Asia Pacific Laxative Market

Market Size in USD Billion

CAGR :

%

USD

7.91 Billion

USD

13.60 Billion

2024

2032

USD

7.91 Billion

USD

13.60 Billion

2024

2032

| 2025 –2032 | |

| USD 7.91 Billion | |

| USD 13.60 Billion | |

|

|

|

|

Asia-Pacific Laxative Market Size

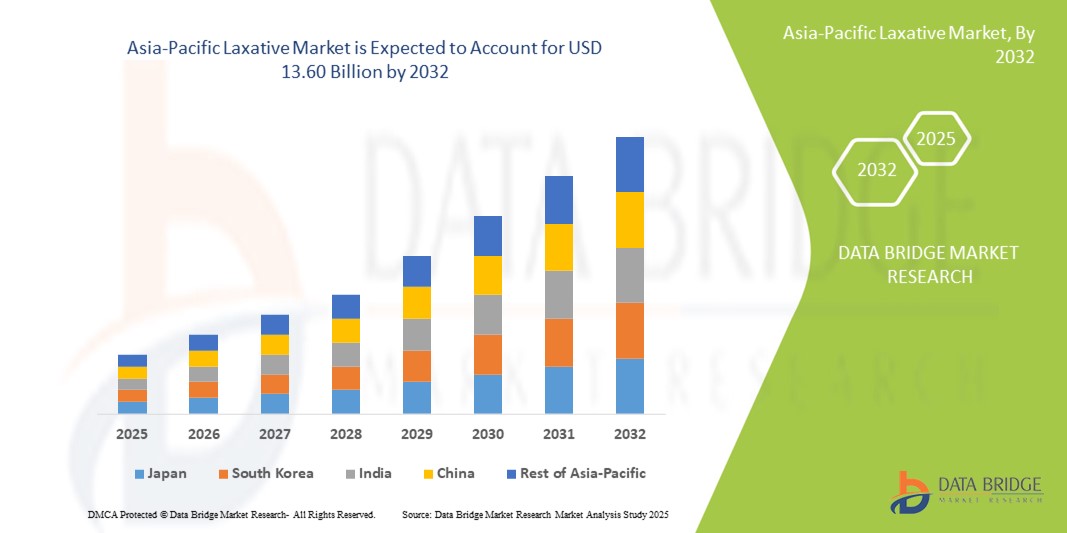

- The Asia-Pacific laxative market size was valued at USD 7.91 billion in 2024 and is expected to reach USD 13.60 billion by 2032, at a CAGR of 7.00% during the forecast period

- The market growth is largely fueled by the increasing prevalence of gastrointestinal disorders, constipation, and other digestive health issues, driving higher demand for effective laxative solutions

- Furthermore, rising consumer awareness about digestive health, coupled with the growing preference for convenient, safe, and fast-acting laxative products, is establishing modern laxative formulations as the preferred choice for managing bowel health. These converging factors are accelerating the adoption of laxative solutions, thereby significantly boosting the industry's growth

Asia-Pacific Laxative Market Analysis

- Laxatives, used to relieve constipation and regulate bowel movements, are increasingly important in healthcare and wellness, addressing dietary deficiencies, gastrointestinal disorders, and lifestyle-related bowel irregularities in both clinical and home settings. Their effectiveness, ease of use, and availability in multiple formulations make them essential in therapeutic regimens

- The escalating demand for laxatives in the Asia-Pacific region is primarily driven by rising prevalence of constipation, changing dietary habits, sedentary lifestyles, and growing awareness about digestive health. Expansion of retail pharmacy networks and e-commerce channels has made these products more accessible to consumers

- China dominated the Asia-Pacific laxative market with the largest revenue share of 36.5% in 2024, attributed to its large population, high healthcare awareness, rapid urbanization, and well-established pharmaceutical supply chains. Increasing physician recommendations and over-the-counter availability further reinforce China’s market leadership

- India is expected to be the fastest-growing country in the Asia-Pacific laxative market during the forecast period, registering a CAGR of 10.8% from 2025 to 2032. Growth is driven by rising disposable incomes, increased healthcare access, awareness campaigns about digestive health, and expansion of retail and online distribution channels in urban and rural areas

