Asia Pacific Healthcare Advertising Market

Market Size in USD Million

CAGR :

%

USD

7,394.70 Million

USD

11,348.55 Million

2021

2029

USD

7,394.70 Million

USD

11,348.55 Million

2021

2029

| 2022 –2029 | |

| USD 7,394.70 Million | |

| USD 11,348.55 Million | |

|

|

|

|

Asia-Pacific Healthcare Advertising Market Analysis and Size

Mobile advertising in the healthcare industry is contributing to the growth in Asia-Pacific region and the healthcare marketing industries within the region. The factors such as the increasing penetration of smartphones and the growing use of social media have encouraged healthcare companies to target customers through mobile advertising within the region. For instance, the Indian government launched national telemedicine service or eSanjeevni OPD on 2020, which completed about 1.3 crore teleconsultations for enhancing remote patient monitoring services for long-term care services. This factor is also expect to boost the growth of the market over the forecasted period

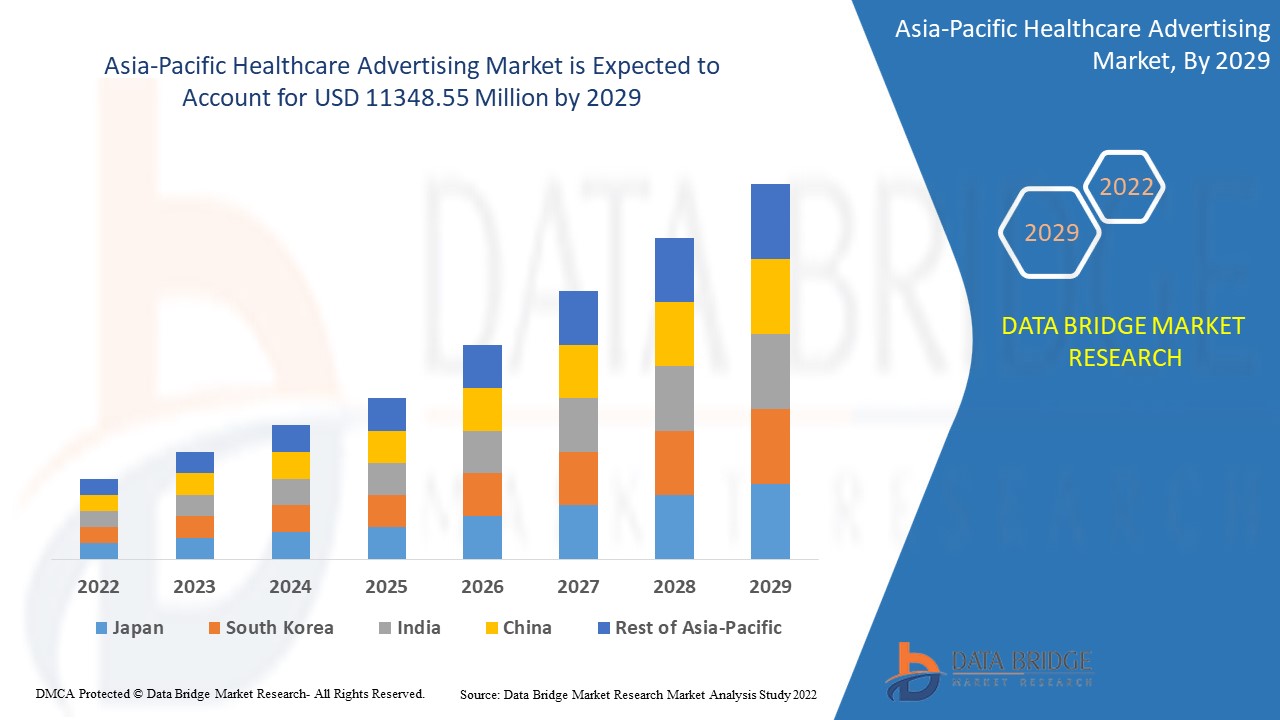

Asia-Pacific healthcare advertising market was valued at USD 7394.70 million in 2021 and is expected to reach USD 11348.55 million by 2029, registering a CAGR of 5.50% during the forecast period of 2022-2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Asia-Pacific Healthcare Advertising Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Traditional, Online, Public Relations, Unique Branding and Awareness, Internal Marketing, Employer Marketing, Physician Referrals, Others), Form of Engagement (Healthcare Facility, Digital, In Home/Person, Others), Technology (Telemedicine, Artificial Intelligence, Personal Data Tracking, Others), Approach (Detailing (Health Professionals), Direct-to-Customer Advertising), Format (Display, Search, Video), Applications (Pharmaceutical Advertising, Biopharmaceuticals, Vaccines, Over-The-Counter Drugs, Prescription Medicines, Medical Device and Equipment, Biotech Companies, Medical Insurance, Fitness and Diet Products, Hygiene Products, Others) |

|

Countries Covered |

Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific |

|

Market Players Covered |

PUBLICIS GROUPE (France), Syneos Health. (U.S.), CDM New York (U.S.), Havas Health & You (U.S.), FCB Global, Inc. (U.S.), McCann (U.S.), VMLY&R (U.S.), Wunderman Thompson. (U.S.), AbelsonTaylor, Inc. (U.S.), TBWA\WorldHealth (U.S.), Thrive Health (Canada), Levo Healthcare Consulting, LLC (U.S.), Dobies Health Marketing (U.S.), Sagefrog Marketing Group, LLC (U.S.), Communications Strategy Group. (U.S.), Distill Health (U.S.), Trajectory Inc. (U.S.) |

|

Market Opportunities |

|

Market Definition

Establishing advertising communication and strategies enhances patients care by creating an open healthcare line between doctors and healthcare advertisers is referred as healthcare advertising. These services include mobile advertising, website advertising and other platforms.

Asia-Pacific Healthcare Advertising Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Increasing Demand Of Home Care Health Services

