Asia Pacific Mainframe Market

Market Size in USD Billion

CAGR :

%

USD

7.31 Billion

USD

9.83 Billion

2024

2032

USD

7.31 Billion

USD

9.83 Billion

2024

2032

| 2025 –2032 | |

| USD 7.31 Billion | |

| USD 9.83 Billion | |

|

|

|

|

Mainframe Market Size

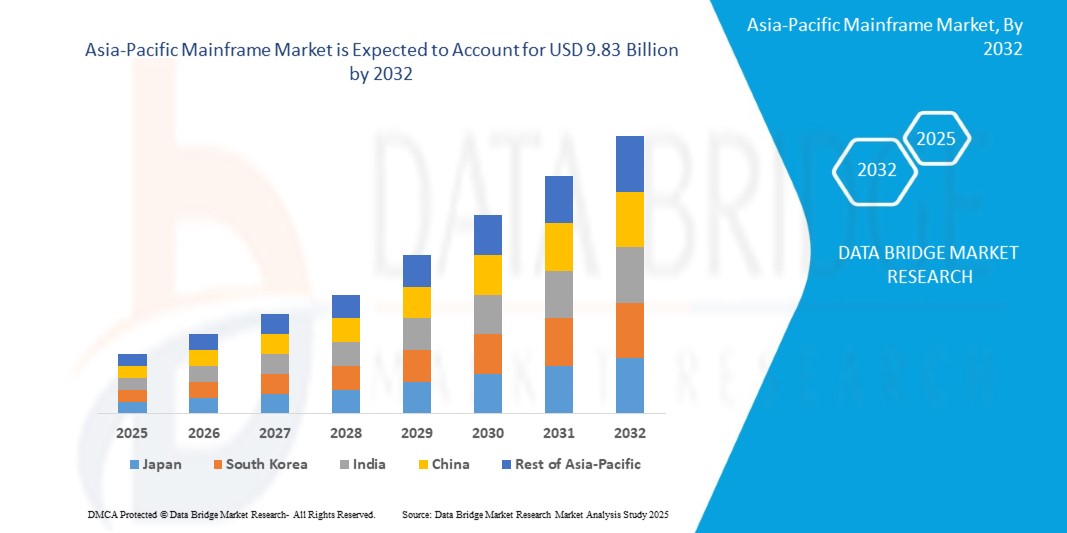

- The global mainframe market was valued at USD 7.31 billion in 2024 and is expected to reach USD 9.83 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 3.8%, primarily driven by the accelerated digitalization across industries, and rising cybersecurity threats and data breaches

- This growth is driven by factors such as rising data processing needs, cloud integration, cybersecurity demands, AI adoption, and increasing enterprise digital transformation

Asia-Pacific Mainframe Market Analysis

- Mainframes are critical computing systems used across various industries, providing high-performance processing, security, and reliability for complex operations. They are extensively utilized in Banking, Financial Services, and Insurance (BFSI), healthcare, and government sectors

- The demand for mainframes is significantly driven by the increasing trend of digitalization, growing cybersecurity threats, and the need for high-speed data processing. Industries such as BFSI rely on mainframes for transaction processing, core banking systems, risk management, and regulatory compliance

- The North America region stands out as one of the dominant markets for mainframes, driven by strong enterprise IT infrastructure, increasing investments in cybersecurity, and high adoption in financial institutions and government operations

- For instance, major U.S. banks and healthcare providers heavily depend on mainframes for real-time transaction processing and secure data storage, ensuring uninterrupted operations and regulatory compliance

- Asia-Pacificly, mainframes rank among the most essential computing systems, renowned for their superior security features, including encryption, access control, security monitoring, and high availability, making them the preferred choice for mission-critical applications in finance, healthcare, and government sectors

Report Scope and Market Segmentation

|

Attributes |

Asia-Pacific Mainframe Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Mainframe Market Trends

“Growing Demand For High-Performance Computing”

- The increasing demand for powerful computing systems is driven by the explosion of data in the digital age, necessitating HPC solutions capable of processing and analyzing massive and complex datasets.

- The rise of Artificial Intelligence (AI) and Machine Learning (ML) has significantly contributed to the growing need for HPC, as AI and ML algorithms require immense computational power to train and optimize models efficiently.

