Asia Pacific Interventional Cardiology Peripheral Vascular Devices Market

Market Size in USD Billion

CAGR :

%

USD

2.92 Billion

USD

5.59 Billion

2024

2032

USD

2.92 Billion

USD

5.59 Billion

2024

2032

| 2025 –2032 | |

| USD 2.92 Billion | |

| USD 5.59 Billion | |

|

|

|

Interventional Cardiology and Peripheral Vascular Devices Market Analysis

The term interventional cardiology is an area of medicine within the subspecialty of cardiology and peripheral vascular devices that uses enhanced, conventional, and advanced and other diagnostic techniques to evaluate blood flow and pressure in the coronary arteries and chambers of the heart, as well as technical procedures and medications to treat abnormalities that impair the function of the cardiovascular system. The interventional cardiology and peripheral vascular devices are used, since the devices make changes in sedentary lifestyle. It reduces the complications of chronic cardiac diseases, such as coronary artery disease, ischemic heart disease and vascular diseases. The Asia-Pacific Interventional Cardiology and Peripheral Vascular Devices Market is experiencing robust growth driven by an aging population, rising rates of cardiovascular diseases, and advancements in minimally invasive techniques. Here is a detailed analysis:

Interventional Cardiology and Peripheral Vascular Devices Market Size

The Asia-Pacific Interventional Cardiology and Peripheral Vascular Devices Market size was valued at USD 2.92 billion in 2024 and is projected to reach USD 5.59 billion by 2032, with a CAGR of 8.44 % during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Midlines Catheter Market Trends

“Growing Awareness About Cardiovascular Health and The Increasing Availability of Treatment Options”

Rising awareness of cardiovascular health and increased treatment options are key drivers of the interventional cardiology and peripheral vascular devices market in the Asia-Pacific region. As public understanding of cardiovascular diseases (CVDs) grows, more individuals recognize the importance of heart health and the risks associated with these conditions, leading to higher demand for preventive measures, regular check-ups, and effective treatments. Educational initiatives by governments, healthcare organizations, and non-profits are promoting awareness of CVD risk factors, encouraging proactive healthcare behaviors. This cultural shift is boosting demand for interventional devices like stents, catheters, and balloons essential for diagnosing and treating cardiovascular issues.

Report Scope and Interventional Cardiology and Peripheral Vascular Devices Market Segmentation

|

Attributes |

Interventional Cardiology and Peripheral Vascular Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

China, India, Japan, South Korea, Australia, Singapore, Indonesia, Thailand, Malaysia, Philippines, and Rest of Asia-Pacific |

|

Key Market Players |

Abbott (U.S.), Boston Scientific Corporation (U.S.), BD (U.S.), Medtronic (U.S.), Terumo Corporation (Japan), B.Braun SE (Germany), ENDOCOR GmbH & CO. KG (Germany), Teleflex Incorporated (U.S.), Lepu Medical Technology (Beijing)Co.,Ltd. (China), MicroPort Scientific Corporation (China), Koninklijke Philips N.V. (Netherlands), Biotronik (Germany), SMT (China), OrbusNeich Medical Group Holdings Limited (China), Biosensors International Group, Ltd. (Singapore), Edwards Lifesciences Corporation (U.S.), AngioDynamics (U.S.), Alvimedica (Turkey), Cook (U.S.), Cordis (U.S.), Palex (Spain), and W. L. Gore & Associates (U.S.), Inc. |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Interventional Cardiology and Peripheral Vascular Devices Market Definition

Interventional cardiology is a branch of cardiology dealing with catheter-based treatment of heart diseases, such as coronary artery disease, heart valve diseases, and structural heart issues. Peripheral vascular devices are used to treat peripheral artery diseases, aneurysms, and other vascular disorders outside the heart, typically affecting arteries, veins, and lymphatic systems in areas like the legs and arms.

Interventional Cardiology and Peripheral Vascular Devices Market Dynamics

Drivers

- Increasing Prevalence of Autoimmune Diseases Across the Globe

The Asia-Pacific region is seeing a sharp increase in cardiovascular diseases (CVDs), influenced by lifestyle shifts, urbanization, and a growing elderly population. Rising sedentary behaviors, poor diets, smoking, alcohol use, and stress are contributing to higher obesity rates and conditions like hypertension, diabetes, and dyslipidemia, all of which increase CVD risk. Additionally, with one of the world’s fastest-aging populations, age-related vulnerabilities to heart disease are more common. These trends are transforming healthcare needs and driving demand for interventional cardiology and vascular devices to manage and treat CVDs effectively.