- The oral sub-segment dominated the Asia-Pacific laxative market in 2024 with 72.4% revenue share, due to ease of use and widespread acceptance. Oral laxatives are convenient, suitable for both chronic and acute constipation, and widely available in pharmacies

Report Scope and Asia-Pacific Laxative Market Segmentation

|

Attributes |

Asia-Pacific Laxative Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Laxative Market Trends

Rising Awareness and Accessibility Driving Laxative Adoption

- A significant trend in the Asia-Pacific Laxative market is the growing consumer focus on digestive health and preventive care, leading to increased adoption of laxatives in both clinical and home settings. Rising awareness about gastrointestinal disorders, constipation, and the importance of regular bowel health is fueling demand

- The expansion of retail pharmacies, e-commerce platforms, and over-the-counter availability has made laxatives more accessible to a broader population across urban and semi-urban areas. Consumers are increasingly seeking convenient and effective solutions to manage digestive health

- Increasing prevalence of lifestyle-related conditions, such as poor dietary habits, sedentary lifestyles, and stress, is contributing to higher usage of laxatives. Healthcare professionals are also recommending them as part of routine gastrointestinal care, further strengthening market growth

- Product innovation, including fiber-based formulations, herbal options, and sugar-free variants, is enhancing consumer choice and encouraging adoption. Manufacturers are introducing easy-to-use forms such as tablets, liquids, powders, and chewables to cater to different age groups and preferences

- Government initiatives and public health awareness campaigns promoting digestive health and preventive care are driving demand in both emerging and developed countries in the region. Educational programs about the importance of regular bowel movement and safe laxative use are expanding the consumer base

- The trend of self-medication and home care is supporting market growth, as individuals prefer accessible and reliable options to maintain daily digestive health without frequent hospital visits

- Overall, the combination of increasing health awareness, accessibility through multiple channels, and product diversification is significantly reshaping the Asia-Pacific Laxative market, with consumers prioritizing convenience, effectiveness, and safety in their choices

Asia-Pacific Laxative Market Dynamics

Driver

Rising Digestive Health Awareness Boosting Laxative Market

- A major factor fueling the growth of the Asia-Pacific laxative market is the increasing focus on digestive health and preventive care. Consumers are becoming more proactive in managing gastrointestinal wellness, leading to higher adoption of laxative products for maintaining regular bowel movements and preventing complications

- For instance, in March 2024, Abbott Laboratories (U.S.) launched new fiber-rich and liquid laxative formulations in select Asia-Pacific countries, designed to provide faster relief and better tolerability. Such strategic product launches are expected to drive market expansion during the forecast period

- Healthcare providers are increasingly recommending laxatives as part of daily wellness regimens for both young and elderly populations, further reinforcing adoption

- The rise of lifestyle-related digestive issues, caused by changes in diet, sedentary behavior, and stress, is pushing consumers to seek effective over-the-counter solutions. Laxatives are seen as a convenient, quick-acting, and safe option to address these issues

- Availability through multiple channels, including pharmacies, supermarkets, and e-commerce platforms, is increasing consumer access to laxative products. The convenience of online purchasing, coupled with product variety, is encouraging more frequent use

- Educational campaigns by healthcare organizations and wellness programs emphasizing gut health are also raising awareness about the importance of preventive digestive care, directly contributing to market growth

- Overall, increasing awareness, lifestyle-driven demand, and broader product accessibility are collectively driving sustained adoption of laxatives across Asia-Pacific markets

Restraint/Challenge

Concerns Regarding Safety and Product Misuse

- Concerns regarding potential side effects, improper usage, or over-reliance on laxatives pose a significant challenge to broader market penetration. Consumers are cautious about the long-term effects of frequent laxative use, which may limit adoption in some regions

- For instance, reports highlighting misuse of stimulant laxatives in certain populations have made some consumers hesitant to use over-the-counter options regularly

- Addressing these concerns through clear labeling, dosage instructions, and public education on safe usage is crucial for building consumer trust. Companies such as Abbott and B. Braun emphasize product safety, proper guidance, and physician recommendations in their marketing to reassure potential buyers

- In addition, the relatively high price of specialty or herbal laxative variants compared to conventional options can be a barrier for price-sensitive consumers, particularly in developing countries. While generic formulations are available, premium features such as sugar-free, flavored, or fiber-enriched variants often come at a higher price point

- Overcoming these challenges through consumer education, safety assurances, and the introduction of affordable, high-quality options will be vital for sustained market growth in the Asia-Pacific region

Asia-Pacific Laxative Market Scope

The market is segmented on the basis of type, flavors, source, indication, mode of purchase, dosage form, route of administration, population type, sales channel, and distribution channel.

