Asia Pacific Low E Glass Market

Market Size in USD Billion

CAGR :

%

USD

9.29 Billion

USD

14.92 Billion

2024

2032

USD

9.29 Billion

USD

14.92 Billion

2024

2032

| 2025 –2032 | |

| USD 9.29 Billion | |

| USD 14.92 Billion | |

|

|

|

|

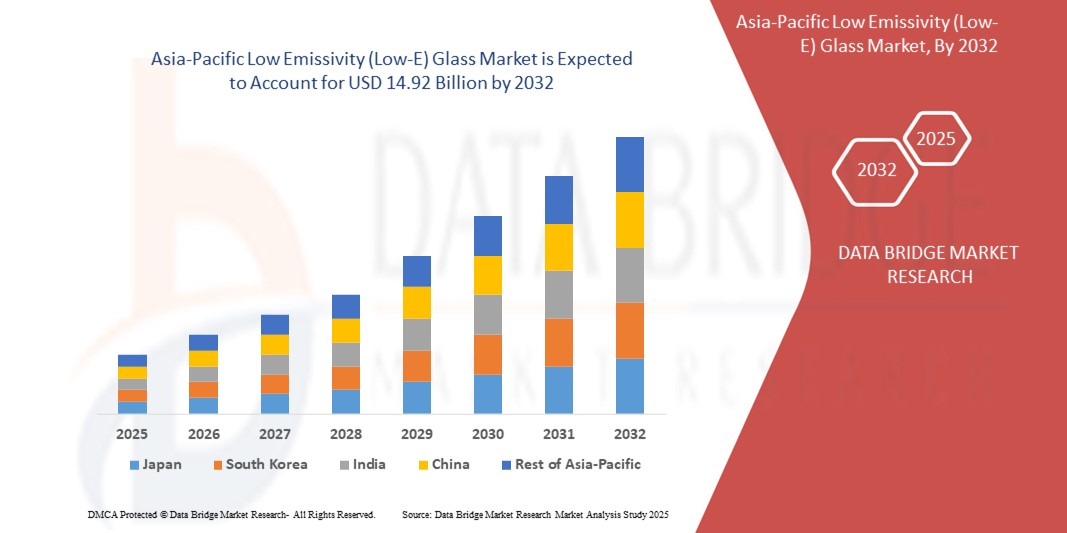

Asia-Pacific Low Emissivity (Low-E) Glass Market Size

- The Asia-Pacific low emissivity (Low-E) glass market size was valued at USD 9.29 billion in 2024 and is expected to reach USD 14.92 billion by 2032, at a CAGR of 6.10% during the forecast period

- The market growth is largely fuelled by the increasing demand for energy-efficient building materials and rising construction activities in the region

- Increasing government regulations and initiatives promoting sustainable and energy-saving building solutions are further boosting market expansion

Asia-Pacific Low Emissivity (Low-E) Glass Market Analysis

- The market is witnessing increased adoption of low emissivity glass in commercial and residential construction due to its ability to improve energy efficiency and indoor comfort

- Manufacturers are focusing on product innovation and expanding production capacities to meet the rising demand for advanced glass solutions in building applications

- China Low-E glass market accounted for the largest market revenue share of 62.5% in Asia Pacific in 2024, attributed to the country's rapid economic development, massive building and construction industry, and substantial investments in green building projects

- Japan is expected to witness the highest compound annual growth rate (CAGR) in the Asia-Pacific low emissivity (Low-E) glass market due to its stringent energy efficiency regulations, strong emphasis on sustainable building practices, and a high-tech culture that drives innovation in glass technology

- The soft coat low-E glass segment is expected to dominate the largest market revenue share of 71.1% in the forecast period, driven by its superior thermal performance and better insulation properties. Soft coat Low-E glass, also known as sputtered Low-E, offers enhanced energy efficiency by effectively blocking solar heat gain while retaining indoor heat, making it highly preferred for both residential and commercial buildings aiming for optimal energy savings

Report Scope and Asia-Pacific Low Emissivity (Low-E) Glass Market Segmentation

|

Attributes |

Asia-Pacific Low Emissivity (Low-E) Glass Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Low Emissivity (Low-E) Glass Market Trends

“Growing Adoption of Energy-Efficient Glass in Construction”

- Rising demand for energy-efficient construction is driving increased use of low emissivity glass in both residential and commercial buildings

- This glass reduces heat transfer through windows, leading to better indoor comfort and lower energy costs

- Governments are promoting green building standards, encouraging the adoption of low emissivity glass in new developments

