Asia Pacific Lipid Poct Market

Market Size in USD Million

CAGR :

%

USD

182.98 Million

USD

307.41 Million

2025

2033

USD

182.98 Million

USD

307.41 Million

2025

2033

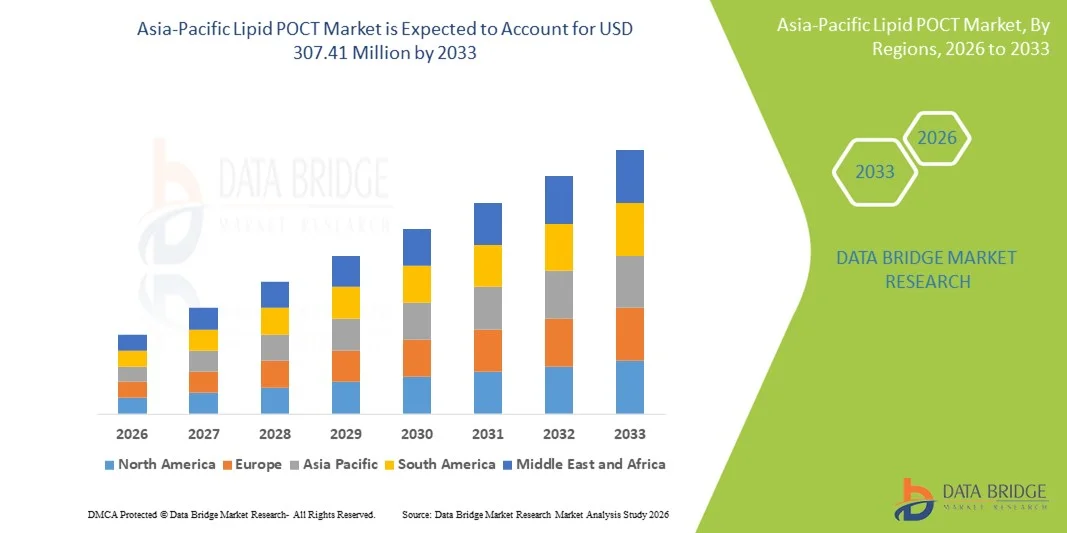

| 2026 –2033 | |

| USD 182.98 Million | |

| USD 307.41 Million | |

|

|

|

|

Asia-Pacific Lipid POCT Market Size

- The Asia-Pacific lipid POCT market size was valued at USD 182.98 million in 2025 and is expected to reach USD 307.41 million by 2033, at a CAGR of 6.7% during the forecast period

- The market growth is largely fueled by the rising burden of cardiovascular and metabolic disorders, increasing awareness of early lipid screening and preventive healthcare, and the rapid expansion of decentralized diagnostic solutions including on‑site point‑of‑care lipid tests in clinics, hospitals, and community health settings across the region

- Furthermore, growing healthcare infrastructure investment, government initiatives to expand preventive screening programs, and the demand for affordable, user‑friendly diagnostic kits that provide quick, actionable results are establishing lipid POCT as a preferred tool for cardiovascular risk management. These converging factors are accelerating the uptake of lipid POCT solutions, thereby significantly boosting the industry’s growth

Asia-Pacific Lipid POCT Market Analysis

- Lipid Point-of-Care Testing (POCT), providing rapid on-site assessment of lipid profiles, is becoming increasingly vital in both clinical and home care settings across Asia-Pacific due to its convenience, quick turnaround, and support for early cardiovascular risk management

- The escalating demand for lipid POCT is primarily fueled by the growing prevalence of cardiovascular and metabolic disorders, increasing awareness of preventive healthcare, and a rising preference for fast, easy-to-use, and reliable testing over conventional laboratory diagnostics

- China dominated the Asia-Pacific lipid POCT market with a revenue share of 35.2% in 2025, driven by advanced healthcare infrastructure, high adoption of point-of-care diagnostics, and strong government initiatives promoting preventive screening program

- India is expected to be the fastest-growing country in the Asia-Pacific lipid POCT market during the forecast period, driven by urbanization, rising disposable incomes, and increasing awareness of cardiovascular health management

- Instruments segment dominated the Asia-Pacific lipid POCT market with a market share of 60.9% in 2025, supported by advanced platforms such as lateral flow assays, immunoassays, and microfluidics, which are widely used in hospitals, professional diagnostic centers, and home care settings