For instance,

In August 2024, according to an article published by THE LANCET, between 2025 and 2050, crude cardiovascular mortality is projected to rise by 91.2%, despite a 23% decline in the age-standardized mortality rate (ASMR). Ischaemic heart disease and stroke will remain the top causes, with Central Asia’s ASMR reaching 676 deaths per 100,000, far above Asia's average of 186, and high-income Asia at just 22. High systolic blood pressure will lead ASMR causes across Asia, while high fasting plasma glucose will dominate in Central Asia, contributing to 546 deaths per 100,000. These trends highlight the need for intervention, fueling demand for interventional cardiology and vascular devices across Asia-Pacific

In August 2024, according to an article published by THE LANCET, the cardiovascular disease (CVD) epidemic is particularly severe in Asia, accounting for 60% of the 18.6 million global CVD deaths in 2019. By 2050, the region's CVD prevalence is projected to rise by 109% from 2025, reaching 729.5 million cases. Ischaemic heart disease, peripheral artery disease, and stroke will make up 86.8% of cases, with heart failure affecting 74.5 million people. This surge underscores the urgent need for effective treatment and is expected to boost demand for interventional cardiology and vascular devices in Asia-Pacific healthcare systems

The interplay of lifestyle changes, an aging population, heightened awareness, and technological innovations is expected to sustain and enhance the demand for interventional devices. As healthcare providers continue to prioritize cardiovascular health and invest in advanced treatment solutions, the market for interventional cardiology and peripheral vascular devices is projected to grow substantially, addressing the urgent healthcare needs posed by the increasing burden of cardiovascular diseases in the region.

- Expansion of Diagnostic Centers and Laboratories

The growing geriatric population in the Asia-Pacific region is a significant driver of the interventional cardiology and peripheral vascular devices market. As older adults age, the prevalence of cardiovascular diseases (CVDs) rises, necessitating specialized medical devices to address their unique needs. Older adults are particularly susceptible to CVDs due to age-related changes and risk factors like hypertension, diabetes, and hyperlipidemia, increasing the demand for interventional devices such as stents and catheters. Furthermore, the elderly population's growth is leading to a rise in demand for invasive procedures and a proactive approach to cardiovascular health, enhancing the utilization of diagnostic and therapeutic devices and driving market expansion.

For instance,

In May 2024, according to an article published by Asian Development Bank, the population aged 60 and older in developing Asia and the Pacific is projected to nearly double to 1.2 billion by 2050. This dramatic rise in the elderly population highlights the increasing need for specialized healthcare services to address age-related health issues. As the geriatric population expands, it is expected to significantly drive growth in the Asia-Pacific interventional cardiology and peripheral vascular devices market, as healthcare systems focus on delivering effective treatments for conditions prevalent among older adults, particularly cardiovascular diseases

In September 2023, according to an article published by The Hindu, India’s elderly population is growing at a decadal rate of 41%, with the share of seniors expected to double to over 20% of the total population by 2050.

As the number of elderly individual’s increases, so does the prevalence of cardiovascular diseases, which results in heightened demand for specialized medical devices and interventional procedures. With an emphasis on preventive healthcare and ongoing technological innovations, the market is expected to experience substantial growth, effectively addressing the unique healthcare needs of the aging population and improving patient outcomes in cardiovascular care.

Opportunities

- Increasing Collaboration and Partnerships

Increasing collaboration and partnerships among companies in the Asia-Pacific interventional cardiology and peripheral vascular devices market create significant opportunities for growth and innovation. By forming strategic alliances, medical device manufacturers can improve distribution channels and market access, allowing for faster introduction of innovative products in clinical settings. These collaborations help companies understand the specific needs of healthcare providers and patients, enabling them to tailor their products to local market dynamics and regulatory requirements. Additionally, joint efforts can lead to co-development initiatives, fostering innovation and speeding up the time-to-market for new technologies.

