Asia Pacific Hyaluronic Acid Market

Market Size in USD Billion

CAGR :

%

USD

1.69 Billion

USD

2.97 Billion

2024

2032

USD

1.69 Billion

USD

2.97 Billion

2024

2032

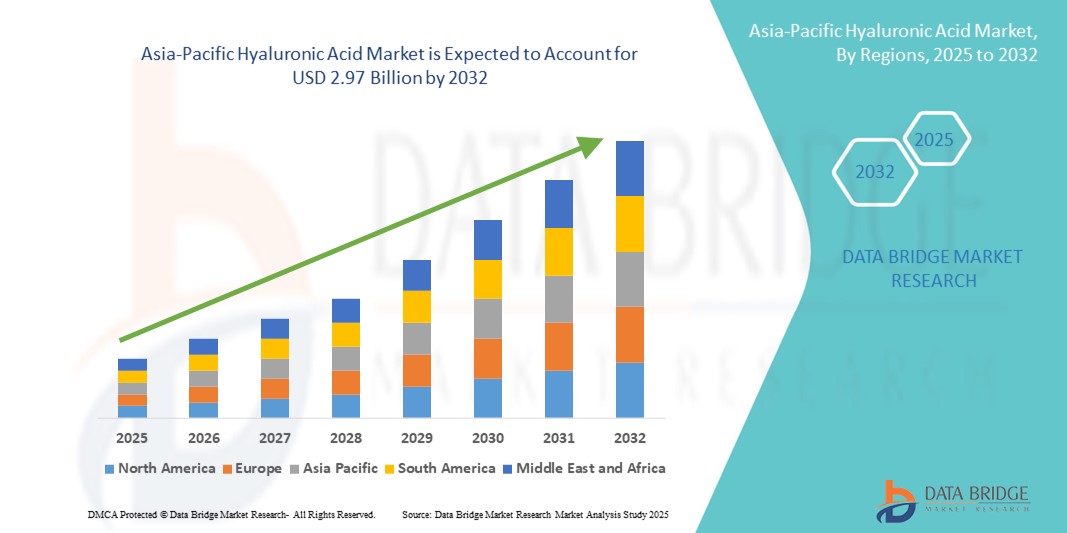

| 2025 –2032 | |

| USD 1.69 Billion | |

| USD 2.97 Billion | |

|

|

|

|

Asia-Pacific Hyaluronic Acid Market Size

- The Asia-Pacific hyaluronic acid market size was valued at USD 1.69 billion in 2024 and is expected to reach USD 2.97 billion by 2032, at a CAGR of 7.3% during the forecast period

- The market growth is primarily driven by increasing demand for cosmetic and pharmaceutical applications, coupled with rising awareness about skincare and anti-aging products across the region

- In addition, expanding investments in biotechnology, growing prevalence of osteoarthritis, and rising disposable incomes are propelling the adoption of hyaluronic acid in medical and aesthetic treatments, fueling market expansion. These combined factors are accelerating the use of hyaluronic acid solutions, thereby significantly boosting industry growth in Asia-Pacific

Asia-Pacific Hyaluronic Acid Market Analysis

- Hyaluronic acid, a naturally occurring biopolymer widely used in cosmetics, pharmaceuticals, and medical treatments, is gaining significant traction in the Asia-Pacific region due to rising consumer awareness of skincare and healthcare benefits

- The increasing demand is driven by growing adoption in anti-aging products, osteoarthritis therapies, and wound healing, supported by rising disposable incomes and expanding healthcare infrastructure

- China dominated the Asia-Pacific hyaluronic acid market with the largest revenue share of 55.5% in 2024, fueled by a robust beauty and pharmaceutical industry and substantial investments in biotechnology research

- India is expected to be the fastest-growing country in the Asia-Pacific hyaluronic acid market during the forecast period, propelled by urbanization, growing middle-class populations, and increasing use of hyaluronic acid in cosmetic and medical applications

- Sodium hyaluronate segment dominated the Asia-Pacific hyaluronic acid market with a share of 45.5% in 2024, driven by its wide usage across cosmetic, pharmaceutical, and medical sectors due to superior bioavailability and effectiveness

Report Scope and Asia-Pacific Hyaluronic Acid Market Segmentation

|

Attributes |

Asia-Pacific Hyaluronic Acid Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Hyaluronic Acid Market Trends

