Asia Pacific Health Screening Market

Market Size in USD Billion

CAGR :

%

USD

74.83 Billion

USD

207.54 Billion

2025

2033

USD

74.83 Billion

USD

207.54 Billion

2025

2033

| 2026 –2033 | |

| USD 74.83 Billion | |

| USD 207.54 Billion | |

|

|

|

|

Asia-Pacific Health Screening Market Size

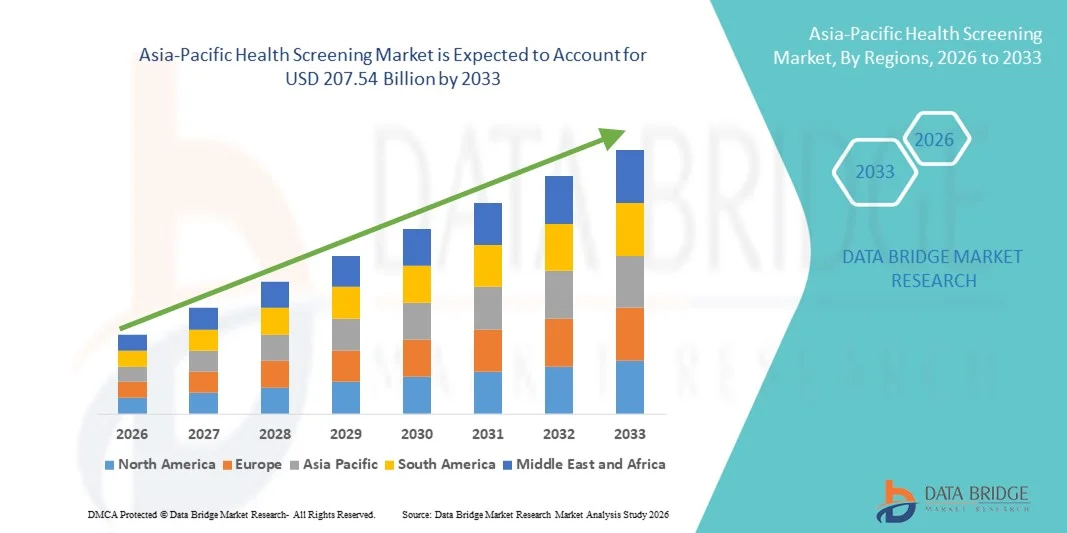

- The Asia-Pacific health screening market size was valued at USD 74.83 billion in 2025 and is expected to reach USD 207.54 billion by 2033, at a CAGR of 13.6% during the forecast period

- The market growth is largely fueled by increasing healthcare awareness, rising disposable incomes, expansion of preventive healthcare services, and rapid adoption of advanced diagnostic and screening technologies across key regional countries, leading to enhanced early disease detection and better patient outcomes

- Furthermore, growing consumer demand for accessible, accurate, and integrated health evaluations supported by public health initiatives and digital healthcare infrastructure improvements is establishing health screening as an essential service in both residential and clinical settings. These converging factors are accelerating the uptake of preventive screening solutions, thereby significantly boosting the industry’s growth

Asia-Pacific Health Screening Market Analysis

- Health screening services in Asia-Pacific, covering a wide range of tests and diagnostic packages, are increasingly vital components of modern healthcare systems in both urban and rural settings due to their ability to enable early disease detection, preventive care, and integration with digital health platforms

- The escalating demand for health screening is primarily fueled by growing consumer awareness, rising prevalence of chronic diseases, increasing disposable incomes, and a strong shift toward preventive care. Key drivers also include the adoption of advanced technologies such as immunoassays, medical imaging, QPCR, and Q-FISH for accurate and rapid diagnostics

- China dominated the Asia-Pacific health screening market with the largest revenue share of 24.9%, characterized by expanding healthcare infrastructure, growing adoption of multi-test panels, and increased accessibility of home and office-based sample collection services