Report Scope and Asia-Pacific Lipid POCT Market Segmentation

|

Attributes |

Asia-Pacific Lipid POCT Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Lipid POCT Market Trends

Enhanced Convenience Through Rapid, Point-of-Care Testing

- A significant and accelerating trend in the Asia-Pacific lipid POCT market is the increasing adoption of rapid, on-site lipid testing devices that provide clinicians and patients with near-instant results, reducing reliance on traditional laboratory workflows

- For instance, Roche Reflotron and Alere Cholestech LDX allow healthcare providers to measure lipid profiles in under 10 minutes at the patient’s bedside or clinic, improving clinical decision-making and patient compliance

- Advanced platforms such as lateral flow assays and microfluidic-based immunoassays are enabling greater portability and ease of use, supporting decentralized testing in hospitals, diagnostic centers, and home care settings

- The integration of POCT devices with digital health platforms, mobile applications, and electronic health records facilitates streamlined patient monitoring, automated reporting, and better management of cardiovascular risk factors

- This trend towards faster, portable, and connected lipid POCT solutions is reshaping expectations for preventive healthcare and routine cardiovascular monitoring, prompting companies such as Samsung Labgeo to introduce compact, user-friendly devices compatible with home and clinical use

- The demand for lipid POCT solutions offering convenience, speed, and connectivity is growing rapidly across both clinical and home care segments, as patients and providers prioritize timely results and improved care outcomes

- Emerging miniaturized and battery-operated POCT devices allow use in rural and remote areas, expanding access to lipid testing beyond urban healthcare facilities

Asia-Pacific Lipid POCT Market Dynamics

Driver

Rising Prevalence of Cardiovascular and Metabolic Disorders

- The increasing incidence of hyperlipidemia, hypertriglyceridemia, and other lipid disorders across Asia-Pacific is a key driver of heightened demand for lipid POCT solutions

- For instance, in 2024, rising cardiovascular disease cases in India prompted hospitals and diagnostic centers to adopt rapid POCT devices such as Alere Afinion and Roche Cobas B 101 for faster patient screening and monitoring

- POCT devices offer actionable results at the point of care, enabling physicians to implement timely interventions and manage patient therapy more effectively

- The growing awareness of preventive healthcare and routine lipid monitoring, particularly in urban populations, is boosting the adoption of decentralized testing outside traditional laboratory settings

- The convenience of on-site lipid testing, ease of operation for clinical staff, and the ability to conduct both prescription-based and OTC testing are key factors propelling market growth in both hospital and home care segments

- Government initiatives promoting cardiovascular health programs and national screening campaigns are driving procurement of POCT devices in public hospitals and clinics

- Rising healthcare expenditure in countries such as China, Japan, and South Korea is enabling hospitals to invest in modern POCT technologies, further accelerating market expansion

Restraint/Challenge

Device Cost and Regulatory Compliance Hurdles

- The relatively high cost of advanced lipid POCT devices compared to standard laboratory testing is a significant barrier to adoption, particularly in smaller clinics and price-sensitive markets

- For instance, premium devices such as Roche Cobas B 101 or Samsung Labgeo require investment in both instruments and consumables, which may limit uptake in emerging countries despite clinical benefits

- Regulatory compliance across multiple countries, including approvals from health authorities, adds complexity and delays market entry for new devices

- Addressing these challenges requires balancing device affordability with quality and accuracy, while ensuring manufacturers meet country-specific certification and safety standards for clinical use

- Overcoming cost and regulatory barriers through innovations in low-cost kits, standardized protocols, and regional approvals will be vital for sustained market growth in Asia-Pacific

- Limited technical expertise and training among healthcare staff for operating advanced POCT devices can hinder adoption in smaller clinics and rural areas

- Supply chain challenges and inconsistent availability of consumables in remote markets may affect continuous operation of lipid POCT devices, creating adoption bottlenecks

Asia-Pacific Lipid POCT Market Scope

The market is segmented on the basis of type, application, mode, brand, platform, end user, and distribution channel.

- By Type

On the basis of type, the Asia-Pacific lipid POCT market is segmented into instruments and consumables/kits. The instruments segment dominated the market with the largest revenue share of 60.9% in 2025, driven by their essential role in performing accurate lipid tests and enabling rapid results at the point of care. Hospitals and diagnostic centers invest in instruments for repeated testing and long-term usage, ensuring reliability and efficiency. Instruments are compatible with multiple testing platforms such as lateral flow assays, immunoassays, and microfluidics, supporting diverse clinical applications. Manufacturers are introducing compact, portable, and digitally integrated instruments that streamline workflow and connect to patient management systems. High adoption in urban hospitals and research labs further reinforces its dominant position. The combination of accuracy, reusability, and digital reporting makes instruments the preferred choice for clinical professionals.