Rising Popularity of Multifunctional and Biotechnologically Enhanced Products

- A key and rapidly evolving trend in the Asia-Pacific hyaluronic acid market is the development of multifunctional formulations that combine hyaluronic acid with other bioactive ingredients such as peptides, vitamins, and natural extracts to boost efficacy in skincare and therapeutic applications

- For instance, several cosmetic brands in South Korea and Japan are innovating by integrating hyaluronic acid with collagen and botanical antioxidants, enhancing anti-aging and moisturizing benefits. Similarly, pharmaceutical firms are exploring bioengineered hyaluronic acid variants with improved purity and molecular weight control for targeted medical uses

- Advances in biotechnology, including microbial fermentation techniques, have increased the availability of high-quality, animal-free hyaluronic acid, aligning with consumer demand for sustainable and cruelty-free products. This has expanded market reach in both cosmetics and pharmaceutical sectors

- The growing emphasis on personalized and precision skincare is also driving product innovation, enabling tailored hyaluronic acid treatments that suit different skin types and medical conditions, enhancing consumer satisfaction and adoption

- This trend of combining biotechnology with multifunctionality is reshaping product development strategies, encouraging companies such as Bloomage BioTechnology and Shandong Topscience Biotech to invest in R&D focused on next-generation hyaluronic acid solutions

- The increasing demand for advanced, multifunctional hyaluronic acid products is strong across beauty, medical aesthetics, and pharmaceutical markets, driven by consumers’ pursuit of effective, science-backed skincare and therapeutic options

Asia-Pacific Hyaluronic Acid Market Dynamics

Driver

Increasing Consumer Awareness and Expanding Medical Applications

- The rising consumer awareness about the benefits of hyaluronic acid in skincare and medical therapies is a major growth driver, especially in countries such as China, South Korea, and Japan where beauty standards and wellness trends are prominent

- For instance, in 2023, South Korea's leading cosmetic company, Amorepacific, launched a new line of hyaluronic acid-infused skincare products that gained rapid popularity, fueling regional market growth

- In addition, the expanding use of hyaluronic acid in osteoarthritis treatment, wound care, and ophthalmology is driving pharmaceutical and medical demand. For example, hospitals in China have increasingly adopted hyaluronic acid injections for osteoarthritis patients, improving quality of life and increasing product adoption

- The growth of medical spas, dermatology clinics, and cosmetic surgery centers offering hyaluronic acid-based treatments further propels market expansion

- Growing disposable incomes and urbanization facilitate higher spending on cosmetic and therapeutic products containing hyaluronic acid

Restraint/Challenge

Regulatory Complexities and High Production Costs

- The stringent regulatory requirements and quality standards for hyaluronic acid products, especially in pharmaceutical and injectable segments, pose challenges to market entry and product approvals

- For instance, regulatory delays in India due to differing approval processes have slowed the introduction of new hyaluronic acid-based injectable therapies

- Variations in regulatory frameworks across Asia-Pacific countries increase complexity for manufacturers seeking cross-border expansion

- The relatively high cost of biotechnologically produced hyaluronic acid, coupled with expensive clinical trials for medical applications, can limit affordability and accessibility, especially in price-sensitive markets

- Moreover, concerns around product adulteration and lack of standardized quality control in some regions affect consumer confidence

- Overcoming these challenges requires investment in regulatory compliance, quality assurance, and cost-efficient production methods to sustain growth in the Asia-Pacific hyaluronic acid market

Asia-Pacific Hyaluronic Acid Market Scope

The market is segmented on the basis of grade, type, application, end user, and distribution channel.

- By Grade

On the basis of grade, the Asia-Pacific hyaluronic acid market is segmented into cosmetic grade and pharmaceutical grade. The cosmetic grade segment dominated the market with the largest revenue share of 60% in 2024, driven by widespread consumer demand for effective anti-aging and moisturizing skincare products. Cosmetic-grade hyaluronic acid is favored for its safety and versatility in daily skincare formulations, which appeals to a broad customer base across the region.

The pharmaceutical grade segment is expected to witness the fastest growth during the forecast period, supported by expanding applications in medical treatments such as osteoarthritis injections, wound healing, and ophthalmic solutions. Increasing regulatory approvals and advancements in drug delivery methods are contributing to the rapid adoption of pharmaceutical-grade hyaluronic acid.

