Asia Pacific Laboratory Information Management Systems Market

Market Size in USD Billion

CAGR :

%

USD

1.78 Billion

USD

3.86 Billion

2024

2032

USD

1.78 Billion

USD

3.86 Billion

2024

2032

| 2025 –2032 | |

| USD 1.78 Billion | |

| USD 3.86 Billion | |

|

|

|

|

Asia-Pacific Laboratory Information Management Systems (LIMS) Market Size

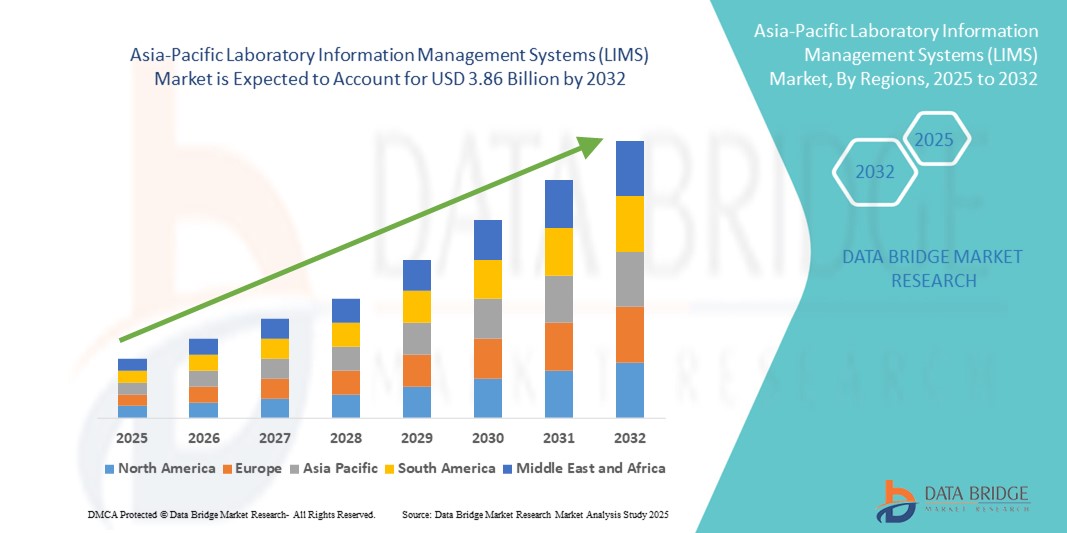

- The Asia-Pacific laboratory information management systems (LIMS) market size was valued at USD 1.78 billion in 2024 and is expected to reach USD 3.86 billion by 2032, at a CAGR of 10.10% during the forecast period

- The market growth is largely fueled by increasing digital transformation initiatives in laboratories, driven by the rising need for efficient data management, regulatory compliance, and automation across pharmaceutical, biotechnology, and clinical research sectors in the region

- Furthermore, the expanding adoption of cloud-based LIMS, coupled with government investments in healthcare infrastructure and R&D, is positioning LIMS as an indispensable tool for modern laboratories. These converging factors are accelerating the uptake of LIMS solutions, thereby significantly boosting the industry's growth

Asia-Pacific Laboratory Information Management Systems (LIMS) Market Analysis

- Laboratory Information Management Systems (LIMS), enabling efficient sample tracking, workflow automation, regulatory compliance, and data management, are becoming indispensable tools for modern laboratories across pharmaceuticals, biotechnology, diagnostics, CRO/CMO, and environmental testing sectors in Asia-Pacific due to their ability to enhance operational efficiency, accuracy, and audit readiness

- The rising demand for LIMS is primarily fueled by rapid expansion in life sciences R&D, increased adoption of digital transformation initiatives in laboratories, and the growing need to manage complex, high-volume datasets while ensuring compliance with stringent regional and global quality standards

- China dominated the Asia-Pacific laboratory information management systems (LIMS) market with the largest revenue share in 2024, contributing 24.5% of the region’s LIMS revenue, supported by substantial government investments in healthcare infrastructure, expansion of pharmaceutical manufacturing, and a strong base of both domestic and global LIMS providers

