynamics

Driver

Growing Need Due to Rising Demand for Efficient and Sustainable Chemical Manufacturing

- The increasing demand for more efficient, safe, and environmentally friendly chemical synthesis methods in pharmaceutical, specialty chemicals, and fine chemicals sectors is a significant driver for the accelerated adoption of flow chemistry technologies in Asia-Pacific.

- For instance, in early 2024, Syrris announced the launch of an advanced flow reactor system designed to enhance continuous process efficiency and reduce chemical waste, targeting pharmaceutical manufacturers in the region. Such innovations by key players are expected to boost the flow chemistry market growth during the forecast period.

- As manufacturers face mounting pressure to improve production yields, reduce hazardous waste, and comply with stricter environmental regulations, flow chemistry offers precise reaction control, better heat management, and safer handling of hazardous reagents, providing compelling advantages over traditional batch processes.

- Furthermore, the rising focus on process intensification and the push towards Industry 4.0 digital manufacturing ecosystems make flow chemistry systems critical components of modern chemical production lines, facilitating integration with automation, real-time monitoring, and data analytics.

- The scalability and flexibility of flow chemistry platforms enable faster drug development and custom chemical synthesis, meeting growing market demands across pharmaceutical and specialty chemical sectors. The expansion of contract manufacturing organizations (CMOs) and research institutions in Asia-Pacific also propels adoption.

Restraint/Challenge

High Initial Investment and Technical Expertise Requirements

- The relatively high initial investment cost for advanced flow chemistry equipment and infrastructure poses a significant challenge to widespread adoption, particularly among small- and medium-sized enterprises (SMEs) and manufacturers in developing Asia-Pacific countries.

- ForInstance, despite clear benefits, many chemical manufacturers remain hesitant to switch from conventional batch reactors to flow chemistry due to upfront capital expenditure and the need for process re-optimization.

- Additionally, the operation of flow chemistry systems often requires specialized technical expertise in continuous processing and process analytics, which can limit rapid deployment and scale-up in regions with limited skilled workforce availability.

- Addressing these barriers requires increased training programs, collaboration with technology providers, and the development of more cost-effective, modular flow chemistry solutions tailored to diverse industrial needs. Companies like Chemtrix and Vapourtec are actively working on user-friendly and scalable platforms to lower entry barriers.

- While prices are gradually decreasing and more accessible solutions are emerging, overcoming the perception of complexity and cost remains crucial for broader adoption, especially in emerging markets within Asia-Pacific.

- Sustained market growth will depend on continued innovation to reduce costs, improve ease of use, and provide strong customer support alongside efforts to raise awareness of flow chemistry’s long-term economic and environmental benefits.

Asia-Pacific Flow Chemistry Market Scope

The flow chemistry market is segmented on the basis of technology, reactor type, and end-user.

- By Technology

On the basis of technology, the Asia-Pacific Flow Chemistry Market is segmented into gas-based flow chemistry, photochemistry-based flow chemistry, and microwave irradiation-based flow chemistry. The gas-based flow chemistry segment dominated the market with the largest revenue share of 44.5% in 2024, driven by its extensive application in fine chemicals and pharmaceutical synthesis. Gas-based flow chemistry offers superior control over gaseous reagents, enhancing safety and reaction efficiency, which appeals to industries focused on sustainable and scalable processes.

Photochemistry-based flow chemistry is anticipated to witness the fastest CAGR of 22.3% from 2025 to 2032, fueled by increasing adoption in drug discovery and specialty chemical manufacturing. This technology enables highly selective and energy-efficient reactions under mild conditions, which are difficult to achieve using traditional batch photochemical reactors. The integration of LED light sources and advances in reactor design are accelerating its uptake across pharmaceutical and chemical sectors.

