Asia Pacific Pelvic Floor Electric Stimulator Market

Market Size in USD Million

CAGR :

%

USD

24.62 Million

USD

50.51 Million

2025

2033

USD

24.62 Million

USD

50.51 Million

2025

2033

| 2026 –2033 | |

| USD 24.62 Million | |

| USD 50.51 Million | |

|

|

|

|

Asia-Pacific Pelvic Floor Electric Stimulator Market Size

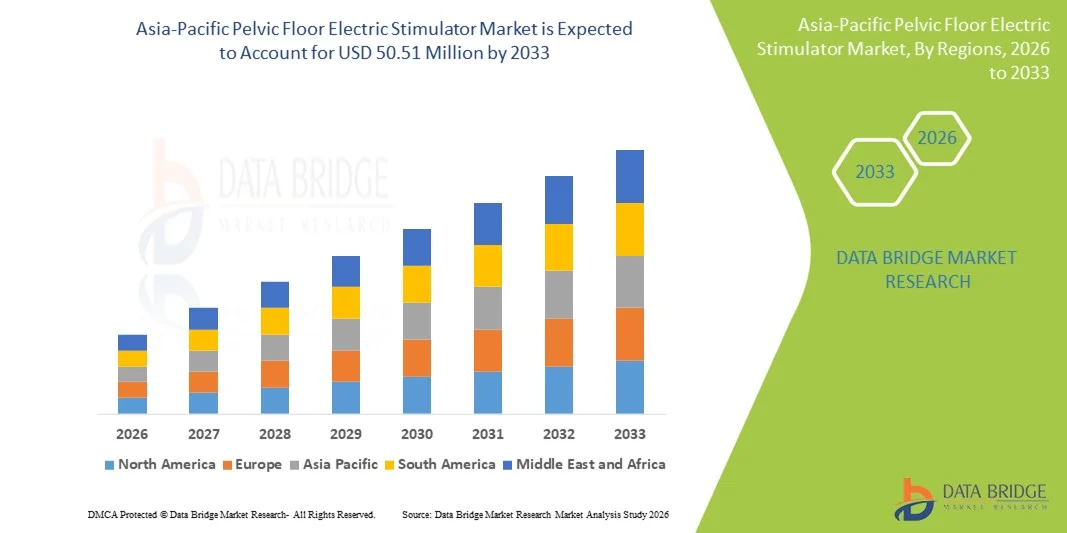

- The Asia-Pacific pelvic floor electric stimulator market size was valued at USD 24.62 Million in 2025 and is expected to reach USD 50.51 Million by 2033, at a CAGR of 9.40% during the forecast period

- The market growth is largely driven by the rising prevalence of pelvic floor disorders, including urinary incontinence and pelvic organ prolapse, along with increasing awareness about non-invasive and home-based therapeutic solutions, leading to higher adoption of pelvic floor electric stimulators in both clinical and homecare settings

- Furthermore, growing demand for cost-effective, user-friendly, and technologically advanced rehabilitation devices, coupled with increasing recommendations from healthcare professionals and expanding geriatric and postnatal populations, is accelerating the uptake of pelvic floor electric stimulator solutions, thereby significantly boosting the industry’s growth

Asia-Pacific Pelvic Floor Electric Stimulator Market Analysis

- Pelvic floor electric stimulators, designed to strengthen pelvic floor muscles through controlled electrical impulses, are increasingly recognized as effective therapeutic devices for managing urinary incontinence, pelvic floor dysfunction, and postnatal or post-surgical rehabilitation in both clinical and homecare settings

- The escalating demand for pelvic floor electric stimulators is primarily fueled by the rising prevalence of pelvic floor disorders, growing awareness of non-invasive treatment options, increasing geriatric and female populations, and a strong preference for home-based and self-managed rehabilitation solutions

- China dominated the pelvic floor electric stimulator market with the largest revenue share of 36.7% in 2025, supported by advanced healthcare infrastructure, high awareness of pelvic health therapies, widespread adoption of physiotherapy-based treatments, and a strong presence of established medical device manufacturers, with sustained demand across hospitals, rehabilitation centers, and homecare environments

