Asia Pacific Immunoassay Gamma Counters Market

Market Size in USD Million

CAGR :

%

USD

19.19 Million

USD

32.73 Million

2025

2033

USD

19.19 Million

USD

32.73 Million

2025

2033

| 2026 –2033 | |

| USD 19.19 Million | |

| USD 32.73 Million | |

|

|

|

|

Asia-Pacific Immunoassay-Gamma Counters Market Size

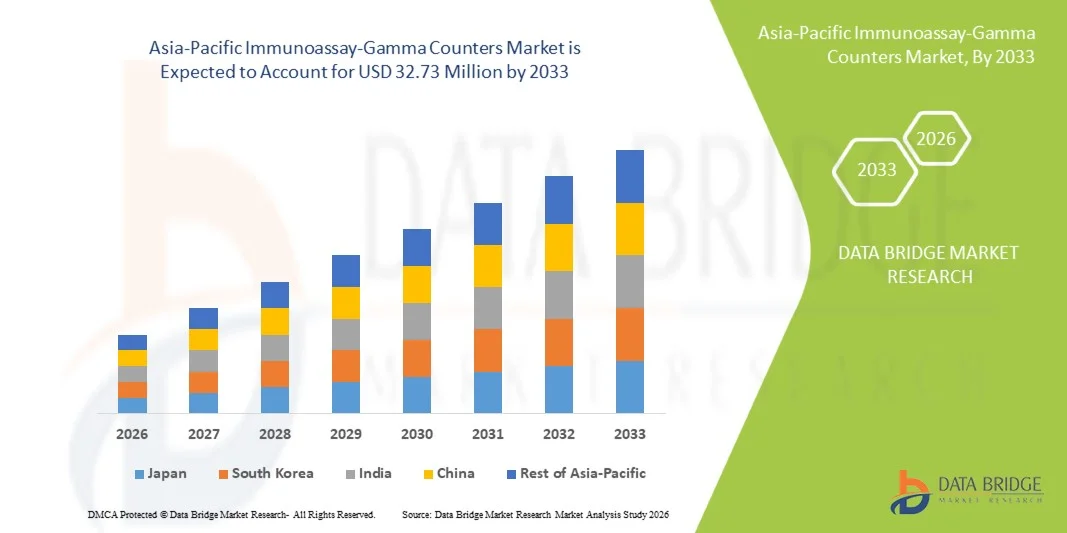

- The Asia-Pacific immunoassay-gamma counters market size was valued at USD 19.19 million in 2025 and is expected to reach USD 32.73 million by 2033, at a CAGR of 6.9% during the forecast period

- The market growth is largely fueled by increasing adoption of radioimmunoassays and nuclear medicine assays, technological advancements in gamma counting systems, and rising investment in diagnostic laboratories across the region

- Furthermore, rising prevalence of chronic and infectious diseases, expanding healthcare infrastructure, and growing demand for efficient, sensitive, and user‑friendly diagnostic solutions are driving the uptake of immunoassay gamma counters, thereby significantly boosting the industry's growth

Asia-Pacific Immunoassay-Gamma Counters Market Analysis

- Immunoassay gamma counters, providing precise measurement of radioactivity in biological samples, are increasingly vital components in clinical diagnostics, research laboratories, and nuclear medicine centers across Asia-Pacific due to their high sensitivity, automation capabilities, and seamless integration with laboratory information systems

- The escalating demand for immunoassay gamma counters is primarily fueled by the growing prevalence of chronic and infectious diseases, expanding healthcare infrastructure, and a rising preference for automated, high-throughput, and reliable diagnostic solutions

- Japan dominated the Asia-Pacific immunoassay gamma counters market with the largest revenue share of 27.8% in 2025, supported by advanced healthcare infrastructure, widespread adoption of nuclear medicine assays, and strong investments in research and development activities

- India is expected to be the fastest growing market in the immunoassay gamma counters market during the forecast period due to rising healthcare expenditure, rapid urbanization, and increasing focus on early disease detection and diagnostic research