- Japan is expected to be the fastest-growing country in the Asia-Pacific laboratory information management systems (LIMS) market during the forecast period, driven by the country’s expanding research ecosystem, strong biotechnology sector, and rapid adoption of cloud-enabled laboratory informatics solutions

- Cloud-based LIMS dominated the Asia-Pacific laboratory information management systems (LIMS) market with a market share of 47.93% in 2024, reflecting preferences for scalability, remote access, cost-effectiveness, and flexibility across both large enterprises and smaller research facilities

Report Scope and Asia-Pacific Laboratory Information Management Systems (LIMS) Market Segmentation

|

Attributes |

Asia-Pacific Laboratory Information Management Systems (LIMS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Laboratory Information Management Systems (LIMS) Market Trends

Cloud-Driven Scalability and AI-Enhanced Analytics

- A significant and accelerating trend in the Asia-Pacific LIMS market is the rapid adoption of cloud-based platforms integrated with artificial intelligence (AI) and advanced analytics, enabling laboratories to scale operations, enhance data accuracy, and improve decision-making efficiency. This shift is particularly pronounced in pharmaceutical, biotechnology, and clinical research facilities across China, Japan, and India, where data-intensive workflows demand robust and agile informatics solutions

- For instance, LabWare’s cloud-based LIMS with AI-assisted workflow recommendations is being deployed in regional CROs to automate quality control and flag anomalies in real time. Similarly, Thermo Fisher Scientific’s Watson LIMS integrates predictive analytics to anticipate resource needs and optimize sample processing schedules

- AI integration within LIMS enables functionalities such as predictive maintenance of laboratory instruments, intelligent data validation, and automated anomaly detection, reducing manual errors and improving compliance. For instance, some platforms now use machine learning models to predict test turnaround times and recommend process adjustments based on historical data trends

- Cloud-based LIMS further allows laboratories to operate across distributed locations with unified data access, supporting multi-site collaboration. This is particularly valuable in Asia-Pacific, where multinational pharma firms, academic institutions, and government labs often coordinate large-scale, cross-border projects

- The fusion of cloud scalability with AI-enabled insights is transforming LIMS from a data management tool into a proactive decision-support system. As laboratories seek greater flexibility, security, and integration with other informatics tools, this convergence is expected to accelerate adoption, especially among research-intensive industries in the region

- The demand for cloud-AI enabled LIMS is growing rapidly across both public and private sectors, driven by the need for efficiency, regulatory compliance, and advanced analytics in high-growth Asian markets

Asia-Pacific Laboratory Information Management Systems (LIMS) Market Dynamics

Driver

Rising Life Sciences R&D Investment and Digital Transformation

- The substantial investments in life sciences research and development, coupled with widespread adoption of digital transformation initiatives, are key drivers of LIMS demand in Asia-Pacific

- For instance, in 2024, the Chinese government announced expanded funding for biotech and pharmaceutical innovation zones, encouraging the implementation of digital lab infrastructure including LIMS. Similar initiatives in Japan, such as the Ministry of Health’s push for e-data management in clinical trials, are boosting market uptake

- LIMS offers critical features such as compliance management, audit trails, and integration with laboratory instruments, helping labs meet stringent regulations such as OECD GLP and ISO/IEC 17025 while improving efficiency

- The integration of LIMS into laboratory ecosystems allows centralized management of workflows, quality control, and reporting, enhancing productivity in both R&D and quality assurance operations

- Growing collaborations between regional research institutions and global pharma/CRO companies are also driving the need for standardized, interoperable informatics platforms to ensure seamless data sharing and compliance across geographies

Restraint/Challenge

Cybersecurity Risks and High Implementation Costs

- As LIMS becomes more connected especially through cloud-based deployments concerns about cybersecurity and data privacy are emerging as significant barriers to adoption

