Asia Pacific High Purity Anhydrous Hydrogen Chloride Hcl Gas Market

Market Size in USD Billion

CAGR :

%

USD

1.20 Billion

USD

1.92 Billion

2025

2033

USD

1.20 Billion

USD

1.92 Billion

2025

2033

| 2026 –2033 | |

| USD 1.20 Billion | |

| USD 1.92 Billion | |

|

|

|

|

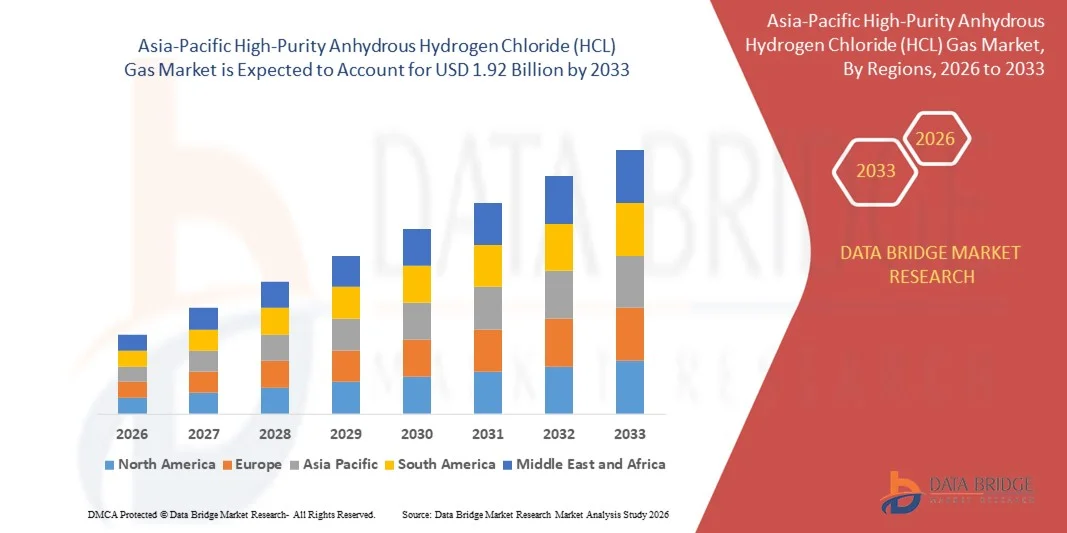

Asia-Pacific High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Size

- The Asia-Pacific High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market size was valued at USD 1.20 billion in 2025 and is projected to reach USD 1.92 billion by 2033, growing at a CAGR of 6.06% during the forecast period.

- The market expansion is primarily driven by increasing industrial applications of HCL gas in semiconductor manufacturing, metal processing, and chemical synthesis, coupled with advancements in high-purity gas production and distribution technologies.

- Additionally, escalating demand for high-purity chemicals in electronics, pharmaceuticals, and specialty chemicals is fueling the adoption of anhydrous HCL gas, while stringent quality and safety standards are encouraging investments in reliable and efficient gas supply solutions, collectively propelling market growth.

Asia-Pacific High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Analysis

- High-purity anhydrous hydrogen chloride (HCL) gas, used across semiconductor manufacturing, metal processing, and chemical synthesis, is increasingly critical in industrial and laboratory applications due to its high reactivity, precision, and essential role in producing advanced materials and chemicals.

- The growing demand for high-purity HCL gas is primarily driven by rapid industrialization, increasing electronics manufacturing, and expanding pharmaceutical and specialty chemical sectors requiring ultra-pure chemical inputs.

- China dominated the Asia-Pacific High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market with the largest revenue share of 34% in 2025, supported by early adoption of advanced chemical processing technologies, well-established industrial infrastructure, and the presence of major gas manufacturers, with the U.S. leading in high-purity gas consumption for semiconductor and pharmaceutical production.

- India is expected to be the fastest-growing region in the Asia-Pacific High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market during the forecast period due to expanding electronics manufacturing, growing chemical processing industries, and rising urbanization and industrial investment.