- Automated gamma counters dominated the Asia-Pacific immunoassay gamma counters market with a market share of 61.8% in 2025, driven by their high accuracy, efficiency, and capability to handle multi-well assays commonly used in clinical laboratories and research institutes

Report Scope and Asia-Pacific Immunoassay-Gamma Counters Market Segmentation

|

Attributes |

Asia-Pacific Immunoassay-Gamma Counters Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Immunoassay-Gamma Counters Market Trends

“Advancements in Automation and Multi-Well Assay Handling”

- A significant and accelerating trend in the Asia-Pacific immunoassay gamma counters market is the shift towards fully automated systems capable of handling multi-well assays, enhancing throughput and reducing manual error in clinical and research laboratories

- For instance, the PerkinElmer 2480 Wizard2 gamma counter can automatically process multi-well plates, minimizing hands-on operator time and improving reproducibility across repeated assays

- Automation in gamma counters enables features such as rapid sample processing, automated calibration, and integration with laboratory information management systems (LIMS), supporting high-throughput workflows and accurate data capture

- The integration of automation and data management platforms facilitates centralized control over multiple assay types and sample sets, allowing laboratories to efficiently manage large-scale studies and diagnostic testing

- This trend towards more automated, efficient, and integrated gamma counting solutions is reshaping expectations for laboratory workflows, prompting companies such as Wallac Oy to develop counters with high-throughput and multi-assay compatibility

- The demand for gamma counters with enhanced automation and multi-well handling capabilities is growing rapidly across clinical, research, and pharmaceutical laboratories as users increasingly prioritize speed, accuracy, and operational efficiency

- There is a growing trend towards remote monitoring and diagnostics, enabling labs to track instrument performance, maintenance schedules, and assay results remotely, improving operational efficiency

- Integration with data analytics and AI-based predictive maintenance is becoming more common, allowing laboratories to anticipate maintenance needs, reduce downtime, and optimize assay performance

Asia-Pacific Immunoassay-Gamma Counters Market Dynamics

Driver

“Increasing Diagnostic Needs and Research Investments”

- The rising prevalence of chronic and infectious diseases, coupled with increasing investment in research and diagnostic infrastructure, is a significant driver for the heightened demand for immunoassay gamma counters

- For instance, in March 2025, Data Bridge Market Research reported increased adoption of gamma counters in oncology and infectious disease testing across hospitals and research institutes in Japan and India

- As healthcare providers and researchers aim for rapid, reliable, and high-throughput diagnostics, gamma counters offer accurate quantification of radioimmunoassays, supporting critical decision-making in patient care and drug development

- Furthermore, the growing emphasis on early disease detection and biomarker research is making gamma counters integral to laboratory workflows, enabling comprehensive analysis of patient samples

- The need for precise, reproducible, and efficient assay measurement in clinical and pharmaceutical research, combined with government and private sector investments in laboratory infrastructure, is propelling the adoption of advanced gamma counters in Asia-Pacific laboratories

- Increasing collaborations between hospitals, research institutes, and pharmaceutical companies are driving the use of gamma counters for high-volume and specialized testing, expanding market penetration

- Rising awareness and training programs for laboratory personnel on advanced diagnostic tools are enhancing adoption rates and operational efficiency of gamma counters across the region

Restraint/Challenge

“High Cost and Regulatory Compliance Hurdles”

- The relatively high cost of advanced automated gamma counters, compared to manual systems, poses a challenge for adoption, particularly in smaller laboratories or in developing regions of Asia-Pacific

- For instance, premium models with multi-well automation and integration with LIMS often require substantial capital investment, limiting their uptake among budget-conscious institutions

- Regulatory compliance and adherence to nuclear safety and radiation handling standards present another barrier, as laboratories must meet stringent guidelines before deploying gamma counters for clinical or research applications

- Ensuring operator training, proper calibration, and maintenance in line with safety protocols adds to operational complexity and can deter smaller labs from adoption

- Overcoming these challenges through cost-effective solutions, leasing options, and simplified regulatory support will be vital for broader adoption and sustained growth of gamma counters across Asia-Pacific laboratories

- Limited availability of technical support and spare parts in remote regions can impede smooth operation and maintenance, affecting adoption in less-developed areas

- Rapid technological advancements may lead to obsolescence of older models, requiring continuous investment in upgrades, which can be a financial challenge for some institutions

Asia-Pacific Immunoassay-Gamma Counters Market Scope

The market is segmented on the basis of product type, well type, application, disease condition, purchase mode, end user, and distribution channel.

