Asia Pacific Ldl Test Market

Market Size in USD Billion

CAGR :

%

USD

2.80 Billion

USD

5.37 Billion

2025

2033

USD

2.80 Billion

USD

5.37 Billion

2025

2033

| 2026 –2033 | |

| USD 2.80 Billion | |

| USD 5.37 Billion | |

|

|

|

|

Asia-Pacific Low Density Lipoprotein (LDL) Test Market Size

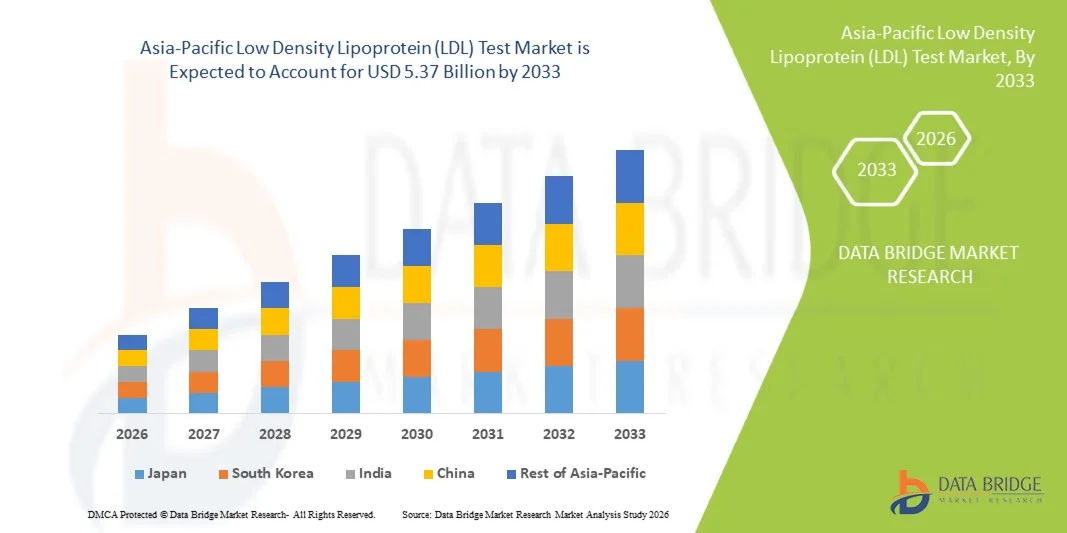

- The Asia-Pacific Low Density Lipoprotein (LDL) Test Market size was valued at USD 2.80 billion in 2025 and is expected to reach USD 5.37 billion by 2033, at a CAGR of 8.50% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cardiovascular diseases, rising health awareness among consumers, and advancements in diagnostic technologies, leading to greater adoption of low density lipoprotein (LDL) test solutions in both clinical and home care settings

- Furthermore, growing demand for early detection and management of cholesterol-related disorders is accelerating the uptake of LDL Test solutions, thereby significantly boosting the industry's growth

Asia-Pacific Low Density Lipoprotein (LDL) Test Market Analysis

- Low Density Lipoprotein (LDL) Tests, providing critical cholesterol and cardiovascular health monitoring, are increasingly vital in both clinical and home settings due to their accuracy, rapid results, and ease of use

- The escalating demand for LDL Test solutions is primarily fueled by growing awareness of cardiovascular diseases, preventive healthcare trends, and increasing adoption of at-home diagnostic technologies

- China dominated the Asia-Pacific Low Density Lipoprotein (LDL) Test Market in 2025 with the largest revenue share of 42%, driven by increasing prevalence of cardiovascular diseases, government initiatives to promote early disease detection, and high adoption of advanced diagnostic technologies

- India is expected to register the fastest growth in the Asia-Pacific region during the forecast period, with a CAGR of 25%, owing to rising healthcare access, increasing awareness of cholesterol-related disorders, and expanding investments in diagnostic infrastructure

- The LDL-C segment dominated the largest market revenue share of 41.8% in 2025, owing to its widespread use in assessing cardiovascular risk and guiding cholesterol-lowering therapy

Report Scope and Asia-Pacific Low Density Lipoprotein (LDL) Test Market Segmentation

|

Attributes |

Asia-Pacific Low Density Lipoprotein (LDL) Test Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Asia-Pacific Low Density Lipoprotein (LDL) Test Market Trends

“Enhanced Convenience Through Technological Advancements and Improved Diagnostics”

- A significant and accelerating trend in the Asia-Pacific Low Density Lipoprotein (LDL) Test Market is the increasing adoption of automated and point-of-care testing devices, which improve testing speed, accuracy, and patient convenience. This trend is driven by advancements in assay technology, miniaturization of diagnostic devices, and integration with telemedicine platforms, allowing faster reporting and remote patient monitoring