- For instance, In April 2023, TechDay published an article which stated, the government of the United Arab Emirates began pushing digital transformation objectives into practice. Numerous of these are referred to as Smart Dubai and Smart Abu Dhabi. These activities expected to increase the demand for high-performance computing

- Beyond scientific applications, HPC is revolutionizing business analytics, allowing companies to process vast amounts of data for optimizing supply chains, predicting customer behavior, and identifying market trends, leading to more informed decision-making and competitive advantages.

Asia-Pacific Mainframe Market Dynamics

Drivers

“Accelerated Digitalization Across Industries”

- The rising trend of digitalization in the Banking, Financial Services, and Insurance (BFSI) and healthcare industries is significantly driving the demand for mainframes, as organizations require secure and reliable computing infrastructure.

- Mainframes play a critical role in high-volume transaction processing applications, including ATM transactions, credit card processing, and stock trading, where scalability, reliability, and security are essential.

- In the banking sector, mainframes serve as the backbone of core banking systems, supporting key functions such as customer account management, loan processing, and payment processing, ensuring seamless financial operations.

- The healthcare industry increasingly relies on mainframes for handling electronic medical records (EMRs), providing the necessary processing power, security, and availability for managing vast volumes of sensitive patient data.

- As financial institutions and healthcare providers continue to adopt digital solutions, the need for high-performance computing systems like mainframes grows, ensuring secure, efficient, and uninterrupted operations.

For Instance,

- As per an IBM report, mainframe is used an automated teller machine (ATM) to interact with customer’s bank account. Corporations use mainframes for applications that depend on scalability and reliability. For example, a banking institution could use a mainframe to host the database of its customer accounts, for which transactions can be submitted from any of thousands of ATM locations worldwide. Report also mentioned that in banking, finance, health care, insurance, utilities, government, and a multitude of other public and private enterprises, the mainframe computer continues to be the foundation of modern business

- In December 2020, Maintec Technologies published an article which stated, it has been mentioned that the requirement to pass the patient records to and fro from the organization has sparked a demand for standardized patient electronic health records (EHR’s), which requires mainframe-style increased storage as well as Linux-style Web standards. It has also mentioned that there is high security and compliance associated with mainframe. Healthcare needs the most secure systems available to protect these data. Mainframes have a reputation as the most securable platform. Mainframe servers and software now have pervasive encryption of data. These security measures help the healthcare organization to protect their patient’s data and privacy

Opportunities

“Growing Focus On Mainframe Modernization”

- Hybrid cloud integration is transforming the mainframe market, allowing businesses to seamlessly connect on-premises systems with cloud environments while maintaining high performance, security, and scalability.

- Organizations are increasingly adopting hybrid cloud architectures to optimize workloads, manage vast data volumes, and support mission-critical applications, ensuring efficient and uninterrupted operations.

- Mainframes play a crucial role in real-time data processing and secure transactions, making them essential for industries such as banking, insurance, and retail, where data security and operational continuity are top priorities.

- Hybrid cloud solutions enable organizations to retain sensitive data on-premises while leveraging the cost-efficiency and flexibility of cloud computing, enhancing IT infrastructure modernization.

Restraints/Challenges

“Intense Competition From Cloud-Based Platforms”

- Despite the rise of cloud computing, mainframes remain an essential part of IT infrastructure, offering unique benefits that cloud solutions cannot fully replace.

- Cloud computing provides greater flexibility than mainframe technology, allowing organizations to scale resources up or down based on demand, improving efficiency and reducing costs.

- For specific workloads, cloud computing can be a more cost-effective option, as pay-as-you-go pricing models enable organizations to pay only for the resources they use.

- Cloud computing enhances accessibility, allowing organizations with a Asia-Pacific presence to access computing resources from anywhere in the world, facilitating remote operations.

- Cloud providers manage infrastructure maintenance, reducing the burden on organizations and freeing up time and resources for core business functions

For Instance,

- In September 2022, InfoWorld published an article which stated that the FedEx has announced that by 2024 it will shutter its data centers and the mainframes that go with them to go “all in” on cloud (likely Microsoft Azure, if past purchasing habits continue)

- In March 2022, Fujitsu published an article which stated Fujitsu announced that the company is going to stop making mainframe solutions in the next nine years. Fujitsu recently revealed that it will end sales of its mainframes by April 2031, discontinuing support five years after that. Company’s management said that Fujitsu remains very much interested in the mainframe market, with a new model still on its roadmap for 2024, and a move under way to “shift its mainframes and UNIX servers to the cloud, gradually enhancing its existing business systems to optimize the experience for its end-users. This development explained that organizations are losing faith in mainframe solutions

