Asia Pacific Natural Gas Engine Market

Market Size in USD Billion

CAGR :

%

USD

2.92 Billion

USD

5.48 Billion

2024

2032

USD

2.92 Billion

USD

5.48 Billion

2024

2032

| 2025 –2032 | |

| USD 2.92 Billion | |

| USD 5.48 Billion | |

|

|

|

|

Asia Pacific Natural Gas Engine Market Size

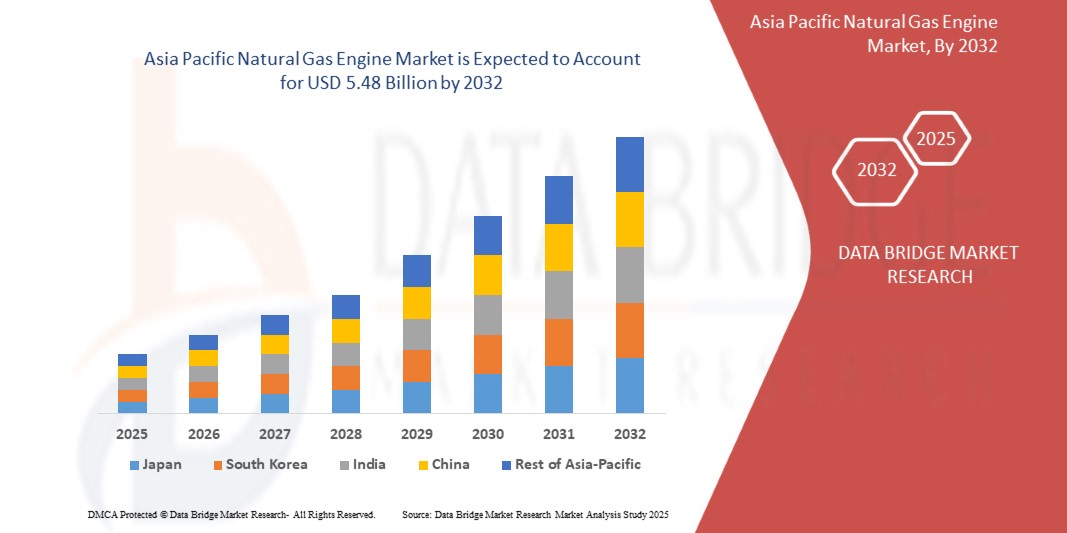

- The Asia Pacific Natural Gas Engine Market size was valued at USD 2.92 Billion in 2024 and is expected to reach USD 5.48 Billion by 2032, at a CAGR of 7.4% during the forecast period

- Growth is powered by rapid industrialization, rising energy demand, and the region’s transition toward cleaner power solutions, spurring widespread adoption of natural gas engines for distributed generation, automotive, and utility backup.

- Government initiatives promoting cleaner fuels, investments in gas transmission and LNG infrastructure, and expansion of manufacturing sectors continue to propel market expansion.

- Rising urbanization and electricity needs, especially in China, India, and Southeast Asia, drive significant volume and investment in engine technologies.

Asia Pacific Natural Gas Engine Market Analysis

- Natural gas engines are increasingly recognized as a preferred solution for flexible, efficient, and environmentally friendly power generation throughout the Asia Pacific region. The engines operate with a range of gas inputs (natural gas, biogas, LNG, CNG), enabling their use in decentralized generation, emergency backup, and automotive fleets.

- The transition from coal and diesel toward lower-emission natural gas is fueling new installations in municipal utilities, industrial plants, and commercial complexes.

- Distributed generation—with engines deployed close to demand centers—is becoming a priority to increase grid reliability, reduce transmission losses, and support renewable energy integration.

- Applications in food processing, wastewater treatment, agriculture, and manufacturing benefit from the engines’ ability to deliver both power and heat (combined heat and power), supporting energy cost reduction and sustainability goals.

- China leads the markets due to fast-growing urban and industrial populations, robust investment in infrastructure, supportive policy frameworks, and strong domestic engine manufacturing capability.