- Laboratories handling sensitive patient, clinical trial, or proprietary R&D data face risks from hacking, data breaches, and unauthorized access. High-profile incidents of compromised healthcare data have heightened caution among potential adopters

- For instance, in March 2023, SingHealth, Singapore’s largest healthcare group, reported a security incident involving unauthorized access attempts to its research data systems, prompting regional labs to reassess cloud-security protocols before deploying LIMS

- Addressing these concerns requires robust security architectures, including end-to-end encryption, role-based access controls, and continuous monitoring. Providers such as LabVantage and STARLIMS have been emphasizing their compliance with ISO 27001 and other data security standards to reassure customers

- In addition, the high initial cost of implementing a comprehensive LIMS covering software licensing, customization, integration, and staff training can be prohibitive for smaller labs or research facilities in developing Asia-Pacific economies

- While cloud-based subscription models are reducing some capital expenditure barriers, the perception of high costs remains a restraint, particularly among institutions with limited budgets

- Overcoming these challenges will require ongoing investment in cybersecurity, demonstration of ROI through efficiency gains, and the development of cost-effective, modular LIMS solutions tailored to smaller organizations

Asia-Pacific Laboratory Information Management Systems (LIMS) Market Scope

The market is segmented on the basis of component, product type, delivery, industry type, and distribution channel.

- By Component

On the basis of component, the Asia-Pacific laboratory information management systems (LIMS) market is segmented into services and software. The software segment dominated the market with the largest revenue share of 58.4% in 2024, driven by the rising demand for centralized data management, workflow automation, and compliance reporting across research, diagnostics, and manufacturing laboratories. Software solutions are increasingly tailored for industry-specific requirements, offering advanced modules for sample tracking, instrument integration, and regulatory compliance, making them indispensable in modern laboratory operations.

The services segment is anticipated to record the fastest growth rate of 12.9% from 2025 to 2032 in the Asia-Pacific LIMS market, driven by the growing reliance on external expertise for system integration, customization, and ongoing technical support. Laboratories across healthcare, pharmaceuticals, and research institutions in emerging economies such as India, China, and Southeast Asia often lack in-house IT infrastructure, creating strong demand for managed services and training. Additionally, increasing digital transformation initiatives, rising regulatory compliance needs, and the push for efficient data management further accelerate the adoption of specialized service providers.

- By Product Type

On the basis of product type, the Asia-Pacific laboratory information management systems (LIMS) market is segmented into broad-based and industry-specific solutions. The broad-based segment held the largest revenue share of 61.7% in 2024, owing to its versatility in catering to multiple laboratory workflows across diverse sectors such as life sciences, food testing, environmental monitoring, and chemicals. Broad-based LIMS offer modular features that can be customized to different industry needs, making them highly attractive for institutions seeking scalable and future-ready systems.

The industry-specific segment is projected to witness the fastest CAGR in the market during the forecast period, driven by rising adoption across highly specialized sectors such as diagnostics, clinical research, pharmaceuticals, food & beverage testing, and oil & gas laboratories. These industries require tailored LIMS solutions to address strict compliance standards, complex workflows, and data integrity challenges. Growing R&D investments, rapid industrialization, and tightening regulatory frameworks in countries such as China, India, and South Korea are fueling demand for customized, sector-focused LIMS platforms that enhance efficiency and ensure reliable outcomes.

- By Delivery

On the basis of delivery mode, the Asia-Pacific laboratory information management systems (LIMS) market is segmented into on-premise, cloud-based, and remotely-hosted LIMS. The cloud-based segment dominated with a revenue share of 47.93% in 2024, driven by increasing adoption of SaaS models, reduced upfront costs, and the growing need for remote data access. Cloud-based solutions are especially popular among mid-sized laboratories and multinational research collaborations, enabling secure data sharing across geographies.

