Asia Pacific Interventional Imaging Market

Market Size in USD Billion

CAGR :

%

USD

1.35 Billion

USD

2.66 Billion

2024

2032

USD

1.35 Billion

USD

2.66 Billion

2024

2032

| 2025 –2032 | |

| USD 1.35 Billion | |

| USD 2.66 Billion | |

|

|

|

|

Asia-Pacific Interventional Imaging Market Size

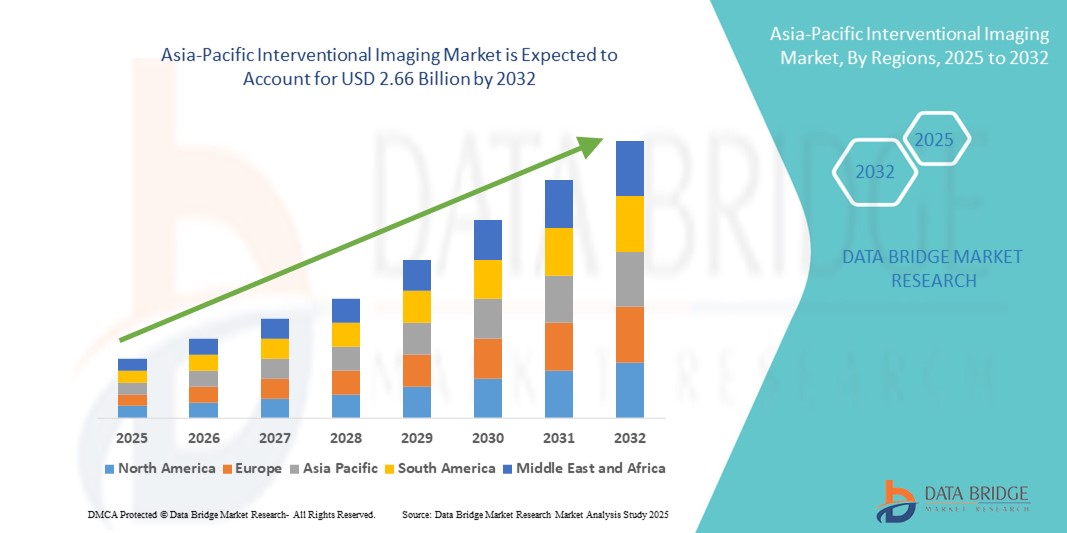

- The Asia-Pacific interventional imaging market size was valued at USD 1.35 billion in 2024 and is expected to reach USD 2.66 billion by 2032, at a CAGR of 8.78% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within connected healthcare systems and digital imaging infrastructure, leading to increased digitalization of diagnostic and interventional procedures across hospitals and specialty clinics in both urban and rural settings

- Furthermore, the rising demand for real-time, image-guided therapeutic interventions and minimally invasive procedures is positioning interventional imaging as a cornerstone of modern medical practice in the Asia-Pacific region. Healthcare providers are increasingly relying on integrated imaging platforms for enhanced procedural precision and patient safety

Asia-Pacific Interventional Imaging Market Analysis

- Interventional Imaging, offering digital storage, retrieval, and sharing of patient health information, is becoming an increasingly vital component of modern healthcare systems in Asia-Pacific due to its ability to enhance care coordination, reduce medical errors, and streamline clinical workflows

- The escalating demand for interventional imaging solutions in the region is primarily fueled by government-led digital health initiatives, growing awareness about the benefits of health IT, and rising investments in healthcare infrastructure across emerging economies such as India, China, and Indonesia

- China dominated the Asia-Pacific interventional imaging market with the largest revenue share of 32.4% in 2024, attributed to its expanding middle class, robust healthcare reforms, and extensive rollout of digital health records. Government initiatives such as the “Healthy China 2030” program are accelerating the adoption of cloud-based EMRs in hospitals and community health centers. In addition, China’s local vendors, supported by favorable pricing models and increasing investments in AI-enabled EMRs, are significantly reinforcing the country's leadership position in the regional market