- By Type

On the basis of type, the Asia-Pacific laxative market is segmented into osmotic laxatives, stimulant laxatives, bulk laxatives, and lubricant & emollient laxatives. The osmotic laxatives segment dominated the largest market revenue share of 41.5% in 2024, driven by its effectiveness in drawing water into the bowel and softening stool for smooth bowel movements. These laxatives are widely recommended for chronic constipation and are highly tolerated by pediatric and geriatric populations. Healthcare professionals prefer them for long-term management due to their predictable action and minimal side effects. Products such as polyethylene glycol and lactulose are particularly popular in both OTC and prescription formats. The segment’s dominance is reinforced by strong retail distribution and increasing consumer awareness about digestive health. Natural and plant-based variants are gaining traction among health-conscious consumers. Overall, osmotic laxatives remain the backbone of constipation treatment in the Asia-Pacific region.

The stimulant laxatives segment is anticipated to witness the fastest CAGR of 10.3% from 2025 to 2032, fueled by the growing demand for rapid-acting solutions for acute constipation and opioid-induced constipation. Stimulant laxatives act directly on intestinal walls to stimulate bowel movements and are preferred in clinical scenarios requiring immediate relief. Increasing availability in flavored, child-friendly, and convenient dosage forms supports market growth. The rising incidence of constipation due to lifestyle changes and opioid usage further drives adoption. OTC availability enhances accessibility for self-medication. Pharmaceutical innovation continues to improve formulation and patient compliance. Stimulant laxatives are especially popular in home healthcare and hospital settings, making them a fast-growing segment.

- By Flavors

On the basis of flavors, the Asia-Pacific laxative market is segmented into with flavor and without flavor. The with flavor segment dominated the market in 2024 with a revenue share of 58.7%, as flavored formulations improve patient adherence, especially among children and elderly populations. Flavored laxatives are widely preferred because they enhance the taste, making consumption easier and more pleasant. These formulations are common in pediatric and homecare applications. The segment benefits from high availability in retail pharmacies and OTC channels. Flavor variety, including fruit and natural flavors, drives consumer preference. Continuous innovation, including sugar-free options, supports ongoing market leadership. Ease of administration also reduces caregiver burden in home settings. Flavored laxatives are thus the preferred choice across multiple demographic groups in the Asia-Pacific region.

The without flavor segment is expected to witness the fastest CAGR of 9.5% from 2025 to 2032, driven by increasing consumer preference for minimalist, chemical-free, and natural formulations. Adult consumers particularly prefer these products due to concerns about artificial flavors or additives. They cater to health-conscious populations and those with dietary restrictions. Hospitals and clinical settings favor these formulations for their safety and simplicity. Pharmaceutical innovation ensures that efficacy remains high despite the lack of flavor. Growing awareness of natural and clean-label products further drives adoption. OTC availability ensures wide accessibility for self-medication. This trend positions “without flavor” laxatives as the fastest-growing flavor sub-segment in the Asia-Pacific market.

- By Source

On the basis of source, the Asia-Pacific laxative market is segmented into natural, synthetic, and others. The natural segment dominated in 2024 with a revenue share of 52.8%, driven by growing consumer preference for plant-based and safer therapeutic options. Natural laxatives, such as psyllium husk and senna, are widely used for long-term constipation management. They are particularly suitable for children, elderly patients, and patients with chronic constipation. Physicians often recommend them due to their minimal side effects and natural composition. They also cater to the rising demand for clean-label, eco-friendly products. Their use is widespread in homecare, pharmacies, and clinical settings. Natural laxatives are considered safer alternatives to synthetic options for prolonged use. Continuous awareness campaigns about digestive health further reinforce their market dominance.