The on-premise segment continues to dominate in highly regulated industries such as pharmaceuticals and healthcare, where strict compliance, data sovereignty, and internal control are paramount. However, the remotely-hosted segment is projected to grow at the fastest pace in the Asia-Pacific LIMS market. Increasing adoption of cloud-based infrastructure, coupled with cost efficiency, scalability, and reduced IT maintenance, makes this model attractive for emerging economies. Organizations in diagnostics, biotech, and research are turning to remotely-hosted LIMS to streamline operations, ensure secure access, and achieve faster deployment across multiple sites.

- By Industry Type

On the basis of industry type, the Asia-Pacific laboratory information management systems (LIMS) market is segmented into life sciences industry, chemical/energy, food and beverage and agriculture industries, diagnostics/medical device, clinical research organization/contract manufacturing organizations (CRO/CMO), and others. The life sciences industry segment led the market with the largest revenue share of 37.9% in 2024, driven by expanding pharmaceutical R&D activities, biobanking, and genomics research across the region. LIMS adoption is propelled by the sector’s stringent regulatory requirements and the growing volume of complex datasets generated from high-throughput research.

The diagnostics and medical device segment is anticipated to record the fastest growth in the market over the forecast period. This surge is driven by the region’s rapidly aging population, which is contributing to a rising prevalence of chronic and lifestyle-related diseases that require frequent diagnostic testing. Clinical laboratories and diagnostic centers are increasingly adopting advanced LIMS platforms to improve sample tracking, enhance data accuracy, and integrate seamlessly with medical devices. Additionally, regulatory emphasis on quality assurance and automation further boosts demand.

- By Distribution Channel

On the basis of distribution channel, the Asia-Pacific laboratory information management systems (LIMS) market is segmented into direct tenders and retail sales. The direct tenders segment accounted for the largest revenue share of 68.5% in 2024, primarily due to bulk procurement by government agencies, research institutes, and large private laboratories through contractual agreements. Direct tenders ensure cost efficiency and allow buyers to negotiate for customized LIMS solutions tailored to institutional needs.

The retail sales segment is projected to witness robust growth in the market during the forecast period. This growth is largely attributed to the expanding base of small and medium-sized private laboratories, diagnostic centers, and research facilities that prefer cost-effective, off-the-shelf, or subscription-based LIMS solutions. Online platforms and regional distributors are making these systems more accessible, reducing implementation barriers and enabling faster adoption. The trend toward affordable, scalable, and user-friendly LIMS platforms is accelerating demand in emerging Asia-Pacific economies.

Asia-Pacific Laboratory Information Management Systems (LIMS) Market Regional Analysis

- China dominated the Asia-Pacific laboratory information management systems (LIMS) market with the largest revenue share in 2024, contributing 24.5% of the region’s LIMS revenue, supported by substantial government investments in healthcare infrastructure, expansion of pharmaceutical manufacturing, and a strong base of both domestic and global LIMS providers

- The country’s laboratories are increasingly adopting LIMS solutions to meet stringent regulatory compliance standards, improve operational efficiency, and manage large-scale data generated from drug discovery, clinical trials, and diagnostics

- This dominance is further reinforced by the surge in contract research organizations (CROs) and contract manufacturing organizations (CMOs) in China, alongside the government’s “Made in China 2025” initiative, which promotes digitalization and automation in laboratory environments, solidifying China’s leadership position in the region

The China Laboratory Information Management Systems (LIMS) Market Insight

The China laboratory information management systems (LIMS) market captured the largest revenue share in Asia-Pacific in 2024, driven by the country’s strong pharmaceutical and biotechnology sectors, significant investments in R&D, and increasing regulatory compliance requirements. Adoption is further boosted by the rise of large-scale CROs and CMOs, along with the government’s focus on laboratory modernization under the “Made in China 2025” strategy. Cloud-based and AI-enabled LIMS solutions are gaining popularity, supporting enhanced data analytics and streamlined workflows across research and quality control labs.

