Asia Pacific Intraoperative Imaging Market

Market Size in USD Billion

CAGR :

%

USD

1.07 Billion

USD

1.96 Billion

2024

2032

USD

1.07 Billion

USD

1.96 Billion

2024

2032

| 2025 –2032 | |

| USD 1.07 Billion | |

| USD 1.96 Billion | |

|

|

|

|

Asia-Pacific Intraoperative Imaging Market Size

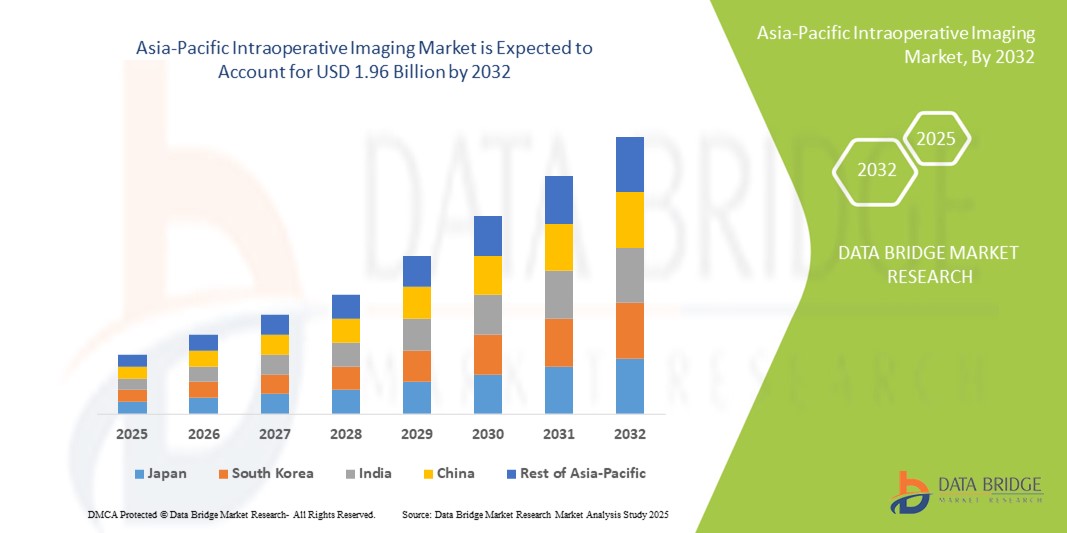

- The Asia-Pacific intraoperative imaging market size was valued at USD 1.07 billion in 2024 and is expected to reach USD 1.96 billion by 2032, at a CAGR of 7.80% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced imaging technologies, such as C-arms, intraoperative MRI (iMRI), and intraoperative computed tomography (iCT), which enhance surgical precision and patient outcomes

- Furthermore, the rising demand for minimally invasive surgeries, coupled with the growing prevalence of chronic diseases and neurological disorders, is driving higher adoption of intraoperative imaging solutions across hospitals and surgical centers in the region, significantly boosting the industry's growth

Asia-Pacific Intraoperative Imaging Market Analysis

- Intraoperative imaging, providing real-time imaging during surgical procedures, is becoming an essential component of modern operating rooms in Asia-Pacific due to its ability to enhance surgical precision, improve patient outcomes, and integrate seamlessly with advanced surgical workflows

- The increasing demand for intraoperative imaging is primarily driven by the rising adoption of minimally invasive surgeries, technological advancements in imaging systems such as C-arms, iMRI, and iCT, and the growing prevalence of chronic diseases and neurological disorders requiring complex surgical interventions

- Japan dominated the Asia-Pacific intraoperative imaging market with the largest revenue share of 32.5% in 2024, supported by advanced healthcare infrastructure, high adoption of innovative surgical technologies, and strong investments from leading medical device manufacturers; substantial usage of intraoperative imaging is observed in orthopedic, neurological, and cardiovascular surgeries

