Asia Pacific Major Domestic Cooking Appliances Market

Market Size in USD Billion

CAGR :

%

USD

30.35 Billion

USD

55.76 Billion

2025

2033

USD

30.35 Billion

USD

55.76 Billion

2025

2033

| 2026 –2033 | |

| USD 30.35 Billion | |

| USD 55.76 Billion | |

|

|

|

|

Asia-Pacific Major Domestic Cooking Appliances Market Size

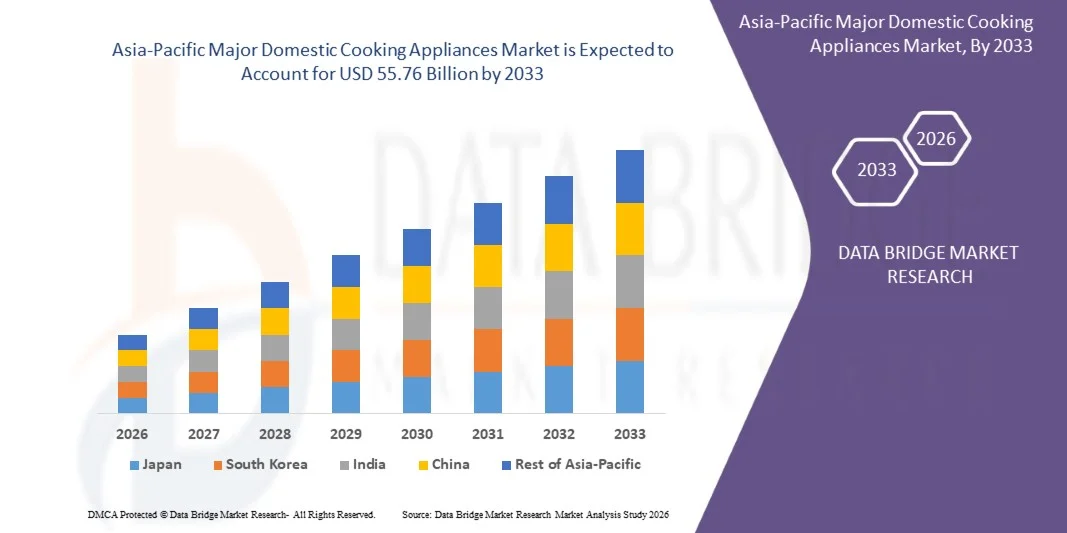

- The Asia-Pacific Asia-Pacific Major Domestic Cooking Appliances Market size was valued at USD 30.35 billion in 2025 and is expected to reach USD 55.76 billion by 2033, at a CAGR of 7.9% during the forecast period

- The market growth is largely driven by rising urbanization and evolving consumer lifestyles, which are increasing demand for efficient, time-saving, and technologically advanced cooking solutions across residential households. Continuous product innovation focused on energy efficiency, safety features, and modern aesthetics is further supporting higher adoption of domestic cooking appliances

- Furthermore, growing consumer emphasis on convenience, hygiene, and improved cooking performance is encouraging the replacement of traditional cooking equipment with advanced appliances. These converging factors are accelerating the penetration of modern domestic cooking appliances, thereby significantly strengthening overall market growth

Asia-Pacific Major Domestic Cooking Appliances Market Analysis

- Major domestic cooking appliances, designed to support daily food preparation and cooking activities, play a central role in modern households due to their ability to enhance cooking efficiency, ensure consistent performance, and align with contemporary kitchen designs

- The increasing demand for major domestic cooking appliances is primarily fueled by rising disposable incomes, expanding residential construction, and growing preference for energy-efficient and smart-enabled cooking solutions that offer greater convenience and long-term cost savings

- China dominated Asia-Pacific Major Domestic Cooking Appliances Market in 2025, due to its strong manufacturing ecosystem, large urban population, and rising demand for modern kitchen solutions

- India is expected to be the fastest growing region in the Asia-Pacific Major Domestic Cooking Appliances Market during the forecast period due to rapid urbanization, rising disposable incomes, and growing adoption of modern kitchen appliances