- In December 2021, Informa USA Inc., released a report regarding mainframe. In this report, it has been mentioned that AWS has announced a new managed service that enables businesses to migrate mainframe workloads to the cloud. Companies are managing to integrate mainframe to cloud

Mainframe Market Scope

The market is segmented on the basis of systems, component, organization size, and end-use.

|

Segmentation |

Sub-Segmentation |

|

By systems |

|

|

By Component |

|

|

By Organization Size |

|

|

By End-Use

|

|

Mainframe Market Regional Analysis

“China is the Dominant Region in the Mainframe Market”

- China leads the mainframe market, driven by a strong presence of key industry players, early adoption of advanced IT infrastructure, and significant investments in digital transformation

“China is Projected to Register the Highest Growth Rate”

- China is expected to witness significant growth in the mainframe market, driven by early adoption of advanced IT infrastructure, increasing investments in digital transformation, and strong demand for secure computing solutions

Mainframe Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- IBM Corporation (U.S.)

- Unisys (U.S.)

- Fujitsu (Japan)

- NEC Corporation (Japan)

- BMC Software, Inc. (U.S.)

- Hitachi Vantara LLC (U.S.)

- Dell Inc. (U.S.)

- Broadcom (U.S.)

- Atos SE (France)

- Cognizant (U.S.)

- DXC Technology Company (U.S.)

- HCL Technologies Limited (India)

- Tieotoevry (Finland)

- Infosys Limited (India)

- Hewlett Packard Enterprise Development LP (U.S.)

Latest Developments in Asia-Pacific Mainframe Market

- In September 2024, IBM launching its new IBM DS8000, is designed to enhance enterprise-class storage for IBM Z mainframe architectures. It offers high reliability, achieving up to 99.999999% availability and protecting critical data from cyber-attacks with built-in security features. The DS8000 supports next-gen workloads, improving performance by reducing latency and increasing throughput for high-volume transactions. It also enhances data center efficiency, doubling storage capacity with advanced FlashCore modules. This innovation ensures businesses can scale effectively while maintaining data resilience, providing agile and secure infrastructure for mission-critical workloads

- In August 2024, IBM announced the development of the Telum II Processor and Spyre Accelerator, designed to enhance AI capabilities on IBM Z mainframes. These innovations aim to accelerate AI workloads, particularly supporting large language models (LLMs) and generative AI. They will improve memory management, data handling, and compute power, enabling businesses to efficiently process complex tasks like fraud detection and financial risk management. The benefits include scalable, secure, and high-performance AI solutions that help businesses tackle data-intensive challenges, optimize decision-making, and foster innovation while maintaining the mainframe’s robust security

- In August 2023, IBM unveiled watsonx Code Assistant for Z, a generative AI tool aimed at accelerating mainframe application modernization. This development is designed to help organizations refactor and transform COBOL code into Java, boosting developer productivity. By leveraging a 20 billion parameter large language model, the tool automates and optimizes code translation, allowing businesses to modernize critical applications faster while maintaining performance, security, and resiliency. It also enhances developer skills and speeds onboarding, addressing the skills gap. The solution is expected to significantly reduce modernization time and improve code quality across enterprise systems

- In February 2025, Unisys has partnered with the Chicago Quantum Exchange (CQE) to advance quantum technology applications. This collaboration allows Unisys to engage with leading talent, participate in quantum innovation events, form strategic alliances for co-developing industry-specific quantum solutions, and share expertise within the CQE network.

- In January 2025, Unisys has expanded its Asia-Pacific network by adding Finnair Cargo to its Cargo Portal Services (CPS) platform. This collaboration enhances Finnair Cargo's digital presence, streamlines operations, and provides access to a broader customer base. CPS offers Asia-Pacific carriers a trusted multi-carrier air cargo booking portal, increasing operational efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTE PRODUCTS