The growing senior population, which is more susceptible to various ailments and the rise of home care health services all contribute to market growth. The advertisements regarding various ailments and their effects on people have resulted in an increased demand for healthcare services across the region. Furthermore, governments' growing adoption of big data analytics to initiate advertisements within the region is also fueling the market's growth. The rising disposable income of the population will further positively impact the market's growth rate during the forecast period.

Opportunities

- Adoption of Various Advanced Technologies

The increased adoption of various advanced technologies is further estimated to generate lucrative opportunities for the market, which will further expand the market’s growth rate in the future. Advanced technologies such as artificial intelligence, machine learning, and big data analytics are being used for advertisements. These technologies are rising worldwide due to their expanding use across numerous healthcare industries.

Restraints/Challenges

- High Implementation Costs

Advertising and other related activities such as printed advertising, require or demands a significant financial investment. Therefore, the high costs as well as the investments required, are further expected to obstruct market growth over the forecast period.

- Stringent Regulations

The stringent regulations made by the government regarding healthcare advertising such as in the welfare of retargeting patients and sharing their personal information, may hinder the growth of the market.

This healthcare advertising market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the healthcare advertising market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Covid-19 Impact on Healthcare Advertising Market

The rapid COVID-19 proliferation has a negative impact on the market. Firm closures and strict lockdowns have badly impacted nearly every industry in the world. Companies in the healthcare advertising system market have developed effective solutions in a matter of months as a result of the abrupt shift in working conditions. In the market for smart advertising, the largest media companies are increasingly investing in OTT services which are opening up value-grab opportunities for healthcare advertising regarding increased awareness for various ailments, including the pandemic. Moreover, increased ad spends on several clients, including TV viewership, can better meet customer expectations and are the resulting factors of the quickly evolving technology trends in the market.

Recent Developments

- In 2020, an Asia-Pacific based digital-based healthcare provider, Medi-assist healthcare services ltd. Launched its first TV campaign, “Apka Healthcare Buddy” this advertisement broadcasted on television and other platforms and focuses on the utilization of digital healthcare services and emergency situations.

