Asia Pacific Optical Fiber Components Market

Market Size in USD Billion

CAGR :

%

USD

4.89 Billion

USD

13.42 Billion

2024

2032

USD

4.89 Billion

USD

13.42 Billion

2024

2032

| 2025 –2032 | |

| USD 4.89 Billion | |

| USD 13.42 Billion | |

|

|

|

|

Asia-Pacific Optical Fiber Components Market Size

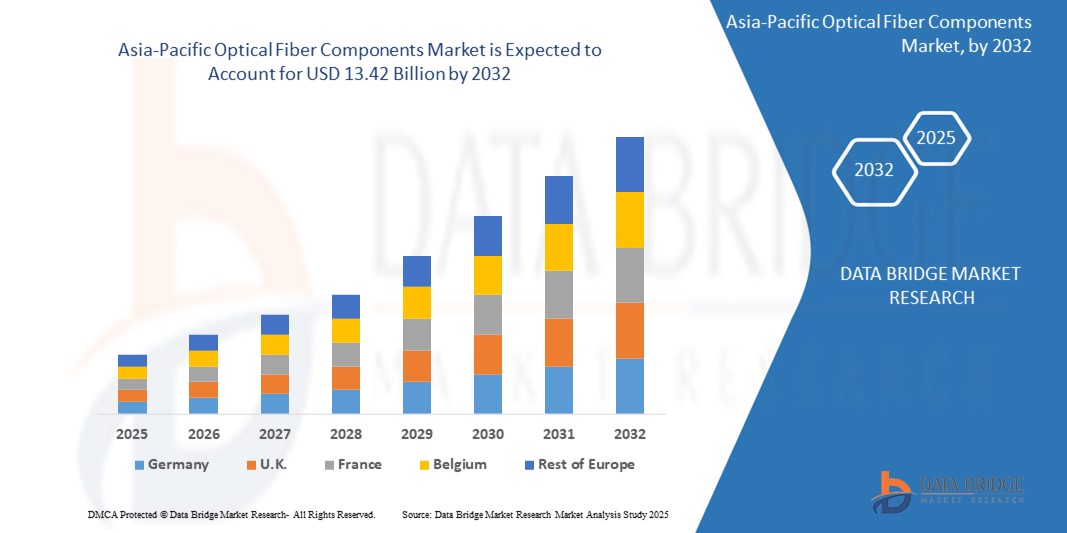

- The Asia-Pacific optical fiber components market is projected to reach USD 4.89 billion by 2024 and is expected to grow to USD 13.42 billion by 2032, registering a CAGR of 15.51% during the forecast period..

- This strong growth reflects rising demand for high-speed connectivity, the rollout of 5G networks, and the growing importance of seamless communication across industries. As the digital economy expands, wireless infrastructure is becoming the backbone of everything from smart cities and connected homes to industrial automation and remote healthcare.

Asia-Pacific Optical Fiber Components Market Analysis

- Optical fiber technology is quietly transforming how Asia-Pacific connects, communicates, and evolves digitally. From everyday internet use to advanced technologies like AI and cloud computing, the demand for faster, more reliable data transmission is pushing countries across the region to upgrade their digital infrastructure. Optical fiber components—like amplifiers, connectors, and transceivers—are at the heart of this shift, enabling seamless, high-speed communication across long distances.

- A major driver behind this growth is the rollout of 5G. But it’s not just about faster smartphones—5G powers smart cities, connected vehicles, automated factories, and telemedicine. To handle this surge in data, networks need stronger, faster backbones—and that’s exactly where fiber steps in. Whether it's connecting base stations or supporting ultra-low latency applications, fiber components are essential in making the 5G vision a reality.

- Across the region, both governments and private players are stepping up investments. In countries like China and South Korea, the focus is on expanding and optimizing next-gen networks, while in emerging markets like India and Southeast Asia, efforts are being made to close connectivity gaps and improve rural access. No matter the stage of digital development, optical fiber infrastructure is seen as the key to enabling a connected and future-ready Asia-Pacific.

Report Scope and Asia-Pacific Optical Fiber Components Market Segmentation

|

Attributes |

Asia-Pacific Optical Fiber Components Market Key Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

As both developed and emerging economies in the region ramp up 5G deployment, there's a soaring need for high-bandwidth, low-latency optical fiber infrastructure to support dense networks and seamless backhaul connectivity.