4.2.5 INDUSTRY RIVALRY

4.2.6 CONCLUSION

4.3 COMPANY COMPARATIVE ANALYSIS

4.3.1 IBM CORPORATION

4.3.2 FUJITSU

4.3.3 NEC CORPORATION

4.3.4 UNISYS

4.3.5 BMC SOFTWARE, INC.

4.3.6 CONCLUSION

4.4 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.4.1 INDUSTRY OVERVIEW

4.4.2 MARKET TRENDS & DYNAMICS

4.4.3 FUTURISTIC SCENARIO

4.4.4 CONCLUSION

4.5 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

4.5.1 NORTH AMERICA AND SOUTH AMERICA

4.5.1.1 U.S.

4.5.1.2 CANADA

4.5.1.3 MEXICO, BRAZIL, AND ARGENTINA

4.5.2 EUROPE

4.5.2.1 U.K.

4.5.2.2 GERMANY

4.5.2.3 FRANCE & ITALY

4.5.3 ASIA-PACIFIC

4.5.3.1 CHINA

4.5.3.2 JAPAN

4.5.3.3 INDIA

4.5.3.4 SOUTH KOREA & AUSTRALIA

4.5.4 MIDDLE EAST & AFRICA

4.5.4.1 SAUDI ARABIA & U.A.E.

4.5.4.2 ISRAEL

4.5.4.3 SOUTH AFRICA & EGYPT

4.6 TECHNOLOGY ANAYSIS

4.6.1 MARKET GROWTH AND PROJECTIONS

4.6.1.1 KEY DRIVERS OF MAINFRAME MODERNIZATION

4.6.1.1.1 Cost Efficiency

4.6.1.1.2 Scalability and Performance

4.6.1.1.3 Security and Compliance

4.6.1.1.4 Integration with Emerging Technologies

4.6.1.1.5 Digital Transformation Initiatives

4.6.1.2 INDUSTRY TRENDS

4.6.1.2.1 Cloud Adoption

4.6.1.2.2 Hybrid Environments

4.6.1.2.3 AI and ML Integration

4.6.2 KEY BUSINESS OUTCOMES AND INDUSTRY USE CASES

4.6.2.1 FINANCIAL SERVICES

4.6.2.2 HEALTHCARE

4.6.2.3 RETAIL

4.6.2.4 MANUFACTURING

4.6.2.5 GOVERNMENT

4.6.3 CHALLENGES AND CONSIDERATIONS

4.6.3.1 SKILLS SHORTAGE

4.6.3.2 INTEGRATION COMPLEXITY

4.6.3.3 DOWNTIME RISKS

4.6.3.4 SECURITY CONCERNS

4.6.4 CONCLUSION

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 ACCELERATED DIGITALIZATION ACROSS INDUSTRIES

6.1.2 RISING CYBERSECURITY THREATS AND DATA BREACHES

6.1.3 GROWING DEMAND FOR HIGH-PERFORMANCE COMPUTING

6.1.4 EXPANDING NEED FOR LARGE-SCALE TRANSACTION PROCESSING AND REAL-TIME ANALYTICS

6.2 RESTRAINS

6.2.1 INTENSE COMPETITION FROM CLOUD-BASED PLATFORMS

6.2.2 HIGH COSTS ASSOCIATED WITH MAINFRAME INSTALLATION

6.3 OPPORTUNITIES

6.3.1 GROWING FOCUS ON MAINFRAME MODERNIZATION

6.3.2 EXPANDING ADOPTION OF HYBRID CLOUD SOLUTIONS

6.3.3 RISING DEMAND FOR ADVANCED SECURITY SOLUTIONS

6.4 CHALLENGES

6.4.1 ENSURING SECURITY AND COMPLIANCE IN DYNAMIC, INTERCONNECTED HYBRID ECOSYSTEMS AMID EVOLVING ASIA-PACIFIC REGULATIONS

6.4.2 SHORTAGE OF SKILLED MAINFRAME PROFESSIONALS

7 ASIA-PACIFIC MAINFRAME MARKET, BY SYSTEMS

7.1 OVERVIEW

7.2 MAINFRAMES

7.3 MIDRANGE SYSTEMS

8 ASIA-PACIFIC MAINFRAME MARKET, BY COMPONENT

8.1 OVERVIEW

8.2 HARDWARE

8.3 SERVICES

8.4 SOFTWARE

9 ASIA-PACIFIC MAINFRAME MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

10 ASIA-PACIFIC MAINFRAME MARKET, BY END USE

10.1 OVERVIEW

10.2 FINANCIAL SERVICES

10.3 IT & TELECOMMUNICATIONS

10.4 HEALTHCARE

10.5 PUBLIC SECTOR

10.6 AUTOMOTIVE AND MANUFACTURING

10.7 RETAIL AND CONSUMER PACKAGED GOODS (CPG)

10.8 TRAVEL, MEDIA, AND ENTERTAINMENT

10.9 OTHERS

11 ASIA-PACIFIC MAINFRAME MARKET, BY REGION

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 JAPAN

11.1.3 INDIA

11.1.4 SOUTH KOREA

11.1.5 AUSTRALIA

11.1.6 SINGAPORE

11.1.7 MALAYSIA

11.1.8 THAILAND

11.1.9 INDONESIA

11.1.10 PHILIPPINES

11.1.11 REST OF ASIA-PACIFIC

12 ASIA-PACIFIC MAINFRAME MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 IBM CORPORATION

14.1.1 COMPANY PROFILES

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT/NEWS

14.2 UNISYS

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 BMC SOFTWARE, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 COGNIZANT

