Asia Pacific Ink Resins Market

Market Size in USD Million

CAGR :

%

USD

443.53 Million

USD

712.28 Million

2024

2032

USD

443.53 Million

USD

712.28 Million

2024

2032

| 2025 –2032 | |

| USD 443.53 Million | |

| USD 712.28 Million | |

|

|

|

|

Asia-Pacific Ink Resins Market Size

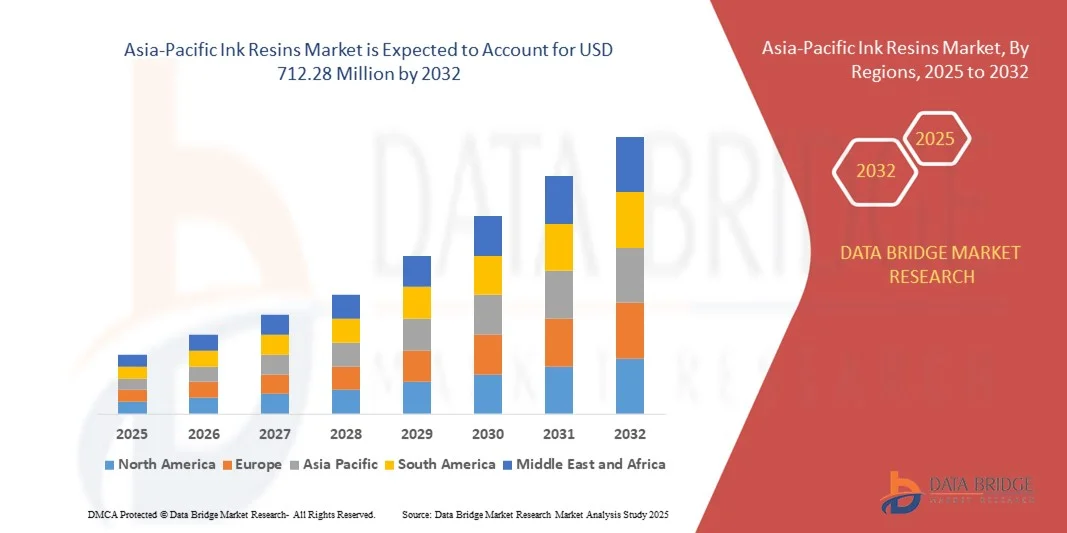

- The Asia-Pacific ink resins market size was valued at USD 443.53 million in 2024 and is expected to reach USD 712.28 million by 2032, at a CAGR of 6.1% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-performance printing inks across packaging, publishing, and commercial printing applications

- Rising adoption of eco-friendly and sustainable ink formulations is further driving innovation and product development in the market

Asia-Pacific Ink Resins Market Analysis

- The ink resins market is experiencing steady expansion, supported by the rapid growth of the packaging sector, which is the primary consumer of printing inks

- Manufacturers are focusing on developing bio-based and low-VOC resins to align with stringent environmental regulations and shifting consumer preferences toward sustainable solutions

- China dominated the ink resins market in 2024 with the largest revenue share, driven by rapid industrialization, booming packaging and e-commerce sectors, and high production capacity in printing and publication industries

- Japan is expected to witness the highest compound annual growth rate (CAGR) in the Asia-Pacific ink resins market due to rising demand for specialty packaging, advanced digital printing solutions, and increasing adoption of eco-friendly and high-performance resins

- The Acrylic segment held the largest market revenue share in 2024, driven by its excellent gloss, quick drying, and strong adhesion properties. Acrylic resins are widely used in packaging and commercial printing due to their versatility and ability to perform well across different substrates

Report Scope and Asia-Pacific Ink Resins Market Segmentation

|

Attributes |

Asia-Pacific Ink Resins Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Ink Resins Market Trends

Shift Toward Sustainable and Eco-Friendly Ink Resins

- The growing demand for sustainable printing solutions is transforming the ink resins market, with a strong shift toward bio-based, water-based, and low-VOC formulations. These eco-friendly alternatives help printing companies comply with stringent environmental regulations while meeting consumer expectations for greener products

- Rising adoption of recyclable and compostable packaging is accelerating the need for resins that support high-quality printing without compromising on sustainability. This trend is particularly pronounced in the food, beverage, and personal care industries, where brand owners prioritize eco-labeling and sustainable packaging

- Advancements in resin technology, such as UV-curable and energy-efficient curing systems, are making sustainable inks more commercially viable. These innovations not only reduce carbon footprints but also improve print quality, adhesion, and durability, widening their application scope

- For instance, in 2023, several packaging companies integrated bio-based resins into their ink systems to meet corporate sustainability targets. This shift resulted in enhanced brand value, improved compliance with environmental standards, and reduced production costs associated with waste management

- While sustainable ink resins are gaining traction, widespread adoption depends on balancing performance with cost-effectiveness. Manufacturers must continue innovating with scalable, affordable, and region-specific solutions to ensure long-term market growth

Asia-Pacific Ink Resins Market Dynamics

Driver

Rising Demand for Packaging and Commercial Printing Applications

- The rapid expansion of the packaging industry is fuelling demand for high-performance ink resins that deliver superior print quality, adhesion, and resistance. Flexible packaging, labels, and corrugated boxes increasingly rely on advanced resins for durability and aesthetics, making them indispensable in the packaging supply chain

- Commercial printing, including publications, brochures, and promotional materials, is also driving resin consumption. Businesses and publishers seek inks with enhanced gloss, clarity, and fast-curing properties, ensuring cost efficiency and high-volume production for competitive markets

