Asia Pacific Laboratory Filtration Market

Market Size in USD Million

CAGR :

%

USD

664.50 Million

USD

1,220.86 Million

2025

2033

USD

664.50 Million

USD

1,220.86 Million

2025

2033

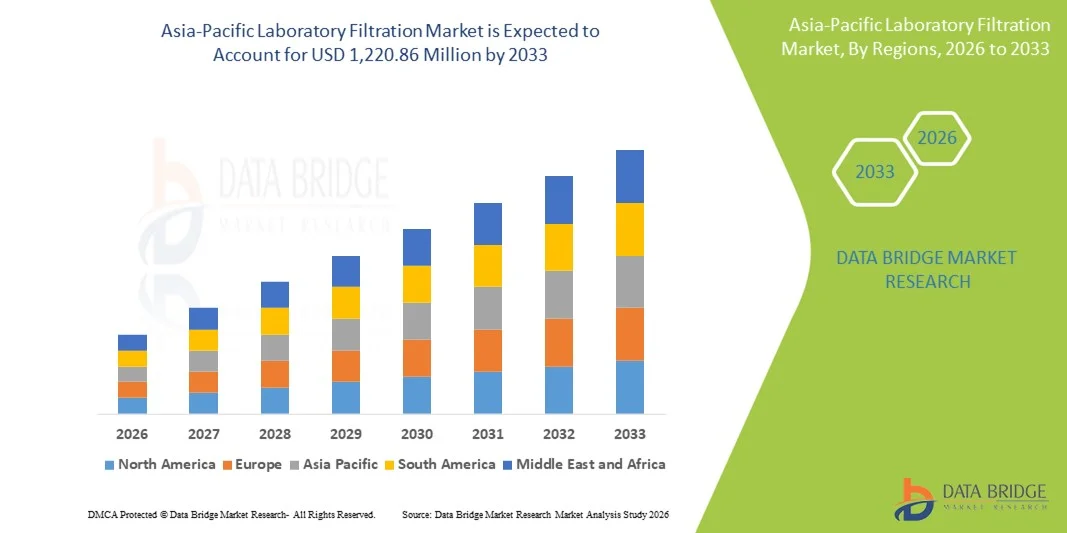

| 2026 –2033 | |

| USD 664.50 Million | |

| USD 1,220.86 Million | |

|

|

|

|

Asia-Pacific Laboratory Filtration Market Size

- The Asia-Pacific laboratory filtration market size was valued at USD 664.50 million in 2025 and is expected to reach USD 1,220.86 million by 2033, at a CAGR of 7.9% during the forecast period

- The market growth is primarily driven by expanding life sciences research, rising pharmaceutical manufacturing, and increasing investments in biotechnology and academic laboratories across major APAC countries, which are accelerating the adoption of advanced filtration technologies

- Moreover, growing demand for high-performance, efficient, and contamination-free filtration systems supported by advancements in membrane technologies and automation is reinforcing laboratory filtration as an essential component of modern research workflows. These converging factors are rapidly boosting the uptake of laboratory filtration solutions, thereby significantly strengthening the region’s market expansion

Asia-Pacific Laboratory Filtration Market Analysis

- Laboratory filtration, essential for separating, purifying, and preparing biological and chemical samples, is becoming a critical component of research, diagnostics, and industrial laboratory workflows across Asia-Pacific due to its ability to enhance accuracy, sterility, and operational efficiency

- The rising biopharmaceutical manufacturing, expanding life sciences research, increasing diagnostic testing volumes, and strong government support for biotechnology development are the primary drivers fueling the demand for advanced laboratory filtration products in the region

- China dominated the Asia-Pacific laboratory filtration market in 2025 with a market share of 38.5%, supported by large-scale pharmaceutical production, rapid expansion of biologics facilities, and continuous upgrades in R&D infrastructure, while Japan and South Korea contributed significantly through established research institutions and high adoption of precision filtration technologies

- India is expected to be the fastest-growing country during the forecast period due to growing CRO/CMO activities, expanding academic research capacity, and rising investment in pharmaceutical and diagnostics laboratories