Asia-Pacific Healthcare Advertising Market Scope

The healthcare advertising market is segmented on the basis of type, form of engagement, technology, approach, format and applications. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Traditional

- Television

- Radio

- Others

- Online

- Online advertising

- Search engine optimization

- Mobile first website

- Public Relations

- Publicity

- Sponsorships

- Community events

- Others

- Unique Branding and Awareness

- Internal Marketing

- Employer Marketing

- Meeting and presentation

- Business targets

- Others

- Physician Referrals

- Others

Form of Engagement

- Healthcare Facility

- Digital

- In Home/Person

- Others

Technology

- Telemedicine

- Artificial Intelligence

- Personal Data Tracking

- Others

Approach

- Detailing (Health Professionals)

- Direct-to-Customer Advertising

Format

- Display

- Search

- Video

Applications

- Pharmaceutical Advertising

- Biopharmaceuticals

- Vaccines

- Over-The-Counter Drugs

- Prescription Medicines

- Medical Device and Equipment

- Biotech Companies

- Medical Insurance

- Fitness and Diet Products

- Hygiene Products

- Others

Healthcare Advertising Market Regional Analysis/Insights

The healthcare advertising market is analyzed and market size insights and trends are provided by type, form of engagement, technology, approach, format, applications as referenced above.

The countries covered in the healthcare advertising market report are China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC).

China dominates the healthcare advertising market because of the growing implementation of digital channels for advertising if several healthcare products are specific to the region's geriatric population. Moreover, increasing awareness among the increasing population regarding the medical insurance is also the factor boosting growth of the market within the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Healthcare Advertising Market Share Analysis

The healthcare advertising market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to healthcare advertising market.

Some of the major players operating in the healthcare advertising market are

- PUBLICIS GROUPE (France)

- Syneos Health. (U.S.)

- CDM New York (U.S.)

- Havas Health & You (U.S.)

- FCB Global, Inc. (U.S.)

- McCann (U.S.)

- VMLY&R (U.S.)

- Wunderman Thompson. (U.S.)

- AbelsonTaylor, Inc. (U.S.)

- TBWA\WorldHealth (U.S.)

- Thrive Health (Canada)

- Levo Healthcare Consulting, LLC (U.S.)

- Dobies Health Marketing (U.S.)

- Sagefrog Marketing Group, LLC (U.S.)

- Communications Strategy Group. (U.S.)

- Distill Health (U.S.)

- Trajectory Inc. (U.S.)

Research Methodology: Asia-Pacific Healthcare Advertising Market

Data collection and base year analysis is done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. Also market share analysis and key trend analysis are the major success factors in the market report. To know more please request an analyst call or can drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Factbook) or can assist you in creating presentations from the data sets available in the report.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC HEALTHCARE ADVERTISING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE ASIA-PACIFIC HEALTHCARE ADVERTISING MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 ASIA-PACIFIC HEALTHCARE ADVERTISING MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 COST ANALYSIS BREAKDOWN