- By Reactor Type

On the basis of reactor type, the Asia-Pacific Flow Chemistry Market is segmented into continuous flow reactors, continuous stirred tank reactors (CSTR), plug flow reactors (PFR), and microwave systems. Continuous flow reactors dominated the market with the largest revenue share of 47.8% in 2024, due to their flexibility and scalability for a wide range of chemical processes, from laboratory R&D to industrial manufacturing. They provide excellent control over reaction conditions, improved safety, and ease of integration with process analytics, making them highly favored in pharmaceutical and fine chemical industries.

Microwave systems are expected to be the fastest growing segment, with a CAGR of 23.1% from 2025 to 2032. Their rapid heating capabilities, reduced reaction times, and energy efficiency make microwave-assisted flow chemistry increasingly attractive, especially for accelerating reaction screening and synthesis of complex molecules in research and specialty chemical production.

- By End-User

On the basis of end-user, the Asia-Pacific Flow Chemistry Market is segmented into pharmaceutical biotechnology companies, chemical industries, food and beverage industries, agriculture and environmental sectors, nutraceutical firms, academics and research institutes, and analytical laboratories. Pharmaceutical biotechnology companies held the largest market revenue share of 52.6% in 2024, driven by the urgent need for efficient, scalable, and safe synthesis methods to accelerate drug development and production. Flow chemistry technologies facilitate continuous manufacturing and process intensification, helping meet stringent regulatory requirements and market demands.

The chemical industries segment is anticipated to witness the fastest CAGR of 20.7% from 2025 to 2032, supported by expanding specialty chemicals production and growing interest in sustainable and automated chemical manufacturing processes. Increasing investments in green chemistry and regulatory pressure to reduce environmental impact further propel demand in this sector.

Asia-Pacific Flow Chemistry Market Regional Analysis

- China dominated the flow chemistry market with the largest revenue share of 39.7% in 2024, driven by rapid industrialization, increasing adoption of advanced chemical manufacturing technologies, and growing investments in pharmaceutical and specialty chemical sectors.

- Manufacturers and researchers in the region highly value the efficiency, scalability, and enhanced safety offered by flow chemistry systems compared to traditional batch processes.

- This widespread adoption is further supported by expanding R&D activities, government initiatives promoting green chemistry, and rising demand for continuous manufacturing processes, establishing flow chemistry as a preferred solution across pharmaceuticals, chemicals, and materials industries.

Japan Flow Chemistry Market Insight

Japan’s flow chemistry market is growing steadily, supported by its advanced pharmaceutical industry and strong emphasis on innovation and precision manufacturing. The country’s investment in cutting-edge reactor technologies and automation is fostering the integration of flow chemistry into both research and commercial production. Japan’s aging population also drives demand for efficient drug manufacturing, enhancing the relevance of continuous flow processes in healthcare-related applications.

India Flow Chemistry Market Insight

India is anticipated to experience the highest CAGR in the Asia-Pacific flow chemistry market, fueled by expanding pharmaceutical production and contract manufacturing services. The country’s increasing focus on cost-effective and scalable chemical synthesis methods is boosting flow chemistry adoption. Government initiatives promoting pharmaceutical exports, coupled with rising investments in biotech and chemical industries, are expected to drive significant market growth over the forecast period.

South Korea Flow Chemistry Market Insight

South Korea’s flow chemistry market is advancing rapidly, supported by a strong pharmaceutical and fine chemicals sector and growing R&D activities. The country emphasizes technological innovation and smart manufacturing, encouraging the adoption of flow chemistry for efficient and environmentally friendly production. Collaborations between academia and industry, along with government support for digital transformation in manufacturing, are further accelerating market expansion.

Asia-Pacific Flow Chemistry Market Share

The Flow Chemistry industry is primarily led by well-established companies, including:

- HEL Group (U.K.)

- IDEX Health & Science ( U.S.)

- Biotage AB (Sweden)

- Dolomite Microfluidics (U.K.)

- CEM Corporation (U.S.)

- Asynt Ltd. (U.K.)

- AM Technology (U.K.)

- Chemtrix B.V. (Netherlands)

- Syrris Ltd (U.K.)