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT/NEWS

14.5 NEC CORPORATION

14.5.1 COMPANY SNAPSHOTS

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 ATOS SE

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT/NEWS

14.7 BROADCOM

14.7.1 COMPANY PROFILES

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT/NEWS

14.8 DELL INC

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 DXC TECHNOLOGY COMPANY

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT/NEWS

14.1 FUJITSU

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT/NEWS

14.11 HCL TECHNOLOGIES LIMITED

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT/NEWS

14.12 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT/NEWS

14.13 HITACHI VANTARA LLC

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT/NEWS

14.14 INFOSYS LIMITED

14.14.1 COMPANY SNAPSHOTS

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENT

14.15 TIEOTOEVRY

14.15.1 COMPANY SNAPSHOTS

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 COMPANY COMPARATIVE ANALYSIS

TABLE 2 REGULATORY COVERAGE

TABLE 3 IMPACT ON UNPLANNED DOWNTIME AND SECURITY

TABLE 4 ASIA-PACIFIC MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 5 ASIA-PACIFIC MAINFRAMES IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 6 ASIA-PACIFIC MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 7 ASIA-PACIFIC IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 8 ASIA-PACIFIC FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 9 ASIA-PACIFIC OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 10 ASIA-PACIFIC MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 11 ASIA-PACIFIC MIDRANGE IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 12 ASIA-PACIFIC IBM POWER SYSTEMS (AIX, AS/400) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 13 ASIA-PACIFIC HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 14 ASIA-PACIFIC ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 15 ASIA-PACIFIC MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 16 ASIA-PACIFIC HARDWARE IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 17 ASIA-PACIFIC HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 18 ASIA-PACIFIC SERVICES IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 19 ASIA-PACIFIC SERVICES IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 20 ASIA-PACIFIC SOFTWARE IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 21 ASIA-PACIFIC SOFTWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 22 ASIA-PACIFIC MAINFRAME MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD MILLION)

TABLE 23 ASIA-PACIFIC LARGE ENTERPRISES IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 24 ASIA-PACIFIC SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 25 ASIA-PACIFIC MAINFRAME MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 26 ASIA-PACIFIC FINANCIAL SERVICES IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 27 ASIA-PACIFIC FINANCIAL SERVICES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 28 ASIA-PACIFIC BANKING AND CAPITAL MARKETS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 29 ASIA-PACIFIC INSURANCE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 30 ASIA-PACIFIC PAYMENTS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 31 ASIA-PACIFIC FINANCIAL SERVICES IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 32 ASIA-PACIFIC IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 33 ASIA-PACIFIC IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 34 ASIA-PACIFIC HEALTHCARE IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 35 ASIA-PACIFIC HEALTHCARE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 36 ASIA-PACIFIC PUBLIC SECTOR IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 37 ASIA-PACIFIC PUBLIC SECTOR IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 38 ASIA-PACIFIC AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 39 ASIA-PACIFIC AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 40 ASIA-PACIFIC RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 41 ASIA-PACIFIC RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 42 ASIA-PACIFIC TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 43 ASIA-PACIFIC TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 44 ASIA-PACIFIC OTHERS IN MAINFRAME MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 45 ASIA-PACIFIC OTHERS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 46 ASIA-PACIFIC MAINFRAME MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 47 ASIA-PACIFIC MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 48 ASIA-PACIFIC MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 49 ASIA-PACIFIC IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 50 ASIA-PACIFIC FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 51 ASIA-PACIFIC OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 52 ASIA-PACIFIC MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 53 ASIA-PACIFIC IBM POWER SYSTEMS (AIX, AS/400) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 54 ASIA-PACIFIC HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 55 ASIA-PACIFIC ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 56 ASIA-PACIFIC MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 57 ASIA-PACIFIC HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 58 ASIA-PACIFIC SERVICES IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 59 ASIA-PACIFIC SOFTWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 60 ASIA-PACIFIC MAINFRAME MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD MILLION)