- India is expected to be the fastest-growing country in the Asia-Pacific interventional imaging market during the forecast period, with a projected CAGR of over 17.6% from 2025 to 2032. This growth is attributed to the government’s strong push for digital healthcare through initiatives such as the Ayushman Bharat Digital Mission, increasing demand for accessible and efficient healthcare services, and a surge in private sector investments

- The general application segment dominated the Asia-Pacific interventional imaging market with a revenue share of 64.5% in 2024, being widely used across general practices, pediatrics, and internal medicine for routine imaging and diagnostics

Report Scope and Asia-Pacific Interventional Imaging Market Segmentation

|

Attributes |

Asia-Pacific Interventional Imaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Interventional Imaging Market Trends

Rising Demand for Image-Guided Precision and Integrated Diagnostics

- A major trend shaping the Asia-Pacific interventional imaging market is the increasing emphasis on real-time image-guided procedures and integrated diagnostic ecosystems. Healthcare providers are prioritizing minimally invasive therapies that rely heavily on precise imaging modalities such as CT, MRI, fluoroscopy, and ultrasound for procedural guidance and treatment planning

- For instance, governments across Asia-Pacific—including India, China, and Australia—are launching large-scale investments to upgrade diagnostic imaging capabilities in public hospitals and regional health centers, recognizing the vital role of interventional radiology in improving patient outcomes and reducing surgical risk

- In response, imaging technology firms are developing AI-enhanced platforms and hybrid systems that integrate fluoroscopy with 3D CT or MRI for higher diagnostic accuracy during procedures such as cardiac catheterization, neuro-interventions, and oncology treatments

- Moreover, cloud-based imaging systems and Picture Archiving and Communication Systems (PACS) are being adopted across developing economies in Southeast Asia due to their cost-effectiveness, accessibility, and support for remote image sharing, especially in rural and semi-urban areas with limited physical infrastructure

- The rise of mobile-compatible interventional imaging solutions is another defining trend, enabling radiologists and clinicians to review, annotate, and collaborate on diagnostic scans remotely using tablets and mobile devices—improving workflow efficiency and reducing procedural delays

- As healthcare systems across Asia-Pacific continue to prioritize early diagnosis, precision therapy, and data-driven care models, the demand for advanced interventional imaging platforms is expanding rapidly, opening new growth avenues for med-tech innovation, public-private partnerships, and regional market penetration

Asia-Pacific Interventional Imaging Market Dynamics

Driver

Growing Need Due to Rising Imaging Demands and Government Investments in Healthcare Infrastructure

- The increasing burden of chronic diseases, aging population, and growing demand for early and accurate diagnostics are significantly driving the adoption of interventional imaging systems across Asia-Pacific healthcare institutions

- For instance, in March 2024, China’s National Health Commission announced a nationwide diagnostic imaging upgrade project across county-level hospitals to enhance access to minimally invasive procedures, CT-guided interventions, and hybrid operating rooms. This reflects growing public sector investment in interventional imaging technology

- As hospitals and clinics seek precision-driven, image-guided procedures to improve patient outcomes, interventional imaging systems—such as real-time ultrasound, fluoroscopy, and MRI-guided devices—are becoming integral to modern clinical workflows across oncology, cardiology, and neurology

- Furthermore, expanding health insurance coverage, a growing focus on outpatient interventional radiology (IR) services, and increasing procedural volumes are propelling market demand. Countries like India, Malaysia, and Thailand are scaling up tertiary care centers and investing in AI-assisted diagnostic tools, creating fertile ground for market expansion

- The integration of interventional imaging with robotic surgical platforms, navigation software, and AI-enabled decision support tools is enhancing procedural accuracy, reducing recovery times, and increasing the adoption of these technologies in both public and private healthcare sectors

- The rising preference for minimally invasive surgeries and the expansion of value-based care models are also driving the shift towards real-time, image-guided therapeutic interventions across Asia-Pacific