- China is expected to be the fastest-growing country in the Asia-Pacific intraoperative imaging market during the forecast period, driven by expanding healthcare infrastructure, increasing surgical volumes, rising government initiatives for advanced medical technologies, and growing investments in hospitals

- Mobile C-arm systems dominate the Asia-Pacific intraoperative imaging market with a market share of 45.5% in 2024, owing to their versatility, real-time imaging capability, and ease of integration into existing surgical setups

Report Scope and Asia-Pacific Intraoperative Imaging Market Segmentation

|

Attributes |

Asia-Pacific Intraoperative Imaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Intraoperative Imaging Market Trends

Advancements in Real-Time Imaging and Surgical Navigation

- A major and accelerating trend in the Asia-Pacific intraoperative imaging market is the adoption of advanced real-time imaging technologies, including C-arms, intraoperative MRI (iMRI), and intraoperative CT (iCT), which significantly enhance surgical accuracy and patient outcomes

- For instance, some hospitals in Japan have implemented hybrid operating rooms equipped with real-time imaging and navigation systems, allowing surgeons to perform complex procedures with improved precision

- Integration with surgical navigation and robotic-assisted systems enables surgeons to plan, monitor, and adjust procedures in real time, reducing complications and improving recovery times. For instance, robotic-assisted spinal surgeries in South Korea utilize intraoperative imaging for accurate implant placement

- The convergence of imaging and navigation technologies facilitates minimally invasive surgeries, enhancing operational efficiency and reducing patient trauma. Through these systems, surgeons can visualize critical anatomy, confirm instrument placement, and adjust techniques without repeated imaging cycles

- This trend towards more precise, integrated, and real-time imaging solutions is reshaping expectations in surgical care. Consequently, companies such as Shimadzu and Siemens Healthineers are developing advanced intraoperative imaging systems with features such as 3D imaging and seamless integration with surgical navigation platforms

- The demand for intraoperative imaging systems with enhanced real-time capabilities is rapidly growing across hospitals and surgical centers, as clinicians increasingly prioritize accuracy, safety, and procedure efficiency

Asia-Pacific Intraoperative Imaging Market Dynamics

Driver

Increasing Adoption Due to Minimally Invasive Surgeries and Rising Surgical Volumes

- The rising adoption of minimally invasive and complex surgeries, coupled with increasing surgical volumes in Asia-Pacific, is a significant driver for the heightened demand for intraoperative imaging

- For instance, in 2024, a hospital in China integrated intraoperative CT into its orthopedic surgery unit to improve implant placement accuracy and reduce post-operative complications. Such initiatives by hospitals are expected to drive market growth during the forecast period

- As surgeons increasingly perform minimally invasive procedures requiring precision, intraoperative imaging provides real-time guidance, reduces errors, and enhances patient safety, offering a compelling upgrade over conventional imaging methods

- Furthermore, the growing prevalence of chronic diseases and neurological disorders is increasing the need for complex surgical procedures, making intraoperative imaging a critical component of modern operating rooms

- The convenience of real-time imaging, improved surgical outcomes, and compatibility with robotic-assisted systems are key factors propelling the adoption of intraoperative imaging in hospitals. The trend towards hybrid operating rooms and advanced imaging suites further contributes to market expansion

Restraint/Challenge

High Costs and Infrastructure Requirements

- The relatively high cost of advanced intraoperative imaging systems, along with the infrastructure requirements for integration into existing operating rooms, poses a significant challenge to broader market adoption in Asia-Pacific

- For instance, some mid-sized hospitals in India and Indonesia have delayed adoption due to the high capital expenditure and space needed for C-arm or iMRI systems

- Maintaining and upgrading imaging equipment, along with training staff to operate complex systems, further adds to operational challenges. For instance, intensive training programs are often required to ensure safe and effective use of intraoperative MRI in neurosurgical units

- While the benefits of real-time imaging are clear, the perceived high costs and complexity can hinder adoption in budget-constrained hospitals, particularly in developing countries within the region

- Addressing these challenges through cost-effective solutions, modular systems, and training programs will be crucial for expanding intraoperative imaging adoption and sustaining market growth

Asia-Pacific Intraoperative Imaging Market Scope

The market is segmented on the basis of product, component, application, and end-user.

