Asia Pacific Pharmaceutical Packaging Market

Market Size in USD Billion

CAGR :

%

USD

32.18 Billion

USD

89.56 Billion

2024

2032

USD

32.18 Billion

USD

89.56 Billion

2024

2032

| 2025 –2032 | |

| USD 32.18 Billion | |

| USD 89.56 Billion | |

|

|

|

|

Asia-Pacific Pharmaceutical Packaging Market Size

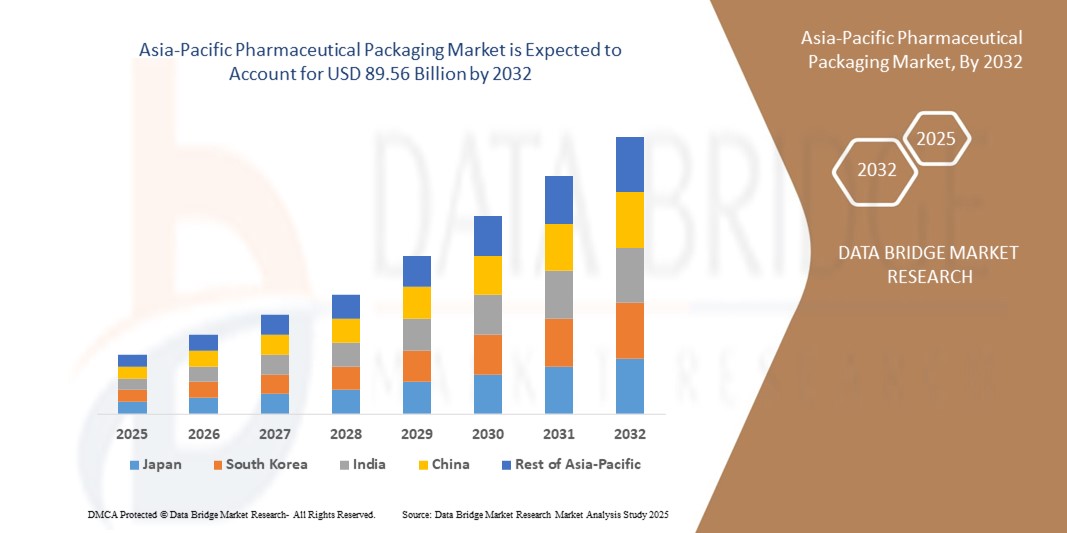

- The Asia-Pacific pharmaceutical packaging market size was valued at USD 32.18 billion in 2024 and is expected to reach USD 89.56 billion by 2032, at a CAGR of 13.65% during the forecast period

- The market growth is largely fueled by the increasing demand for safe, reliable, and sustainable packaging solutions to protect drug integrity, ensure patient safety, and comply with stringent regulatory requirements across pharmaceutical supply chains

- Furthermore, rising consumption of biologics, injectables, and specialty medicines is driving the adoption of advanced formats such as pre-filled syringes, blister packs, and temperature-controlled packaging. These converging factors are accelerating the uptake of innovative pharmaceutical packaging solutions, thereby significantly boosting the industry’s growth

Asia-Pacific Pharmaceutical Packaging Market Analysis

- Pharmaceutical packaging refers to the materials and solutions designed to protect, preserve, and deliver medicines in formats such as bottles, blister packs, vials, ampoules, syringes, and specialty bags. These solutions ensure stability, extend shelf life, and provide tamper evidence while supporting patient compliance and safety

- The escalating demand for pharmaceutical packaging is primarily driven by the growth of drug production, rising emphasis on eco-friendly and recyclable materials, and the increasing need for advanced packaging technologies to support biologics, vaccines, and self-administered therapies

- China dominated the pharmaceutical packaging market in 2024, due to its expansive pharmaceutical manufacturing base, large-scale drug production, and strong domestic demand for advanced packaging solutions

- India is expected to be the fastest growing country in the pharmaceutical packaging market during the forecast period due to rapid growth of its domestic pharmaceutical sector, expanding generics production, and rising healthcare access among its growing population

