Asia Pacific Non Surgical Procedures Market

Market Size in USD Billion

CAGR :

%

USD

2.31 Billion

USD

4.77 Billion

2025

2033

USD

2.31 Billion

USD

4.77 Billion

2025

2033

| 2026 –2033 | |

| USD 2.31 Billion | |

| USD 4.77 Billion | |

|

|

|

|

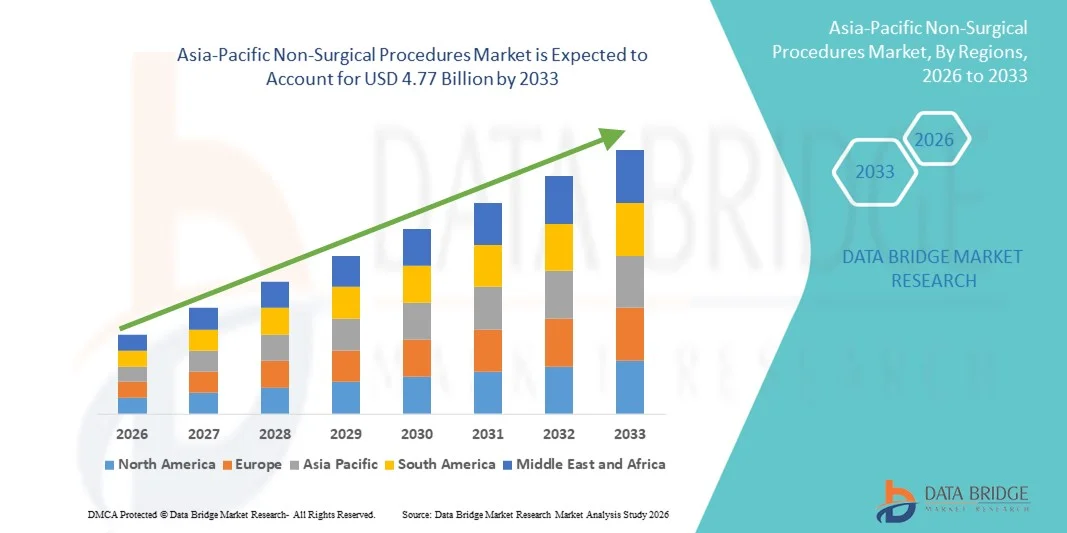

Asia-Pacific Non-Surgical Procedures Market Size

- The Asia-Pacific non-surgical procedures market size was valued at USD 2.31 billion in 2025 and is expected to reach USD 4.77 billion by 2033, at a CAGR of 9.50% during the forecast period

- The market growth is largely fueled by rising adoption of non‑surgical aesthetic and cosmetic treatments such as injectables, face care, and skin procedures, driven by increasing consumer interest in minimally invasive solutions with minimal downtime

- Furthermore, advancements in aesthetic technologies, growing disposable incomes, heightened beauty consciousness, and expanding dermatology and aesthetic clinics across the region are boosting demand for non‑surgical procedures, positioning them as preferred alternatives to traditional surgical approaches

Asia-Pacific Non-Surgical Procedures Market Analysis

- Non-surgical procedures, including injectables, laser treatments, and minimally invasive cosmetic therapies, are increasingly becoming essential components of aesthetic and dermatology services in both medical and cosmetic settings due to their reduced downtime, lower risk, and growing consumer preference for less invasive options

- The escalating demand for non-surgical procedures is primarily fueled by rising beauty consciousness, increasing disposable incomes, technological advancements in aesthetic treatments, and a preference for minimally invasive solutions over traditional surgical methods

- South Korea dominated the Asia-Pacific non-surgical procedures market with the largest revenue share of 28.5% in 2025, characterized by early adoption of advanced cosmetic technologies, a high number of dermatology and aesthetic clinics, and a strong presence of key market players

- India is expected to be the fastest growing country in the Asia-Pacific non-surgical procedures market during the forecast period, due to urbanization, rising disposable incomes, and increasing demand for aesthetic and wellness services

