Asia Pacific Injectable Drug Delivery Market

Market Size in USD Billion

CAGR :

%

USD

192.70 Billion

USD

458.69 Billion

2025

2033

USD

192.70 Billion

USD

458.69 Billion

2025

2033

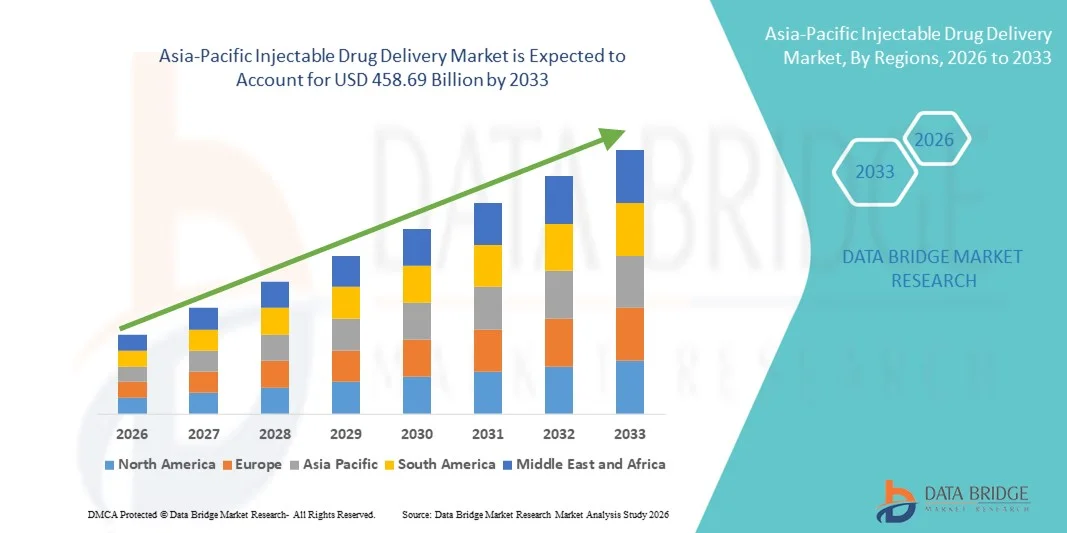

| 2026 –2033 | |

| USD 192.70 Billion | |

| USD 458.69 Billion | |

|

|

|

|

Asia-Pacific Injectable Drug Delivery Market Size

- The Asia-Pacific injectable drug delivery market size was valued at USD 192.70 billion in 2025 and is expected to reach USD 458.69 billion by 2033, at a CAGR of 11.45% during the forecast period

- The market growth is primarily driven by the rising prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disorders, along with expanding vaccination programs and increasing healthcare expenditure across emerging economies in the region

- Furthermore, technological advancements in prefilled syringes, auto-injectors, and biologics administration systems, coupled with growing demand for self-administration and home healthcare solutions, are positioning injectable drug delivery as a critical component of modern therapeutics, thereby significantly accelerating regional market growth

Asia-Pacific Injectable Drug Delivery Market Analysis

- Injectable drug delivery systems, including devices and formulations, are increasingly critical for safe, precise, and efficient administration of biologics, vaccines, and therapeutic agents across hospitals, clinics, and home-care settings, driven by rising patient demand for convenience and adherence

- The market growth is primarily fueled by increasing prevalence of chronic and rare diseases, expanding immunization programs, and rising healthcare expenditure, along with growing awareness of self-administration and advanced drug delivery technologies

- China dominated the Asia-Pacific injectable drug delivery market with the largest revenue share of 35.2% in 2025, supported by rapid urbanization, government-led vaccination programs, increasing prevalence of chronic diseases, and strong adoption of advanced injectable devices in both hospital and home-care settings

- India is expected to be the fastest-growing country in the Asia-Pacific injectable drug delivery market during the forecast period, driven by rising healthcare infrastructure, expanding rural healthcare access, increasing incidence of chronic diseases, and growing adoption of self-administered injectable therapies

- Vials segment dominated the Asia-Pacific injectable drug delivery market with a market share of 38.7% in 2025, driven by their widespread use in hospitals and clinics for biologics, vaccines, and multi-dose therapies

Report Scope and Asia-Pacific Injectable Drug Delivery Market Segmentation

|

Attributes |

Asia-Pacific Injectable Drug Delivery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Injectable Drug Delivery Market Trends

Rising Adoption of Self-Administration and Connected Devices

- A significant and accelerating trend in the Asia-Pacific injectable drug delivery market is the increasing adoption of self-administered devices such as auto-injectors and pen systems, coupled with digital connectivity for monitoring adherence and dosage tracking

