Asia Pacific Hop Water Market

Market Size in USD Million

CAGR :

%

USD

17.06 Million

USD

45.59 Million

2025

2033

USD

17.06 Million

USD

45.59 Million

2025

2033

| 2026 –2033 | |

| USD 17.06 Million | |

| USD 45.59 Million | |

|

|

|

|

Asia-Pacific Hop Water Market Size

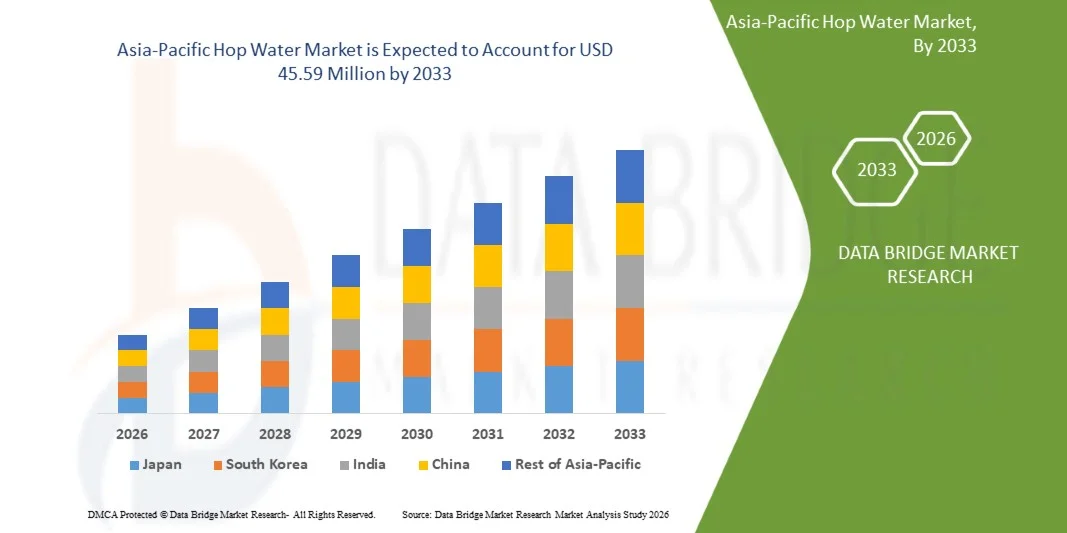

- The Asia-Pacific Hop Water Market was valued at USD 17.06 million in 2025 and is expected to reach USD 45.59 million by 2033 at a CAGR of 13.5% during the forecast period

- The Asia-Pacific Hop Water Market is primarily influenced by the rising consumer preference for alcohol-free, clean-label beverages, supported by increasing health awareness, moderation trends, and demand for functional alternatives to traditional carbonated and alcoholic drinks across the region.

- Market expansion is further supported by the growth of premium and craft beverage segments, wider availability through organized retail and e-commerce channels, evolving regulatory clarity around non-alcoholic beverages, and continuous product innovation focused on natural ingredients, flavor variety, and sustainable packaging solutions.

Asia-Pacific Hop Water Market Analysis

- Hop Water is becoming increasingly relevant across Asia-Pacific as consumer preferences continue to shift toward alcohol-free, low-calorie, and functional beverage alternatives. The accelerating adoption of health-focused lifestyles, moderation trends, and clean-label consumption has heightened demand for hop-infused sparkling beverages that deliver flavor complexity without alcohol, sugar, or artificial additives, supporting broader acceptance across mainstream and premium beverage channels.

- The product segment is expected to dominate the Asia-Pacific Hop Water Market, driven by growing demand for naturally flavored, zero-alcohol beverages that align with wellness, hydration, and mindful consumption trends. Its appeal across multiple consumer groups—including health-conscious adults, fitness enthusiasts, and sober-curious consumers—combined with flexible flavor innovation and clean ingredient positioning, makes hop water a preferred choice within the evolving non-alcoholic beverage landscape.

- Rising consumption of alcohol-free beverages, high urbanization levels, and a well-developed retail and foodservice ecosystem across major Asia-Pacific an economies are driving sustained demand for hop water products. Strong presence across supermarkets, specialty health stores, cafés, and e-commerce platforms is supporting greater product visibility, while premium positioning and functional beverage trends are enhancing consumer trial and repeat purchases.

- Additionally, increasing regulatory focus on sugar reduction, transparent labeling, and sustainable packaging continues to influence market dynamics across Asia-Pacific . Beverage producers are progressively adopting recyclable cans, minimal-ingredient formulations, and environmentally responsible sourcing practices to align with regional sustainability goals and evolving consumer expectations around ethical and health-driven consumption.

- China is expected to dominate the Asia-Pacific Hop Water Market with the largest market share of 24.89% in 2026 and is also projected to register the highest CAGR of 14.6% during the forecast period. This dominance is supported by the country’s strong non-alcoholic beverage culture, high consumer awareness of functional drinks, expanding craft and wellness beverage segments, and widespread availability through organized retail and specialty distribution channels.

- In 2026, the Classic segment is expected to dominate the market with a market share of 57.18%, growing at a CAGR of 12.9% during the forecast period of 2026 to 2033 in the Asia-Pacific Hop Water Market, driven by increasing demand for refreshing, low-calorie, alcohol-free beverages that offer flavor differentiation and align with long-term health, wellness, and moderation trends.

Report Scope and Asia-Pacific Hop Water Market Segmentation

|

Attributes |

Asia-Pacific Hop Water Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Hop Water Market Trends

“Advancements in Product Innovation, Distribution Channels, and Consumer Adoption”

- One prominent trend in the Asia-Pacific Hop Water Market is the accelerated launch of innovative hop water beverages, expanded distribution networks, and premium flavor variants to enhance product appeal, increase market reach, and cater to diverse consumer segments across fitness, wellness, culinary, and non-alcoholic beverage categories.

- The market is witnessing rising demand for flavored, lightly carbonated, and functional hop water products, driven by their ability to meet health-conscious consumption trends, support moderation lifestyles, and provide alternatives to traditional carbonated and alcoholic drinks. This shift is particularly strong in urban centers, specialty retail outlets, online grocery platforms, and premium hospitality channels where variety, convenience, and quality are key drivers of consumer choice.

- For instance, in 2025, several Asia-Pacific an beverage brands and craft breweries expanded their hop water portfolios with new flavor-infused, low-calorie variants and extended distribution through e-commerce platforms and retail chains. Similarly, producers increasingly introduced limited-edition and seasonal offerings to attract millennial and Gen Z consumers seeking novel, functional, and wellness-oriented beverage experiences.

- Industry participants are incorporating innovations such as natural flavor extraction, low-sugar formulations, recyclable packaging solutions, and cold-chain logistics enhancements to address growing consumer expectations for freshness, quality, and sustainability. At the same time, eco-friendly initiatives and sustainable sourcing practices are strengthening brand positioning while aligning with Asia-Pacific an regulations and consumer demand for ethical and environmentally responsible products.

- As sectors such as health and wellness beverages, functional drinks, and non-alcoholic craft beverages continue to expand, demand for differentiated, convenient, and premium hop water offerings is intensifying. Market players are also aligning with labeling requirements, quality standards, and consumer education programs by adopting transparent ingredient disclosure, improving packaging functionality, and investing in marketing campaigns to strengthen their competitive positioning in the evolving Asia-Pacific beverage landscape.

Asia-Pacific Hop Water Market Dynamics

Driver

““Rising Stakeholder Expectations for Seamless Product Experience and Beverage Innovation”

- In recent years, the Asia-Pacific Hop Water Market has undergone a significant transformation, with stakeholders expecting more than just a beverage option; they increasingly demand premium flavors, functional benefits, sustainable packaging, and an overall consumer experience that reflects quality, transparency, and wellness alignment. As consumption volumes and retail interactions continue to rise across supermarkets, specialty stores, e-commerce platforms, and hospitality channels, minimizing product inconsistency while improving Hop Water availability and freshness has become a strategic priority for manufacturers. This convergence of expectations—premium quality, operational efficiency, and eco-conscious packaging—is fueling sustained growth in the Asia-Pacific Hop Water Market. Hop Water is no longer viewed as a niche beverage, but as a critical enabler of brand trust, consumer engagement, and long-term market expansion.

- Rising expectations for innovative flavors, functional benefits, and high-quality beverage experience are acting as key drivers for the Asia-Pacific Hop Water Market. As consumers demand refreshing, naturally flavored, low-calorie, and alcohol-free alternatives, producers are increasingly investing in new formulations, flavor-infused variants, eco-friendly packaging, and scalable distribution channels. This shift is accelerating the adoption of advanced production processes, cold-chain logistics, sustainable packaging solutions, and real-time market feedback tools that improve product consistency, availability, and consumer satisfaction. As expectations continue to rise across Asia-Pacific an markets, Hop Water innovation is becoming a competitive differentiator, driving continuous product development and expanding demand for specialized, premium hop water offerings.

