Asia Pacific Medical Nonwoven Market

Market Size in USD Billion

CAGR :

%

USD

16.89 Billion

USD

29.23 Billion

2025

2033

USD

16.89 Billion

USD

29.23 Billion

2025

2033

| 2026 –2033 | |

| USD 16.89 Billion | |

| USD 29.23 Billion | |

|

|

|

|

Asia-Pacific Medical Nonwoven Market Size

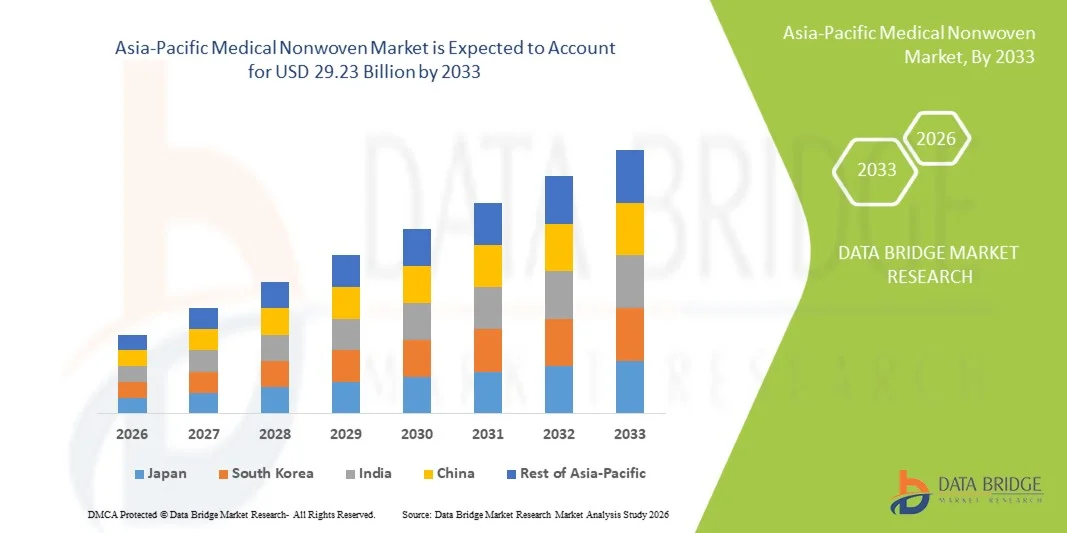

- The Asia-Pacific Medical Nonwoven Market size was valued at USD 16.89 billion in 2025 and is expected to reach USD 29.23 billion by 2033, at a CAGR of7.10% during the forecast period

- The market growth is largely fueled by the growing adoption of advanced medical materials and innovations in healthcare hygiene products, leading to increased utilization of medical nonwovens in both hospital and outpatient settings

- Furthermore, rising demand for sterile, cost-effective, and high-performance medical textiles for applications such as surgical gowns, drapes, face masks, and wound care products is driving market expansion. These converging factors are accelerating the uptake of Medical Nonwoven solutions, thereby significantly boosting the industry's growth

Asia-Pacific Medical Nonwoven Market Analysis

- Medical nonwoven products, including surgical gowns, drapes, face masks, and wound care materials, are increasingly vital components in modern healthcare settings due to their sterility, cost-effectiveness, and ability to prevent infections

- The escalating demand for medical nonwovens is primarily fueled by rising surgical procedures, growing awareness of hospital-acquired infection prevention, and increasing adoption of disposable medical products across hospitals and outpatient facilities

- China dominated the Asia-Pacific Medical Nonwoven Market with the largest revenue share of 42.8% in 2025, supported by expanding hospital infrastructure, high demand for disposable medical products, and strong local manufacturing capabilities, with key healthcare providers increasingly adopting advanced nonwoven solutions for patient safety and operational efficiency

- India is expected to be the fastest-growing region in the Asia-Pacific Medical Nonwoven Market during the forecast period, projected to record a CAGR of 13.7% from 2026 to 2033, driven by rising healthcare investments, growing surgical volumes, and increasing awareness of infection prevention across hospitals, clinics, and homecare settings

- The Disposable segment dominated with a revenue share of 61.4% in 2025, due to its wide use in surgical gowns, drapes, masks, and hygiene products across hospitals and clinics