- By Product Type

On the basis of product type, the Asia-Pacific immunoassay gamma counters market is segmented into automated and manual/semi-automated. The Automated segment dominated the market with the largest market revenue share of 61.8% in 2025, driven by its high throughput capability, accuracy, and reduced human intervention. Automated gamma counters are widely preferred in clinical laboratories and research institutes where rapid, reproducible, and reliable assay measurement is critical. The ability to process multi-well plates efficiently and integrate with laboratory information management systems (LIMS) enhances operational efficiency and data management. High adoption in oncology, infectious disease testing, and biomarker research further supports the dominance of automated systems. Leading manufacturers are investing in advanced features such as predictive maintenance and AI-assisted monitoring, reinforcing their market position. The reliability and consistency offered by automated counters make them a preferred choice for large hospitals and pharmaceutical companies in the region.

The Manual/Semi-Automated segment is anticipated to witness the fastest growth during the forecast period due to its cost-effectiveness and suitability for small to mid-sized laboratories. These systems require lower upfront investment and are easier to maintain, making them accessible for emerging laboratories in countries such as India and Indonesia. They are preferred in academic and research institutes where budget constraints exist and sample throughput requirements are moderate. Improvements in semi-automated workflows and user-friendly interfaces are encouraging adoption. For instance, multi-well semi-automated counters are increasingly being used in therapeutic drug monitoring and specialized diagnostic assays. Growing awareness of semi-automated solutions and training programs in regional laboratories is expected to drive their adoption further.

- By Well Type

On the basis of well type, the market is segmented into multi-well and single-well. The Multi-Well segment dominated the market with the largest revenue share in 2025, driven by its ability to simultaneously process multiple samples, improving throughput and efficiency. Multi-well gamma counters are highly valued in clinical and research settings where large sample volumes are common, such as infectious disease testing and cancer biomarker analysis. Integration with automated systems enhances accuracy and reduces human error in repeated assays. Leading hospitals and pharmaceutical labs prefer multi-well counters for high-volume workflows and data consistency. Advanced multi-well systems often include features such as automated sample handling and LIMS connectivity, further strengthening their market position. For instance, multi-well automated counters are widely deployed in oncology and endocrine hormone testing in Japan and South Korea.

The Single-Well segment is expected to witness the fastest growth during forecast period, due to increasing adoption in smaller laboratories, blood banks, and specialized testing centers. Single-well counters are ideal for low-volume testing and budget-conscious facilities, offering flexibility and lower operational costs. Their ease of use and portability make them suitable for neonatal screening, allergy testing, and small-scale research projects. Improvements in sensitivity and detection capabilities of single-well counters are enhancing their appeal. For instance, single-well automated counters are increasingly used in rural hospitals and emerging markets for infectious disease monitoring. Growing healthcare infrastructure in India and Southeast Asia is anticipated to drive the adoption of single-well systems.

- By Application

On the basis of application, the market is segmented into radio immunoassays, nuclear medicine assays, and others. The Radio Immunoassays segment dominated the market in 2025, supported by widespread use in therapeutic drug monitoring, endocrine hormone measurement, and biomarker detection. Radioimmunoassay applications require high sensitivity and reproducibility, which gamma counters provide efficiently. The high prevalence of chronic diseases and increasing diagnostic testing in hospitals and research institutes is boosting demand. Integration with automated systems further improves workflow efficiency and reduces manual error. Leading research laboratories across Japan, China, and India extensively use gamma counters for radioimmunoassays. For instance, oncology research labs rely on gamma counters for multi-sample hormone and biomarker assays. Continuous advancements in radioimmunoassay protocols and reagent compatibility are sustaining the dominance of this segment.