- Cooktops segment dominated the market with a market share of 39.1% in 2025, due to their widespread adoption across both urban and semi-urban households for daily cooking needs. Consumers prefer cooktops due to their versatility, space efficiency, and availability across electric and gas variants, making them suitable for diverse kitchen layouts

Report Scope and Asia-Pacific Major Domestic Cooking Appliances Market Segmentation

|

Attributes |

Major Domestic Cooking Appliances Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Major Domestic Cooking Appliances Market Trends

“Rising Adoption of Smart and Energy-Efficient Cooking Appliances”

- A key trend in the Asia-Pacific Major Domestic Cooking Appliances Market is the growing adoption of smart and energy-efficient products, driven by increasing consumer interest in convenience, connectivity, and reduced household energy consumption. Smart cooking appliances are becoming integral to modern kitchens as they offer automated controls, remote monitoring, and optimized cooking performance aligned with evolving lifestyle needs

- For instance, Whirlpool has introduced smart ovens and cooktops equipped with IoT-enabled features that allow users to control temperature settings and cooking modes through mobile applications. These appliances enhance user convenience while improving energy efficiency and precise cooking outcomes

- Manufacturers are increasingly integrating advanced sensors and digital interfaces into ovens, cooktops, and ranges to ensure consistent heating and optimized power usage. This is supporting the shift toward appliances that balance performance with sustainability objectives

- Energy efficiency regulations across major economies are encouraging brands to innovate and launch products with lower energy ratings and improved insulation technologies. This trend is reinforcing demand for appliances that help households manage energy costs more effectively

- The adoption of induction-based cooking appliances is expanding as consumers seek faster heating, enhanced safety, and reduced energy loss during cooking. This shift is strengthening the market presence of technologically advanced cooking solutions

- Overall, the increasing focus on smart functionality and energy efficiency is reshaping product development strategies and positioning advanced cooking appliances as essential components of modern, connected households

Asia-Pacific Major Domestic Cooking Appliances Market Dynamics

Driver

“Growing Urbanization and Changing Consumer Lifestyles”

- Rapid urbanization and evolving consumer lifestyles are major drivers of growth in the Asia-Pacific Major Domestic Cooking Appliances Market, as urban households prioritize convenience, space efficiency, and modern kitchen solutions. Busy work schedules and changing food consumption habits are increasing demand for appliances that simplify cooking processes

- For instance, Samsung offers multifunctional built-in ovens and compact cooking appliances designed for urban homes with limited kitchen space. These products cater to consumers seeking efficient and time-saving cooking solutions without compromising performance

- The rise in nuclear families and dual-income households is boosting demand for appliances that support faster meal preparation and automated cooking functions. This is encouraging manufacturers to focus on user-friendly designs and advanced features

- Urban consumers are also showing greater willingness to invest in premium cooking appliances that align with modern kitchen aesthetics and lifestyle aspirations. This preference is supporting higher adoption of technologically advanced products

- The growing influence of modular kitchens in urban residential developments is further accelerating demand for integrated and built-in cooking appliances. This driver continues to strengthen market growth by aligning appliance offerings with contemporary living patterns

Restraint/Challenge

“High Initial Cost of Advanced Cooking Appliances”

- The Asia-Pacific Major Domestic Cooking Appliances Market faces challenges due to the high initial cost associated with advanced and smart cooking appliances, which can limit adoption among price-sensitive consumers. Technologies such as smart connectivity, induction systems, and advanced control panels significantly increase product prices

- For instance, Bosch offers premium smart ovens and induction cooktops that incorporate advanced sensors and connectivity features, resulting in higher upfront costs compared to conventional appliances. These pricing levels can restrict demand in emerging and cost-conscious markets

- The inclusion of sophisticated electronic components and energy-efficient technologies increases manufacturing complexity and overall production costs. These factors are often reflected in higher retail prices for end users

- Consumers in developing regions may delay replacement or upgrades of traditional cooking appliances due to budget constraints, slowing market penetration of advanced models. This creates a gap between technological availability and actual adoption

- The challenge of balancing innovation with affordability remains a key concern for manufacturers as they aim to expand their customer base. High initial investment requirements continue to act as a restraint, influencing purchasing decisions and moderating market growth momentum

Asia-Pacific Major Domestic Cooking Appliances Market Scope

The market is segmented on the basis of type, power, structure, and distribution channel.