- Ongoing innovations include engines with higher thermal efficiency, reduced methane leakage, digital monitoring and predictive maintenance features, and compatibility with renewable natural gas sources.

- Challenges remain from gas pipeline infrastructure gaps, initial capital expenditure, and the need for technical expertise for installation and maintenance, especially in rural and emerging economies.

Report Scope and Asia Pacific Natural Gas Engine Market Segmentation

|

Attributes |

Asia Pacific Natural Gas Engine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia Pacific Natural Gas Engine Market Trends

Growing Adoption of Distributed Generation and Cleaner Energy Integration

- Distributed energy systems utilizing natural gas engines gain traction for grid support, peak load balancing, and backup in urban centers and industrial parks.

- Expansion of CNG and LNG fueling networks fuels growth of natural gas automotive fleets in China and India and supports innovation in passenger vehicles and heavy-duty transport.

- Digitalization, connectivity (IoT integration), and predictive maintenance are enhancing system reliability and cost efficiency.

- Increasing adoption of biogas and renewable methane engines supports sustainability and net-zero transition strategies.

Asia Pacific Natural Gas Engine Market Dynamics

Driver

Rising adoption of clean energy policies, coupled with infrastructure expansion and rapid industrialization

- National priorities centered on emissions reduction (especially in China, India, Japan, and South Korea) drive adoption of natural gas engines for power generation and mobility.

- Investments in LNG terminals, cross-border pipelines, and gas grid modernization improve access to clean gas and support new installations.

- Urban population growth, rising consumer energy demand, and manufacturing sector expansion sustain elevated market growth through demand for reliable, flexible power.

- Increasing focus on energy security, grid resilience, and integration of renewables pairs with natural gas engines’ capability for fast ramp-up and low emissions

Restraint/Challenge

Infrastructure Gaps and Relative Cost Barriers

- Limited distribution infrastructure in developing and rural regions restricts access to natural gas, hampering uptake beyond major cities and industrial zones.

- Upfront capital costs and skilled labor requirements for installation and maintenance can deter adoption among smaller utilities and enterprises.

- Regulatory uncertainty and evolving emissions standards may complicate investment decisions and technology selection across diverse APAC markets.

- Competition from alternative technologies (renewables, batteries, hydrogen solutions) and fluctuating gas prices create volatility and strategic challenge for long-term planning.

Asia Pacific Natural Gas Engine Market Scope

The market is segmented based on engine family, power output, and application.

- By Engine Family

On the basis of engine family, the Asia Pacific Natural Gas Engine Market is segmented into spark ignited, dual fuel, and high pressure direct injection (HPDI) engines. The spark ignited segment dominates the largest market revenue share in 2024, primarily due to the simplicity, reliability, and cost-effectiveness of these engines for grid support, distributed generation, and automotive applications across various fuel types including CNG and LNG.

- By Power Output

The market is segmented into 15KW–100KW, 100KW–399KW, 400KW–800KW, 1000–2000KW, and 3000–4500KW categories. The 400KW–800KW ranges currently hold the largest revenue share, fueled by their widespread deployment in industrial parks, commercial complexes, and decentralized energy generation.Engines in the 15KW–100KW and 100KW–399KW segments are set to register the fastest CAGR during the forecast period, benefiting from increased demand for commercial, rural, and backup power applications across emerging economies.

- By Application

On the basis of application, the Asia Pacific Natural Gas Engine Market is segmented into natural gas gensets, automotive, and decentralized energy generation. The natural gas gensets segment dominates, supported by extensive utilization in distributed power generation for factories, commercial buildings, and off-grid facilities, ensuring energy reliability and lower emissions.

Asia Pacific Natural Gas Engine Market Regional Analysis

- China dominates the Asia Pacific Natural Gas Engine Market, holding the largest revenue share in 2024, primarily driven by aggressive investments in LNG infrastructure, expanding pipeline networks, and strong government support for clean energy adoption. The country’s rapid urbanization and industrial growth fuel substantial demand for natural gas engines in distributed generation, combined heat and power (CHP) systems, and public transportation.

