Asia Pacific Foot Ankle Allograft Market

Market Size in USD Billion

CAGR :

%

USD

170.94 Billion

USD

316.40 Billion

2024

2032

USD

170.94 Billion

USD

316.40 Billion

2024

2032

| 2025 –2032 | |

| USD 170.94 Billion | |

| USD 316.40 Billion | |

|

|

|

|

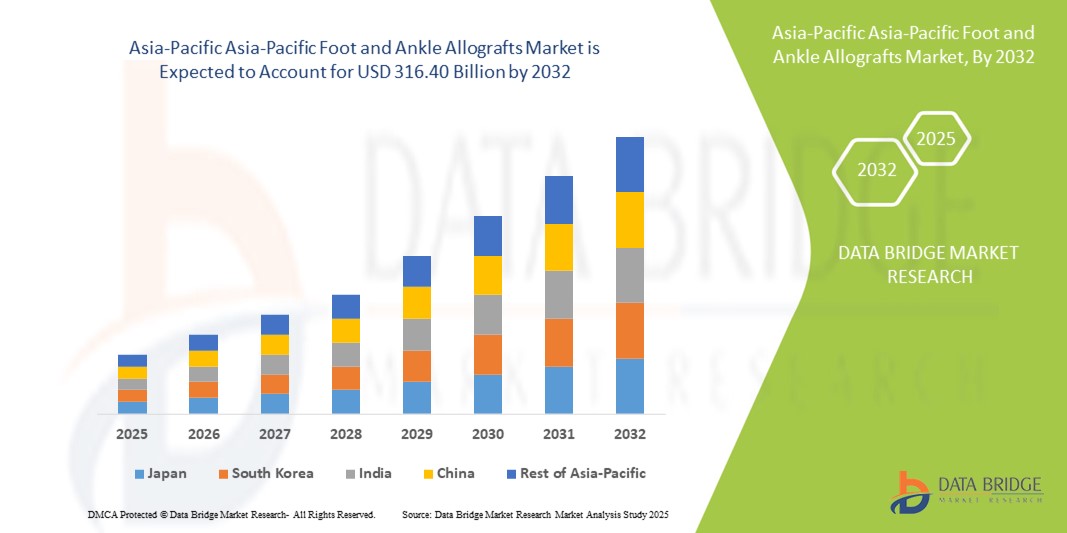

Asia-Pacific Foot and Ankle Allografts Market Size

- The Asia-Pacific foot and ankle allografts market size was valued at USD 170.94 billion in 2024 and is expected to reach USD 316.40 billion by 2032, at a CAGR of 8.00% during the forecast period

- This growth is driven by factors such as the increasing prevalence of orthopaedic conditions, rising geriatric population, growing demand for minimally invasive surgical procedures, advancements in allograft processing technologies, and expanding healthcare infrastructure across emerging economies in the Asia-Pacific region

Asia-Pacific Foot and Ankle Allografts Market Analysis

- The Asia-pacific foot and ankle allografts market is experiencing growth due to the increasing number of musculoskeletal surgeries

- The demand for advanced biologic implants is rising as healthcare providers focus on effective bone healing and joint reconstruction solutions

- China is expected to dominate the Asia-pacific foot and ankle allografts market due to with share of 36.05% due to its high patient population with orthopedic conditions

- India is expected to be the fastest growing region in the Asia -pacific foot and ankle allografts market during the forecast period due to rising incidences of trauma, fractures, and lifestyle-related orthopaedic issues

- The orthopaedic reconstruction segment is expected to dominate the Asia-pacific foot and ankle allografts market with the largest share of 56.35% in 2025 due to the rising prevalence of degenerative joint diseases and traumatic injuries requiring surgical intervention. Increased demand for restoring mobility and function in aging populations has led to a surge in reconstructive procedures.