Restraint/Challenge

High Cost, Lack of Trained Professionals, and Infrastructure Gaps

- The relatively high cost of interventional imaging systems and installation of hybrid ORs continues to be a major challenge, especially in lower-middle-income Asia-Pacific countries. The capital investment, infrastructure upgrades, and maintenance required for these advanced modalities limit adoption in rural and tier-2/3 cities

- For instance, while major urban hospitals in China and Japan are rapidly adopting angiography and fluoroscopy systems, facilities in Indonesia, Vietnam, and the Philippines struggle with outdated equipment and budgetary constraints

- In addition, the shortage of skilled interventional radiologists, technicians, and biomedical engineers hinders the widespread utilization of these technologies. Without adequate training programs and standardized certifications across the region, optimal use of interventional imaging remains a barrier

- Challenges in integrating imaging systems with hospital information systems (HIS), PACS, and EHRs also contribute to underutilization. Hospitals with legacy IT infrastructure face compatibility issues when upgrading to advanced interventional platforms

- To overcome these challenges, public-private partnerships, international collaborations for knowledge transfer, and government-backed subsidies will be essential. In addition, AI-powered automation, remote guidance tools, and portable imaging systems may help address workforce and infrastructure limitations over time

Asia-Pacific Interventional Imaging Market Scope

The market is segmented on the basis of component, type, delivery mode, application, and end user.

- By Component

On the basis of component, the Asia-Pacific Interventional Imaging market is segmented into software and services. The software segment dominated the market with a revenue share of 69.2% in 2024, driven by rising demand for digital healthcare platforms that streamline clinical operations and improve patient outcomes.

The services segment is projected to witness the fastest CAGR of 7.9% from 2025 to 2032, owing to increased investments in implementation, training, system upgrades, and data migration support—particularly among smaller and mid-sized healthcare facilities.

- By Type

Based on type, the market is segmented into interoperable EMR, traditional EMR, speech-enabled EMR, and others. The interoperable EMR segment led the market with a 41.5% revenue share in 2024, as the need for data-sharing across multiple healthcare systems rises amid national health IT initiatives.

The speech-enabled EMR segment is expected to grow at the fastest CAGR of 8.3% from 2025 to 2032, driven by increasing clinician preference for voice-assisted charting and real-time documentation.

- By Delivery Mode

On the basis of delivery mode, the market is segmented into cloud-based setups, hybrid setups, and client server setups. The cloud-based setups segment dominated with a 52.8% revenue share in 2024, owing to its ease of deployment, cost-efficiency, and real-time accessibility across diverse geographic locations.

The hybrid setups segment is expected to witness the fastest CAGR of 8.7% from 2025 to 2032, as healthcare providers seek customizable solutions combining local control with cloud agility.

- By Application

By application, the Asia-Pacific Interventional Imaging market is segmented into specialty application and general application. The general application segment held the largest revenue share of 64.5% in 2024, being widely used across general practices, pediatrics, and internal medicine for routine imaging and diagnostics.

The specialty application segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by rising demand for advanced imaging in oncology, cardiology, and neurology.

- By End User

On the basis of end user, the market is segmented into hospitals, ambulatory surgical centers, specialized clinics, general physician clinics, and others. The hospital segment led the market with a 48.7% revenue share in 2024, attributed to high patient volumes, integrated workflow requirements, and government mandates for digitized health systems.

The general physician clinics segment is projected to grow at the fastest CAGR of 22.9% from 2025 to 2032, driven by rising EMR adoption at the primary care level and demand for simplified, cost-effective imaging tools.