Report Scope and Asia-Pacific Medical Nonwoven Market Segmentation

|

Attributes |

Asia-Pacific Medical Nonwoven Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Asia-Pacific Medical Nonwoven Market Trends

“Rising Focus on Hygiene and Disposable Medical Products”

- A significant and accelerating trend in the global Asia-Pacific Medical Nonwoven Market is the increasing demand for high-quality, hygienic, and disposable medical textiles in hospitals, clinics, and diagnostic centers. This trend is driven by heightened awareness of infection control and patient safety standards

- For instance, in January 2024, Berry Global launched its advanced disposable surgical gown range, featuring reinforced barriers against microbial penetration, which received rapid adoption across hospitals in North America and Europe. Similarly, Ahlstrom-Munksjö introduced a new line of nonwoven face masks in February 2023, designed to meet stringent medical filtration standards, enhancing safety in healthcare environments

- The growing emphasis on infection prevention and hospital-acquired infection (HAI) reduction is driving hospitals and healthcare providers to adopt premium disposable medical textiles. Nonwoven materials, offering superior fluid resistance, comfort, and cost-effectiveness, are becoming integral in surgical drapes, gowns, and protective barriers

- Furthermore, the COVID-19 pandemic has accelerated awareness of single-use medical products, reinforcing the preference for nonwoven materials in both public and private healthcare facilities globally

- Environmental sustainability is emerging as another key trend, with manufacturers increasingly focusing on biodegradable and recyclable nonwoven products to minimize medical waste and comply with stricter regulatory norm

Asia-Pacific Medical Nonwoven Market Dynamics

Driver

“Growing Demand for Infection Control and Healthcare Safety”

- The rising prevalence of hospital-acquired infections (HAIs) and stringent hygiene regulations across healthcare facilities is a major driver for the adoption of medical nonwoven products

- For instance, in March 2025, Kimberly-Clark Health Care expanded its nonwoven surgical drape portfolio to enhance fluid repellency and barrier performance, catering to growing safety requirements in operating rooms. Such innovations are expected to strengthen the Medical Nonwoven industry in the forecast period

- Healthcare providers increasingly rely on nonwoven disposables to ensure patient safety and reduce contamination risks during surgeries, diagnostic procedures, and patient care

- The convenience of ready-to-use disposable items, coupled with consistent quality, reduces sterilization requirements and operational burden for medical staff, further driving market adoption

- Rising healthcare infrastructure investment in emerging markets and the expansion of hospitals, clinics, and diagnostic centers are contributing to higher demand for medical nonwoven products

Restraint/Challenge

“Environmental Concerns and Cost Pressures”

- Despite their benefits, medical nonwoven products face challenges regarding environmental sustainability due to their single-use nature and disposal impact. Hospitals and regulatory bodies are increasingly scrutinizing waste management practices associated with disposable products

- For instance, high volumes of single-use gowns, masks, and drapes have raised concerns about landfill accumulation and microplastic pollution, prompting some healthcare institutions to explore alternative eco-friendly solutions

- The relatively high cost of advanced nonwoven materials, particularly those with reinforced fluid barriers or antimicrobial properties, can be a barrier for adoption in price-sensitive markets or smaller healthcare facilities

- Manufacturers must balance product performance with cost-effectiveness while complying with environmental regulations, which may limit rapid deployment in certain regions

- Overcoming these challenges through sustainable product development, cost optimization, and government incentives for eco-friendly medical products will be crucial for long-term growth in the Asia-Pacific Medical Nonwoven Market

Asia-Pacific Medical Nonwoven Market Scope

The market is segmented on the basis of type, material, product type, usability, distribution channel, and end-user.

• By Type

On the basis of type, the Asia-Pacific Medical Nonwoven Market is segmented into Spun-bond, Spun-melt-spun (SMS), Drylaid, Wet-laid, Melt-blown, and Others. The Spun-melt-spun (SMS) segment dominated the largest market revenue share of 36.8% in 2025, driven by its superior strength, softness, and barrier properties, making it ideal for surgical gowns, masks, and medical drapes. Hospitals and clinics prioritize SMS nonwovens for critical applications due to their high durability and compliance with stringent infection control standards. The material’s versatility allows its use across hygiene products, protective apparel, and disposable medical devices. Increasing adoption of SMS fabrics in personal protective equipment (PPE) during health crises supports revenue dominance. Production scalability and cost-effectiveness make it attractive to manufacturers. Regulatory approvals and hospital procurement programs further strengthen its market position. Continuous innovations in fiber bonding and layering enhance product performance. Demand from emerging markets is rising due to increased healthcare infrastructure. The segment benefits from integration in both disposable and reusable medical products. Long-term supplier contracts with hospitals maintain steady revenue. Strong compatibility with sterilization techniques adds to preference.