Report Scope and Asia -Pacific Foot and Ankle Allografts Market Segmentation

|

Attributes |

Asia-Pacific Foot and Ankle Allografts Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Asia-Pacific Foot and Ankle Allografts Market Trends

“Advancements in Operating Microscopes & 3D Visualization for Intraocular Surgery”

- The Asia Pacific foot and ankle allograft market is seeing increasing demand for minimally invasive procedures

- Healthcare providers are opting for advanced techniques that reduce recovery time and enhance patient outcomes

- The trend towards personalized treatment plans is gaining traction in the market, with tailored allograft solutions

- Integration of cutting-edge technologies, such as 3D printing, is improving the precision of foot and ankle allograft procedures

- For instance, some clinics are now using 3D-printed models to better match grafts to individual patient anatomy

- In conclusion, the growing trend of advanced, personalized treatment solutions is shaping the future of the foot and ankle allograft market in Asia Pacific.

Asia-Pacific Foot and Ankle Allografts Market Dynamics

Driver

“Increasing Demand for Minimally Invasive Surgeries”

- Minimally invasive foot and ankle surgeries are gaining traction in Asia Pacific due to smaller incisions, faster recovery, and less postoperative pain, especially among younger patients and athletes

- Hospitals in countries such as India and Singapore are increasingly adopting arthroscopic procedures, with Fortis Healthcare reporting a rise in outpatient foot and ankle surgeries

- These procedures lower infection risk and blood loss, making them ideal for elderly patients or those with diabetes and cardiovascular issues

- Surgeons are receiving advanced training in minimally invasive techniques while facilities invest in equipment to support less invasive approaches, as seen in Apollo Hospitals’ orthopedic advancements

- For instance, the National University Hospital in Singapore has introduced day surgery programs for foot and ankle procedures, reducing hospital stays and improving patient outcomes

- In conclusion, this shift toward minimally invasive surgeries continues to fuel growth in the Asia Pacific foot and ankle allograft market by increasing patient preference and procedural efficiency

Opportunity

“Growing Healthcare Investments in Emerging Markets”

- Rising urbanization and lifestyle changes are driving higher rates of obesity, diabetes, and sports injuries, creating greater demand for surgical interventions

- Emerging economies such as India, China, and Thailand are heavily investing in healthcare infrastructure, increasing access to advanced surgical options including foot and ankle allografts

- For instance, India's Ayushman Bharat scheme has expanded healthcare coverage for millions, improving access to orthopedic surgeries in both rural and urban areas

- Healthcare tourism is booming, with countries such as Thailand offering affordable, high-quality procedures that attract international patients needing foot and ankle surgeries

- Major hospital chains such as Bumrungrad International and Apollo Hospitals are expanding specialized orthopedic units to cater to this growing demand

- In conclusion, these developments present a strong opportunity for the Asia Pacific foot and ankle allograft market to grow through improved accessibility, affordability, and medical tourism initiatives

Restraint/Challenge

“Limited Availability of Donor Tissue”

- The Asia Pacific foot and ankle allograft market is challenged by limited availability of cadaveric donor tissue needed for surgical procedures

- Low tissue donation rates due to cultural and religious beliefs continue to hinder supply, especially in countries such as Japan and parts of Southeast Asia

- For instance, Japan’s donation rate remains one of the lowest globally, limiting the number of allografts available for orthopedic surgeries

- Logistical issues in tissue collection, preservation, and transport across diverse geographies delay procedures and increase operational costs for hospitals

- Inconsistent donor tissue quality leads to concerns over graft rejection and postoperative complications, adding another layer of risk for surgeons and patients

- In conclusion, addressing the donor shortage through awareness campaigns and improved donation infrastructure is essential for market stability and long-term growth

Asia-Pacific Foot and Ankle Allografts Market Scope

The market is segmented on the basis of product type, surgery type, procedure, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Surgery Type |

|

|

By Procedure |

|

|

By End User |

|

In 2025, the orthopaedic reconstruction segment is projected to dominate the market with a largest share in surgery type segment

The orthopaedic reconstruction segment is expected to dominate the Asia-pacific foot and ankle allografts market with the largest share of 56.35% in 2025 due to the rising prevalence of degenerative joint diseases and traumatic injuries requiring surgical intervention. Increased demand for restoring mobility and function in aging populations has led to a surge in reconstructive procedures. Advancements in surgical techniques and graft technologies have made reconstruction more effective and accessible. Surgeons are increasingly opting for allografts in complex reconstructions due to their compatibility and reduced recovery times.