- Manufacturer segment dominated the market with a market share of 50.4% in 2024, due to their direct involvement in ensuring packaging quality, regulatory compliance, and product safety. Pharmaceutical companies heavily invest in packaging solutions to maintain drug integrity, extend shelf life, and meet stringent global standards. The ability to customize packaging formats for diverse drug delivery modes, along with integration of anti-counterfeit and patient-friendly features, further strengthens the role of manufacturers. Growing production volumes of oral formulations, injectables, and biologics reinforce their dominance, as packaging remains a critical element of the overall drug development and commercialization process

Report Scope and Pharmaceutical Packaging Market Segmentation

|

Attributes |

Pharmaceutical Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Pharmaceutical Packaging Market Trends

Shift Toward Sustainable and Recyclable Packaging Solutions

- A notable trend in the pharmaceutical packaging market is the industry’s decisive tilt toward sustainable and recyclable solutions. Companies and regulators are both driving initiatives that prioritize eco-friendly materials, resulting in increased investment in bio-based plastics, paper-based alternatives, and recycled polymers for compliance with sustainability goals

- For instance, Amcor launched its ECO initiative introducing recyclable polyethylene-based blister packs in collaboration with pharma major Bayer. This development underscores how global leaders in packaging are pivoting toward more sustainable and circular materials to meet environmental standards and customer expectations

- A growing emphasis on reducing carbon footprints has compelled companies to adopt materials such as biodegradable films and lightweight primary packaging. These options reduce resource usage in production as well as transportation costs, driving operational efficiency alongside sustainability improvements

- Integration of advanced technologies for sustainable packaging, such as recyclable barrier coatings and compostable laminates, is further enhancing the usability of eco-friendly solutions. These innovations allow packaging to preserve drug stability and extend shelf life without relying on traditional plastic-heavy formats

- The adoption of sustainable manufacturing practices, in addition to material innovation, is becoming a strong competitive factor. For instance, organizations are increasingly investing in renewable energy sourcing and waste reduction programs within their production facilities to align their packaging operations with ESG benchmarks

- The cumulative effect of these sustainability-focused shifts is the redefining of industry standards in pharmaceutical packaging. As demand for recycled and renewable materials continues to surge, packaging firms must balance product safety and regulatory compliance with environmentally responsible strategies, shaping the future of the entire sector

Asia-Pacific Pharmaceutical Packaging Market Dynamics

Driver

Rising Demand for Biologics and Injectable Therapies

- The expanding growth of biologics and injectable therapies is a major driver reinforcing pharmaceutical packaging demand. Specialized packaging formats such as prefilled syringes, vials, and cartridges are increasingly required to ensure stability, sterility, and patient safety in advanced treatments

- For instance, Gerresheimer partnered with Eli Lilly in 2024 for the supply of innovative prefilled syringes dedicated to large molecule biologics. Such collaborations highlight how pharmaceutical brands are depending on specialized packaging companies to ensure effective delivery of complex therapies

- The safety and efficacy of biologics demand temperature-stable and contamination-resistant packaging formats, which provides packaging companies opportunities to create differentiated solutions. High-barrier materials, tamper-resistant closures, and advanced sterilization methods are gaining traction as essential product attributes

- The shift toward self-administered injectables is fueling demand for patient-friendly packaging solutions such as auto-injectors and prefilled pens. In addition to reducing hospital dependency, these ready-to-use formats improve patient compliance and treatment outcomes, acting as a strong driver for packaging adoption

- Collectively, the rise of biologics and injectables is reshaping the pharmaceutical packaging industry by making specialized, patient-centric, and high-quality formats indispensable. This acceleration is expected to sustain long-term industry expansion and elevate packaging as a critical differentiator in biologics therapy delivery

Restraint/Challenge

Stringent Regulations for Using Plastic Packaging

- Regulatory scrutiny on the safety and environmental profile of plastic-based packaging is a central challenge for the pharmaceutical sector. Governments and health authorities are pushing for stricter rules on material traceability, recyclability, and limits around potential leachables from plastics

- For instance, the US FDA and European Medicines Agency have both mandated comprehensive testing for extractables and leachables in plastic packaging used for drugs. These directives are compelling companies to redesign packaging materials and undertake costly compliance processes before approval