- By Product

On the basis of product, the Asia-Pacific intraoperative imaging market is segmented into Mobile C-Arms, Intraoperative Computed Tomography (iCT), Intraoperative Magnetic Resonance Imaging (iMRI), and Intraoperative Ultrasound. The Mobile C-Arms segment dominated the market with the largest revenue share of 45.5% in 2024, driven by their versatility, real-time imaging capability, and cost-effectiveness. Mobile C-Arms are widely used across multiple surgical disciplines including orthopedics, trauma, and cardiovascular procedures, offering ease of positioning and integration into existing operating rooms. Hospitals in Japan and South Korea prefer Mobile C-Arms for their compact design, high imaging accuracy, and compatibility with surgical navigation systems. In addition, their portability allows use across multiple operating rooms, maximizing utilization and reducing the need for additional equipment. Strong manufacturer presence and after-sales services further strengthen the dominance of this segment. These factors make Mobile C-Arms the most adopted intraoperative imaging product across the region.

The Intraoperative MRI segment is anticipated to witness the fastest growth rate of 9.1% from 2025 to 2032, fueled by the increasing adoption of minimally invasive neurosurgeries and the rising demand for high-resolution real-time imaging. iMRI provides superior soft tissue visualization, making it critical for tumor resections and neurological procedures. Hospitals in China and India are increasingly investing in iMRI systems to improve surgical precision and reduce post-operative complications. Growing awareness among surgeons about improved outcomes with intraoperative MRI and government support for advanced surgical technologies are accelerating adoption. The integration of iMRI with robotic-assisted surgical systems also contributes to its rapid growth. Rising investment in advanced operating rooms is further driving the demand for iMRI solutions.

- By Component

On the basis of component, the market is segmented into system, software, and services. The System segment dominated the market in 2024 due to the high value and essential nature of imaging hardware such as C-Arms, iMRI, and iCT units. Systems are often bundled with essential features including 3D imaging, high-resolution monitors, and surgical navigation compatibility, making them critical for hospitals and surgical centers. Leading hospitals in Japan and South Korea invest heavily in systems to ensure high-quality imaging during surgeries. Strong manufacturer support and extensive service networks further enhance the system segment’s dominance. Hospitals prefer complete system installations as they provide reliability, consistency, and long-term service benefits. Mobile C-Arms and iCT units largely contribute to this segment’s high adoption.

The Software segment is expected to witness the fastest growth, driven by advancements in image processing, AI-based surgical guidance, and integration with hospital information systems. AI-enabled software enhances real-time decision-making and accuracy in procedures, providing predictive analytics and alerts. Hospitals in China and India are adopting software solutions to optimize workflow and improve surgical outcomes. Increasing investment in digital surgical infrastructure and cloud-based imaging solutions is accelerating software adoption. Software solutions are also critical for robotic-assisted and minimally invasive surgeries. Continuous updates and AI integration make this the fastest-growing component segment.

- By Application

On the basis of application, the market is segmented into neurosurgery, orthopedic & trauma surgery, spine surgery, cardiovascular surgery, and other applications. Neurosurgery dominated the Asia-Pacific market with the largest revenue share in 2024, owing to the critical need for precision and accuracy in brain and spinal procedures. Intraoperative imaging aids in tumor resections, epilepsy surgeries, and complex neurological procedures by providing real-time guidance and reducing risks. Hospitals in Japan and South Korea heavily rely on imaging technologies such as iMRI and iCT for neurosurgeries, driving high adoption. Growing prevalence of neurological disorders and increasing investments in advanced neurosurgical centers further strengthen dominance. Real-time imaging also reduces the risk of reoperations and improves patient outcomes. Surgeons increasingly rely on intraoperative imaging for complex brain surgeries.