8 TECHNONLOGY ROADMAP

9 INNOVATION TRACKER AND STRATEGIC ANALYSIS

9.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

9.1.1 JOINT VENTURES

9.1.2 MERGERS AND ACQUISITIONS

9.1.3 LICENSING AND PARTNERSHIP

9.1.4 TECHNOLOGY COLLABORATIONS

9.1.5 STRATEGIC DIVESTMENTS

9.2 NUMBER OF PRODUCTS IN DEVELOPMENT

9.3 STAGE OF DEVELOPMENT

9.4 TIMELINES AND MILESTONES

9.5 INNOVATION STRATEGIES AND METHODOLOGIES

9.6 RISK ASSESSMENT AND MITIGATION

9.7 FUTURE OUTLOOK

10 REGULATORY COMPLIANCE

10.1 REGULATORY AUTHORITIES

10.2 REGULATORY SUBMISSIONS

10.3 INTERNATIONAL HARMONIZATION

10.4 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

10.5 REGULATORY CHALLENGES AND STRATEGIES

11 REIMBURSEMENT FRAMEWORK

12 OPPUTUNITY MAP ANALYSIS

13 VALUE CHAIN ANALYSIS

14 HEALTHCARE ECONOMY

14.1 HEALTHCARE EXPENDITURE

14.2 CAPITAL EXPENDITURE

14.3 CAPEX TRENDS

14.4 CAPEX ALLOCATION

14.5 FUNDING SOURCES

14.6 INDUSTRY BENCHMARKS

14.7 GDP RATION IN OVERALL GDP

14.8 HEALTHCARE SYSTEM STRUCTURE

14.9 GOVERNMENT POLICIES

14.1 ECONOMIC DEVELOPMENT

15 ASIA-PACIFIC HEALTHCARE ADVERTISING MARKET, BY TYPE

15.1 OVERVIEW

15.2 TRADITIONAL

15.2.1 TELEVISION

15.2.2 RADIO

15.2.3 PRINT/INSERTS

15.2.3.1. NEWSPAPER

15.2.3.2. MAGAZINES

15.2.3.3. MEDICAL JOURNALS

15.2.4 DIRECT MAIL

15.2.5 OUTDOOR

15.3 PUBLIC RELATION

15.3.1 SPONSORSHIP

15.3.2 PUBLICITY AND PROMOTIONS

15.3.3 MEDIA COLLABORATION

15.3.4 COMMUNITY EVENTS

15.3.5 SHOWS AND EXHIBITIONS

15.3.6 INTERVIEWS AND APPEARANCE

15.3.7 OTHERS

15.4 ONLINE/DIGITAL MARKETING

15.4.1 SOCIAL MEDIA

15.4.1.1. FACEBOOK ADVERTISISNG

15.4.1.2. INSTAGRAM ADVERTISING

15.4.1.3. LINKEDIN

15.4.1.4. YOUTUBE

15.4.1.5. OTHERS

15.4.2 ONLINE ADVERTISING

15.4.3 MOBILE MARKETING

15.4.3.1. SMARTPHONES

15.4.3.2. TABLETS

15.4.3.3. OTHERS

15.4.4 SEARCH ENGINE OPTIMIZATION (SEO)

15.4.4.1. BRAND VISIBILITY

15.4.4.2. MOBILE AND VOICE SEARCH OPTIMIZATION

15.4.4.3. CONTENT ANALYSIS

15.4.4.4. GENERIC SEARCH

15.4.4.5. GEOFENCING / LOCATION BASED TRACKING

15.4.4.6. OTHERS

15.4.5 REPUTATION MANAGEMENT

15.4.6 PAID SEARCH

