Asia Pacific Medical Devices Market

Market Size in USD Billion

CAGR :

%

USD

5.52 Billion

USD

9.01 Billion

2024

2032

USD

5.52 Billion

USD

9.01 Billion

2024

2032

| 2025 –2032 | |

| USD 5.52 Billion | |

| USD 9.01 Billion | |

|

|

|

|

Asia-Pacific Medical Devices Market Size

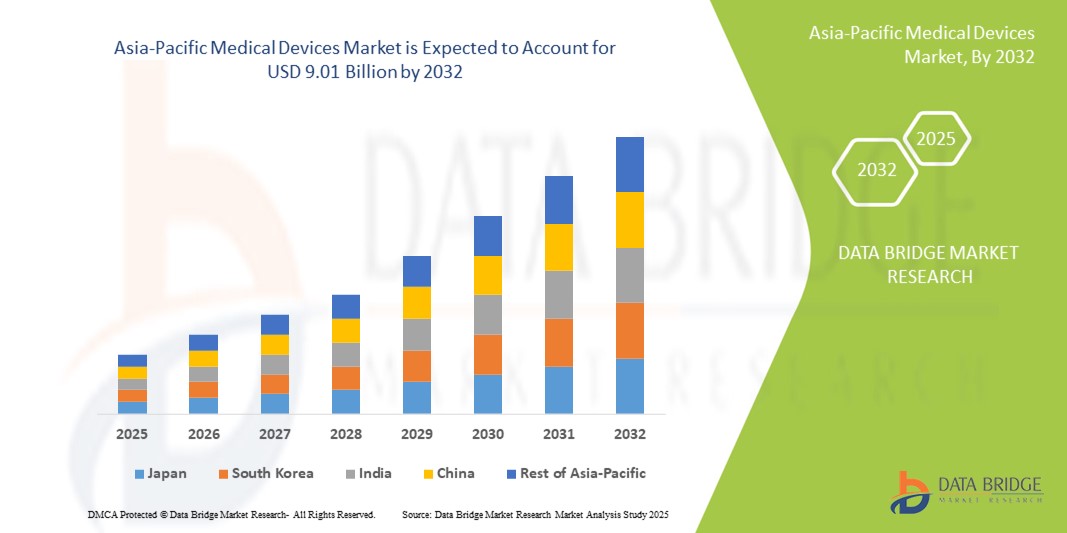

- The Asia-Pacific medical devices market size was valued at USD 5.52 billion in 2024 and is expected to reach USD 9.01 billion by 2032, at a CAGR of 6.30% during the forecast period

- The market growth is largely fueled by the rapid urbanization, expanding healthcare infrastructure, and technological advancements in medical diagnostics and therapeutic equipment across emerging economies in the Asia-Pacific region, leading to enhanced accessibility and modernization of healthcare delivery systems

- Furthermore, rising demand for affordable, portable, and minimally invasive medical devices, coupled with increasing government investments and favorable regulatory reforms, is establishing the Asia-Pacific region as a key growth hub in the global medical devices market. These converging factors are accelerating the adoption of innovative medical technologies, thereby significantly boosting the industry’s growth across countries such as China, India, Japan, and South Korea

Asia-Pacific Medical Devices Market Analysis

- Medical devices, including diagnostic, therapeutic, and monitoring equipment, are becoming increasingly essential in Asia-Pacific due to rising chronic disease prevalence, expanding healthcare access, and a growing focus on early and accurate diagnosis. Rapid technological advancements and increased healthcare expenditure across both public and private sectors are further accelerating the adoption of innovative medical devices in hospitals, clinics, and homecare settings

- The surging demand for medical devices in Asia-Pacific is primarily driven by the aging population, an increase in respiratory and cardiovascular conditions, and the widespread need for efficient home-based care solutions. The rising prevalence of conditions such as COPD, asthma, and sleep apnea is fueling demand for devices such as ventilators, CPAP/BIPAP, and oxygen concentrators

- China dominated the Asia-Pacific medical devices market with the largest market share of 39.6% in 2024, driven by a large patient base, fast-growing healthcare digitization, and strong domestic production of affordable yet advanced medical technologies. Government initiatives supporting rural healthcare modernization and chronic disease screening programs are also key contributors

- India is expected to be the fastest growing region in the Asia-Pacific medical devices market between 2025 and 2032. Factors such as increasing healthcare investments, expansion of private hospitals, government initiatives such as Make in India, and rising awareness of joint and trauma-related treatments are significantly propelling market growth