Businesses across sectors like BFSI, IT, and healthcare are upgrading to fiber-based LANs and data center connections to support real-time operations, cloud migration, and advanced analytics..

Governments in countries such as China, India, and Singapore are investing heavily in smart city infrastructure, requiring robust fiber connectivity for smart lighting, surveillance, public Wi-Fi, and connected transport systems.

With the rise of IoT devices and demand for localized data processing, fiber optics are becoming crucial for connecting distributed edge data centers and ensuring minimal latency

The boom in digital services is driving large-scale investments in hyperscale and regional data centers, all of which require high-performance optical fiber links for storage, processing, and communication |

|

Value Added Data Infosets |

|

Asia-Pacific Optical Fiber Components Market Trends

“Fiber First: Powering Asia-Pacific’s Digital Shift”

- The demand for high-speed, reliable internet is skyrocketing across Asia-Pacific, and optical fiber is at the heart of this transformation. As more countries roll out 5G networks, expand cloud infrastructure, and adopt smart technologies, the need for faster, more stable data transmission is becoming critical. Optical fiber components like connectors, amplifiers, and transceivers are enabling this shift, acting as the foundation for everything from streaming videos and remote work to real-time medical services and connected vehicles.

- One of the biggest drivers of this market is the massive rollout of 5G. Unlike previous generations, 5G isn’t just about faster phones it supports entire ecosystems of connected devices, from smart traffic systems to industrial automation. But to make 5G work, you need strong fiber backhaul to carry all that data. Countries like China, Japan, South Korea, and India are investing heavily in fiber infrastructure to keep up with the surge in data demand.

- At the same time, fiber deployment isn’t without its challenges. High installation costs, time-consuming regulatory processes, and a shortage of skilled labor in some emerging markets can slow progress. Laying cables through urban landscapes or across remote regions often involves complex logistics and significant expenses. However, innovative approaches like shared fiber networks and public-private partnerships are helping ease the burden and speed up implementation.

- Opportunities are also opening up with the growth of edge computing and IoT. As more devices collect and process data locally, the need for low-latency connections is increasing. Fiber supports this by offering the kind of speed and reliability wireless solutions can’t always guarantee. Whether it’s powering a smart factory or enabling real-time healthcare monitoring, fiber is proving essential in supporting advanced, data-driven applications across the region

Asia-Pacific Optical Fiber Components Market Dynamics

Drive

“Surging Digital Demand and 5G-Driven Fiber Expansion”

- Across Asia-Pacific, the digital landscape is evolving fast driven by a wave of 5G rollouts, smart city initiatives, and skyrocketing data consumption. From high-definition streaming and cloud computing to AI-powered services and IoT ecosystems, the region's hunger for speed and bandwidth is pushing telecom operators to upgrade their networks at scale. And at the core of these upgrades lies optical fiber.

- 5G, in particular, is a major catalyst. Unlike earlier mobile generations, 5G requires ultra-fast, low-latency fiber backhaul to support dense networks of small cells and edge data centers. This is prompting major investments in optical fiber components like transceivers, connectors, and amplifiers across countries such as China, India, South Korea, and Japan.

- Additionally, governments are playing an active role offering incentives, funding broadband expansion plans, and easing regulatory bottlenecks to accelerate fiber deployments. Public-private partnerships are on the rise, especially in rural and semi-urban areas where infrastructure gaps still exist.

- The growing presence of hyperscale data centers and rising demand for FTTH (Fiber-to-the-Home) connections further fuel the need for high-performance optical fiber networks. With more users working from home, gaming online, or accessing cloud-based tools, the importance of reliable, fiber-enabled connectivity has never been clearer.

Restraint/Challenge

“High Installation Costs and Infrastructure Complexities”

- Deploying fiber networks isn’t as simple as flipping a switch it involves significant capital investments, time, and logistical planning. In densely populated urban areas, challenges include right-of-way permissions, road excavation, and coordinating with multiple municipal agencies. Meanwhile, rural and remote regions face issues like difficult terrain, lack of existing infrastructure, and lower population density making returns on investment less attractive.

- Moreover, inconsistent regulatory environments across Asia-Pacific can delay projects. While some countries have streamlined their fiber deployment policies, others still struggle with fragmented permitting processes, import restrictions on components, or lack of clarity in infrastructure-sharing norms. For many operators, these factors not only increase deployment time and cost but also slow down the pace of digital inclusion in underserved areas.

