Asia Pacific Gas Equipment Market

Market Size in USD Billion

CAGR :

%

USD

5.25 Billion

USD

11.50 Billion

2025

2033

USD

5.25 Billion

USD

11.50 Billion

2025

2033

| 2026 –2033 | |

| USD 5.25 Billion | |

| USD 11.50 Billion | |

|

|

|

|

Asia-Pacific Gas Equipment Market Size

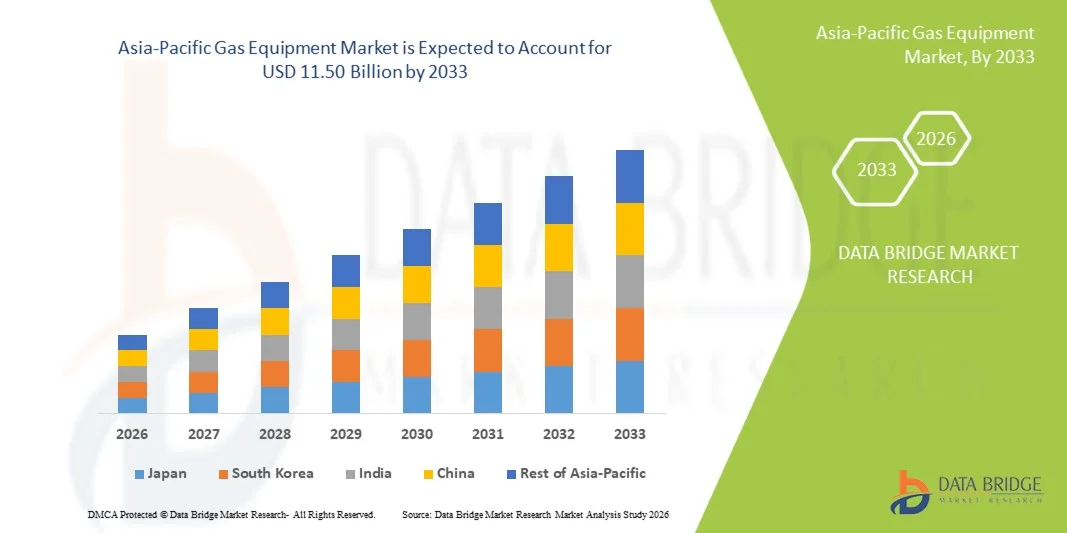

- The Asia-Pacific gas equipment market size was valued at USD 5.25 billion in 2025 and is expected to reach USD 11.50 billion by 2033, at a CAGR of 10.30% during the forecast period

- The market growth is largely driven by the rapid industrialization and expanding energy infrastructure across countries such as China, India, and Japan, alongside the increasing adoption of advanced gas storage, distribution, and handling solutions

- Furthermore, growing demand for clean and efficient energy solutions in manufacturing, chemical, and power generation industries is positioning modern gas equipment as a critical component in operational safety and efficiency. These converging factors are accelerating the deployment of gas equipment solutions, thereby significantly boosting the industry's growth

Asia-Pacific Gas Equipment Market Analysis

- Gas equipment, including delivery systems, regulators, flow devices, purifiers, and detection systems, is increasingly critical for industrial, healthcare, and energy applications across Asia-Pacific due to rising industrialization, stringent safety regulations, and the need for efficient gas management solutions

- The growing demand for gas equipment is primarily fueled by rapid expansion of manufacturing and energy sectors, increasing focus on workplace safety, and the rising adoption of advanced gas handling technologies for operational efficiency and process optimization

- China dominated the Asia-Pacific gas equipment market with the largest revenue share of 38.2% in 2025, driven by large-scale industrial projects, strong local manufacturing capabilities, and government initiatives supporting energy infrastructure development

- India is expected to be the fastest-growing country in the Asia-Pacific gas equipment market during the forecast period due to rising industrial investments, urbanization, and increasing adoption of modern gas equipment across multiple end-users, including chemicals, healthcare, and metal fabrication

- Gas Delivery Systems segment dominated the Asia-Pacific gas equipment market with a market share of 42.9% in 2025, driven by their essential role in safe and efficient transportation of gases across industrial and commercial applications and growing investments in advanced delivery infrastructure