- Filtration Media segment dominated the Asia-Pacific laboratory filtration market with a market share of 41.7% in 2025, driven by its extensive use across microfiltration, ultrafiltration, and vacuum filtration processes for sample preparation, purification, and sterilization in biotechnology companies, pharmaceutical firms, academic institutes, and diagnostic centers

Report Scope and Asia-Pacific Laboratory Filtration Market Segmentation

|

Attributes |

Asia-Pacific Laboratory Filtration Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Laboratory Filtration Market Trends

Adoption of Automated and High-Precision Filtration Systems

- A significant and accelerating trend in the Asia-Pacific laboratory filtration market is the growing adoption of automated filtration systems integrated with high-precision technologies such as real-time monitoring sensors and robotics, improving workflow efficiency and reproducibility

- For instance, automated vacuum filtration systems in China streamline sample processing in high-throughput laboratories, reducing manual errors and ensuring consistent results across multiple experiments

- Integration with digital laboratory management platforms enables filtration devices to track usage patterns, optimize filter replacement schedules, and provide predictive maintenance alerts, enhancing operational efficiency

- These systems also allow laboratories to standardize filtration procedures across multiple sites, ensuring consistent quality in biopharmaceutical, diagnostic, and research applications

- This trend towards intelligent, automated, and interconnected filtration workflows is redefining laboratory expectations in the region. Consequently, companies such as Sartorius and Merck are developing filtration systems with advanced automation and digital monitoring capabilities

- The demand for automated, high-precision filtration solutions is growing rapidly across biotechnology, pharmaceutical, and academic sectors, as laboratories increasingly prioritize efficiency, reproducibility, and contamination-free processing

- Adoption of multi-technology filtration platforms, combining microfiltration, ultrafiltration, and nanofiltration in a single workflow, is gaining traction to meet diverse application requirements within limited laboratory space

- Increasing integration of filtration systems with AI-based data analytics and IoT-enabled laboratory devices allows real-time process optimization and predictive insights, further enhancing operational reliability

Asia-Pacific Laboratory Filtration Market Dynamics

Driver

Rising Demand Due to Expanding Biopharma and Life Sciences Research

- The rapid growth of biopharmaceutical manufacturing, expanding life sciences research, and rising investments in diagnostic and clinical laboratories are key drivers for the Asia-Pacific laboratory filtration market

- For instance, in April 2025, Merck KGaA launched advanced sterile filtration units in India, targeting biologics production and CRO operations, which is expected to drive regional market expansion

- The need for high-purity samples, sterile environments, and efficient workflow in research and manufacturing laboratories is propelling the adoption of microfiltration, ultrafiltration, and vacuum filtration systems

- Moreover, growing academic and contract research activities are increasing the demand for versatile and reliable filtration solutions that can handle diverse applications

- Enhanced process efficiency, reduced contamination risk, and regulatory compliance for pharmaceutical and diagnostic outputs are further boosting filtration system adoption across biotechnology, pharmaceutical, and diagnostic laboratories

- Increasing government funding and incentives for biotechnology and pharmaceutical research in APAC countries such as China, India, and South Korea are fueling laboratory infrastructure expansion, creating additional demand for filtration solutions

- Rising collaborations between local laboratories and global pharmaceutical/biotech firms are accelerating the adoption of advanced filtration technologies, driving market growth across the region

Restraint/Challenge

High Costs and Regulatory Compliance Hurdles

- The relatively high cost of advanced laboratory filtration systems, coupled with stringent regulatory compliance requirements in biopharma and clinical laboratories, poses a significant challenge to market growth

- For instance, smaller research labs in Southeast Asia may delay adoption of high-end filtration technologies due to budget constraints and lengthy validation processes

- Compliance with ISO and GMP standards for sterile filtration, along with quality certifications for membranes and consumables, adds additional complexity and cost for manufacturers and end-users

- Addressing these challenges through cost-effective filtration solutions, modular systems, and simplified validation processes is crucial for expanding market reach, particularly in emerging APAC countries

- While affordability and compliance hurdles persist, growing awareness of the benefits of high-performance filtration systems and supportive government initiatives are expected to gradually mitigate these restraints

- Overcoming these challenges through innovative product design, local manufacturing, and training programs for lab personnel will be vital for sustained market growth in the region

- Limited availability of skilled laboratory personnel trained in operating advanced filtration systems can slow adoption, particularly in emerging APAC countries with expanding laboratory infrastructure

- Volatility in raw material costs for filtration membranes and assemblies, coupled with supply chain disruptions, can impact pricing and accessibility of high-end filtration solutions, creating short-term challenges for market growth

Asia-Pacific Laboratory Filtration Market Scope

The market is segmented on the basis of products, technology, utility, and end users.