Restraint/Challenge

“Volatility in Raw Material Costs and Production Expenses”

- Volatility in raw material costs, including hops, natural flavor extracts, carbonated water, and packaging materials, continues to pose a key challenge for the Asia-Pacific Hop Water Market. The cost of producing flavored hop water, maintaining consistent carbonation levels, and ensuring sustainable packaging fluctuates due to changing agricultural yields, supplier pricing strategies, logistics expenses, and regulatory compliance requirements. These unpredictable cost structures increase total production and distribution expenses for breweries, beverage producers, and specialty brands—particularly small and mid-sized enterprises limiting their ability to scale production or consistently invest in premium formulations and eco-friendly solutions. Similar to how global beverage producers must maintain quality while managing ingredient costs, Asia-Pacific an Hop Water manufacturers face pressure to deliver reliable, high-quality products while navigating cost volatility across raw materials and production inputs.

- The impact of cost volatility extends across multiple channels, including retail, hospitality, e-commerce, and on-premise outlets, where product consistency, freshness, and brand reputation are mission-critical. Sudden increases in ingredient, packaging, or logistics costs can strain budgets, delay product launches, and disrupt marketing and distribution timelines. Addressing these challenges through strategic supplier partnerships, flexible production models, batch optimization, and cost-efficient logistics is essential for maintaining competitiveness. By adopting scalable production processes, leveraging local sourcing, and optimizing supply chain efficiency, Asia-Pacific Hop Water stakeholders can better manage cost volatility while ensuring consistent, high-quality, and sustainable hop water offerings across connected consumer markets.

Asia-Pacific Hop Water Market Scope

The global Asia-Pacific Hop Water Market is segmented into eight notable segments based on the product type, flavor, carbonation level, packaging, price, application, end user, distribution channel.

• By Product type

On the basis of product type, the Global Asia-Pacific Hop Water Market is segmented into Classic and Blended.

In 2026, the Classic segment is expected to dominate the Asia-Pacific Hop Water Market, accounting for the highest share of 59.10%, reflecting its widespread adoption across retail, e-commerce, hospitality, and wellness channels. This dominance is primarily driven by the extensive availability of traditional hop water formulations, consumer familiarity, and preference for clean-label, naturally flavored beverages. Classic hop water offers a balanced flavor profile and low-calorie composition that appeals to a broad spectrum of consumers, from health-conscious adults to fitness enthusiasts, ensuring strong repeat purchases and brand loyalty across Asia-Pacific. Its compatibility with multiple distribution channels—including supermarkets, specialty stores, cafés, and online platforms—makes it the preferred choice for beverage producers targeting large-scale adoption and sustained market presence.

Furthermore, the strong market position of the Blended segment is reinforced by its innovative flavor combinations, functional benefits, and premium positioning, which align well with the evolving tastes and wellness preferences of Asia-Pacific an consumers. The Blended segment enables producers to differentiate their offerings, introduce limited-edition and seasonal variants, and capture niche markets seeking novel, functional, or flavored hop water options. As consumer interest in alcohol-free, low-sugar, and functional beverages continues to grow across Asia-Pacific, demand for both Classic and Blended hop water products is expected to remain robust, supported by product innovation, sustainable packaging initiatives, and expanded retail and online distribution networks.

• By Flavor

On the basis of flavor, the Global Asia-Pacific Hop Water Market is segmented into With Flavor and Without Flavor

In 2026, the With Flavor segment is expected to dominate the Asia-Pacific Hop Water Market, accounting for the highest share of 71.13%, reflecting its widespread adoption across retail, e-commerce, hospitality, and wellness channels. This dominance is primarily driven by the growing consumer preference for flavored hop water beverages, including natural fruit infusions, botanical blends, and functional variants that offer unique taste experiences. With Flavor hop water appeals to health-conscious adults, fitness enthusiasts, and millennials seeking refreshing, low-calorie, and alcohol-free alternatives, making it the preferred choice for beverage producers targeting repeat purchases and broad consumer engagement. Its versatility across multiple distribution channels—supermarkets, specialty stores, cafés, and online platforms enhances availability and strengthens brand visibility across Asia-Pacific.

Furthermore, the strong market position of the Without Flavor segment is reinforced by its cost efficiency, clean-label positioning, and simplicity, which align well with the operational priorities of producers seeking to offer a reliable, no-frills hop water option that satisfies core consumer demand. The Without Flavor segment provides a consistent base product for retailers, cafés, and hospitality providers, while enabling scalability and ease of inventory management. As consumer interest in functional, low-calorie, and alcohol-free beverages continues to grow across Asia-Pacific an markets, demand for both With Flavor and Without Flavor hop water products is expected to remain robust, supported by product innovation, sustainable packaging initiatives, and expanding distribution networks.

• By Carbonation Level

On the basis of carbonation level, the Global Asia-Pacific Hop Water Market is segmented into Low Carbonated, Medium Carbonated, and Highly Carbonated

In 2026, the Low Carbonated segment is expected to dominate the Asia-Pacific Hop Water Market, accounting for the highest share of 46.56%, reflecting its widespread adoption across retail, e-commerce, hospitality, and wellness channels. This dominance is primarily driven by consumer preference for lightly carbonated beverages that provide a smooth, refreshing taste without overpowering fizziness, appealing to health-conscious adults, fitness enthusiasts, and alcohol-free beverage consumers. Low Carbonated hop water ensures better flavor balance, improved hydration experience, and easier pairing with meals or mixers, making it the preferred choice for producers targeting broad consumer acceptance across Asia-Pacific. Its compatibility with multiple packaging formats—cans, bottles, and kegs—further strengthens its presence across supermarkets, specialty stores, cafés, and online platforms.

Furthermore, the strong market position of the Medium Carbonated segment is reinforced by its moderate fizziness and versatility, which align well with evolving consumer preferences for sparkling, refreshing beverages that offer more pronounced effervescence while remaining suitable for everyday consumption. Medium Carbonated hop water enables producers to differentiate offerings through flavor variety, functional ingredients, and limited-edition products, supporting brand engagement and repeat purchases. As demand for alcohol-free, low-calorie, and functional beverages continues to grow across Asia-Pacific , consumption of both Low and Medium Carbonated hop water products is expected to remain robust, supported by ongoing product innovation, sustainable packaging initiatives, and expanded retail and e-commerce distribution networks.

By Packaging

On the basis of packaging, the Global Asia-Pacific Hop Water Market is segmented into Aluminium Cans, Bottles, Kegs/Barrels, Pouches, and Others

In 2026, the Aluminium Cans segment is projected to lead the Asia-Pacific Hop Water Market, capturing the largest share of 69.00%, indicating its sustained adoption across retail, e-commerce, hospitality, and wellness channels. This leadership is largely attributed to the segment’s ability to offer convenience, portability, and superior shelf-life, making it ideal for consumers seeking ready-to-drink, eco-friendly, and on-the-go hop water beverages. Aluminium cans also support branding and marketing flexibility, maintain beverage carbonation, and reduce environmental impact through recyclability, further strengthening their appeal among Asia-Pacific an consumers and producers.

Additionally, the Pouches segment maintains a strong market presence due to its cost efficiency, lightweight design, and suitability for flexible and scalable packaging solutions. This aligns well with the operational strategies of beverage producers and distributors aiming to optimize logistics, minimize material use, and enhance accessibility across diverse sales channels, including supermarkets, specialty stores, and online platforms. As demand for functional, alcohol-free, and low-calorie beverages continues to grow across Asia-Pacific, both Aluminium Cans and Pouches segments are expected to maintain robust adoption, supported by ongoing product innovation, sustainable packaging initiatives, and expanded distribution networks.

• By Price

On the basis of Price, the Global Asia-Pacific Hop Water Market is segmented into 2–5 USD, Up to 2 USD, 5–10 USD, Above 10 USD

In 2026, the 2–5 USD segment is expected to dominate the Asia-Pacific Hop Water Market, accounting for the highest share of 43.45%, reflecting its widespread adoption across retail, e-commerce, hospitality, and wellness channels. This dominance is primarily driven by the strong consumer preference for affordable, high-quality hop water beverages that offer value without compromising taste, natural ingredients, or functional benefits. Products in this price range provide accessible options for a broad consumer base, including health-conscious adults, fitness enthusiasts, and alcohol-free beverage seekers, supporting repeat purchases and sustained market growth across Asia-Pacific .

Furthermore, the strong market position of the 5–10 USD segment is reinforced by its premium positioning, innovative flavors, and functional enhancements, which align well with evolving consumer demands for specialty, craft, or limited-edition hop water products. This segment allows producers to differentiate offerings, introduce seasonal and flavored variants, and target niche markets willing to pay for added taste complexity, functional benefits, and sustainable packaging. As the Asia-Pacific Hop Water Market continues to expand, demand for both affordable and premium-priced beverages is expected to remain robust, supported by product innovation, brand differentiation, and growing distribution across retail, hospitality, and online channels.

By Application

On the basis of application, the Global Asia-Pacific Hop Water Market is segmented into Fitness & Wellness, Mixers for Alcoholic Beverages, Culinary Use, Medical & Therapeutic Use, and Others

In 2026, the Fitness & Wellness segment is expected to dominate the Asia-Pacific Hop Water Market, accounting for the highest share of 39.69% , reflecting its growing adoption across retail, e-commerce, gyms, wellness centers, and health-focused hospitality outlets. This dominance is primarily driven by consumer demand for low-calorie, functional, and alcohol-free beverages that support hydration, fitness routines, and overall wellness. Fitness & Wellness hop water products offer natural flavors, added functional benefits such as electrolytes or botanicals, and easy portability, making them the preferred choice for health-conscious consumers across Asia-Pacific . Their widespread availability in gyms, specialty stores, cafés, and online platforms further strengthens market penetration and brand visibility.