• By Type

On the basis of type, the domestic cooking appliances market is segmented into built-in hobs, cooker, microwaves, cooktops, hot plate, and others. The cooktops segment dominated the market with the largest revenue share of 39.1% in 2025, driven by their widespread adoption across both urban and semi-urban households for daily cooking needs. Consumers prefer cooktops due to their versatility, space efficiency, and availability across electric and gas variants, making them suitable for diverse kitchen layouts. Continuous product upgrades focusing on safety features, temperature control, and modern aesthetics further support strong demand. The compatibility of cooktops with modular kitchens and their affordability compared to full cooking ranges also reinforces their dominant position.

The microwaves segment is anticipated to witness the fastest growth rate from 2026 to 2033, supported by changing lifestyles and increasing preference for quick and convenient cooking solutions. Rising adoption of ready-to-eat and frozen foods is encouraging households to invest in advanced microwave ovens with grilling and convection features. Growing urbanization and higher working population levels further accelerate demand. Manufacturers are also introducing energy-efficient and compact microwave models, enhancing their appeal among younger consumers and smaller households.

• By Power

On the basis of power, the domestic cooking appliances market is segmented into electric powered and gas powered. The gas powered segment dominated the market in 2025, owing to its strong penetration in developing regions and consumer familiarity with gas-based cooking. Gas-powered appliances are widely preferred for their instant heat control, lower operating costs, and reliability in areas with inconsistent electricity supply. Their extensive availability and compatibility with traditional cooking practices continue to drive sustained adoption.

The electric powered segment is expected to grow at the fastest pace during the forecast period, driven by increasing electrification, rising energy efficiency standards, and growing awareness of clean cooking solutions. Electric appliances offer advanced features such as precise temperature control, safety automation, and seamless integration with smart kitchens. Government initiatives promoting electric appliances and the expansion of renewable energy infrastructure further support market growth.

• By Structure

On the basis of structure, the domestic cooking appliances market is segmented into built-in and freestanding. The freestanding segment accounted for the largest market share in 2025, as these appliances are easy to install, cost-effective, and suitable for a wide range of housing types. Consumers favor freestanding appliances for their flexibility, portability, and minimal renovation requirements. Their strong presence in both rural and urban households continues to sustain high demand.

The built-in segment is projected to register the fastest growth from 2026 to 2033, supported by the rising popularity of modular kitchens and premium home interiors. Built-in appliances enhance kitchen aesthetics and optimize space utilization, making them attractive to urban consumers and high-income households. Increasing residential construction and growing preference for customized kitchen solutions further contribute to rapid segment expansion.

• By Distribution Channel

On the basis of distribution channel, the domestic cooking appliances market is segmented into supermarket, specialty store, e-commerce, and others. The specialty store segment dominated the market in 2025, driven by the availability of a wide product range, expert assistance, and hands-on product demonstrations. Consumers often rely on specialty stores for high-value appliances, as they offer installation support, warranties, and after-sales services. Brand-exclusive outlets also strengthen consumer trust and purchase confidence.

The e-commerce segment is expected to witness the fastest growth rate over the forecast period, fueled by increasing internet penetration and the convenience of online shopping. Competitive pricing, easy product comparison, and doorstep delivery are encouraging consumers to shift toward digital platforms. Attractive discounts, flexible payment options, and expanding logistics networks further accelerate the growth of online sales channels.