- The reconstructive joint replacements segment dominated the Asia-Pacific medical devices market with the largest revenue share of 32.8% in 2024, owing to the rising incidence of osteoarthritis and rheumatoid arthritis, along with a growing geriatric population requiring knee and hip replacements

Report Scope and Asia-Pacific Medical Devices Market Segmentation

|

Attributes |

Asia-Pacific Medical Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Medical Devices Market Trends

“Increasing Demand for Intelligent and Interconnected Healthcare Solutions”

- A significant and accelerating trend in the Asia-Pacific medical devices market is the deepening integration of advanced technologies such as artificial intelligence (AI) and Internet of Things (IoT) to enhance functionality, accuracy, and user experience across various devices. These innovations are streamlining healthcare delivery and enabling real-time data-driven decision-making in clinical and home settings

- For instance, AI-enabled ventilators and portable oxygen concentrators are being adopted to automatically adjust respiratory support based on patient vitals. Similarly, smart CPAP/BiPAP devices are providing real-time feedback and compliance tracking, empowering both patients and providers to optimize therapy outcomes

- The integration of medical devices with mobile applications and cloud-based platforms allows remote patient monitoring, early diagnostics, and preventive care, which is particularly beneficial in rural or underserved regions. This digital transformation is creating a more connected healthcare ecosystem across Asia-Pacific

- Technologies that enable centralized control and interoperability between medical devices and electronic health records (EHRs) are also improving workflow efficiency and reducing administrative burdens in hospitals and clinics

- The growing availability of user-friendly, intelligent healthcare equipment is reshaping expectations for both patients and providers. Consequently, companies in the region are developing smarter, more accessible medical devices with features such as automated alerts, remote adjustments, and health tracking dashboards

- The demand for integrated, data-driven medical solutions is growing rapidly across the Asia-Pacific region, driven by rising healthcare awareness, increasing chronic disease burden, and government support for digital health initiatives

Asia-Pacific Medical Devices Market Dynamics

Driver

“Growing Need Due to Rising Healthcare Demands and Technological Adoption”

- The increasing burden of chronic diseases, aging population, and the demand for improved healthcare infrastructure are key drivers accelerating the adoption of advanced medical devices across the Asia-Pacific region. Rapid urbanization and healthcare awareness are further pushing governments and private sectors to invest in modern diagnostic and therapeutic equipment

- For instance, in March 2024, Japan’s Ministry of Health approved funding for next-generation ventilators and portable diagnostic devices to enhance home-based care and pandemic preparedness. Such initiatives by public bodies and private players are expected to drive growth in the Asia-Pacific Medical Devices Market over the forecast period

- Patients and providers are becoming more aware of the benefits of early diagnosis and preventive care, driving the adoption of technologies such as portable oxygen concentrators, digital spirometers, and AI-integrated CPAP/BiPAP machines that offer superior patient outcomes

- Furthermore, the growing popularity of telehealth services and the trend toward decentralized care are making medical devices more crucial in homecare settings. Devices that integrate easily with mobile health platforms and electronic health records (EHRs) are becoming essential tools for remote patient monitoring

- The shift toward portable, user-friendly, and efficient healthcare equipment is encouraging adoption across both large hospitals and small clinics. With expanding health insurance coverage and government support for digital health, medical devices are becoming more accessible to the general population in countries such as India, China, and Southeast Asian nations

Restraint/Challenge

“Concerns Regarding Regulatory Complexity and High Initial Costs”

- The Asia-Pacific medical devices Market faces challenges related to varying regulatory frameworks across countries, which can hinder product approvals and market entry. Manufacturers must navigate different compliance requirements in markets such as China, India, and Japan, adding complexity and cost to their operations

- For instance, the implementation of China’s new Medical Device Regulations (MDR) in 2021 increased requirements for clinical evidence, which can delay product launches and add to development costs

- In addition, the high upfront cost of sophisticated medical equipment such as ventilators, anesthesia machines, and diagnostic imaging systems can be a barrier for smaller healthcare providers and facilities in developing regions. Budget limitations and lack of access to financing options limit widespread adoption in rural and underserved areas

- While prices are gradually decreasing and local manufacturing is rising, the perceived high cost of premium medical devices remains a concern, particularly for long-term care and small-scale facilities

- Overcoming these challenges will require harmonized regulatory processes, increased investment in local manufacturing, government subsidies, and awareness campaigns to improve affordability and trust in new medical technologies

Asia-Pacific Medical Devices Market Scope

The market is segmented on the basis of product, device type, biomaterial, procedures, and end user.