- For instance, Singapore’s Marina One complex, which utilizes low emissivity glass to meet sustainability goals

- Continuous innovation by manufacturers is enhancing the durability and thermal performance of these glass products

Asia-Pacific Low Emissivity (Low-E) Glass Market Dynamics

Driver

“Rising Focus on Sustainable Infrastructure and Energy-Efficient Buildings”

- Growing urbanization in countries such as China, India, and Australia are accelerating demand for energy-efficient and sustainable construction materials

- Low emissivity glass enhances thermal efficiency by reflecting infrared energy and reducing heat transfer in buildings

- The use of Low-E glass lowers energy consumption for heating and cooling, making it ideal for eco-friendly residential and commercial projects

- Governments are implementing strict building codes and offering incentives to encourage the adoption of energy-efficient materials

- For instance, India’s Energy Conservation Building Code (ECBC) promotes the use of Low-E glass in new constructions to reduce energy use in buildings

Restraint/Challenge

“High Cost Associated with Advanced Glass Manufacturing and Installation.”

- The high production cost of Low-E glass due to advanced coating technologies makes it less accessible for price-sensitive consumers

- Specialized labour is required for installation to retain the glass’s energy-efficient performance, increasing overall project expenses

- Limited awareness in rural and underdeveloped areas leads to lower demand, as consumers often opt for traditional glass options

- Inconsistent enforcement of energy efficiency regulations across the region results in uneven market adoption

- For instance, countries with weaker implementation of green building codes see slower uptake of Low-E glass compared to those with strict mandates

Asia-Pacific Low Emissivity (Low-E) Glass Market Scope

The market is segmented on the basis of type, coating type, coating material, glazing, technology, and end-user.

- By Type

On the basis of type, the Asia-Pacific low-emissivity (Low-E) glass market is segmented into hard coat low-E glass and soft coat low-E glass. The soft coat low-E glass segment is expected to dominate the largest market revenue share of 71.1% in the forecast period, driven by its superior thermal performance and better insulation properties. Soft coat Low-E glass, also known as sputtered Low-E, offers enhanced energy efficiency by effectively blocking solar heat gain while retaining indoor heat, making it highly preferred for both residential and commercial buildings aiming for optimal energy savings.

The hard coat low-E glass segment is expected to witness the fastest growth rate, fuelled by its durability, ease of handling, and suitability for various applications, including single glazing and storm windows. Hard coat Low-E glass, produced through a pyrolytic process, is more robust and less susceptible to damage during fabrication, making it a cost-effective solution for certain building projects.

- By Coating Type

On the basis of coating type, the Asia-Pacific low-emissivity (Low-E) glass market is segmented into passive low-E coating and solar control low-e coating. The solar control low-E coating segment held the largest market revenue share in 2024, driven by the increasing demand for energy-efficient buildings in regions with high solar radiation. This coating type is highly effective in reflecting solar heat, thereby reducing the need for air conditioning and lowering cooling costs in warm climates.

The passive low-E coating segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its growing adoption in colder climates to maximize solar heat gain while minimizing heat loss. This coating type helps to keep interiors warmer by reflecting heat back into the building, reducing heating costs and improving overall thermal comfort, making it ideal for northern regions of Asia-Pacific.

- By Coating Material

On the basis of coating material, the Asia-Pacific low-emissivity (Low-E) glass market is segmented into metallic and semi-conductive coating. The metallic segment held the largest market revenue share in 2024, driven by the widespread use of silver-based coatings known for their excellent low-emissivity properties and superior thermal performance. Metallic coatings are highly effective in reflecting infrared radiation, contributing significantly to energy savings in buildings.

The semi-conductive coating segment is expected to witness the fastest growth rate, fuelled by ongoing research and development in new materials that offer improved performance and durability. Semi-conductive coatings, often tin oxide-based, are known for their robust nature and are commonly used in hard coat low-E glass applications due to their ease of manufacturing.

- By Glazing

On the basis of glazing, the Asia-Pacific low-emissivity (Low-E) glass market is segmented into single low-E glazing, double low-E glazing, and triple low-E glazing. The double low-E glazing segment held the largest market revenue share in 2024, driven by its optimal balance of energy efficiency, cost-effectiveness, and acoustic insulation. Double glazing with Low-E coatings is widely adopted in both residential and commercial constructions to meet increasingly stringent energy codes and reduce heating and cooling loads.

The triple low-E glazing segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the growing demand for highly energy-efficient buildings in extreme climates and the increasing focus on achieving net-zero energy consumption. Triple glazing offers superior thermal performance and sound reduction, making it ideal for high-performance buildings and passive house designs.