- Injectables segment dominated the Asia-Pacific non-surgical procedures market with a significant market share of 43.7% in 2025, driven by their established popularity, proven effectiveness, and ease of administration compared to invasive surgical alternatives

Report Scope and Asia-Pacific Non-Surgical Procedures Market Segmentation

|

Attributes |

Asia-Pacific Non-Surgical Procedures Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Non-Surgical Procedures Market Trends

Rising Adoption of Advanced Minimally Invasive Technologies

- A significant and accelerating trend in the Asia-Pacific non-surgical procedures market is the growing adoption of advanced minimally invasive aesthetic technologies such as injectables, laser therapies, and body contouring devices, enhancing treatment outcomes with minimal downtime

- For instance, Botulinum Toxin and dermal filler treatments in South Korea integrate precision delivery systems and innovative formulations, allowing clinicians to achieve highly customized results with improved safety and efficacy

- Technological advancements enable real-time monitoring of treatment parameters, improved patient comfort, and more predictable results. For instance, devices such as HIFU-based skin tightening systems can deliver targeted energy with precision while minimizing side effects

- The seamless integration of diagnostic imaging and treatment technologies allows practitioners to plan and execute procedures with higher accuracy, offering patients safer and more personalized aesthetic solutions

- This trend toward safer, more effective, and technologically enhanced non-surgical treatments is reshaping patient expectations in the Asia-Pacific region. Consequently, companies such as Hugel and Medytox are developing innovative injectable and device-based solutions that provide precision, convenience, and minimal invasiveness

- The demand for advanced non-surgical aesthetic solutions is growing rapidly across both medical and cosmetic sectors, as consumers increasingly seek treatments that offer visible results without surgical intervention

- Emerging hybrid treatments combining multiple non-surgical procedures, such as injectables with laser therapies, are gaining popularity, offering synergistic results and shorter recovery times

Asia-Pacific Non-Surgical Procedures Market Dynamics

Driver

Increasing Consumer Awareness and Rising Disposable Incomes

- The growing awareness of aesthetic treatments among consumers, coupled with rising disposable incomes in countries such as South Korea, Japan, and China, is a major driver for the rising adoption of non-surgical procedures

- For instance, in March 2025, Medytox introduced a new line of botulinum toxin products targeting mid-income consumers in China, expanding access to advanced treatments

- As individuals become more conscious of personal appearance and aging concerns, non-surgical procedures offer a less invasive, lower-risk alternative to surgical interventions, attracting a wider patient base

- Furthermore, increasing urbanization and the proliferation of dermatology and aesthetic clinics are making non-surgical procedures more accessible, integrating these treatments into mainstream cosmetic healthcare

- The convenience, minimal recovery time, and ability to customize procedures according to patient needs are key factors driving adoption. The trend toward outpatient clinics and aesthetic medical chains further supports market growth

- Rising influence of social media and celebrity endorsements is increasing demand for aesthetic procedures, motivating younger consumers to adopt non-surgical treatments earlier

- Government initiatives promoting medical tourism in countries such as South Korea, Japan, and India are creating growth opportunities by attracting international patients seeking non-surgical aesthetic procedures

Restraint/Challenge

Safety Concerns and Regulatory Compliance Hurdles

- Concerns regarding potential side effects, complications, and inconsistent treatment outcomes pose a significant challenge to market expansion, affecting consumer confidence in non-surgical procedures

- For instance, reports of skin irritation, allergic reactions, or suboptimal results with certain dermal fillers have made some patients hesitant to adopt these treatments

- Ensuring robust safety protocols, physician training, and strict adherence to regulatory standards is crucial for building trust among consumers. Companies such as Hugel and Daewoong emphasize high-quality formulations and regulatory compliance in their marketing strategies to reassure patients

- In addition, relatively high treatment costs for advanced procedures compared to traditional options can limit adoption, particularly in price-sensitive markets such as India and Southeast Asia. While basic injectable treatments are more affordable, premium technologies such as laser body contouring often carry a higher price tag