Furthermore, the strong market position of the Mixers for Alcoholic Beverages segment is reinforced by its versatility and convenience, aligning well with evolving consumer preferences for non-alcoholic alternatives in cocktail preparation, home bars, and hospitality settings. This segment allows producers to target both functional beverage consumers and mixology enthusiasts, supporting brand differentiation, product innovation, and seasonal or limited-edition launches. As the Asia-Pacific Hop Water Market continues to expand, demand for both Fitness & Wellness and Mixers for Alcoholic Beverages hop water products is expected to remain robust, driven by growing health awareness, product variety, and distribution across retail, hospitality, and online channels.

By End User

On the basis of end user, the Global Asia-Pacific Hop Water Market is segmented into Household/Residential, Commercial, and Institutional

In 2026, the Household/Residential segment is expected to dominate the Asia-Pacific Hop Water Market, accounting for the highest share of 73.49%, reflecting its growing adoption across homes, retail, e-commerce, and wellness-focused outlets. This dominance is primarily driven by consumer demand for convenient, low-calorie, functional, and alcohol-free beverages that support daily hydration, wellness routines, and healthy lifestyles. Household/Residential hop water products offer natural flavors, functional benefits such as botanicals or electrolytes, and easy portability, making them the preferred choice for health-conscious consumers and families across Asia-Pacific . Their widespread availability in supermarkets, specialty stores, cafés, and online platforms further strengthens market penetration and brand recognition.

Furthermore, the strong market position of the Commercial/Institutional segment is reinforced by its versatility and suitability for bulk consumption, aligning well with evolving preferences in offices, gyms, hotels, restaurants, and hospitality outlets seeking ready-to-serve, non-alcoholic beverage options. This segment allows producers to cater to larger-scale consumption needs while supporting brand visibility, product variety, and seasonal or promotional campaigns. As the Asia-Pacific Hop Water Market continues to expand, demand for both Household/Residential and Commercial/Institutional hop water products is expected to remain robust, driven by growing health awareness, functional beverage trends, and broad distribution across retail, hospitality, and online channels.

By Distribution Channel

On the basis of distribution channel, the Global Asia-Pacific Hop Water Market is segmented into Store-Based and Non-Store Based

In 2026, the Store Based segment is expected to dominate the Asia-Pacific Hop Water Market, accounting for the highest share of 72.61%, reflecting its growing adoption across supermarkets, specialty stores, cafés, gyms, and wellness-focused outlets. This dominance is primarily driven by consumer preference for convenient, ready-to-drink, low-calorie, functional, and alcohol-free beverages that are easily accessible through physical retail channels. Store Based distribution ensures immediate product availability, enhances brand visibility, and supports repeat purchases, making it the preferred channel for producers targeting broad Asia-Pacific an consumer segments.

Furthermore, the strong market position of the Non-Store Based segment is reinforced by its versatility and suitability for e-commerce, direct-to-consumer subscriptions, online marketplaces, and corporate or hospitality delivery models. This segment allows producers to reach health-conscious consumers, fitness enthusiasts, and niche audiences who prefer the convenience of home delivery, personalized packs, or subscription-based options. As the Asia-Pacific Hop Water Market continues to expand, demand for both Store Based and Non-Store Based distribution channels is expected to remain robust, driven by growing health awareness, functional beverage trends, and increasing adoption of omnichannel strategies across retail and online platforms.

Asia-Pacific Hop Water Market Regional Analysis

China Asia-Pacific Hop Water Market Insight

China’s Asia-Pacific Hop Water Market is experiencing consistent growth, driven by strong consumer demand for functional, alcohol-free, and naturally flavored beverages, along with increasing adoption of wellness-focused products across retail, e-commerce, and hospitality channels. Rising health consciousness, fitness trends, and interest in low-calorie, premium non-alcoholic drinks are encouraging producers to expand their hop water portfolios with innovative flavors and functional variants. Furthermore, China’s rapidly developing retail and distribution infrastructure, combined with growing consumer awareness of sustainability and eco-friendly packaging, is positioning the country as one of the most dynamic and fast-evolving Asia-Pacific Hop Water Markets within the Asia-Pacific region.

Japan Asia-Pacific Hop Water Market Insight

Japan’s Asia-Pacific Hop Water Market is witnessing steady expansion, supported by a growing consumer preference for functional, flavored, and low-calorie beverages across both retail and on-premise channels. Increasing demand for non-alcoholic alternatives in cafés, gyms, restaurants, and online platforms is prompting producers to introduce innovative flavor combinations, seasonal offerings, and environmentally friendly packaging solutions. Additionally, strong investment in beverage branding, wellness-oriented marketing campaigns, and strategic distribution partnerships is enabling producers to scale product availability and reach new consumer segments, reinforcing Japan’s position as a key innovation-driven market within the Asia-Pacific hop water landscape.

India Asia-Pacific Hop Water Market Insight

India’s Asia-Pacific Hop Water Market is expanding steadily, supported by rising consumer interest in functional, low-calorie, and alcohol-free beverages, along with increasing demand for flavored and blended hop water variants. Rapid urbanization, improving disposable incomes, and the growth of café culture and wellness-focused lifestyles are driving adoption across specialty stores, supermarkets, and hospitality channels. Consumers’ growing focus on sustainable and recyclable packaging, combined with producer efforts in flavor innovation and targeted marketing, is enhancing product appeal, strengthening market penetration, and reinforcing India’s role as a significant Asia-Pacific market for premium and functional hop water products.

Australia Asia-Pacific Hop Water Market Insight

Australia’s Asia-Pacific Hop Water Market is gaining momentum, driven by a strong emphasis on healthy lifestyles, wellness beverages, and functional alcohol-free alternatives. Increasing consumer adoption across urban centers, cafés, gyms, and e-commerce platforms is creating opportunities for producers to expand their portfolios with both classic and flavored hop water offerings. Moreover, rising awareness of eco-friendly packaging, ongoing product innovation, and premium branding strategies are supporting scalable distribution and sustained market growth, positioning Australia as an emerging and high-potential market within the Asia-Pacific hop water landscape.

The Major Market Leaders Operating in the Market Are:

- HOP WTR (U.S.)

- Lagunitas Brewing Company (U.S.)

- Hoplark (U.S.)

- Athletic Brewing Company LLC (U.S.)

- Sierra Nevada Brewing Co. (U.S.)

- Founders Brewing Co. (U.S.)

- H2OPS Sparkling Hop Water (U.S.)

- Deschutes Brewery (U.S.)

- John I. Haas (U.S.)

- Abita Brewing Company (U.S.)

- Surly Brewery (U.S.)

- Pelican Brewing Company (U.S.)

- Fieldwork Brewing Co (U.S.)

- Griffin Claw Brewing Company (U.S.)

- Untitled Art (U.S.)

- Wooden Hill Brewing Company (U.S.)

- Dr Hops (U.S.)

- Denver Beer Co. (U.S.)

- Burlington Beer Company (U.S.)

Latest Developments in Asia-Pacific Hop Water

- In 2025, Cabin Brewing Company introduced its Quench Hop Water line of non‑alcoholic hop‑infused sparkling waters—including Super Hop Blend, NZ Hop Blend, Noble Hop Blend, and PNW Blend—expanding beyond traditional beer offerings to include refreshing hop water alternatives with zero alcohol, calories, and sugars.

- In November 2025, BrewDog Distilling Co.—the spirits arm of BrewDog—was announced as the official gin and vodka partner of Aberdeen Football Club in a multi‑year agreement that will run for the next three seasons. As part of the partnership, BrewDog is releasing limited‑edition bottles of LoneWolf Gin and Abstrakt Vodka branded for the club, with each year’s release forming part of a three‑bottle collectible series. These premium spirits, produced in Aberdeen, will be available through BrewDog’s online shop, local BrewDog bars, and the AFC Shop at Pittodrie Stadium, deepening BrewDog’s engagement with local fans and strengthening its presence in sports‑linked lifestyle branding.

- In November 2025, Wooden Hill Brewing Company updated its tap offerings including the returning Cahill Cream Ale, seasonal food specials, and continued festive Jingle Bar experiences as part of evolving taproom engagements for the holiday season

- On October 2025, Pelican Brewing Company — the iconic Oregon Coast brewery known for its award-winning beers and scenic coastal taprooms — opened a new taproom in Rockaway Beach, positioned just steps from the sand. The site marks Pelican’s fifth coastal location and offers a cozy, laid-back setting where visitors can enjoy the brewery’s signature craft beers, light bites, and ocean views in a casual, community-centric atmosphere. This expansion continues Pelican’s investment in Oregon’s coastal towns, supports local tourism, and enhances access to its craft offerings along the Pacific shoreline.