- By Technology

On the basis of technology, the Asia-Pacific low-emissivity (Low-E) glass market is segmented into pyrolytic process and sputtered process. The sputtered process segment held the largest market revenue share in 2024, driven by its ability to produce highly efficient and multi-layered Low-E coatings with precise control over their optical and thermal properties. Sputtered coatings offer superior performance in terms of solar control and thermal insulation, leading to wider adoption in high-performance window systems.

The pyrolytic process segment is expected to witness the fastest growth rate, fuelled by its robustness, durability, and suitability for applications where the coating is exposed. Pyrolytic coatings are chemically bonded to the glass surface during manufacturing, making them highly resistant to scratches and corrosion, and ideal for demanding environments.

- By End-User

On the basis of end-user, the Asia-Pacific low-emissivity (Low-E) glass market is segmented into construction and transportation. The construction segment accounted for the largest market revenue share of 91.5% in 2024, driven by the rapid growth in residential and commercial building activities across the Asia-Pacific region, coupled with increasing awareness of energy conservation and green building initiatives. Low-E glass is widely used in windows, doors, and facades to improve energy efficiency in buildings.

The transportation segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing demand for energy-efficient vehicles and the increasing adoption of Low-E glass in automotive, railway, and marine applications to reduce heat gain and improve passenger comfort. The focus on lightweight materials and fuel efficiency also contributes to its increasing use in transportation.

Asia-Pacific Low Emissivity (Low-E) Glass Market Regional Analysis

- China Low-E glass market accounted for the largest market revenue share of 62.5% in Asia Pacific in 2024, attributed to the country's rapid economic development, massive building and construction industry, and substantial investments in green building projects

- China's push towards energy-efficient infrastructure and its position as a leading manufacturer of glass and solar photovoltaic systems are key factors propelling the market

- The availability of diverse and affordable low-e glass options from strong domestic manufacturers further contributes to its dominance

Japan Low Emissivity (Low-E) Glass Market Insight

The Japan low-e glass market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country's high-tech culture, stringent energy efficiency regulations, and a strong emphasis on sustainable building practices. The Japanese market prioritizes energy-efficient construction materials, with a growing demand for Low-E glass in smart buildings and for solar photovoltaic panels to meet ambitious carbon emission reduction targets. This is further supported by innovations in glass technology and an increasing need for enhanced thermal performance in both new constructions and existing structures.

Asia-Pacific Low Emissivity (Low-E) Glass Market Share

The Asia-Pacific Low Emissivity (Low-E) Glass industry is primarily led by well-established companies, including:

- Nippon Sheet Glass Co., Ltd., (Japan)

- AGC Inc., (Japan)

- Central Glass Co. Ltd., (Japan)

- Xinyi Glass Holdings Limited., (China)

- China Glass Holdings Limited (China)

- GUARDIAN INDUSTRIES (U.S.)

- Fuyao Glass Industry Group Co., Ltd., (China)

- Taiwan Glass Ind. Corp. (Taiwan)

- Beijing Northglass Technologies Co. Ltd., (China)

- Qingdao Tsing Glass Co. Limited (China)

- Guangzhou Topo Glass Co., Ltd., (China)

Latest Developments in Asia-Pacific Low Emissivity (Low-E) Glass Market

-

In February 2022, Pivotal Commware announced the commercial launch of Echo 5G, a cutting-edge product designed to enhance indoor 5G signal coverage. This development introduces a smart repeater solution that redirects and strengthens 5G millimeter wave signals, improving connectivity in areas with weak reception. Echo 5G enables mobile operators to expand their network coverage without extensive infrastructure changes. The product is expected to benefit both consumers and service providers by offering better speed and reliability indoors. This innovation supports the broader adoption of 5G technology and strengthens Pivotal Commware's position in the telecommunications market

- In June 2023, Vitro Architectural Glass introduced its Advanced Low-Emissivity (Low-E) Glass Sample Kit, featuring a selection of Solarban solar control, low-e glass products. This kit enables architects and designers to conveniently compare high-performance glass options that offer a solar heat gain coefficient (SHGC) of 0.25 or less, enhancing energy efficiency in building designs. By facilitating hands-on evaluation, the kit supports professionals in selecting glass solutions that meet stringent energy codes and aesthetic requirements. This initiative underscores Vitro's commitment to sustainability and innovation in the architectural glass market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Low E Glass Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Low E Glass Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Low E Glass Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.