- India is expected to be the fastest-growing region in the pelvic floor electric stimulator market during the forecast period, registering a robust CAGR of 9.5%, driven by rising healthcare expenditure, increasing focus on women’s health and geriatric care, growing preference for non-invasive pelvic floor treatments, expanding home-based rehabilitation programs, and improving access to advanced pelvic health devices across clinical and homecare settings

- The non-implantable device segment dominated the market with a revenue share of nearly 62.4% in 2025, owing to its non-invasive nature and high patient acceptance

Report Scope and Pelvic Floor Electric Stimulator Market Segmentation

|

Attributes |

Pelvic Floor Electric Stimulator Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

• Boston Scientific Corporation (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Asia-Pacific Pelvic Floor Electric Stimulator Market Trends

Growing Shift Toward Non-Invasive and Conservative Treatment Approaches

- A major and accelerating trend in the global pelvic floor electric stimulator market is the increasing preference for non-invasive, conservative treatment options for pelvic floor dysfunctions, including urinary incontinence, fecal incontinence, and pelvic pain disorders. Patients and healthcare providers worldwide are increasingly favoring electrical stimulation therapies as an alternative or complement to pharmacological and surgical interventions

- For instance, globally recognized medical device manufacturers have expanded their pelvic floor therapy portfolios with clinically validated electrical stimulation systems designed for both hospital-based and home-care settings, supporting wider patient access and therapy adherence

- Rising awareness of pelvic health, supported by international continence societies and public health initiatives, is contributing to higher diagnosis rates and earlier initiation of pelvic floor rehabilitation programs across developed and emerging markets

- Technological improvements in device design, including adjustable stimulation parameters, enhanced patient comfort, and improved safety profiles, are further strengthening acceptance among clinicians and patients

- In addition, the growing adoption of pelvic floor electrical stimulation within physiotherapy, rehabilitation, and women’s health clinics globally is reinforcing its role as a standard component of pelvic floor disorder management

- This global trend reflects a broader healthcare shift toward patient-centric care, preventive therapies, and cost-effective management of chronic conditions, supporting sustained market growth

Asia-Pacific Pelvic Floor Electric Stimulator Market Dynamics

Driver

Rising Prevalence of Pelvic Floor Disorders and Expanding Aging Population

- The increasing global prevalence of pelvic floor disorders, particularly among women and elderly populations, is a primary driver of growth in the pelvic floor electric stimulator market

- Factors such as aging, childbirth, obesity, and lifestyle-related health conditions are significantly contributing to weakened pelvic musculature worldwide

- For instance, growing clinical adoption of pelvic floor electrical stimulation as a first-line or adjunct therapy in hospitals and specialty clinics across North America, Europe, and parts of Asia-Pacific is driving increased device demand

- The rapidly expanding global geriatric population is further fueling market growth, as age-related muscle degeneration and neurological conditions increase the incidence of urinary and bowel incontinence

- In addition, rising healthcare expenditure, improved access to diagnostic services, and greater focus on women’s health and postpartum rehabilitation are supporting broader adoption of pelvic floor therapy devices in both developed and emerging economies

- Favorable reimbursement policies in select countries and the inclusion of pelvic floor therapy in clinical treatment guidelines are further strengthening market expansion

Restraint/Challenge

Limited Awareness, Social Stigma, and Cost Barriers

- Despite increasing clinical evidence supporting pelvic floor electrical stimulation, limited patient awareness and persistent social stigma associated with pelvic floor disorders continue to restrain market growth in many regions

- Many patients delay diagnosis and treatment due to embarrassment or lack of education regarding available non-surgical therapies

- For instance, in several low- and middle-income countries, pelvic floor disorders remain underreported, and access to specialized rehabilitation services and electrical stimulation devices is limited, constraining market penetration

- The relatively high cost of advanced pelvic floor electric stimulators and associated therapy sessions can also pose a barrier, particularly in regions with limited reimbursement coverage or high out-of-pocket healthcare expenses

- Furthermore, disparities in clinical expertise, inconsistent treatment protocols, and limited availability of trained pelvic health professionals can restrict adoption in certain markets

- Addressing these challenges through patient education, improved reimbursement frameworks, and expanded clinician training programs will be critical for unlocking the full growth potential of the global Pelvic floor electric stimulator market

Asia-Pacific Pelvic Floor Electric Stimulator Market Scope

The market is segmented on the basis of product type, device type, number of channels, therapy, treatment, application, end user, and distribution channel.

