Asia Pacific Immunoassay Reagents And Devices Market

Market Size in USD Billion

CAGR :

%

USD

8.24 Billion

USD

12.84 Billion

2025

2033

USD

8.24 Billion

USD

12.84 Billion

2025

2033

| 2026 –2033 | |

| USD 8.24 Billion | |

| USD 12.84 Billion | |

|

|

|

|

Asia-Pacific Immunoassay Reagents and Devices Market Size

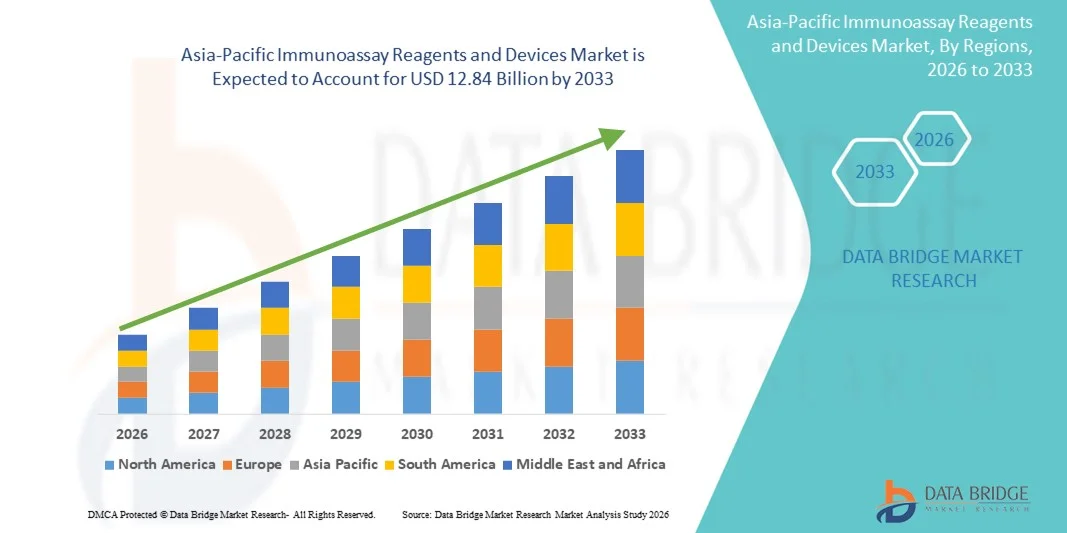

- The Asia-Pacific immunoassay reagents and devices market size was valued at USD 8.24 billion in 2025 and is expected to reach USD 12.84 billion by 2033, at a CAGR of 5.7% during the forecast period

- The market growth is largely fueled by rising prevalence of infectious and chronic diseases, increased demand for advanced diagnostic technologies, and continual product innovations in reagents, kits, and immunoassay platforms that support timely and accurate clinical decision‑making

- Furthermore, expanding healthcare infrastructure, greater adoption of immunoassay‑based diagnostics in hospitals and clinical labs, and growing focus on early disease detection and personalized healthcare solutions are driving strong uptake of immunoassay reagents and devices across key Asia‑Pacific countries such as China, India, Japan, and Southeast Asia, solidifying immunoassay systems as critical tools within regional diagnostic workflows

Asia-Pacific Immunoassay Reagents and Devices Market Analysis

- Immunoassay reagents and devices, enabling precise detection and quantification of biomolecules in clinical samples, are increasingly vital components of modern diagnostic workflows in hospitals, laboratories, and research settings due to their high sensitivity, rapid turnaround time, and compatibility with automated platforms

- The escalating demand for immunoassay products is primarily fueled by the rising prevalence of infectious and chronic diseases, growing focus on early diagnosis, and increasing adoption of advanced diagnostic technologies in healthcare institutions

- China dominated the Asia-Pacific immunoassay market with the largest revenue share of 24.8% in 2025, characterized by well-established healthcare infrastructure, high adoption of laboratory automation, and a strong presence of key industry players

- India is expected to be the fastest growing country in the Asia-Pacific immunoassay market during the forecast period due to expanding healthcare infrastructure, increasing government initiatives for disease detection, and rising disposable incomes

- Chemiluminescence Immunoassay segment dominated the Asia-Pacific immunoassay market with a market share of 40.9% in 2025, driven by its high sensitivity, wide dynamic range, and seamless integration with automated laboratory systems