- Fluence Technologies (U.S.)

- Vapourtec Ltd ( U.K.)

- YMC Co. Ltd. ( Japan)

- ThalesNano Inc. (Hungary)

- Corning Inc. (U.S.)

- Uniqsis Ltd. (U.K.)

What are the Recent Developments in Asia-Pacific Flow Chemistry Market?

- In April 2023, Corning Inc. launched an advanced continuous flow reactor system in China, designed to enhance chemical process efficiency and safety for pharmaceutical and specialty chemical manufacturers. This initiative highlights Corning’s commitment to delivering innovative flow chemistry solutions tailored to the unique manufacturing demands of the Asia-Pacific region. By leveraging its global expertise and cutting-edge technology, Corning is strengthening its presence in one of the fastest-growing markets for flow chemistry.

- In March 2023, Dolomite Microfluidics, a UK-based company with a growing footprint in Asia-Pacific, introduced a novel photochemistry flow reactor optimized for rapid drug synthesis and chemical screening. The new system offers precise control over light exposure and reaction conditions, accelerating pharmaceutical R&D. This launch underscores Dolomite’s dedication to advancing flow chemistry technologies that meet the evolving needs of Asia-Pacific’s pharmaceutical and biotech industries.

- In March 2023, Syrris Ltd. partnered with a leading Indian pharmaceutical company to deploy continuous stirred tank reactor (CSTR) technology for large-scale API production. The collaboration aims to improve process scalability and reduce manufacturing costs while enhancing sustainability. Syrris’ engagement exemplifies the growing adoption of flow chemistry reactors in India’s pharmaceutical sector to meet rising global demand.

- In February 2023, ThalesNano Inc. expanded its presence in the Asia-Pacific market through a partnership with academic research institutes in Japan, providing state-of-the-art microwave irradiation flow chemistry systems for advanced organic synthesis. This collaboration facilitates cutting-edge research and innovation, emphasizing ThalesNano’s role in supporting scientific advancement and industrial development across the region.

- In January 2023, Vapourtec Ltd. launched its next-generation plug flow reactor (PFR) system in Australia, featuring enhanced automation and real-time monitoring capabilities. This innovation allows chemical manufacturers and researchers to optimize reaction conditions efficiently, boosting productivity and safety. Vapourtec’s new offering demonstrates the company’s ongoing commitment to integrating advanced technology in the Asia-Pacific flow chemistry market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC FLOW CHEMISTRY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE ASIA-PACIFIC FLOW CHEMISTRY MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 ASIA-PACIFIC FLOW CHEMISTRY MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 PRICE INDEX OVERVIEW

5 EXECUTIVE SUMMARY

6 PREMIUM INSIGHTS

6.1 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

6.2 PORTER’S FIVE FORCES

6.3 VENDOR SELECTION CRITERIA

6.4 PESTEL ANALYSIS

6.5 IMPORT EXPORT SCENARIO

6.6 REGULATION COVERAGE

7 SUPPLY CHAIN ANALYSIS

7.1 OVERVIEW

7.2 LOGISTIC COST SCENARIO

7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

8 CLIMATE CHANGE SCENARIO

8.1 ENVIRONMENTAL CONCERNS

8.2 INDUSTRY RESPONSE

8.3 GOVERNMENT’S ROLE

8.4 ANALYST RECOMMENDATIONS

9 ASIA-PACIFIC FLOW CHEMISTRY MARKET, BY REACTOR TYPE, (2020-2029), (USD MILLION)

10 (VALUE, VOLUME AND ASP FOR EACH SEGMENT WILL BE PROVIDED)