- By Type

On the basis of type, the Asia-Pacific hyaluronic acid market is segmented into hydrolyzed hyaluronic acid, sodium acetylated hyaluronic acid, and sodium hyaluronate. The sodium hyaluronate segment dominated the market with 45.5% market share in 2024, owing to its superior bioavailability, compatibility with various formulations, and extensive use in both cosmetic and medical applications. Sodium hyaluronate’s ability to retain moisture and promote skin regeneration makes it highly desirable in anti-aging and therapeutic products.

The hydrolyzed hyaluronic acid segment is projected to register the fastest CAGR during the forecast period due to its smaller molecular size that enhances skin penetration, leading to increased efficacy in cosmetic products. This type is increasingly incorporated in premium skincare lines across Asia-Pacific, driving robust growth.

- By Application

On the basis of application, the Asia-Pacific hyaluronic acid market is segmented into aesthetics, osteoarthritis, pharmaceutical API, cosmetics, ophthalmology, and others. The aesthetics segment held the dominant position with the largest revenue share in 2024, propelled by the growing popularity of minimally invasive cosmetic procedures such as dermal fillers, skin rejuvenation, and anti-wrinkle treatments. The rising influence of beauty trends and increasing disposable incomes in key markets such as China and South Korea are fueling demand.

The osteoarthritis segment is anticipated to be the fastest-growing application area during forecast period, supported by an aging population and increased awareness of hyaluronic acid’s efficacy in joint health management. Expanding healthcare infrastructure and growing adoption of injectable hyaluronic acid therapies in countries such as India and Japan further accelerate this growth.

- By End User

On the basis of end user, the Asia-Pacific hyaluronic acid market is segmented into medical spas and beauty centers, dermatology clinics, and cosmetic surgery centers. The dermatology clinics segment dominated the market in 2024 with the largest revenue share, driven by the rise in patient visits seeking both injectable and topical hyaluronic acid treatments. Dermatology clinics are often preferred for their professional expertise and access to advanced treatment options.

The medical spas and beauty centers segment is expected to witness the fastest growth during forecast period, due to the increasing consumer preference for non-invasive aesthetic procedures and wellness treatments that incorporate hyaluronic acid. The expanding network of beauty centers across emerging markets such as Southeast Asia is also contributing to the rapid growth of this segment.

- By Distribution Channel

On the basis of distribution channel, the Asia-Pacific hyaluronic acid market is segmented into direct tender and retail sales. The retail sales segment dominated the market with the largest revenue share in 2024, supported by the surge in e-commerce platforms and growing consumer inclination towards purchasing over-the-counter skincare products containing hyaluronic acid. Easy availability and the rise of online beauty marketplaces are driving retail sales dominance.

The direct tender segment is forecasted to grow at the fastest rate during the forecast period, especially in pharmaceutical and medical sectors where hospitals, clinics, and government institutions procure hyaluronic acid products in bulk. Increased public healthcare spending and growing demand for injectable hyaluronic acid in therapeutic treatments are key growth drivers for this channel.

Asia-Pacific Hyaluronic Acid Market Regional Analysis

- China dominated the Asia-Pacific hyaluronic acid market with the largest revenue share of 55.5% in 2024, fueled by a robust beauty and pharmaceutical industry and substantial investments in biotechnology research

- Consumers in the region increasingly prioritize skincare and medical treatments incorporating hyaluronic acid due to rising awareness of its anti-aging, moisturizing, and therapeutic benefits. This is supported by expanding urban populations and growing disposable incomes in key countries such as South Korea, Japan, and India

- The widespread adoption is further fueled by a strong presence of cosmetic manufacturers, increasing prevalence of age-related medical conditions such as osteoarthritis, and improving healthcare infrastructure, positioning hyaluronic acid as a critical ingredient in both cosmetic and medical applications across the region

The China Hyaluronic Acid Market Insight

The China hyaluronic acid market leads the regional market with a significant revenue share, propelled by robust investments in R&D, increasing urbanization, and a flourishing cosmetics sector. The country’s rapidly aging population is also driving the growth of hyaluronic acid in osteoarthritis treatment and other therapeutic uses. Continuous product innovation, expanding distribution networks, and the rise of e-commerce platforms support strong market expansion across cosmetic and pharmaceutical applications.