The Nuclear Medicine Assays segment is expected to witness the fastest growth during forecast period, due to increasing adoption of nuclear imaging and radiopharmaceutical research in Asia-Pacific. Hospitals and diagnostic centers are increasingly using gamma counters to measure radioactivity in nuclear medicine procedures accurately. For instance, cardiac imaging and oncology diagnostics require precise quantification of radiotracers, enhancing demand. Expansion of nuclear medicine departments in India, China, and South Korea is driving the uptake of gamma counters. Training programs for laboratory technicians and regulatory approvals for radiopharmaceutical use are further supporting market growth. Continuous technological upgrades, such as faster counting rates and improved detector efficiency, are expected to accelerate adoption.

- By Disease Condition

On the basis of disease condition, the market is segmented into cancer biomarker, infectious diseases, therapeutic drug monitoring, endocrine hormones, allergy, neonatal screening, cardiac markers, autoimmune disease, and others. The Infectious Diseases segment dominated the market with the largest revenue share in 2025, driven by the high prevalence of viral and bacterial infections in Asia-Pacific and the critical need for accurate and timely diagnostics. Gamma counters are widely used in hospitals and research laboratories to quantify radioimmunoassays for infectious disease detection, ensuring rapid clinical decisions. Multi-well automated counters enable high-throughput testing, which is essential during outbreaks and epidemiological studies. For instance, laboratories in Japan and India rely on gamma counters for HIV, hepatitis, and COVID-19 related assays. Increasing government funding for infectious disease surveillance and research is further boosting the segment. The segment also benefits from continuous improvements in assay sensitivity and throughput, enhancing its adoption across hospitals and academic institutes.

The Cancer Biomarker segment is expected to witness the fastest growth during forecast period, due to rising cancer incidence and increased focus on early detection and personalized therapy. Gamma counters play a key role in detecting biomarkers in oncology research and clinical diagnostics. For instance, Japanese and South Korean hospitals utilize multi-well automated counters for high-volume biomarker analysis. Growing investment in oncology research, coupled with government initiatives for cancer screening programs, is driving adoption. The development of new radiolabeled tracers and reagents compatible with gamma counters is supporting growth. Academic and pharmaceutical research centers increasingly rely on gamma counters for cancer biomarker quantification. The segment’s growth is further fueled by integration with laboratory information systems and automation.

- By Purchase Mode

On the basis of purchase mode, the market is segmented into out-right purchase and rental purchase. The Out-right Purchase segment dominated the market in 2025, driven by preference among hospitals and research institutions for full ownership of gamma counters to ensure consistent availability for routine and high-volume testing. Out-right purchase provides flexibility to customize counters and integrate them with existing laboratory workflows. For instance, large hospitals in Japan and China prefer to buy multi-well automated counters for oncology and endocrine hormone testing. Ownership allows laboratories to perform continuous research without rental limitations. Bulk purchasing and long-term investment plans further reinforce the dominance of this segment. Manufacturers often offer maintenance packages with out-right purchases, adding value to the acquisition. The segment also benefits from government funding programs supporting laboratory infrastructure upgrades.

The Rental Purchase segment is expected to witness the fastest growth during forecast period, as small laboratories, academic institutes, and emerging market facilities seek cost-effective access to advanced gamma counters without heavy upfront investment. For instance, startups and university labs in India and Southeast Asia rent automated counters for short-term research projects. Rental models reduce financial burden and allow access to the latest technology. Flexibility in rental terms and availability of technical support makes this option attractive. The trend of renting gamma counters for temporary studies, clinical trials, and seasonal testing is expanding. Adoption is also supported by leasing programs offered by manufacturers and distributors.

- By End User

On the basis of end user, the market is segmented into laboratory, hospitals, research & academic institutes, pharmaceutical & biotechnology companies, blood banks, and others. The Hospitals segment dominated the market in 2025, driven by the widespread use of gamma counters in clinical diagnostics, including infectious disease testing, therapeutic drug monitoring, and oncology assays. Hospitals require high-throughput and reliable counters for patient care, supporting multi-well automated systems. For instance, leading hospitals in China, Japan, and India utilize gamma counters for endocrine hormone and cancer biomarker testing. Rising patient volumes and increasing demand for early diagnostics contribute to segment dominance. Hospitals also invest in integrated laboratory systems combining gamma counters with LIMS and other diagnostic instruments. Government healthcare programs and private hospital expansions in Asia-Pacific further strengthen adoption.