- The shift toward advanced printing techniques such as digital, gravure, and flexography is further boosting resin adoption. Specialized formulations are needed to ensure compatibility, reduce maintenance downtime, and support the growing demand for faster, more sustainable printing solutions

- For instance, in 2022, a leading printing group reported a surge in demand for resin-based inks tailored for flexible packaging, citing improved adhesion and reduced waste during high-speed operations. This reflects the broader industry trend of investing in resin innovation to meet high-capacity needs

- While packaging and commercial applications drive consistent growth, the challenge remains to develop multipurpose resins that can meet diverse printing needs without escalating costs. Manufacturers that balance performance, flexibility, and affordability will gain a strong competitive advantage

Restraint/Challenge

Volatility in Raw Material Prices and Dependence on Petrochemical Feedstocks

- Ink resins are largely derived from petrochemical feedstocks such as acrylics, epoxies, and polyurethanes, which are subject to fluctuating crude oil prices. This volatility directly impacts production costs, profit margins, and overall pricing stability for manufacturers operating in highly competitive markets

- The dependence on non-renewable raw materials also raises concerns over sustainability and regulatory compliance. With governments enforcing stricter environmental policies, producers must invest in greener alternatives while managing risks associated with existing petrochemical reliance

- Supply chain disruptions and geopolitical tensions further exacerbate raw material shortages. Delayed shipments, higher freight costs, and inconsistent raw material availability put added pressure on resin manufacturers and downstream ink producers

- For instance, in 2023, several Asian ink producers reported price hikes in resin-based inks due to supply chain interruptions and rising petrochemical costs. This led to reduced competitiveness in export markets, particularly against producers adopting bio-based solutions

- While bio-based and recycled alternatives are emerging, scaling them to meet global demand remains a challenge. Continuous R&D, sustainable sourcing partnerships, and investment in circular economy models will be essential to stabilize the ink resins market

Asia-Pacific Ink Resins Market Scope

The market is segmented on the basis of resin, ink technology, application, and printing process.

- By Resin

On the basis of resin, the ink resins market is segmented into Acrylic, Polyurethane, Polyamide, Modified Rosin, Modified Cellulose, Hydrocarbon, and Others. The Acrylic segment held the largest market revenue share in 2024, driven by its excellent gloss, quick drying, and strong adhesion properties. Acrylic resins are widely used in packaging and commercial printing due to their versatility and ability to perform well across different substrates.

The Polyurethane segment is expected to witness the fastest growth rate from 2025 to 2032, supported by its superior resistance to chemicals, solvents, and abrasion. Polyurethane-based resins are increasingly preferred for applications demanding durability and flexibility, particularly in high-performance packaging and specialty printing.

- By Ink Technology

On the basis of ink technology, the market is segmented into Water-Based, Solvent-Based, UV-Curable, and Powder. The Water-Based segment accounted for the largest share in 2024, attributed to its eco-friendly characteristics, low VOC emissions, and compliance with environmental regulations. Its wide adoption in food packaging and labeling applications strengthens its market position.

The UV-Curable segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its fast-curing speed, excellent adhesion, and superior print quality. UV-curable resins also offer energy efficiency and enhanced durability, making them ideal for advanced digital and commercial printing.

- By Application

On the basis of application, the market is segmented into Packaging, Corrugated Boards, Printing and Publication, and Others. The Packaging segment held the dominant share in 2024, owing to the booming demand for flexible packaging, labels, and consumer goods printing. Ink resins enhance durability, clarity, and aesthetic appeal in packaging, which drives consistent usage.

The Corrugated Boards segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by rising demand for e-commerce shipments and sustainable packaging solutions. Corrugated board printing requires resins with excellent adhesion and resistance, making this segment a significant growth driver.

- By Printing Process

On the basis of printing process, the market is segmented into Lithographic, Flexographic, Gravure, Letterpress, and Digital. The Flexographic printing process led the market in 2024, supported by its suitability for large-scale packaging, labeling, and corrugated board applications. The ability to print on a wide range of substrates with cost efficiency fuels its dominance.

The Digital printing process is expected to witness the fastest growth rate from 2025 to 2032, fuelled by increasing adoption of short-run and customized printing applications. Digital printing requires advanced resin formulations to ensure superior image quality and fast curing, making it a rapidly emerging segment.

Asia-Pacific Ink Resins Market Regional Analysis

- China dominated the ink resins market in 2024 with the largest revenue share, driven by rapid industrialization, booming packaging and e-commerce sectors, and high production capacity in printing and publication industries

- Manufacturers are increasingly investing in high-performance and UV-curable resins to meet the growing demand for durable, high-quality printed materials

- The dominance is further supported by government initiatives promoting smart manufacturing, technological upgrades in printing facilities, and increasing export-oriented production, making China a key global hub for ink resins

Japan Ink Resins Market Insight

Japan is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for specialty packaging, advanced digital printing solutions, and innovative resin technologies. Companies are adopting eco-friendly and high-performance resins to enhance product quality while complying with stringent environmental and safety regulations. The growth is further strengthened by a focus on R&D, strong collaborations between resin manufacturers and printing firms, and increasing adoption of UV-curable and water-based inks across commercial and packaging applications.

Asia-Pacific Ink Resins Market Share

The Asia-Pacific ink resins industry is primarily led by well-established companies, including:

- DIC Corporation (Japan)

- Sakata INX Corporation (Japan)

- T&K TOKA Corporation (Japan)

- Toyochem Co., Ltd. (Japan)

- Fujifilm Holdings Corporation (Japan)

- Yip’s Chemical Holdings Limited (Hong Kong)

- Tokyo Printing Ink Mfg. Co., Ltd. (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Ink Resins Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Ink Resins Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Ink Resins Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.