Report Scope and Asia-Pacific Gas Equipment Market Segmentation

|

Attributes |

Asia-Pacific Gas Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Gas Equipment Market Trends

“Advancements in Digital and Automated Gas Equipment”

- A significant and accelerating trend in the Asia-Pacific gas equipment market is the growing adoption of digital monitoring and automated control systems across gas delivery, detection, and generation equipment, enhancing operational efficiency and safety

- For instance, Honeywell Analytics’ advanced gas detection systems in Southeast Asia provide real-time monitoring and automated alerts for hazardous gas leaks, improving industrial safety standards

- Integration of IoT-enabled sensors and remote monitoring capabilities allows operators to track gas flow, pressure, and purity levels in real time, reducing downtime and maintenance costs while optimizing resource usage

- The seamless connectivity of gas equipment with centralized industrial control systems facilitates unified management of gas generation, storage, and transportation processes, enabling predictive maintenance and process automation

- This trend towards smarter, automated, and interconnected gas equipment is reshaping operational expectations across industries. Consequently, companies such as Emerson and Yokogawa are developing AI-enabled monitoring solutions with predictive diagnostics and automated alerts

- The demand for digitalized and automated gas equipment is growing rapidly across industrial, healthcare, and energy sectors as organizations prioritize safety, efficiency, and real-time operational control

- Increasing adoption of cloud-based analytics for gas equipment is allowing industries to gather and analyze large volumes of operational data, improving decision-making and resource management

- Collaborations between gas equipment manufacturers and technology providers are accelerating innovation, resulting in smarter, energy-efficient, and safer solutions for complex industrial applications

Asia-Pacific Gas Equipment Market Dynamics

Driver

“Rising Industrialization and Expanding Energy Infrastructure”

- The rapid industrialization and expansion of energy infrastructure across Asia-Pacific, particularly in China, India, and Southeast Asia, is a major driver of gas equipment demand

- For instance, Linde India has deployed advanced gas delivery and purification systems to support large-scale chemical and metal fabrication plants, enhancing operational efficiency

- Growing industrial output and increasing investments in oil & gas, chemicals, and manufacturing sectors are fueling the need for safe, efficient, and technologically advanced gas handling solutions

- Rising emphasis on workplace safety and regulatory compliance is encouraging industries to adopt modern gas storage, detection, and transportation systems to prevent accidents and ensure operational reliability

- In addition, increasing adoption of automated and IoT-enabled gas equipment allows companies to optimize processes, reduce human error, and improve overall productivity, driving market growth

- Expansion of renewable energy projects, such as hydrogen production facilities, is boosting the demand for specialized gas equipment capable of handling emerging energy sources safely and efficiently

- Government incentives and favorable policies for industrial modernization and clean energy adoption in countries such as Japan, South Korea, and Australia are further supporting market growth

Restraint/Challenge

“High Costs and Regulatory Compliance Hurdles”

- The relatively high cost of advanced gas equipment, combined with complex installation and maintenance requirements, poses a significant challenge for widespread adoption across smaller industrial setups

- For instance, small and medium-scale manufacturers in Southeast Asia may delay procurement of automated gas detection and delivery systems due to budget constraints

- Compliance with strict safety and environmental regulations across multiple countries adds complexity and can increase lead times for deployment of gas equipment, limiting market penetration

- In addition, technical expertise is required for operating and maintaining sophisticated systems such as cryogenic products, gas purifiers, and digital monitoring solutions, which can hinder adoption in regions with limited skilled workforce

- Overcoming these challenges through cost-effective solutions, regional manufacturing, and enhanced training programs will be critical for sustained market growth in Asia-Pacific

- Market fragmentation and lack of standardized protocols across countries may slow adoption of advanced gas equipment and create interoperability challenges between systems

- Volatility in raw material prices for gas equipment manufacturing, such as steel and electronic components, can increase overall costs and impact investment decisions in the region

Asia-Pacific Gas Equipment Market Scope

The market is segmented on the basis of equipment type, process, gas type, and end-user.