15.4.6.1. COST-PER-MILE (CPM)

15.4.6.2. PAY-PER-CLICK (PPC)

15.4.7 VIRTUAL REALITY MARKETING

15.4.8 EMAIL MARKETING

15.4.8.1. COMMUNICATION MANAGEMENT/MARKETING EMAIL

15.4.8.2. INFORMATION DELIVERY

15.4.8.3. PATIENTS ENGAGEMENT/ PATIENT HEALTH EMAILS

15.4.8.4. TRANSACTIONAL HEALTHCARE EMAILS (APPOINTMENTS/BILLING & INSURANCE)

15.4.9 CONTENT MARKETING

15.4.9.1. BLOGS

15.4.9.2. VIDEOS

15.4.9.3. E-BOOKS

15.4.9.4. INFOGRAPHICS

15.4.10 INSTANT MESSAGE MARKETING

15.4.11 AFFILIATE MARKETING

15.5 EMPLOYER MARKETING

15.5.1 BUSINESS TARGETS

15.5.2 MEETING AND PRESENTATION

15.5.3 SALES SYSTEM

15.5.4 OTHERS

15.6 UNIQUE BRANDING AND AWARENESS

15.6.1 PRODUCTS AND SERVICES

15.6.2 PRICING

15.6.3 PACKAGING

15.6.4 OTHERS

15.7 PHYSICIANS REFFERRALS

15.7.1 TEXTS AND E MAIL

15.7.2 REPORTS

15.7.3 CASE STUDIES

15.7.4 COLLATERAL

15.7.5 CME EVENTS

15.7.6 PRACTICE REP

15.8 INTERNAL MARKETING

15.8.1 TEXTS AND E MAIL

15.8.2 EVENTS

15.8.3 TESTIMONIALS AND REVIEW

15.8.4 TRACKING SYSTEM

15.8.5 PATIENT EXPERIENCE

15.8.6 PHONE COMMUNICATION

15.8.7 INTERNAL SIGNAGE

15.8.8 OTHERS

15.9 OTHERS

16 ASIA-PACIFIC HEALTHCARE ADVERTISING MARKET, BY TECHNOLOGY

16.1 OVERVIEW

16.2 PERSONAL DATA TRACKING

16.3 TELEMEDICINE

16.4 ARTIFICIAL INTELLIGENCE

16.5 OTHERS

17 ASIA-PACIFIC HEALTHCARE ADVERTISING MARKET, BY APPROACH

17.1 OVERVIEW

17.2 HEALTHCARE PROFESSIONAL (DETAILING)

17.2.1 BY TECHNOLOGY

17.2.1.1. PERSONAL DATA TRACKING

17.2.1.2. TELEMEDICINE

17.2.1.3. ARTIFICIAL INTELLIGENCE

17.2.1.4. OTHERS

17.3 DIRECT TO CONSUMER (DTC)

17.3.1 BY TECHNOLOGY

17.3.1.1. PERSONAL DATA TRACKING

17.3.1.2. TELEMEDICINE

17.3.1.3. ARTIFICIAL INTELLIGENCE

17.3.1.4. OTHERS

18 ASIA-PACIFIC HEALTHCARE ADVERTISING MARKET, BY MODE

18.1 OVERVIEW

18.2 ONLINE

18.2.1 SEARCH ADVERTISING

18.2.2 DISPLAY ADVERTISING

18.2.3 VIDEO ADVERTISING

18.2.4 NATIVE ADVERTISING

18.3 OFFLINE

18.3.1 HEALTHCARE FACILITY

18.3.2 IN-HOME/ IN PERSON

19 ASIA-PACIFIC HEALTHCARE ADVERTISING MARKET, BY PLATFORM

19.1 OVERVIEW

19.2 MOBILE

19.2.1 IPHONES

19.2.2 ANDROID

19.3 DESKTOP

19.4 LAPTOP