• By Product

On the basis of product, the Asia-Pacific medical devices market is segmented into reconstructive joint replacements, spinal implants, trauma and craniomaxillofacial, dental implants, and orthobiologics. The reconstructive joint replacements segment dominated the market with the largest revenue share of 32.8% in 2024, owing to the rising incidence of osteoarthritis and rheumatoid arthritis, along with a growing geriatric population requiring knee and hip replacements.

The dental implants segment is projected to witness the fastest CAGR of 24.1% from 2025 to 2032, driven by increasing dental tourism, rising awareness of oral health, and advancements in implant materials and techniques.

• By Device Type

On the basis of device type, the Asia-Pacific medical devices market is segmented into internal fixation devices and external fixation devices. The internal fixation devices segment accounted for the largest market share of 58.5% in 2024, due to the high preference for internal stabilization in fracture treatments and spinal fixation, which promotes better healing and reduced hospitalization time.

The external fixation devices segment is expected to grow at a steady CAGR, supported by increased application in trauma care and orthopedic emergency interventions.

• By Biomaterial

On the basis of biomaterial, the Asia-Pacific medical devices market is segmented into metallic biomaterials, polymeric biomaterials, ceramic biomaterials, natural biomaterials, and others. Metallic biomaterials held the largest share at 41.3% in 2024, attributed to their widespread use in load-bearing implants such as joint replacements and spinal fixation due to superior strength and durability.

Polymeric biomaterials are expected to record the fastest CAGR of 22.6%, owing to their rising adoption in tissue engineering, drug delivery, and bioresorbable devices.

• By Procedures

On the basis of procedures, the Asia-Pacific medical devices market is segmented into open surgery and minimally invasive surgery (MIS). Open surgery captured the largest share of 56.4% in 2024, largely due to its continued use in complex orthopedic reconstructions and trauma care.

Minimally invasive surgery (MIS) is anticipated to grow at the fastest CAGR of 27.8% from 2025 to 2032, fueled by benefits such as reduced recovery time, less postoperative pain, and improved surgical precision.

• By End User

On the basis of end users, the Asia-Pacific medical devices market is segmented into hospitals, ambulatory care centers, specialized clinics, orthopedic centers, and others. Hospitals led the market with the highest revenue share of 48.9% in 2024, due to their comprehensive service offerings, advanced infrastructure, and higher patient footfall for surgical interventions.

Orthopedic centers are expected to grow at the fastest CAGR, driven by the increasing establishment of dedicated orthopedic and rehabilitation facilities across developing countries in the region.

Asia-Pacific Medical Devices Market Regional Analysis

- Asia-Pacific dominated the global medical devices market with the largest revenue share of 34.80% in 2024, driven by increasing healthcare expenditures, rapid urbanization, and an expanding geriatric population that requires orthopedic and diagnostic interventions

- Regional governments are heavily investing in improving healthcare infrastructure, while rising medical tourism, particularly in countries such as India, Thailand, and Malaysia, further fuels demand for advanced medical technologies

- Growing awareness of minimally invasive procedures, increased accessibility to medical facilities, and favorable reimbursement policies are also major contributors to the region’s market growth

China Asia-Pacific Medical Devices Market Insight

The China medical devices market held the largest share with 39.6% in Asia-Pacific in 2024, attributed to the country's massive population base, rising elderly demographic, and increased demand for orthopedic procedures. Strategic efforts by domestic manufacturers and favorable government healthcare reforms have accelerated the availability and affordability of cutting-edge medical devices.

Japan Asia-Pacific Medical Devices Market Insight

The Japan medical devices market continues to grow due to its strong technological foundation, an aging population, and a robust preference for high-quality and precise healthcare solutions. Japan’s commitment to innovation and early adoption of advanced surgical techniques supports increased usage of minimally invasive and reconstructive devices.

India Asia-Pacific Medical Devices Market Insight

The India medical devices market is expected to witness the fastest CAGR between 2025 and 2032. Factors such as increasing healthcare investments, expansion of private hospitals, government initiatives such as Make in India, and rising awareness of joint and trauma-related treatments are significantly propelling market growth.

Asia-Pacific Medical Devices Market Share

The Asia-Pacific medical devices industry is primarily led by well-established companies, including:

- Zimmer Biomet (U.S.)

- Smith + Nephew (U.K.)

- Medtronic (Ireland)

- Stryker (U.S.)

- B. Braun SE (Germany)

- NuVasive, Inc. (U.S.)

- ENOVIS CORPORATION (U.S.)

- Institut Straumann AG (Switzerland)

- OSSTEM IMPLANT CO., LTD. (South Korea)

- Narang Medical Limited (U.S.)

- Globus Medical (U.S.)

- Arthrex, Inc. (U.S.)

- CONMED Corporation (U.S.)