- For instance, the NovoPen 6 enables patients to record injection history and connect data to mobile apps for diabetes management, improving compliance and reducing administration errors. Similarly, YpsoMate Smart allows integration with digital health platforms to track biologic injections remotely

- Connected and smart injectable devices facilitate real-time monitoring, reminders, and alerts for missed doses, enhancing treatment adherence and providing healthcare professionals with actionable insights. For instance, some SmartDose systems can detect improper use and send notifications to caregivers or clinicians

- This trend is reshaping patient expectations for injectable therapies, driving demand for user-friendly, accurate, and technologically advanced delivery devices. Consequently, companies such as Owen Mumford are developing auto-injectors with Bluetooth connectivity to support home-care administration

- The demand for digitally enabled, self-administered injectable devices is growing rapidly across hospitals, clinics, and home-care settings, as patients and caregivers increasingly prioritize convenience, safety, and adherence in chronic and acute therapy management

- Advances in smart formulation packaging, including connected vials and cartridges, are allowing pharmaceutical companies to track supply chain, usage patterns, and product integrity, enhancing safety and operational efficiency

Asia-Pacific Injectable Drug Delivery Market Dynamics

Driver

Growing Need Due to Rising Chronic Diseases and Healthcare Access

- The increasing prevalence of chronic diseases, combined with expanding healthcare infrastructure and vaccination programs across Asia-Pacific, is a significant driver for the rising demand for injectable drug delivery systems

- For instance, in March 2025, Becton Dickinson introduced new prefilled syringes for oncology treatments in India to improve safety and administration efficiency, reflecting broader regional adoption trends

- As patients and healthcare providers seek more convenient, safe, and accurate methods for administering biologics, vaccines, and other therapeutics, injectable delivery devices provide advanced features such as prefilled dosing, reduced needle-stick risk, and precise administration

- Furthermore, growing awareness of self-administration and home-care therapies is making auto-injectors and pen devices integral components of modern treatment regimens, offering seamless integration with digital adherence monitoring systems

- The convenience of self-administered therapies, coupled with increasing access to clinics and hospitals in urban and rural areas, is propelling adoption of injectable drug delivery solutions across multiple therapeutic segments in Asia-Pacific

- Increasing government initiatives and public-private partnerships to enhance vaccination coverage and biologic therapy availability are further supporting market expansion

- Rising investments by pharmaceutical and medtech companies in device innovation and localized manufacturing are also driving growth by making advanced injectable systems more accessible and affordable

Restraint/Challenge

Device Usability and Regulatory Compliance Hurdles

- Concerns regarding safe usage, device handling, and regulatory compliance pose a significant challenge to wider adoption of injectable drug delivery systems in Asia-Pacific, particularly among first-time users and elderly patients

- For instance, reports of incorrect dosing or improper device handling in self-administered biologics have made some patients hesitant to switch from in-clinic injections to home-based delivery systems

- Addressing these usability and regulatory challenges through clear instructions, device design improvements, and adherence to stringent health authority standards is crucial for building patient trust. For instance, companies such as Sanofi emphasize ergonomic design and compliance with CDSCO and PMDA guidelines to ensure safe usage

- In addition, the relatively high cost of advanced delivery devices such as smart auto-injectors compared to conventional syringes can be a barrier to adoption for price-sensitive patients in developing countries

- Overcoming these challenges through enhanced patient education, cost-effective device offerings, and adherence to regional regulatory requirements will be vital for sustained growth in the Asia-Pacific injectable drug delivery market

- Fragmented healthcare systems in some Asia-Pacific countries and limited trained personnel for patient guidance can restrict widespread adoption of self-administered injectables

- Challenges in maintaining cold chain logistics and ensuring drug stability in remote areas further complicate the distribution and effective use of injectable drug delivery products

Asia-Pacific Injectable Drug Delivery Market Scope

The market is segmented on the basis of type, formulation packaging, therapeutic application, usage pattern, site of administration, end-users, and distribution channel.

- By Type

On the basis of type, the market is segmented into injectable drug delivery devices and injectable drug delivery formulations. The injectable drug delivery formulations segment dominated the market with a revenue share of 57.4% in 2025. This dominance is due to the widespread use of biologics, vaccines, and therapeutic injectables across hospitals, clinics, and home-care settings. Formulations such as prefilled syringes, vials, and ampoules provide precision dosing, enhanced safety, and ease of administration. Hospitals and clinics prefer formulations for their reliability, compatibility with multiple administration devices, and adherence to regulatory standards. Growing demand for vaccines and biologics in chronic and acute therapies further supports the segment. Pharmaceutical companies continue to innovate high-concentration and combination therapies, enhancing convenience and patient compliance.