- By Equipment Type

On the basis of equipment type, the Asia-Pacific gas equipment market is segmented into gas delivery systems, gas regulators, flow devices, purifiers and filters, gas generating systems, gas detection systems, cryogenic products, and accessories. The Gas Delivery Systems segment dominated the market with the largest revenue share of 42.9% in 2025, driven by its critical role in ensuring safe and efficient gas transportation across industrial and commercial facilities. Gas delivery systems are widely deployed in manufacturing, chemicals, and healthcare industries due to their reliability in transferring gases such as oxygen, nitrogen, and carbon dioxide. These systems are often favored for their ease of integration with automated and IoT-enabled monitoring solutions, providing enhanced operational safety. The established presence of key manufacturers such as Linde, Air Products, and Praxair in the Asia-Pacific region further strengthens this segment’s dominance. Increasing investments in industrial infrastructure and expanding energy projects also boost the demand for robust delivery systems. The segment benefits from the versatility of applications ranging from metal fabrication to food processing, making it a cornerstone of the regional gas equipment market.

The Gas Detection Systems segment is anticipated to witness the fastest growth rate of 23.5% from 2026 to 2033, fueled by the rising emphasis on workplace safety and stringent regulatory standards across Asia-Pacific. Gas detection systems enable real-time monitoring of hazardous gases, minimizing risks and ensuring compliance with industrial safety regulations. Industries such as oil & gas, chemicals, and healthcare are increasingly adopting smart, connected detection systems with automated alerts and cloud-based analytics. The integration of IoT and AI technologies enhances predictive maintenance and operational efficiency, further propelling growth. The rising awareness of industrial accidents and gas leak hazards is increasing adoption, particularly in high-risk facilities. The expanding industrial base in countries such as India, China, and Southeast Asia supports strong market potential for advanced detection systems.

- By Process

On the basis of process, the market is segmented into gas generation, gas storage, gas detection, and gas transportation. The Gas Storage segment dominated the market with a revenue share of 40.7% in 2025, driven by its essential role in maintaining supply continuity and operational efficiency in industries such as healthcare, chemicals, and metal fabrication. Gas storage solutions are crucial for safely storing compressed or liquefied gases under controlled conditions and are often paired with monitoring systems to ensure pressure and purity compliance. Large-scale projects in China and Japan have accelerated demand for advanced storage tanks, cylinders, and cryogenic containers. Technological innovations in storage materials and designs enhance safety, durability, and energy efficiency, reinforcing this segment’s leading position. Storage systems also enable industrial operators to manage peak demand and mitigate supply disruptions. Companies such as Air Liquide and Linde provide region-specific storage solutions tailored to varying industrial requirements.

The Gas Detection segment is expected to witness the fastest growth at a CAGR of 22.9% from 2026 to 2033, fueled by increasing industrial safety regulations and the adoption of automated monitoring technologies. Detection systems allow real-time identification of gas leaks and hazardous concentrations, significantly reducing operational risk. IoT-enabled detection systems provide remote monitoring, predictive maintenance, and data-driven safety alerts, which are increasingly demanded across chemical, oil & gas, and manufacturing facilities. The rising focus on worker safety and environmental compliance across Asia-Pacific countries further accelerates market growth. Growth is also supported by the deployment of smart sensors and analytics platforms that integrate with central industrial control systems. The segment is witnessing innovation with portable and wearable detection devices, enhancing accessibility in various industrial settings.

- By Gas

On the basis of gas type, the market is segmented into nitrogen, hydrogen, helium, oxygen, carbon dioxide, and others. The Oxygen segment dominated the market with a revenue share of 38.3% in 2025, driven by its widespread use across healthcare, chemicals, and metal fabrication industries. Oxygen is critical for medical applications, welding, and combustion processes, creating consistent demand for reliable supply and delivery systems. Hospitals, industrial facilities, and chemical plants in China and India are significant consumers of oxygen equipment, further strengthening market dominance. The growing focus on healthcare infrastructure and industrial safety drives continuous adoption of oxygen generation, storage, and delivery solutions. Technological advancements, including portable oxygen systems and integrated monitoring solutions, enhance safety and operational efficiency. Manufacturers such as Air Liquide and Linde are expanding regional production to meet growing demand.