- Integra LifeSciences Corporation (U.S.)

- RTI Surgical (U.S.)

- W. L. Gore & Associates, Inc. (U.S.)

- Corin Group (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

Latest Developments in Asia-Pacific Medical Devices Market

- In May 2024, Smith & Nephew plc opened a new R&D and manufacturing center in Malaysia to support the growing demand for orthopedic and wound care products in the Asia-Pacific region. This facility enhances the company’s regional capabilities, underlining its commitment to expanding access to advanced medical devices across Southeast Asia and boosting local production efficiency

- In April 2024, Stryker launched its Mako SmartRobotics system in several hospitals across Japan and Australia, enabling precise and minimally invasive joint replacement surgeries. This move reinforces Stryker’s presence in the region and showcases the growing adoption of robotic-assisted surgical technologies in APAC healthcare systems

- In March 2024, Medtronic partnered with India’s Apollo Hospitals to expand access to its Micra AV pacemaker, a miniaturized device designed for atrioventricular (AV) block treatment. This collaboration supports the growing need for innovative cardiac care in India and reflects Medtronic’s strategy to improve patient outcomes in emerging markets

- In February 2024, Zimmer Biomet announced the launch of its Persona IQ smart knee system in select hospitals across South Korea. This device combines orthopedic implants with smart sensor technology, providing surgeons and patients with real-time data insights for postoperative monitoring and rehabilitation

- In January 2024, Fisher & Paykel Healthcare expanded its respiratory care product line in China by introducing the Airvo 3 high-flow system, addressing the region’s increasing demand for non-invasive oxygen therapy solutions. The initiative demonstrates the company’s focus on innovation and tailored healthcare solutions for the APAC market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC MEDICAL DEVICE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL SWINE AND POULTRY RESPIRATORY DISEASES TREATMENT MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VOLUME DATA

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 ASIA-PACIFIC MEDICAL DEVICE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 MERGERS AND ACQUISITIONS

10.8 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR ASIA-PACIFIC MEDICAL DEVICE MARKET

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 VALUE CHAIN ANALYSIS

15 HEALTHCARE ECONOMY

15.1 HEALTHCARE EXPENDITURE

15.2 CAPITAL EXPENDITURE

15.3 CAPEX TRENDS

15.4 CAPEX ALLOCATION

15.5 FUNDING SOURCES

15.6 INDUSTRY BENCHMARKS

15.7 GDP RATION IN OVERALL GDP

15.8 HEALTHCARE SYSTEM STRUCTURE

15.9 GOVERNMENT POLICIES

15.1 ECONOMIC DEVELOPMENT

16 ASIA-PACIFIC MEDICAL DEVICE MARKET, BY PRODUCT TYPE

16.1 OVERVIEW

(NOTE: MARKET VALUE, VOLUME AND ASP ANALYSIS WOULD BE PROVIDED FOR ALL SEGMENTS AND SUB-SEGMENTS OF PRODUCTS)