- Overcoming these challenges through enhanced safety measures, consumer education on potential risks, and development of cost-effective treatment options will be vital for sustained growth in the Asia-Pacific non-surgical procedures market

- Limited awareness about potential long-term effects of repeated non-surgical treatments can deter cautious consumers from adopting these procedures

- Strict and varying regulatory frameworks across Asia-Pacific countries increase compliance costs for manufacturers and clinics, creating entry barriers for new market participants

Asia-Pacific Non-Surgical Procedures Market Scope

The market is segmented on the basis of product type, material type, gender, usability, indication, procedure, practicians, service provider, and distribution channel.

- By Product Type

On the basis of product type, the Asia-Pacific non-surgical procedures market is segmented into injectable, non-injectables, facial rejuvenation, nonsurgical skin tightening, microdermabrasion, laser skin resurfacing, and others. The injectable segment dominated the market with the largest revenue share of 43.7% in 2025, driven by strong consumer preference for minimally invasive anti-aging solutions such as Botox and dermal fillers. Injectables are widely used for wrinkle reduction, facial contouring, and volume restoration, offering rapid results with minimal downtime. Their established safety profile and growing availability across dermatology and aesthetic clinics support widespread adoption. Social media influence and celebrity endorsements further enhance patient demand. Many providers emphasize advanced formulations and precision injection protocols to maximize efficacy and satisfaction. The segment continues to lead in both revenue and clinical adoption across key Asia-Pacific markets.

The injectable segment is also the fastest growing with a projected CAGR of 18.7% during 2025–2032, supported by innovations in biocompatible materials, expanded applications in facial aesthetics, and rising demand for preventive anti-aging treatments among younger populations. Continuous technological developments in delivery systems, tailored injection protocols, and new formulations are encouraging wider adoption. Market players are also investing in training programs for clinicians to expand treatment offerings. Social media awareness campaigns targeting millennials and Gen Z contribute to increased interest. The rising trend of combining injectables with other non-surgical procedures is enhancing patient outcomes.

- By Material Type

On the basis of material type, the market is segmented into natural and synthetic. The natural material segment dominated the market in 2025 due to patient preference for biologically derived agents perceived as safer and more compatible. Hyaluronic acid-based injectables and plant-derived ingredients in non-injectables are widely used in facial and skin rejuvenation procedures. Natural materials reduce the risk of adverse reactions, supporting higher adoption among clinics and hospitals. Clinics emphasize safe formulations and consistent quality to build patient confidence. Consumer preference for “clean” aesthetic options further reinforces demand. Many aesthetic brands market natural materials as premium offerings to attract high-value clients.

The natural material segment is the fastest growing during 2025–2032, propelled by rising consumer demand for holistic and wellness-aligned aesthetic solutions. Advancements in natural ingredient formulations and energy-based treatments are expanding applications. Patient preference for biocompatible and non-synthetic agents continues to rise. The segment is also benefiting from regulatory approvals that emphasize safety and efficacy. Awareness campaigns highlighting the benefits of natural-based procedures are increasing adoption rates. The trend of combining natural ingredients with minimally invasive technologies further boosts growth.

- By Gender

On the basis of gender, the market is segmented into male and female. The female segment dominated the market with the largest revenue share of 71.5% in 2025, as women historically account for the highest number of aesthetic procedure patients. Women show greater preference for injectables, facial rejuvenation, and skin care treatments. Social, cultural, and lifestyle factors in the region strongly influence female adoption. Clinics and hospitals design treatment packages targeting female clients to increase engagement. Marketing campaigns emphasizing beauty and wellness drive higher patient visits. Female-focused non-surgical procedures continue to lead in adoption across major Asia-Pacific countries.

The female segment is the fastest growing during 2025–2032, reflecting increased interest among younger women in preventive aesthetics and minimally invasive treatments. Social media exposure and celebrity influence accelerate adoption. Rising disposable incomes among women in urban areas support affordability. New treatment innovations targeting specific facial features appeal to younger demographics. Clinics are increasingly offering personalized consultation services to attract female patients. Awareness campaigns highlighting safety and efficacy of non-surgical procedures contribute to growth.