Spine Surgery is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising spinal disorders, aging population, and the adoption of minimally invasive spinal procedures. Intraoperative imaging ensures accurate implant placement and reduces post-operative complications. Hospitals in China and India are increasingly upgrading operating rooms with C-Arms and iCT for spine surgeries. Government initiatives to enhance surgical infrastructure and private investment in orthopedic centers are driving rapid adoption. The growth of minimally invasive techniques and robotic-assisted procedures is further boosting demand. Increasing awareness among surgeons about improved patient outcomes is supporting the segment’s growth.

- By End-User

On the basis of end-user, the market is segmented into hospitals, ambulatory surgical centers and clinics, academic institutes, and research centers. Hospitals dominated the Asia-Pacific market with the largest revenue share in 2024, as they perform the highest number of complex surgical procedures requiring real-time imaging. Large tertiary care hospitals in Japan, South Korea, and China are increasingly investing in advanced intraoperative imaging systems to enhance surgical precision and patient outcomes. Comprehensive service offerings and high patient volumes make hospitals the primary end-user for these technologies. Hospitals also prefer full-system installations and long-term service contracts, adding to revenue dominance. The availability of skilled surgical staff and advanced infrastructure further strengthens hospital adoption.

Ambulatory Surgical Centers and Clinics are expected to witness the fastest growth during forecast period, driven by the rising trend of outpatient minimally invasive surgeries and increasing investments in advanced imaging infrastructure. These centers in China, India, and Southeast Asia are adopting portable C-Arms and compact imaging solutions to enhance efficiency and reduce surgical time. The growth of outpatient surgical procedures and cost-effective imaging solutions are key factors driving this segment. Expanding healthcare access and increasing patient preference for outpatient care are contributing to the segment’s rapid growth. Portable imaging solutions also make integration easier in smaller facilities.

Asia-Pacific Intraoperative Imaging Market Regional Analysis

- Japan dominated the Asia-Pacific intraoperative imaging market with the largest revenue share of 32.5% in 2024, supported by advanced healthcare infrastructure, high adoption of innovative surgical technologies, and strong investments from leading medical device manufacturers; substantial usage of intraoperative imaging is observed in orthopedic, neurological, and cardiovascular surgeries

- Hospitals in Japan highly value real-time imaging solutions such as Mobile C-Arms, iCT, and iMRI for enhancing precision in neurosurgery, orthopedic, spine, and cardiovascular procedures, contributing to high adoption rates

- The widespread usage of intraoperative imaging is supported by a technologically advanced medical workforce, strong government initiatives promoting modern operating room infrastructure, and increasing awareness among surgeons about the benefits of real-time guidance

The Japan Intraoperative Imaging Market Insight

The Japan intraoperative imaging market dominated the Asia-Pacific region in 2024, driven by advanced healthcare infrastructure, high technological adoption, and a strong focus on improving surgical precision. Hospitals extensively use Mobile C-Arms, iCT, and iMRI systems for neurosurgery, spine, and cardiovascular procedures. The integration of imaging solutions with robotic-assisted surgeries and AI-enabled software enhances procedural accuracy and patient outcomes. Government support for hospital modernization and increasing surgical volumes further spur market growth. Japan’s aging population and emphasis on minimally invasive procedures are such asly to drive demand for intraoperative imaging in both public and private healthcare sectors.

China Intraoperative Imaging Market Insight

The China intraoperative imaging market is expected to be the fastest-growing country in Asia-Pacific during the forecast period, fueled by rising surgical volumes, expanding healthcare infrastructure, and government initiatives promoting advanced medical technologies. Hospitals and specialty surgical centers are increasingly adopting Mobile C-Arms, iCT, and iMRI systems for complex procedures in neurosurgery, orthopedic, and cardiovascular applications. Integration with robotic-assisted surgeries and AI-based software solutions enhances surgical precision and efficiency. In addition, domestic manufacturing of imaging equipment improves affordability and accessibility. Growing awareness about minimally invasive surgeries and improved patient outcomes further accelerates market adoption.