- By Product

On the basis of products, the Asia-Pacific laboratory filtration market is segmented into filtration media, filtration assembly, and filtration accessories. The Filtration Media segment dominated the market with the largest market revenue share of 41.7% in 2025, driven by its essential role in ensuring purity, sterility, and efficiency across laboratory processes. Filtration media are widely used in microfiltration, ultrafiltration, and vacuum filtration applications in biotechnology, pharmaceutical, and diagnostic laboratories. The segment benefits from ongoing innovations in membrane materials and pore-size technologies, which enhance filtration performance and reliability. Laboratories prioritize filtration media for their versatility, high throughput capability, and consistent results in both research and production workflows. Compatibility with automated filtration systems and digital monitoring platforms further strengthens its adoption. In addition, growing demand from pharmaceutical R&D and academic research contributes to its market dominance.

The Filtration Assembly segment is anticipated to witness the fastest growth rate of 10% CAGR from 2026 to 2033, fueled by increasing adoption in pharmaceutical and contract research laboratories. Filtration assemblies provide ready-to-use solutions, combining membranes and housings for efficient sample processing. Their ease of use, standardized configuration, and integration with laboratory automation make them attractive for high-throughput applications. Growing outsourcing of R&D activities to contract research organizations is also driving assembly demand. Filtration assemblies reduce contamination risk, save preparation time, and support consistent performance, making them increasingly preferred over traditional manual setups. The increasing focus on laboratory efficiency and process standardization accelerates adoption across the APAC region.

- By Technology

On the basis of technology, the market is segmented into microfiltration, ultrafiltration, vacuum filtration, nano filtration, and reverse osmosis. The Microfiltration segment dominated the market in 2025 with a share of 40.2%, owing to its essential role in sterilization, sample clarification, and removal of microbial contaminants in biopharma and diagnostic applications. Microfiltration membranes are widely adopted due to their versatility, high reproducibility, and compatibility with various laboratory workflows. The segment benefits from ongoing innovations in high-throughput filtration devices and automation compatibility. Laboratories across APAC rely on microfiltration for critical processes, ensuring reliable and contamination-free results. Continuous improvement in membrane materials enhances both durability and filtration efficiency. Regulatory compliance and standardization further support the dominance of this segment.

The Ultrafiltration segment is expected to witness the fastest growth rate of 17.3% CAGR from 2026 to 2033, driven by increasing use in protein concentration, purification, and biopharmaceutical production. Ultrafiltration technologies are critical for large-molecule separation and biomolecule enrichment. Rising demand from contract research organizations, biopharma, and diagnostic labs supports adoption. Automation integration, reduced processing times, and higher recovery rates further contribute to rapid growth. The segment benefits from growing biologics and biosimilar production across APAC. Advances in membrane technology and scalability for industrial bioprocesses enhance its attractiveness.

- By Utility

On the basis of utility, the market is segmented into disposable and reusable filtration systems. The Disposable segment dominated the market with the largest revenue share of 57.9% in 2025, due to its convenience, reduced risk of cross-contamination, and compliance with stringent regulatory requirements. Disposable filtration units are widely adopted in clinical, diagnostic, and biopharmaceutical laboratories for one-time sterile processes, ensuring safety and operational efficiency. Their ease of handling, minimal cleaning requirements, and compatibility with automated systems make them highly preferred in high-throughput settings. Continuous improvements in disposable filtration technology and availability of pre-sterilized units further drive market adoption. The segment is also supported by growing demand for single-use systems in academic and industrial labs.