The Melt-blown segment is expected to witness the fastest CAGR of 20.5% from 2026 to 2033, driven by its critical role as a filtration layer in surgical masks and respirators. Rising awareness of infection control and pandemic preparedness fuels adoption. Melt-blown fabrics are highly effective in preventing pathogen transmission, boosting demand in hospitals and clinics. Innovations in fiber fineness and density improve filtration efficiency. High global demand for masks in both healthcare and personal use supports rapid growth. Increased production capacity by key manufacturers accelerates market penetration. Emerging markets show strong uptake due to healthcare expansion. Rising regulatory standards for PPE increase melt-blown integration. Strategic partnerships with nonwoven producers enhance supply chain reliability. Adoption in hygiene products and medical disposables further broadens application. Government stockpiling programs contribute to sales spikes. Online and retail channels expand accessibility to smaller facilities.

• By Material

On the basis of material, the market is segmented into Polyester, Polypropylene, Polyethylene, Rayon, and Other Materials. The Polypropylene segment dominated the largest revenue share of 41.2% in 2025, driven by its affordability, excellent barrier properties, and wide use in surgical drapes, gowns, and hygiene products. Hospitals and clinics prefer polypropylene nonwovens due to compatibility with sterilization processes and high-volume procurement advantages. Its lightweight nature and breathability make it suitable for both patient comfort and protective wear. Polypropylene’s low production cost enables cost-effective solutions for disposable medical products. Regulatory approvals and compliance with infection prevention standards enhance adoption. Manufacturer familiarity and supply chain readiness reinforce market dominance. Material durability supports multiple healthcare applications. Continuous innovation in polypropylene fiber technology enhances product quality. Adoption in PPE and hygiene products ensures steady demand. Expansion in emerging healthcare markets strengthens revenue. Partnerships with medical textile manufacturers ensure consistent supply.

The Rayon segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, supported by its high absorbency, softness, and suitability for medical wipes and hygiene products. Growing awareness of patient comfort in hospitals drives adoption. Rayon nonwovens are increasingly used in disposable wipes, gowns, and surgical drapes. Rising demand in home healthcare and ambulatory surgical centers contributes to growth. Improvements in fiber bonding and blending increase product performance. Regulatory support for hygienic and safe medical materials fuels adoption. Emerging economies are adopting rayon for cost-effective hygiene solutions. Integration in combination products, such as wet wipes and absorbent pads, accelerates sales. Production capacity expansion by manufacturers enhances availability. Innovative fiber treatments improve softness and absorbency. Physician and caregiver preference for rayon in patient care boosts uptake. Retail channels for homecare hygiene products also increase visibility.

• By Product Type

On the basis of product type, the market is segmented into Hygiene Technology and Apparel Products. The Apparel Products segment dominated with a revenue share of 52.1% in 2025, driven by the growing demand for surgical gowns, masks, caps, and protective wear in hospitals and clinics. Rising surgical procedures globally increase consumption of medical apparel. Hospital procurement contracts prioritize certified, disposable apparel for infection control. Integration of SMS and polypropylene materials enhances product performance. Innovations in antimicrobial coatings and comfort features further support adoption. High compliance with regulatory standards makes apparel products essential in healthcare facilities. Surge in outpatient surgeries and ambulatory centers contributes to segment dominance. Emergency preparedness and stockpiling by hospitals further boost revenue. Standardization of surgical dress codes drives repeat purchases. Disposable medical apparel ensures hygiene and reduces contamination risks. Product versatility across hospitals, clinics, and homecare adds to growth. Supply agreements with global manufacturers maintain steady availability.