The synthetic segment is expected to witness the fastest CAGR of 11.2% from 2025 to 2032, driven by increasing demand for rapid-acting and precise dosing solutions. Synthetic products such as polyethylene glycol and lactulose are preferred for acute constipation or opioid-induced constipation cases. Their high effectiveness and predictability make them suitable for both prescription and OTC formats. Advancements in formulation technology have improved taste, solubility, and patient compliance. Hospitals and clinics increasingly use these products for quick relief. Wider availability in retail and pharmacy channels supports market expansion. Growing consumer awareness about the benefits of synthetic formulations also drives adoption. This makes synthetic laxatives the fastest-growing source segment in the Asia-Pacific market.

- By Indication

On the basis of indication, the Asia-Pacific laxative market is segmented into chronic constipation, irritable bowel syndrome with constipation (IBS-C), opioid-induced constipation, acute constipation, and others. The chronic constipation segment dominated in 2024 with a revenue share of 44.3%, driven by the increasing prevalence of lifestyle-related digestive disorders and aging populations. Chronic constipation requires ongoing management, making it a major contributor to market demand. Patients rely on both OTC and prescription laxatives for long-term treatment. Healthcare professionals prefer safe and effective formulations such as osmotic and natural laxatives. Chronic constipation cases are rising in both urban and rural areas due to sedentary lifestyles and dietary habits. Awareness campaigns about digestive health support higher adoption of laxatives for this indication. The segment remains central to market revenue in Asia-Pacific.

The opioid-induced constipation segment is expected to witness the fastest CAGR of 12.1% from 2025 to 2032, driven by rising use of opioid medications for pain management. Patients taking opioids require targeted laxatives to prevent severe constipation and maintain quality of life. Prescription and OTC stimulant laxatives are increasingly preferred for quick relief. Hospitals and homecare services are adopting these solutions more frequently. Pharmaceutical innovations, including easy-to-administer forms, support this growth. Growing awareness among physicians and patients regarding opioid side effects further drives adoption. The segment is particularly significant in countries with expanding pain management therapies.

- By Mode of Purchase

On the basis of mode of purchase, the Asia-Pacific laxative market is segmented into prescription and over-the-counter (OTC). The OTC segment dominated in 2024 with a revenue share of 61.6%, driven by consumer preference for easily accessible, self-administered laxatives. OTC availability allows for quick intervention for occasional constipation without a doctor’s visit. Pharmacies and retail chains provide wide distribution. Flavored and child-friendly formulations enhance compliance. The segment benefits from awareness campaigns and education about digestive health. Convenience and affordability further support dominance. OTC laxatives are widely accepted in both homecare and clinical settings. Consumer trust in recognized brands also plays a key role.

The prescription segment is expected to witness the fastest CAGR of 9.8% from 2025 to 2032, driven by chronic constipation and opioid-induced constipation cases requiring medical supervision. Prescription laxatives provide targeted, high-efficacy solutions for patients with severe or long-term conditions. Physicians prefer specific formulations for rapid or controlled relief. Hospitals, clinics, and homecare services increasingly rely on prescription products. Regulatory support ensures safety and efficacy standards. Prescription laxatives also include synthetic and stimulant products, driving higher growth. Growing awareness about appropriate medical guidance further fuels adoption.

- By Dosage Form

On the basis of dosage form, the Asia-Pacific laxative market is segmented into tablets, capsules, powder, liquid & gels, suppositories, and others. The tablets segment dominated in 2024 with 46.2% revenue share, due to convenience, portability, and precise dosing. Tablets are widely preferred for both adults and children. They are available in both OTC and prescription formats. Easy administration and high patient adherence support dominance. Tablets are suitable for chronic constipation management and repeated use. Retail availability ensures strong penetration in urban and rural markets. Healthcare professionals often recommend tablets for predictable effects. Consumer familiarity with tablets also boosts adoption.