- The need for full material validation to prove safety against drug interactions has increased expenses for packaging manufacturers. Certifications, multi-phase testing, and continuous documentation raise both time requirements and costs for companies, particularly for SMEs struggling with scalability

- Transitioning away from conventional plastics is complex due to their strong protective performance against moisture, oxygen, and contamination. While alternatives such as bio-based plastics and paper laminates exist, scaling them in a cost-effective manner while ensuring drug stability continues to pose an ongoing challenge

- Addressing these regulatory and material challenges requires long-term investment in R&D, close collaboration with regulators, and progressive adaptation to new compliance frameworks. This path, while resource-intensive, is essential for maintaining patient safety and market competitiveness in an evolving regulatory landscape

Asia-Pacific Pharmaceutical Packaging Market Scope

The market is segmented on the basis of type, raw material, drug delivery mode, purchase organization, and application.

- By Type

On the basis of type, the pharmaceutical packaging market is segmented into plastic bottles, blister packs, labels and accessories, caps and closures, medical specialty bags, pre-filled syringes, temperature-controlled packaging, pouches and strip packs, ampoules, vials, pre-filled inhalers, medication tubes, jars and canisters, cartridges, and others. The blister packs segment dominated the largest market revenue share in 2024, driven by their high adoption for solid oral dosage forms such as tablets and capsules. They provide superior product protection, extended shelf life, and convenient unit-dose dispensing, which makes them highly preferred by both patients and healthcare providers. The growing emphasis on compliance packaging and the ability of blister packs to incorporate anti-counterfeit features further fuel their dominance in the market.

The pre-filled syringes segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by the increasing trend toward self-administration of biologics and chronic disease treatments. Pre-filled syringes enhance dosage accuracy, minimize medication waste, and reduce contamination risks, making them highly suitable for injectable therapies. With the rising prevalence of diabetes, autoimmune disorders, and cancer, demand for pre-filled syringes is surging across developed and emerging healthcare systems. Their convenience for at-home care and alignment with patient-centric drug delivery models are key drivers for rapid growth.

- By Raw Material

On the basis of raw material, the pharmaceutical packaging market is segmented into plastics and polymers, paper and paperboards, glass, metals, and others. Plastics and polymers dominated the largest revenue share in 2024, as they offer versatility, lightweight structure, cost-effectiveness, and ease of molding into various formats such as bottles, blisters, and closures. Their barrier properties against moisture, oxygen, and contaminants, coupled with compatibility with a wide range of formulations, support widespread use. Furthermore, advancements in sustainable and recyclable polymer solutions continue to strengthen their dominance in the industry.

The glass segment is projected to witness the fastest CAGR from 2025 to 2032, driven by its critical role in storing injectable drugs, vaccines, and biologics that require high inertness and non-reactivity. Glass vials and ampoules remain the gold standard for sensitive formulations, ensuring safety and efficacy. The expansion of biologics and biosimilars markets, alongside large-scale immunization programs and the surge in injectable therapies, significantly boosts demand for pharmaceutical glass packaging. Innovations in lightweight and break-resistant glass are also fueling growth.

- By Drug Delivery Mode

On the basis of drug delivery mode, the pharmaceutical packaging market is segmented into oral drug delivery packaging, pulmonary drug delivery packaging, transdermal drug delivery packaging, injectable packaging, nasal drug delivery packaging, ocular drug delivery packaging, IV drug delivery packaging, and others. Oral drug delivery packaging held the largest market share in 2024, supported by the dominance of tablets and capsules in pharmaceutical consumption. Blister packs, bottles, and strip packs designed for oral dosage forms provide ease of administration, patient compliance, and affordability, which sustains their extensive demand. The sheer volume of oral formulations in chronic and acute treatments consolidates this segment’s leadership.

The injectable packaging segment is expected to record the fastest growth from 2025 to 2032, owing to the increasing use of biologics, vaccines, and personalized medicines that require precise and sterile delivery systems. Syringes, vials, cartridges, and IV containers are essential for advanced injectable therapies, which are gaining traction globally. The trend toward pre-filled injectables and self-injectors further accelerates packaging innovations in this segment. Rising investments in oncology, immunotherapy, and novel drug classes make injectable packaging the most dynamic growth driver.