The Hygiene Technology segment is expected to witness the fastest CAGR of 17.8% from 2026 to 2033, driven by rising adoption of incontinence products, wipes, and absorbent pads in hospitals, homecare, and clinics. Increasing awareness about patient hygiene and infection prevention fuels adoption. Innovations in absorbent core technology and biodegradable nonwovens enhance product appeal. Demand in long-term care facilities and home healthcare settings accelerates growth. E-commerce channels enable convenient access for homecare users. Integration with disposable medical apparel creates bundled product offerings. Government programs promoting hygiene products increase procurement. Rising prevalence of chronic diseases requiring hygiene management boosts adoption. Manufacturers are investing in R&D for high-performance, eco-friendly products. Online and retail distribution channels expand market reach. Nursing and caregiver training programs encourage proper usage. Emerging markets show significant growth due to expanding healthcare infrastructure.

• By Usability

On the basis of usability, the market is segmented into Disposable and Reusable. The Disposable segment dominated with a revenue share of 61.4% in 2025, due to its wide use in surgical gowns, drapes, masks, and hygiene products across hospitals and clinics. Disposable products reduce cross-contamination risks and simplify hospital logistics. Increasing adoption in ambulatory surgical centers and homecare settings drives revenue. Regulatory emphasis on single-use products supports dominance. Cost-effectiveness and ease of use favor disposables over reusable alternatives. Stockpiling and emergency preparedness measures ensure consistent demand. Integration with SMS and melt-blown materials enhances functionality. Standardization of hospital protocols mandates disposable usage. Rising surgical volumes globally increase consumption. Growth in hygiene awareness boosts adoption in clinics. Hospitals and homecare providers prefer disposables for efficiency.

The Reusable segment is expected to witness the fastest CAGR of 16.9% from 2026 to 2033, driven by increasing adoption of sterilizable surgical gowns, masks, and protective apparel. Cost benefits over multiple uses encourage procurement in high-volume hospitals. Innovations in fabric durability and sterilization compatibility enhance usability. Growing focus on sustainability and waste reduction supports reusable nonwovens. Emerging markets with budget-conscious healthcare facilities favor reusable options. Textile advancements improve comfort and performance. Long-term contracts with hospitals and clinics accelerate adoption. Integration with eco-friendly initiatives encourages usage. Awareness campaigns promote sustainable healthcare solutions. Physician and caregiver preference for quality reusable products contributes to growth. Hospitals adopting reusable PPE during supply shortages increase market share. Regulatory approvals ensure safety and efficacy.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Direct Tenders and Retail. The Direct Tenders segment dominated with a revenue share of 57.3% in 2025, driven by centralized hospital procurement systems. Bulk purchasing for large-scale healthcare facilities ensures cost efficiency. Hospitals and clinics prefer direct tender contracts for reliability and quality assurance. Integration with national health programs and government procurement strengthens dominance. Strong supply chain networks and established relationships with manufacturers drive adoption. Standardization of product quality and certifications ensure safety. Hospitals benefit from long-term agreements for uninterrupted supply. Strategic partnerships with manufacturers improve pricing and service. Large hospital groups streamline procurement through tenders. Emergency preparedness stockpiles increase purchase volumes. Regulatory compliance for tendered products supports dominance.

The Retail segment is expected to witness the fastest CAGR of 18.2% from 2026 to 2033, fueled by rising demand from home healthcare, clinics, and small ambulatory surgical centers. Convenience of purchasing hygiene and apparel products directly supports growth. Online retail channels expand access to disposable and reusable nonwovens. Awareness campaigns targeting homecare users accelerate adoption. Growth in e-commerce platforms facilitates subscription and bulk purchasing. Small healthcare facilities prefer retail procurement for flexibility. Innovative packaging and product bundles encourage consumer adoption. Retail visibility drives brand awareness. Price competitiveness and promotions stimulate uptake. Retail expansion in emerging markets increases penetration. Consumer education on hygiene and infection control supports adoption. Integration with telemedicine and homecare delivery strengthens growth.

• By End-User

On the basis of end-user, the market is segmented into Hospitals, Clinics, Home Healthcare, Laboratory, Ambulatory Surgical Centres, and Others. The Hospitals segment dominated with a revenue share of 48.9% in 2025, driven by high patient volumes, surgical procedures, and infection control requirements. Hospitals require a steady supply of disposable and reusable medical nonwovens. Integration with surgical and hygiene workflows ensures adoption. Regulatory guidelines mandate usage of certified nonwovens. Procurement contracts and bulk purchasing support dominance. Hospitals lead demand for PPE, surgical drapes, and hygiene products. Specialized departments prioritize quality nonwovens. Clinical staff training enhances compliance and product usage. High turnover of disposable products ensures recurring revenue. Partnerships with manufacturers ensure supply consistency. Hospital accreditation and safety standards drive product adoption.