- By Product Type

On the basis of product type, the Pelvic Floor Electric Stimulator market is segmented into Mobile, Fixed, and Wearable devices. The mobile segment dominated the global market with a revenue share of approximately 45.8% in 2025, primarily due to its portability and suitability for home-based pelvic floor therapy. Mobile stimulators allow patients to perform therapy sessions without frequent hospital visits, improving compliance. Rising prevalence of urinary incontinence among women and the elderly significantly supports demand. These devices are easy to operate and often come with adjustable intensity and pre-programmed modes. Increasing preference for non-invasive and self-managed treatment options further drives adoption. Growing awareness of pelvic health in emerging markets contributes to expansion. Favorable reimbursement policies in developed countries support usage. Integration with mobile apps enhances therapy monitoring. Lower overall treatment costs compared to clinical alternatives strengthen dominance. Strong recommendations from physiotherapists reinforce demand. The segment benefits from wide product availability. Continuous product upgrades sustain leadership.

The wearable segment is expected to witness the fastest CAGR of around 11.2% from 2026 to 2033, driven by rising demand for discreet and continuous therapy solutions. Wearable devices enable hands-free treatment, improving patient convenience and adherence. Increasing adoption among working women and postpartum patients supports growth. Technological advancements such as Bluetooth connectivity and real-time tracking enhance appeal. Growing investments in digital pelvic health platforms accelerate innovation. Expansion of telehealth services supports remote monitoring. Increasing awareness of preventive pelvic care drives uptake. Rising penetration in developed markets boosts growth. Lightweight and ergonomic designs improve comfort. Regulatory approvals for advanced wearables support commercialization. Increasing clinical validation strengthens trust. Strong marketing by manufacturers fuels rapid adoption.

- By Device Type

On the basis of device type, the market is segmented into Non-Implantable Electrical Stimulator Devices and Implantable Electrical Stimulator Devices. The non-implantable device segment dominated the market with a revenue share of nearly 62.4% in 2025, owing to its non-invasive nature and high patient acceptance. These devices are widely used as first-line therapy for pelvic floor dysfunction. Ease of availability across hospitals, clinics, and home-care settings supports dominance. Lower procedural risks compared to implantable alternatives strengthen preference. Cost-effectiveness enhances accessibility in low- and middle-income countries. Strong clinical guidelines recommend non-implantable solutions initially. Growing geriatric population increases usage. High adoption in outpatient rehabilitation centers drives demand. Minimal regulatory barriers support rapid commercialization. Increasing physiotherapy integration boosts utilization. Strong physician preference reinforces dominance. Broad product portfolios from manufacturers sustain leadership.

The implantable device segment is projected to grow at the fastest CAGR of approximately 9.7% from 2026 to 2033, driven by increasing use in severe and refractory cases. Implantable stimulators provide long-term neuromodulation benefits. Advancements in minimally invasive implantation techniques reduce surgical risks. Rising prevalence of neurogenic bladder disorders supports growth. Increasing clinical evidence improves physician confidence. Higher success rates in chronic cases drive adoption. Growing healthcare spending supports affordability. Expanding availability in specialized hospitals accelerates demand. Technological improvements enhance battery life and efficacy. Favorable outcomes boost patient acceptance. Increasing regulatory approvals drive commercialization. Strong R&D investments fuel innovation.

- By Number of Channels

On the basis of number of channels, the market is segmented into 1 Channel and 2 Channel devices. The 1-channel segment held the largest revenue share of approximately 54.1% in 2025, due to its simplicity and affordability. These devices are widely used for basic pelvic floor muscle training. Ease of operation improves patient compliance. High adoption in home-care settings supports dominance. Lower training requirements enhance usability. Suitable for mild to moderate pelvic disorders. Strong preference among elderly patients drives demand. Broad availability across regions strengthens penetration. Cost advantages support adoption in emerging markets. Clinician preference for initial therapy boosts use. High durability supports long-term usage. Stable performance sustains leadership.