- By Usability

On the basis of usability, the market is segmented into professional use and direct patient. The professional use segment dominated the market in 2025, as most non-surgical procedures require certified practitioners, specialized equipment, and controlled clinical environments. Hospitals, dermatology clinics, and cosmetic centers are primary venues. Professional administration ensures efficacy and safety. Clinics emphasize staff training and adherence to standardized protocols. High-end procedures such as laser resurfacing and HIFU skin tightening are largely restricted to professional use. Professional use also drives recurring revenue through maintenance, follow-ups, and combination treatments.

The professional use segment is the fastest growing during 2025–2032, supported by the increasing number of trained practitioners and expanding aesthetic clinic networks. Urbanization in Asia-Pacific fuels demand. Investments in advanced equipment and training programs enhance adoption. Professional clinics are launching packages that combine multiple procedures for better outcomes. The growth of medical tourism contributes to increasing patient volumes. Awareness campaigns about professional-grade procedures encourage trust and utilization.

- By Indication

On the basis of indication, the market is segmented into skin lightening, facial aesthetic, body contouring, reconstructive, and others. The skin lightening segment dominated the market in 2025 due to strong cultural preferences for even and brighter skin tones across Asia-Pacific countries such as South Korea, Japan, and China. This segment includes treatments for pigmentation, sun spots, and tone uniformity. Skin lightening procedures are offered both as injectables and topical non-injectable solutions. Clinics provide customized treatment plans based on skin type and tone. Rising consumer awareness about cosmetic procedures further drives adoption. The segment benefits from high repeat usage as patients often undergo maintenance sessions to sustain results.

The skin lightening segment is the fastest growing during 2025–2032, fueled by innovations in laser therapies, chemical peels, and combination treatments. Social media and influencer marketing accelerate patient interest. Increasing disposable incomes and urbanization expand access to treatments. Clinics are introducing affordable packages targeting younger demographics. Advanced technologies ensure safer, more predictable outcomes, encouraging adoption. Government support for medical tourism in key countries also contributes to segment growth.

- By Procedure

On the basis of procedure, the market is categorized into body care, face care, and skin care. The face care segment dominated the market in 2025, driven by high demand for facial aesthetics including wrinkle reduction, dermal volume restoration, and skin rejuvenation. Facial procedures are often the first choice for patients seeking visible results with minimal downtime. Clinics prioritize face care treatments due to higher revenue potential and patient repeat visits. Social media influence and celebrity endorsements contribute to increased adoption. Advanced injectables, HIFU, and laser treatments are concentrated in this segment. Customized treatment protocols enhance patient satisfaction and drive market dominance.

The face care segment is the fastest growing during 2025–2032, reflecting growing interest in non-invasive treatments for anti-aging, skin tightening, and contouring. Rising awareness among millennials drives early adoption. Technological innovations improve precision and safety. Clinics are offering combination treatments to enhance efficacy. Urban population growth and disposable incomes expand patient access. Marketing campaigns targeting aesthetic-conscious consumers further accelerate adoption.

- By Practicians

On the basis of practicians, the market is segmented into dermatologists, aesthetic doctors, plastic surgeons, independent aesthetic professionals, and others. The dermatologists segment dominated in 2025 as dermatologists provide the majority of non-surgical procedures with clinical expertise in skin and facial aesthetics. Their established reputation ensures patient trust and safety. Dermatology clinics offer full-service portfolios including injectables, lasers, and rejuvenation therapies. Repeat treatments and long-term follow-ups generate stable revenue. Clinics leverage certified dermatologists to attract high-value clients. Training programs and workshops further strengthen dermatologists’ market position.