- India is expected to be the fastest-growing country in the Asia-Pacific health screening market during the forecast period due to rising government healthcare initiatives, increasing health awareness campaigns, rapid urbanization, and the growing availability of technologically advanced and affordable screening solutions across both urban and semi-urban areas

- Cancer screening segment dominated the Asia-Pacific health screening market with a market share of 38.9% in 2025, driven by widespread implementation of breast, colorectal, and cervical cancer screening programs, along with increasing adoption of advanced imaging and biomarker-based diagnostic techniques

Report Scope and Asia-Pacific Health Screening Market Segmentation

|

Attributes |

Asia-Pacific Health Screening Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Health Screening Market Trends

Integration of Digital Health Platforms and AI-Driven Diagnostics

- A significant and accelerating trend in the Asia-Pacific health screening market is the growing integration of digital health platforms with AI-driven diagnostic tools, enabling faster, more accurate, and personalized preventive care

- For instance, AI-enabled diagnostic platforms such as Niramai’s Thermalytix and Healthians’ AI-based test reporting systems are increasingly being deployed to streamline early detection of conditions such as cancer and metabolic disorders

- AI integration enables features such as predictive risk assessments, automated analysis of test results, and intelligent scheduling reminders for follow-up screenings. For instance, some Healthians models use AI to suggest personalized health check packages based on a user’s previous test patterns

- The seamless integration of health screening services with mobile applications and telehealth platforms allows centralized monitoring of patient health, facilitating remote consultations and digital record management

- This trend towards more intelligent, connected, and patient-centric screening solutions is fundamentally reshaping expectations for preventive healthcare. For instance, companies such as Healthians and Niramai are developing AI-powered health screening solutions capable of early disease detection and real-time reporting

- The demand for health screening services offering AI integration and mobile platform compatibility is growing rapidly across urban and semi-urban populations, as consumers increasingly prioritize convenience, speed, and personalized preventive care

- The rise of corporate wellness programs and employee health initiatives is promoting regular health screenings and adoption of comprehensive test packages. For instance, some large IT firms in India have partnered with diagnostic providers to offer AI-enabled health check-ups for employees

- Increasing government focus on preventive healthcare programs and national screening initiatives is accelerating market adoption. For instance, India’s National Health Mission is promoting large-scale screenings for non-communicable diseases using digital reporting tools

Asia-Pacific Health Screening Market Dynamics

Driver

Rising Awareness and Preventive Healthcare Adoption

- The creasing health awareness among consumers, coupled with growing adoption of preventive healthcare practices, is a major driver for the expansion of health screening services

- For instance, in April 2025, Healthians launched AI-driven preventive health packages in India targeting cardiovascular and metabolic disorders, driving awareness and adoption among urban populations

- As chronic diseases and lifestyle-related disorders become more prevalent, consumers are proactively seeking regular health check-ups and condition-specific screenings such as cancer, diabetes, and heart health tests

- The growing penetration of digital health platforms and telemedicine services facilitates easy access to health screening, making comprehensive preventive care more convenient and widely available

- The availability of home sample collection, corporate wellness packages, and affordable screening solutions is further propelling adoption in both urban and semi-urban areas

- Rising disposable incomes and expanding private healthcare infrastructure are enabling greater accessibility of advanced screening technologies. For instance, premium diagnostic centers in India and China are witnessing increased patient volumes due to affordability and convenience

- Strategic partnerships between hospitals, diagnostic chains, and technology providers are driving the adoption of integrated health screening solutions. For instance, collaborations between Apollo Hospitals and Healthians have expanded reach of preventive check-up packages

Restraint/Challenge

High Costs and Limited Rural Accessibility

- The high cost of advanced diagnostic tests and specialized health packages remains a challenge, limiting accessibility among price-sensitive consumers in developing Asia-Pacific regions

- For instance, advanced imaging and AI-based diagnostics offered by private providers may be unaffordable for lower-income populations, restricting widespread market penetration

- Limited healthcare infrastructure and fewer diagnostic laboratories in rural areas pose barriers to timely and convenient health screening services