• By Infrastructure Type

- Core Network: The backbone of all data transmission, core fiber networks connect regional and national hubs, ensuring high-speed communication over long distances. These are crucial for managing large-scale internet traffic, cloud connectivity, and intercontinental data flow.

- Access Network: These networks bring fiber directly to homes and businesses (FTTH/B). In Asia-Pacific, access networks are rapidly expanding due to rising broadband demand, especially in metro and suburban areas..

- Metro Network: These serve densely populated city centre’s and commercial zones. Metro fiber networks bridge the gap between core and access layers, supporting everything from 5G small cells to data-intensive urban applications.

- Data Center Interconnect: With the rise of hyperscale and edge data centers in APAC, there’s growing need for fast, reliable fiber links between them. This infrastructure type is key for cloud services, streaming platforms, and real-time analytics

• By Component

- Hardware: Hardware remains the dominant segment, driven by strong demand for transceivers, connectors, amplifiers, optical cables, and splitters. These components are vital for building out physical fiber networks supporting 5G, FTTx, and enterprise connectivity.

- Software: As networks get smarter and more complex, software is playing a growing role in monitoring, managing, and optimizing fiber performance. AI-based tools are helping operators reduce downtime, predict failures, and ensure efficiency.

- Services: Planning, deployment, and ongoing maintenance services are essential especially in large, multi-country rollouts. Skilled services help ensure quality control, faster installations, and long-term performance of fiber networks.

• By Network Technology

- 4G LTE: Still a major driver in several developing markets across Asia-Pacific, 4G networks heavily rely on fiber for backhaul and expansion, especially in semi-urban and rural zones.

- 5G: The fastest-growing segment, 5G demands dense, low-latency fiber backhaul to connect small cells, edge nodes, and data centers. Countries like China, South Korea, and India are heavily investing in fiber to support national 5G coverage.

- Wi-Fi 6/6E: Rising adoption in enterprise campuses, education, and healthcare environments is boosting the need for robust fiber links that support higher bandwidth and more devices simultaneously.

- Future Technologies (6G, Edge, LEO Satellites): While still in early development, these technologies will eventually need fiber to support ground infrastructure and interconnect global data networks with ultra-low latency.

- Future Technologies (6G, LEO Satellites) are in early development stages, with strong long-term potential for ultra-high-speed connectivity.

• By Ownership Type

- Telecom Operators: Lead fiber ownership in most APAC markets. From 5G backhaul to last-mile FTTH networks, operators like Reliance Jio, China Mobile, and NTT are aggressively expanding fiber footprints.

- Cloud & Content Providers: Major hyper scalers like Google, Amazon, and Tencent are investing in private fiber networks to support data centers and regional cloud zones.

- Private Network Providers: Enterprises in manufacturing, mining, and logistics are deploying their own fiber-based private networks for secure, high-performance connectivity.

- Government Agencies: Governments play a major role in broadband infrastructure, especially in rural and underserved areas. Programs like BharatNet (India) and digital inclusion efforts in Southeast Asia are fueling fiber deployment

By End User

- Telecom: The largest consumer segment, as operators build and upgrade networks to handle rising data demand and prepare for future technologies.

- Data Centers: With APAC becoming a data hub, hyperscale and edge data centers depend on fiber for fast, secure, and scalable interconnection.

- Enterprises (BFSI, Healthcare, Retail): These industries require reliable, high-speed connections for digital operations, remote monitoring, AI tools, and cloud-based applications.

- Government & Smart Cities: Fiber powers smart infrastructure—from surveillance cameras and traffic sensors to public Wi-Fi and e-governance platforms.

- Transportation & Logistics: Fiber supports real-time tracking, automated logistics systems, and connected infrastructure for rail, air, and shipping sectors.

- Residential: Smart homes, streaming, online gaming, and IoT device usage are driving demand for fiber-based broadband, especially in urban and tier-2 cities.

Asia-Pacific Optical Fiber Components Market – Regional Development Analysis

- China

China leads the region—and the world—in optical fiber deployment. Backed by large-scale 5G rollouts, smart city initiatives, and massive investments in data center infrastructure, China is also home to major manufacturers like YOFC and ZTT. The government’s focus on “New Infrastructure” and digital economy expansion ensures continued demand for fiber components across telecom, enterprise, and industrial sectors.