TABLE 61 ASIA-PACIFIC MAINFRAME MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 62 ASIA-PACIFIC FINANCIAL SERVICES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 63 ASIA-PACIFIC BANKING AND CAPITAL MARKETS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 64 ASIA-PACIFIC INSURANCE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 65 ASIA-PACIFIC PAYMENTS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 66 ASIA-PACIFIC FINANCIAL SERVICES IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 67 ASIA-PACIFIC IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 68 ASIA-PACIFIC HEALTHCARE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 69 ASIA-PACIFIC PUBLIC SECTOR IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 70 ASIA-PACIFIC AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 71 ASIA-PACIFIC RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 72 ASIA-PACIFIC TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 73 ASIA-PACIFIC OTHERS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 74 CHINA MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 75 CHINA MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 76 CHINA IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 77 CHINA FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 78 CHINA OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 79 CHINA MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 80 CHINA IBM POWER SYSTEMS (AIX, AS/400) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 81 CHINA HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 82 CHINA ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 83 CHINA MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 84 CHINA HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 85 CHINA SERVICES IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 86 CHINA SOFTWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 87 CHINA MAINFRAME MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD MILLION)

TABLE 88 CHINA MAINFRAME MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 89 CHINA FINANCIAL SERVICES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 90 CHINA BANKING AND CAPITAL MARKETS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 91 CHINA INSURANCE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 92 CHINA PAYMENTS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 93 CHINA FINANCIAL SERVICES IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 94 CHINA IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 95 CHINA HEALTHCARE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 96 CHINA PUBLIC SECTOR IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 97 CHINA AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 98 CHINA RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 99 CHINA TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 100 CHINA OTHERS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 101 JAPAN MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 102 JAPAN MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 103 JAPAN IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 104 JAPAN FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 105 JAPAN OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 106 JAPAN MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 107 JAPAN IBM POWER SYSTEMS (AIX, AS/400) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 108 JAPAN HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 109 JAPAN ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 110 JAPAN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 111 JAPAN HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 112 JAPAN SERVICES IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 113 JAPAN SOFTWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 114 JAPAN MAINFRAME MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD MILLION)

TABLE 115 JAPAN MAINFRAME MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 116 JAPAN FINANCIAL SERVICES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 117 JAPAN BANKING AND CAPITAL MARKETS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 118 JAPAN INSURANCE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 119 JAPAN PAYMENTS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 120 JAPAN FINANCIAL SERVICES IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 121 JAPAN IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 122 JAPAN HEALTHCARE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 123 JAPAN PUBLIC SECTOR IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 124 JAPAN AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 125 JAPAN RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 126 JAPAN TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 127 JAPAN OTHERS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 128 INDIA MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 129 INDIA MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 130 INDIA IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 131 INDIA FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 132 INDIA OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 133 INDIA MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 134 INDIA IBM POWER SYSTEMS (AIX, AS/400) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 135 INDIA HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 136 INDIA ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 137 INDIA MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 138 INDIA HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 139 INDIA SERVICES IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 140 INDIA SOFTWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 141 INDIA MAINFRAME MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD MILLION)

TABLE 142 INDIA MAINFRAME MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 143 INDIA FINANCIAL SERVICES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 144 INDIA BANKING AND CAPITAL MARKETS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 145 INDIA INSURANCE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 146 INDIA PAYMENTS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 147 INDIA FINANCIAL SERVICES IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 148 INDIA IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 149 INDIA HEALTHCARE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 150 INDIA PUBLIC SECTOR IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 151 INDIA AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 152 INDIA RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 153 INDIA TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 154 INDIA OTHERS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 155 SOUTH KOREA MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 156 SOUTH KOREA MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 157 SOUTH KOREA IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 158 SOUTH KOREA FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 159 SOUTH KOREA OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 160 SOUTH KOREA MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 161 SOUTH KOREA IBM POWER SYSTEMS (AIX, AS/400) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 162 SOUTH KOREA HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 163 SOUTH KOREA ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 164 SOUTH KOREA MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 165 SOUTH KOREA HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 166 SOUTH KOREA SERVICES IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 167 SOUTH KOREA SOFTWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 168 SOUTH KOREA MAINFRAME MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD MILLION)

