Asia Pacific High Integrity Pressure Protection System Hipps Market

Market Size in USD million

CAGR :

%

USD

155.67 million

USD

333.70 million

2022

2030

USD

155.67 million

USD

333.70 million

2022

2030

| 2023 –2030 | |

| USD 155.67 million | |

| USD 333.70 million | |

|

|

|

Asia-Pacific High-Integrity Pressure Protection System (HIPPS) Market Analysis and Size

A rise in accidents at industrial facilities has led to the government enacting more regulations to ensure their safety and security. The high integrity pressure protection system (HIPPS) is a safety instrument that shuts off the source and captures overpressure to lessen overpressure caused by risky processes, particularly in the oil and gas industries. Furthermore, the oil and gas industry accounts for the largest share of the HIPPS market in 2021 owing to the growing transportation sector, increased energy demand, and rising drilling activities.

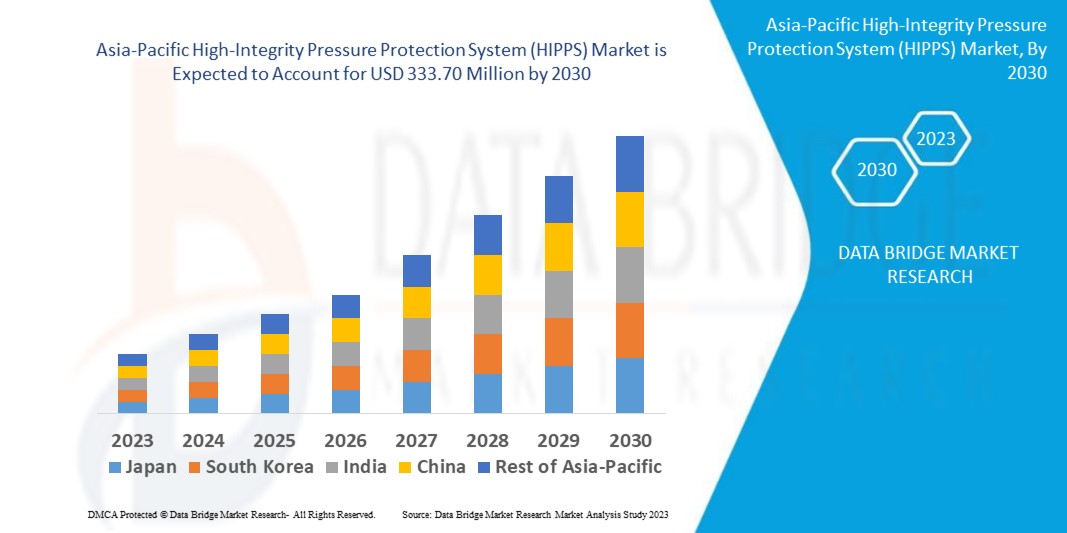

Data Bridge Market Research analyses that the high-integrity pressure protection system (HIPPS) market, valued at USD 155.67 million in 2022, will reach USD 333.70 million by 2030, growing at a CAGR of 10% during the forecast period of 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Asia-Pacific High-Integrity Pressure Protection System (HIPPS) Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Electronics HIPPS, Hydraulic/Mechanical HIPPS, Others), Offerings (Components, Services), Industry (Power Generation, Water and Wastewater, Food and Beverages, Pharmaceutical, Metal and Mining, Paper and Pulp, Others), End User (Upstream, Mid-Stream, Downstream, Oil and Gas, Chemicals) |

|

Countries Covered |

China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC) |

|

Market Players Covered |

Honeywell International, Inc. (U.S.), Siemens AG (Germany), Wagner Group Gmbh (Germany), Hochiki Corporation (Japan), Halma Plc. (U.K.), Apollo Fire Detectors Limited (U.K.), Robert Bosch Gmbh (Germany), EUROFYRE LTD. (U.K.), Detectomat Systems GmbH (Germany), Ceasefire Industries Pvt. Ltd (India), Johnson Controls (Ireland), Napco Security technologies, Inc. (U.S.), Zeta Alarm ltd (U.K.), Libelium Comunicaciones Distribuidas S.L (Spain), Emerson Electric Co. (U.S.), Yokogawa Electric Corporation (Japan), HIMA (Germany), Rockwell Automation (U.S.), Schneider Electric (France), Baker Hughes Company (U.S.) |

|

Market Opportunities |

|

Market Definition

High-integrity pressure protection systems (HIPPS) are a collection of parts that are specifically designed to isolate the source of dangerously high pressure rather than relieve the excess flow. According to the established ANSI/ISA and IEC standards, HIPPS is a trustworthy, safe, and independent instrumented system engineered with high integrity to either match or surpass the performance of conventional safety valves in terms of safety.

High-Integrity Pressure Protection System (HIPPS) Market Dynamics

Drivers

- Increasing need for reducing flaring and venting to protect the environment

Gas flaring occurs at oil and gas production facilities during scheduled maintenance, equipment repairs, or shutdown times. This technology enables controlled pressure releases in a gas collection and processing systems. In industrial facilities, this is used to maintain pressures and ensure secure and effective operations. However, gas flaring has lately grown to be a significant issue in businesses that support pressurized systems and guarantee safe and efficient operations, which aids in the expansion of the HIPPS market.

- Rising accidents at plants create a market surge

In order to safeguard gas production facilities or pipelines, mechanical relief devices are frequently required when connecting new gas production sources to a gas plant facility. For new production sources connected to existing pipelines, the protection of the pipeline against potential overpressure that could result in the release of hydrocarbons into the atmosphere or the unintentional burning of these hydrocarbons via a flare system is required. The government has passed more regulations to ensure the safety and security of industrial facilities as a result of an increase in accidents at these locations.