Report Scope and Asia-Pacific Immunoassay Reagents and Devices Market Segmentation

|

Attributes |

Asia-Pacific Immunoassay Reagents and Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Immunoassay Reagents and Devices Market Trends

Integration of Multiplex and Automated Platforms

- A significant and accelerating trend in the Asia-Pacific immunoassay market is the growing adoption of multiplex immunoassay platforms and automated systems, which allow simultaneous detection of multiple biomarkers and reduce manual handling errors in clinical laboratories

- For instance, the Luminex xMAP technology integrates multiplex immunoassays with automated sample handling, enabling high-throughput testing for hospitals and research centers

- Automation and multiplexing improve workflow efficiency, reduce turnaround times, and minimize human error, thereby enhancing laboratory productivity and reliability of results

- The seamless integration of immunoassay platforms with laboratory information management systems (LIMS) allows centralized monitoring of sample processing, quality control, and data reporting, streamlining laboratory operations

- The trend of cloud-enabled diagnostics is emerging, allowing remote monitoring, real-time data analysis, and integration with hospital networks for faster clinical decisions

- Growing focus on personalized medicine is pushing demand for immunoassays capable of detecting multiple disease-specific biomarkers simultaneously, enabling tailored treatment plans

- This trend towards more automated, high-throughput, and integrated diagnostic solutions is reshaping expectations in clinical laboratories, pushing companies such as Abbott and Siemens Healthineers to develop platforms that combine multiplex testing with digital reporting

- The demand for immunoassay systems offering high-throughput automation and multiplex capability is growing rapidly across hospitals, diagnostic centers, and research institutes, as efficiency and accuracy in testing become critical priorities

Asia-Pacific Immunoassay Reagents and Devices Market Dynamics

Driver

Increasing Prevalence of Chronic and Infectious Diseases

- The rising incidence of chronic conditions such as diabetes, cancer, and infectious diseases including hepatitis and COVID-19 is a significant driver for the heightened adoption of immunoassay reagents and devices

- For instance, in March 2025, Roche Diagnostics launched new automated immunoassay kits for COVID-19 and influenza screening across India and China, driving market growth in high-demand clinical settings

- As healthcare providers prioritize early detection and disease monitoring, immunoassay platforms provide high sensitivity and specificity for timely and accurate clinical decisions

- Furthermore, government healthcare initiatives promoting preventive diagnostics and early screening programs are increasing demand for immunoassay testing solutions in hospitals and labs

- Expansion of private diagnostic chains and laboratory networks across Asia-Pacific is driving demand for reliable, high-throughput immunoassay systems

- Increasing investment in research and development by regional and global players for novel immunoassay reagents and portable devices is supporting market growth

- The convenience of high-throughput testing, reduced turnaround times, and integration with existing laboratory infrastructure are key factors propelling immunoassay adoption across Asia-Pacific

Restraint/Challenge

High Costs and Regulatory Compliance Barriers

- Concerns surrounding the high cost of advanced immunoassay systems and reagents pose a significant challenge to broader adoption, particularly in developing countries with limited healthcare budgets

- For instance, smaller laboratories in Southeast Asia may struggle to invest in CLIA or multiplex platforms despite their advantages, limiting market penetration in price-sensitive regions

- Addressing stringent regulatory requirements for diagnostic devices and obtaining approvals in multiple countries increases time-to-market and operational complexity for manufacturers

- In addition, the need for skilled personnel to operate sophisticated immunoassay platforms and maintain equipment is a challenge for smaller diagnostic centers

- Limited awareness among smaller clinics and rural healthcare providers regarding the benefits of advanced immunoassay technologies can slow adoption rates

- Supply chain constraints for specialized reagents and consumables in some Asia-Pacific countries may hinder timely deployment of immunoassay devices

- While prices for basic immunoassay kits are gradually decreasing, advanced automated and multiplex systems remain expensive, restricting access in lower-income regions

- Overcoming these challenges through cost-effective solutions, regulatory support, and training initiatives will be crucial for sustained market growth across the Asia-Pacific region

Asia-Pacific Immunoassay Reagents and Devices Market Scope

The market is segmented on the basis of product, platform, technique, specimen type, application, and end user.