- By Purchase Organization

On the basis of purchase organization, the pharmaceutical packaging market is segmented into manufacturers, packaging companies, and government agencies. Manufacturers accounted for the largest revenue share of 50.4% in 2024, driven by their direct involvement in ensuring packaging quality, regulatory compliance, and product safety. Pharmaceutical companies heavily invest in packaging solutions to maintain drug integrity, extend shelf life, and meet stringent standards. The ability to customize packaging formats for diverse drug delivery modes, along with integration of anti-counterfeit and patient-friendly features, further strengthens the role of manufacturers. Growing production volumes of oral formulations, injectables, and biologics reinforce their dominance, as packaging remains a critical element of the overall drug development and commercialization process.

Packaging companies are anticipated to witness the fastest growth from 2025 to 2032, as outsourcing trends gain momentum among pharmaceutical firms seeking cost efficiency and expertise in advanced packaging. Specialized packaging providers are offering smart packaging, sustainability-focused materials, and anti-counterfeiting technologies that attract strong demand. Growing collaboration between pharma firms and packaging service providers is enhancing innovation and accelerating adoption, positioning this segment as the fastest-growing.

- By Application

On the basis of application, the pharmaceutical packaging market is segmented into drug delivery and veterinary vaccines. Drug delivery dominated the largest revenue share in 2024, as packaging plays a pivotal role in ensuring the safe transport, storage, and administration of medicines across oral, injectable, and transdermal routes. The rise in chronic diseases, large-scale vaccine programs, and the expansion of biologics pipeline drive demand for robust drug delivery packaging formats. Continuous advancements in compliance packaging and patient-friendly solutions further reinforce this segment’s dominance.

Veterinary vaccines are projected to grow at the fastest rate from 2025 to 2032, supported by rising pet ownership, livestock disease prevention programs, and increasing awareness of animal health. The growing use of vaccines in poultry, cattle, and companion animals creates demand for specialized packaging formats such as vials, syringes, and cold-chain solutions. Government initiatives promoting animal vaccination and zoonotic disease prevention further accelerate the adoption of veterinary vaccine packaging, making it the fastest-expanding application segment.

Asia-Pacific Pharmaceutical Packaging Market Regional Analysis

- China dominated the pharmaceutical packaging market with the largest revenue share in 2024, driven by its expansive pharmaceutical manufacturing base, large-scale drug production, and strong domestic demand for advanced packaging solutions

- Government initiatives to strengthen healthcare infrastructure and stringent regulations on drug safety and anti-counterfeiting packaging further reinforce China’s leadership in the regional market

- The presence of leading domestic packaging companies, collaborations with global pharma players, and rapid adoption of innovative formats such as pre-filled syringes and blister packs continue to consolidate China’s dominant position during the forecast period. Expanding e-commerce distribution for medicines and the rising use of patient-friendly packaging across urban and semi-urban areas further strengthen market penetration

Japan Pharmaceutical Packaging Market Insight

The Japan market is anticipated to grow steadily from 2025 to 2032, supported by its advanced pharmaceutical industry and strong emphasis on quality compliance and safety regulations. Japanese manufacturers are increasingly adopting premium and technologically enhanced packaging solutions, including smart packaging and temperature-controlled formats, reflecting the country’s focus on innovation and reliability. The demand for compact, sustainable, and user-friendly packaging is rising due to urban living and an aging population with high medicine consumption. Continuous R&D investments and collaborations between Japanese packaging firms and multinational pharma companies reinforce steady growth. Japan’s commitment to quality assurance, innovation, and sustainability underpins its strong regional positioning.

India Pharmaceutical Packaging Market Insight

India is projected to register the fastest CAGR in the Asia-Pacific pharmaceutical packaging market during 2025–2032, fueled by rapid growth of its domestic pharmaceutical sector, expanding generics production, and rising healthcare access among its growing population. Increasing demand for affordable yet effective packaging formats such as blister packs, bottles, and vials is particularly strong due to cost-sensitive markets. Government initiatives to promote healthcare access, stricter regulatory enforcement on drug safety, and the rise of contract manufacturing organizations (CMOs) are accelerating adoption of advanced packaging solutions. Expanding retail pharmacies, strong growth of e-commerce medicine delivery, and collaborations with global packaging firms further enhance India’s emergence as the fastest-growing market in the region.