The injectable drug delivery devices segment is expected to witness the fastest growth rate of 19.2% from 2026 to 2033. Rising adoption of auto-injectors, pen devices, and smart injection systems is driving this growth in home-care and chronic disease management. Devices improve patient adherence, reduce errors, and simplify administration. Integration with digital health apps allows real-time monitoring and reminders. Increasing healthcare awareness in countries such as India and Japan accelerates adoption. Manufacturers are investing in ergonomic and connected devices to further boost market penetration.

- By Formulation Packaging

On the basis of formulation packaging, the market is segmented into ampoules, vials, cartridges, and bottles. The vials segment dominated the Asia-Pacific market with a 38.7% share in 2025. Vials are widely used in multi-dose therapies, hospital administrations, and vaccination programs due to stability, standardized dosing, and compatibility with various injection devices. Hospitals and clinics prefer vials for operational efficiency, ease of handling, and sterility compliance. Regulatory standards favor vials for biologics and vaccines, reinforcing their adoption. Pharmaceutical innovations continue to enhance vial safety, reduce contamination risks, and enable high-volume dosing. The segment is further supported by government vaccination initiatives and public health programs.

The cartridges segment is expected to witness the fastest growth during 2026–2033. Prefilled cartridges are increasingly used in auto-injectors and pen devices for home-based therapies. Cartridges offer convenience, reduce drug wastage, and improve adherence. Growth in chronic disease management, particularly diabetes and autoimmune therapies, drives adoption. Smart cartridges with digital tracking are becoming popular for dose monitoring. Rising patient preference for self-administration accelerates market growth.

- By Therapeutic Application

On the basis of therapeutic application, the market is segmented into autoimmune diseases, hormonal disorders, orphan diseases, cancer, and others. The cancer segment dominated with a 29.8% share in 2025, driven by rising cancer incidence and the use of injectable chemotherapy and biologics. Hospitals and oncology clinics prefer injectables for targeted treatment, precise dosing, and reduced systemic side effects. Pharmaceutical innovations, including combination therapies and high-potency biologics, reinforce this dominance. Government programs supporting oncology care also contribute to growth. Increasing awareness and accessibility of cancer treatments further strengthen adoption. Hospitals continue to invest in trained staff and device technologies to safely deliver oncology injectables.

The autoimmune diseases segment is expected to witness the fastest growth from 2026 to 2033. Rising prevalence of rheumatoid arthritis, psoriasis, and other autoimmune conditions fuels demand. Injectable biologics such as monoclonal antibodies are increasingly self-administered at home. Awareness programs and early diagnosis initiatives support adoption. Devices such as auto-injectors and pen systems enhance adherence and convenience. Increasing healthcare spending in Asia-Pacific countries further accelerates growth.

- By Usage Pattern

On the basis of usage pattern, the market is segmented into curative care, immunization, and others. The immunization segment dominated with a 41.5% share in 2025, supported by large-scale vaccination programs and rising awareness of preventable diseases. Hospitals, clinics, and community centers rely on injectable vaccines in vials and ampoules for routine immunization. Standardized dosing, safety compliance, and operational efficiency favor injectables. Government initiatives and global vaccination campaigns reinforce dominance. Increasing biologic vaccine development for infectious and chronic diseases further supports this segment. Healthcare providers prioritize immunization programs as a public health measure.

The curative care segment is expected to witness the fastest growth during 2026–2033. Rising prevalence of chronic diseases, home-based therapies, and use of therapeutic biologics drive adoption. Self-administration programs enhance patient adherence. Digital health tools and remote monitoring facilitate growth. Hospitals and clinics expand access to biologics for curative treatments. The increasing demand for the personalized medicine and targeted therapies supports rapid expansion.

- By Site of Administration

On the basis of site of administration, the market is segmented into skin, circulatory/musculoskeletal system, organs, and central nervous system. The circulatory/musculoskeletal system segment dominated in 2025 with a 46.3% share due to extensive use of vaccines, insulin, and biologics administered intramuscularly or intravenously. Hospitals and clinics prefer these routes for systemic delivery and precise dosing. Auto-injectors, infusion systems, and prefilled syringes enhance safety and compliance. High patient volumes and chronic therapy requirements reinforce adoption. Biologics and multi-dose therapies commonly use this route. Regulatory standards for intravenous and intramuscular administration strengthen this segment.

