Asia Pacific Lined Valve Market

Market Size in USD Billion

CAGR :

%

USD

1.58 Billion

USD

2.43 Billion

2025

2033

USD

1.58 Billion

USD

2.43 Billion

2025

2033

| 2026 –2033 | |

| USD 1.58 Billion | |

| USD 2.43 Billion | |

|

|

|

|

Asia-Pacific Lined Valve Market Size

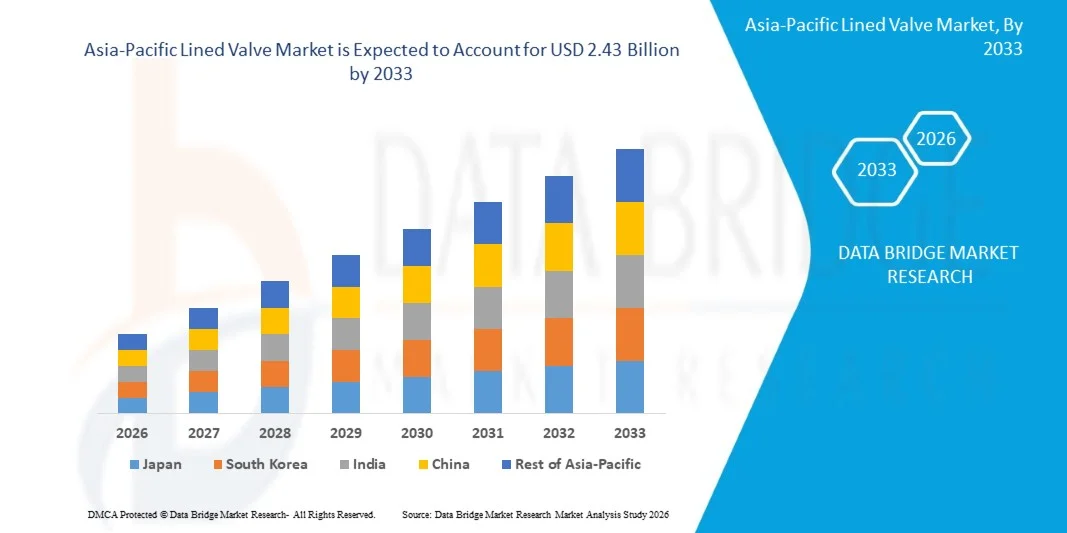

- The Asia-Pacific Lined Valve Market size was valued at USD 1.58 billion in 2025 and is expected to reach USD 2.43 billion by 2033, at a CAGR of 5.7% during the forecast period.

- The Asia-Pacific Lined Valve Market is witnessing steady growth, driven by increasing demand for corrosion-resistant flow control solutions across industries handling aggressive, toxic, and high-purity fluids. Market expansion is primarily supported by the rapid growth of the chemical, petrochemical, pharmaceutical, water & wastewater treatment, and specialty manufacturing sectors, where operational safety, regulatory compliance, and equipment longevity are critical. The rising need to minimize leakage, reduce unplanned downtime, and extend valve service life in harsh operating environments continues to accelerate adoption.

- Technological advancements in lining materials, precision manufacturing, CNC machining, and quality assurance processes are enhancing valve performance, dimensional accuracy, and reliability. Additionally, the integration of advanced actuation systems, automation, and digital monitoring technologies is improving process control, predictive maintenance, and plant efficiency, further strengthening market penetration.

Asia-Pacific Lined Valve Market Analysis

- The market serves diverse end-use industries, including chemical processing, petrochemicals, pharmaceuticals, oil & gas, water and wastewater treatment, power generation, mining, pulp & paper, and specialty industrial manufacturing. Lined valves play a critical role in fluid isolation, flow regulation, backflow prevention, safety protection, and corrosion-resistant fluid transfer, supporting operational efficiency, regulatory compliance, and plant safety.

- China is expected to dominate the Asia-Pacific Lined Valve Market with the largest market share of 23.20% in 2026 and is also projected to record the CAGR 5.8%. This dominance is supported by its robust industrial expansion and strategic investments. The kingdom's oil and gas sector leads demand, fueled by massive infrastructure projects, refinery upgrades, and unconventional gas production initiatives under Vision 2030, which prioritize reliable valves for high-pressure handling in petrochemical and energy operations.

- India is expected to holds the Asia-Pacific Lined Valve Market with the highest CAGR of 6.6% from 2026-2033 due to rapid industrialization, expanding chemical and pharmaceutical sectors, rising infrastructure investments, stricter safety regulations, and increasing demand for corrosion-resistant valves across process industries.