- The electronics grade segment dominated the market with a revenue share of 57.6% in 2025, driven by its critical use in semiconductor fabrication, printed circuit boards, and precision electronic components where ultra-high purity is essential.

Report Scope and Asia-Pacific High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Segmentation

|

Attributes |

High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

• Air Liquide (France) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Trends

Enhanced Efficiency Through Advanced Purification and Automation

- A significant and accelerating trend in the Asia-Pacific High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market is the growing adoption of advanced purification technologies and automated gas handling systems. These innovations are significantly improving the efficiency, safety, and reliability of HCL gas supply for industrial, pharmaceutical, and semiconductor applications.

- For instance, high-precision purification units from companies such as Air Liquide and Linde enable ultra-high purity HCL gas production, minimizing impurities that could affect semiconductor fabrication or specialty chemical processes. Similarly, automated cylinder and pipeline delivery systems from Matheson Tri-Gas and Taiyo Nippon Sanso ensure precise, continuous, and safe gas distribution.

- Integration of automation and real-time monitoring systems allows predictive maintenance, leak detection, and optimized usage of HCL gas. Some advanced systems from Air Products & Chemicals utilize AI-based analytics to monitor gas quality and usage patterns, alerting operators to anomalies and reducing the risk of contamination or process interruptions.

- The seamless integration of high-purity HCL gas systems with industrial control platforms and chemical production lines facilitates centralized management of gas supply, pressure regulation, and safety protocols. Through a single interface, manufacturers can control multiple gas streams, monitor purity levels, and ensure compliance with stringent industrial standards.

- This trend towards more intelligent, automated, and high-precision gas handling is fundamentally transforming expectations for chemical processing and semiconductor industries. Consequently, companies such as Praxair India and Shanghai Hua Rui Gas are developing automated HCL gas solutions with features such as real-time purity monitoring, remote control, and predictive maintenance alerts.

- The demand for high-purity HCL gas with advanced purification and automation capabilities is growing rapidly across electronics, pharmaceuticals, and specialty chemical sectors, as manufacturers increasingly prioritize process reliability, safety, and efficiency.

Asia-Pacific High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Dynamics

Driver

Growing Demand Due to Expanding Industrial Applications and Technological Advancements

- The increasing demand for high-purity anhydrous HCL gas across semiconductor manufacturing, chemical synthesis, and specialty chemical industries, coupled with rapid technological advancements in production and purification processes, is a significant driver for market growth.

- For instance, in early 2025, Air Liquide announced the expansion of its high-purity HCL gas production capabilities for the Asia-Pacific region, including the integration of advanced purification and automated delivery systems. Such strategic initiatives by key players are expected to propel the market during the forecast period.

- As industries increasingly require ultra-pure chemicals for critical processes, HCL gas offers precise reactivity, consistent quality, and reliable supply, making it an indispensable input in electronics, pharmaceuticals, and metal processing.

- Furthermore, the growth of advanced manufacturing technologies and the adoption of automated chemical production lines are increasing the reliance on high-purity HCL gas, as it ensures product consistency and compliance with stringent industry standards.

- The convenience of ready-to-use, cylinder- or pipeline-based HCL gas delivery, along with the ability to monitor purity and flow remotely through digital control systems, are key factors driving adoption in both industrial and laboratory settings. Rising industrialization, urbanization, and growing electronics manufacturing in Asia-Pacific further amplify demand.

Restraint/Challenge

Safety Risks, Regulatory Compliance, and Handling Costs

- Safety concerns associated with the highly corrosive and reactive nature of anhydrous HCL gas present significant challenges to broader market penetration. Strict handling and storage protocols are required to prevent accidents, which can increase operational complexity and costs.

- For instance, improper storage or leakage incidents in chemical plants have underscored the critical need for robust safety measures, making some smaller manufacturers hesitant to adopt high-purity HCL gas without adequate infrastructure.

- Adhering to strict regulatory standards, including environmental and occupational safety regulations, is essential for building operational credibility. Companies such as Linde, Matheson Tri-Gas, and Taiyo Nippon Sanso emphasize safety training, automated monitoring, and compliant delivery systems to mitigate these risks.