For instance,

In September 2021, Medtronic announced that the company collaborated with Mpirik, which is known to provide a suite of cloud-based automated patient screening and care pathways for cardiovascular diseases. This collaboration helps the company to address disparities in care associated with the prevention of sudden cardiac arrest with their advanced artificial intelligence platform, thereby aiding the company to improve their leadership in market further

The trend of increasing collaboration and partnerships, along with a focus on timely product launches, offers substantial opportunities for growth in the Asia-Pacific interventional cardiology and peripheral vascular devices market. By harnessing these catheters, companies can enhance patient care, improve clinical outcomes, and strengthen their competitive positions in a rapidly evolving healthcare environment..

- Increasing Investment in Research & Development

Rising R&D investments offer crucial growth opportunities for the Asia-Pacific interventional cardiology and peripheral vascular devices market. With the increasing prevalence of cardiovascular diseases, demand for innovative treatment solutions is surging. By focusing on R&D, companies can develop advanced technologies, like bioabsorbable materials and minimally invasive devices, improving patient outcomes and addressing current treatment gaps. Moreover, R&D investment promotes collaboration with academic and research institutions, accelerating the translation of innovations into clinical use. These advancements not only enhance healthcare delivery efficiency but also strengthen market competitiveness by meeting the evolving needs of providers and patients.

For instance,

In July 2021, Abbott announced that the company confirms to invest USD 41.19 million for R&D for projects that focus on next-generation stents as well as coronary and endovascular balloon technologies for interventional cardiology treatments. This investment was specifically provided for their Clonmel facility in Ireland, which is a new research and development program in the area of cardiovascular devices.

By prioritizing research and innovation, companies can develop ground-breaking products that not only address the challenges posed by cardiovascular diseases but also enhance patient care. As the market continues to grow, the emphasis on R&D will be crucial for stakeholders looking to capitalize on emerging trends, ultimately leading to improved health outcomes and increased market competitiveness in the region.

Restraints/Challenges

- Increasing Collaboration and Partnerships

Increasing collaboration and partnerships among companies in the Asia-Pacific interventional cardiology and peripheral vascular devices market create significant opportunities for growth and innovation. By forming strategic alliances, medical device manufacturers can improve distribution channels and market access, allowing for faster introduction of innovative products in clinical settings. These collaborations help companies understand the specific needs of healthcare providers and patients, enabling them to tailor their products to local market dynamics and regulatory requirements. Additionally, joint efforts can lead to co-development initiatives, fostering innovation and speeding up the time-to-market for new technologies.

For instance,

In September 2021, Medtronic announced that the company collaborated with Mpirik, which is known to provide a suite of cloud-based automated patient screening and care pathways for cardiovascular diseases. This collaboration helps the company to address disparities in care associated with the prevention of sudden cardiac arrest with their advanced artificial intelligence platform, thereby aiding the company to improve their leadership in market further

The trend of increasing collaboration and partnerships, along with a focus on timely product launches, offers substantial opportunities for growth in the Asia-Pacific interventional cardiology and peripheral vascular devices market. By harnessing these catheters, companies can enhance patient care, improve clinical outcomes, and strengthen their competitive positions in a rapidly evolving healthcare environment..

- Increasing Investment in Research & Development

Rising R&D investments offer crucial growth opportunities for the Asia-Pacific interventional cardiology and peripheral vascular devices market. With the increasing prevalence of cardiovascular diseases, demand for innovative treatment solutions is surging. By focusing on R&D, companies can develop advanced technologies, like bioabsorbable materials and minimally invasive devices, improving patient outcomes and addressing current treatment gaps. Moreover, R&D investment promotes collaboration with academic and research institutions, accelerating the translation of innovations into clinical use. These advancements not only enhance healthcare delivery efficiency but also strengthen market competitiveness by meeting the evolving needs of providers and patients.

For instance,

In July 2021, Abbott announced that the company confirms to invest USD 41.19 million for R&D for projects that focus on next-generation stents as well as coronary and endovascular balloon technologies for interventional cardiology treatments. This investment was specifically provided for their Clonmel facility in Ireland, which is a new research and development program in the area of cardiovascular devices.