- In 2026, the ball valves segment is expected to dominate the market with an 25.13% market share, growing at the highest CAGR of 6.5% during the forecast period of 2026 to 2033 in the Asia-Pacific Lined Valve packaging market, driven by surging demand in oil & gas, petrochemicals, and water infrastructure.

Report Scope and Asia-Pacific Lined Valve Market Segmentation

|

Attributes |

Asia-Pacific Lined Valve Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Asia-Pacific Lined Valve Market Trends

“Rapid Integration of Automation And IoT Technologies Into Lined Valves”

- Predictive analytics via IoT sensors analyze vibration, pressure, and temperature data continuously, forecasting potential failures before they disrupt operations in extreme desert heat or corrosive flows common in Saudi refineries.

- Remote monitoring eliminates frequent manual inspections across vast oil fields like Ghawar, slashing labor and travel expenses while enabling centralized control from Riyadh hubs. Data-driven insights optimize maintenance schedules, reducing overall ownership costs by integrating with SCADA systems for seamless fleet management.

- Automated shutoffs trigger instantly on anomaly detection, preventing leaks of hazardous substances and aligning with strict Saudi Aramco and GCC regulations like API 6D standards. IoT logging provides audit trails for environmental compliance, crucial amid rising ESG mandates in desalination and LNG facilities. Enhanced traceability also supports insurance reductions through proven reliability records.

Asia-Pacific Lined Valve Market Dynamics

Driver

“Pharmaceutical Sector Growth Is Increasing Demand for Corrosion-Resistant Lined Valves”

- The growth of the pharmaceutical sector is significantly increasing demand for corrosion-resistant lined valves due to the industry’s strict requirements for purity, safety, and process reliability.

- Pharmaceutical manufacturing involves the handling of highly aggressive chemicals, solvents, acids, and active pharmaceutical ingredients that rapidly degrade conventional metal valves. Lined valves, typically coated with materials such as PTFE or PFA, provide strong resistance to corrosion while preventing product contamination, making them well-suited for sensitive drug production processes.

- As pharmaceutical companies expand manufacturing capacities and invest in new facilities to meet rising healthcare needs, the installation of hygienic and durable flow control equipment becomes a priority.

- Additionally, increased adoption of advanced drug formulations and complex chemical synthesis processes requires valves that can withstand frequent cleaning, sterilization, and exposure to harsh media without compromising performance. Regulatory pressure to maintain consistent product quality and comply with stringent validation standards further encourages the use of lined valves that offer long service life and stable operation.

- The sector’s shift toward continuous processing and higher automation levels also supports demand for reliable valves that minimize downtime and maintenance risks. Collectively, these factors make corrosion-resistant lined valves a critical component in supporting the pharmaceutical industry’s ongoing expansion and operational excellence.

Restraint/Challenge

“Volatile Raw Material Prices Are Increasing Cost Pressures for Lined Valve Manufacturers”

- Volatile raw material prices are creating significant cost pressures for lined valve manufacturers and are hindering overall market growth. Lined valves rely heavily on specialized materials such as fluoropolymers, elastomers, and high-grade metals such as nickel alloys, stainless steel, titanium and others, which are often subject to price fluctuations driven by supply chain disruptions, energy cost changes, and geopolitical uncertainties.

- When the prices of these inputs rise unpredictably, manufacturers face difficulty in accurately forecasting production costs and setting stable pricing strategies. This uncertainty compresses profit margins, especially for companies operating under long-term supply contracts or fixed-price agreements.

- Smaller and mid-sized manufacturers are particularly vulnerable, as they have limited bargaining power with suppliers and less flexibility to absorb sudden cost increases. To protect margins, manufacturers may pass higher costs on to customers, making lined valves less price-competitive compared to alternative valve solutions. This can delay purchasing decisions or push end users to seek lower-cost substitutes, slowing demand growth.

- Additionally, volatile input costs can disrupt procurement planning and inventory management, leading to inefficiencies and longer lead times. The resulting financial strain often limits manufacturers’ ability to invest in product innovation, capacity expansion, and quality improvements. Collectively, these factors reduce market momentum and create barriers to sustained growth in the lined valve industry.

Asia-Pacific Lined Valve Market Scope

The Asia-Pacific Lined Valve Market segmented into Six notable segments which are based on six notable segments which are based on product type, lining material, actuation type, end user industry, application, and distribution channel.

By Product Type

On the basis of product, the Asia-Pacific Lined Valve Market is segmented into ball valves, butterfly valves, check valves, gate valves, globe valves, plug valves, diaphragm valves, and others. In 2026, the ball valves segment is expected to dominate the Asia-Pacific Lined Valve Market, accounting for the highest share of 25.13% due to its unmatched suitability for high-pressure hydrocarbon flows in oil & gas operations, where quick quarter-turn operation ensures rapid shutoff and minimal leakage in corrosive environments.

