Asia Pacific Meat Poultry And Seafood Processing Equipment Market

Market Size in USD Billion

CAGR :

%

USD

3.86 Billion

USD

7.41 Billion

2025

2033

USD

3.86 Billion

USD

7.41 Billion

2025

2033

| 2026 –2033 | |

| USD 3.86 Billion | |

| USD 7.41 Billion | |

|

|

|

|

Asia-Pacific Meat, Poultry and Seafood Processing Equipment Market Size

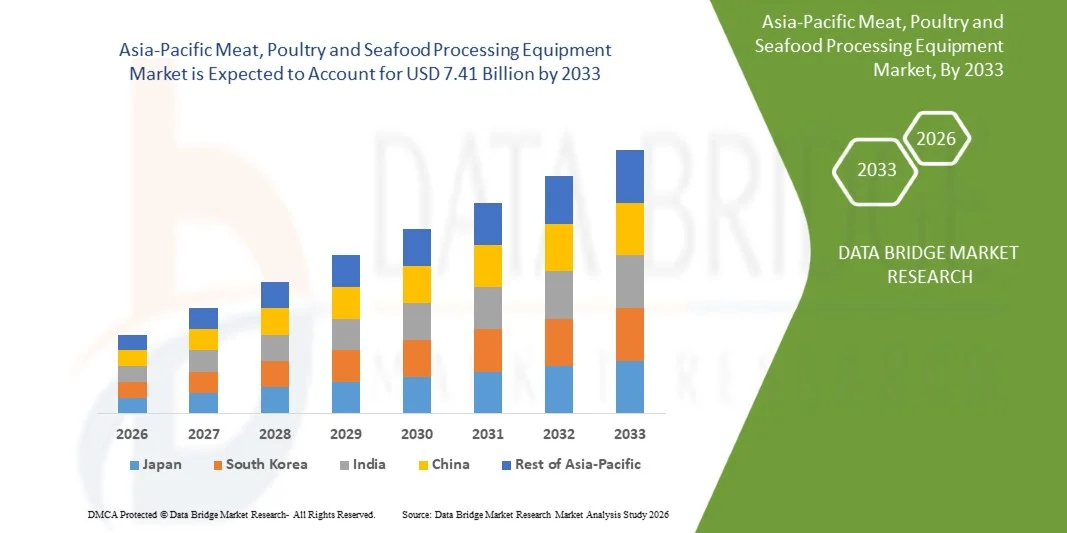

- The Asia-Pacific meat, poultry and seafood processing equipment market size was valued at USD 3.86 billion in 2025 and is expected to reach USD 7.41 billion by 2033, at a CAGR of 8.49% during the forecast period

- The market growth is largely fuelled by the increasing demand for processed and packaged meat, poultry, and seafood products driven by urbanization and changing dietary patterns

- Rising automation and adoption of advanced processing equipment to improve operational efficiency and reduce labor costs are accelerating market expansion

Asia-Pacific Meat, Poultry and Seafood Processing Equipment Market Analysis

- Technological innovations in processing equipment, including automated cutting, deboning, and packaging machines, are enhancing production efficiency and product quality

- Increasing consumer preference for convenience foods and ready-to-cook protein products is driving demand for advanced processing solutions

- The China market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to rapid urbanization, expanding middle-class consumption, and high rates of technological adoption

- Japan is expected to witness the highest compound annual growth rate (CAGR) in the Asia-Pacific meat, poultry and seafood processing equipment market due to increasing adoption of advanced automation and high-efficiency processing equipment, rising demand for convenient ready-to-cook and value-added protein products, and stringent food safety and hygiene standards

- The Portioning Equipment segment held the largest market revenue share in 2025, driven by its essential role in precise meat, poultry, and seafood portioning to maintain product consistency and reduce waste. Portioning equipment is widely adopted in large-scale processing plants to enhance operational efficiency and ensure uniform product quality across batches

Report Scope and Asia-Pacific Meat, Poultry and Seafood Processing Equipment Market Segmentation

|

Attributes |

Asia-Pacific Meat, Poultry and Seafood Processing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Meat, Poultry and Seafood Processing Equipment Market Trends

“Rise Of Automation And Advanced Processing Technologies”

- The growing adoption of automated cutting, deboning, and packaging systems is transforming meat, poultry, and seafood processing by improving efficiency and reducing labor dependency. These technologies allow plants to handle higher volumes with minimal errors, enhancing overall operational productivity. Large-scale processors benefit from consistent product quality, reduced waste, and faster turnaround times, meeting rising consumer demand for fresh and processed protein

- Increasing focus on food safety and hygiene standards is accelerating the integration of advanced processing equipment with sanitation and traceability features. Automated cleaning and monitoring systems reduce human contact, minimizing contamination risks. This not only ensures compliance with stringent regulations but also strengthens brand credibility and consumer confidence in product safety