- In October 2024, HOP WTR launched the “Up To No Good” brand campaign to celebrate the positive power of saying “No,” emphasizing its hop water’s no‑alcohol, no‑calories, no‑sugar, no‑gluten, and no‑GMOs positioning while engaging consumers in a bold lifestyle narrative.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC HOP WATER MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 TIMLINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.1.1 Capital Requirement (Moderate):

4.1.1.2 Product Knowledge (Low):

4.1.1.3 Technical Knowledge (Low to Moderate):

4.1.1.4 Customer Relations (High):

4.1.1.5 Access to Raw Materials & Technology (Low):

4.1.2 THREAT OF SUBSTITUTES

4.1.2.1 Cost (High):

4.1.2.2 Performance (Moderate):

4.1.2.3 Availability (High):

4.1.2.4 Brand & Marketing (High):

4.1.2.5 Durability / Health Profile (Moderate):

4.1.3 BARGAINING POWER OF BUYERS

4.1.3.1 Number of Buyers Relative to Suppliers (High for Retailers):

4.1.3.2 Product Differentiation (Moderate):

4.1.3.3 Threat of Forward Integration (Low):

4.1.3.4 Buyers' Volume (High):

4.1.4 BARGAINING POWER OF SUPPLIERS

4.1.4.1 Suppliers Concentration (Low for Inputs, Moderate for Co-Packers):

4.1.4.2 Buyers' Switching Cost to Other Suppliers (Low for Materials, Moderate for Co-Packers):

4.1.4.3 Threat of Backward Integration (Very Low):

4.1.5 COMPETITIVE RIVALRY

4.1.5.1 Industry Concentration (Currently Low, Moving Towards Consolidation):

4.1.5.2 Industry Growth Rate (High):

4.1.5.3 Product Differentiation (Moderate and Critical):

4.2 COMPANY SHARE ANALYSIS: IMPORT IN GCC

4.3 GCC IMPORT OUTLOOK

4.3.1 IMPORT STATISTICS USD THOUSAND AND THOUSAND LITRES, BY COUNTRY, 2018-2024, (USD THOUSAND) (THOUSAND LITRES)

4.4 INDUSTRY ECOSYSTEM ANALYSIS

4.4.1 PROMINENT COMPANIES

4.4.2 SMALL & MEDIUM SIZE COMPANIES

4.4.3 END USERS

4.5 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.5.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.5.2 PRODUCTS DEVELOPMENTS

4.5.3 STAGE OF DEVELOPMENT

4.5.3.1 Early Emergence and Category Formation

4.5.3.2 Growing Adoption but Uneven Sales Trajectory

4.5.3.3 Emerging but Still Nascent Within Non-Alcoholic Sector

4.5.3.4 Consumer Profile and Demand Signals

4.5.3.5 Market Structure & Competitive Dynamics

4.5.3.6 Structural Position in the Beverage Industry

4.5.3.7 Summary — Stage of Development

4.5.4 TIMELINES AND MILESTONES

4.5.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.5.6 RISK ASSESSMENT AND MITIGATION

4.5.7 FUTURE OUTLOOK

4.6 PRICING ANALYSIS

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.2 INDUSTRY RESPONSE

4.7.3 GOVERNMENT’S ROLE

4.8 ANALYST RECOMMENDATIONS

4.9 RAW MATERIAL COVERAGE – ASIA-PACIFIC HOP WATER MARKET

4.9.1 INTRODUCTION

4.9.2 CORE RAW MATERIALS USED IN HOP WATER PRODUCTION

4.9.3 NATURAL FLAVOR ENHANCERS AND BOTANICALS

4.9.4 RAW MATERIAL SOURCING AND SUPPLY CHAIN CONSIDERATIONS

4.9.5 CONCLUSION

4.1 BRAND OUTLOOK

4.10.1 H2OPS ORIGINAL & GRAPEFRUIT HOP WATER

4.10.1.1 Brand Positioning and Identity

4.10.1.2 Brand Communication and Consumer Perception

4.10.1.3 Packaging and Brand Evolution

4.10.2 HOP WTR (CLASSIC AND FLAVORED VARIANTS)

4.10.2.1 Brand Positioning and Functional Identity

4.10.2.2 Narrative and Lifestyle Communication

4.10.2.3 Visual Branding and Innovation

4.10.3 LAGUNITAS HOPPY REFRESHER

4.10.3.1 Brand Positioning and Heritage Leverage

4.10.3.2 Consumer Messaging and Experience

4.10.3.3 Packaging and Market Role

4.10.4 SIERRA NEVADA HOP SPLASH

4.10.4.1 Brand Positioning and Flavor Expression

4.10.4.2 Sensory-Driven Communication

4.10.4.3 Design and Innovation Outlook

4.10.5 HOPLARK SPARKLING HOP WATER

4.10.5.1 Premium Brand Positioning and Craft Focus

4.10.5.2 Educational Storytelling and Consumer Engagement

4.10.5.3 Packaging and Innovation Strategy

4.10.6 CONCLUSION

4.11 CONSUMER BUYING BEHAVIOUR

4.11.1 INTRODUCTION

4.11.2 HEALTH AND WELLNESS ORIENTATION

4.11.3 INFLUENCE OF TASTE SOPHISTICATION AND SENSORY EXPERIENCE

4.11.4 ROLE OF LIFESTYLE ALIGNMENT AND IDENTITY EXPRESSION

4.11.5 PRICE SENSITIVITY AND VALUE PERCEPTION

4.11.6 PACKAGING, LABELING, AND VISUAL APPEAL

4.11.7 DISTRIBUTION CHANNEL PREFERENCES AND ACCESSIBILITY

4.11.8 REPEAT PURCHASE DRIVERS AND BRAND LOYALTY

4.11.9 BARRIERS TO ADOPTION AND CONSUMER HESITATION

4.11.10 CONCLUSION

4.12 TECHNOLOGICAL ADVANCEMENTS IN THE ASIA-PACIFIC HOP WATER MARKET

4.12.1 INTRODUCTION

4.12.2 PRECISION FERMENTATION AND FLAVOR EXTRACTION TECHNOLOGIES

4.12.3 AUTOMATED PRODUCTION SYSTEMS AND DIGITAL PROCESS CONTROLS

4.12.4 PACKAGING INNOVATIONS AND SHELF STABILITY ENHANCEMENTS

4.12.5 QUALITY ASSURANCE THROUGH ANALYTICAL TECHNOLOGIES

4.12.6 DIGITAL MARKETING TECHNOLOGIES AND CONSUMER CO‑CREATION PLATFORMS

4.12.7 CONCLUSION

4.13 SUPPLY CHAIN ANALYSIS

4.13.1 OVERVIEW

4.13.2 LOGISTIC COST SCENARIO

4.13.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.13.4 CHALLENGES IN SUPPLY CHAIN MANAGEMENT

4.13.5 CONCLUSION

4.14 VALUE CHAIN ANALYSIS

4.14.1 RAW MATERIAL SOURCING

4.14.2 PRODUCTION AND MANUFACTURING

4.14.3 PACKAGING AND BRANDING

4.14.4 DISTRIBUTION AND LOGISTICS

4.14.5 MARKETING, SALES, AND CUSTOMER ENGAGEMENT

4.14.6 AFTER-SALES SERVICE AND FEEDBACK INTEGRATION

4.14.7 CONCLUSION

4.15 VENDOR SELECTION CRITERIA FOR BUSINESS ESTABLISHMENT IN DUBAI

4.15.1 RAW MATERIAL SOURCING PATTERNS

4.15.2 CURRENT PRODUCTION OUTLOOK

4.15.3 INDICATORS REQUIRED FOR SELECTION OF PRODUCTION UNIT LOCATIONS

4.15.4 GOVERNMENT SUPPORT

4.15.5 LIST OF KEY TECHNOLOGY AND ENGINEERING COMPANIES

4.15.5.1 Turnkey beverage-line and process-technology providers

4.15.5.2 Local machinery OEMs and engineering firms serving Dubai

4.15.5.3 Packaging, closures and labelling technology partners

4.15.6 LIST OF KEY DISTRIBUTORS

4.15.6.1 Whizz.ae

4.15.6.2 Noon

4.15.6.3 Amazon

4.15.6.4 The Non-Alcoholic Club (UAE)

4.15.6.5 Desertcart

4.15.6.6 Ubuy

4.15.6.7 Noble Alliance

5 REGULATION COVERAGE

5.1 PRODUCT CODES

5.2 CERTIFIED STANDARDS

5.3 SAFETY STANDARDS

5.3.1 MATERIAL HANDLING & STORAGE

5.3.2 TRANSPORT & PRECAUTIONS

5.3.3 HAZARD IDENTIFICATION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING CONSUMER DEMAND FOR LOW-CALORIE, SUGAR-FREE, AND NON-ALCOHOLIC BEVERAGES DRIVEN BY HEALTH AND WELLNESS TRENDS