The allograft wedges segment is expected to account for the largest share during the forecast period in product type segment

In 2025, the allograft wedges segment is expected to dominate the market with the largest market % due to their increasing use in corrective foot and ankle surgeries, particularly for deformities such as flatfoot and high arches. These grafts provide structural support and help restore proper alignment, making them a preferred choice among orthopedic surgeons. Their biological compatibility reduces the risk of rejection and promotes natural bone integration. The growing number of osteotomies and reconstructive procedures in the region is driving demand for these wedges.

Asia-Pacific Foot and Ankle Allografts Market Regional Analysis

“China Holds the Largest Share in the Asia-Pacific Foot and Ankle Allografts Market”

- China holds the largest share in the Asia Pacific foot and ankle allograft market with share of 36.05% due to its high patient population with orthopedic conditions

- The country benefits from strong healthcare infrastructure and increasing investments in advanced surgical technologies

- Growing awareness about bone and joint health among the aging population supports the sustained demand for allografts

- The presence of leading medical device manufacturers enables quicker product availability and innovation in graft materials

- Government focus on modernizing public health systems is further enhancing access to foot and ankle surgical treatments

“India is Projected to Register the Highest CAGR in the Asia-Pacific Foot and Ankle Allografts Market”

- India is the fastest-growing market in the region due to rising incidences of trauma, fractures, and lifestyle-related orthopedic issues

- Expanding medical tourism, driven by cost-effective and quality surgical care, is attracting both domestic and international patients

- Increasing urbanization and a more health-conscious middle class are fueling the demand for modern surgical interventions

- Healthcare reforms and state-sponsored insurance schemes are improving access to specialized surgeries such as allograft procedures

- Surge in private hospital investments and orthopedic specialty clinics is rapidly boosting the country's surgical capacity and market growth

Asia-Pacific Foot and Ankle Allografts Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- LifeNet Health (U.S.)

- Zimmer Biomet (U.S.)

- Johnson and Johnson services Inc (U.S.)

- Integra LifeSciences (U.S.)

- CONMED Corporation. (U.S.)

- Stryker (U.S.)

- Globus Medical (U.S.)

- Smith –Nephew (U.S.)

- Institut Straumann AG (Switzerland)

- Arthrex, Inc. (Germany)

- Organogenesis Inc. (U.S.)

- Tissue Regenix Group (China)

- Skeletal Dynamics (Australia)

- Orthofix International N.V. (Australia)

- MediConnect (Japan)

- Nihon Kohden Corporation (Japan)

- Biocomposites Ltd. (India)

- MediProMed (South Korea)

- Stryker Corporation (India)

- Sanofi (Australia)

Latest Developments in Asia-Pacific Foot and Ankle Allografts Market

- In March 2022, Lifenet Health announce that they will be showcasing their innovative all-human research solutions at SOT ToxExpo which has increased company’s customer’s engagement

- In March 2022, Zimmer Biomet announced that they have sign a multiyear agreement with Biocomposites to exclusively distribute genex Bone Graft Substitute with its new mixing system and delivery options in the U.S. orthopaedic market. This will help company to increase their revenue and sales

- In August 2021, Johnson & Johnson Services Inc., announced that their company DePuy Synthes has featured their new products and technology solutions shaping new standards of care for modern day orthopaedics during the American Academy of Orthopaedic Surgeons (AAOS) annual meeting. This has helped the company to gain more customers and sales

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.