Asia Pacific Paint Protection Film Market

Market Size in USD Million

CAGR :

%

USD

133.81 Million

USD

205.36 Million

2025

2033

USD

133.81 Million

USD

205.36 Million

2025

2033

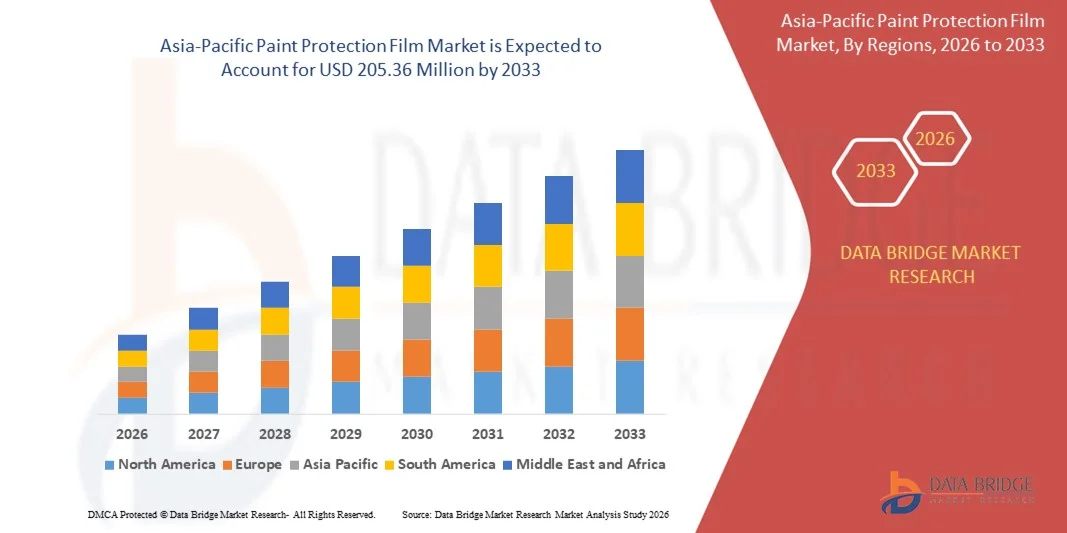

| 2026 –2033 | |

| USD 133.81 Million | |

| USD 205.36 Million | |

|

|

|

|

Asia-Pacific Paint Protection Film Market Size

- The Asia-Pacific paint protection film market size was valued at USD 133.81 million in 2025 and is expected to reach USD 205.36 million by 2033, at a CAGR of 5.5% during the forecast period

- The market growth is largely fuelled by the rising demand for vehicle surface durability such as improved scratch resistance, stain protection, and long-term gloss retention

- Increasing adoption across automotive OEMs and aftermarket applications to enhance vehicle resale value

Asia-Pacific Paint Protection Film Market Analysis

- The market is witnessing steady expansion due to the shift toward premium car care solutions and technological advancements such as self-healing films

- Rising penetration of TPU-based materials, coupled with growing awareness of protective coatings among car owners, continues to accelerate market adoption

- China dominated the Asia-Pacific paint protection film market with the largest revenue share in 2025, driven by rapid vehicle sales, rising disposable incomes, and growing consumer awareness of vehicle maintenance

- Japan is expected to witness the highest compound annual growth rate (CAGR) in the Asia-Pacific paint protection film market due to technological advancements in PPF, rising adoption of self-healing and anti-yellowing films, and strong aftermarket services for vehicle maintenance

- The Clear Bra segment held the largest market revenue share in 2025 driven by its established presence, strong brand recognition, and high-quality durable films. Clear Bra products are widely adopted by premium automotive owners and service centers for long-lasting protection and ease of installation. Their robust performance, compatibility with different vehicle surfaces, and widespread availability make them a preferred choice across commercial and individual users

Report Scope and Asia-Pacific Paint Protection Film Market Segmentation

|

Attributes |

Asia-Pacific Paint Protection Film Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Paint Protection Film Market Trends