Asia-Pacific Pharmaceutical Packaging Market Share

The pharmaceutical packaging industry is primarily led by well-established companies, including:

- Gerresheimer AG (Germany)

- SCHOTT AG (Germany)

- Alpha Packaging (U.S.)

- Klöckner Pentaplast (Germany)

- Amcor Plc (Switzerland)

- Berry Global, Inc (U.S.)

- BD (U.S.)

- Parekhplast India Ltd (India)

- West Pharmaceutical Services, Inc (U.S.)

- Wipak Group (Finland)

- Mondi (U.K.)

- Sealed Air (U.S.)

- Constantia Flexible (Austria)

- Clondalkin Group (Netherlands)

- Huhtamaki (Finland)

- Transcontinental Inc. (Canada)

- Crown Holdings, Inc (U.S.)

- Westrock Company (U.S.)

- Drug plastics Group (U.S.)

- SGD Pharma (India)

Latest Developments in Asia-Pacific Pharmaceutical Packaging Market

- In November 2023, Amcor Plc signed a Memorandum of Understanding (MOU) with NOVA Chemicals Corporate to procure mechanically recycled polyethylene resin (rPE) for use in flexible packaging films. This collaboration is expected to strengthen Amcor’s leadership in sustainable packaging by reducing dependence on virgin plastics and increasing the adoption of circular materials. By integrating rPE into pharmaceutical packaging, the company is reinforcing industry-wide momentum toward eco-friendly solutions, regulatory compliance, and long-term sustainability in flexible packaging

- In July 2023, Constantia Flexibles launched REGULA CIRC, a pharmaceutical packaging innovation based on coldform foil with a PE sealing layer that replaces conventional PVC. This advancement significantly reduces plastic content while enhancing recyclability and material recovery, aligning with global sustainability goals. The introduction of REGULA CIRC strengthens the company’s market position by catering to the rising demand for greener blister packaging solutions, particularly in markets focused on reducing plastic dependency

- In April 2023, Südpack introduced PharmaGuard blister packaging, a polypropylene-based solution offering high barrier protection against water vapor, oxygen, and UV radiation. This development provides an effective alternative to traditional materials while maintaining product safety and stability. PharmaGuard is anticipated to drive market growth by addressing the dual need for enhanced barrier performance and improved recyclability, thereby supporting the pharmaceutical sector’s transition toward environmentally responsible packaging formats

- In 2021, Amcor Plc launched customer trials for its recyclable mono-material polyethylene blister pack named AmSky, designed to minimize the use of polyvinyl chloride (PVC). By enabling recyclability in blister formats, AmSky sets a new benchmark for sustainable pharmaceutical packaging. The trial underscores Amcor’s role in driving material innovation and is expected to accelerate industry adoption of recyclable blister packs, meeting regulatory pressures and consumer demand for eco-friendly solutions

- In 2021, Keystone Folding Box Co. reported a surge in demand for its paperboard-based blister packs, driven by sustainability regulations in India and increasing need for child-resistant pharmaceutical packaging in the U.S. This growth highlights the company’s adaptability to evolving regulatory landscapes and consumer safety needs. The shift toward paperboard formats indicates a broader market trend toward sustainable and safe packaging materials, reinforcing Keystone’s relevance in the global market

- In 2021, Klöckner Pentaplast Group (U.K.) launched kpNext, the first recyclable PET blister film designed for pharmaceutical packaging. This pioneering innovation directly addresses recyclability challenges associated with traditional blister films and positions the company as a front-runner in sustainable packaging. By providing a scalable and eco-friendly alternative, kpNext is expected to reshape the blister packaging segment, supporting pharmaceutical companies in meeting both sustainability targets and regulatory expectations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Pharmaceutical Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Pharmaceutical Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Pharmaceutical Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.