India Laboratory Information Management Systems (LIMS) Market Insight

The India laboratory information management systems (LIMS) market is expected to expand at a notable CAGR during the forecast period, fueled by the country’s rapidly growing pharmaceutical exports, booming life sciences sector, and expanding network of diagnostic laboratories. Government-backed programs for healthcare digitization and quality certification in testing facilities are accelerating demand. Affordable, customizable LIMS solutions are particularly appealing to mid-sized laboratories, while larger pharmaceutical firms are adopting enterprise-level platforms to support integrated data management and regulatory audits.

Japan Laboratory Information Management Systems (LIMS) Market Insight

The Japan laboratory information management systems (LIMS) market is witnessing steady growth, supported by its advanced healthcare infrastructure, strong biotechnology research base, and strict regulatory framework for laboratory operations. High adoption of automation, robotics, and IoT integration in laboratories enhances operational precision and efficiency, making LIMS essential for quality management. In addition, the country’s emphasis on precision medicine and advanced diagnostics is pushing demand for next-generation, interoperable LIMS platforms that integrate seamlessly with other healthcare IT systems.

South Korea Laboratory Information Management Systems (LIMS) Market Insight

The South Korea laboratory information management systems (LIMS) market is set to grow at a robust pace, propelled by the nation’s strong presence in biopharmaceutical manufacturing, clinical trials, and diagnostics. Government initiatives such as the Biohealth Innovation Strategy are fostering modernization in laboratory infrastructure and promoting compliance with global standards. The integration of LIMS with advanced analytics, AI, and IoT-enabled lab equipment is enhancing operational efficiency. South Korean laboratories are increasingly opting for cloud-based and hybrid LIMS models to enable flexible, real-time access to laboratory data across multiple facilities.

Asia-Pacific Laboratory Information Management Systems (LIMS) Market Share

The Asia-Pacific laboratory information management systems (LIMS) industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- LabWare, Inc. (U.S.)

- LabVantage Solutions, Inc. (U.S.)

- STARLIMS Corporation (U.S.)

- Autoscribe Informatics (U.K.)

- Agilent Technologies, Inc. (U.S.)

- PerkinElmer (U.S.)

- Illumina, Inc. (U.S.)

- Xybion Digital Inc. (U.S.)

- CloudLIMS (U.S.)

- Benchling (U.S.)

- RURO, Inc. (U.S.)

- Labworks, LLC (U.S.)

- Abbott (U.S.)

- Accelerated Technology Laboratories, Inc. (U.S.)

- Computing Solutions, Inc. (U.S.)

- Sapio Sciences, LLC (U.S.)

- Dassault Systèmes (France)

- Bio-ITech BV (Netherlands)

What are the Recent Developments in Asia-Pacific Laboratory Information Management Systems (LIMS) Market?

- In April 2025, LabWare introduced LabWare ASSURE, a new SaaS-based platform specifically designed for food and beverage laboratories. It delivers digital traceability and real-time decision-making across the entire quality, safety, and compliance spectrum—from ingredients through to finished products

- In March 2025, LabVantage Solutions launched LabVantage 8.9, their next-generation LIMS platform embracing a "SaaS 2.0" ("Services-as-a-Software") model. This version introduces AI-powered enhancements tailored to elevate lab productivity and data management through advanced partitioning, filtering, and embedded AI capabilities

- In September 2024, Agilent announced the successful completion of its acquisition of BIOVECTRA, reinforcing its CDMO services lineup. This acquisition expands Agilent’s offerings, particularly in gene editing, and enhances its ability to support advanced therapeutics programs. The move underscores Agilent’s commitment to providing top-tier manufacturing solutions in the biotech sector

- In January 2024, the Belize National Forensic Science Services (BNFSS), supported by ICITAP and UNDP, launched JusticeTrax, a web-based LIMS for managing workflows, evidence tracking, chain of custody, and reporting—delivering modernization to the forensic labs in record time

- In July 2021, Francisco Partners signed a definitive agreement to acquire the STARLIMS informatics product suite from Abbott, marking a strategic divestment and positioning STARLIMS for independent growth and renewed market competitiveness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.