Rising Adoption of Advanced Automotive Paint Protection Films

- The growing emphasis on vehicle aesthetics and long-term maintenance is driving the adoption of paint protection films (PPF) in the automotive sector. These films provide a protective barrier against scratches, stone chips, UV exposure, and environmental contaminants, extending the vehicle’s lifespan and preserving its resale value. Vehicle owners are increasingly recognizing PPF as a cost-effective alternative to frequent repairs and repainting

- Increasing consumer preference for premium cars and luxury vehicles is accelerating demand for high-quality, self-healing, and anti-yellowing PPFs. Automotive dealerships and service centers are integrating film installation as part of after-sales services, offering convenience and boosting adoption rates. The trend is supported by growing consumer awareness of the impact of exterior damage on resale value and vehicle aesthetics

- Technological advancements, such as nano-ceramic coatings and enhanced adhesive formulations, are making modern PPFs easier to install, more durable, and visually seamless. This improves consumer confidence and supports routine application across new and existing vehicles. Continuous innovation is enhancing scratch resistance, hydrophobic properties, and clarity, making films almost invisible while maintaining protection

- For instance, vehicle owners who applied self-healing, anti-yellowing films reported fewer scratches and reduced maintenance costs within the first year, demonstrating the practical benefits of protective films. Service providers have noticed improved customer satisfaction and higher demand for repeat installations, highlighting growing trust in PPF solutions

- While PPF adoption is growing rapidly, sustained market expansion relies on product innovation, skilled installers, and awareness campaigns highlighting long-term benefits to both consumers and fleet operators. Educating end-users about proper maintenance, film lifespan, and cost advantages is essential for wider acceptance

Asia-Pacific Paint Protection Film Market Dynamics

Driver

Increasing Vehicle Ownership and Rising Awareness of Exterior Vehicle Protection

- The surge in global vehicle sales is encouraging consumers to invest in PPF to maintain vehicle aesthetics and prevent depreciation. Awareness campaigns, influencer marketing, and automotive expos have highlighted the long-term protective benefits, boosting consumer demand. The preventive approach is now seen as an investment rather than an optional service

- Fleet operators, including car rental and ride-sharing companies, are increasingly adopting PPF to reduce repair costs and maintain fleet appearance, reflecting a shift from reactive to preventive maintenance practices. Minimizing vehicle downtime and lowering operational expenses are key factors driving fleet-wide adoption

- Government regulations and insurance incentives supporting vehicle protection measures further encourage the adoption of protective films. Policies targeting environmental impact, repair reduction, and vehicle maintenance indirectly promote PPF usage. Compliance with such standards also motivates commercial operators and individual owners to adopt PPF

- For instance, businesses using PPF across multiple vehicles observed significant cost savings due to fewer repainting and repair requirements, highlighting the economic advantage of protective films. Preventive maintenance using PPF has become an effective strategy for sustaining vehicle aesthetics and operational efficiency

- Although rising awareness and growing vehicle ownership are key drivers, market expansion depends on making installation services more accessible and promoting affordable yet durable PPF solutions. Collaboration between manufacturers, distributors, and service providers is crucial for scaling adoption

Restraint/Challenge

High Cost of Premium Films and Limited Availability of Skilled Installers

- The premium price of advanced PPFs, including self-healing and nano-ceramic films, remains a major barrier for individual consumers and small dealerships. High costs often restrict adoption to luxury car segments or commercial fleets. Price sensitivity among budget-conscious buyers limits broader market penetration

- Limited availability of trained installers capable of applying films without defects poses another challenge. Incorrect installation can lead to bubbles, peeling, or reduced film effectiveness, deterring potential users. The need for certified training programs and skilled labor remains critical for consistent quality

- In many regions, access to genuine PPF products and replacement films is inconsistent due to supply chain limitations, counterfeit products, and logistical hurdles, affecting overall market penetration. Consumers often delay purchases until trusted products and skilled installers are available