10.1 OVERVIEW

10.2 CONTINUOUS FLOW REACTORS

10.2.1 ASP

10.2.2 VALUE

10.2.3 VOLUME

10.3 CONTINUOUS STIRRED TANK REACTORS (CSTR)

10.3.1 ASP

10.3.2 VALUE

10.3.3 VOLUME

10.4 PLUG FLOW REACTORS (PFR)

10.4.1 ASP

10.4.2 VALUE

10.4.3 VOLUME

10.5 MICROWAVE SYSTEMS

10.5.1 ASP

10.5.2 VALUE

10.5.3 VOLUME

10.6 MICRO REACTOR SYSTEMS (MRT)

10.6.1 ASP

10.6.2 VALUE

10.6.3 VOLUME

11 ASIA-PACIFIC FLOW CHEMISTRY MARKET, BY TECHNOLOGY, (2020-2029), (USD MILLION)

11.1 OVERVIEW

11.2 GAS BASED FLOW CHEMISTRY

11.3 PHOTOCHEMISTRY BASED FLOW CHEMISTRY

11.4 MICROWAVE IRRADIATION BASED FLOW CHEMISTRY

12 ASIA-PACIFIC FLOW CHEMISTRY MARKET, BY END-USE, (2020-2029), (USD MILLION)

12.1 OVERVIEW

12.2 PHARMACEUTICAL BIOTECHNOLOGY COMPANIES

12.2.1 CONTINUOUS FLOW REACTORS

12.2.2 CONTINUOUS STIRRED TANK REACTORS (CSTR)

12.2.3 PLUG FLOW REACTORS (PFR)

12.2.4 MICROWAVE SYSTEMS

12.2.5 MICRO REACTOR SYSTEMS (MRT)

12.3 CHEMICAL INDUSTRIES

12.3.1 CONTINUOUS FLOW REACTORS

12.3.2 CONTINUOUS STIRRED TANK REACTORS (CSTR)

12.3.3 PLUG FLOW REACTORS (PFR)

12.3.4 MICROWAVE SYSTEMS

12.3.5 MICRO REACTOR SYSTEMS (MRT)

12.4 FOOD AND BEVERAGE INDUSTRIES

12.4.1 CONTINUOUS FLOW REACTORS

12.4.2 CONTINUOUS STIRRED TANK REACTORS (CSTR)

12.4.3 PLUG FLOW REACTORS (PFR)

12.4.4 MICROWAVE SYSTEMS

12.4.5 MICRO REACTOR SYSTEMS (MRT)

12.5 AGRICULTURE AND ENVIRONMENTAL SECTOR

12.5.1 CONTINUOUS FLOW REACTORS

12.5.2 CONTINUOUS STIRRED TANK REACTORS (CSTR)

12.5.3 PLUG FLOW REACTORS (PFR)

12.5.4 MICROWAVE SYSTEMS

12.5.5 MICRO REACTOR SYSTEMS (MRT)

12.6 NUTRACEUTICAL FIRMS

12.6.1 CONTINUOUS FLOW REACTORS

12.6.2 CONTINUOUS STIRRED TANK REACTORS (CSTR)

12.6.3 PLUG FLOW REACTORS (PFR)

12.6.4 MICROWAVE SYSTEMS

12.6.5 MICRO REACTOR SYSTEMS (MRT)

12.7 ACADEMICS AND RESEARCH INSTITUTES

12.7.1 CONTINUOUS FLOW REACTORS

12.7.2 CONTINUOUS STIRRED TANK REACTORS (CSTR)

12.7.3 PLUG FLOW REACTORS (PFR)

12.7.4 MICROWAVE SYSTEMS

12.7.5 MICRO REACTOR SYSTEMS (MRT)

12.8 ANALYTICAL LABORATORIES

12.8.1 CONTINUOUS FLOW REACTORS

12.8.2 CONTINUOUS STIRRED TANK REACTORS (CSTR)

12.8.3 PLUG FLOW REACTORS (PFR)

12.8.4 MICROWAVE SYSTEMS

12.8.5 MICRO REACTOR SYSTEMS (MRT)

12.9 OTHERS

12.9.1 CONTINUOUS FLOW REACTORS

12.9.2 CONTINUOUS STIRRED TANK REACTORS (CSTR)

12.9.3 PLUG FLOW REACTORS (PFR)

12.9.4 MICROWAVE SYSTEMS

12.9.5 MICRO REACTOR SYSTEMS (MRT)

13 ASIA-PACIFIC FLOW CHEMISTRY MARKET, BY REGION, (2020-2029), (USD MILLION)

13.1 ASIA-PACIFIC FLOW CHEMISTRY MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.2 ASIA-PACIFIC

13.2.1 JAPAN

13.2.2 CHINA

13.2.3 SOUTH KOREA

13.2.4 INDIA

13.2.5 SINGAPORE

13.2.6 THAILAND

13.2.7 INDONESIA

13.2.8 MALAYSIA

13.2.9 PHILIPPINES

13.2.10 AUSTRALIA & NEW ZEALAND