- For instance, in 2023, several diagnostic companies launched portable LDL analyzers capable of providing results within minutes, enabling quicker clinical decisions in hospitals, clinics, and home care settings. These devices enhance patient compliance and allow for routine monitoring in both urban and rural areas

- The development of multiplexed testing kits, combining LDL with other lipid profile parameters, is becoming increasingly common, providing comprehensive cardiovascular risk assessments with a single test. Such solutions reduce the need for multiple blood draws and improve laboratory efficiency

- The integration of cloud-based platforms with LDL testing systems facilitates real-time data management, allowing healthcare providers to track patient progress and intervene proactively when abnormal lipid levels are detected

- This trend towards rapid, user-friendly, and highly accurate LDL testing is reshaping healthcare workflows, supporting preventative care strategies, and increasing adoption in hospitals, diagnostic centers, and home care settings

- Companies such as Roche Diagnostics and Siemens Healthineers are actively investing in R&D to expand their LDL test offerings with improved sensitivity, portability, and integration with digital health records, underscoring the focus on technological innovation

Asia-Pacific Low Density Lipoprotein (LDL) Test Market Dynamics

Driver

“Growing Need Due to Rising Prevalence of Cardiovascular Diseases”

- The rising incidence of cardiovascular diseases (CVDs) in Asia-Pacific, coupled with increasing awareness about the importance of lipid monitoring, is a significant driver for the Asia-Pacific Low Density Lipoprotein (LDL) Test Market

- For instance, in March 2024, Abbott Laboratories introduced a new rapid LDL testing kit designed for routine hospital and clinic use, capable of producing reliable results within minutes. Such product launches are expected to support market expansion in the forecast period

- As healthcare providers focus on early detection and prevention of CVDs, LDL testing has become a critical diagnostic tool for assessing patient risk and guiding treatment decisions

- The adoption of preventive healthcare practices, growing patient awareness about cholesterol management, and the increasing number of health check-up programs are driving consistent demand for LDL tests

- Integration of LDL testing with telemedicine and home care services allows patients to monitor cholesterol levels conveniently, further supporting adoption

- The convenience, accuracy, and speed of modern LDL testing solutions are propelling growth across both hospital and home care segments

Restraint/Challenge

“Concerns Regarding Test Accuracy and High Cost of Advanced Systems”

- Concerns regarding the accuracy of some rapid or point-of-care LDL testing devices, particularly in home settings, pose a challenge to broader market adoption. Variability in test results compared to laboratory-based systems can create hesitation among healthcare providers and patients

- For instance, reports of minor inconsistencies in certain portable LDL analyzers have prompted recommendations for confirmatory testing in clinical settings, affecting adoption in some regions

- Addressing these accuracy concerns through validation studies, quality control measures, and certification standards is crucial for building trust in the market

- Furthermore, the high cost of advanced LDL testing devices compared to conventional laboratory assays can limit adoption, particularly in smaller clinics or rural healthcare settings

- While the prices of rapid LDL testing kits are gradually decreasing, cost sensitivity remains a barrier for widespread adoption in price-conscious segments

- Overcoming these challenges through improved test reliability, cost reduction, and enhanced patient and provider education will be vital for sustained market growth

Asia-Pacific Low Density Lipoprotein (LDL) Test Market Scope

The market is segmented on the basis of type, component, disease, end-user, and distribution channel.

• By Type

On the basis of type, the Asia-Pacific Low Density Lipoprotein (LDL) Test Market is segmented into LDL-C, LDL-B, LDL-P, and others. The LDL-C segment dominated the largest market revenue share of 41.8% in 2025, owing to its widespread use in assessing cardiovascular risk and guiding cholesterol-lowering therapy. LDL-C is the most commonly prescribed test in routine health checkups and hospital laboratories due to its high reliability, cost-effectiveness, and standardized methodology. Its dominance is strengthened by strong clinical adoption, availability of automated testing platforms, and global guideline recommendations. Hospitals, clinics, and diagnostic laboratories heavily rely on LDL-C for patient screening, treatment monitoring, and cardiovascular risk assessment. The segment’s established position is reinforced by government preventive programs and increasing public awareness of heart disease. Clinicians prefer LDL-C testing for its interpretability and ability to track therapy outcomes efficiently. Moreover, repeat testing requirements in chronic patients ensure continuous demand, maintaining its leading market share.

The LDL-P segment is expected to witness the fastest CAGR of 19.2% from 2026 to 2033, driven by growing recognition of LDL particle number as a more precise predictor of cardiovascular risk than traditional LDL-C. Adoption is increasing in specialized clinical and research settings where high-risk patients require detailed lipid profiling. Advanced automated platforms capable of accurate LDL-P measurement are fueling rapid growth. Increasing awareness among physicians and patients regarding residual cardiovascular risk, even under standard LDL-C control, supports the segment’s expansion. Rising prevalence of dyslipidemia and metabolic syndrome in Asia-Pacific further accelerates demand. The segment is gaining traction particularly in urban healthcare and preventive care initiatives.