16.2 RESPIRATORY DEVICES

16.2.1 THERAPEUTIC

16.2.1.1. VENTILATOR

16.2.1.1.1. MARKET VALUE (USD)

16.2.1.1.2. MARKET VOLUME (UNIT)

16.2.1.1.3. ASP (USD)

16.2.1.2. MASK

16.2.1.3. PAP DEVICE

16.2.1.4. INHALER

16.2.1.5. NEB

16.2.1.6. ULIZER

16.2.2 MONITORING

16.2.2.1. PULSE OXIMETER

16.2.2.1.1. MARKET VALUE (USD)

16.2.2.1.2. MARKET VOLUME (UNIT)

16.2.2.1.3. ASP (USD)

16.2.3 CAPNOGRAPH

16.2.3.1. MARKET VALUE (USD)

16.2.3.2. MARKET VOLUME (UNIT)

16.2.3.3. ASP (USD)

16.2.4 DIAGNOSTIC

16.2.4.1. MARKET VALUE (USD)

16.2.4.2. MARKET VOLUME (UNIT)

16.2.4.3. ASP (USD)

16.2.5 CONSUMABLES

16.2.5.1. MARKET VALUE (USD)

16.2.5.2. MARKET VOLUME (UNIT)

16.2.5.3. ASP (USD)

16.3 DIAGNOSTIC DEVICES

16.3.1 ELECTRODIAGNOSTIC DEVICE

16.3.1.1. ULTRASOUND SYSTEMS

16.3.1.2. MAGNETIC RESONANCE IMAGING (MRI)

16.3.1.3. ELECTROCARDIOGRAPHS

16.3.1.4. SCINTIGRAPHIC APPARATUS

16.3.1.5. OTHER ELECTRODIAGNOSTIC DEVICE

16.3.2 RADIATION DEVICE

16.3.2.1. SMARTWATCHES WITH HEALTH MONITORING

16.3.2.2. WEARABLE BLOOD PRESSURE MONITORS

16.3.2.3. REMOTE MONITORING SYSTEMS

16.3.2.4. TELEMEDICINE DEVICES

16.3.2.5. CT SCANNER16.3.2.6.

16.3.3 IMAGING PARTS & ACCESSORIES

16.3.3.1. CONTRAST MEDIA

16.3.3.2. X-RAY TUBES

16.3.3.3. MEDICAL X-RAY FILM16.3.3.4.

16.4 CARDIOVASCULAR DEVICES

16.4.1 ELECTROCARDIOGRAM (ECG)

16.4.1.1. REMOTE CARDIAC MONITORING

16.4.1.2. OTHER DIAGNOSTIC AND MONITORING DEVICE

16.4.2 THERAPEUTIC AND SURGICAL DEVICE

16.4.2.1. CARDIAC ASSIST DEVICE

16.4.2.2. CARDIAC RHYTHM MANAGEMENT DEVICE

16.4.2.3. CATHETER

16.4.2.4. GRAFTS

16.4.2.5. HEART VALVES

16.4.2.6. STENTS

16.4.2.7. OTHER THERAPEUTIC AND SURGICAL DEVICE

16.5 DENTAL

16.5.1 DENTAL INSTRUMENT & SUPPLIES

16.5.1.1. DENTAL INSTRUMENTS

16.5.1.2. DENTAL CEMENTS

16.5.1.3. TEETH & OTHER FITTINGS

16.5.2 DENTAL CAPITAL EQUIPMENT

16.5.2.1. DENTAL DRILLS

16.5.2.2. DENTAL X-RAY

16.5.2.3. DENTAL CHAIRS

16.6 ORTHOPEDIC DEVICES

16.6.1 FIXATION DEVICE

16.6.2 ARTIFICIAL JOINTS

16.6.3 OTHER ARTIFICIAL BODY PARTS

16.7 ENDOSCOPY DEVICES

16.7.1 VISUALIZATION EQUIPMENT

16.7.1.1. ENDOSCOPIC CAMERA

16.7.1.2. SD VISUALIZATION SYSTEM

16.7.1.3. HD VISUALIZATION SYSTEM

16.7.2 ENDOSCOPES

16.7.2.1. RIGID ENDOSCOPE

16.7.2.2. FLEXIBLE ENDOSCOPE

16.7.2.3. CAPSULE ENDOSCOPE

16.7.2.4. ROBOT-ASSISTED ENDOSCOPE

16.7.3 ENDOSCOPIC OPERATIVE DEVICE

16.7.3.1. IRRIGATION/SUCTION SYSTEM