The skin segment is expected to witness the fastest growth from 2026 to 2033, driven by microneedle-based injectables, subcutaneous biologics, and home-administered therapies. Skin-based delivery offers reduced pain and increased convenience. Patient adherence improves with easy-to-use devices. Growth in diabetes, hormone therapies, and vaccines supports expansion. Smart and connected skin delivery devices further accelerate adoption. Home-care programs and patient preference for non-invasive administration contribute to growth.

- By End-Users

On the basis of end users, the market is segmented into clinics, hospitals, and others. The hospitals segment dominated with a 52.7% share in 2025 due to high patient volumes, extensive use of injectables, and investment in trained staff. Hospitals manage chronic and acute disease treatments using prefilled vials, syringes, and auto-injectors. Regulatory compliance, cold chain management, and operational efficiency favor hospital adoption. Advanced device integration for biologics and vaccines supports dominance. Large-scale treatment programs in urban centers reinforce growth. Hospitals continue to be primary end-users for therapeutic injectables.

The clinics segment is expected to witness the fastest growth during 2026–2033. Rising outpatient care, home-based self-administration programs, and adoption of auto-injectors fuel growth. Clinics offer convenient access to biologics and chronic disease therapies. Increasing healthcare awareness in suburban and rural areas supports expansion. Pen devices and smart auto-injectors are increasingly used in clinics. Telemedicine integration and patient monitoring further accelerate adoption.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The hospital pharmacy segment dominated with a 44.1% share in 2025 due to large-scale patient coverage, immunization programs, and high-volume biologics and vaccines. Hospitals ensure regulatory compliance, trained personnel, and proper storage conditions. Prefilled vials and syringes are primarily distributed through hospital pharmacies. Multi-dose therapy management and clinical safety reinforce adoption. Government programs and hospital-led vaccination initiatives strengthen dominance.

The online pharmacy segment is expected to witness the fastest growth from 2026 to 2033, driven by digital adoption, e-commerce penetration, and patient preference for home delivery of injectable devices and formulations. Online pharmacies provide convenience, easy access to prefilled pens, auto-injectors, and biologics. Remote monitoring tools and digital adherence apps support growth. Rising home-care therapies accelerate demand. Patient preference for contactless delivery and rapid access further drives adoption. Expansion of online pharmacy infrastructure across Asia-Pacific strengthens growth potential.

Asia-Pacific Injectable Drug Delivery Market Regional Analysis

- China dominated the Asia-Pacific injectable drug delivery market with the largest revenue share of 35.2% in 2025, supported by rapid urbanization, government-led vaccination programs, increasing prevalence of chronic diseases, and strong adoption of advanced injectable devices in both hospital and home-care settings

- Healthcare providers and patients in the region increasingly prioritize convenience, precision, and safety offered by prefilled syringes, auto-injectors, and vials, supporting widespread adoption in hospitals, clinics, and home-care settings

- This strong market presence is further reinforced by government-led initiatives for immunization, investments in healthcare infrastructure, and growing awareness of self-administered therapies, establishing injectable drug delivery as a preferred mode for both chronic and acute treatments

The China Injectable Drug Delivery Market Insight

The China injectable drug delivery market captured the largest revenue share of 35.2% in Asia-Pacific in 2025, fueled by rising prevalence of chronic diseases, expanding vaccination programs, and increasing adoption of advanced biologics and therapeutic injectables. Patients and healthcare providers prioritize precision, safety, and convenience offered by prefilled syringes, auto-injectors, and vials. The growing preference for self-administered therapies and home-care treatments, combined with digital monitoring systems, further propels the industry. Government-led initiatives to improve immunization coverage and investments in healthcare infrastructure are significantly contributing to market expansion. Hospitals, clinics, and home-care providers increasingly integrate advanced delivery devices to enhance treatment adherence. China’s domestic manufacturing capabilities also improve availability and reduce costs for these devices.

India Injectable Drug Delivery Market Insight

The India injectable drug delivery market accounted for a significant revenue share in Asia-Pacific in 2025, driven by rising chronic disease prevalence, rapid urbanization, and growing healthcare awareness. The market benefits from a large and expanding middle-class population with increasing access to hospitals, clinics, and home-care services. Patients and caregivers are increasingly adopting self-administered therapies using auto-injectors, prefilled syringes, and pen devices. Government initiatives such as vaccination programs and smart healthcare projects further support growth. Affordable domestic manufacturing of injectable devices and formulations enhances accessibility. E-commerce and pharmacy distribution channels are also accelerating adoption in both urban and rural areas.