- Additionally, the relatively high cost of ultra-pure HCL gas compared to standard-grade alternatives can be a barrier for price-sensitive users, particularly in developing regions or smaller chemical operations. While bulk supply contracts and automated handling solutions are improving cost efficiency, the perceived premium remains a challenge.

- Overcoming these challenges through advanced safety protocols, staff training, automated monitoring, and more cost-effective delivery solutions will be vital for sustained market growth across the Asia-Pacific region.

Asia-Pacific High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Scope

The market is segmented on market based on product, application

- By Product

On the basis of product, the Asia-Pacific High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market is segmented into electronics grade and chemical grade. The electronics grade segment dominated the market with a revenue share of 57.6% in 2025, driven by its critical use in semiconductor fabrication, printed circuit boards, and precision electronic components where ultra-high purity is essential. Electronics grade HCL ensures minimal contamination, enabling consistent performance and reliability in sensitive processes.

The chemical grade segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, owing to rising demand in chemical synthesis, metal processing, and industrial manufacturing applications. Chemical grade HCL gas is increasingly adopted due to expanding industrialization across Asia-Pacific, where cost-effective but high-quality gas is essential for large-scale chemical processes. The segment growth is further supported by technological advancements in gas production and automated delivery systems, ensuring safe and efficient usage across various industries.

- By Application

On the basis of application, the Asia-Pacific High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market is segmented into electronics and electricals, pharmaceuticals, chemicals, and others. The electronics and electricals segment dominated the market with a revenue share of 52.3% in 2025, driven by increasing semiconductor manufacturing, printed circuit board production, and advanced electronic device fabrication across Asia-Pacific. High-purity HCL is critical in these processes to maintain stringent quality standards and reduce defects.

The pharmaceuticals segment is expected to witness the fastest CAGR of 19.7% from 2026 to 2033, fueled by rising demand for ultra-pure chemicals in drug synthesis, active pharmaceutical ingredient production, and laboratory research. Growth is further accelerated by stringent regulatory requirements and the expanding healthcare sector in emerging economies. The chemicals segment also contributes significantly due to industrial applications in metal etching, water treatment, and chemical synthesis, while other niche applications such as research laboratories and specialty materials continue to gain traction.

Asia-Pacific High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Regional Analysis

- China dominated the Asia-Pacific High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market with the largest revenue share of 34% in 2025, driven by the early adoption of advanced industrial processes and a well-established chemical and electronics manufacturing infrastructure.

- Companies in the region benefit from high demand for ultra-pure chemicals in semiconductor fabrication, specialty chemicals, and pharmaceutical production, where precision, quality, and reliability are critical.

- This widespread adoption is further supported by robust industrial safety standards, advanced supply chain infrastructure, and the presence of leading HCL gas manufacturers, establishing high-purity anhydrous HCL gas as the preferred solution for electronics, chemical, and pharmaceutical industries in North America.

China HCL Gas Market Insight

The China high-purity anhydrous HCL gas market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid industrialization, expansion of semiconductor and electronics manufacturing, and strong growth in pharmaceutical and specialty chemical industries. The country’s push toward smart manufacturing, chemical process automation, and high-quality production standards is fueling demand for ultra-pure HCL gas. Additionally, the presence of domestic HCL gas manufacturers and competitive pricing enhances accessibility, while government initiatives supporting industrial modernization further accelerate market adoption.

Japan HCL Gas Market Insight

The Japan high-purity anhydrous HCL gas market is gaining momentum due to the country’s advanced electronics, semiconductor, and pharmaceutical sectors, along with high-quality manufacturing standards. Adoption is driven by the need for ultra-pure chemicals in sensitive production processes, coupled with automated gas handling systems and integration into precision manufacturing lines. Japan’s emphasis on innovation, technological advancement, and stringent quality control measures is further supporting growth in both industrial and laboratory applications.

India HCL Gas Market Insight

The India high-purity anhydrous HCL gas market is poised for rapid growth at the fastest CAGR in the Asia-Pacific region during the forecast period, supported by expanding electronics manufacturing, pharmaceutical production, and specialty chemical industries. Increasing urbanization, industrialization, and investments in high-purity chemical production infrastructure are driving demand. Additionally, government initiatives promoting “Make in India” and modernization of chemical manufacturing facilities are enhancing market accessibility and encouraging adoption across industrial sectors.