The 2-channel segment is expected to register the fastest CAGR of around 8.9% from 2026 to 2033, driven by demand for advanced therapy customization. Dual-channel devices allow stimulation of multiple muscle groups simultaneously. Growing use in complex pelvic disorders supports growth. Rising adoption in rehabilitation centers boosts demand. Increasing clinician awareness drives preference. Technological advancements improve precision. Growing demand for tailored therapy accelerates uptake. Higher effectiveness enhances patient outcomes. Expanding clinical applications support growth. Increasing healthcare infrastructure investments boost sales. Specialist recommendations strengthen adoption. Strong product innovation sustains momentum.

- By Therapy

On the basis of therapy, the market is segmented into Physical Therapy and Occupational Therapy. The physical therapy segment dominated the market with a revenue share of about 57.6% in 2025, due to its established role in pelvic rehabilitation. Electric stimulators are widely incorporated into physiotherapy regimens. Strong clinical evidence supports effectiveness. High referral rates drive utilization. Availability of trained physiotherapists boosts adoption. Increasing awareness of conservative treatment options strengthens demand. Growing sports injury and postpartum recovery cases contribute. Integration into rehabilitation programs supports dominance. Favorable reimbursement policies enhance uptake. Expanding physical therapy clinics drive demand. Strong patient outcomes reinforce usage. Global acceptance sustains leadership.

The occupational therapy segment is anticipated to grow at the fastest CAGR of approximately 9.3% from 2026 to 2033, driven by holistic patient care approaches. Focus on functional recovery supports growth. Increasing use in post-surgical rehabilitation boosts demand. Rising geriatric population supports adoption. Expansion of multidisciplinary care models drives uptake. Growing healthcare awareness accelerates usage. Increasing integration with assistive devices supports growth. Technological advancements enhance therapy effectiveness. Expanding occupational therapy programs globally drive demand. Improved training availability supports adoption. Rising patient-centric care trends fuel growth. Supportive healthcare policies enhance expansion.

- By Treatment

On the basis of treatment, the market is segmented into PFMT, NMES, and TTNS. The PFMT segment dominated the market with a share of approximately 48.9% in 2025, due to its widespread recommendation as first-line therapy. High safety profile supports preference. Strong clinical guidelines reinforce usage. Broad patient acceptance drives demand. Integration with electric stimulators improves outcomes. Low treatment cost enhances accessibility. Strong physician recommendation supports dominance. Suitable for all age groups. Growing awareness programs boost adoption. High success rates sustain demand. Easy implementation supports usage. Consistent clinical outcomes reinforce leadership.

The TTNS segment is projected to grow at the fastest CAGR of around 11.4% from 2026 to 2033, driven by its non-invasive nature. Rising adoption in refractory cases supports growth. Increasing clinical trials validate efficacy. Growing neurologic disorder prevalence boosts demand. Expanding awareness among clinicians accelerates uptake. Improved device portability enhances usage. Growing patient preference supports adoption. Technological advancements improve comfort. Expanding outpatient use boosts growth. Favorable reimbursement trends support expansion. Rising global healthcare spending fuels demand. Strong innovation pipeline accelerates growth.

- By Application

On the basis of application, the market is segmented into Urinary Incontinence, Sexual Dysfunction, Neurodegenerative Diseases, and Others. The urinary incontinence segment accounted for the largest share of approximately 52.7% in 2025, driven by high global prevalence. Aging population significantly contributes. Strong demand among women supports growth. Increasing diagnosis rates drive adoption. Conservative therapy preference boosts usage. Rising postpartum care needs support demand. Strong clinical endorsement reinforces dominance. Availability of effective devices strengthens uptake. Growing awareness campaigns increase usage. Integration with home therapy supports dominance. Expanding treatment access drives growth. Favorable reimbursement policies enhance adoption.

The sexual dysfunction segment is expected to witness the fastest CAGR of around 10.7% from 2026 to 2033, driven by increasing awareness and reduced stigma. Growing focus on quality of life supports growth. Rising pelvic floor disorder diagnosis boosts demand. Increasing acceptance of non-drug therapies accelerates adoption. Technological advancements improve treatment comfort. Expanding patient education programs support growth. Growing healthcare spending boosts access. Increasing female sexual health focus supports expansion. Rising telehealth consultations drive awareness. Strong marketing efforts accelerate adoption. Clinical validation improves trust. Innovation fuels rapid growth.