- By Product

On the basis of product, the market is segmented into reagents & kits and analyzers. The reagents & kits segment dominated the market in 2025, driven by recurring demand for high-quality reagents and assay kits in hospitals, clinical laboratories, and research institutes. Reagents and kits are essential for all immunoassay platforms and techniques, ensuring reliable and reproducible results. The dominance is supported by continuous innovations, such as multiplex and high-sensitivity kits for diverse disease detection. Hospitals prefer standardized kits for regulatory compliance and consistent diagnostic outcomes. Moreover, high prevalence of infectious diseases and chronic conditions across Asia-Pacific drives sustained consumption. Leading players focus on expanding their reagent portfolios, further reinforcing this segment’s market share.

The analyzers segment is expected to witness the fastest growth during forecast period, fueled by increasing adoption of automated immunoassay systems in diagnostic laboratories. Analyzers reduce human errors, improve throughput, and allow simultaneous testing of multiple samples. Urban hospitals and private diagnostic chains are investing heavily in high-throughput systems to improve efficiency. Emerging countries such as India, Indonesia, and Vietnam are adopting automated platforms to reduce turnaround times and enhance accuracy. In addition, manufacturers are introducing compact and affordable analyzers for smaller labs. The rising trend of integrating analyzers with digital data management systems further accelerates adoption.

- By Platform

On the basis of platform, the market is segmented into chemiluminescence immunoassays (CLIA), fluorescence immunoassays (FIA), enzyme immunoassays (EIA), radioimmunoassays (RIA), and others. The chemiluminescence immunoassays (CLIA) segment dominated the market in 2025 with a market share of 40.9% due to high sensitivity, wide dynamic range, and compatibility with automated systems. CLIA platforms are widely used in hospitals and research labs for oncology, infectious diseases, and hormone testing. Their ability to handle high sample volumes and deliver fast results makes them highly preferred. Strong presence of global players such as Abbott and Roche reinforces dominance. Hospitals and clinical labs rely on CLIA platforms for regulatory-compliant testing. The segment benefits from continuous R&D and adoption of multiplex CLIA systems.

The FIA segment is expected to witness the fastest growth during forecast period, driven by its suitability for point-of-care diagnostics and specialized research applications. FIA provides high specificity, multiplexing capability, and miniaturized platform compatibility. Growing biotechnology research and demand for portable diagnostics in Asia-Pacific are accelerating adoption. Countries such as China, India, and Japan are investing in FIA-based platforms. FIA’s adaptability for rapid disease screening enhances its market appeal. Increasing awareness about multiplexed testing supports growth in clinical and research labs.

- By Technique

On the basis of technique, the market is segmented into ELISA, rapid tests, ELISPOT, Western blotting, immuno-PCR, and other techniques. The ELISA segment dominated the market in 2025 due to its widespread use in routine clinical diagnostics, high reproducibility, and cost-effectiveness. ELISA is the preferred method for infectious disease screening, hormone testing, and research applications. Standardized protocols and regulatory approvals make it popular in hospitals and labs. It is compatible with multiple sample types and platforms. High throughput testing in ELISA contributes to efficiency in busy labs. Global and regional manufacturers continue to expand ELISA offerings for diverse applications.

The rapid tests segment is expected to witness the fastest growth during forecast period, fueled by rising demand for point-of-care diagnostics and home-based testing. Rapid tests provide quick results with minimal sample preparation. They are suitable for urgent infectious disease screening in rural or resource-limited areas. Portable formats make them convenient for clinics and field testing. Awareness about rapid disease detection is growing in emerging Asia-Pacific countries. Manufacturers are innovating with high-sensitivity rapid test kits, boosting adoption in hospitals and diagnostic centers.

- By Specimen Type

On the basis of specimen type, the market is segmented into blood, urine, saliva, and others. The blood segment dominated in 2025, accounting for the largest revenue share, due to broad applicability in detecting infectious diseases, oncology biomarkers, endocrine disorders, and autoimmune conditions. Blood samples are standard in hospitals and laboratories and are compatible with most immunoassay platforms. Established clinical guidelines and high reliability further strengthen dominance. Blood-based testing supports high-volume screening and regulatory compliance. Reagent and analyzer manufacturers prioritize blood-based kits. Hospitals prefer blood samples for their reproducibility and proven clinical utility.