South Korea HCL Gas Market Insight

The South Korea high-purity anhydrous HCL gas market is expected to expand significantly due to the country’s strong semiconductor and electronics manufacturing base, advanced pharmaceutical sector, and emphasis on high-quality chemical processes. Adoption is fueled by the need for ultra-pure chemicals in precision production, increasing automation in chemical and electronic plants, and strict industrial quality standards. Additionally, South Korea’s focus on technological innovation and export-oriented manufacturing supports continued growth in high-purity HCL gas demand.

Asia-Pacific High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Share

The High-Purity Anhydrous Hydrogen Chloride (HCL) Gas industry is primarily led by well-established companies, including:

• Air Liquide (France)

• Linde plc (Germany)

• Taiyo Nippon Sanso Corporation (Japan)

• Air Products & Chemicals (U.S.)

• Matheson Tri-Gas (U.S.)

• Praxair India Pvt. Ltd. (India)

• Shanghai Hua Rui Gas (China)

• Sinochem Group (China)

• Nippon Chemical Industrial Co., Ltd. (Japan)

• Guangdong Huate Gas (China)

• Hangzhou Wahaha Group (China)

• Showa Denko K.K. (Japan)

• Messer Group GmbH (Germany)

• Gulf Cryo (U.A.E.)

• Chongqing Tianyuan Gas Co., Ltd. (China)

• Beijing Jinhai Special Gas Co., Ltd. (China)

• Hubei Yuancheng Technology Co., Ltd. (China)

• OCI Company Ltd. (South Korea)

• Samyoung Chemical Co., Ltd. (South Korea)

• SK Gas Co., Ltd. (South Korea)

What are the Recent Developments in Asia-Pacific High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market?

- In April 2024, Air Liquide, a global leader in industrial gases, expanded its high-purity anhydrous HCL gas production facilities in Shanghai, China, aimed at supporting semiconductor, electronics, and pharmaceutical manufacturing. This initiative underscores the company’s commitment to delivering ultra-pure HCL solutions tailored to the high-precision requirements of the regional market. By leveraging its global expertise and advanced purification technologies, Air Liquide is addressing growing industrial demand while reinforcing its position in the rapidly expanding Asia-Pacific HCL gas market.

- In March 2024, Linde plc commissioned a state-of-the-art automated HCL gas delivery and monitoring system in Bengaluru, India, designed for electronics and chemical manufacturing facilities. The system ensures precise purity levels, continuous supply, and enhanced safety, highlighting Linde’s dedication to providing reliable, high-quality chemical solutions for critical industrial applications across the Asia-Pacific region.

- In March 2024, Taiyo Nippon Sanso Corporation successfully deployed a high-purity HCL gas pipeline system as part of the Seoul Advanced Electronics Cluster Project in South Korea. The initiative enhances industrial efficiency and supports large-scale semiconductor and specialty chemical production, demonstrating the company’s commitment to enabling advanced manufacturing processes and sustainable chemical supply chains.

- In February 2024, Matheson Tri-Gas announced a strategic partnership with leading pharmaceutical manufacturers in Tokyo, Japan, to supply ultra-high-purity HCL gas for drug synthesis and active pharmaceutical ingredient production. This collaboration ensures stringent quality compliance, process reliability, and operational efficiency, reflecting Matheson’s focus on innovation and industry-specific chemical solutions in the Asia-Pacific region.

- In January 2024, Air Products & Chemicals inaugurated a new electronics-grade HCL gas production facility in Hyderabad, India, equipped with advanced purification and automated delivery systems. The facility enables manufacturers to access ultra-pure HCL gas with precise control over purity levels, reinforcing Air Products’ commitment to supporting high-tech industries and strengthening its leadership in the Asia-Pacific high-purity HCL gas market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific High Purity Anhydrous Hydrogen Chloride Hcl Gas Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific High Purity Anhydrous Hydrogen Chloride Hcl Gas Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific High Purity Anhydrous Hydrogen Chloride Hcl Gas Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.