20 ASIA-PACIFIC HEALTHCARE ADVERTISING MARKET, BY APPLICATION

20.1 OVERVIEW

20.2 PHARMACEUTICALS

20.2.1 BY TYPE

20.2.1.1. TRADITIONAL

20.2.1.2. PUBLIC RELATION

20.2.1.3. ONLINE/DIGITAL MARKETING

20.2.1.4. EMPLOYER MARKETING

20.2.1.5. UNIQUE BRANDING AND AWARENESS

20.2.1.6. PHYSICIANS REFFERRALS

20.2.1.7. INTERNAL MARKETING

20.2.1.8. OTHERS

20.3 BIOPHARMACEUTICALS

20.3.1 BY TYPE

20.3.1.1. TRADITIONAL

20.3.1.2. PUBLIC RELATION

20.3.1.3. ONLINE/DIGITAL MARKETING

20.3.1.4. EMPLOYER MARKETING

20.3.1.5. UNIQUE BRANDING AND AWARENESS

20.3.1.6. PHYSICIANS REFFERRALS

20.3.1.7. INTERNAL MARKETING

20.3.1.8. OTHERS

20.4 MEDICAL DEVICES AND EQUIPMENTS

20.4.1 BY TYPE

20.4.1.1. TRADITIONAL

20.4.1.2. PUBLIC RELATION

20.4.1.3. ONLINE/DIGITAL MARKETING

20.4.1.4. EMPLOYER MARKETING

20.4.1.5. UNIQUE BRANDING AND AWARENESS

20.4.1.6. PHYSICIANS REFFERRALS

20.4.1.7. INTERNAL MARKETING

20.4.1.8. OTHERS

20.5 WEARABLES

20.5.1 BY TYPE

20.5.1.1. TRADITIONAL

20.5.1.2. PUBLIC RELATION

20.5.1.3. ONLINE/DIGITAL MARKETING

20.5.1.4. EMPLOYER MARKETING

20.5.1.5. UNIQUE BRANDING AND AWARENESS

20.5.1.6. PHYSICIANS REFFERRALS

20.5.1.7. INTERNAL MARKETING

20.5.1.8. OTHERS

20.6 VACCINE

20.6.1 BY TYPE

20.6.1.1. TRADITIONAL

20.6.1.2. PUBLIC RELATION

20.6.1.3. ONLINE/DIGITAL MARKETING

20.6.1.4. EMPLOYER MARKETING

20.6.1.5. UNIQUE BRANDING AND AWARENESS

20.6.1.6. PHYSICIANS REFFERRALS

20.6.1.7. INTERNAL MARKETING

20.6.1.8. OTHERS

20.7 MEDICAL INSURANCE

20.7.1 BY TYPE

20.7.1.1. TRADITIONAL

20.7.1.2. PUBLIC RELATION

20.7.1.3. ONLINE/DIGITAL MARKETING

20.7.1.4. EMPLOYER MARKETING

20.7.1.5. UNIQUE BRANDING AND AWARENESS

20.7.1.6. PHYSICIANS REFFERRALS

20.7.1.7. INTERNAL MARKETING

20.7.1.8. OTHERS

20.8 OVER-THE-COUNTER DRUGS

20.8.1 BY TYPE

20.8.1.1. TRADITIONAL

20.8.1.2. PUBLIC RELATION

20.8.1.3. ONLINE/DIGITAL MARKETING

20.8.1.4. EMPLOYER MARKETING

20.8.1.5. UNIQUE BRANDING AND AWARENESS

20.8.1.6. PHYSICIANS REFFERRALS

20.8.1.7. INTERNAL MARKETING

20.8.1.8. OTHERS

20.9 FITNESS AND DIET

20.9.1 BY TYPE

20.9.1.1. TRADITIONAL

20.9.1.2. PUBLIC RELATION