By prioritizing research and innovation, companies can develop ground-breaking products that not only address the challenges posed by cardiovascular diseases but also enhance patient care. As the market continues to grow, the emphasis on R&D will be crucial for stakeholders looking to capitalize on emerging trends, ultimately leading to improved health outcomes and increased market competitiveness in the region.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Interventional Cardiology and Peripheral Vascular Devices Market Scope

The market is segmented on the basis of product, type, procedure, indication, age group, end user, and distribution channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Angioplasty Balloons

- Old/Normal Balloons

- Drug Eluting Balloons

- Cutting And Scoring Balloons

- Stents

- Angioplasty Stents

- Coronary Stents

- Bare-Metal Stents

- Drug-Eluting Stents (Des)

- Bio Absorbable Stents

- Peripheral Stents

- Others

- Catheters

- Product

- Guiding Catheters

- Micro Catheters

- Cto Catheters

- Specialty

- Angiography Catheter

- Coronary Aspiration Catheter

- Others

- Product

- Aneurysm Repair Products

- Neuro Aneurysm (Coiling)

- Others

- Others And Accessories

- Guidewires

- Introducer Sheaths

- Balloon Inflation Devices

- Vascular Closure Devices

- Others

- Others And Accessories

Type

- Conventional

- Stents

- Catheters

- Guidewires

- Vascular Closure Devices (Vcds)

- Others

- Advanced

- Balloon Catheters

- Stent Grafts

Procedure

- Peripheral Angioplasty

- Angioplasty Balloons

- Stent

- Catheters

- Aneurysm Repair Products

- Others And Accessories

Indication

- Peripheral Arterial Disease

- Atherosclerosis

- Neuro Aneurysm (Coiling)