- The demand for value-added and ready-to-cook protein products is driving processors to adopt multifunctional equipment that supports diverse processing steps on a single platform. Processors can perform cutting, marination, cooking, and packaging in one line, reducing manual handling and operational costs. This flexibility enables quicker product launches and adaptation to changing consumer preferences

- For instance, in 2025, several leading meat processing companies in China implemented robotic portioning and packaging lines, reducing manual labor by over 30% while improving product consistency and shelf-life. The automated systems also allowed for real-time monitoring of production metrics, leading to better inventory management and reduced food loss

- While automation and technology adoption are expanding rapidly, the market’s growth depends on continued innovation, cost-effective solutions, and training programs for operators to fully leverage advanced machinery. Companies must also consider integrating AI and IoT solutions to optimize maintenance schedules, improve production accuracy, and reduce downtime

Asia-Pacific Meat, Poultry and Seafood Processing Equipment Market Dynamics

Driver

“Increasing Demand For Processed And Packaged Protein Products”

- The rising consumption of processed meat, poultry, and seafood products is pushing manufacturers to invest in high-capacity, automated processing lines. Urbanization, busier lifestyles, and a preference for ready-to-eat meals are accelerating this trend. High-volume production capabilities help processors meet surging domestic and export demand while maintaining product quality

- Manufacturers are increasingly focused on improving operational efficiency and reducing production costs by deploying advanced equipment. Automation reduces labor-intensive processes, lowers error rates, and improves throughput. This allows businesses to scale operations efficiently while minimizing waste and energy consumption

- Regulatory requirements for food safety and traceability are compelling processors to upgrade their equipment, integrating features such as automated hygiene systems and digital monitoring. These initiatives ensure compliance with local and international standards, helping avoid penalties. Enhanced traceability also supports brand reputation and consumer trust in a competitive market

- For instance, in 2023, several poultry processing facilities in Southeast Asia upgraded to fully automated chilling and packaging lines, resulting in improved shelf-life and reduced microbial contamination. The new systems enabled better control over temperature and processing speed, reducing spoilage and ensuring product consistency across batches

- While demand and regulatory factors are driving market growth, companies must continue to innovate and optimize equipment designs to address cost constraints and operational complexities. Future growth will depend on the adoption of energy-efficient, flexible, and scalable processing solutions suitable for both large and medium-scale producers

Restraint/Challenge

“High Initial Investment And Maintenance Costs Of Advanced Equipment”

- The high capital expenditure associated with automated processing equipment makes it challenging for small and medium-sized enterprises to adopt modern solutions. Beyond purchase costs, installation, calibration, and training add to the financial burden. This often limits access to advanced technology, preventing smaller processors from fully competing in growing markets

- Operational and maintenance requirements for sophisticated equipment necessitate trained personnel and technical support, which are often lacking in rural or smaller processing units. Downtime due to equipment malfunction or improper operation can significantly impact production schedules and profitability. Companies must invest in continuous training programs to maximize equipment efficiency

- Supply chain constraints and limited availability of spare parts and service networks in some countries further hinder consistent equipment performance and reliability. Delays in procurement or servicing can result in production halts, increased costs, and missed delivery timelines. This challenge is particularly acute in remote areas with underdeveloped industrial infrastructure

- For instance, in 2023, several small poultry processors in Indonesia reported delays in equipment maintenance due to the unavailability of certified technicians, affecting production schedules and output. Some processors had to revert to manual methods temporarily, increasing labor costs and reducing operational efficiency

- While technological advancements continue to improve processing efficiency, addressing high costs, technical skill gaps, and maintenance challenges remains critical for wider market adoption. Industry stakeholders are exploring modular, scalable solutions and local support networks to make advanced equipment more accessible and sustainable for smaller players

Asia-Pacific Meat, Poultry and Seafood Processing Equipment Market Scope

The market is segmented on the basis of equipment type, process, mode of operation, application, function, and processed products type

• By Equipment Type

On the basis of equipment type, the market is segmented into Portioning Equipment, Frying Equipment, Filtering Equipment, Coating Equipment, Cooking Equipment, Smoking Equipment, Killing/Slaughtering Equipment, Refrigeration Equipment, High Pressure Processing (High Pressure Processor), Massaging Equipment, and Others. The Portioning Equipment segment held the largest market revenue share in 2025, driven by its essential role in precise meat, poultry, and seafood portioning to maintain product consistency and reduce waste. Portioning equipment is widely adopted in large-scale processing plants to enhance operational efficiency and ensure uniform product quality across batches.

The High Pressure Processing segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for minimally processed, safe, and shelf-stable protein products. High Pressure Processors are increasingly used to extend shelf-life while preserving nutritional value, taste, and texture, making them a preferred choice for value-added and ready-to-eat products.