6.1.2 GROWING POPULARITY OF CRAFT-INSPIRED AND FUNCTIONAL BEVERAGES, PARTICULARLY AMONG MILLENNIALS AND GEN Z CONSUMERS

6.1.3 INCREASING ADOPTION OF ALCOHOL ALTERNATIVES SUPPORTED BY THE SOBER-CURIOUS MOVEMENT AND LIFESTYLE SHIFTS

6.1.4 EXPANSION OF E-COMMERCE AND DIRECT-TO-CONSUMER CHANNELS, IMPROVING PRODUCT ACCESSIBILITY AND MARKET PENETRATION

6.2 RESTRAINTS

6.2.1 LIMITED CONSUMER AWARENESS OF HOP WATER COMPARED TO ESTABLISHED BEVERAGE CATEGORIES

6.2.2 SHELF-SPACE COMPETITION IN RETAIL ENVIRONMENTS DOMINATED BY ESTABLISHED BEVERAGE BRANDS

6.3 OPPORTUNITIES

6.3.1 PRODUCT INNOVATION USING BOTANICAL, ORGANIC, AND FUNCTIONAL INGREDIENT BLENDS TO ENHANCE DIFFERENTIATION.

6.3.2 EXPANSION INTO EMERGING MARKETS WITH RISING DEMAND FOR PREMIUM NON-ALCOHOLIC BEVERAGES

6.3.3 STRATEGIC PARTNERSHIPS WITH FITNESS, WELLNESS, AND HOSPITALITY SECTORS TO INCREASE CONSUMER AWARENESS AND TRIAL

6.4 CHALLENGES

6.4.1 COMPETITION FROM SUBSTITUTES SUCH AS SPARKLING WATER, KOMBUCHA, AND NON-ALCOHOLIC BEERS.

6.4.2 MANAGING LOGISTICS AND DISTRIBUTION COSTS, ESPECIALLY FOR DTC AND SUBSCRIPTION-BASED MODELS

7 ASIA-PACIFIC HOP WATER MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 ASIA-PACIFIC HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