- Lower Extremity Peripheral Arterial Disease

- Supra-Inguinal Arterial Disease

- Infra-Inguinal Arterial Disease

- Infra-Popliteal Disease

- Upper Extremity Occlusive Disease

- Carotid Artery Disease

- Others

- Coronary Intervention

- Ischemic Heart Disease

- Thoracic Aortic Aneurysm

- Valve Disease

- Percutaneous Valve Repair or Replacement

- Congenital Heart Abnormalities

- Others

Age Group

- Geriatric

- Adults

- Pediatric

End User

- Hospitals

- Private

- Public

- Ambulatory Surgery Centers

- Nursing Facilities

- Clinics

- Others

Distribution Channel

- Third Party Distributors

- Direct Tender

- Others

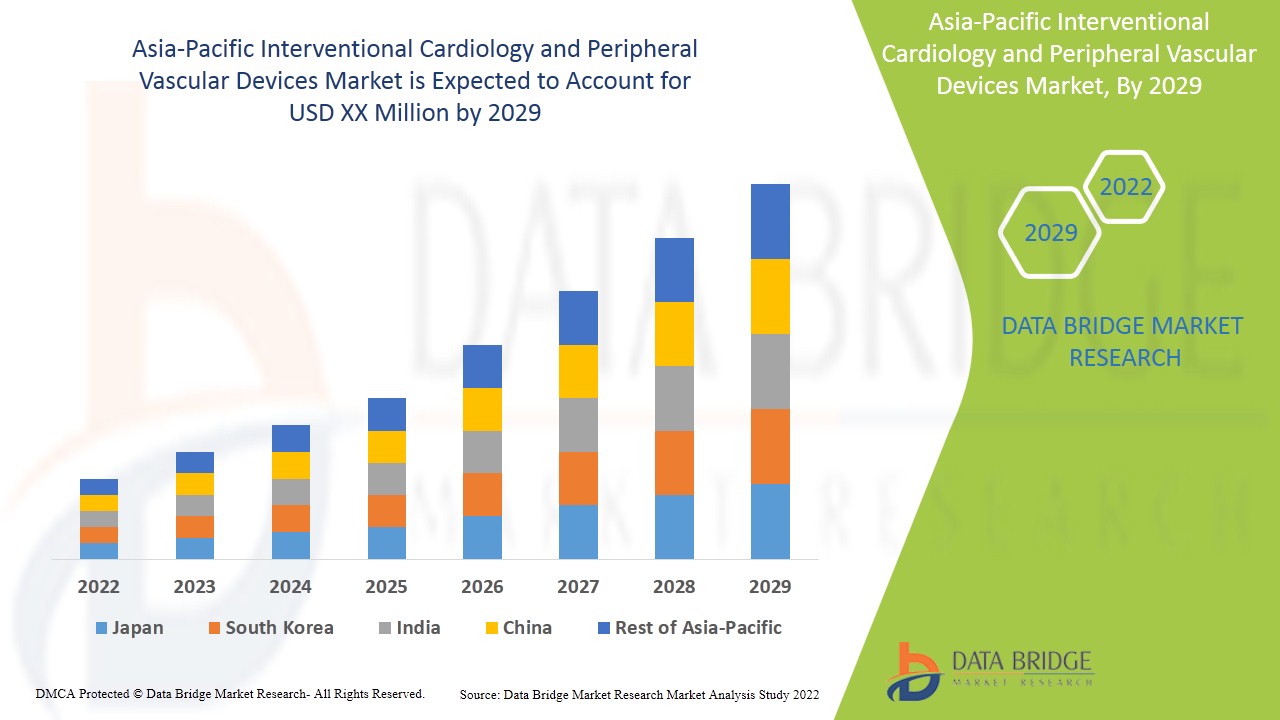

Interventional Cardiology and Peripheral Vascular Devices Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product, type, procedure, indication, age group, end user, and distribution channel as referenced above.

The countries covered in the market report are China, India, Japan, South Korea, Australia, Singapore, Indonesia, Thailand, Malaysia, Philippines, and rest of Asia-Pacific.

China is expected to dominate the market due to the region's advanced healthcare infrastructure, high prevalence of cardiac diseases, and increasing adoption of early treatment devices.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Interventional Cardiology and Peripheral Vascular Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Interventional Cardiology and Peripheral Vascular Devices Market Leaders Operating in the Market Are:

- Abbott (U.S.)

- Boston Scientific Corporation (U.S.)

- BD (U.S.)

- Medtronic (U.S.)

- Terumo Corporation (Japan)

- B.Braun SE (Germany)

- ENDOCOR GmbH & CO. KG (Germany)

- Teleflex Incorporated (U.S.)

- Lepu Medical Technology (Beijing)Co.,Ltd. (China)

- MicroPort Scientific Corporation (China)

- Koninklijke Philips N.V. (Netherlands)

- Biotronik (Germany)

- SMT (China)

- OrbusNeich Medical Group Holdings Limited (China)

- Biosensors International Group, Ltd. (Singapore)

- Edwards Lifesciences Corporation (U.S.)

- AngioDynamics (U.S.)

- Alvimedica (Turkey)

- Cook (U.S.)

- Cordis (U.S.)

- Palex (Spain)

- W. L. Gore & Associates (U.S.)

Latest Developments in Interventional Cardiology and Peripheral Vascular Devices Market

- In September 2024, Abbott and Seed Global Health are partnering to enhance maternal and child healthcare in Malawi. Their initiative includes establishing a Maternal Health Center of Excellence at Queen Elizabeth Central Hospital, focusing on training health workers to improve care quality and sustainability

- In September 2024, BD completed its acquisition of Edwards Lifesciences' Critical Care product group, renaming it BD Advanced Patient Monitoring. This move expanded BD's portfolio with advanced monitoring technologies and AI-enabled clinical tools, enhancing its smart connected care solutions and supporting future innovations in patient care

- In March 2024, Medtronic has received FDA approval for its latest Evolut FX+ TAVR system, designed to treat symptomatic severe aortic stenosis. This new generation features a modified diamond-shaped frame that offers larger coronary access windows, enhancing catheter maneuverability while maintaining the exceptional valve performance and strength associated with the Evolut platform

- In March 2024, Abbott has extended its partnership with Real Madrid and the Real Madrid Foundation through the 2026-27 season, focusing on combating childhood malnutrition and promoting healthy habits. The collaboration has provided extensive nutrition education and screening for millions of children worldwide

- In November 2023, Boston Scientific Corporation concluded its acquisition of Relievant Medsystems on November 17, 2023, adding the Intracept Intraosseous Nerve Ablation System to its chronic pain portfolio. The acquisition, costing USD 850 million upfront plus contingent payments, expands access to vertebrogenic pain treatment through national coverage, benefiting over 150 million lives

- In November 2023, BD and Bio Farma signed a memorandum of understanding to combat tuberculosis in Indonesia by providing access to BD's TB diagnostics. This collaboration aimed to optimize the supply chain and enhance TB diagnosis, aligning with Indonesia’s goal to eliminate the disease by 2030

- In September 2023, Boston Scientific Corporation announced it had entered into an agreement to acquire Relievant Medsystems, Inc.for USD 850 million upfront, plus contingent payments. The acquisition, expected to close in early 2024, aimed to enhance Boston Scientific's chronic low back pain treatment portfolio with the Intracept system

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.