The Research & Academic Institutes segment is expected to witness the fastest growth during forecast period, due to increasing focus on scientific research, drug development, and clinical trials. For instance, universities and pharmaceutical R&D centers in Japan and India are adopting automated gamma counters for multi-well assays and high-throughput research. The expansion of biotechnology and pharmaceutical research in Asia-Pacific is driving demand. Research institutes benefit from flexible configurations and automation features for complex experiments. Collaboration between academic institutions and industry partners further accelerates adoption. Rising funding for research programs and grants in emerging countries supports this trend.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and third party distributors. The Direct Tender segment dominated the market in 2025, driven by preference among large hospitals, research institutes, and government agencies for direct procurement from manufacturers to ensure authenticity, warranty, and support services. Direct procurement allows for customization of gamma counters to meet specific laboratory requirements. For instance, major hospitals in Japan and China place direct tenders for multi-well automated counters used in oncology and infectious disease testing. The direct tender approach simplifies installation, maintenance, and service agreements. Manufacturers often provide training, calibration, and extended support under direct contracts. Government and private sector funding for high-end diagnostic infrastructure further strengthens the dominance of this segment.

The Third Party Distributors segment is expected to witness the fastest growth during forecast period, due to increasing penetration of gamma counters in smaller hospitals, laboratories, and emerging regions where direct manufacturer access may be limited. For instance, distributors in India, Southeast Asia, and South Korea supply gamma counters to remote labs and academic institutions. They provide localized sales, installation, and maintenance support, making advanced technology more accessible. The expansion of distributor networks and partnership models enhances market reach. Third-party channels also offer flexible financing, rental options, and bundled packages that attract small-scale end users. This segment’s growth is accelerated by the rising number of private and regional laboratories adopting gamma counters.

Asia-Pacific Immunoassay-Gamma Counters Market Regional Analysis

- Japan dominated the Asia-Pacific immunoassay gamma counters market with the largest revenue share of 27.8% in 2025, supported by advanced healthcare infrastructure, widespread adoption of nuclear medicine assays, and strong investments in research and development activities

- Hospitals, clinical laboratories, and research institutes in the region highly value the accuracy, high throughput, and automation capabilities of gamma counters, which are critical for multi-well assays, biomarker analysis, and infectious disease testing

- This widespread adoption is further supported by government initiatives to strengthen healthcare and diagnostic capabilities, increasing R&D expenditure, and growing awareness of early disease detection, establishing gamma counters as essential instruments for both clinical and research applications in Asia-Pacific

Japan Immunoassay-Gamma Counters Market Insight

The Japan immunoassay gamma counters market captured a significant revenue share in 2025, driven by advanced healthcare infrastructure, high adoption of nuclear medicine assays, and strong investment in clinical and research laboratories. Hospitals and research institutes highly value automated, multi-well gamma counters for oncology, endocrine hormone, and infectious disease testing. Integration with laboratory information management systems (LIMS) and advanced automation features enhances workflow efficiency and reproducibility. Japan’s focus on early disease detection and government support for diagnostic innovation further fuels growth. Moreover, rising demand for precise, high-throughput diagnostic tools is encouraging adoption in both public and private healthcare facilities.

China Immunoassay-Gamma Counters Market Insight

The China immunoassay gamma counters market is expected to witness the fastest growth during the forecast period, fueled by rapid urbanization, expansion of healthcare infrastructure, and increasing prevalence of chronic and infectious diseases. Hospitals and diagnostic laboratories are investing in automated and semi-automated gamma counters to support high-volume testing and research initiatives. For instance, multi-well automated counters are increasingly used in cancer biomarker analysis and therapeutic drug monitoring. Government initiatives promoting advanced diagnostics and rising R&D spending in pharmaceutical and biotechnology sectors are accelerating market adoption. Moreover, the local manufacturing of gamma counters and reagents is improving affordability and accessibility for a wider range of laboratories.