13.2.11 REST OF ASIA-PACIFIC

14 ASIA-PACIFIC FLOW CHEMISTRY MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.2 MERGERS AND ACQUISITIONS

14.3 NEW PRODUCT DEVELOPMENT AND APPROVALS

14.4 EXPANSIONS

14.5 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

16 ASIA-PACIFIC FLOW CHEMISTRY MARKET - COMPANY PROFILES

16.1 AM TECHNOLOGY

16.1.1 COMPANY SNAPSHOT

16.1.2 PRODUCT PORTFOLIO

16.1.3 SWOT ANALYSIS

16.1.4 REVENUE ANALYSIS

16.1.5 RECENT UPDATES

16.2 BIOTAGE

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 SWOT ANALYSIS

16.2.4 REVENUE ANALYSIS

16.2.5 RECENT UPDATES

16.3 CHEMTRIX BV

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 SWOT ANALYSIS

16.3.4 REVENUE ANALYSIS

16.3.5 RECENT UPDATES

16.4 DSM

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 SWOT ANALYSIS

16.4.4 REVENUE ANALYSIS

16.4.5 RECENT UPDATES

16.5 FUTURE CHEMISTRY HOLDING BV

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 SWOT ANALYSIS

16.5.4 REVENUE ANALYSIS

16.5.5 RECENT UPDATES

16.6 IMM

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 SWOT ANALYSIS

16.6.4 REVENUE ANALYSIS

16.6.5 RECENT UPDATES

16.7 LITTLE THINGS FACTORY

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 SWOT ANALYSIS

16.7.4 REVENUE ANALYSIS

16.7.5 RECENT UPDATES

16.8 LONZA GROUP LTD.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 SWOT ANALYSIS

16.8.4 REVENUE ANALYSIS

16.8.5 RECENT UPDATES

16.9 MILESTONE SRL

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 SWOT ANALYSIS

16.9.4 REVENUE ANALYSIS

16.9.5 RECENT UPDATES

16.1 SYRRIS

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 SWOT ANALYSIS

16.10.4 REVENUE ANALYSIS

16.10.5 RECENT UPDATES

16.11 THALESNANO INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 SWOT ANALYSIS

16.11.4 REVENUE ANALYSIS

16.11.5 RECENT UPDATES

16.12 YMC CO. LTD.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 SWOT ANALYSIS

16.12.4 REVENUE ANALYSIS

16.12.5 RECENT UPDATES

16.13 VAPOURTEC LTD.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 SWOT ANALYSIS

16.13.4 REVENUE ANALYSIS

16.13.5 RECENT UPDATES

16.14 CORNING INCORPORATED

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 SWOT ANALYSIS

16.14.4 REVENUE ANALYSIS

16.14.5 RECENT UPDATES

16.15 CEM CORPORATION

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 SWOT ANALYSIS

16.15.4 REVENUE ANALYSIS

16.15.5 RECENT UPDATES

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

17 RELATED REPORTS

18 QUESTIONNAIRE

19 CONCLUSION

20 ABOUT DATA BRIDGE MARKET RESEARCH

Asia Pacific Flow Chemistry Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Flow Chemistry Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Flow Chemistry Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.