7.2.1 CLASSIC

7.2.2 BLENDED

7.3 ASIA-PACIFIC HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (THOUSAND LITRES)

7.3.1 CLASSIC

7.3.2 BLENDED

7.4 ASIA-PACIFIC CLASSIC IN HOP WATER MARKET, BY REGION, 2018-2033

7.4.1 NORTH AMERICA

7.4.2 EUROPE

7.4.3 ASIA-PACIFIC

7.4.4 SOUTH AMERICA

7.4.5 MIDDLE EAST AND AFRICA

7.5 ASIA-PACIFIC BLENDED IN HOP WATER MARKET, BY REGION, 2018-2033

7.5.1 NORTH AMERICA

7.5.2 EUROPE

7.5.3 ASIA-PACIFIC

7.5.4 SOUTH AMERICA

7.5.5 MIDDLE EAST AND AFRICA

8 ASIA-PACIFIC HOP WATER MARKET, BY FLAVOR

8.1 OVERVIEW

8.2 ASIA-PACIFIC HOP WATER MARKET, BY FLAVOR, 2018-2033 (USD THOUSAND)

8.2.1 WITH FLAVOR

8.2.2 WITHOUT FLAVOR

8.3 ASIA-PACIFIC HOP WATER MARKET, BY FLAVOR, 2018-2033 (THOUSAND LITRES)

8.3.1 WITH FLAVOR

8.3.2 WITHOUT FLAVOR

8.4 ASIA-PACIFIC WITH FLAVOR IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.4.1 CITRUS

8.4.2 FRUITS

8.4.3 BERRIES

8.4.4 HERBAL

8.4.5 OTHERS

8.5 ASIA-PACIFIC CITRUS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.5.1 LIME

8.5.2 LEMON

8.5.3 ORANGE

8.5.4 OTHERS

8.6 ASIA-PACIFIC FRUITS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.6.1 MANGO

8.6.2 PEACH

8.6.3 PINEAPPLE

8.6.4 APPLE

8.6.5 GUAVA

8.6.6 GRAPES

8.6.7 COCONUT

8.6.8 OTHERS

8.7 ASIA-PACIFIC BERRIES IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.7.1 RASPBERRY

8.7.2 STRAWBERRY

8.7.3 BLUEBERRY

8.7.4 OTHERS

8.8 ASIA-PACIFIC HERBAL IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.8.1 MINT

8.8.2 GINGER

8.8.3 CUCUMBER

8.8.4 KOMBUCHA (TEA)

8.9 ASIA-PACIFIC WITH FLAVOR IN HOP WATER MARKET, BY REGION, 2018-2033

8.9.1 NORTH AMERICA

8.9.2 EUROPE

8.9.3 ASIA-PACIFIC

8.9.4 SOUTH AMERICA

8.9.5 MIDDLE EAST AND AFRICA

8.1 ASIA-PACIFIC WITHOUT FLAVOR IN HOP WATER MARKET, BY REGION, 2018-2033

8.10.1 NORTH AMERICA

8.10.2 EUROPE

8.10.3 ASIA-PACIFIC

8.10.4 SOUTH AMERICA

8.10.5 MIDDLE EAST AND AFRICA

9 ASIA-PACIFIC HOP WATER MARKET, BY CARBONATION LEVEL

9.1 OVERVIEW

9.2 ASIA-PACIFIC HOP WATER MARKET, BY CARBONATION LEVEL, 2018-2033 (USD THOUSAND)

9.2.1 LOW CARBONATED

9.2.2 MEDIUM CARBONATED

9.2.3 HIGHLY CARBONATED

9.3 ASIA-PACIFIC LOW CARBONATED IN HOP WATER MARKET, BY REGION, 2018-2033

9.3.1 NORTH AMERICA

9.3.2 EUROPE

9.3.3 ASIA-PACIFIC

9.3.4 SOUTH AMERICA

9.3.5 MIDDLE EAST AND AFRICA

9.4 ASIA-PACIFIC MEDIUM CARBONATED IN HOP WATER MARKET, BY REGION, 2018-2033

9.4.1 NORTH AMERICA

9.4.2 EUROPE

9.4.3 ASIA-PACIFIC

9.4.4 SOUTH AMERICA

9.4.5 MIDDLE EAST AND AFRICA

9.5 ASIA-PACIFIC HIGHLY CARBONATED IN HOP WATER MARKET, BY REGION, 2018-2033

9.5.1 NORTH AMERICA

9.5.2 EUROPE

9.5.3 ASIA-PACIFIC

9.5.4 SOUTH AMERICA

9.5.5 MIDDLE EAST AND AFRICA

10 ASIA-PACIFIC HOP WATER MARKET, BY PACKAGING

10.1 OVERVIEW

10.2 ASIA-PACIFIC HOP WATER MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.2.1 ALUMINIUM CANS

10.2.2 BOTTLES

10.2.3 KEGS/BARREL

10.2.4 POUCHES

10.2.5 OTHERS

10.3 ASIA-PACIFIC ALUMINIUM CANS IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

10.3.1 250–500 ML

10.3.2 MORE THAN 500 ML

10.3.3 LESS THAN 250 ML

10.4 ASIA-PACIFIC ALUMINIUM CANS IN HOP WATER MARKET, BY REGION, 2018-2033

10.4.1 NORTH AMERICA

10.4.2 EUROPE

10.4.3 ASIA-PACIFIC

10.4.4 SOUTH AMERICA

10.4.5 MIDDLE EAST AND AFRICA

10.5 ASIA-PACIFIC BOTTLES IN HOP WATER MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

10.5.1 GLASS

10.5.2 PLASTIC

10.6 ASIA-PACIFIC PLASTIC IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.6.1 PET /PETE

10.6.2 HDPE

10.6.3 PLA

10.6.4 OTHERS

10.7 ASIA-PACIFIC BOTTLES IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

10.7.1 250–500 ML

10.7.2 LESS THAN 250 ML

10.7.3 500–1000 ML

10.7.4 1000–2000 ML

10.7.5 MORE THAN 2000 ML

10.8 ASIA-PACIFIC BOTTLES IN HOP WATER MARKET, BY REGION, 2018-2033

10.8.1 NORTH AMERICA

10.8.2 EUROPE

10.8.3 ASIA-PACIFIC

10.8.4 SOUTH AMERICA

10.8.5 MIDDLE EAST AND AFRICA

10.9 ASIA-PACIFIC KEGS/BARREL IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

10.9.1 15–25 L

10.9.2 5–15 L

10.9.3 MORE THAN 25 L

10.9.4 UP TO 5 L

10.1 ASIA-PACIFIC KEGS/BARREL IN HOP WATER MARKET, BY REGION, 2018-2033

10.10.1 NORTH AMERICA

10.10.2 EUROPE

10.10.3 ASIA-PACIFIC

10.10.4 SOUTH AMERICA

10.10.5 MIDDLE EAST AND AFRICA

10.11 ASIA-PACIFIC POUCHES IN HOP WATER MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

10.11.1 POLYETHYLENE (PE)

10.11.2 POLYPROPYLENE (PP)

10.11.3 POLYETHYLENE TEREPHTHALATE (PET)

10.11.4 OTHERS

10.12 ASIA-PACIFIC POUCHES IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

10.12.1 250–500 ML

10.12.2 LESS THAN 250 ML

10.12.3 MORE THAN 500 ML

10.13 ASIA-PACIFIC POUCHES IN HOP WATER MARKET, BY REGION, 2018-2033

10.13.1 NORTH AMERICA

10.13.2 EUROPE

10.13.3 ASIA-PACIFIC

10.13.4 SOUTH AMERICA

10.13.5 MIDDLE EAST AND AFRICA

10.14 ASIA-PACIFIC OTHERS IN HOP WATER MARKET, BY REGION, 2018-2033

10.14.1 NORTH AMERICA

10.14.2 EUROPE

10.14.3 ASIA-PACIFIC

10.14.4 SOUTH AMERICA

10.14.5 MIDDLE EAST AND AFRICA

11 ASIA-PACIFIC HOP WATER MARKET, BY PRICE

11.1 OVERVIEW

11.2 ASIA-PACIFIC HOP WATER MARKET, BY PRICE, 2018-2033 (USD THOUSAND)

11.2.1 2–5 USD

11.2.2 UP TO 2 USD

11.2.3 5–10 USD

11.2.4 ABOVE 10 USD

11.3 ASIA-PACIFIC 2–5 USD IN HOP WATER MARKET, BY REGION, 2018-2033

11.3.1 NORTH AMERICA

11.3.2 EUROPE

11.3.3 ASIA-PACIFIC

11.3.4 SOUTH AMERICA

11.3.5 MIDDLE EAST AND AFRICA

11.4 ASIA-PACIFIC UP TO 2 USD IN HOP WATER MARKET, BY REGION, 2018-2033

11.4.1 NORTH AMERICA

11.4.2 EUROPE

11.4.3 ASIA-PACIFIC

11.4.4 SOUTH AMERICA

11.4.5 MIDDLE EAST AND AFRICA

11.5 ASIA-PACIFIC 5–10 USD IN HOP WATER MARKET, BY REGION, 2018-2033

11.5.1 NORTH AMERICA

11.5.2 EUROPE

11.5.3 ASIA-PACIFIC

11.5.4 SOUTH AMERICA

11.5.5 MIDDLE EAST AND AFRICA

11.6 ASIA-PACIFIC ABOVE 10 USD IN HOP WATER MARKET, BY REGION, 2018-2033

11.6.1 NORTH AMERICA

11.6.2 EUROPE

11.6.3 ASIA-PACIFIC

11.6.4 SOUTH AMERICA

11.6.5 MIDDLE EAST AND AFRICA

12 ASIA-PACIFIC HOP WATER MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 ASIA-PACIFIC HOP WATER MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

12.2.1 FITNESS & WELLNESS

12.2.2 MIXERS FOR ALCOHOLIC BEVERAGES

12.2.3 CULINARY USE

12.2.4 MEDICAL & THERAPEUTIC USE

12.2.5 OTHERS

12.3 ASIA-PACIFIC FITNESS & WELLNESS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.3.1 PRE-WORKOUT HYDRATION

12.3.2 POST-WORKOUT RECOVERY

12.3.3 DETOX

12.3.4 OTHERS

12.4 ASIA-PACIFIC FITNESS & WELLNESS IN HOP WATER MARKET, BY REGION, 2018-2033

12.4.1 NORTH AMERICA

12.4.2 EUROPE

12.4.3 ASIA-PACIFIC

12.4.4 SOUTH AMERICA

12.4.5 MIDDLE EAST AND AFRICA

12.5 ASIA-PACIFIC MIXERS FOR ALCOHOLIC BEVERAGES IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.5.1 GIN & TONIC COMBINATIONS

12.5.2 VODKA MIXERS

12.5.3 WHISKEY HIGHBALLS

12.5.4 WINE SPRITZERS

12.5.5 OTHERS

12.6 ASIA-PACIFIC MIXERS FOR ALCOHOLIC BEVERAGES IN HOP WATER MARKET, BY REGION, 2018-2033

12.6.1 NORTH AMERICA

12.6.2 EUROPE

12.6.3 ASIA-PACIFIC

12.6.4 SOUTH AMERICA

12.6.5 MIDDLE EAST AND AFRICA

12.7 ASIA-PACIFIC CULINARY USE IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.7.1 COOKING & RECIPE INGREDIENT

12.7.2 DEGLAZING & MARINATING

12.7.3 BAKING

12.7.4 OTHERS

12.8 ASIA-PACIFIC CULINARY USE IN HOP WATER MARKET, BY REGION, 2018-2033

12.8.1 NORTH AMERICA

12.8.2 EUROPE

12.8.3 ASIA-PACIFIC

12.8.4 SOUTH AMERICA

12.8.5 MIDDLE EAST AND AFRICA

12.9 ASIA-PACIFIC MEDICAL & THERAPEUTIC USE IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.9.1 DIGESTIVE AID

12.9.2 IBS

12.9.3 GERD-FRIENDLY OPTIONS

12.9.4 OTHERS

12.1 ASIA-PACIFIC MEDICAL & THERAPEUTIC USE IN HOP WATER MARKET, BY REGION, 2018-2033

12.10.1 NORTH AMERICA

12.10.2 EUROPE

12.10.3 ASIA-PACIFIC

12.10.4 SOUTH AMERICA

12.10.5 MIDDLE EAST AND AFRICA

12.11 ASIA-PACIFIC OTHERS IN HOP WATER MARKET, BY REGION, 2018-2033

12.11.1 NORTH AMERICA

12.11.2 EUROPE

12.11.3 ASIA-PACIFIC

12.11.4 SOUTH AMERICA

12.11.5 MIDDLE EAST AND AFRICA

13 ASIA-PACIFIC HOP WATER MARKET, BY END USER

13.1 OVERVIEW

13.2 ASIA-PACIFIC HOP WATER MARKET, BY END USER, 2018-2033 (USD THOUSAND)

13.2.1 HOUSEHOLD/RESIDENTIAL

13.2.2 COMMERCIAL

13.2.3 INSTITUTIONAL

13.3 ASIA-PACIFIC HOUSEHOLD/RESIDENTIAL IN HOP WATER MARKET, BY REGION, 2018-2033

13.3.1 NORTH AMERICA

13.3.2 EUROPE

13.3.3 ASIA-PACIFIC

13.3.4 SOUTH AMERICA

13.3.5 MIDDLE EAST AND AFRICA

13.4 ASIA-PACIFIC COMMERCIAL IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.4.1 RESTAURANTS

13.4.2 BARS

13.4.3 CAFÉ

13.4.4 HOTEL

13.4.5 AIRPORT

13.4.6 RAILWAY/METRO STATION

13.4.7 BUS STATION

13.4.8 OTHERS

13.5 ASIA-PACIFIC RESTAURANTS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.5.1 FSR

13.5.2 QSR

13.6 ASIA-PACIFIC COMMERCIAL IN HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

13.6.1 CLASSIC

13.6.2 BLENDED

13.7 ASIA-PACIFIC COMMERCIAL IN HOP WATER MARKET, BY REGION, 2018-2033

13.7.1 NORTH AMERICA

13.7.2 EUROPE

13.7.3 ASIA-PACIFIC

13.7.4 SOUTH AMERICA

13.7.5 MIDDLE EAST AND AFRICA

13.8 ASIA-PACIFIC INSTITUTIONAL IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.8.1 HEALTHCARE FACILITIES

13.8.2 EDUCATIONAL INSTITUTES

13.8.3 MILITARY FACILITES

13.8.4 OTHERS

13.9 ASIA-PACIFIC HEALTHCARE FACILITIES IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.9.1 HOSPITALS

13.9.2 SPA CENTER

13.9.3 REHABILITATION CENTERS

13.9.4 OTHERS

13.1 ASIA-PACIFIC SPA CENTER IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.10.1 HYDRATION STATIONS IN SPA LOBBIES

13.10.2 DETOX & CLEANSE PACKAGES

13.10.3 INCLUDED IN SKIN & BEAUTY TREATMENTS

13.10.4 CLOGS CLEANING

13.10.5 OTHERS

13.11 ASIA-PACIFIC EDUCATIONAL INSTITUTES USE IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.11.1 UNIVERSITIES

13.11.2 COLLEGES

13.11.3 SCHOOLS

13.11.4 OTHERS

13.12 ASIA-PACIFIC INSTITUTIONAL IN HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

13.12.1 BLENDED

13.12.2 CLASSIC

13.13 ASIA-PACIFIC INSTITUTIONAL IN HOP WATER MARKET, BY REGION, 2018-2033

13.13.1 NORTH AMERICA

13.13.2 EUROPE

13.13.3 ASIA-PACIFIC

13.13.4 SOUTH AMERICA

13.13.5 MIDDLE EAST AND AFRICA

14 ASIA-PACIFIC HOP WATER MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 ASIA-PACIFIC HOP WATER MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