- India

India is experiencing rapid growth in fiber deployments driven by nationwide 5G rollouts, rural broadband initiatives like BharatNet, and the expansion of data centers. Telecom operators such as Jio and Airtel are investing heavily in FTTH (Fiber-to-the-Home) and fiber backhaul to support increasing data traffic. Government support and public-private partnerships are helping bridge connectivity gaps in tier-2 and rural areas..

- Japan

Japan maintains a mature and highly advanced fiber network landscape, with high penetration of FTTH services and early adoption of 5G. The country is investing in upgrading its metro and core networks to support emerging applications such as robotics, autonomous mobility, and smart manufacturing—all of which demand high-speed, low-latency fiber connectivity.

- South Korea

South Korea has one of the most fiber-connected populations globally. The nation is investing in next-gen technologies like 6G, edge computing, and AI, which will further strengthen demand for optical fiber components. Continuous upgrades to its ultra-dense network infrastructure are making South Korea a model for digital transformation in the region

- Southeast Asia

Countries like Singapore, Malaysia, Vietnam, and Thailand are witnessing significant growth in fiber deployments, fueled by smart city projects, 5G rollouts, and the rise of digital services. While urban areas are seeing robust infrastructure development, rural regions are still catching up—creating opportunities for both public investment and private innovation.

Asia-Pacific Optical Fiber Components Market Insight

The Asia-Pacific optical fiber components market is competitive, with a mix of global fiber manufacturers and regionally dominant suppliers.

Companies like Corning Incorporated, Fujikura Ltd., and Sumitomo Electric Industries lead the global market with end-to-end fiber optic solutions. These vendors offer everything from optical cables and connectors to high-density fiber systems for telecom and data center applications. YOFC (Yangtze Optical Fibre and Cable), ZTT Group, and Hengtong Group dominate the Chinese market and are expanding regionally through large-scale 5G and broadband projects. Sterlite Technologies is gaining share through its integrated fiber network solutions and growing presence in South and Southeast Asia. Other notable players include Prysmian Group, CommScope, Furukawa Electric, and HUBER+SUHNER, who are innovating in areas like fiber-to-the-home (FTTH), high-speed interconnects, and passive optical components..

The following companies are recognized as major players in the Global Wireless Infrastructure market:

- Corning Incorporated (US)

- Sumitomo Electric Industries, Ltd. (Japan)

- Prysmian Group (Italy)

- Yangtze Optical Fibre and Cable Joint Stock Limited Company (China)

- Fujikura Ltd. (Japan)

- LEONI (Germany)

- LS Cable & System Ltd. (South Korea)

- Hengtong Group Co., Ltd. (China)

- Furukawa Electric Co. Ltd. (Japan)

- Optical Cable Corporation (US)

- LS Cable & System Ltd. (South Korea)

- Proterial Cable America Inc., (US)

- Coherent Corporation (US)

- Finolex Cables Ltd. (India)

- CommScope Holding Company, Inc. (US)

- FiberHome Telecommunication Technologies Co., Ltd. (China)

- Aksh Optifibre (India)

- Art Photonics GmbH (Germany)

- RPG Cables (India)

- Nestor Cables (Finland)

- Orbis Oy (Finland)

- Birla Cable Ltd. (India)

- Belden Inc. (US)

- Fiber Mountain (US)

Latest Developments in Asia-Pacific Optical Fiber Components Market

- May 2025: Corning Incorporated announced the expansion of its optical fiber manufacturing facility in India to support growing regional demand driven by 5G and FTTH deployments.

- April 2025: YOFC launched a new ultra-low loss fiber product line optimized for long-haul 5G backhaul and metro network applications across Asia-Pacific..

- February 2025: Sterlite Technologies (STL) introduced AI-enabled fiber network design and monitoring tools to accelerate deployment and reduce downtime in dense urban areas.

- January 2025: Sumitomo Electric Industries unveiled its next-generation optical connectors designed for ultra-high-density data center interconnects and edge cloud environments...

- November 2024: ZTT Group partnered with a Southeast Asian telecom operator to deploy high-capacity submarine fiber cables aimed at boosting regional internet connectivity and cross-border data transmission.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.