The Home Healthcare segment is expected to witness the fastest CAGR of 17.6% from 2026 to 2033, driven by increasing homecare services, remote monitoring, and awareness of infection prevention. Growing elderly population and chronic disease prevalence drive product demand. Convenience of disposable hygiene products for homecare patients accelerates adoption. Telehealth and e-commerce support distribution. Caregiver awareness programs encourage proper use. Integration with homecare kits and bundled products increases uptake. Manufacturers are developing lightweight, easy-to-use products. Rising chronic care management programs further support growth. Online delivery channels expand market access. Government initiatives promote homecare hygiene. Homecare nurses and caregivers rely on disposables. Emerging markets show strong potential for adoption.

Asia-Pacific Medical Nonwoven Market Regional Analysis

- The Asia-Pacific Medical Nonwoven Market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by increasing urbanization, rising disposable incomes, expanding healthcare infrastructure, and growing awareness of infection prevention

- Demand for disposable medical products—such as surgical gowns, masks, drapes, hygiene products, and wound care materials—is rapidly increasing as healthcare systems across the region strengthen safety and hygiene standard

- In addition, APAC’s strong manufacturing capabilities in spun-bond, melt-blown, and SMS nonwoven materials contribute to improved affordability and widespread availability across hospitals, clinics, laboratories, and home healthcare environments

China Asia-Pacific Medical Nonwoven Market Insight

The China Asia-Pacific Medical Nonwoven Market held the largest revenue share in the Asia-Pacific region in 2025, supported by rapid expansion in healthcare infrastructure, high surgical procedure volumes, and strong domestic production of nonwoven materials. China’s manufacturing ecosystem enables large-scale, cost-effective production of spun-bond, melt-blown, and SMS nonwovens widely used in protective apparel, surgical consumables, and hygiene products. Increasing investments in hospital upgrades and infection prevention protocols continue to drive the adoption of medical nonwovens across clinical and homecare settings.

India Asia-Pacific Medical Nonwoven Market Insight

The India Asia-Pacific Medical Nonwoven Market is expected to be the fastest-growing in the Asia-Pacific region, projected to record a CAGR of 13.7% from 2026 to 2033. Growth is driven by rising healthcare expenditure, increasing surgical volumes, expanding private hospital networks, and heightened awareness of infection control. The demand for disposable medical nonwoven products—such as masks, gowns, drapes, wound dressings, and hygiene items—is rising significantly in hospitals, clinics, ambulatory surgical centres, and home healthcare. Additionally, government initiatives to strengthen public health infrastructure, along with the growth of local nonwoven manufacturing capabilities, are accelerating adoption across urban and semi-urban regions.

Asia-Pacific Medical Nonwoven Market Share

The Medical Nonwoven industry is primarily led by well-established companies, including:

- Fitesa (Brazil)

- Avintiv (U.S.)

- Noble Biomaterials (U.S.)

- Welspun Group (India)

- Saint-Gobain (France)

- DuPont (U.S.)

- Grasim Industries (India)

- Kimberly-Clark (U.S.)

- Toray Industries (Japan)

- Precision Fabrics Group (U.S.)

- Avgol (Israel)

- Tweave (China)

- Constantia Flexibles (Austria)

- Cardinal Health (U.S.)

- Surgitech (India)

Latest Developments in Asia-Pacific Medical Nonwoven Market

- In July 2023, Berry Global announced the launch of SustainaMed, a biodegradable nonwoven fabric line for medical gowns and face masks. This move responded to increasing demand from hospitals and healthcare facilities in Asia‑Pacific for eco‑friendly disposable medical products

- In January 2024, Owens & Minor completed the expansion of its surgical drape production facility in Thailand — boosting capacity to meet rising demand for disposable drapes, gowns, and protective apparel across Southeast Asia amid growing surgical volumes and expanded hospital infrastructure

- In August 2024, a manufacturer in Asia introduced new high‑performance hybrid nonwoven fabrics (for chemotherapy gowns) with enhanced barrier properties against chemicals and hazardous drugs — complying with international safety standards for protective medical wear. This underlines a trend toward specialized nonwovens for advanced medical applications beyond basic surgical disposables

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.