Japan Injectable Drug Delivery Market Insight

The Japan injectable drug delivery market is witnessing steady growth due to high healthcare standards, technological adoption, and strong demand for self-administered biologics. Patients prioritize safety, accuracy, and adherence, driving adoption of auto-injectors, prefilled syringes, and pen devices. Integration with digital health platforms allows monitoring and adherence tracking, supporting home-based therapy. Rapid urbanization and a growing aging population increase demand for convenient and precise delivery systems. Hospitals, clinics, and home-care providers actively incorporate advanced injectables. Government initiatives promoting vaccination and chronic disease management further enhance market growth.

South Korea Injectable Drug Delivery Market Insight

The South Korea injectable drug delivery market is expected to expand at a considerable CAGR during the forecast period, driven by advanced healthcare infrastructure, strong adoption of biologics, and patient preference for safe and precise delivery systems. Auto-injectors, prefilled syringes, and pen devices are increasingly used in hospitals, clinics, and home-based care programs. Integration with digital health monitoring platforms improves adherence and treatment outcomes. Regulatory compliance and government support for chronic disease and vaccination programs reinforce market growth. The country’s technology-oriented healthcare environment encourages adoption of connected and user-friendly delivery devices. Patients and caregivers value convenience, safety, and reliability in injectable therapies.

Asia-Pacific Injectable Drug Delivery Market Share

The Asia-Pacific Injectable Drug Delivery industry is primarily led by well-established companies, including:

- BD (U.S.)

- Terumo Corporation (Japan)

- NIPRO Corporation (Japan)

- B. Braun SE (Germany)

- Pfizer Inc., (U.S.)

- Sanofi (France)

- F. Hoffmann La Roche Ltd, (Switzerland)

- Novo Nordisk A/S, (Denmark)

- Novartis AG (Switzerland)

- West Pharmaceutical Services, Inc., (U.S.)

- Gerresheimer AG (Germany)

- Schott Pharma AG & CO KGaA, (Germany)

- Ypsomed Holding AG (Switzerland)

- Takeda Pharmaceutical Company Limited, (Japan)

- AstraZeneca (U.K.)

- Sun Pharmaceutical Industries Ltd. (India)

- Cipla (India)

- Dr. Reddy’s Laboratories Ltd. (India)

- Daiichi Sankyo Company Limited

- Hindustan Syringes & Medical Devices Ltd, (India)

What are the Recent Developments in Asia-Pacific Injectable Drug Delivery Market?

- In July 2025, Terumo Corporation announced the commercial launch of its Immucise™ Intradermal Injection System a new device designed to deliver vaccines and other approved drugs into the dermal layer with improved efficiency and reduced volume requirements, potentially enhancing immunogenicity and ease of use

- In July 2025, Innovent Biologics launched Xinermei (mazdutide) in China a new once‑weekly injectable GLP‑1 therapy for weight management and potential extension into type‑2 diabetes treatment intensifying competition in the Asia‑Pacific biologics sector and expanding the region’s injectable therapy landscape

- In June 2025, Ypsomed AG opened its first dedicated production site in China for injection systems, enabling local manufacture of up to 100 million devices annually to meet growing demand for self‑injectable drug delivery solutions in the region

- In January 2025, researchers at the Indian Institute of Technology Guwahati and Bose Institute, Kolkata developed an innovative injectable hydrogel for targeted breast cancer therapy, demonstrating controlled drug release and significant tumor reduction in preclinical models a breakthrough in localized injectable therapeutics

- In January 2025, Becton Dickinson (BD) unveiled its BD Accuspray™ Nasal Spray System, BD Hylok™ Glass Prefillable Syringe, and new wearable injectors including BD Evolve™ on‑body injector and BD Libertas™ wearable injector to support next‑generation biologic and vaccine delivery, highlighting innovation in self‑administration and advanced device formats for complex therapies across the Asia‑Pacific region

- https://www.terumo.com/newsrelease/detail/20250702/6651

- https://www.ypsomed.com/en/news-insights/news/press-releases/news-reader-detail-page/ypsomed-opens-production-site-in-china

- https://asianews.network/indian-institute-of-technology-guwahati-develops-injectable-hydrogel-for-cancer-treatment

- https://www.globenewswire.com/news-release/2025/02/18/3028158/0/en/Injectable-Drug-Delivery-Devices-Market-Size-Expected-to-Reach-USD-1-217-Bn-by-2034.html?

- https://www.reuters.com/business/healthcare-pharmaceuticals/innovents-weight-loss-drug-highlights-china-challenge-novo-lilly-2025-09-22

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.