Ball valves segment is projected to grow with the highest CAGR of 6.5% owing to surging infrastructure investments and technological advancements tailored to oil & gas dominance.

By Lining Material

On the basis of Lining Material, the global Asia-Pacific Lined Valve Market is segmented into PTFE (Polytetrafluoroethylene), PFA (Perfluoroalkoxy), FEP (Fluorinated Ethylene Propylene), ETFE (Ethylene Tetrafluoroethylene), and Others. In 2026, the PTFE (Polytetrafluoroethylene) segment is expected to dominate the Asia-Pacific Lined Valve Market, accounting for the highest share of 40.56%, due to its unparalleled chemical inertness and broad compatibility with aggressive media in oil & gas and petrochemical sectors.

PFA (Perfluoroalkoxy) segment is projected to grow with the highest CAGR of 5.7% owing to its superior mechanical strength and flexibility over PTFE, enabling thinner linings for larger diameters in high-pressure petrochemical applications.

By Actuation Type

On the basis of actuation type, the Asia-Pacific Lined Valve Market is segmented into manual, electric, pneumatic, and hydraulic. In 2026, the manual segment is expected to dominate the Asia-Pacific Lined Valve Market, accounting for the highest share of 47.22%, due to its proven reliability, simplicity, and cost-effectiveness in routine operations across oil & gas and water treatment facilities.

Pneumatic segment is projected to grow with the highest CAGR of 5.3% owing to its seamless integration with automated process control systems in expanding oil & gas refineries and chemical plants, where compressed air availability drives rapid actuation.

By End User Industry

On the basis of End User Industry, the Asia-Pacific Lined Valve Market is segmented into chemical processing, petrochemical, water and wastewater treatment, pharmaceutical, food and beverage, pulp and paper, mining, others. In 2026, the chemical processing segment is projected to lead the Asia-Pacific Lined Valve Market, capturing the largest share of 30.33%, due to its intensive handling of corrosive acids, alkalis, and solvents in expanding petrochemical complexes, where lined valves prevent contamination and ensure process integrity.

Water And Wastewater Treatment segment is projected to grow with the highest CAGR of 5.7% owing to acute water scarcity driving massive desalination and recycling investments across GCC nations.

By Application

On the basis of application, the Asia-Pacific Lined Valve Market is segmented into Corrosion-Resistant Handling Function, Isolation Function, Regulation / Modulation Function, Backflow Prevention Function, Safety & Protection Function, Others. In 2026, the Corrosion-Resistant Handling Function segment is expected to dominate the Asia-Pacific Lined Valve Market, accounting for the highest share of 37.44%, due to the prevalence of aggressive chemicals, acids, and high-salinity brines in oil & gas refineries and petrochemical plants, where standard metal valves rapidly degrade.

Regulation /Modulation Function segment is projected to grow with the highest CAGR of 5.6% owing to escalating demand for precise flow and pressure control in automated chemical processing and water treatment systems amid Vision 2030 infrastructure upgrades.

By Distribution Channel

On the basis of distribution channel, the Asia-Pacific Lined Valve Market is segmented into direct, indirect. In 2026, the direct segment is expected to dominate the Asia-Pacific Lined Valve Market, accounting for the highest share of 63.60%, due to its straightforward design that enables immediate, reliable operation in critical isolation applications across oil & gas pipelines and chemical plants, where simplicity trumps complexity.

Direct segment is projected to grow with the highest CAGR of 5.9% owing to surging infrastructure projects and the need for reliable, low-maintenance shut-off solutions in remote oil & gas fields and expanding chemical facilities.

Asia-Pacific Lined Valve Market Regional Analysis

- The China represents one of the most mature and high-volume Asia-Pacific Lined Valve Markets in Asia-Pacific, driven by its dominant oil & gas sector, massive Vision 2030 infrastructure projects, and strategic economic diversification efforts.

- India is witnessing sustained demand for advanced Lined Valve solutions, supported by its thriving oil & gas sector, ambitious desalination expansions, and rapid infrastructure diversification under national visions like UAE Energy Strategy 2050.

- Japan emerging Lined Valve ecosystem is contributing steadily to regional market growth due to its robust mining sector, expanding water treatment infrastructure, and strategic investments in industrial diversification.

China Asia-Pacific Lined Valve Market Insight

China Asia-Pacific Lined Valve Market is experiencing consistent growth, driven by nation's expansive oil and gas sector, which demands corrosion-resistant valves for handling aggressive chemicals in refineries and petrochemical plants. Vision 2030 initiatives accelerate this trend through massive infrastructure projects like NEOM, desalination expansions, and renewable energy developments, necessitating durable lined valves for water treatment and power generation. Rapid industrialization, urbanization, and investments in LNG/hydrogen infrastructure further boost demand.