16.7.3.2. ACCESS DEVICE

16.7.3.3. WOUND PROTECTOR

16.7.3.4. INSUFFLATION DEVICE

16.7.3.5. OPERATIVE MANUAL INSTRUMENT

16.7.3.6. OTHER ENDOSCOPIC OPERATIVE DEVICE

16.8 OPHTHALMOLOGY DEVICES

16.9 RADIOTHERAPY DEVICES

16.1 AESTHETIC DEVICES

16.10.1 LABORATORY EQUIPMENT

16.10.1.1. GENERAL EQUIPMENT

16.10.1.2. INCUBATORS

16.10.1.3. CENTRIFUGES

16.10.1.4. LABORATORY HOOD

16.10.1.5. AUTOCLAVE

16.10.1.6. SCOPES

16.10.1.7. SONICATORS

16.10.1.8. OTHERS

16.11 ANALYTICAL EQUIPMENT

16.11.1 SPECTROMETER

16.11.1.1. MASS SPECTROMETER

16.11.1.2. FLUORESCENCE SPECTROMETER

16.11.1.3. INFRARED SPECTROMETER

16.11.1.4. OTHERS

16.11.2 ANALYZER

16.11.2.1. ELEMENTAL ANALYZERS

16.11.2.2. PARTICLE SIZE ANALYZERS

16.11.2.3. OTHERS

16.11.3 TITRATORS

16.11.4 RHEOMETERS

16.11.5 FLOW INJECTION SYSTEM

16.11.6 SAMPLE PREPARATION SYSTEM

16.11.7 CHROMATOGRAPHY EQUIPMENT

16.11.7.1. GAS CHROMATOGRAPHY EQUIPMENT

16.11.7.2. LIQUID CHROMATOGRAPHY EQUIPMENT

16.11.8 OTHERS

16.12 SUPPORT EQUIPMENT

16.12.1 CELL HARVESTERS

16.12.2 RADIOMETRIC DETECTORS

16.12.3 MICROPLATE READERS

16.12.4 OTHERS

16.13 SPECIALTY EQUIPMENT

16.13.1 CYTOGENETICS INSTRUMENTS

16.13.2 CELL IMAGING DEVICE

16.13.3 LABORATORY EVAPORATORS

16.13.4 POLARIMETERS

16.13.5 MEMBRANE FILTRATION SYSTEMS

16.13.6 LASER SYSTEMS

16.13.7 OTHERS

16.14 SPECTROMETERS

16.15 OTHERS

17 ASIA-PACIFIC MEDICAL DEVICE MARKET, BY DEVICE CLASS

17.1 CLASS I

17.2 CLASS II

17.3 CLAS III

17.4 CLASS IV

18 ASIA-PACIFIC MEDICAL DEVICE MARKET, BY TYPE

18.1 INVASIVE DEVICE

18.2 NON-INVASIVE DEVICE

18.3 IMPLANTABLE DEVICE

18.4 WEARABLE DEVICE

18.5 OTHERS

19 ASIA-PACIFIC MEDICAL DEVICE MARKET, BY APPLICATION

19.1 DIAGNOSTIC

19.2 THERAPEUTIC

20 ASIA-PACIFIC MEDICAL DEVICE MARKET, BY MANUFACTURING METHOD

20.1 IN-HOUSE MANUFACTURING

20.2 OUTSOURCING

21 ASIA-PACIFIC MEDICAL DEVICE MARKET, BY END USER

21.1 OVERVIEW

21.2 HOSPITALS & CLINICS

21.2.1 IN-PATIENT

21.2.2 OUT-PATIENT

21.3 SPECIALTY CLINICS

21.4 AMBULATORY CARE CENTERS

21.5 BIOPHARMACEUTICAL COMPANIES

21.6 LABORATORIES

21.7 ACADEMICS & RESEARCH INSTITUTES

21.8 OTHERS

22 ASIA-PACIFIC MEDICAL DEVICE MARKET, BY DISTRIBUTION CHANNEL

22.1 OVERVIEW

22.2 DIRECT TENDER

22.3 DISTRIBUTORS

22.4 RETAIL SALES

22.5 OTHERS

23 ASIA-PACIFIC MEDICAL DEVICE MARKET, BY GEOGRAPHY

ASIA-PACIFIC MEDICAL DEVICE MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