- Consumer hesitancy due to lack of awareness regarding preventive care and digital health platforms further constrains market growth

- Overcoming these challenges through affordable screening solutions, mobile health units, government initiatives, and consumer education will be crucial for sustained market expansion

- Data privacy and patient confidentiality concerns with digital health platforms may deter some consumers from adopting AI-driven health screening services. For instance, some patients remain hesitant to share medical data on mobile health apps

- Supply chain disruptions, including limited availability of test kits and diagnostic reagents, can impact the timely delivery of screening services, particularly in semi-urban and rural areas. For instance, shortages in blood test reagents during peak demand periods have occasionally delayed diagnostics

Asia-Pacific Health Screening Market Scope

The market is segmented on the basis of test type, package type, panel type, sample type, technology, condition, sample collection sites, and distribution channel.

- By Test Type

On the basis of test type, the Asia-Pacific health screening market is segmented into cholesterol tests, diabetes test, cancer screening, general checkup test, STDs, blood pressure test, and others. The Cancer Screening segment dominated the market with a revenue share of 38.9% in 2025, driven by the rising prevalence of cancer across the region and increasing government and private sector initiatives for early detection. Hospitals and diagnostic centers prioritize advanced imaging and AI-powered cancer screening tools to provide accurate, timely results. The growing awareness of preventive healthcare among consumers further fuels the adoption of cancer screening. High demand is observed in urban centers with access to modern diagnostic technologies. Multi-test packages that include cancer screening are also boosting uptake, particularly among high-risk populations. The segment benefits from continuous technological advancements in imaging and molecular diagnostics.

The Diabetes Test segment is expected to witness the fastest growth during forecast period, due to increasing prevalence of lifestyle-related metabolic disorders and rising awareness of early detection programs. Regular monitoring of blood glucose levels and associated risk factors is becoming more common in both home and clinical settings. The adoption of portable testing devices and integration with mobile health platforms further supports growth. Corporate wellness programs and government preventive initiatives are actively promoting diabetes screening. Affordability and convenience of home-based sample collection also enhance market penetration. Rising disposable incomes in emerging Asia-Pacific countries are contributing to higher adoption rates of diabetes screening.

- By Package Type

On the basis of package type, the market is segmented into basic health screening, senior citizen profile, women health check, men health check, heart check, diabetes check, and others. The Basic Health Screening segment dominated with a share of 28% in 2025, as it caters to a wide audience seeking routine preventive care. These packages typically include a set of essential tests such as blood pressure, cholesterol, and general metabolic panels. Urban residents and corporate employees frequently opt for basic packages due to cost-effectiveness and convenience. Hospitals and diagnostic labs promote basic screening as an entry point for preventive healthcare adoption. Bundled packages allow for centralized reporting and follow-up recommendations. Awareness campaigns and government initiatives promoting general health check-ups further strengthen the segment.

The Women Health Check segment is expected to be the fastest-growing during forecast period, driven by increasing focus on gender-specific preventive healthcare, rising awareness of breast and cervical cancer screenings, and expanding adoption of specialized packages in urban and semi-urban areas. Many diagnostic centers offer AI-assisted imaging and hormone testing to enhance early detection. Home-based sample collection and telehealth consultations are contributing to higher accessibility. Increasing female workforce participation in Asia-Pacific is driving demand for convenient and comprehensive health check packages. Marketing efforts emphasizing women’s health awareness and corporate wellness programs are accelerating growth.

- By Panel Type

On the basis of panel type, the market is segmented into multi-test panels and single-test panels. The Multi-Test Panels segment dominated with a share of 62% in 2025, as consumers increasingly prefer comprehensive screening solutions that combine multiple diagnostic tests in one package. These panels allow early detection of multiple conditions such as diabetes, cardiovascular diseases, and cancer. Hospitals and diagnostic labs promote multi-test panels for better risk stratification. AI-assisted interpretation of results improves patient understanding and follow-up planning. Multi-test panels save time and reduce repetitive sampling. Urban and corporate adoption is strong due to the convenience of centralized reporting and cost efficiency.