The consumables/kits segment is anticipated to witness the fastest growth rate of 12.5% from 2026 to 2033, fueled by rising adoption in home care, smaller clinics, and outreach programs. Consumables and kits offer low-cost, easy-to-use options for decentralized lipid testing, reducing dependence on full-scale instruments. Their convenience and portability make them ideal for community screening campaigns and remote monitoring. Recurring purchase of kits ensures steady revenue streams for manufacturers and distributors. Kits are increasingly compatible with digital health platforms and smartphone applications, enabling easier patient monitoring. Growing awareness of preventive healthcare is driving kit adoption in rural and semi-urban regions.

- By Application

On the basis of application, the market is segmented into hyperlipidemia, hypertriglyceridemia, hyperlipoproteinemia, familial hypercholesterolemia, Tangier disease, and others. The hyperlipidemia segment dominated the market in 2025, accounting for over 50% of revenue, as it represents the most common lipid disorder in the region. Hospitals and diagnostic centers prioritize rapid screening of hyperlipidemia to initiate timely interventions and manage patient therapy. Government and NGO-led awareness campaigns targeting cholesterol management further drive market demand. Hyperlipidemia testing often requires repeated monitoring, increasing consumption of instruments and consumables. The segment benefits from established clinical guidelines recommending regular lipid testing for adults. Technological compatibility with multiple POCT devices ensures broad adoption across healthcare facilities.

The familial hypercholesterolemia segment is expected to witness the fastest CAGR from 2026 to 2033, driven by growing awareness of genetic lipid disorders and early screening initiatives. Early diagnosis enables targeted treatment plans and preventive care, increasing adoption of point-of-care solutions in specialized clinics. Genetic counseling and patient monitoring programs are supporting adoption. The segment also benefits from integration with digital platforms for remote patient follow-up. Rising investments in rare disease screening programs enhance accessibility. Countries such as Japan, China, and India are increasingly including familial hypercholesterolemia in preventive health check-ups.

- By Mode

On the basis of mode, the market is segmented into prescription-based testing and OTC-based testing. The prescription-based testing segment dominated the market in 2025, supported by clinical protocols requiring healthcare provider supervision for accurate diagnosis. Hospitals, diagnostic centers, and research labs prefer prescription-based devices for standardized testing. Regulatory frameworks and reimbursement policies in developed countries further reinforce dominance. Prescription-based tests are widely used for managing chronic cardiovascular patients. Integration with hospital information systems enhances workflow efficiency. Continuous monitoring and professional oversight make this segment reliable and preferred.

The OTC-based testing segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing home care adoption, patient empowerment, and preventive health awareness. OTC kits allow self-monitoring without frequent hospital visits. Digital connectivity and smartphone compatibility improve patient engagement. Growing disposable incomes and rising health consciousness support home adoption. Government campaigns promoting preventive screening boost OTC usage. E-commerce channels and retail availability increase accessibility.

- By Brand

On the basis of brand, the market is segmented into Roche Reflotron, Roche Cobas B 101, Alere Cholestech LDX, Alere Afinion, Samsung Labgeo, PTS Cardiochek, and others. The Roche Reflotron segment dominated the market in 2025, owing to its well-established presence, reliable performance, and wide adoption in hospitals. Its compatibility with multiple lipid parameters and digital reporting enhances clinical workflow efficiency. Hospitals and labs prefer this brand for repeat testing and accuracy. Government and corporate procurement agreements support market dominance. Strong brand recognition and post-sales support reinforce preference.

The Alere Cholestech LDX segment is expected to witness the fastest growth from 2026 to 2033, driven by portability, ease of use, and suitability for home care, small clinics, and community programs. Its user-friendly interface supports non-professional operators. Integration with digital platforms allows remote monitoring. Frequent marketing campaigns increase visibility in emerging markets. Strategic partnerships with telehealth providers enhance adoption. Rising preventive health initiatives among consumers accelerate demand.