23.1 ASIA-PACIFIC

23.1.1 JAPAN

23.1.2 CHINA

23.1.3 SOUTH KOREA

23.1.4 INDIA

23.1.5 AUSTRALIA

23.1.6 SINGAPORE

23.1.7 THAILAND

23.1.8 MALAYSIA

23.1.9 INDONESIA

23.1.10 PHILIPPINES

23.1.11 REST OF ASIA-PACIFIC

23.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

24 ASIA-PACIFIC MEDICAL DEVICE MARKET, COMPANY LANDSCAPE

24.1 COMPANY SHARE ANALYSIS: GLOBAL

24.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

24.3 COMPANY SHARE ANALYSIS: EUROPE

24.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

24.5 MERGERS & ACQUISITIONS

24.6 NEW PRODUCT DEVELOPMENT & APPROVALS

24.7 EXPANSIONS

24.8 REGULATORY CHANGES

24.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

25 ASIA-PACIFIC MEDICAL DEVICE MARKET, SWOT AND DBMR ANALYSIS

26 ASIA-PACIFIC MEDICAL DEVICE MARKET, COMPANY PROFILE

26.1 MEDICAL DEVICE

26.1.1 MEDTRONIC PLC.

26.1.1.1. COMPANY OVERVIEW

26.1.1.2. REVENUE ANALYSIS

26.1.1.3. GEOGRAPHIC PRESENCE

26.1.1.4. PRODUCT PORTFOLIO

26.1.1.5. RECENT DEVELOPMENTS

26.1.2 BOSTON SCIENTIFIC CORPORATION

26.1.2.1. COMPANY OVERVIEW

26.1.2.2. REVENUE ANALYSIS

26.1.2.3. GEOGRAPHIC PRESENCE

26.1.2.4. PRODUCT PORTFOLIO

26.1.2.5. RECENT DEVELOPMENTS

26.1.3 JOHNSON & JOHNSON

26.1.3.1. COMPANY OVERVIEW

26.1.3.2. REVENUE ANALYSIS

26.1.3.3. GEOGRAPHIC PRESENCE

26.1.3.4. PRODUCT PORTFOLIO

26.1.3.5. RECENT DEVELOPMENTS

26.1.4 BECTON, DICKINSON AND COMPANY

26.1.4.1. COMPANY OVERVIEW

26.1.4.2. REVENUE ANALYSIS

26.1.4.3. GEOGRAPHIC PRESENCE

26.1.4.4. PRODUCT PORTFOLIO

26.1.4.5. RECENT DEVELOPMENTS

26.1.5 CARDINAL HEALTH

26.1.5.1. COMPANY OVERVIEW

26.1.5.2. REVENUE ANALYSIS

26.1.5.3. GEOGRAPHIC PRESENCE

26.1.5.4. PRODUCT PORTFOLIO

26.1.5.5. RECENT DEVELOPMENTS

26.1.6 STRYKER CORPORATION

26.1.6.1. COMPANY OVERVIEW

26.1.6.2. REVENUE ANALYSIS

26.1.6.3. GEOGRAPHIC PRESENCE

26.1.6.4. PRODUCT PORTFOLIO

26.1.6.5. RECENT DEVELOPMENTS

26.1.7 ABBOTT LABORATORIES

26.1.7.1. COMPANY OVERVIEW

26.1.7.2. REVENUE ANALYSIS

26.1.7.3. GEOGRAPHIC PRESENCE

26.1.7.4. PRODUCT PORTFOLIO

26.1.7.5. RECENT DEVELOPMENTS

26.1.8 BAXTER INTERNATIONAL

26.1.8.1. COMPANY OVERVIEW

26.1.8.2. REVENUE ANALYSIS

26.1.8.3. GEOGRAPHIC PRESENCE

26.1.8.4. PRODUCT PORTFOLIO

26.1.8.5. RECENT DEVELOPMENTS

26.1.9 DANAHER CORPORATION

26.1.9.1. COMPANY OVERVIEW

26.1.9.2. REVENUE ANALYSIS

26.1.9.3. GEOGRAPHIC PRESENCE

26.1.9.4. PRODUCT PORTFOLIO

26.1.9.5. RECENT DEVELOPMENTS

26.1.10 3M

26.1.10.1. COMPANY OVERVIEW

26.1.10.2. REVENUE ANALYSIS

26.1.10.3. GEOGRAPHIC PRESENCE

26.1.10.4. PRODUCT PORTFOLIO

26.1.10.5. RECENT DEVELOPMENTS

26.1.11 NOVARTIS AG

26.1.11.1. COMPANY OVERVIEW

26.1.11.2. REVENUE ANALYSIS

26.1.11.3. GEOGRAPHIC PRESENCE

26.1.11.4. PRODUCT PORTFOLIO

26.1.11.5. RECENT DEVELOPMENTS

26.1.12 GENERAL ELECTRIC COMPANY

26.1.12.1. COMPANY OVERVIEW

26.1.12.2. REVENUE ANALYSIS

26.1.12.3. GEOGRAPHIC PRESENCE

26.1.12.4. PRODUCT PORTFOLIO

26.1.12.5. RECENT DEVELOPMENTS

26.1.13 BD

26.1.13.1. COMPANY OVERVIEW

26.1.13.2. REVENUE ANALYSIS

26.1.13.3. GEOGRAPHIC PRESENCE

26.1.13.4. PRODUCT PORTFOLIO

26.1.13.5. RECENT DEVELOPMENTS

26.1.14 INTUITIVE SURGICAL