• By Component

On the basis of component, the market is segmented into kits and reagents, devices, and services. The kits and reagents segment accounted for the largest market revenue share of 45.6% in 2025, due to its critical role in enabling accurate LDL testing across hospitals, clinics, and research laboratories. High adoption is supported by repeat testing, ease of integration with automated analyzers, and the broad availability of standardized kits from multiple suppliers. Kits and reagents are indispensable for laboratory workflows and routine testing protocols. Their dominance is reinforced by strong institutional demand, cost-effectiveness, and compatibility with high-throughput testing platforms. Hospitals and diagnostic centers continue to procure bulk kits, ensuring reliable supply and sustained growth in market revenue.

The devices segment is expected to witness the fastest CAGR of 18.5% from 2026 to 2033, fueled by demand for portable and point-of-care LDL testing devices. Miniaturization, rapid assay capabilities, and ease of use are driving adoption in outpatient and home-care settings. Increasing focus on early detection and patient convenience is pushing device penetration. Rising chronic disease prevalence and home-based monitoring programs further accelerate growth.

• By Disease

On the basis of disease, the market is segmented into diabetes, stroke, atherosclerosis, obesity, dyslipidemia, carotid artery disease, peripheral arterial disease, angina, and others. The dyslipidemia segment held the largest market revenue share of 38.9% in 2025, as elevated LDL levels are directly linked to lipid disorders and cardiovascular complications. Routine LDL testing for early detection and treatment monitoring drives strong adoption in hospitals and clinics. Awareness campaigns, preventive health checkups, and government health programs further reinforce its market dominance. Dyslipidemia testing is critical for chronic patient management, supporting high-volume adoption and repeat testing cycles.

The atherosclerosis segment is expected to witness the fastest CAGR of 17.8% from 2026 to 2033, driven by increasing prevalence of atherosclerotic cardiovascular diseases in the Asia-Pacific region. Early detection of arterial plaque and risk assessment through LDL testing is prompting adoption in hospitals, clinics, and preventive care settings. Advanced imaging integration and automated LDL testing solutions further accelerate growth. Rising urbanization, lifestyle-related risk factors, and government awareness programs support rapid uptake in this segment. Furthermore, the growing emphasis on preventive cardiology and routine health screenings is encouraging both healthcare providers and patients to prioritize regular LDL monitoring, reinforcing market expansion.

• By End-User

On the basis of end-user, the market is segmented into hospitals, clinics, ambulatory care, and research laboratories. The hospitals segment dominated the market with a 46.2% revenue share in 2025, driven by the presence of advanced diagnostic infrastructure, high patient volumes, and the routine integration of LDL testing in chronic disease monitoring and health checkups. Hospitals prefer automated LDL testing platforms for their accuracy, high throughput, and ability to handle large numbers of samples efficiently. The dominance of this segment is further strengthened by skilled clinical personnel, adherence to guideline-based protocols, and long-term institutional procurement policies. Hospitals ensure repeat testing for chronic patients, which maintains sustained demand. In addition, government funding and preventive care programs reinforce hospitals’ market leadership. High adoption of advanced analyzers and integration with electronic health records make hospitals the backbone of LDL testing services. Partnerships with diagnostic kit suppliers and consistent institutional demand further secure this segment’s top position. Its reliability, accuracy, and capability to support large-scale testing continue to drive steady market growth.

The ambulatory care segment is expected to witness the fastest CAGR of 20.4% from 2026 to 2033, fueled by the increasing prevalence of outpatient testing facilities and preventive healthcare services. Patients are increasingly preferring convenient and accessible testing outside traditional hospital environments. Ambulatory care centers offer rapid LDL testing services, catering to routine screenings and chronic disease management. Integration of LDL testing into health checkup packages, workplace wellness programs, and community preventive initiatives further supports adoption. Rising awareness of cardiovascular risks and cholesterol management is accelerating the demand for these services. Portable LDL testing devices and streamlined workflows enhance operational efficiency, contributing to rapid growth. The segment benefits from flexibility in patient scheduling, faster turnaround times, and targeted testing for high-risk groups. Government initiatives promoting early detection and community health screenings are also supporting expansion. Increased insurance coverage for outpatient testing amplifies accessibility. Telemedicine and remote reporting integration further boost segment growth. Rapid adoption in urban and semi-urban regions highlights the segment’s increasing market share over the forecast period.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tenders and retail. The direct tenders segment held the largest market revenue share of 52.1% in 2025, primarily due to bulk procurement by hospitals, clinics, and government programs, ensuring a consistent and reliable supply of LDL testing kits, reagents, and devices. Long-term contracts, institutional adoption, and centralized purchasing agreements maintain dominance. Direct tenders benefit from predictable procurement cycles and large-volume purchasing, reducing costs and ensuring timely availability of high-quality testing materials. Hospitals and diagnostic chains prefer this channel for its reliability, cost-effectiveness, and streamlined supply management. Strategic partnerships between manufacturers and healthcare institutions further reinforce its market position. The segment’s dominance is also backed by the adoption of automated analyzers, standardized protocols, and routine bulk usage in large healthcare facilities. Repeat testing needs for chronic patients ensure continuous demand. The structured distribution and institutional trust in suppliers contribute to sustained market leadership.

