Asia Pacific Nutraceutical Excipients Market

Market Size in USD Million

CAGR :

%

USD

297.61 Million

USD

463.72 Million

2024

2032

USD

297.61 Million

USD

463.72 Million

2024

2032

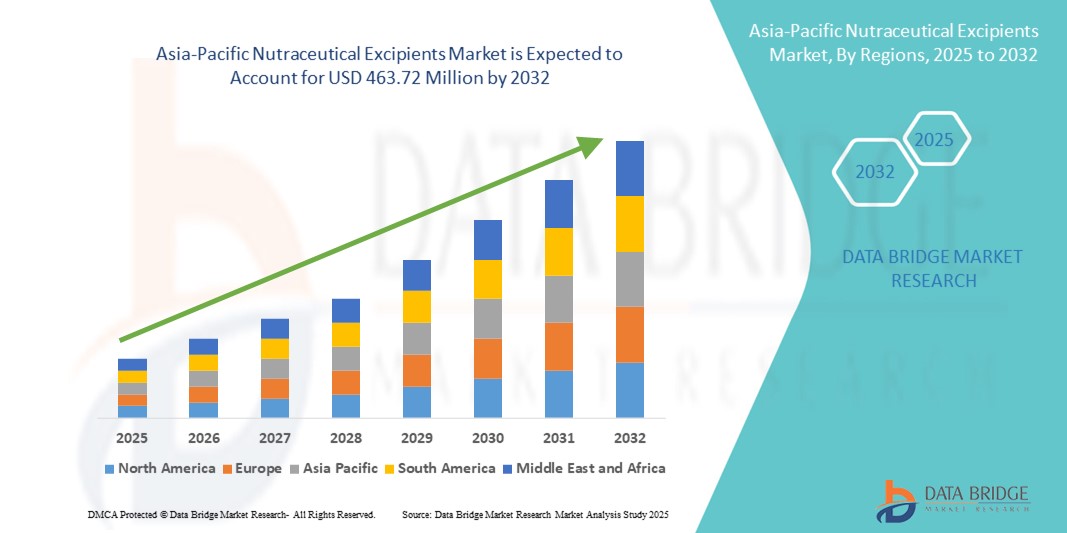

| 2025 –2032 | |

| USD 297.61 Million | |

| USD 463.72 Million | |

|

|

|

|

Asia-Pacific Nutraceutical Excipients Market Size

- The Asia-Pacific nutraceutical excipients market size was valued at USD 297.61 million in 2024 and is expected to reach USD 463.72 million by 2032, at a CAGR of 5.7% during the forecast period

- The market growth is primarily driven by increasing consumer awareness of health and wellness, coupled with the rising demand for dietary supplements and functional foods across countries such as China, India, and Japan

- Moreover, advancements in formulation technologies and the need for improved bioavailability, stability, and taste masking in nutraceutical products are fueling the adoption of specialized excipients. Growing regulatory support and expanding nutraceutical manufacturing infrastructure further support market expansion in the region

Asia-Pacific Nutraceutical Excipients Market Analysis

- Nutraceutical excipients, essential for improving the formulation, stability, and delivery of dietary supplements and functional foods, are gaining increasing importance in the Asia-Pacific region driven by rising health awareness and expanding nutraceutical consumption

- The escalating demand for nutraceutical excipients is primarily fueled by growing consumer preference for natural and clean-label products, stringent regulatory frameworks, and advancements in excipient technologies enhancing bioavailability and product quality

- China dominated the Asia-Pacific nutraceutical excipients market with the largest revenue share of 39% in 2024, supported by its robust nutraceutical manufacturing industry and increasing consumer health consciousness

- India is expected to be the fastest-growing country in the Asia-Pacific nutraceutical excipients market during the forecast period, owing to rising disposable incomes and expanding urban populations adopting healthier lifestyles

- Carriers segment dominated the Asia-Pacific nutraceutical excipients market with a share of 43.2% in 2024, driven by their critical role in improving ingredient stability and nutrient delivery in various nutraceutical formulations