20.9.1.3. ONLINE/DIGITAL MARKETING

20.9.1.4. EMPLOYER MARKETING

20.9.1.5. UNIQUE BRANDING AND AWARENESS

20.9.1.6. PHYSICIANS REFFERRALS

20.9.1.7. INTERNAL MARKETING

20.9.1.8. OTHERS

20.1 HEALTH AND HYGIENE

20.10.1 BY TYPE

20.10.1.1. TRADITIONAL

20.10.1.2. PUBLIC RELATION

20.10.1.3. ONLINE/DIGITAL MARKETING

20.10.1.4. EMPLOYER MARKETING

20.10.1.5. UNIQUE BRANDING AND AWARENESS

20.10.1.6. PHYSICIANS REFFERRALS

20.10.1.7. INTERNAL MARKETING

20.10.1.8. OTHERS

20.11 BIOTECH COMPANIES

20.11.1 BY TYPE

20.11.1.1. TRADITIONAL

20.11.1.2. PUBLIC RELATION

20.11.1.3. ONLINE/DIGITAL MARKETING

20.11.1.4. EMPLOYER MARKETING

20.11.1.5. UNIQUE BRANDING AND AWARENESS

20.11.1.6. PHYSICIANS REFFERRALS

20.11.1.7. INTERNAL MARKETING

20.11.1.8. OTHERS

20.12 CORRECTIVE LENSES AND GLASSES

20.12.1 BY TYPE

20.12.1.1. TRADITIONAL

20.12.1.2. PUBLIC RELATION

20.12.1.3. ONLINE/DIGITAL MARKETING

20.12.1.4. EMPLOYER MARKETING

20.12.1.5. UNIQUE BRANDING AND AWARENESS

20.12.1.6. PHYSICIANS REFFERRALS

20.12.1.7. INTERNAL MARKETING

20.12.1.8. OTHERS

20.13 MEDICAL SPAS

20.13.1 BY TYPE

20.13.1.1. TRADITIONAL

20.13.1.2. PUBLIC RELATION

20.13.1.3. ONLINE/DIGITAL MARKETING

20.13.1.4. EMPLOYER MARKETING

20.13.1.5. UNIQUE BRANDING AND AWARENESS

20.13.1.6. PHYSICIANS REFFERRALS

20.13.1.7. INTERNAL MARKETING

20.13.1.8. OTHERS

20.14 SENIOR HOME CARE SERVICES

20.14.1 BY TYPE

20.14.1.1. TRADITIONAL

20.14.1.2. PUBLIC RELATION

20.14.1.3. ONLINE/DIGITAL MARKETING

20.14.1.4. EMPLOYER MARKETING

20.14.1.5. UNIQUE BRANDING AND AWARENESS

20.14.1.6. PHYSICIANS REFFERRALS

20.14.1.7. INTERNAL MARKETING

20.14.1.8. OTHERS

20.15 HOSPITALS AND CLINICS

20.15.1 BY TYPE

20.15.1.1. TRADITIONAL

20.15.1.2. PUBLIC RELATION

20.15.1.3. ONLINE/DIGITAL MARKETING

20.15.1.4. EMPLOYER MARKETING

20.15.1.5. UNIQUE BRANDING AND AWARENESS

20.15.1.6. PHYSICIANS REFFERRALS

20.15.1.7. INTERNAL MARKETING

20.15.1.8. OTHERS

20.16 OTHERS

21 ASIA-PACIFIC HEALTHCARE ADVERTISING MARKET, BY COUNTRY

ASIA-PACIFIC HEALTHCARE ADVERTISING MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