Asia-Pacific Lined Valve Market Share

The Lined Valve industry is primarily led by well-established companies, including:

- Emerson Electric Co. (U.S.)

- Flowserve Corporation (U.S.)

- Georg Fischer Ltd. (Switzerland)

- KITZ Corporation (Japan)

- Crane Company (U.S.)

- SAMSON AG (Germany)

- AVK Holding A/S (Denmark)

- ITT Inc. (U.S.U.S.)

- Bray International (U.S.)

- Richter Chemie-Technik GmbH (IDEX Corporation) (U.S.)

- Chemvalve-Schmid AG (Switzerland)

- Asahi Yukizai Corporation / Asahi/America (Japan / U.S.)

- UNP Polyvalves (India) Pvt. Ltd. (India)

- Nivz Valves & Automation (India)

- Frenstar Valves Ltd. (India)

- Aira Euro Automation Pvt. Ltd. (India)

- ICON Valves & Engineering Pvt. Ltd. (India)

- Andronaco Industries (Chemtite) (U.S.)

- Chemtech Polyplast Private Limited (India)

- Bflon (India)

- Zhejiang Youfumi Valve Co., Ltd. (China)

- Lianke Valve Co., Ltd. (China)

- MVS Valves Pvt. Ltd. (India)

- Galaxy Thermoplast Pvt. Ltd. (India)

- Flow Line Valve Pvt. Ltd. (India)

- Polycoat Flowchem Pvt. Ltd. (India)

Latest Developments in Asia-Pacific Lined Valve Market

- In January 2026, Crane Company Completes Acquisition of Precision Sensors & Instrumentation. Crane Company (NYSE: CR) announced it has finalized the acquisition of Precision Sensors & Instrumentation (PSI) from Baker Hughes (NASDAQ: BKR). PSI specializes in sensor-based technologies for aerospace, nuclear, and process industries. Crane will discuss the acquisition during its fourth quarter 2025 earnings call, with the release scheduled for January 26, 2026, and a teleconference on January 27, 2026. Investors can access the call and slides via the company’s website. The acquisition strengthens Crane’s technology portfolio, enhancing its capabilities in advanced sensor solutions across critical industrial markets.

- In January 2026, Emerson (NYSE: EMR) has been honored as the ‘2026 Industrial IoT Company of the Year’ by the IoT Breakthrough Awards for its innovation and technology leadership. Following its 2025 acquisition of Aspen Technology, Emerson offers a comprehensive industrial IoT technology stack, supporting industries like energy, life sciences, aerospace, and semiconductors with AI-enabled autonomous operations. The company’s software-defined, data-centric automation platform enables faster deployment, seamless modernization, and optimized performance across mission-critical operations. Strengthens Emerson’s position as a global automation leader, driving digital transformation and operational excellence for industrial customers worldwide.

- In November 2025, Emerson (NYSE: EMR) has been selected by global mining company South32 to provide advanced automation solutions for its Hermosa mine in Arizona, the company’s first ‘next generation mine.’ Emerson’s software portfolio, including the DeltaV platform, will enable a centralized remote operations center, optimizing safety, efficiency, and environmental performance. The project aims to produce critical metals like zinc, silver, and lead to support renewable energy, transportation, and low-carbon infrastructure. Emerson’s automation technology helps South32 improve operational efficiency while minimizing environmental impact at its Hermosa mine.

- In November 2025, Flowserve to Participate in Investor Conferences. Flowserve Corporation (NYSE: FLS), a global leader in flow control products and services, announced its participation in several upcoming investor conferences. CEO Scott Rowe and CFO Amy Schwetz will attend the Baird Global Industrial Conference on November 12, with Rowe also joining a fireside chat. The company will engage in meetings at the UBS Global Industrials and Transportation Conference on December 2, and Schwetz will participate in the Goldman Sachs Industrials and Materials Conference on December 3, including a fireside chat. Webcasts and replays will be available via Flowserve’s Investor Relations website. Enhances transparency and engagement with investors worldwide.

- In March 2025,Flowserve has launched the INNOMAG TB-MAG Dual Drive Pump, the world’s first sealless pump with true secondary containment, setting a new safety standard. The pump features double hermetic sealing and an independent containment system, preventing leaks and protecting the motor even if a failure occurs. Designed for hazardous chemicals, it includes a corrosion-resistant non-metallic liner and supports solids handling up to 30% concentration. The modular design allows upgrading standard INNOMAG TB-MAG pumps to Dual Drive or purchasing it as a complete unit. This innovation aligns with Flowserve’s strategy of diversification, decarbonization, and digitization.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Lined Valve Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Lined Valve Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Lined Valve Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.