The Hydrogen segment is expected to witness the fastest growth at a CAGR of 24.1% from 2026 to 2033, fueled by increasing investments in clean energy projects and green hydrogen production across Asia-Pacific. Hydrogen is emerging as a key energy source for fuel cells, industrial processes, and renewable energy integration. Governments in Japan, South Korea, and China are actively supporting hydrogen infrastructure development, driving demand for hydrogen generation, storage, and distribution equipment. Advanced storage technologies, cryogenic containers, and safety-compliant delivery systems further facilitate market expansion. Industrial focus on decarbonization and clean energy adoption accelerates the uptake of hydrogen-related gas equipment. The segment benefits from innovation in automated monitoring, leak detection, and IoT-based management solutions.

- By End-User

On the basis of end-user, the market is segmented into metal fabrication, chemicals, healthcare, oil and gas, food and beverage, and others. The Chemicals segment dominated the market with a revenue share of 39.5% in 2025, driven by high demand for precision gas equipment in chemical processing, reaction control, and purification processes. Chemical plants require reliable gas delivery, detection, and purification systems to ensure safety, regulatory compliance, and uninterrupted operations. Countries such as China, India, and South Korea are investing heavily in chemical manufacturing infrastructure, boosting equipment demand. Integration of smart and automated gas systems enhances operational efficiency and reduces risks associated with hazardous gases. Leading manufacturers provide end-to-end solutions tailored to the chemical industry, reinforcing the segment’s market dominance. Technological innovations in flow control and monitoring further support growth in this end-user segment.

The Healthcare segment is expected to witness the fastest growth at a CAGR of 23.2% from 2026 to 2033, fueled by rising demand for medical gases such as oxygen, nitrogen, and carbon dioxide in hospitals, clinics, and pharmaceutical production. Increasing patient population, healthcare infrastructure expansion, and technological adoption of connected gas delivery and monitoring systems drive segment growth. IoT-enabled equipment allows hospitals to track consumption, maintain safety standards, and optimize operational efficiency. Portable and on-demand gas generation solutions are gaining traction in emerging markets. Government initiatives to improve healthcare access and standards in countries such as India, China, and Southeast Asia further support the adoption of advanced gas equipment.

Asia-Pacific Gas Equipment Market Regional Analysis

- China dominated the Asia-Pacific gas equipment market with the largest revenue share of 38.2% in 2025, driven by large-scale industrial projects, strong local manufacturing capabilities, and government initiatives supporting energy infrastructure development

- Countries such as China, India, and Japan are witnessing substantial demand due to large-scale manufacturing, chemical processing, healthcare facilities, and energy projects requiring reliable gas delivery, storage, and detection systems

- This widespread adoption is further supported by government initiatives promoting industrial modernization, regulatory compliance for workplace safety, and growing investments in clean energy projects, establishing advanced gas equipment as a critical component for operational efficiency and safety in industrial, healthcare, and commercial settings

The China Gas Equipment Market Insight

The China gas equipment market captured the largest revenue share in Asia-Pacific in 2025, fueled by large-scale industrial projects, energy infrastructure expansion, and strong domestic manufacturing capabilities for gas handling systems. The country’s growing chemical, metal fabrication, and healthcare industries are major consumers of gas delivery, detection, and storage equipment. Integration of automated and IoT-enabled gas solutions for monitoring flow, pressure, and gas purity enhances safety, reduces operational downtime, and ensures regulatory compliance. Government support for clean energy initiatives, including hydrogen and oxygen production facilities, is driving demand for specialized equipment. Furthermore, investments in modern gas pipelines and storage infrastructure are contributing to the market’s sustained growth.

Japan Gas Equipment Market Insight

The Japan gas equipment market is witnessing steady growth due to its advanced industrial landscape, high adoption of automation, and stringent safety regulations. Industries are increasingly deploying gas delivery, storage, and detection systems integrated with real-time monitoring and control technologies to optimize operations and reduce risks. The healthcare and chemical sectors are key drivers of demand for reliable oxygen, nitrogen, and carbon dioxide handling systems. Japan’s emphasis on sustainability and energy-efficient technologies encourages the adoption of low-emission, technologically advanced gas equipment. In addition, the aging industrial infrastructure is prompting upgrades to modern, automated systems, further boosting market expansion.