The retail segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, driven by the growing availability of point-of-care and home-use LDL testing solutions. Rising patient awareness of cholesterol management, cardiovascular risk, and preventive care supports rapid adoption of retail solutions. Convenience, easy accessibility, and self-testing opportunities allow patients to monitor LDL levels without visiting traditional healthcare facilities. The increasing popularity of preventive healthcare packages, home-based monitoring, and chronic disease management at the individual level is boosting growth. Retail distribution also benefits from partnerships with pharmacies, online platforms, and consumer healthcare stores. Expansion into semi-urban and rural areas, coupled with improved awareness campaigns, further accelerates segment growth. Innovative packaging, simplified instructions, and telehealth integration enhance the user experience. The segment’s rapid adoption is also driven by lifestyle diseases and demand for early risk detection. Growing adoption of portable LDL testing devices and kits in retail channels continues to expand reach and market share.

Asia-Pacific Low Density Lipoprotein (LDL) Test Market Regional Analysis

- The Asia-Pacific Low Density Lipoprotein (LDL) Test Market is poised to grow at the fastest CAGR of 25% during the forecast period of 2026 to 2033, driven by increasing healthcare access, rising awareness of cholesterol-related disorders, and expanding investments in diagnostic infrastructure in countries such as India, China, and Japan

- The region's growing inclination towards preventive healthcare, supported by government initiatives promoting early disease detection, is boosting the adoption of LDL testing solution

- Furthermore, as APAC emerges as a manufacturing hub for LDL Test components and systems, affordability and accessibility are expanding to a wider population base

China Asia-Pacific Low Density Lipoprotein (LDL) Test Market Insight

The China Asia-Pacific Low Density Lipoprotein (LDL) Test Market dominated the Asia-Pacific region in 2025 with the largest revenue share of 42%, attributed to the increasing prevalence of cardiovascular diseases, strong government initiatives promoting early disease detection, and high adoption of advanced diagnostic technologies. The country's expanding middle class and rapid urbanization are also key factors driving widespread adoption of LDL testing in hospitals, clinics, and research laboratories.

India Asia-Pacific Low Density Lipoprotein (LDL) Test Market Insight

The India Asia-Pacific Low Density Lipoprotein (LDL) Test Market is expected to register the fastest growth in the Asia-Pacific region with a CAGR of 25% during the forecast period, driven by rising healthcare awareness, government-led initiatives for cardiovascular disease prevention, and expanding diagnostic networks. Increasing availability of affordable testing solutions and growing adoption of preventive health check-ups are further propelling market growth.

Asia-Pacific Low Density Lipoprotein (LDL) Test Market Share

The Low Density Lipoprotein (LDL) Test industry is primarily led by well-established companies, including:

- Siemens Healthineers (Germany)

- Roche Diagnostics (Switzerland)

- Abbott (U.S.)

- Bio-Rad Laboratories (U.S.)

- Ortho Clinical Diagnostics (U.S.)

- Hologic (U.S.)

- Beckman Coulter (U.S.)

- Danaher Corporation (U.S.)

- Thermo Fisher Scientific (U.S.)

- Awareness Technology (India)

- ARKRAY Inc. (Japan)

- Werfen (Spain)

Latest Developments in Asia-Pacific Low Density Lipoprotein (LDL) Test Market

- In August 2024, Amgen expanded its no‑cost LDL‑C testing programme to approximately 1,000 MinuteClinic locations inside select CVS Pharmacy stores across the U.S., aiming to broaden community access to LDL cholesterol testing and drive early detection of high LDL levels

- In July 2023, Numares Health announced U.S. FDA clearance of its AXINON® LDL‑p Test System, providing physicians with a new tool to measure LDL particle number and enhancing physician ability to assess cardiovascular risk

- In September 2022, PocDoc launched a smartphone‑based, home‑use quantitative cholesterol test kit in the U.K., which includes measurement of LDL‑C among other lipid parameters, enabling users to conduct the test via finger‑prick and receive results via app in minutes

- In March 2022, Accurex Biomedical introduced its “LDL – Cholesterol Direct 40 – Infinite” reagent kit for direct quantitative determination of LDL‑C in human serum or plasma, enhancing laboratory testing workflows for LDL‑C measurement

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.