The aesthetic doctors segment is the fastest growing during 2025–2032, driven by increasing specialization in cosmetic procedures outside traditional dermatology. Trained aesthetic practitioners expand access to non-surgical treatments in smaller towns and semi-urban areas. Rising consumer awareness supports adoption of newer technologies. Clinics provide tailored consultation services to increase patient satisfaction. Partnerships with global brands for training and certification improve credibility. Growth in medical tourism and cross-border procedures also supports the segment.

- By Service Provider

On the basis of service provider, the market is segmented into hospitals, medical spas & beauty centers, cosmetic centers, dermatology clinics, homecare setting, and others. Dermatology clinics dominated the market in 2025 due to their expertise, full-service offerings, and professional credibility. Clinics are equipped with advanced injectables, lasers, and skin care technologies. They attract repeat visits through personalized care and maintenance treatments. Urban expansion of dermatology networks increases patient accessibility. Clinics often bundle treatments to improve patient outcomes and revenues. Established reputation and clinician expertise drive patient preference for dermatology clinics over other service providers.

Dermatology clinics are the fastest growing during 2025–2032, supported by increasing clinic openings in urban and semi-urban Asia-Pacific regions. Expansion of certified practitioners improves service availability. Clinics invest in advanced equipment to offer premium non-surgical procedures. Awareness campaigns highlight safety and efficacy to attract new patients. Combination treatment offerings further enhance adoption rates. Growth in aesthetic medical tourism contributes to increasing patient inflow.

- By Distribution Channel

On the basis of distribution channel, the market is categorized into direct tender and retail sales. The direct tender segment dominated in 2025, as hospitals, dermatology clinics, and professional service providers purchase consumables and devices in bulk through institutional channels. Bulk procurement ensures a steady supply of injectables, energy-based devices, and non-injectable products. Institutions prioritize quality, regulatory compliance, and reliability in supplier selection. Direct tender channels allow cost efficiency through negotiated pricing. Clinics and hospitals rely on tenders to maintain consistent inventory for high patient volumes. Institutional purchases also support treatment scalability and clinic growth.

The retail sales segment is the fastest growing during 2025–2032, driven by the increasing availability of OTC skin care products, home-use devices, and patient-driven self-care treatments. Rising consumer interest in home-based beauty solutions complements professional procedures. Affordable home-use alternatives encourage trial and adoption. Online and retail channels expand accessibility to smaller towns. Social media and influencer marketing support awareness and demand. Growing trend of integrating retail products with clinic services fuels segment growth

Asia-Pacific Non-Surgical Procedures Market Regional Analysis

- South Korea dominated the Asia-Pacific non-surgical procedures market with the largest revenue share of 28.5% in 2025, characterized by early adoption of advanced cosmetic technologies, a high number of dermatology and aesthetic clinics, and a strong presence of key market players

- Consumers in the region highly value the effectiveness, safety, and convenience offered by non-surgical procedures such as injectables, laser skin resurfacing, and facial rejuvenation, which provide visible results with minimal downtime

- This widespread adoption is further supported by rising disposable incomes, increasing urbanization, and growing awareness of aesthetic and wellness treatments, establishing non-surgical procedures as the preferred choice for cosmetic enhancements in both medical and spa settings

South Korea Non-Surgical Procedures Market Insight

The South Korea non-surgical procedures market accounted for the largest revenue share in Asia-Pacific in 2025, fueled by the country’s reputation as a global leader in cosmetic and aesthetic innovations. Consumers are highly receptive to advanced non-invasive treatments such as Botox, dermal fillers, and skin tightening procedures. The market benefits from a dense network of clinics, high disposable incomes, and strong cultural emphasis on appearance. Government support for medical tourism and continuous technological advancements further accelerate growth. Clinics also leverage personalized treatment protocols to meet patient-specific aesthetic goals, ensuring high adoption rates.