Japan Hyaluronic Acid Market Insight

The Japan hyaluronic acid market growth is supported by a well-established skincare culture and advanced pharmaceutical sector. Consumers prioritize high-quality and technologically advanced hyaluronic acid products, with increasing integration in anti-aging and medical treatments. Japan’s aging population further stimulates demand for therapeutic applications such as ophthalmology and osteoarthritis, while stringent regulatory standards ensure product efficacy and safety, boosting consumer confidence.

India Hyaluronic Acid Market Insight

The India hyaluronic acid market is witnessing rapid growth in hyaluronic acid demand, attributed to rising health awareness, increasing adoption of medical aesthetics, and government initiatives to boost healthcare infrastructure. The expanding middle class and urbanization facilitate higher spending on skincare and medical products. Strong local manufacturing capabilities and availability of cost-effective hyaluronic acid formulations support market penetration, especially in tier-2 and tier-3 cities.

South Korea Hyaluronic Acid Market Insight

The South Korea hyaluronic acid market, a global beauty innovation hub, is a major driver of the Asia-Pacific hyaluronic acid market, with its consumers highly receptive to advanced skincare technologies. The country’s thriving K-beauty industry heavily incorporates hyaluronic acid in formulations, fueling demand for both cosmetic and medical-grade products. Rising medical tourism and increased use of aesthetic treatments in dermatology clinics further propel market growth. Continuous R&D and collaborations between cosmetic companies and biotech firms are enhancing product offerings in the region.

Asia-Pacific Hyaluronic Acid Market Share

The Asia-Pacific hyaluronic acid industry is primarily led by well-established companies, including:

- Bloomage BioTechnology Corporation Limited (China)

- Shiseido Company, Limited (Japan)

- LG Household & Health Care Ltd. (South Korea)

- Shandong Freda Biotechnology Co., Ltd. (China)

- Hyundai Biopharm Co., Ltd. (South Korea)

- Dongying Fufeng Biotechnologies Co., Ltd. (China)

- SK Bioland Co., Ltd. (South Korea)

- Anhui BBCA Biochemical Co., Ltd. (China)

- Amorepacific Corporation (South Korea)

- LG Chem Ltd. (South Korea)

- Solace Biotech Co., Ltd. (China)

- TEOXANE Laboratories SA (Switzerland)

- DSM-Firmenich (Netherlands)

- Chongqing Hexie Biological Technology Co., Ltd. (China)

- Qufu Hengyuan Biotechnology Co., Ltd. (China)

- Meiji Seika Pharma Co., Ltd. (Japan)

- Croma-Pharma GmbH (Austria)

- Fidia Farmaceutici S.p.A. (Italy)

- Bioiberica S.A.U. (Spain)

- Seikagaku Corporation (Japan)

What are the Recent Developments in Asia-Pacific Hyaluronic Acid Market?

- In March 2025, Koru Pharma, a global medical aesthetics company, secured a patent for its next-generation hyaluronic acid-agarose filler technology. This is a breakthrough as it eliminates chemical cross-linkers, addressing a key safety concern with traditional fillers and improving biocompatibility, stability, and injection precision. The innovation was recognized by Asia Economy as a major advancement in dermal fillers, highlighting its importance for the Asia-Pacific market

- In February 2025, Evolus announced that the U.S. FDA approved its Evolysse Form and Evolysse Smooth injectable hyaluronic acid gels. While this is a U.S. approval, it's a significant development for the global aesthetics market, including Asia-Pacific. The company's expansion into the dermal filler market is a key indicator of competitive pressures and new product introductions that will inevitably influence the regional

- In July 2024, Bloomage Biotech launched MitoPQQ, a new water-soluble ingredient designed to support mitochondrial function and promote healthy aging. This product launch reflects the ongoing trend of expanding hyaluronic acid applications beyond traditional cosmetics and into the broader health and wellness market, including ingestible beauty and anti-aging supplements

- In August 2021, Fufeng Group, a major China-based manufacturer of hyaluronic acid, initiated a USD 5.4 million project to revamp its existing HA production lines. This investment in technological upgrades and increased production capacity highlights the growing demand for hyaluronic acid in the region and Fufeng's commitment to maintaining its position as a key global player

- In March 2021, DSM, a global science company, launched its new HYA-ACT range of hyaluronic acid. This product line consists of three different molecular weights, each designed to provide specific benefits for skin care. This development reflects the industry's shift towards more specialized and targeted hyaluronic acid formulations, and the company highlights that the new range is Halal certified and China compliant, underscoring its focus on the Asian market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.