26.1.14.1. COMPANY OVERVIEW

26.1.14.2. REVENUE ANALYSIS

26.1.14.3. GEOGRAPHIC PRESENCE

26.1.14.4. PRODUCT PORTFOLIO

26.1.14.5. RECENT DEVELOPMENTS

26.1.15 ALLERGAN

26.1.15.1. COMPANY OVERVIEW

26.1.15.2. REVENUE ANALYSIS

26.1.15.3. GEOGRAPHIC PRESENCE

26.1.15.4. PRODUCT PORTFOLIO

26.1.15.5. RECENT DEVELOPMENTS

26.1.16 HOYA CORPORATION

26.1.16.1. COMPANY OVERVIEW

26.1.16.2. REVENUE ANALYSIS

26.1.16.3. GEOGRAPHIC PRESENCE

26.1.16.4. PRODUCT PORTFOLIO

26.1.16.5. RECENT DEVELOPMENTS

26.1.17 SIEMENS HEALTHCARE GMBH

26.1.17.1. COMPANY OVERVIEW

26.1.17.2. REVENUE ANALYSIS

26.1.17.3. GEOGRAPHIC PRESENCE

26.1.17.4. PRODUCT PORTFOLIO

26.1.17.5. RECENT DEVELOPMENTS

26.1.18 RESMED

26.1.18.1. COMPANY OVERVIEW

26.1.18.2. REVENUE ANALYSIS

26.1.18.3. GEOGRAPHIC PRESENCE

26.1.18.4. PRODUCT PORTFOLIO

26.1.18.5. RECENT DEVELOPMENTS

26.1.19 TERUMO MEDICAL CORPORATION

26.1.19.1. COMPANY OVERVIEW

26.1.19.2. REVENUE ANALYSIS

26.1.19.3. GEOGRAPHIC PRESENCE

26.1.19.4. PRODUCT PORTFOLIO

26.1.19.5. RECENT DEVELOPMENTS

26.1.20 OLYMPUS CORPORATION

26.1.20.1. COMPANY OVERVIEW

26.1.20.2. REVENUE ANALYSIS

26.1.20.3. GEOGRAPHIC PRESENCE

26.1.20.4. PRODUCT PORTFOLIO

26.1.20.5. RECENT DEVELOPMENTS

26.1.21 ZIMMER BIOMET

26.1.21.1. COMPANY OVERVIEW

26.1.21.2. REVENUE ANALYSIS

26.1.21.3. GEOGRAPHIC PRESENCE

26.1.21.4. PRODUCT PORTFOLIO

26.1.21.5. RECENT DEVELOPMENTS

26.1.22 FESENIUS MEDICAL CARE

26.1.22.1. COMPANY OVERVIEW

26.1.22.2. REVENUE ANALYSIS

26.1.22.3. GEOGRAPHIC PRESENCE

26.1.22.4. PRODUCT PORTFOLIO

26.1.22.5. RECENT DEVELOPMENTS

26.1.23 EDWARDS LIFESCIENCES CORPORATION

26.1.23.1. COMPANY OVERVIEW

26.1.23.2. REVENUE ANALYSIS

26.1.23.3. GEOGRAPHIC PRESENCE

26.1.23.4. PRODUCT PORTFOLIO

26.1.23.5. RECENT DEVELOPMENTS

26.1.24 KONINKLIJKE PHILIPS N.V.

26.1.24.1. COMPANY OVERVIEW

26.1.24.2. REVENUE ANALYSIS

26.1.24.3. GEOGRAPHIC PRESENCE

26.1.24.4. PRODUCT PORTFOLIO

26.1.24.5. RECENT DEVELOPMENTS

26.1.25 DRÄGERWERK AG & CO. KGAA

26.1.25.1. COMPANY OVERVIEW

26.1.25.2. REVENUE ANALYSIS

26.1.25.3. GEOGRAPHIC PRESENCE

26.1.25.4. PRODUCT PORTFOLIO

26.1.25.5. RECENT DEVELOPMENTS

26.1.26 COLOPLAST GROUP

26.1.26.1. COMPANY OVERVIEW

26.1.26.2. REVENUE ANALYSIS

26.1.26.3. GEOGRAPHIC PRESENCE

26.1.26.4. PRODUCT PORTFOLIO

26.1.26.5. RECENT DEVELOPMENTS

26.1.27 WATERS CORPORATION

26.1.27.1. COMPANY OVERVIEW

26.1.27.2. REVENUE ANALYSIS

26.1.27.3. GEOGRAPHIC PRESENCE

26.1.27.4. PRODUCT PORTFOLIO

26.1.27.5. RECENT DEVELOPMENTS

26.1.28 HOLOGIC, INC.

26.1.28.1. COMPANY OVERVIEW

26.1.28.2. REVENUE ANALYSIS

26.1.28.3. GEOGRAPHIC PRESENCE

26.1.28.4. PRODUCT PORTFOLIO

26.1.28.5. RECENT DEVELOPMENTS

26.1.29 STERIS

26.1.29.1. COMPANY OVERVIEW

26.1.29.2. REVENUE ANALYSIS

26.1.29.3. GEOGRAPHIC PRESENCE

26.1.29.4. PRODUCT PORTFOLIO

26.1.29.5. RECENT DEVELOPMENTS

26.1.30 INSTITUT STRAUMANN AG

26.1.30.1. COMPANY OVERVIEW

26.1.30.2. REVENUE ANALYSIS

26.1.30.3. GEOGRAPHIC PRESENCE

26.1.30.4. PRODUCT PORTFOLIO

26.1.30.5. RECENT DEVELOPMENTS

27 CONCLUSION

28 QUESTIONNAIRE

29 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.