The Single-Test Panels segment is expected to witness the fastest growth during forecast period due to rising demand for condition-specific diagnostics such as cholesterol or blood pressure testing. Single tests are often used in follow-up monitoring or targeted screening programs. Home-based kits and mobile health applications make single tests more accessible. Affordability and convenience are driving adoption in semi-urban and rural areas. Telemedicine integration supports remote result interpretation. Personalized healthcare programs are increasingly recommending single-test panels for specific risk groups.

- By Sample Type

On the basis of sample type, the market is segmented into blood, urine, serum, saliva, and others. The Blood segment dominated with a share of 58% in 2025, as it is essential for a wide range of diagnostic tests including cholesterol, diabetes, and cancer markers. Blood samples offer high accuracy and compatibility with advanced laboratory testing technologies. Hospitals and diagnostic centers prioritize blood-based testing for multi-test panels. AI and automation in blood testing streamline results processing and reporting. Blood tests are widely covered under insurance and corporate wellness programs. Urban populations have greater access to blood collection centers, strengthening dominance.

The Saliva segment is expected to witness the fastest growth during forecast period, driven by its non-invasive nature and increasing use in genetic testing, infectious disease screening, and hormone level monitoring. Saliva-based diagnostics are suitable for home testing and mobile health applications. Growing consumer preference for minimally invasive procedures is boosting adoption. Telehealth platforms are promoting saliva collection kits for remote consultations. Saliva testing is gaining traction in pediatric and geriatric populations. Emerging companies are innovating with saliva-based biomarker panels, supporting rapid growth.

- By Technology

On the basis of technology, the market is segmented into Immunoassays, Medical Imaging, QPCR, Q-FISH, TRF, STELA, and Others. The Medical Imaging segment dominated with a share of 35% in 2025, driven by advanced diagnostic imaging tools for cancer, cardiovascular, and neurological screenings. Imaging technologies such as CT, MRI, and AI-assisted ultrasound provide high accuracy for early disease detection. Hospitals and diagnostic labs are heavily investing in imaging infrastructure. Integration with digital health platforms enables seamless reporting and analysis. Medical imaging is a preferred method for high-risk populations requiring detailed assessments. Government and private screening initiatives further boost adoption in urban regions.

The QPCR segment is expected to witness the fastest growth during forecast period, due to rising adoption for molecular diagnostics, infectious disease detection, and personalized medicine applications. QPCR offers rapid and precise results, making it ideal for preventive healthcare and research applications. Home and mobile testing kits using QPCR technology are expanding market reach. Increasing awareness of early detection benefits and government support for molecular diagnostic programs accelerate adoption. Diagnostic laboratories are scaling QPCR capabilities to meet growing demand. Integration with AI for automated interpretation enhances usability and accuracy.

- By Condition

On the basis of condition, the market is segmented into cardiovascular disease, metabolic disorders, cancer, inflammatory conditions, musculoskeletal disorders, neurological conditions, hepatitis-c complications, immunology-related conditions, and others. The Cardiovascular Disease segment dominated with a share of 22% in 2025, as heart-related disorders remain the leading cause of mortality in Asia-Pacific. Screening for cholesterol, blood pressure, and ECG-based diagnostics is widely adopted in hospitals and corporate wellness programs. Multi-test panels often include cardiovascular assessments. Preventive healthcare initiatives focus heavily on early detection of cardiovascular risk factors. Urban populations and high-risk groups drive strong demand. Integration with AI platforms for risk prediction enhances accuracy and follow-up management.

The Metabolic Disorders segment is expected to witness the fastest growth during forecast period, driven by rising diabetes, obesity, and lifestyle-related disorders. Screening for glucose, HbA1c, and lipid profiles is increasingly incorporated into preventive health packages. Government awareness campaigns and corporate wellness initiatives promote regular monitoring. Home-based sample collection kits are facilitating adoption in semi-urban and rural areas. Telehealth platforms support remote consultations and follow-up. Rising disposable incomes and expanding private diagnostic networks accelerate segment growth.