Report Scope and Asia-Pacific Nutraceutical Excipients Market Segmentation

|

Attributes |

Asia-Pacific Nutraceutical Excipients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Nutraceutical Excipients Market Trends

Rising Preference for Natural and Clean-Label Excipients

- A major and growing trend in the Asia-Pacific nutraceutical excipients market is the increasing demand for natural, plant-based, and clean-label excipients, driven by consumer preference for safer and additive-free dietary supplements

- For instance, suppliers such as Roquette and Cargill are expanding their portfolios with natural excipients derived from sources such as corn, rice, and tapioca to meet rising clean-label demands. This shift supports manufacturers in developing products that appeal to health-conscious consumers

- The emphasis on natural excipients also aligns with stricter regional regulatory frameworks encouraging transparency and safety in nutraceutical formulations

- Companies are investing in R&D to enhance the functionality of natural excipients, such as improving bioavailability and taste masking, which helps expand their application in diverse nutraceutical products

- Increasing collaboration between excipient manufacturers and nutraceutical producers is driving innovation in customized excipient blends tailored for specific health benefits and delivery mechanisms

- Digitalization and automation in nutraceutical manufacturing are enhancing excipient processing efficiency and quality consistency, further propelling market growth

Asia-Pacific Nutraceutical Excipients Market Dynamics

Driver

Increasing Health Awareness and Functional Food Demand

- The growing consumer focus on health and wellness in countries such as China and India is a key driver fueling the demand for nutraceuticals and, consequently, for high-performance excipients

- For instance, rising prevalence of lifestyle-related diseases is prompting greater intake of vitamin and mineral supplements, driving the need for excipients that enhance formulation stability and efficacy

- The expanding functional food market, along with growing urbanization and disposable incomes, supports steady growth in nutraceutical production and excipient consumption

- Furthermore, government initiatives promoting nutrition and preventive healthcare in the region encourage innovation and investment in nutraceutical ingredients and excipients

- Increasing penetration of e-commerce channels in Asia-Pacific is expanding access to nutraceutical products, boosting excipient demand as manufacturers scale up production

- Growing consumer preference for personalized nutrition is encouraging the development of specialized excipient formulations to support targeted health benefits

Restraint/Challenge

Stringent Regulatory Requirements and Supply Chain Constraints

- Compliance with evolving regulatory standards related to excipient safety, quality, and labeling poses significant challenges for manufacturers and suppliers in the Asia-Pacific region

- For instance, in 2023, several nutraceutical excipient shipments were delayed at Indian ports due to tightened import inspections and documentation requirements, causing supply bottlenecks

- Variations in regulations across countries complicate market entry and increase costs for excipient producers

- In addition, sourcing high-quality natural raw materials can be affected by agricultural inconsistencies and supply chain disruptions, impacting excipient availability and pricing

- Rising raw material costs due to climate change impacts on crop yields may further pressure excipient pricing and margins

- Limited awareness among smaller nutraceutical manufacturers regarding excipient quality standards can lead to inconsistent product performance, hindering market expansion

- Addressing these challenges through enhanced quality control, regulatory harmonization efforts, and strategic sourcing partnerships is critical for sustained market growth

Asia-Pacific Nutraceutical Excipients Market Scope

The market is segmented on the basis of type, end product, form, excipient source, and distribution channel.

- By Type

On the basis of type, the Asia-Pacific nutraceutical excipients market is segmented into flavoring agents, coloring agents, sweeteners, coating agents, buffers, solvents, carriers, antifoams, gliding agents, wetting agents, thickeners/gelling agents, preservatives, binders, disintegrates, lubricants, fillers and diluents, and others. The carriers segment dominated the market with the largest revenue share of 43.2% in 2024, driven by their critical role in improving the stability, bioavailability, and delivery of active nutraceutical ingredients. Carriers are widely used across various supplement formulations, enabling effective ingredient dispersion and sustained release. The functional versatility of carriers makes them essential for manufacturers aiming to optimize product efficacy and consumer appeal.