India Gas Equipment Market Insight

India accounted for a significant revenue share in the Asia-Pacific gas equipment market in 2025, supported by rapid industrialization, urbanization, and infrastructure growth in healthcare, chemicals, and manufacturing sectors. The government’s push for smart cities, industrial modernization, and clean energy adoption is accelerating the deployment of advanced gas delivery, detection, and purification systems. Domestic and international manufacturers are offering cost-effective, scalable solutions tailored to India’s growing demand. Rising awareness of occupational safety and stringent regulatory compliance further encourages industries to adopt automated and IoT-enabled gas equipment. In addition, the country’s expanding pharmaceutical and food & beverage industries are increasingly investing in reliable and precise gas handling systems.

South Korea Gas Equipment Market Insight

The South Korea gas equipment market is witnessing steady growth, driven by technological advancements, industrial modernization, and rising demand for clean energy and safety-compliant solutions. Gas storage, delivery, and detection systems are increasingly deployed across chemical, healthcare, and metal fabrication industries. Integration with IoT-enabled monitoring platforms allows predictive maintenance, automated alerts, and process optimization. Government initiatives to support smart manufacturing, industrial safety, and green energy adoption are further propelling the market. In addition, South Korea’s well-developed infrastructure and strong industrial base contribute to rapid adoption of technologically advanced gas equipment solutions.

Asia-Pacific Gas Equipment Market Share

The Asia-Pacific Gas Equipment industry is primarily led by well-established companies, including:

- Asia Pacific Gas Enterprise Company Limited (Hong Kong)

- CSI Oil & Gas Pte Ltd (Singapore)

- Air Liquide (India)

- Linde PLC (India)

- China Industrial Gas Corporation Limited (China)

- Taiyo Nippon Sanso Corporation (Japan)

- Nippon Sanso Holdings Corporation (Japan)

- Bharat Petroleum Corporation Limited (India)

- Mitsubishi Gas Chemical Company, Inc. (Japan)

- Osaka Gas Co., Ltd. (Japan)

- Korea Gas Corporation (South Korea)

- Daehan Industrial Gas Co., Ltd. (South Korea)

- Pan Asia Pacific Engineering & Construction Co., Ltd. (Thailand)

- PT Aneka Gas Industri Tbk (Indonesia)

- Shanghai Sanso Co., Ltd. (China)

- Sumitomo Corporation (Japan)

- UMW Holdings Berhad (Malaysia)

- Air Products Asia, Inc. (Singapore)

- Hong Kong Oxygen Company Limited (Hong Kong)

- Ever Gas Industry Co., Ltd. (Taiwan)

What are the Recent Developments in Asia-Pacific Gas Equipment Market?

- In January 2025, PacificLight Power was awarded the rights by Singapore’s Energy Market Authority (EMA) to build a hydrogen-ready Combined Cycle Gas Turbine (CCGT) plant on Jurong Island. The plant will be at least 600 MW in capacity, making it one of Singapore’s largest and most efficient gas-fired plants

- In September 2023, BASF began construction on a world-scale syngas plant at its Zhanjiang Verbund site in Guangdong, China. This syngas plant will use CO₂ off-gas from BASF’s ethylene-oxide process + excess fuel gas from its cracker to create syngas and hydrogen

- In May 2023, the Cummins–Sinopec JV’s hydrogen equipment factory in Foshan started production, as reported by Yicai. The plant spans roughly 70,000 square meters and is described as China’s largest PEM electrolyzer base

- In April 2023, Enze Hydrogen Energy (the Sinopec–Cummins JV) officially commissioned its PEM water electrolysis equipment production base in Foshan. The first locally produced product, HyLYZER 1000, went online, representing a milestone in China’s self-reliance for hydrogen generation equipment

- In December 2021, Cummins and Sinopec announced a 50:50 joint venture Cummins Enze (Guangdong) Hydrogen Technology Co., based in Foshan, China. The plant is designed to manufacture proton-exchange membrane (PEM) electrolyzers, which convert water into green hydrogen

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.