The saliva segment is expected to witness the fastest growth during forecast period, driven by the adoption of non-invasive testing and point-of-care diagnostics. Saliva-based immunoassays reduce infection risk and offer convenience for pediatric and geriatric patients. Emerging applications include detection of oral biomarkers for systemic diseases. Countries such as India, China, and Japan are increasingly adopting saliva-based testing. Growing awareness and research into saliva diagnostics support market expansion. Manufacturers are developing portable and sensitive saliva-based immunoassays, enhancing adoption in clinics and labs.

- By Application

On the basis of application, the market is segmented into infectious diseases, oncology and endocrinology, bone & mineral disorders, cardiology, hematology & blood screening, autoimmune disorders, toxicology, neonatal screening, and others. The infectious diseases segment dominated the market in 2025 due to high prevalence of viral and bacterial infections and large-scale government screening initiatives. Hospitals and labs rely on immunoassay platforms for rapid and accurate infectious disease testing. Public health programs in China, India, and Southeast Asia reinforce demand. High patient volume and screening frequency contribute to segment dominance. Continuous introduction of new infectious disease assays strengthens market presence. Global manufacturers actively supply reagents and kits for infectious disease testing.

The oncology and endocrinology segment is expected to witness the fastest growth during forecast period, driven by increasing cancer incidence, rising hormonal disorder detection, and awareness of preventive diagnostics. Hospitals and specialty labs adopt immunoassay solutions for early disease detection and personalized treatment. Expanding healthcare infrastructure in emerging Asia-Pacific countries accelerates adoption. Research initiatives for biomarker discovery also boost demand. Multiplex platforms for oncology and endocrinology testing enhance efficiency. Rising investment by local and global players in these disease areas supports segment growth.

- By End User

On the basis of end user, the market is segmented into hospitals, clinical laboratories, pharmaceutical and biotechnology companies, blood banks, research & academic laboratories, and others. The hospitals segment dominated in 2025 due to large patient volumes, continuous routine diagnostics, and established laboratory infrastructure. Hospitals rely on immunoassay systems for infectious diseases, oncology, cardiology, and endocrine testing. High throughput and integration with automated analyzers support efficiency. Hospitals’ preference for standardized kits reinforces segment dominance. Regulatory compliance and accuracy are critical in hospital settings. Global and regional suppliers focus on hospital solutions to maintain market share.

The research & academic laboratories segment is expected to witness the fastest growth during forecast period, driven by increasing biotechnology research, government funding, and adoption of advanced immunoassay techniques for biomarker discovery. Expanding research initiatives in China, India, and South Korea are creating strong demand. Laboratories require high-sensitivity platforms for experimental assays. Multiplex and automated systems are increasingly used in academic research. Investment in training and advanced instrumentation further supports adoption. Pharmaceutical R&D collaborations boost immunoassay demand in this segment.

Asia-Pacific Immunoassay Reagents and Devices Market Regional Analysis

- China dominated the Asia-Pacific immunoassay market with the largest revenue share of 24.8% in 2025, characterized by well-established healthcare infrastructure, high adoption of laboratory automation, and a strong presence of key industry players

- Healthcare providers in the region prioritize rapid, reliable, and high-throughput immunoassay platforms for detecting infectious diseases, oncology biomarkers, and endocrine disorders

- This widespread adoption is further supported by government initiatives for early disease screening, rising prevalence of chronic and infectious diseases, and strong presence of global and domestic immunoassay manufacturers, establishing immunoassay systems as a critical tool in hospitals, clinical laboratories, and research centers

The China Immunoassay Market Insight

The China immunoassay reagents and devices market captured the largest revenue share of 24.8% in 2025, fueled by the country’s large patient population, expanding hospital and clinical laboratory infrastructure, and growing government initiatives for early disease detection. Healthcare providers are increasingly prioritizing advanced immunoassay platforms for infectious disease screening, oncology, and endocrine diagnostics. The strong presence of global and domestic immunoassay manufacturers, along with technological advancements in high-throughput and automated systems, further supports market expansion. Moreover, rising awareness about preventive healthcare and continuous introduction of innovative reagents and kits are driving adoption across hospitals and research institutes.