The Reusable segment is anticipated to witness the fastest growth rate of 16.97% CAGR from 2026 to 2033, supported by increasing cost-consciousness in academic and research institutes. Reusable filtration systems offer long-term savings and sustainable laboratory practices. Advanced cleaning protocols and durable membrane materials enable multiple cycles of use without compromising performance. Growing focus on reducing laboratory waste and environmental footprint is accelerating adoption. High initial investment in reusable systems is justified by operational efficiency, making them increasingly popular in large-scale research and pharmaceutical production facilities. Integration with automated cleaning and sterilization systems further enhances adoption.

- By End User

On the basis of end user, the market is segmented into biotechnology companies, pharmaceutical companies, food and beverage companies, contract research organizations, Academic and Research Institutes, and Diagnostic Centers. The Biotechnology Companies segment dominated the market in 2025 with a share of 44.6%, driven by extensive adoption of filtration solutions for R&D, cell culture, biologics manufacturing, and purification workflows. Biotechnology labs require high-precision, contamination-free filtration systems to comply with regulatory standards and ensure product safety. Increasing biologics and vaccine production in APAC countries such as China and India continues to reinforce demand. The segment benefits from long-term contracts with filtration solution providers and continuous investment in R&D infrastructure. Advanced filtration systems integrated with automation further strengthen adoption among biotechnology companies.

The Contract Research Organizations (CROs) segment is expected to witness the fastest growth rate of 18.09% CAGR from 2026 to 2033, fueled by the increasing outsourcing of research and development activities by biotechnology and pharmaceutical firms. CROs rely on versatile and high-throughput filtration systems to support multiple clients and diverse research projects. The need for reproducibility, operational efficiency, and rapid turnaround times makes advanced filtration technologies critical. Growth in the APAC biopharma sector and rising CRO presence in India, China, and Southeast Asia significantly contribute to the segment’s rapid expansion. Integration with automated systems and digital monitoring further enhances process efficiency, driving adoption. The segment also benefits from increasing regulatory requirements for standardized laboratory processes.

Asia-Pacific Laboratory Filtration Market Regional Analysis

- China dominated the Asia-Pacific laboratory filtration market in 2025 with a market share of 38.5%, supported by large-scale pharmaceutical production, rapid expansion of biologics facilities, and continuous upgrades in R&D infrastructure, while Japan and South Korea contributed significantly through established research institutions and high adoption of precision filtration technologies

- Laboratories in China highly value filtration systems that ensure precision, sterility, and high throughput, supporting widespread adoption of both disposable and reusable filtration systems. Strong government support for R&D, coupled with increasing private sector investments, is further accelerating market growth

- The market growth is bolstered by rising regulatory compliance requirements, increasing automation in laboratory processes, and the need for standardized, high-efficiency filtration solutions in research and industrial workflows. These factors establish laboratory filtration as a critical component for quality and reliability

The China Laboratory Filtration Market Insight

The China laboratory filtration market captured the largest revenue share of 38.5% in 2025 within Asia-Pacific, driven by rapid expansion in biotechnology, pharmaceutical, and academic research sectors. Chinese laboratories are increasingly prioritizing high-precision filtration solutions to ensure sterility, purity, and reproducibility in both R&D and manufacturing workflows. Strong government support for research infrastructure, coupled with rising private sector investments in biopharma and diagnostics, is further propelling market growth. Moreover, the growing adoption of disposable filtration systems and automation-compatible assemblies enhances operational efficiency. China is emerging as a regional hub for biopharma production and CRO activities, increasing both affordability and accessibility of advanced filtration solutions.

India Laboratory Filtration Market Insight

The India laboratory filtration market accounted for the largest market revenue share in South Asia in 2025, driven by rapid urbanization, a growing biotechnology sector, and increasing R&D investments. Laboratories in India are adopting advanced filtration technologies, including microfiltration and ultrafiltration, to support research, clinical testing, and biopharmaceutical production. Rising focus on contract research organizations (CROs) and academic institutes further accelerates market demand. Government initiatives promoting biotechnology, healthcare, and smart laboratory infrastructure contribute to widespread adoption. In addition, the availability of cost-effective filtration solutions and growing domestic manufacturing capabilities enhance market penetration in India.