- By Sample Collection Sites

On the basis of sample collection sites, the market is segmented into hospital, homes, diagnostic laboratories, offices, and others. The Hospitals segment dominated with a share of 45% in 2025, as most advanced diagnostic tests require controlled clinical environments and professional handling. Hospitals provide comprehensive testing services including imaging, blood work, and AI-assisted analysis. Urban populations frequently prefer hospital-based testing for accuracy and credibility. Hospitals also offer integrated follow-up and referral services. Insurance coverage and corporate tie-ups strengthen hospital dominance. Technological advancements in hospital diagnostics further drive adoption.

The Homes segment is expected to witness the fastest growth during forecast period, driven by increasing demand for convenience, remote sample collection, and integration with telehealth platforms. Home-based services are particularly popular for chronic disease monitoring and routine check-ups. AI-assisted home kits provide instant guidance and secure reporting. Mobile diagnostic vans and app-based booking systems enhance accessibility. Consumer preference for minimal travel and contactless testing supports growth. Companies are innovating with portable kits suitable for home collection, accelerating adoption.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tenders, retail sales, and others. The Direct Tenders segment dominated with a share of 50% in 2025, as hospitals, corporates, and government agencies prefer bulk procurement of health screening services. This segment ensures structured service delivery, standardized test panels, and corporate wellness program implementation. It also facilitates partnerships between diagnostic providers and large institutions. Urban hospitals and large diagnostic chains heavily rely on direct tenders for recurring contracts. Government health initiatives for preventive screenings contribute significantly to this segment. Standardized reporting and service agreements enhance reliability and market dominance.

The Retail Sales segment is expected to witness the fastest growth during forecast period, driven by increasing availability of health check packages at standalone diagnostic centers, pharmacies, and online platforms. Rising awareness and the convenience of walk-in testing attract urban and semi-urban consumers. Integration with mobile apps for appointment booking, result delivery, and consultation drives adoption. Retail sales also include home sample collection services, enhancing reach. Promotional campaigns and AI-assisted test recommendations support rapid market penetration. Consumer preference for flexible, pay-per-service testing fuels segment growth.

Asia-Pacific Health Screening Market Regional Analysis

- China dominated the Asia-Pacific health screening market with the largest revenue share of 24.9%, characterized by expanding healthcare infrastructure, growing adoption of multi-test panels, and increased accessibility of home and office-based sample collection services

- Consumers in China increasingly prioritize early detection of conditions such as cancer, cardiovascular disease, and diabetes, valuing the convenience, accuracy, and comprehensive nature of modern health screening services integrated with digital health platforms

- This widespread adoption is further supported by rising disposable incomes, government health initiatives, expanding private diagnostic networks, and the growing preference for corporate wellness programs and home-based screening solutions, establishing health screening as a critical preventive healthcare solution for both individuals and organizations

The China Health Screening Market Insight

The China health screening market dominated the Asia-Pacific region with a revenue share of 24.9% in 2025, driven by a large population, growing incidence of lifestyle-related diseases, and rapid expansion of private and public diagnostic infrastructure. Chinese consumers increasingly value early disease detection and comprehensive health check-ups. Integration of AI-based diagnostics, imaging, and multi-test panels enables accurate and timely reporting, while government initiatives for cancer and cardiovascular screening promote widespread adoption. Urban centers and corporate wellness programs are key growth drivers. Rising disposable incomes and accessibility to modern diagnostic technologies further strengthen market penetration.