The coating agents segment is anticipated to witness the fastest growth rate during the forecast period due to increasing demand for taste masking and enhanced product aesthetics in supplements, especially in capsules and tablets.

- By End Product

On the basis of end product, the Asia-Pacific nutraceutical excipients market is segmented into prebiotics, probiotics, protein and amino acid supplements, mineral supplements, vitamin supplements, omega-3 supplements, and other supplements. The vitamin supplements segment held the largest market revenue share of 36.2% in 2024, reflecting the high consumer demand for immune support and overall wellness products in the region. Vitamin supplements benefit from steady year-round consumption and are often the first choice for nutraceutical formulations, driving excipient usage.

The protein and amino acid supplements segment is expected to register the fastest growth rate during forecast period, due to the rising fitness culture and increasing demand for sports nutrition products across urban centers.

- By Form

On the basis of form, the Asia-Pacific nutraceutical excipients market is segmented into dry and liquid forms. The dry form segment dominated the market with a 58.4% share in 2024, favored for its longer shelf life, ease of transport, and compatibility with various manufacturing technologies. Dry excipients such as powders and granules are widely used in tablet, capsule, and powder supplement production.

The liquid form segment is anticipated to grow steadily during forecast period, due to increasing consumption of liquid nutraceutical products such as syrups and functional beverages requiring specialized excipients for stability and texture.

- By Excipient Source

On the basis of excipient source, the Asia-Pacific nutraceutical excipients market is segmented into natural and synthetic excipients. Natural excipients dominated the market with a 54.1% share in 2024, driven by growing consumer preference for clean-label, plant-based ingredients perceived as safer and healthier. This trend is supported by regulatory encouragement for natural ingredient use and innovations in sourcing sustainable raw materials.

The synthetic excipients segment is expected to grow moderately during forecast period, favored for its cost-effectiveness and consistent quality in large-scale manufacturing.

- By Distribution Channel

On the basis of distribution channel, the Asia-Pacific nutraceutical excipients market is segmented into direct tender, retail sales, and others. Retail sales dominated with a 62.3% revenue share in 2024, reflecting the wide availability of nutraceutical products through pharmacies, health stores, supermarkets, and expanding e-commerce platforms. Retail channels provide easy consumer access and support product visibility and brand loyalty.

The direct tender segment is expected to witness growth during forecast period, due to increasing bulk purchases by institutional buyers such as hospitals, nutrition centers, and wellness clinics focusing on preventive healthcare.

Asia-Pacific Nutraceutical Excipients Market Regional Analysis

- China dominated the Asia-Pacific nutraceutical excipients market with the largest revenue share of 39% in 2024, supported by its robust nutraceutical manufacturing industry and increasing consumer health consciousness

- Consumers in China increasingly prioritize dietary supplements and functional foods for wellness and preventive healthcare, boosting demand for advanced excipients that improve product stability and bioavailability

- This dominance is supported by strong government support, increasing disposable incomes, urbanization, and expanding production facilities, positioning China as the central hub for nutraceutical excipient innovation and market growth in the region

The China Nutraceutical Excipients Market Insight

The China nutraceutical excipients market dominated the Asia-Pacific market with the largest revenue share of 39% in 2024, driven by rapid industrialization of nutraceutical manufacturing and increasing consumer health awareness. The growing demand for dietary supplements and functional foods, supported by government policies promoting preventive healthcare, is fueling the adoption of advanced excipients that enhance product stability and efficacy. China’s expanding urban population and rising disposable incomes further support market growth.

India Nutraceutical Excipients Market Insight

The India nutraceutical excipients market accounted for a significant revenue share in the Asia-Pacific region in 2024, propelled by rapid urbanization, a growing middle class, and increasing health consciousness. The surge in demand for dietary supplements and personalized nutrition is driving excipient consumption, especially in vitamin and mineral supplement formulations. Government initiatives aimed at improving nutrition and expanding the nutraceutical sector, alongside rising e-commerce penetration, are key growth factors.