• By Process

On the basis of process, the market is segmented into Size Reduction, Size Enlargement, Homogenization, Mixing, and Others. The Size Reduction segment dominated the market in 2025, as it is critical for meat, poultry, and seafood processing, including grinding, mincing, and tenderizing, which enhances product texture and prepares it for further processing or packaging.

The Mixing segment is expected to register the fastest growth during the forecast period, driven by demand for marinated, blended, and value-added protein products. Mixing equipment enables uniform distribution of ingredients, spices, and preservatives, ensuring consistent flavor and quality.

• By Mode of Operation

On the basis of mode of operation, the market is segmented into Automatic, Semi-Automatic, and Manual. The Automatic segment held the largest share in 2025, owing to its high throughput, labor efficiency, and precision in processing operations. Fully automated lines reduce human intervention, minimize errors, and enhance compliance with hygiene standards.

The Semi-Automatic segment is projected to grow rapidly from 2026 to 2033, particularly among small- and medium-sized processors. Semi-automatic systems offer a balance between cost efficiency and operational control, making them suitable for regional and niche production facilities.

• By Application

On the basis of application, the market is segmented into Fresh Processed, Raw Cooked, Precooked, Raw Fermented, Dried Meat, Cured, Frozen, and Others. The Fresh Processed segment dominated in 2025, driven by high consumer demand for minimally processed, ready-to-cook meat, poultry, and seafood. Fresh processing maintains natural flavor, texture, and nutritional quality, catering to households and foodservice operators.

The Precooked segment is expected to witness the fastest growth over the forecast period, fueled by the increasing popularity of convenient, ready-to-eat protein products. Precooked processing reduces preparation time for consumers while enabling mass production and longer shelf-life.

• By Function

On the basis of function, the market is segmented into Cutting, Blending, Tenderizing, Filling, Marinating, Slicing, Grinding, Smoking, Killing & De-Feathering, Deboning & Skinning, Evisceration, Gutting, Filleting, and Others. The Cutting segment held the largest share in 2025 due to its fundamental role in portioning and preparing raw protein products for further processing. Cutting equipment ensures uniformity, reduces waste, and improves operational workflow.

The Deboning & Skinning segment is expected to grow at the highest CAGR from 2026 to 2033, driven by demand for value-added meat and poultry products. Deboning and skinning equipment reduce manual labor, enhance product yield, and improve consistency, making them essential in modern processing lines.

• By Processed Products Type

On the basis of processed products type, the market is segmented into Meat, Poultry, and Seafood. The Meat segment accounted for the largest market share in 2025, driven by high consumption of beef, pork, and lamb products in both retail and foodservice sectors. Meat processing requires specialized equipment for portioning, grinding, cooking, and packaging to meet hygiene and safety standards.

The Seafood segment is expected to register the fastest growth during the forecast period, fueled by increasing consumer demand for processed and frozen seafood products. Advanced processing equipment such as filleting, gutting, and high-pressure processing systems are driving efficiency and ensuring consistent product quality.

Asia-Pacific Meat, Poultry and Seafood Processing Equipment Market Regional Analysis

- The China market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to rapid urbanization, expanding middle-class consumption, and high rates of technological adoption

- Manufacturers are increasingly investing in automated portioning, deboning, and high-pressure processing equipment to meet demand for fresh, precooked, and frozen products

- Government initiatives supporting food safety, modern processing infrastructure, and the growth of domestic machinery manufacturers are key factors propelling the market in China

Japan Meat, Poultry And Seafood Processing Equipment Market Insight

The Japan market is projected to witness the fastest growth rate from 2026 to 2033 due to high demand for convenience foods, advanced food processing technologies, and stringent hygiene standards. Processors are adopting multifunctional and automated equipment for portioning, cooking, and packaging. Japan’s aging population and preference for safe, ready-to-cook protein products are further driving investment in modern processing solutions across both residential and commercial sectors

Asia-Pacific Meat, Poultry and Seafood Processing Equipment Market Share

The Asia-Pacific meat, poultry and seafood processing equipment industry is primarily led by well-established companies, including:

- Pacific Food Machinery (Australia)

- CF Tech (India)

- Hanghui Food Machinery (China)

- Shijiazhuang Jiangchuan Machinery Co., Ltd. (China)

- Qingdao Empire Machinery Co., Ltd. (China)

- Expro Stainless Steel Mechanical & Engineering Co., Ltd. (China)

- Meatek Food Machineries India Pvt Ltd (India)

- Zaftech Machines & Equipment (India)

- ATS Food Equipment (India) Pvt. Ltd. (India)

- Jarvis Equipment Pvt. Ltd. (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Meat Poultry And Seafood Processing Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Meat Poultry And Seafood Processing Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Meat Poultry And Seafood Processing Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.