India Health Screening Market Insight

The India health screening market is expected to be the fastest-growing country in Asia-Pacific, driven by rapid urbanization, rising health awareness campaigns, and adoption of digital health solutions. India’s growing middle-class population is increasingly investing in preventive care, with hospitals, diagnostic labs, and home-based services expanding rapidly. AI-assisted diagnostics, telemedicine, and affordable health packages are accelerating adoption. Government initiatives under programs such as the National Health Mission are promoting large-scale screenings for chronic and lifestyle-related diseases. Corporate wellness programs and mobile diagnostic vans are enhancing outreach in urban and semi-urban regions.

Japan Health Screening Market Insight

The Japan health screening market is gaining momentum due to high healthcare awareness, an aging population, and widespread adoption of preventive care practices. Consumers prioritize regular health check-ups, cancer screenings, and cardiovascular assessments, often integrated with AI-based analysis and mobile reporting. The country’s technologically advanced diagnostic infrastructure and emphasis on early detection fuel market growth. Corporate wellness programs and government-led initiatives targeting elderly populations further strengthen adoption. Integration with home-based monitoring and telehealth platforms provides convenient access to screening services.

Australia Health Screening Market Insight

The Australia health screening market is expanding steadily, driven by rising preventive healthcare awareness, government-sponsored screening initiatives, and increasing adoption of digital diagnostics. Urban populations and corporate wellness programs are primary drivers for routine health check-ups and condition-specific screenings. Hospitals, private diagnostic centers, and home-based services are widely accessible. AI-assisted imaging and multi-test panels are increasingly integrated into routine health checks. Government policies promoting early disease detection and telemedicine platforms enhance adoption across the country.

Asia-Pacific Health Screening Market Share

The Asia-Pacific Health Screening industry is primarily led by well-established companies, including:

- Asia HealthPartners (Singapore)

- AsiaLabs (Vietnam)

- Metropolis Healthcare Ltd. (India)

- Healthians (India)

- Pacific Edge Limited (New Zealand)

- Seegene Inc. (South Korea)

- Sysmex Corporation (Japan)

- Fujirebio (Japan)

- Quest Diagnostics Incorporated (U.S.)

- Abbott (U.S.)

- Siemens Healthineers AG (Germany)

- Bio Rad Laboratories (U.S.)

- Hologic Inc. (U.S.)

- GE HealthCare (U.S.)

- Danaher (U.S.)

- PerkinElmer (U.S.)

- Mindray Medical International Ltd. (China)

- NIHON KOHDEN CORPORATION (Japan)

- Omron Healthcare (Japan)

- Phoenix Molecular Designs (India)

What are the Recent Developments in Asia-Pacific Health Screening Market?

- In January 2026, multiple Asia‑Pacific countries including Thailand, Singapore, Hong Kong, and Malaysia stepped up airport health screening for the Nipah virus following confirmed cases in India, implementing enhanced thermal and clinical screening to prevent infectious disease spread across entry points in the region

- In October 2025, the International Agency for Research on Cancer (IARC) and National Cancer Center Japan hosted a CanScreen5 training course in Tokyo, bringing together screening programme managers and healthcare professionals from 13 Asia‑Pacific countries to strengthen cancer screening quality improvement efforts and data use in programme evaluation

- In August 2025, the 2025 Asia‑Pacific Health Promotion and Non‑Communicable Disease Prevention Workshop was held at National Taiwan University, fostering international collaboration on cancer screening strategies among 160+ health officials and scholars from Singapore, Japan, South Korea, and Taiwan, enhancing regional public health communication and screening policy exchange

- In June 2025, Dharamshila Narayana Superspeciality Hospital in New Delhi installed an advanced 3D mammography system for precise breast cancer screening, marking the launch of a comprehensive free women’s cancer screening program with 5,000 pap smear and mammography tests under the Ayushman Bharat scheme, including mobile diagnostic services for underserved areas

- In February 2025, Indonesia’s Ministry of Health launched an annual free health screening initiative, allocating approximately USD 183 million (3 trillion rupiah) to provide voluntary preventive checks including blood pressure, heart risk, eye, and mental health tests for Indonesians on their birthdays, aiming to screen up to 100 million people across 20,000+ health centers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.