Japan Immunoassay Market Insight

The Japan immunoassay market is gaining momentum due to the country’s advanced healthcare infrastructure, high focus on preventive medicine, and increasing demand for automation in diagnostic testing. Japanese hospitals and laboratories emphasize high sensitivity and accuracy in immunoassay platforms for oncology, infectious disease, and hormone testing. Integration of automated analyzers and digital data reporting enhances efficiency and workflow reliability. Moreover, the aging population and rising prevalence of chronic diseases are supporting the growth of immunoassay systems. Continuous R&D by manufacturers and adoption of multiplex and chemiluminescence assays are fueling market expansion across both residential and commercial diagnostic settings.

India Immunoassay Market Insight

The India immunoassay reagents and devices market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid urbanization, increasing healthcare awareness, and rising adoption of advanced diagnostic technologies. Hospitals, clinical laboratories, and diagnostic chains are increasingly investing in high-throughput immunoassay platforms for infectious disease screening, oncology, and endocrine disorders. The push towards smart healthcare infrastructure, expansion of private diagnostic networks, and availability of cost-effective reagents and kits are key factors propelling the market. Furthermore, growing government initiatives for preventive healthcare and increased funding for research and development support sustained market growth.

South Korea Immunoassay Market Insight

The South Korea immunoassay market is expanding steadily, fueled by high healthcare expenditure, technologically advanced laboratory facilities, and strong government support for early disease detection programs. Hospitals and clinical laboratories are adopting automated and high-throughput immunoassay systems for infectious disease testing, oncology, and hormone analysis. The rising focus on personalized medicine and biomarker discovery is encouraging adoption of multiplex and high-sensitivity immunoassay platforms. Moreover, the presence of leading global manufacturers and continuous innovation in reagents and kits further drives market growth. South Korea’s emphasis on efficient and accurate diagnostics positions immunoassay systems as an essential tool across healthcare and research settings.

Asia-Pacific Immunoassay Reagents and Devices Market Share

The Asia-Pacific Immunoassay Reagents and Devices industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Bio Rad Laboratories, Inc. (U.S.)

- Beckman Coulter, Inc. (U.S.)

- Fapon Biotech Inc. (China)

- Autobio Diagnostics Co., Ltd. (China)

- Sysmex Corporation (Japan)

- Fujirebio (Japan)

- Siemens Healthineers AG (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- BIOMÉRIEUX (France)

- Danaher (U.S.)

- Qiagen (Netherlands)

- Quidel Corporation (U.S.)

- BD (U.S.)

- PerkinElmer (U.S.)

- Luminex Corporation (U.S.)

- Bio Techne Corporation (U.S.)

- Randox Laboratories Ltd. (U.K.)

- Snibe Diagnostic (China)

- Shenzhen Mindray Bio Medical Electronics Co., Ltd. (China)

What are the Recent Developments in Asia-Pacific Immunoassay Reagents and Devices Market?

- In August 2025, Chinese pharmaceutical and diagnostic companies significantly shifted to domestic immunoassay reagent suppliers such as Shanghai Titan Scientific and Nanjing Vazyme Biotech to cut costs and shorten delivery times amid tariff‑related supply challenges, signaling a localization trend in reagent sourcing that strengthens APAC immunoassay supply chains

- In July 2025, Fapon announced plans to debut its Shine mT8000 open‑access clinical chemistry and immunoassay analyzer at the ADLM 2025 meeting, a versatile high‑throughput system integrating biochemistry and immunoassay testing that aims to modernize lab workflows across the region

- In January 2024, Fujirebio Holdings and Agappe Diagnostics entered into a strategic collaboration to develop and manufacture cartridge‑based CLIA immunoassay reagents and analyzers, enabling Agappe to offer a complete chemiluminescence solution with locally produced reagents and expand immunoassay capabilities in India

- In November 2023, Fapon showcased its expanded immunoassay and diagnostic solutions, including the fully automated Shine i8000/9000 CLIA system, at the MEDICA 2023 event, reinforcing its presence and product offerings for immunoassay testing in APAC and beyond

- In July 2023, Fapon launched its latest high‑throughput chemiluminescence immunoassay analyzer, the Shine i8000/9000, offering up to 900 tests per hour to meet increasing diagnostic demand in clinical laboratories across the Asia‑Pacific region, marking a significant product expansion for immunoassay diagnostics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.