The liquid & gels segment is expected to witness the fastest CAGR of 10.7% from 2025 to 2032, driven by high compliance among children and elderly populations. Liquids and gels are easy to swallow and allow flexible dosing. Flavored forms further increase palatability. They are widely used in homecare and pediatric applications. Growing preference for quick relief solutions supports growth. OTC and hospital availability enhances accessibility. Innovations in formulation improve shelf life and stability. The segment is expected to expand rapidly in Asia-Pacific due to convenience and usability advantages.

- By Route of Administration

On the basis of route of administration, the Asia-Pacific laxative market is segmented into oral and rectal. The oral segment dominated in 2024 with 72.4% revenue share, due to ease of use and widespread acceptance. Oral laxatives are convenient, suitable for both chronic and acute constipation, and widely available in pharmacies. Flavored and child-friendly formulations further enhance adoption. Patients prefer oral administration for home use and OTC access. Oral laxatives are effective for long-term management and repeated use. Strong distribution networks support market dominance. Physician recommendations also favor oral forms for safety and convenience.

The rectal segment is expected to witness the fastest CAGR of 9.6% from 2025 to 2032, driven by demand for rapid-onset relief in clinical and homecare settings. Suppositories are particularly effective for severe constipation and opioid-induced cases. Hospitals, clinics, and homecare providers are major users. Rectal formulations provide targeted action with quick results. Pharmaceutical innovation has improved comfort, ease of use, and effectiveness. Growing awareness among caregivers and patients drives adoption. This segment is particularly significant for elderly populations and patients with limited mobility.

- By Population Type

On the basis of population type, the Asia-Pacific laxative market is segmented into children and adults. The adults segment dominated in 2024 with 64.5% revenue share, due to higher prevalence of chronic constipation and opioid-induced constipation in adults. Adults benefit from a wide range of formulations including tablets, liquids, and natural products. Lifestyle disorders, sedentary habits, and dietary changes further drive demand. Healthcare providers recommend long-term and safe laxative solutions for adults. OTC availability and retail penetration enhance accessibility. Adults prefer convenient and reliable options for self-management. Awareness campaigns support higher adoption. Adults remain the primary revenue-generating population segment.

The children segment is expected to witness the fastest CAGR of 10.2% from 2025 to 2032, fueled by rising awareness of pediatric constipation. Parents increasingly seek safe, palatable, and easy-to-administer formulations for children. Flavored liquids, gels, and chewable tablets are particularly popular. Hospitals, homecare, and retail pharmacy channels support distribution. Pediatric-focused marketing campaigns enhance adoption. Caregivers value products with proven safety and minimal side effects. Increasing prevalence of childhood digestive disorders drives demand.

- By Sales Channel

On the basis of sales channel, the Asia-Pacific laxative market is segmented into hospitals, elderly care centers, home healthcare, pharmacy stores, grocery/health & beauty stores, and others. The pharmacy stores segment dominated in 2024 with 49.1% revenue share, due to convenience, OTC availability, and guidance from pharmacists. Pharmacies offer a wide variety of flavored and adult/pediatric formulations. Strong retail networks enhance accessibility. Consumers prefer pharmacies for trusted brands and quick purchase. Pharmacist recommendations support higher adoption. Pharmacy sales cater to both urban and rural populations. OTC availability boosts self-medication. Continuous awareness campaigns drive consistent growth.

The home healthcare segment is expected to witness the fastest CAGR of 11.5% from 2025 to 2032, driven by the growing adoption of home-based care and self-management solutions. Home healthcare enables patients to administer laxatives conveniently. Pediatric and geriatric populations benefit significantly. Flavored, liquid, and gel formulations enhance ease of use. Rising demand for rapid and safe constipation relief supports growth. OTC availability strengthens adoption. Education and awareness about homecare treatments drive market expansion. Home healthcare is a fast-growing channel in Asia-Pacific.

- By Distribution Channel

On the basis of distribution channel, the Asia-Pacific laxative market is segmented into direct sales, wholesalers, and others. The direct sales segment dominated in 2024 with 53.2% revenue share, due to strong manufacturer presence in key urban centers and marketing strategies targeting consumers. Direct sales enable better brand visibility and controlled pricing. They ensure access to both prescription and OTC products. Manufacturer-led campaigns improve consumer awareness and trust. The segment is widely used in hospitals, pharmacies, and urban retail networks. High-quality assurance and consistent supply reinforce dominance. Direct distribution allows companies to maintain strong relationships with key retailers and healthcare providers.