- For instance, vehicle owners reported delayed PPF adoption due to concerns about installation quality and film durability, highlighting the importance of professional service networks. Market growth is closely tied to enhancing service availability and installer expertise

- While innovation in film durability and self-healing properties continues, addressing cost barriers and expanding skilled installation networks are critical to unlocking broader market potential. Manufacturers and service providers must focus on scalable, affordable, and reliable solutions to reach a wider audience

Asia-Pacific Paint Protection Film Market Scope

The market is segmented on the basis of brand, material, system, finish, application, and end-user

- By Brand

On the basis of brand, the Asia-Pacific paint protection film market is segmented into Clear Bra, Clear Mask, Invisible Shield, Rock Chip Protection, Clear Wrap, Car Scratch Protection Film, and Others. The Clear Bra segment held the largest market revenue share in 2025 driven by its established presence, strong brand recognition, and high-quality durable films. Clear Bra products are widely adopted by premium automotive owners and service centers for long-lasting protection and ease of installation. Their robust performance, compatibility with different vehicle surfaces, and widespread availability make them a preferred choice across commercial and individual users.

The Invisible Shield segment is expected to witness the fastest growth rate from 2026 to 2033, due to increasing demand for self-healing and anti-yellowing films that maintain vehicle aesthetics with minimal maintenance. Rising awareness about advanced protective technologies and their benefits in reducing repainting and repair costs is boosting adoption among both luxury car owners and fleet operators.

- By Material

On the basis of material, the Asia-Pacific paint protection film market is segmented into Polyurethane, Vinyl, Polyvinyl Chloride, and Others. The Polyurethane segment held the largest market revenue share in 2025, attributed to its superior flexibility, impact resistance, and clarity, making it suitable for both luxury and mass-market vehicles. Its durability against scratches, stones, and UV exposure ensures long-term protection while maintaining vehicle appearance. Polyurethane films are also compatible with various application techniques, increasing their adoption among professional installers and service providers.

The Vinyl segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its cost-effectiveness, ease of application, and rising use in fleet vehicles and aftermarket services. Its lightweight and versatile nature makes it appealing for both small businesses and individual vehicle owners seeking affordable protection solutions.

- By System

On the basis of system, the Asia-Pacific paint protection film market is segmented into Water-Based Systems and Solvent-Based Systems. The Water-Based Systems segment held the largest market revenue share in 2025 due to its eco-friendly formulation, low VOC emissions, and compliance with stringent Asia-Pacifican environmental regulations. It is widely preferred by service providers and vehicle owners seeking environmentally responsible yet durable protection. Water-based systems also simplify installation and provide consistent performance across different vehicle surfaces.

The Solvent-Based Systems segment is expected to register the fastest growth from 2026 to 2033, owing to enhanced adhesion, durability, and suitability for high-performance coatings on premium and sports vehicles. Solvent-based systems offer superior chemical resistance, making them ideal for high-stress applications in both commercial and personal vehicles.

- By Finish

On the basis of finish, the Asia-Pacific paint protection film market is segmented into Matt Finish, Gloss Finish, and Others. The Gloss Finish segment held the largest market revenue share in 2025, driven by its widespread adoption for premium vehicles, offering a sleek appearance while providing robust protection. Gloss films are favored for enhancing vehicle aesthetics and maintaining surface clarity over time, contributing to high consumer satisfaction. They are also compatible with self-healing technologies, further increasing their demand.

The Matt Finish segment is expected to witness the fastest growth rate from 2026 to 2033, supported by rising consumer preference for customized aesthetics and the increasing popularity of matte-finished vehicles in Asia-Pacific. Matte films provide a unique visual appeal while offering effective surface protection, particularly for luxury and high-end vehicles.

- By Application

On the basis of application, the Asia-Pacific paint protection film market is segmented into Full Hood, Leading Hood Edge, Bumpers, Fender Panels, Painted Side Mirrors, Door Handle Cavities, Door Edges, Rocker Panels, Trunk Ledge, and Others. The Full Hood segment held the largest market revenue share in 2025, attributed to comprehensive protective coverage and demand among high-value vehicles. Full hood applications offer maximum protection against scratches, stone chips, and environmental damage, making them essential for vehicle preservation.