- By Platform

On the basis of platform, the market is segmented into lateral flow assays, molecular diagnostics, immunoassays, dipsticks, and microfluidics. The lateral flow assays segment dominated the market in 2025, offering rapid results, minimal training requirements, and reliable lipid detection. Its affordability supports high adoption across hospitals and diagnostic centers. Compatibility with multiple sample types improves flexibility. Devices often integrate with digital reporting systems for patient management. Lateral flow assays are preferred for routine screening and large-scale campaigns. Low maintenance and operational simplicity make this platform attractive.

The microfluidics segment is expected to witness the fastest growth from 2026 to 2033, driven by miniaturization, multiplex testing, and digital integration. Precise measurement of multiple lipid parameters is possible with small sample volumes. Portability supports home and remote testing. Rising R&D investments in microfluidic technology enhance device capabilities. Integration with smartphone applications and cloud platforms improves usability. Countries such as India, China, and Japan are adopting microfluidics in clinical and home care applications.

- By End User

On the basis of end user, the market is segmented into hospitals, professional diagnostic centers, home care, research laboratories, and other end users. The hospitals segment dominated the market in 2025, owing to high patient volumes, repeat testing requirements, and integration with clinical workflows. Hospitals invest in both instruments and consumables/kits for reliable diagnosis and preventive screening. Clinical staff are trained for consistent testing. Government procurement programs reinforce hospital dominance. Hospitals also integrate POCT devices with electronic health records. High-volume operations support sustained demand.

The home care segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising health awareness, disposable incomes, and convenience of at-home lipid testing. OTC kits and compact instruments support self-monitoring. Digital connectivity enables remote monitoring by healthcare providers. Home adoption reduces hospital visits and encourages preventive health. Marketing campaigns target health-conscious urban populations. E-commerce availability enhances accessibility and convenience.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and retail sales. The direct tender segment dominated the market in 2025, particularly in hospitals, government programs, and professional diagnostic centers, as it ensures bulk procurement, long-term supply contracts, and lower per-unit costs. Manufacturers supply devices through tender-based agreements for clinical use. Hospitals rely on direct tender for standardized quality and consistent supply. Tender contracts often include training and service packages. Strong presence of major manufacturers reinforces dominance. Bulk procurement reduces operational costs and improves efficiency.

The retail sales segment is expected to witness the fastest growth from 2026 to 2033, driven by OTC kit sales, e-commerce penetration, and consumer preference for at-home lipid testing. Retail availability increases adoption in smaller clinics and home care users. Marketing campaigns and online promotions enhance visibility. Convenient access through pharmacies and online stores supports rapid uptake. Retail channels provide flexibility for recurring purchases. Rising awareness of preventive health drives adoption through retail outlets.

Asia-Pacific Lipid POCT Market Regional Analysis

- China dominated the Asia-Pacific lipid POCT market with a revenue share of 35.2% in 2025, driven by advanced healthcare infrastructure, high adoption of point-of-care diagnostics, and strong government initiatives promoting preventive screening program

- Healthcare providers and patients in China highly value the rapid, on-site results offered by lipid POCT devices, which reduce dependency on centralized laboratories and support timely clinical decision-making

- The widespread adoption is further supported by increasing hospital and clinic investment in advanced instruments, rising awareness of preventive healthcare, and the growing preference for convenient home and community-based testing solutions

The China Lipid POCT Market Insight

The China lipid POCT market captured the largest revenue share of 35.2% in 2025, attributed to high prevalence of hyperlipidemia and other lipid disorders, robust hospital and clinic infrastructure, and strong government support for preventive healthcare programs. Patients and healthcare providers value rapid, on-site lipid testing that reduces dependency on centralized laboratories and enables timely clinical interventions. High adoption of digital healthcare platforms and telemedicine further supports market growth. Both urban hospitals and smaller clinics are increasingly investing in instruments and consumables for efficient testing. In addition, collaborations between device manufacturers and public health initiatives are boosting awareness and adoption of lipid POCT.

Japan Lipid POCT Market Insight

The Japan lipid POCT market is gaining momentum due to the country’s well-established healthcare system, focus on preventive health, and rapid urbanization. High-tech adoption among hospitals and clinics supports the integration of POCT devices with electronic health records and mobile health platforms. The growing geriatric population is increasing demand for easier-to-use lipid testing solutions in both residential and clinical settings. Government campaigns for early detection of cardiovascular disorders are further encouraging POCT adoption. The market is also supported by strong R&D in advanced platforms such as microfluidics and immunoassays. Connectivity with telehealth and remote monitoring systems enhances the clinical utility of these devices.