- By End User

On the basis of end user, the market is segmented into Hospitals, Clinics, and Home-Care Settings. The hospital segment dominated the market with a revenue share of approximately 50.3% in 2025, due to availability of advanced care facilities. High patient volume supports dominance. Presence of skilled professionals boosts usage. Strong procurement capabilities sustain demand. Integration into multidisciplinary care strengthens adoption. Rising hospital infrastructure investment supports growth. Access to advanced devices enhances preference. Strong reimbursement support boosts usage. Growing surgical volumes drive demand. Teaching hospitals support innovation adoption. Global hospital expansion sustains dominance. Continuous device upgrades reinforce leadership.

The home-care settings segment is expected to grow at the fastest CAGR of around 12.2% from 2026 to 2033, driven by preference for home-based treatment. Aging population supports growth. Technological advancements enable safe self-use. Cost savings enhance adoption. Increasing telehealth integration supports monitoring. Rising chronic pelvic disorders drive demand. Improved patient comfort boosts uptake. Growing awareness of self-care therapies accelerates growth. Expanding home healthcare services support expansion. Strong device portability enhances adoption. Increasing insurance coverage supports growth. Rising patient independence fuels demand.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Direct Tenders, Third-Party Distribution, and Others. The direct tenders segment held the largest market share of approximately 46.4% in 2025, driven by bulk hospital procurement. Long-term contracts ensure stability. Competitive pricing strengthens dominance. Government healthcare purchases support demand. Reliable supply chains enhance trust. Strong manufacturer–hospital relationships sustain growth. Standardized procurement processes support efficiency. High-volume purchasing lowers costs. Expansion of public hospitals boosts demand. Strong regulatory compliance supports adoption. Stable demand sustains leadership. Global healthcare funding reinforces dominance.

The third-party distribution segment is anticipated to grow at the fastest CAGR of around 10.9% from 2026 to 2033, driven by expanding outpatient and home-care access. Improved logistics enhance reach. Growing role of medical distributors supports growth. Rising penetration in emerging markets accelerates demand. Increasing clinic adoption boosts sales. E-commerce integration supports expansion. Faster delivery improves adoption. Broader product availability drives growth. Increasing awareness among small providers boosts demand. Flexible pricing models enhance adoption. Distributor partnerships strengthen market presence. Rapid urbanization supports expansion.

Asia-Pacific Pelvic Floor Electric Stimulator Market Regional Analysis

- The Asia-Pacific pelvic floor electric stimulator market is projected to expand at a steady CAGR throughout the forecast period, driven by increasing awareness of pelvic health disorders, rising adoption of non-invasive therapeutic solutions, and strong healthcare infrastructure across the region

- Growing emphasis on rehabilitation and preventive care, particularly for urinary incontinence and postpartum recovery, is supporting market growth

- In addition, favorable reimbursement policies and the presence of well-established medical device manufacturers are contributing to wider adoption across hospitals, rehabilitation centers, and homecare settings

China Pelvic Floor Electric Stimulator Market Insight

The China pelvic floor electric stimulator market dominated the global market with the largest revenue share of 36.7% in 2025, supported by advanced healthcare infrastructure, high awareness of pelvic health therapies, widespread adoption of physiotherapy-based treatments, and a strong presence of established medical device manufacturers. Sustained demand across hospitals, rehabilitation centers, and homecare environments continues to drive growth. Increasing focus on women’s health, geriatric care, and conservative treatment approaches further strengthens China’s market outlook.

India Pelvic Floor Electric Stimulator Market Insight

The India pelvic floor electric stimulator market is expected to grow at the fastest CAGR of 9.5% during the forecast period, driven by rising healthcare expenditure, increasing focus on women’s health and geriatric care, growing preference for non-invasive pelvic floor treatments, expanding home-based rehabilitation programs, and improving access to advanced pelvic health devices across clinical and homecare settings. Strong government initiatives to improve healthcare access and growing awareness of pelvic health disorders are further accelerating market growth.