Japan Laboratory Filtration Market Insight

The Japan laboratory filtration market is gaining momentum, supported by the country’s high-tech R&D infrastructure, emphasis on quality, and demand for precise laboratory processes. Japanese laboratories prioritize filtration systems that ensure reproducibility and contamination-free results in pharmaceuticals, diagnostics, and food & beverage applications. Advanced technologies such as ultrafiltration and vacuum filtration are increasingly integrated into automated workflows, boosting adoption. Japan’s aging population also drives demand for efficient, user-friendly laboratory systems that enhance operational productivity. Government support for R&D and stringent regulatory compliance standards further reinforce market growth.

South Korea Laboratory Filtration Market Insight

The South Korea laboratory filtration market is expected to grow steadily, driven by increasing biotechnology research, pharmaceutical production, and diagnostic testing. South Korean laboratories value advanced filtration systems that improve efficiency, reliability, and contamination control in both research and industrial applications. The government’s focus on innovation and biotechnology R&D provides strong support for laboratory modernization and automation. Growing adoption of disposable filtration units and microfiltration technologies enhances operational throughput and standardization. South Korea’s highly developed healthcare and pharmaceutical sectors, along with collaboration with international CROs, further accelerate market demand.

Asia-Pacific Laboratory Filtration Market Share

The Asia-Pacific Laboratory Filtration industry is primarily led by well-established companies, including:

- Merck KGaA (Germany)

- Danaher (U.S.)

- 3M (U.S.)

- Sartorius AG (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Pall Corporation (U.S.)

- GE Healthcare (U.K.)

- Cantel Medical (U.S.)

- Macherey‑Nagel GmbH & Co. KG (Germany)

- GVS S.p.A (Italy)

- Agilent Technologies, Inc. (U.S.)

- Sterlitech Corporation (U.S.)

- Cole‑Parmer Instrument Company, LLC (U.S.)

- Advantec MFS (Japan)

- Ahlstrom‑Munksjö Oyj (Finland)

- Veolia Water Technologies (France)

- Repligen Corporation (U.S.)

- Meissner Filtration Products (U.S.)

- Porvair Filtration Group (U.K.)

- Hawach Scientific Co., Ltd. (China)

What are the Recent Developments in Asia-Pacific Laboratory Filtration Market?

- In June 2025, Cytiva a global life‑sciences company announced a US$ 1.6 billion global investment to expand its manufacturing capacity for chromatography resins, filtration products, single‑use technologies and cell‑culture media across Europe, North America and Asia‑Pacific

- In September 2025, Thermo Fisher completed the acquisition of Solventum’s Purification & Filtration business. The integration brings advanced filtration technologies under a major global life‑sciences supplier. This consolidation is such asly to accelerate distribution, innovation, and standardization of filtration products especially in growing APAC biotech/pharma markets thereby supporting increased uptake of lab filtration systems

- In February 2025, Thermo Fisher Scientific announced the acquisition of the purification & filtration business of Solventum for about USD 4.1 billion. This move significantly expands Thermo Fisher’s footprint in bioprocessing filtration including lab‑scale and industrial filtration solutions. The acquisition strengthens Thermo Fisher’s ability to supply high‑quality filtration membranes and separation technologies, which will benefit pharmaceutical, biotech and research labs across Asia-Pacific by improving availability and scale of filtration solutions

- In October 2023, Cytiva (formerly part of GE Healthcare Life Sciences) opened a new 33,000 ft² manufacturing facility and “Experience Center” in Pune, India capable of producing bioprocessing equipment including tangential flow devices, virus‑filtration systems, and other filtration assemblies. This expansion directly strengthens local manufacturing capacity in Asia‑Pacific, reducing lead times and costs for labs and biopharma firms in the region

- In October 2023, Cytiva’s new facility in Pune was described as doubling its manufacturing capacity in India reinforcing India’s positioning as a biopharma / lab‑filtration hub. This development supports rising demand in India and surrounding regions for filtration systems used in biopharmaceutical manufacturing, contract research, and diagnostics making high‑quality filtration more accessible locally rather than depending on imports

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.