TABLE 169 SOUTH KOREA MAINFRAME MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 170 SOUTH KOREA FINANCIAL SERVICES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 171 SOUTH KOREA BANKING AND CAPITAL MARKETS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 172 SOUTH KOREA INSURANCE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 173 SOUTH KOREA PAYMENTS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 174 SOUTH KOREA FINANCIAL SERVICES IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 175 SOUTH KOREA IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 176 SOUTH KOREA HEALTHCARE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 177 SOUTH KOREA PUBLIC SECTOR IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 178 SOUTH KOREA AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 179 SOUTH KOREA RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 180 SOUTH KOREA TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 181 SOUTH KOREA OTHERS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 182 AUSTRALIA MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 183 AUSTRALIA MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 184 AUSTRALIA IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 185 AUSTRALIA FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 186 AUSTRALIA OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 187 AUSTRALIA MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 188 AUSTRALIA IBM POWER SYSTEMS (AIX, AS/400) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 189 AUSTRALIA HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 190 AUSTRALIA ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 191 AUSTRALIA MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 192 AUSTRALIA HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 193 SINGAPORE MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 194 SINGAPORE MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 195 SINGAPORE IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 196 SINGAPORE FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 197 SINGAPORE OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 198 SINGAPORE MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 199 SINGAPORE HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 200 SINGAPORE ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 201 SINGAPORE MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 202 SINGAPORE HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 203 SINGAPORE SERVICES IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 204 SINGAPORE SOFTWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 205 SINGAPORE MAINFRAME MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD MILLION)

TABLE 206 SINGAPORE MAINFRAME MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 207 SINGAPORE FINANCIAL SERVICES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 208 SINGAPORE BANKING AND CAPITAL MARKETS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 209 SINGAPORE INSURANCE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 210 SINGAPORE PAYMENTS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 211 SINGAPORE FINANCIAL SERVICES IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 212 SINGAPORE IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 213 SINGAPORE HEALTHCARE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 214 SINGAPORE PUBLIC SECTOR IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 215 SINGAPORE AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 216 SINGAPORE RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 217 SINGAPORE TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 218 SINGAPORE OTHERS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 219 MALAYSIA MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 220 MALAYSIA MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 221 MALAYSIA IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 222 MALAYSIA FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 223 MALAYSIA OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 224 MALAYSIA MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 225 MALAYSIA IBM POWER SYSTEMS (AIX, AS/400) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 226 MALAYSIA HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 227 MALAYSIA ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 228 MALAYSIA MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 229 MALAYSIA HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 230 MALAYSIA SERVICES IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 231 MALAYSIA SOFTWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 232 MALAYSIA MAINFRAME MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD MILLION)

TABLE 233 MALAYSIA MAINFRAME MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 234 MALAYSIA FINANCIAL SERVICES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 235 MALAYSIA BANKING AND CAPITAL MARKETS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 236 MALAYSIA INSURANCE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 237 MALAYSIA PAYMENTS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 238 MALAYSIA FINANCIAL SERVICES IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 239 MALAYSIA IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 240 MALAYSIA HEALTHCARE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 241 MALAYSIA PUBLIC SECTOR IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 242 MALAYSIA AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 243 MALAYSIA RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 244 MALAYSIA TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 245 MALAYSIA OTHERS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 246 THAILAND MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 247 THAILAND MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 248 THAILAND IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 249 THAILAND FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 250 THAILAND OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 251 THAILAND MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 252 THAILAND IBM POWER SYSTEMS (AIX, AS/400) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 253 THAILAND HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 254 THAILAND ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 255 THAILAND MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 256 THAILAND HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 257 THAILAND SERVICES IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 258 THAILAND SOFTWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 259 THAILAND MAINFRAME MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD MILLION)

TABLE 260 THAILAND MAINFRAME MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 261 THAILAND FINANCIAL SERVICES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 262 THAILAND BANKING AND CAPITAL MARKETS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 263 THAILAND INSURANCE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 264 THAILAND PAYMENTS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 265 THAILAND FINANCIAL SERVICES IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 266 THAILAND IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 267 THAILAND HEALTHCARE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 268 THAILAND PUBLIC SECTOR IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 269 THAILAND AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 270 THAILAND RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 271 THAILAND OTHERS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 272 INDONESIA MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 273 INDONESIA MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 274 INDONESIA IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 275 INDONESIA FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 276 INDONESIA OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 277 INDONESIA MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 278 INDONESIA IBM POWER SYSTEMS (AIX, AS/400) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 279 INDONESIA HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 280 INDONESIA ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 281 INDONESIA MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 282 INDONESIA HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 283 INDONESIA SERVICES IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 284 INDONESIA SOFTWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 285 INDONESIA MAINFRAME MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD MILLION)