Asia-Pacific Interventional Imaging Market Regional Analysis

- Asia-Pacific interventional imaging market dominated the global Interventional Imaging market with the largest revenue share of 45% in 2024, driven by a surge in healthcare digitization, government mandates supporting electronic documentation, and expanding healthcare infrastructure across emerging economies such as China and India

- The region’s increasing adoption of cloud computing, telemedicine, and data analytics is encouraging the integration of interventional imaging systems into public and private healthcare institutions

- The push for universal health coverage, along with rising investments in hospital modernization and AI-assisted diagnostics, has significantly contributed to the expansion of interventional radiology services across urban and semi-urban centers in APAC

China Asia-Pacific Interventional Imaging Market Insight

The China interventional imaging market captured the largest revenue share of 32.4% in the Asia-Pacific region in 2024, propelled by robust healthcare reforms and wide-scale implementation of digital diagnostic infrastructure Programs like “Healthy China 2030” are driving large-scale investments in hybrid ORs, CT-guided intervention facilities, and PACS-integrated imaging systems across tertiary care hospitals China’s local vendors, supported by favorable government incentives and a growing focus on AI-enabled diagnostic tools, are helping to maintain its leadership in the regional interventional imaging segment.

Japan Asia-Pacific Interventional Imaging Market Insight

The Japan interventional imaging market is steadily expanding, supported by its aging population, highly digitized hospital infrastructure, and long-standing focus on minimally invasive procedures With strong EMR integration already in place, Japan is investing in advanced imaging-guided robotic systems and precision therapies, especially for neurology and cardiology applications Increased demand for AI-powered image analytics, clinical decision support tools, and hybrid imaging platforms are shaping Japan’s next phase of market growth

India Asia-Pacific Interventional Imaging Market Insight

The India interventional imaging market is expected to register the fastest CAGR of over 17.6% from 2025 to 2032 in the Asia-Pacific Interventional Imaging market The growth is driven by Ayushman Bharat Digital Mission, telemedicine expansion, and a rising emphasis on cancer and cardiovascular interventional procedures in both urban and rural settings Private sector investments and health-tech startups are rapidly introducing cost-effective, portable, and cloud-compatible imaging solutions, facilitating widespread adoption among secondary care hospitals and diagnostic chains.

Australia Asia-Pacific Interventional Imaging Market Insight

The Australia interventional imaging market is advancing rapidly, backed by the My Health Record initiative, universal healthcare access, and the presence of a digitally mature medical ecosystem EMR-linked imaging platforms, real-time ultrasound, and CT-fluoroscopy systems are now standard in most public hospitals and specialty clinics Key focus areas include interoperability, cybersecurity, and AI-integration, enabling high accuracy in image-guided therapy planning and chronic disease monitoring.

Asia-Pacific Interventional Imaging Market Share

The Asia-Pacific Interventional Imaging industry is primarily led by well-established companies, including:

- Siemens Healthineers AG (Germany)

- GE Healthcare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Shimadzu Corporation (Japan)

- Canon Medical Systems Corporation (Japan)

- Fujifilm Holdings Corporation (Japan)

- Hologic, Inc. (United States)

- Carestream Health, Inc. (U.S.)

- Agfa-Gevaert Group (Belgium)

- Toshiba Medical Systems Corporation (Japan)

- Hitachi Medical Corporation (Japan)

Latest Developments in Asia-Pacific Interventional Imaging Market

- In September 2023, Canon Medical unveiled the Alphenix Sky 12 HD interventional system featuring a novel 12" x 12" High-Definition (Hi-Def) Detector. This Alphenix Sky 12 HD, featuring a 12"×12" Hi-Def detector, offers enhanced visualization capabilities for a range of medical procedures including Interventional Cardiology (IC), Interventional Neurology (IN), Interventional Oncology (IO), and Interventional Radiology (IR), including pediatric interventions

- In March 2025, Canon Medical received FDA/CE clearance for major AI enhancements to its Aquilion ONE / INSIGHT Edition CT, including the PIQE 1024 matrix and SilverBeam filtration applied across cardiac, lung, and musculoskeletal imaging applications

- In April 2025 , Canon showcased its Alphenix 4D CT at ECIO 2025 (Rotterdam), demonstrating its versatility in interventional oncology workflows and the ability to integrate CT and angiography imaging in a single suite to streamline complex oncologic procedures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.