Asia-Pacific Major Domestic Cooking Appliances Market Regional Analysis

- China dominated the Asia-Pacific Major Domestic Cooking Appliances Market with the largest revenue share in 2025, driven by its strong manufacturing ecosystem, large urban population, and rising demand for modern kitchen solutions

- Rapid urbanization, growth of middle-income households, and increasing replacement of traditional cooking methods with smart and energy-efficient appliances continue to support China’s market leadership across the region

- The presence of major domestic manufacturers such as Midea and Haier, continuous product innovation, and widespread availability through both offline retail and large e-commerce platforms are strengthening China’s dominance during the forecast period

Japan Asia-Pacific Major Domestic Cooking Appliances Market Insight

The Japan market is expected to grow steadily from 2026 to 2033, supported by high household penetration of advanced cooking appliances and a strong preference for quality, reliability, and technological precision. Japanese consumers increasingly favor compact, multifunctional ovens, induction cooktops, and built-in appliances suited to smaller urban kitchens. Companies such as Panasonic and Toshiba continue to invest in energy-efficient and smart cooking solutions aligned with sustainability goals. High replacement demand, continuous innovation, and strong brand trust underpin Japan’s stable growth outlook. The market remains characterized by premiumization and a focus on long-term performance and safety standards.

India Asia-Pacific Major Domestic Cooking Appliances Market Insight

India is projected to register the fastest CAGR in the Asia-Pacific Asia-Pacific Major Domestic Cooking Appliances Market during 2026–2033, driven by rapid urbanization, rising disposable incomes, and growing adoption of modern kitchen appliances. Increasing participation of working professionals and nuclear families is accelerating demand for time-saving and energy-efficient cooking solutions. Brands such as LG and Samsung are expanding localized manufacturing and affordable product portfolios to cater to diverse consumer segments. The rapid expansion of e-commerce platforms and organized retail is improving product accessibility across urban and semi-urban regions. Government initiatives promoting energy-efficient appliances and rising consumer awareness are positioning India as the fastest-growing market in the region.

Asia-Pacific Major Domestic Cooking Appliances Market Share

The major domestic cooking appliances industry is primarily led by well-established companies, including:

- AB Electrolux (Sweden)

- Whirlpool Corporation (U.S.)

- Samsung Electronics (South Korea)

- LG Electronics (South Korea)

- Panasonic Corporation (Japan)

- Koninklijke Philips N.V. (Netherlands)

- Morphy Richards (U.K.)

- TTK Prestige Ltd (India)

- GE Appliances (U.S.)

- Dacor, Inc. (U.S.)

- Sichuan Changhong Electric Co., Ltd. (China)

- GREE ELECTRIC APPLIANCES, INC. (China)

- Hitachi, Ltd. (Japan)

- BSH Hausgeräte GmbH (Germany)

- Balaji Home Shop (India)

- Lords Home Solutions (India)

Latest Developments in Asia-Pacific Major Domestic Cooking Appliances Market

- In January 2025, LG Electronics expanded its premium kitchen appliance portfolio by launching energy-efficient and AI-enabled cooking appliances, strengthening its competitive positioning in the Asia-Pacific Major Domestic Cooking Appliances Market. This development enhances LG’s market reach by addressing rising consumer demand for smart, connected, and sustainable cooking solutions, while reinforcing brand differentiation through advanced technology integration

- In September 2024, Samsung Electronics introduced an upgraded range of smart cooking appliances with enhanced IoT connectivity and personalized cooking features, supporting deeper penetration into modern households. This initiative improves Samsung’s market competitiveness by aligning product innovation with evolving consumer preferences for convenience, automation, and seamless smart-home integration

- In March 2023, Butterfly Gandhimathi Appliances completed its merger with Crompton Greaves Consumer Electricals Ltd. to strengthen its footprint in the Asia-Pacific Major Domestic Cooking Appliances Market. This strategic move enables operational synergies, broader distribution capabilities, and accelerated product innovation, collectively enhancing market presence and long-term competitiveness

- In May 2021, Whirlpool Corporation announced a US$15 million investment to expand manufacturing operations at its Oklahoma facility, reinforcing its leadership position in the Asia-Pacific Major Domestic Cooking Appliances Market. The investment supports higher production capacity, innovation-driven manufacturing processes, and consistent product quality, strengthening Whirlpool’s ability to meet growing market demand

- In April 2021, Electrolux received four Red Dot Design Awards for its Electrolux and AEG brands, highlighting its focus on innovation and ergonomic excellence within the Asia-Pacific Major Domestic Cooking Appliances Market. This recognition enhances brand value and competitive advantage by reinforcing consumer trust in premium design, functionality, and product performance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.