TABLE 286 INDONESIA MAINFRAME MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 287 INDONESIA FINANCIAL SERVICES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 288 INDONESIA BANKING AND CAPITAL MARKETS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 289 INDONESIA INSURANCE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 290 INDONESIA PAYMENTS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 291 INDONESIA FINANCIAL SERVICES IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 292 INDONESIA IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 293 INDONESIA HEALTHCARE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 294 INDONESIA PUBLIC SECTOR IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 295 INDONESIA AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 296 INDONESIA RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 297 INDONESIA TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 298 INDONESIA OTHERS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 299 PHILIPPINES MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

TABLE 300 PHILIPPINES MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 301 PHILIPPINES IBM Z SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 302 PHILIPPINES FUJITSU GS SERIES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 303 PHILIPPINES OTHER MAINFRAMES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 304 PHILIPPINES MIDRANGE SYSTEMS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 305 PHILIPPINES IBM POWER SYSTEMS (AIX, AS/400) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 306 PHILIPPINES HPE SERVERS IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 307 PHILIPPINES ORACLE SUN SERVERS (SOLARIS) IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 308 PHILIPPINES MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 309 PHILIPPINES HARDWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 310 PHILIPPINES SERVICES IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 311 PHILIPPINES SOFTWARE IN MAINFRAME MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 312 PHILIPPINES MAINFRAME MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD MILLION)

TABLE 313 PHILIPPINES MAINFRAME MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 314 PHILIPPINES FINANCIAL SERVICES IN MAINFRAME MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 315 PHILIPPINES BANKING AND CAPITAL MARKETS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 316 PHILIPPINES INSURANCE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 317 PHILIPPINES PAYMENTS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 318 PHILIPPINES FINANCIAL SERVICES IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 319 PHILIPPINES IT & TELECOMMUNICATIONS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 320 PHILIPPINES HEALTHCARE IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 321 PHILIPPINES PUBLIC SECTOR IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 322 PHILIPPINES AUTOMOTIVE AND MANUFACTURING IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 323 PHILIPPINES RETAIL AND CONSUMER PACKAGED GOODS (CPG) IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 324 PHILIPPINES TRAVEL, MEDIA, AND ENTERTAINMENT IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 325 PHILIPPINES OTHERS IN MAINFRAME MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 326 REST OF ASIA-PACIFIC MAINFRAME MARKET, BY SYSTEMS, 2018-2032 (USD MILLION)

List of Figure

FIGURE 1 ASIA-PACIFIC MAINFRAME MARKET

FIGURE 2 ASIA-PACIFIC MAINFRAME MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC MAINFRAME MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC MAINFRAME MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC MAINFRAME MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC MAINFRAME MARKET: MULTIVARIATE MODELL INC.ING

FIGURE 7 ASIA-PACIFIC MAINFRAME MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC MAINFRAME MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC MAINFRAME MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MARKET APPLICATION COVERAGE GRID

FIGURE 11 ASIA-PACIFIC MAINFRAME MARKET: SEGMENTATION

FIGURE 12 ASIA-PACIFIC MAINFRAME MARKET: EXECUTIVE SUMMARY

FIGURE 13 TWO SEGMENTS COMPRISE THE ASIA-PACIFIC MAINFRAME MARKET, BY SYSTEMS (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 ACCELERATED DIGITALIZATION ACROSS INDUSTRIES IS EXPECTED TO DRIVE THE ASIA-PACIFIC MAINFRAME MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 16 THE MAINFRAMES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE ASIA-PACIFIC MAINFRAME MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA-PACIFIC MAINFRAME MARKET

FIGURE 20 BENEFITS OF MAINFRAME MODERNIZATION

FIGURE 21 ADOPTION OF DIFFERENT MODERNIZATION PATH

FIGURE 22 ADOPTION OF DIFFERENT CLOUDS IN VARIOUS INDUSTRIES

FIGURE 23 ASIA-PACIFIC MAINFRAME MARKET: BY SYSTEMS, 2024

FIGURE 24 ASIA-PACIFIC MAINFRAME MARKET, BY COMPONENT, 2024

FIGURE 25 ASIA-PACIFIC MAINFRAME MARKET: BY ORGANIZATION SIZE, 2024

FIGURE 26 ASIA-PACIFIC MAINFRAME MARKET, BY END USE, 2024

FIGURE 27 ASIA-PACIFIC MAINFRAME MARKET: SNAPSHOT (2024)

FIGURE 28 ASIA-PACIFIC MAINFRAME MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.