Asia-Pacific Pelvic Floor Electric Stimulator Market Share

The Pelvic Floor Electric Stimulator industry is primarily led by well-established companies, including:

• Boston Scientific Corporation (U.S.)

• Medtronic (Ireland)

• Axonics, Inc. (U.S.)

• Verity Medical Ltd. (U.K.)

• TensCare Ltd. (U.K.)

• The Prometheus Group (U.S.)

• Zimmer MedizinSysteme GmbH (Germany)

• Beac Medizintechnik GmbH (Germany)

• NeuroTrac (U.K.)

• Everyway Medical Instruments Co., Ltd. (Taiwan)

• RS Medical (U.S.)

• BMR NeuroTech Inc. (U.S.)

• Verity Medical (U.K.)

• Cefar Medical AB (Sweden)

• Cosman Medical, Inc. (U.S.)

• EMS Physio Ltd. (U.K.)

Latest Developments in Asia-Pacific Pelvic Floor Electric Stimulator Market

- In June 2021, Atlantic Therapeutics, a leading pelvic health device company, announced the expansion of its INNOVO Pelvic Floor Electric Stimulator distribution across major European markets, including Germany, France, and the UK. This expansion significantly increased product availability through pharmacies and medical device retailers and supported higher adoption of non-invasive pelvic floor electrical stimulation for urinary incontinence treatment

- In September 2021, Laborie Medical Technologies strengthened its pelvic health portfolio by expanding clinical adoption of pelvic floor electrical stimulation devices across urology and gynecology departments in North America and Europe. The company emphasized combining electrical stimulation therapy with broader pelvic health diagnostic solutions, reinforcing the role of stimulators in comprehensive pelvic care programs

- In July 2022, Renovia Inc. received U.S. FDA clearance for its leva® Pelvic Health System, a digital pelvic floor therapy device, supporting the broader clinical acceptance of electrical and biofeedback-based pelvic floor treatments. Although not purely an electrical stimulator, this clearance accelerated awareness and adoption of pelvic floor therapy devices globally

- In November 2022, TensCare Ltd., a UK-based medical device manufacturer, launched upgraded pelvic floor electrical stimulators under its Perfect PFE brand, featuring improved electrode comfort and customizable stimulation programs. The product update addressed patient compliance issues and strengthened the company’s position in the home-care pelvic health segment

- In June 2023, Zynex Medical announced the launch of a next-generation muscle stimulation system designed for pelvic floor rehabilitation, incorporating enhanced waveform control and clinician-guided therapy protocols. The launch supported growing demand for advanced electrical stimulation solutions in outpatient and home-based pelvic floor therapy

- In September 2023, Nanjing Vishee Medical Technology Co., Ltd. received U.S. FDA 510(k) clearance for its Pelvic Floor Muscle Stimulator (K230767), authorizing its commercialization in the U.S. market. This regulatory approval enabled wider clinical and home-care adoption and marked a significant milestone for global market expansion

- In February 2024, TensCare Ltd. introduced digital therapy integration through its MyControl mobile application, allowing users of pelvic floor electric stimulators to track therapy progress and personalize stimulation settings remotely. This development aligned pelvic floor stimulators with growing trends in connected and app-based medical devices

- In August 2024, Zynex Medical reported increased clinical adoption of its pelvic floor stimulation devices across U.S. pain management and rehabilitation centers, driven by rising awareness of non-invasive pelvic health treatments. The company highlighted pelvic floor therapy as a key growth area within its electrotherapy portfolio

- In March 2025, Trinity Medical Solutions received U.S. FDA 510(k) clearance for its ReGenesis EMS Chair, a non-invasive pelvic floor muscle stimulation system designed to treat urinary incontinence. This approval expanded the range of pelvic floor stimulation technologies available in clinical settings

- In June 2025, multiple industry reports confirmed rising global adoption of wearable and home-use pelvic floor electric stimulators, driven by increasing prevalence of urinary incontinence and growing preference for non-surgical treatment options. Manufacturers focused on portability, wireless connectivity, and patient-centric designs to strengthen market penetration

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.