Fender Panels and Bumpers segments are expected to witness the fastest growth from 2026 to 2033 due to frequent exposure to road debris and minor collisions, increasing the need for localized protection solutions. These areas are particularly prone to damage, and PPF applications help reduce maintenance costs and extend vehicle lifespan.

- By End-User

On the basis of end-user, the Asia-Pacific paint protection film market is segmented into Automotive, Aerospace and Defense, Electrical and Electronics, Oil and Gas, and Others. The Automotive segment held the largest market revenue share in 2025, driven by increasing vehicle sales, growing consumer focus on aesthetics, and rising demand for premium and luxury vehicles across Asia-Pacific. Automotive owners are increasingly investing in protective solutions to retain resale value and reduce long-term maintenance costs.

The Aerospace and Defense segment is expected to witness the fastest growth from 2026 to 2033, supported by the adoption of PPF for corrosion resistance, surface protection, and maintenance of high-value equipment. PPF provides durable protection against environmental factors, scratches, and operational wear, which is critical for sensitive and expensive aerospace and defense assets.

Asia-Pacific Paint Protection Film Market Regional Analysis

- China dominated the Asia-Pacific paint protection film market with the largest revenue share in 2025, driven by rapid vehicle sales, rising disposable incomes, and growing consumer awareness of vehicle maintenance

- Consumers increasingly prefer durable and self-healing PPFs that provide scratch resistance, UV protection, and enhanced aesthetics for both personal and commercial vehicles

- The strong growth is further supported by expanding automotive dealerships, professional installation services, and increasing popularity of aftermarket vehicle customization, establishing PPF as a widely adopted protective solution

Japan Paint Protection Film Market Insight

The Japan paint protection film market is expected to witness the fastest growth from 2026 to 2033, driven by increasing demand for premium and luxury vehicles and rising focus on long-term vehicle maintenance. Vehicle owners are adopting advanced PPFs with glossy and matte finishes to maintain aesthetic appeal and minimize repair costs. The growth is further supported by technological innovations, self-healing coatings, and the increasing adoption of eco-friendly films in the automotive aftermarket segment.

Asia-Pacific Paint Protection Film Market Share

The Asia-Pacific paint protection film industry is primarily led by well-established companies, including:

- ELOV PPF (China)

- UPPF (China)

- Senbang Car Film (China)

- Nexfil (South Korea)

- LG Hausys (South Korea)

- STEK (South Korea)

- Toray Industries (Japan)

- PreproPPF (China)

- FilmTack (Singapore)

- RhinePro (Malaysia)

Latest Developments in Asia-Pacific Paint Protection Film Market

- In February 2023, Eastman Chemical Company, headquartered in the U.S., acquired Ai-Red Technology (Dalian) Co., Ltd., to strengthen its specialty materials portfolio and expand its service network in China and the Asia Pacific region. This acquisition enhances Eastman’s capabilities in high-performance protective films and positions the company for greater market penetration across APAC

- In April 2024, Nippon Paint, a Japan-based company, launched its new Mastercraft brand for premium automotive body and paint repair services, covering same-day velocity repairs, advanced paint protection, and detailing solutions. The initiative aims to elevate service quality, drive consumer adoption of high-end protective solutions, and expand Nippon Paint’s influence in the Asia Pacific automotive sector

- In May 2024, Turtle Wax, Inc., a U.S.-based company, celebrated five years of operations in India by introducing its Smart Shield Paint Protection Film (PPF), featuring self-healing properties, superior UV resistance, and scratch protection for OEM-painted surfaces. This launch is expected to boost market demand for advanced PPF in India and contribute to the company’s regional growth in the APAC market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Paint Protection Film Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Paint Protection Film Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Paint Protection Film Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.