India Lipid POCT Market Insight

The India lipid POCT market accounted for the largest revenue share in Asia in 2025, driven by rising cardiovascular disease incidence, expanding middle-class population, and increasing health awareness. Rapid urbanization and expansion of private hospitals and diagnostic centers are boosting adoption of point-of-care devices. Affordable instruments and OTC lipid kits are enabling wider accessibility in home care and community-based screenings. Government initiatives promoting preventive health check-ups and public-private partnerships further support market growth. India is also witnessing increased adoption of digital reporting and remote monitoring solutions for lipid management. Local manufacturers and distributors are enhancing availability and affordability of POCT devices, accelerating regional penetration.

Australia Lipid POCT Market Insight

The Australia lipid POCT market is witnessing steady growth due to advanced healthcare infrastructure, high awareness of preventive healthcare, and preference for rapid diagnostic solutions. Hospitals and clinics are increasingly adopting instruments and consumables for point-of-care lipid testing. Integration with electronic health records, cloud-based reporting, and mobile applications improves efficiency and patient management. Rising incidence of hyperlipidemia and metabolic disorders supports continued demand. The market is also supported by government preventive screening programs and reimbursement policies. Availability of compact, easy-to-use POCT devices for home care further accelerates adoption.

Asia-Pacific Lipid POCT Market Share

The Asia-Pacific Lipid POCT industry is primarily led by well-established companies, including:

- SD Biosensor, Inc. (South Korea)

- Abbott (U.S.)

- PTS Diagnostics, LLC (U.S.)

- Trinity Biotech plc (Ireland)

- F. Hoffmann La Roche Ltd. (Switzerland)

- Nova Biomedical (U.S.)

- Calligari Srl (Italy)

- AMD SOLUTIONS (Argentina)

- EuroMedix (Netherlands)

- Siemens Healthineers AG (Germany)

- TASCOM (Japan)

- General Life Biotechnology Co., Ltd. (Taiwan)

- MICO BIOMED (South Korea)

- Jant Pharmacal Corporation (U.S.)

- Samsung Medison Co., Ltd. (South Korea)

- A. Menarini Diagnostics s.r.l (Italy)

- ACON Laboratories, Inc. (U.S.)

- PRIMA Lab SA (Poland)

- Quest Diagnostics Incorporated (U.S.)

- SKYLA CORPORATION (Japan)

What are the Recent Developments in Asia-Pacific Lipid POCT Market?

- In December 2025, Menarini Asia-Pacific announced a major expansion of its manufacturing and export hub, PT. Menarini Indria Laboratories (Milab), in Cikarang, Indonesia. This expansion is designed to meet the surging regional demand for medical devices and pharmaceutical products, including their diagnostics portfolio which covers cardiometabolic care. By doubling its packaging and production capacity and targeting exports to 12 countries, including China and Singapore

- In September 2024, Abbott released a significant technical declaration and update for its Afinion Lipid Panel (which measures TC, HDL, and Triglycerides with calculated LDL) to ensure high accuracy across its global and Asia-Pacific distribution networks. The update included a formal Declaration of Conformity under new IVDR regulations, reinforcing the platform's reliability for rapid 7-minute lipid testing in APAC clinics and physician offices

- In July 2024, Roche successfully completed the acquisition of LumiraDx’s point-of-care technology, which is a pivotal move for the Asia-Pacific region. The LumiraDx platform is a portable, multi-assay system capable of delivering lab-quality lipid profiles and clinical chemistry tests on a single handheld device. This acquisition allows Roche to significantly expand its decentralized testing footprint in APAC

- In March 2024, Siemens Healthineers significantly expanded the availability and clinical integration of its Atellica VTLi system in India and the wider South Asian market. While primarily known for its high-sensitivity troponin I testing, the platform represents a major shift in the APAC market toward "cardiometabolic" workstations. The system is designed to provide lab-quality results from a fingerstick in just 8 minutes.

- In January 2023, The Indian pharmaceutical giant Cipla entered the diagnostic segment by launching Cippoint, a state-of-the-art point-of-care testing device. Cippoint is designed to offer a wide range of testing parameters, including metabolic markers (lipids), cardiac markers, and diabetes. The device targets smaller healthcare establishments, diagnostic labs, and mobile vans in India and South Asia, providing results in 3 to 15 minutes to bridge the gap in diagnostic access for non-communicable diseases

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.