14.2.1 STORE BASED

14.2.2 NON-STORE BASED

14.3 ASIA-PACIFIC STORE BASED IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

14.3.1 SUPERMARKETS & HYPERMARKETS

14.3.2 GROCERY STORES

14.3.3 CONVENIENCE STORES

14.3.4 HEALTH & WELLNESS STORES

14.3.5 SPECIALTY BEVERAGE STORES

14.3.6 CLUB/WHOLESALE STORES

14.3.7 DISCOUNT STORES

14.3.8 COMPANY OUTLETS/STORES

14.3.9 OTHERS

14.4 ASIA-PACIFIC STORE BASED IN HOP WATER MARKET, BY REGION, 2018-2033

14.4.1 NORTH AMERICA

14.4.2 EUROPE

14.4.3 ASIA-PACIFIC

14.4.4 SOUTH AMERICA

14.4.5 MIDDLE EAST AND AFRICA

14.5 ASIA-PACIFIC NON-STORE BASED IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

14.5.1 THIRD PARTY E-COMMERCE

14.5.2 COMPANY OWNED WEBSITE

14.6 ASIA-PACIFIC NON-STORE BASED IN HOP WATER MARKET, BY REGION, 2018-2033

14.6.1 NORTH AMERICA

14.6.2 EUROPE

14.6.3 ASIA-PACIFIC

14.6.4 SOUTH AMERICA

14.6.5 MIDDLE EAST AND AFRICA

15 ASIA-PACIFIC HOP WATER MARKET, BY REGION

15.1 ASIA-PACIFIC

15.1.1 CHINA

15.1.2 JAPAN

15.1.3 INDIA

15.1.4 AUSTRALIA

15.1.5 SOUTH KOREA

15.1.6 INDONESIA

15.1.7 THAILAND

15.1.8 SINGAPORE

15.1.9 HONG KONG

15.1.10 VIETNAM

15.1.11 MALAYSIA

15.1.12 PHILIPPINES

15.1.13 TAIWAN

15.1.14 NEW ZEALAND

15.1.15 REST OF ASIA-PACIFIC

16 ASIA-PACIFIC HOP WATER MARKET

16.1 COMPANY SHARE ANALYSIS: GLOBAL

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 LAGUNITAS BREWING COMPANY

18.1.1 COMPANY SNAPSHOT

18.1.2 COMPANY SHARE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENT

18.2 SIERRA NEVADA BREWING CO.

18.2.1 COMPANY SNAPSHOT

18.2.2 COMPANY SHARE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENT

18.3 ATHLETIC BREWING COMPANY LLC.

18.3.1 COMPANY SNAPSHOT

18.3.2 COMPANY SHARE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENT

18.4 DR HOPS.

18.4.1 COMPANY SNAPSHOT

18.4.2 COMPANY SHARE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENT

18.5 CABIN BREWING COMPANY.

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 RECENT DEVELOPMENT

18.6 HOPLARK

18.6.1 COMPANY SNAPSHOT

18.6.2 COMPANY SHARE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENT

18.7 HOP WTR

18.7.1 COMPANY SNAPSHOT

18.7.2 COMPANY SHARE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENT

18.8 ABITA BREWING COMPANY

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 BURLINGTON BEER COMPANY

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 DENVER BEER CO.

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 DESCHUTES BREWERY.

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 FIELDWORK BREWING CO

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 FOUNDERS BREWING CO.

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 GRIFFIN CLAW BREWING COMPANY

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 H2OPS SPARKLING HOP WATER

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVEOPMENT

18.16 CRAFTZERO

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 PELICAN BREWING COMPANY

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVEOPMENT

18.18 SURLY BREWING CO.

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 UNTITLED ART

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVEOPMENT

18.2 WOODEN HILL BREWING

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 PARTAKE BREWING

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 BREWDOG

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVEOPMENT

18.23 THE NEW BAR

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 PERFECT PEAKS BREWS

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORT

List of Table

TABLE 1 COMPANY SHARE ANALYSIS: IMPORT IN GCC

TABLE 2 UNITED ARAB EMIRATES, BY SOURCE OF COUNTRY (USD THOUSAND)

TABLE 3 UNITED ARAB EMIRATES, BY SOURCE OF COUNTRY (THOUSAND LITRES)

TABLE 4 SAUDI ARABIA, BY SOURCE OF COUNTRY (USD THOUSAND)

TABLE 5 SAUDI ARABIA, BY SOURCE OF COUNTRY (THOUSAND LITRES)

TABLE 6 QATAR, BY SOURCE OF COUNTRY (USD THOUSAND)

TABLE 7 QATAR, BY SOURCE OF COUNTRY (THOUSAND LITRES)

TABLE 8 BAHRAIN, BY SOURCE OF COUNTRY (USD THOUSAND)

TABLE 9 BAHRAIN, BY SOURCE OF COUNTRY (THOUSAND LITRES)

TABLE 10 KUWAIT, BY SOURCE OF COUNTRY (USD THOUSAND)

TABLE 11 KUWAIT, BY SOURCE OF COUNTRY (THOUSAND LITRES)

TABLE 12 OMAN, BY SOURCE OF COUNTRY (USD THOUSAND)

TABLE 13 OMAN, BY SOURCE OF COUNTRY (THOUSAND LITRES)

TABLE 14 SUMMARY OF MARKET STAGE OF DEVELOPMENT — ASIA-PACIFIC HOP WATER MARKET

TABLE 15 SUMMARY OF KEY TIMELINES AND MILESTONES OF THE HOP WATER MARKET

TABLE 16 INNOVATION STRATEGIES AND METHODOLOGIES IN THE HOP WATER MARKET

TABLE 17 RISK ASSESSMENT AND MITIGATION STRATEGIES — HOP WATER MARKET

TABLE 18 PROJECTED PRICE TREND OF THE ASIA-PACIFIC HOP WATER MARKET, 2025–2033 (USD PER LITRE)

TABLE 19 KEY STRATEGIC RECOMMENDATIONS AND EXPECTED IMPACT — HOP WATER MARKET

TABLE 20 STRATEGIC IMPACT OF KEY RAW MATERIALS ON PRICING, RISK, AND INNOVATION

TABLE 21 BRAND COMPARATIVE ANALYSIS

TABLE 22 COMPANY VS BRAND OVERVIEW

TABLE 23 CONSUMER BUYING BEHAVIOUR

TABLE 24 OVERVIEW OF TECHNOLOGICAL ADVANCEMENTS

TABLE 25 HARMONIZED SYSTEM (HS) CODES RELEVANT TO HOP WATER

TABLE 26 ASIA-PACIFIC HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (THOUSAND LITRES)

TABLE 28 ASIA-PACIFIC CLASSIC IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 29 ASIA-PACIFIC BLENDED IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 30 ASIA-PACIFIC HOP WATER MARKET, BY FLAVOR, 2018-2033 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC HOP WATER MARKET, BY FLAVOR, 2018-2033 (THOUSAND LITRES)

TABLE 32 ASIA-PACIFIC WITH FLAVOR IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC CITRUS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC FRUITS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC BERRIES IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC HERBAL IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC WITH FLAVOR IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 38 ASIA-PACIFIC WITHOUT FLAVOR IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 39 ASIA-PACIFIC HOP WATER MARKET, BY CARBONATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC LOW CARBONATED IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 41 ASIA-PACIFIC MEDIUM CARBONATED IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 42 ASIA-PACIFIC HIGHLY CARBONATED IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 43 ASIA-PACIFIC HOP WATER MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC ALUMINIUM CANS IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC ALUMINIUM CANS IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 46 ASIA-PACIFIC BOTTLES IN HOP WATER MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC PLASTIC IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC BOTTLES IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC BOTTLES IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 50 ASIA-PACIFIC KEGS/BARREL IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC KEGS/BARREL IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 52 ASIA-PACIFIC POUCHES IN HOP WATER MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC POUCHES IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC POUCHES IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 55 ASIA-PACIFIC OTHERS IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 56 ASIA-PACIFIC HOP WATER MARKET, BY PRICE, 2018-2033 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC 2–5 USD IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 58 ASIA-PACIFIC UP TO 2 USD IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 59 ASIA-PACIFIC 5–10 USD IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 60 ASIA-PACIFIC ABOVE 10 USD IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 61 ASIA-PACIFIC HOP WATER MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC FITNESS & WELLNESS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC FITNESS & WELLNESS IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 64 ASIA-PACIFIC MIXERS FOR ALCOHOLIC BEVERAGES IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC MIXERS FOR ALCOHOLIC BEVERAGES IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 66 ASIA-PACIFIC CULINARY USE IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 ASIA-PACIFIC CULINARY USE IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 68 ASIA-PACIFIC MEDICAL & THERAPEUTIC USE IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 69 ASIA-PACIFIC MEDICAL & THERAPEUTIC USE IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 70 ASIA-PACIFIC OTHERS IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 71 ASIA-PACIFIC HOP WATER MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 72 ASIA-PACIFIC HOUSEHOLD/RESIDENTIAL IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 73 ASIA-PACIFIC COMMERCIAL IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 74 ASIA-PACIFIC RESTAURANTS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 ASIA-PACIFIC COMMERCIAL IN HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 76 ASIA-PACIFIC COMMERCIAL IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 77 ASIA-PACIFIC INSTITUTIONAL IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 ASIA-PACIFIC HEALTHCARE FACILITIES IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 ASIA-PACIFIC SPA CENTER IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 ASIA-PACIFIC EDUCATIONAL INSTITUTES USE IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 ASIA-PACIFIC INSTITUTIONAL IN HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 82 ASIA-PACIFIC INSTITUTIONAL IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 83 ASIA-PACIFIC HOP WATER MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 84 ASIA-PACIFIC STORE BASED IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 85 ASIA-PACIFIC STORE BASED IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 86 ASIA-PACIFIC NON-STORE BASED IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 87 ASIA-PACIFIC NON-STORE BASED IN HOP WATER MARKET, BY REGION, 2018-2033

TABLE 88 ASIA-PACIFIC HOP WATER MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 89 ASIA-PACIFIC HOP WATER MARKET, BY COUNTRY, 2018-2033 (THOUSAND LITRES)

TABLE 90 ASIA-PACIFIC HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 91 ASIA-PACIFIC HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (THOUSAND LITRES)

TABLE 92 ASIA-PACIFIC HOP WATER MARKET, BY FLAVOR, 2018-2033 (USD THOUSAND)