- Consumers and institutional users—including manufacturing complexes, commercial buildings, municipal utilities, and fleet operators—are increasingly deploying natural gas engines for reliable, low-emission power generation and backup, spurred by strict air quality regulations and sustainability targets in densely populated regions.

- China’s market growth is further supported by favorable government policies promoting natural gas as a transition fuel, robust domestic engine manufacturing, and rising investments in distributed energy projects. The development of cost-effective CNG/LNG supply chains and expansion of fueling networks encourage adoption in both industrial and automotive sectors.

- Local manufacturers are innovating with high-efficiency and hybrid engine technologies to meet evolving environmental standards and consumer expectations for performance and cost-effectiveness. China’s export-oriented manufacturing base and growing use of renewable gas (biomethane) in engines also strengthen its market leadership and support the transition to lower-carbon energy systems.

Asia-Pacific Asia Pacific Natural Gas Engine Market Insight

The Asia Pacific Natural Gas Engine Market accounted for the largest regional share in 2024, propelled by rapidly expanding urban populations, intensifying industrialization, and a robust shift toward cleaner energy solutions. Increased government initiatives to curb emissions, expand LNG/CNG infrastructure, and improve grid reliability are significantly accelerating the adoption of natural gas engines for power generation, distributed energy, and transport across countries such as China, India, and Japan. Advancements in engine technologies and supportive policy frameworks further underpin regional market growth, while affordable manufacturing and strong vendor presence support capacity expansion.

India Asia Pacific Natural Gas Engine Market Insight

India is projected to experience the highest CAGR in the Asia Pacific Natural Gas Engine Market over the forecast period, fueled by aggressive investments in urban and rural electrification, rapid infrastructure development, and rising adoption of clean energy vehicles. Initiatives such as nationwide gas grid expansion, “Make in India” manufacturing focus, and policy support for sustainable distributed generation have accelerated new installations. India's growing middle class, urbanization, and government-backed clean transport programs present substantial opportunities for natural gas engine manufacturers, especially in affordable gensets, public transport fleets, and decentralized energy solutions.

China Asia Pacific Natural Gas Engine Market Insight

China leads the Asia Pacific Natural Gas Engine Market in both revenue and growth, benefiting from its dominant energy infrastructure, expansive pipeline and LNG networks, and assertive national policies to transition from coal to cleaner fuels. The market is expanding rapidly across industrial, municipal, and transport sectors—driven by rising electricity demand, stringent emissions regulations, and strategic investments in distributed generation. Technological innovation, including hybrid and high-efficiency engine platforms and integration with renewable methane, are attracting both local and international buyers. The country’s focus on smart manufacturing, environmental stewardship, and urban development supports sustained market leadership and export growth.

Asia Pacific Natural Gas Engine Market Share

The Natural Gas Engine industry is primarily led by well-established companies, including:

- Cummins Inc. (U.S.)

- Caterpillar (U.S.)

- Siemens (Germany)

- Wärtsilä (Finland)

- INNIO (Austria)

- Doosan Corporation (South Korea)

- Yanmar (Japan)

- Rolls-Royce plc (U.K.)

- Kawasaki Heavy Industries (Japan)

- Mitsubishi Heavy Industries (Japan)

- MAN SE (Germany)

- Liebherr Group (Switzerland)

- Westport Fuel Systems (Canada)

- Volvo Penta (Sweden)

- Hyundai Heavy Industries (South Korea)

- GE Vernova (U.S.)

- Deutz AG (Germany)

- Weichai Power (China)

Latest Developments in Asia Pacific Natural Gas Engine Market

- In Jan 2025: Cummins announced a launch of ultra-low emissions natural gas engines tailored for Asia Pacific distributed power applications.

- In Nov 2024: Caterpillar expanded its manufacturing capacity for natural gas engines in China and India to address regional demand.

- In Aug 2024: Wärtsilä signed agreements with Southeast Asian utilities for combined heat and power facilities powered by biogas and LNG.

- In Mar 2024: Mitsubishi Heavy Industries introduced dual-fuel engines for public transport fleets in India and Indonesia, aligned with regional clean mobility goals.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.