India Intraoperative Imaging Market Insight

The India intraoperative imaging market accounted for a significant revenue share in Asia-Pacific in 2024, driven by rapid urbanization, rising healthcare expenditure, and increasing adoption of advanced imaging solutions. Hospitals and surgical centers are increasingly investing in Mobile C-Arms and iCT systems to enhance procedural accuracy and patient safety. Government initiatives to develop smart hospitals and upgrade surgical infrastructure are key growth drivers. Availability of cost-effective imaging solutions and training programs for surgeons support adoption across metropolitan and tier-2 cities. The growing trend of minimally invasive surgeries and awareness of improved surgical outcomes further propels market expansion.

South Korea Intraoperative Imaging Market Insight

The South Korea intraoperative imaging market is witnessing robust growth, fueled by advanced healthcare infrastructure, high adoption of minimally invasive and robotic-assisted surgeries, and strong government support for medical technology adoption. Hospitals extensively use Mobile C-Arms and iCT systems for orthopedic, neurosurgical, and cardiovascular procedures. Integration of intraoperative imaging with AI-enabled surgical guidance and navigation platforms enhances accuracy and efficiency. Rising investments in private hospitals and specialized surgical centers further drive market demand. The country’s emphasis on precision surgery and patient safety ensures continuous adoption of advanced imaging technologies.

Asia-Pacific Intraoperative Imaging Market Share

The Asia-Pacific Intraoperative Imaging industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- GE HealthCare (U.S.)

- Siemens Healthineers AG (Germany)

- Koninklijke Philips N.V. (Netherlands)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- FUJIFILM Holdings Corporation (Japan)

- Hitachi Ltd. (Japan)

- Esaote S.p.A. (Italy)

- NeuroLogica Corporation (U.S.)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Shanghai United Imaging Healthcare Co., LTD. (China)

- Shenzhen Anke High-Tech Co., Ltd. (China)

- Brainlab AG (Germany)

- Ziehm Imaging GmbH (Germany)

- IMRIS Imaging, Inc. (Canada)

- BJ Wandong Medical Technology Co., Ltd. (China)

- Neusoft Corporation (China)

- Olympus Corporation (Japan)

What are the Recent Developments in Asia-Pacific Intraoperative Imaging Market?

- In August 2025, Samsung India, in collaboration with its subsidiary NeuroLogica, introduced a new suite of mobile CT systems, including the CereTom Elite, OmniTom Elite, OmniTom Elite PCD, and BodyTom 32/64. These AI-powered, mobile CT units are designed to provide advanced diagnostic imaging in diverse medical environments such as ICUs, operating rooms, and emergency departments

- In May 2025, Hong Kong Sanatorium & Hospital (HKSH) Medical Group entered into a strategic collaboration with United Imaging to advance AI-powered imaging technologies. This partnership, announced during the Asia Summit on Global Health 2025, aims to elevate cancer care and position Hong Kong as a hub for high-end medical innovation. The collaboration focuses on integrating advanced imaging solutions to enhance diagnostic capabilities and treatment outcomes in oncology

- In October 2024, researchers introduced the Fast Adaptive Focus Tracking Robotic Optical Coherence Tomography (FACT-ROCT) system, providing real-time, artifact-free multifunctional imaging of spinal cord tumors during surgery. This advancement addresses motion artifacts and resolution degradation from tissue movement, achieving wide-area, high-resolution imaging

- In May 2023, United Imaging unveiled its comprehensive range of medical imaging products at the China International Medical Equipment Fair (CMEF). The showcased portfolio included PET/CT, PET/MR, MR, CT, DR, RT, and digital solutions, all enhanced with artificial intelligence capabilities. This launch underscores the company's commitment to integrating AI across various imaging modalities to improve diagnostic accuracy and operational efficiency in surgical settings

- In February 2022, a new lensless fiber imaging technique was introduced, enabling high-resolution, real-time cancer diagnosis during surgery. This method enhances tumor recognition accuracy and facilitates in vivo diagnostics, particularly for glioblastoma, by improving classification accuracy from 90.8% to 95.6%

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.