The wholesalers segment is expected to witness the fastest CAGR of 10.1% from 2025 to 2032, driven by the expansion of supply networks and growing distribution to pharmacies, hospitals, and retail chains across Asia-Pacific. Wholesalers help penetrate tier-2 and tier-3 cities. They ensure product availability in remote locations. Rising healthcare infrastructure supports the growth of this channel. Wholesaler networks enable manufacturers to reach multiple end-users efficiently. The segment benefits from increasing demand for OTC and prescription laxatives. Growing collaborations between manufacturers and wholesale distributors boost market expansion.

Laxative Market Regional Analysis

- The Asia-Pacific laxative market is poised to grow at a CAGR during the forecast period of 2025 to 2032

- Driven by increasing urbanization, rising disposable incomes, and growing awareness about digestive health in countries such as China, Japan, and India

- The expansion of retail pharmacies, e-commerce platforms, and over-the-counter availability is improving product accessibility, while lifestyle-related digestive issues are increasing the demand for effective laxative solutions

Japan Laxative Market Insight

The Japan laxative market is gaining momentum due to the country’s high awareness of preventive healthcare, aging population, and urbanized lifestyle. Japanese consumers increasingly prefer safe, effective, and easy-to-use laxatives for both therapeutic and daily wellness purposes. Hospitals, clinics, and pharmacies actively recommend laxatives, contributing to steady adoption. Moreover, rising awareness campaigns on digestive health and wellness programs are encouraging consumers to incorporate laxatives into their self-care routines. Product innovations, including fiber-based and liquid formulations, further strengthen market growth.

China Laxative Market Insight

The China laxative market dominated the Asia-Pacific laxative market with the largest revenue share of 36.5% in 2024, driven by its large population, high healthcare awareness, rapid urbanization, and well-established pharmaceutical supply chains. The availability of over-the-counter products and physician recommendations for digestive health management reinforce market leadership. Increased prevalence of lifestyle-related digestive disorders, combined with expanding retail and online distribution networks, is further fueling adoption. Strong domestic pharmaceutical manufacturers are also introducing innovative, convenient, and safe laxative formulations, supporting sustained growth.

India Laxative Market Insight

The India laxative market is expected to be the fastest-growing country in the Asia-Pacific laxative market, registering a CAGR of 10.8% from 2025 to 2032. The growth is supported by rising disposable incomes, improved healthcare access, and increasing awareness about digestive health through educational campaigns. Expansion of retail chains and online distribution channels into urban and rural areas is making laxatives more accessible. In addition, lifestyle changes, increasing prevalence of gastrointestinal disorders, and consumer preference for convenient self-care solutions are driving rapid market adoption.

Asia-Pacific Laxative Market Share

The Laxative industry is primarily led by well-established companies, including:

- Teva Pharmaceutical Industries Ltd. (Ireland)

- Sanofi (France)

- GSK plc (U.K.)

- AstraZeneca (U.K.)

- Johnson & Johnson and its affiliates (U.S.)

- Hikma Pharmaceuticals PLC (U.K.)

- Dr. Reddy's Laboratories Ltd. (India)

- Lupin (India)

- Fresenius Kabi AG (Germany)

- Aurobindo Pharma Limited (India)

- Cipla Inc. (U.S.)

- Bausch Health Companies Inc. (Canada)

- Amneal Pharmaceuticals LLC. (U.S.)

- Apotex Inc. (Canada)

- Bayer AG (Germany)

Latest Developments in Asia-Pacific Laxative Market

- In September 2023, Abbott Laboratories' Indian unit warned of potential supply shortages of two popular laxative syrups after production was prohibited in India's Goa state due to lapses found at a company factory. This incident highlighted the challenges faced by pharmaceutical companies in maintaining consistent production and supply in the region

- In June 2024, India-based Glenmark Pharmaceuticals introduced LaxaGo, an over-the-counter PEG‑3350 osmotic laxative with balanced electrolytes and a neutral taste, designed for effective constipation relief. This launch reflects Glenmark's commitment to addressing the growing demand for digestive health solutions in the Indian market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.