Opportunities

- Development of petrochemical and refinery facilities

The industrial sector, including the oil, gas, and chemical industries, consistently grows in developing and developed countries. The petrochemical industry currently provides 12% of the world's feedstock needs, which is anticipated to increase as demand for fertilizers, plastics, and other goods rises. Numerous projects that are slated for the transportation and production of oil and gas will increase the demand for high-integrity pressure protection systems.

- Lower transportation and storage costs lead expansion

Using a high-integrity pressure protection system lowers the cost of transportation and storage due to the decrease in volume and weight. Furthermore, the need for installing relief devices to stop atmospheric gas emissions has been eliminated because of HIPPS's ability to handle transportation and storage costs. Since they avoid overpressure in vessels further down the line, high-integrity pressure protection systems are gaining popularity.

Restraints/Challenges

- The high cost of HIPPS limits the market expansion

HIPPS components, maintenance, installation, and repair are significant financial burdens for businesses. While large corporations can control these costs, small and medium-sized businesses may find it difficult. Logic solvers, field initiators, pressure transmitters, and valves and actuators are the four final elements of the high-integrity pressure protection system (HIPPS), which assembles safety items. Businesses face high costs associated with HIPPS components, construction, maintenance, and repairs, which limits market growth.

- Designing complexities of HIPPS have limited the market expansion

When numerous applications are in charge of a system, it can be challenging for system designers to develop safety systems that follow functional safety requirements. Engineers must create better-performing systems that prevent hardware and software failure because recurring issues like these can hurt the market.

This high-integrity pressure protection system (HIPPS) market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the high-integrity pressure protection system (HIPPS) market contact Data Bridge Market Research for an analyst brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Developments

- In 2021, the first complete valve assemblies meeting safety level (SIL) 3 AS PER HE IEC 61508 standard of the international electro technical commission were introduced by Emerson.

- In 2021, A SOLUTION TO IDENTIFY WHETHER ACTUAL OPERTAING PERFORMANCE MEETS SAFETY DESIGN TARGETS, Yokogawa introduced its new Electric Exauquantum safety function monitoring (SFM) SOFTWARE. The updated software complies with IEC 61511 standards. It adds several new features to assist SFM users in identifying potential safety issues, optimizing maintenance tasks, and enhancing overall safety solution design.

- In 2020, MOGAS Industries Inc. purchased Watson Valve, a service valves manufacturer headquartered in the United States, to offer coating and pressure control-related repairs and services. More than 3,400 valves are installed by Watson Valve every year in the mining, chemical, and oil & gas industries worldwide.

- In 2020, ASCO 158 Gas Valve Series and 159 Motorized Actuator were introduced by Emerson. New valves were created by ASCO specifically for burner applications in boilers. A new combustion safety shutdown valve option that enhances flow and control while boosting safety and dependability is now available to end users and distributors.

Asia-Pacific High-Integrity Pressure Protection System (HIPPS) Market Scope

The high-integrity pressure protection system (HIPPS) market is segmented on the basis of type, offerings, industry, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Electronics HIPPS

- Hydraulic/Mechanical HIPPS

- Others

Offerings

- Services

- Testing, Inspection and Certification

- Maintenance

- Training and Consolation

- Components

- Field Initiators

- Logic Solver

- Solid State

- Others

- Final Element

- Actuators

- Valve

Industry

- Power Generation

- Water and Wastewater

- Food and Beverages

- Pharmaceutical

- Metal and Mining

- Paper and Pulp

- Others

End User

- Upstream

- Downstream

- Mid-Stream

- Oil and Gas

- Chemicals

High-Integrity Pressure Protection System (HIPPS) Market Regional Analysis/Insights

The high-integrity pressure protection system (HIPPS) market is analysed and market size insights and trends are provided by country, type, offerings, industry and end user as referenced above.

The countries covered in the high-integrity pressure protection system (HIPPS) market report are China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC)

China dominates the market and will continue to flourish its trend of dominance during the forecast period in Asia-Pacific region. The major factors attributable to the region’s dominance are the strict government regulations to reduce environmental carbon emissions. Additionally, the manufacturer in this region is very focused on replacing the conventional HIPPS system with an electronic HIPPS system.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and High-Integrity Pressure Protection System (HIPPS) Market Share Analysis

The high-integrity pressure protection system (HIPPS) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to high-integrity pressure protection system market.

Some of the major players operating in the high-integrity pressure protection system (HIPPS) market are:

- Honeywell International, Inc. (U.S.)

- Siemens AG (Germany)

- Wagner Group Gmbh (Germany)

- Hochiki Corporation (Japan)

- Halma Plc. (U.K.)

- Apollo Fire Detectors Limited (U.K.)

- Robert Bosch Gmbh (Germany)

- EUROFYRE LTD. (U.K.)

- Detectomat Systems GmbH (Germany)

- Ceasefire Industries Pvt. Ltd (India)

- Johnson Controls (Ireland)

- Napco Security Technologies, Inc. (U.S.)

- Zeta Alarm ltd (U.K.)

- Libelium Comunicaciones Distribuidas S.L. (Spain)

- Emerson Electric Co. (U.S.)

- Yokogawa Electric Corporation (Japan)

- HIMA (Germany)

- Rockwell Automation (U.S.)

- Schneider Electric (France)

- Baker Hughes Company (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific High Integrity Pressure Protection System Hipps Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific High Integrity Pressure Protection System Hipps Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific High Integrity Pressure Protection System Hipps Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.