Japan Nutraceutical Excipients Market Insight

The Japan nutraceutical excipients market is growing steadily, supported by its aging population and high consumer preference for health and wellness products. The demand for excipients used in functional foods, prebiotics, and probiotics is rising, fueled by government health programs and a strong focus on product safety and quality. Advanced R&D capabilities in Japan enable the development of innovative excipient solutions tailored for improved bioavailability and consumer appeal.

South Korea Nutraceutical Excipients Market Insight

The South Korea nutraceutical excipients market is witnessing rapid growth due to increasing adoption of functional foods and dietary supplements. The country’s well-established health and wellness culture, combined with technological advancements in excipient formulation and increasing exports, contributes to market expansion. Rising investments in nutraceutical research and development and government support for innovative ingredients also drive growth.

Australia Nutraceutical Excipients Market Insight

The Australia nutraceutical excipients market is expanding, driven by increasing consumer preference for natural and clean-label supplements. The country’s regulatory environment emphasizes product safety and efficacy, encouraging manufacturers to adopt high-quality excipients. Growing health awareness and the rising trend of preventive healthcare among the population are fostering demand for excipient-enabled nutraceutical products across retail and healthcare channels.

Asia-Pacific Nutraceutical Excipients Market Share

The Asia-Pacific nutraceutical excipients industry is primarily led by well-established companies, including:

- Roquette Frères (France)

- Cargill, Incorporated (U.S.)

- Ingredion Incorporated (U.S.)

- BASF SE (Germany)

- DuPont de Nemours, Inc. (U.S.)

- Kerry Group plc (Ireland)

- Associated British Foods plc (U.K.)

- Archer Daniels Midland Company (U.S.)

- Tate & Lyle PLC (U.K.)

- Corbion N.V. (Netherlands)

- JRS Pharma GmbH & Co. KG (Germany)

- DFE Pharma (Netherlands)

- Eastman Chemical Company (U.S.)

- Evonik Industries AG (Germany)

- Ashland Global Holdings Inc. (U.S.)

- Lubrizol Corporation (U.S.)

- Mitsubishi Chemical Holdings Corporation (Japan)

- Kerry Ingredients & Flavours (Ireland)

- Givaudan SA (Switzerland)

- Fuji Chemical Industries Co., Ltd. (Japan)

What are the Recent Developments in Asia-Pacific Nutraceutical Excipients Market?

- In March 2025, IFF Pharma Solutions showcased its cutting-edge excipient technologies at CPhI Japan 2025. The company highlighted innovations in oral disintegrating tablets (ODTs), controlled-release formulations, and novel complex formulations, demonstrating its leadership in excipient development for the nutraceutical industry

- In October 2024, Cargill announced its strategic focus on expanding its specialized nutrition business in the Asia-Pacific region. Building on over 40 years of experience in infant nutrition and flavor expertise, Cargill aims to develop science-backed innovations that support consumer needs across various life stages. This initiative underscores Cargill's commitment to advancing the nutraceutical excipients market by offering tailored solutions that promote health and well-being

- In September 2024, Cargill introduced its Specialized Nutrition category, providing innovative, science-backed nutritional solutions. This initiative reflects Cargill's commitment to advancing the nutraceutical excipients market by offering specialized ingredients that support health and well-being across all life stages

- In April 2023, Ingredion Incorporated announced two strategic investments in India to expand into high-value pharmaceutical applications. This move underscores Ingredion's commitment to enhancing its capabilities in the nutraceutical excipients market, particularly in the rapidly growing Indian pharmaceutical sector

- In September 2022, Roquette, a global leader in plant-based ingredients, announced the acquisition of Crest Cellulose, an Indian excipient manufacturer. This strategic move aims to enhance Roquette's presence in the Asia-Pacific region and expand its portfolio of plant-based excipients for the pharmaceutical and nutraceutical industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.