TABLE 93 ASIA-PACIFIC HOP WATER MARKET, BY FLAVOR, 2018-2033 (THOUSAND LITRES)

TABLE 94 ASIA-PACIFIC WITH FLAVOR IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 ASIA-PACIFIC CITRUS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 ASIA-PACIFIC FRUITS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 ASIA-PACIFIC BERRIES IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 ASIA-PACIFIC HERBAL IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 ASIA-PACIFIC HOP WATER MARKET, BY CARBONATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 100 ASIA-PACIFIC HOP WATER MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 101 ASIA-PACIFIC ALUMINIUM CANS IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

TABLE 102 ASIA-PACIFIC BOTTLES IN HOP WATER MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 103 ASIA-PACIFIC PLASTIC IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 ASIA-PACIFIC BOTTLES IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

TABLE 105 ASIA-PACIFIC KEGS/BARREL IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

TABLE 106 ASIA-PACIFIC POUCHES IN HOP WATER MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 107 ASIA-PACIFIC POUCHES IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

TABLE 108 ASIA-PACIFIC HOP WATER MARKET, BY PRICE, 2018-2033 (USD THOUSAND)

TABLE 109 ASIA-PACIFIC HOP WATER MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 110 ASIA-PACIFIC FITNESS & WELLNESS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 111 ASIA-PACIFIC MIXERS FOR ALCOHOLIC BEVERAGES IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 112 ASIA-PACIFIC CULINARY USE IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 113 ASIA-PACIFIC MEDICAL & THERAPEUTIC USE IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 114 ASIA-PACIFIC HOP WATER MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 115 ASIA-PACIFIC HOUSEHOLD/RESIDENTIAL IN HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 116 ASIA-PACIFIC COMMERCIAL IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 ASIA-PACIFIC RESTAURANTS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 118 ASIA-PACIFIC COMMERCIAL IN HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 119 ASIA-PACIFIC INSTITUTIONAL IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 120 ASIA-PACIFIC HEALTHCARE FACILITIES IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 121 ASIA-PACIFIC SPA CENTER IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 122 ASIA-PACIFIC EDUCATIONAL INSTITUTES USE IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 ASIA-PACIFIC INSTITUTIONAL IN HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 124 ASIA-PACIFIC HOP WATER MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 125 TABLE ASIA-PACIFIC STORE BASED IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 126 ASIA-PACIFIC NON-STORE BASED IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 127 CHINA HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 CHINA HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (THOUSAND LITRES)

TABLE 129 CHINA HOP WATER MARKET, BY FLAVOR, 2018-2033 (USD THOUSAND)

TABLE 130 CHINA HOP WATER MARKET, BY FLAVOR, 2018-2033 (THOUSAND LITRES)

TABLE 131 CHINA WITH FLAVOR IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 CHINA CITRUS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 CHINA FRUITS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 CHINA BERRIES IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 CHINA HERBAL IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 136 CHINA HOP WATER MARKET, BY CARBONATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 137 CHINA HOP WATER MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 138 CHINA ALUMINIUM CANS IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

TABLE 139 CHINA BOTTLES IN HOP WATER MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 140 CHINA PLASTIC IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 CHINA BOTTLES IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

TABLE 142 CHINA KEGS/BARREL IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

TABLE 143 CHINA POUCHES IN HOP WATER MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 144 CHINA POUCHES IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

TABLE 145 CHINA HOP WATER MARKET, BY PRICE, 2018-2033 (USD THOUSAND)

TABLE 146 CHINA HOP WATER MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 147 CHINA FITNESS & WELLNESS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 CHINA MIXERS FOR ALCOHOLIC BEVERAGES IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 149 CHINA CULINARY USE IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 150 CHINA MEDICAL & THERAPEUTIC USE IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 CHINA HOP WATER MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 152 CHINA COMMERICAL IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 153 CHINA RESTAURANTS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 CHINA COMMERCIAL IN HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 CHINA INSTITUTIONAL IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 CHINA HEALTHCARE FACILITIES IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 157 CHINA SPA CENTER IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 CHINA EDUCATIONAL INSTITUTES USE IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 159 CHINA INSTITUTIONAL IN HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 160 CHINA HOP WATER MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 161 CHINA STORE BASED IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 162 CHINA NON-STORE BASED IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 163 JAPAN HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 JAPAN HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (THOUSAND LITRES)

TABLE 165 JAPAN HOP WATER MARKET, BY FLAVOR, 2018-2033 (USD THOUSAND)

TABLE 166 JAPAN HOP WATER MARKET, BY FLAVOR, 2018-2033 (THOUSAND LITRES)

TABLE 167 JAPAN WITH FLAVOR IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 168 JAPAN CITRUS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 JAPAN FRUITS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 JAPAN BERRIES IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 JAPAN HERBAL IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 JAPAN HOP WATER MARKET, BY CARBONATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 173 JAPAN HOP WATER MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 174 JAPAN ALUMINIUM CANS IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

TABLE 175 JAPAN BOTTLES IN HOP WATER MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 176 JAPAN PLASTIC IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 JAPAN BOTTLES IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

TABLE 178 JAPAN KEGS/BARREL IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

TABLE 179 JAPAN POUCHES IN HOP WATER MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 180 JAPAN POUCHES IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

TABLE 181 JAPAN HOP WATER MARKET, BY PRICE, 2018-2033 (USD THOUSAND)

TABLE 182 JAPAN HOP WATER MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 183 JAPAN FITNESS & WELLNESS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 184 JAPAN MIXERS FOR ALCOHOLIC BEVERAGES IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 185 JAPAN CULINARY USE IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 JAPAN MEDICAL & THERAPEUTIC USE IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 187 JAPAN HOP WATER MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 188 JAPAN COMMERICAL IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 189 JAPAN RESTAURANTS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 190 JAPAN COMMERCIAL IN HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 191 JAPAN INSTITUTIONAL IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 192 JAPAN HEALTHCARE FACILITIES IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 193 JAPAN SPA CENTER IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 194 JAPAN EDUCATIONAL INSTITUTES USE IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 195 JAPAN INSTITUTIONAL IN HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 196 JAPAN HOP WATER MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 197 JAPAN STORE BASED IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 JAPAN NON-STORE BASED IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 199 INDIA HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 200 INDIA HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (THOUSAND LITRES)

TABLE 201 INDIA HOP WATER MARKET, BY FLAVOR, 2018-2033 (USD THOUSAND)

TABLE 202 INDIA HOP WATER MARKET, BY FLAVOR, 2018-2033 (THOUSAND LITRES)

TABLE 203 INDIA WITH FLAVOR IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 204 INDIA CITRUS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 205 INDIA FRUITS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 206 INDIA BERRIES IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 207 INDIA HERBAL IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 208 INDIA HOP WATER MARKET, BY CARBONATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 209 INDIA HOP WATER MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 210 INDIA ALUMINIUM CANS IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

TABLE 211 INDIA BOTTLES IN HOP WATER MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 212 INDIA PLASTIC IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 INDIA BOTTLES IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

TABLE 214 INDIA KEGS/BARREL IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

TABLE 215 INDIA POUCHES IN HOP WATER MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 216 INDIA POUCHES IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

TABLE 217 INDIA HOP WATER MARKET, BY PRICE, 2018-2033 (USD THOUSAND)

TABLE 218 INDIA HOP WATER MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 219 INDIA FITNESS & WELLNESS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 220 INDIA MIXERS FOR ALCOHOLIC BEVERAGES IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 221 INDIA CULINARY USE IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 222 INDIA MEDICAL & THERAPEUTIC USE IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 223 INDIA HOP WATER MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 224 INDIA COMMERICAL IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 225 INDIA RESTAURANTS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 226 INDIA COMMERCIAL IN HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 227 INDIA INSTITUTIONAL IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 228 INDIA HEALTHCARE FACILITIES IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 229 INDIA SPA CENTER IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 230 INDIA EDUCATIONAL INSTITUTES USE IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 231 INDIA INSTITUTIONAL IN HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 232 INDIA HOP WATER MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 233 INDIA STORE BASED IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 234 INDIA NON-STORE BASED IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 235 AUSTRALIA HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 236 AUSTRALIA HOP WATER MARKET, BY PRODUCT TYPE, 2018-2033 (THOUSAND LITRES)

TABLE 237 AUSTRALIA HOP WATER MARKET, BY FLAVOR, 2018-2033 (USD THOUSAND)

TABLE 238 AUSTRALIA HOP WATER MARKET, BY FLAVOR, 2018-2033 (THOUSAND LITRES)

TABLE 239 AUSTRALIA WITH FLAVOR IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 240 AUSTRALIA CITRUS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 241 AUSTRALIA FRUITS IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 242 AUSTRALIA BERRIES IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 243 AUSTRALIA HERBAL IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 244 AUSTRALIA HOP WATER MARKET, BY CARBONATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 245 AUSTRALIA HOP WATER MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 246 AUSTRALIA ALUMINIUM CANS IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

TABLE 247 AUSTRALIA BOTTLES IN HOP WATER MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 248 AUSTRALIA PLASTIC IN HOP WATER MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 249 AUSTRALIA BOTTLES IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)

TABLE 250 AUSTRALIA KEGS/BARREL IN HOP WATER MARKET, BY PACKAGING QUANTITY, 2018-2033 (USD THOUSAND)