21.1 ASIA-PACIFIC

21.1.1.1. CHINA

21.1.1.2. JAPAN

21.1.1.3. SOUTH KOREA

21.1.1.4. INDIA

21.1.1.5. SINGAPORE

21.1.1.6. AUSTRALIA

21.1.1.7. MALAYSIA

21.1.1.8. PHILIPPINES

21.1.1.9. THAILAND

21.1.1.10. INDONESIA

21.1.1.11. REST OF ASIA-PACIFIC

21.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

22 ASIA-PACIFIC HEALTHCARE ADVERTISING MARKET, COMPANY LANDSCAPE

22.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

22.2 MERGERS & ACQUISITIONS

22.3 NEW PRODUCT DEVELOPMENT AND APPROVALS

22.4 EXPANSIONS

22.5 REGULATORY CHANGES

22.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

23 ASIA-PACIFIC HEALTHCARE ADVERTISING MARKET, SWOT & DBMR ANALYSIS

24 ASIA-PACIFIC HEALTHCARE ADVERTISING MARKET, COMPANY PROFILE

24.1 SYNEOS HEALTH COMMUNICATIONS

24.1.1 COMPANY SNAPSHOT

24.1.2 REVENUE ANALYSIS

24.1.3 PRODUCT PORTFOLIO

24.1.4 RECENT DEVELOPMENTS

24.2 JOHNSON & JOHNSON SERVICES, INC.

24.2.1 COMPANY SNAPSHOT

24.2.2 REVENUE ANALYSIS

24.2.3 PRODUCT PORTFOLIO

24.2.4 RECENT DEVELOPMENTS

24.3 PFIZER

24.3.1 COMPANY SNAPSHOT

24.3.2 REVENUE ANALYSIS

24.3.3 PRODUCT PORTFOLIO

24.3.4 RECENT DEVELOPMENTS

24.4 MCCANN HEALTH

24.4.1 COMPANY SNAPSHOT

24.4.2 REVENUE ANALYSIS

24.4.3 PRODUCT PORTFOLIO

24.4.4 RECENT DEVELOPMENTS

24.5 HAVAS LYNX GROUP (HAVAS HEALTH GLOBAL NETWORK)

24.5.1 COMPANY SNAPSHOT

24.5.2 REVENUE ANALYSIS

24.5.3 PRODUCT PORTFOLIO

24.5.4 RECENT DEVELOPMENTS

24.6 MEDITWITT

24.6.1 COMPANY SNAPSHOT

24.6.2 REVENUE ANALYSIS

24.6.3 PRODUCT PORTFOLIO

24.6.4 RECENT DEVELOPMENTS

24.7 CHEERS CREATIVES

24.7.1 COMPANY SNAPSHOT

24.7.2 REVENUE ANALYSIS

24.7.3 PRODUCT PORTFOLIO

24.7.4 RECENT DEVELOPMENTS

24.8 RAYADCOM

24.8.1 COMPANY SNAPSHOT

24.8.2 REVENUE ANALYSIS

24.8.3 PRODUCT PORTFOLIO

24.8.4 RECENT DEVELOPMENTS

24.9 OPEN HEALTH

24.9.1 COMPANY SNAPSHOT

24.9.2 REVENUE ANALYSIS

24.9.3 PRODUCT PORTFOLIO

24.9.4 RECENT DEVELOPMENTS

24.1 PMLIVE

24.10.1 COMPANY SNAPSHOT

24.10.2 REVENUE ANALYSIS

24.10.3 PRODUCT PORTFOLIO

24.10.4 RECENT DEVELOPMENTS

24.11 HEALTHCARE DMS

24.11.1 COMPANY SNAPSHOT

24.11.2 REVENUE ANALYSIS

24.11.3 PRODUCT PORTFOLIO

24.11.4 RECENT DEVELOPMENTS

24.12 DOCSTOCK

24.12.1 COMPANY SNAPSHOT

24.12.2 REVENUE ANALYSIS

24.12.3 PRODUCT PORTFOLIO

24.12.4 RECENT DEVELOPMENTS

24.13 COSMETICS CHINA AGENCY

24.13.1 COMPANY SNAPSHOT

24.13.2 REVENUE ANALYSIS

24.13.3 PRODUCT PORTFOLIO

24.13.4 RECENT DEVELOPMENTS

24.14 OXYGEN TWO POINT ZERO COMPANY LIMITED

24.14.1 COMPANY SNAPSHOT

24.14.2 REVENUE ANALYSIS

24.14.3 PRODUCT PORTFOLIO

24.14.4 RECENT DEVELOPMENTS

24.15 IPG HEALTH

24.15.1 COMPANY SNAPSHOT

24.15.2 REVENUE ANALYSIS

24.15.3 PRODUCT PORTFOLIO

24.15.4 RECENT DEVELOPMENTS

24.16 THE BLOC

24.16.1 COMPANY SNAPSHOT

24.16.2 REVENUE ANALYSIS

24.16.3 PRODUCT PORTFOLIO

24.16.4 RECENT DEVELOPMENTS

24.17 PHARMA INTERNATIONAL, INC.

24.17.1 COMPANY SNAPSHOT

24.17.2 REVENUE ANALYSIS

24.17.3 PRODUCT PORTFOLIO

24.17.4 RECENT DEVELOPMENTS

24.18 SPLICE MARKETING

24.18.1 COMPANY SNAPSHOT

24.18.2 REVENUE ANALYSIS

24.18.3 PRODUCT PORTFOLIO

24.18.4 RECENT DEVELOPMENTS

24.19 WELLMARK

24.19.1 COMPANY SNAPSHOT

24.19.2 REVENUE ANALYSIS

24.19.3 PRODUCT PORTFOLIO

24.19.4 RECENT DEVELOPMENTS

24.2 VIVIDUS

24.20.1 COMPANY SNAPSHOT

24.20.2 REVENUE ANALYSIS

24.20.3 PRODUCT PORTFOLIO

24.20.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

25 CONCLUSION

26 QUESTIONNAIRE

27 RELATED REPORTS

28 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.