China Non-Surgical Procedures Market Insight

The China non-surgical procedures market is experiencing rapid growth due to increasing urbanization, rising middle-class incomes, and growing aesthetic awareness among both women and men. The adoption of minimally invasive procedures, such as injectables and laser skin treatments, is supported by an expanding number of clinics and aesthetic centers. Consumer preference for safe, effective, and convenient treatments is driving demand. The growth of online consultations, social media influence, and cosmetic education programs further fuels the market. Moreover, government initiatives to promote healthcare infrastructure and medical tourism are enhancing accessibility to advanced non-surgical treatments.

Japan Non-Surgical Procedures Market Insight

The Japan non-surgical procedures market is gaining momentum due to the country’s high-tech culture, rapid urbanization, and preference for non-invasive aesthetic solutions. Japanese consumers emphasize safety, precision, and minimal recovery time, driving the adoption of injectables, skin rejuvenation, and laser-based treatments. Clinics are increasingly integrating digital imaging and AI-assisted procedures to enhance treatment accuracy. The country’s aging population is further spurring demand for anti-aging and minimally invasive procedures. In addition, rising medical tourism and domestic awareness of aesthetic trends contribute to sustained market growth in Japan.

India Non-Surgical Procedures Market Insight

The India non-surgical procedures market is witnessing significant growth in 2025, driven by a rapidly expanding middle class, increasing urbanization, and rising awareness of minimally invasive aesthetic treatments. Injectables, laser procedures, and facial rejuvenation treatments are gaining traction across metropolitan and tier-2 cities. The emergence of affordable treatment options, alongside a growing number of dermatology clinics and cosmetic centers, is making non-surgical procedures more accessible. Rising medical tourism, coupled with the availability of skilled practitioners and advanced technologies, supports robust market growth. The market is further propelled by increasing social media influence and the desire for aesthetic enhancements among younger populations.

Asia-Pacific Non-Surgical Procedures Market Share

The Asia-Pacific Non-Surgical Procedures industry is primarily led by well-established companies, including:

- AbbVie (U.S.)

- GALDERMA (Switzerland)

- Merz Pharma GmbH & Co. KGaA (Germany)

- Hugel Aesthetics (South Korea)

- Lumenis (Israel)

- Cutera (U.S.)

- Alma Lasers (Israel)

- Cynosure (U.S.)

- Venus Concept (Canada)

- Hologic (U.S.)

- BTL Aesthetics (Czech Republic)

- Ipsen (France)

- Revance Therapeutics (U.S.)

- Medytox (South Korea)

- Classys (South Korea)

- Jeisys Medical (South Korea)

- Dr. Wu Skincare (Taiwan)

- GC Aesthetics (Ireland)

- Candela (U.S.)

- Fotona (Slovenia)

What are the Recent Developments in Asia-Pacific Non-Surgical Procedures Market?

- In October 2025, China’s National Medical Products Administration approved two new domestic cosmetic ingredients for registration, marking a significant advancement in local cosmetic ingredient innovation and opening new opportunities for product development in Asia‑Pacific non‑surgical skin care and aesthetic treatments

- In February 2025, industry data highlighted rising overall demand for non‑surgical procedures such as Botox and hyaluronic acid fillers across Asia‑Pacific, with millions of procedures performed globally and non‑surgical treatments such as neurotoxins and skin tightening among the fastest‑growing segments, reflecting broader consumer adoption trends

- In October 2024, Galderma hosted its largest Asia‑Pacific Aesthetic Injector Network (GAIN) event, bringing together over 650 healthcare professionals from 14 countries to explore future aesthetic trends and elevate clinical expertise across the non‑surgical procedures landscape, highlighting the region’s rapid innovation and skills development

- In September 2024, Allergan Aesthetics announced the approval and launch of BOTOX® Cosmetic for the treatment of masseter muscle prominence (MMP) in China, marking the first neurotoxin approved locally for this indication, addressing significant aesthetic concerns specific to Asian facial anatomy and expanding minimally invasive treatment options in the region

- In August 2022, Allergan Aesthetics launched Juvéderm VOLUX in India, broadening the availability of advanced hyaluronic acid fillers tailored to regional aesthetic preferences and supporting expansion of non‑surgical facial contouring treatments in key emerging markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.