India Immunoassay-Gamma Counters Market Insight

The India immunoassay gamma counters market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, growing healthcare infrastructure, and increasing investments in clinical research and diagnostics. Automated gamma counters are widely adopted in hospitals, research institutes, and pharmaceutical companies for high-throughput assays and accurate diagnostic testing. Government initiatives supporting smart hospitals and diagnostic labs, coupled with affordable gamma counter solutions from domestic manufacturers, are key factors driving market growth. Increasing awareness of early disease detection and biomarker testing further fuels adoption across clinical and research applications. Furthermore, the rise of private hospitals and academic research facilities is expanding the demand for both automated and semi-automated systems.

South Korea Immunoassay-Gamma Counters Market Insight

The South Korea immunoassay gamma counters market is experiencing steady growth due to technologically advanced healthcare facilities, high adoption of laboratory automation, and growing research activities in pharmaceuticals and biotechnology. Hospitals and research institutes prioritize gamma counters for multi-well assays, cancer biomarker analysis, and therapeutic drug monitoring. For instance, automated systems with integration into LIMS are increasingly used for precise and high-throughput testing. Government initiatives to support innovation in diagnostics and funding for clinical research projects are enhancing market growth. In addition, the increasing number of private diagnostic labs and academic research facilities is boosting demand. The adoption of AI-assisted and automated counters further strengthens South Korea’s position as a key market in the Asia-Pacific region.

Asia-Pacific Immunoassay-Gamma Counters Market Share

The Asia-Pacific Immunoassay-Gamma Counters industry is primarily led by well-established companies, including:

- PerkinElmer (U.S.)

- Hidex (Finland)

- Berthold Technologies GmbH & Co. KG (Germany)

- LabLogic Systems Ltd (U.K.)

- Beckman Coulter, Inc. (U.S.)

- Mirion Technologies, Inc. (U.S.)

- AMETEK Inc (U.S.)

- Stratec SE (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- ZECOTEK Photonics Inc. (Canada)

- COMECER S.p.A. (Italy)

- Kromek Group plc (U.K.)

- Scintacor (U.K.)

- EuroProbe Ltd (U.K.)

- Mediso Ltd (Hungary)

- Elysia-raytest GmbH (Germany)

- Canberra Industries (U.S.)

- Ludlum Measurements, Inc. (U.S.)

- Biodex Medical Systems, Inc. (U.S.)

- IBA Group (Belgium)

What are the Recent Developments in Asia-Pacific Immunoassay-Gamma Counters Market?

- In August 2025, LabLogic promoted the Hidex AMG for automated gamma counting in academia and research, highlighting its sample handling automation, intuitive software, and support for radioimmunoassays. The AMG now offers optional automated sample loading, reducing manual intervention and improving workflow consistency

- In April 2025, China Isotope & Radiation Corporation (CIRC) disclosed in its annual report that its domestic gamma‑knife system, Tomo C, sold 22 units in 2024, marking a milestone in localizing high‑precision radiotherapy equipment

- In March 2021, LabLogic and Hidex announced that the Hidex AMG automatic gamma counter now supports a QR code reader on vial caps, allowing automatic sample identification for each measurement. This enhancement helps labs comply with FDA 21 CFR Part 11 by enabling traceability: when measurement starts, the QR code is read and linked to the result file

- In March 2021, BWXT Medical Ltd. and Global Medical Solutions (GMS) formed a joint venture to manufacture and distribute radioisotopes (notably Tc-99m) and radiopharmaceuticals in the Asia Pacific region. Currently, many Asia-Pacific hospitals rely on imported Tc 99m; this JV aims to localize production and improve supply reliability

- In February 2021, BWX Technologies renamed its nuclear medicine business unit to BWXT Medical Ltd., signaling its strategic commitment to serving hospitals, radiopharmacies, and diagnostic markets. The rebranding reflects a sharper focus on medical isotopes and diagnostic imaging, aligning with their joint venture with GMS for local isotope manufacturing in Asia

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.